Where Does DAI's 8% Excess "Risk-Free Rate" Come From?

TechFlow Selected TechFlow Selected

Where Does DAI's 8% Excess "Risk-Free Rate" Come From?

MakerDAO earns substantial profits from RWA yield-generating assets and uses these profits to pay 8% interest, but why does it do so?

Today, MakerDAO officially adjusted the DAI deposit interest rate on its lending protocol Spark Protocol to 8%—a stablecoin "risk-free rate" higher than current U.S. Treasury yields. This raises questions: Is this high yield hiding a Ponzi scheme? Let's dive into where this 8% "risk-free" return comes from, whether it's sustainable, and why MakerDAO is doing this.

This analysis is limited by personal understanding; corrections are welcome. It does not constitute any investment advice. Where does this 8% "risk-free" yield come from? RWA (Real World Assets) has been a hot topic in the industry recently, and MakerDAO has become a focal point among RWA projects due to its large-scale integration of RWA assets. For an explanation of why MakerDAO is incorporating RWA assets, refer to this article.

In short, MakerDAO’s goal in adopting RWA assets is to diversify the collateral backing DAI by leveraging external credit systems. The long-term yield generated by U.S. Treasuries helps stabilize DAI’s exchange rate, increases issuance flexibility, and reduces reliance on USDC by introducing U.S. Treasuries into the balance sheet, thereby mitigating single-point risk.

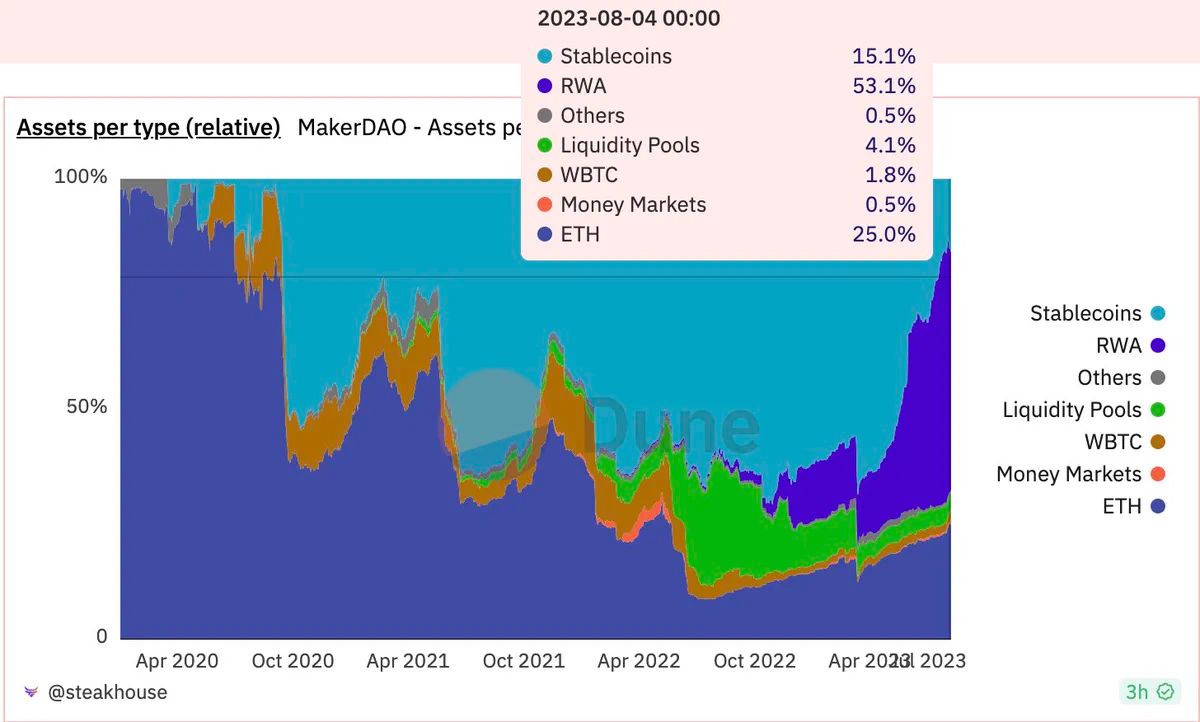

The inclusion of substantial RWA holdings has also brought significant additional revenue to MakerDAO. As shown on Dune, RWA assets now account for over half of MakerDAO’s total balance sheet.

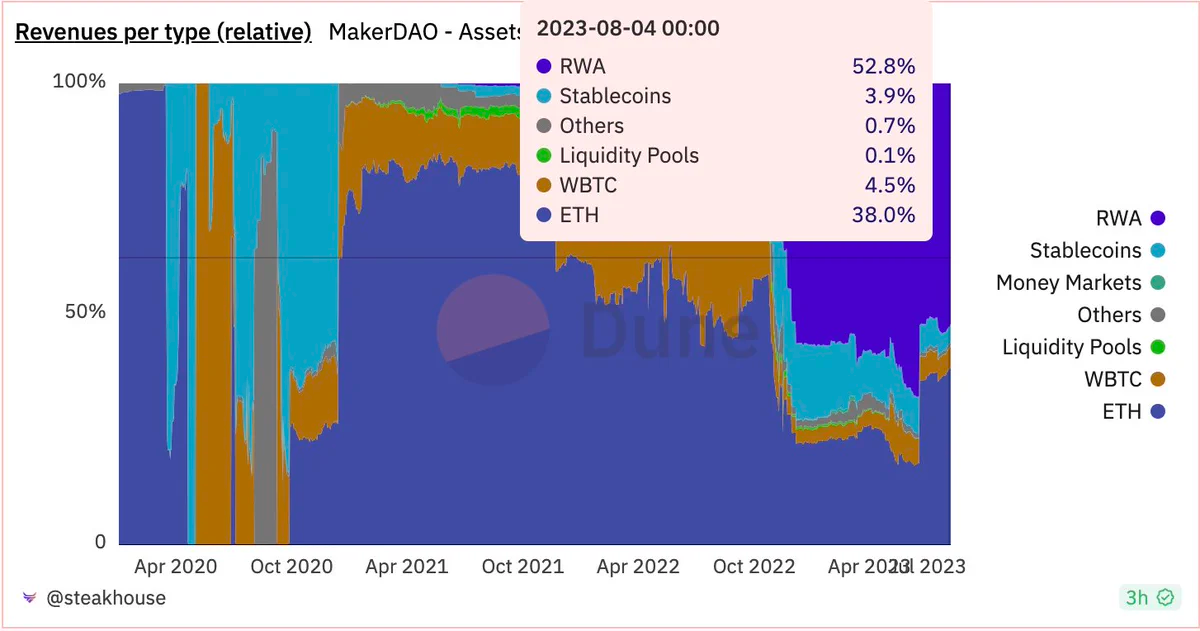

These income-generating RWA assets have significantly boosted MakerDAO’s earnings. Currently, more than half of MakerDAO’s revenue comes from interest-bearing RWA assets, most of which are U.S. Treasuries offering a near 5% risk-free yield. However, this income flows directly to MakerDAO—not to DAI holders.

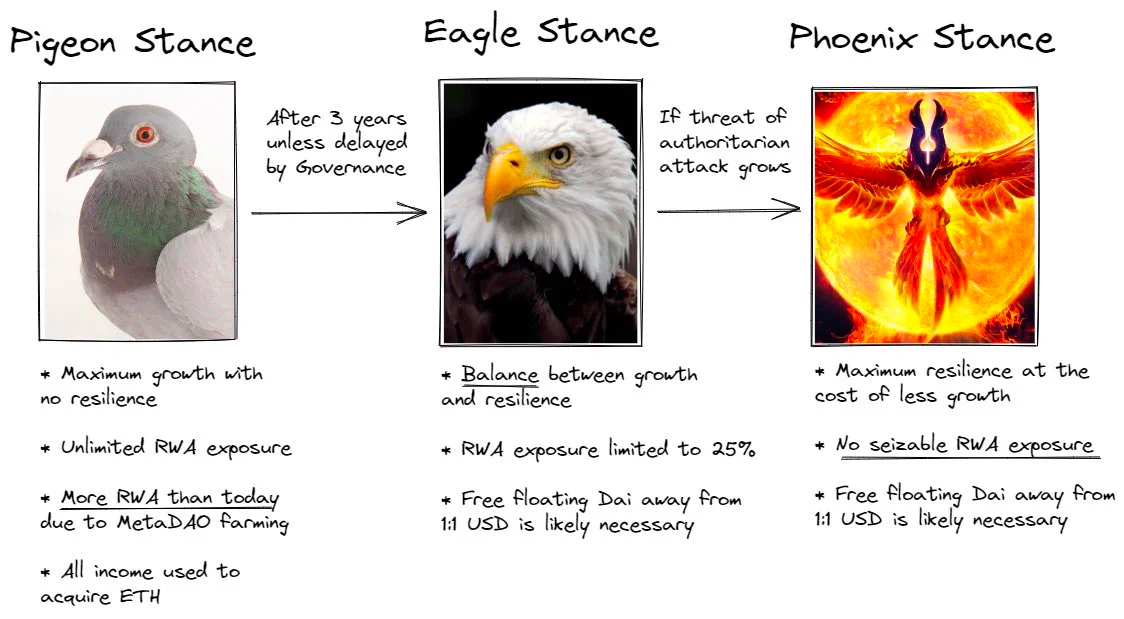

Now the source of the 8% yield becomes clear: MakerDAO earns substantial profits from interest-bearing RWA assets and uses part of those profits to fund the 8% interest payments. But why do this? According to MakerDAO founder Rune, setting the yield at 8% aims to increase demand for DAI and the Dai Savings Rate (DSR), ensuring a growing user base that participates in SubDAOs and other components of the Endgame vision.

Simply put, increasing DAI demand leads to more DAI minted → more collateral → more funds to purchase income-generating RWA assets → higher returns. On the other hand, this strategy accelerates progress toward the Endgame plan—a vision for MakerDAO to achieve full decentralization.

Is this 8% yield sustainable?

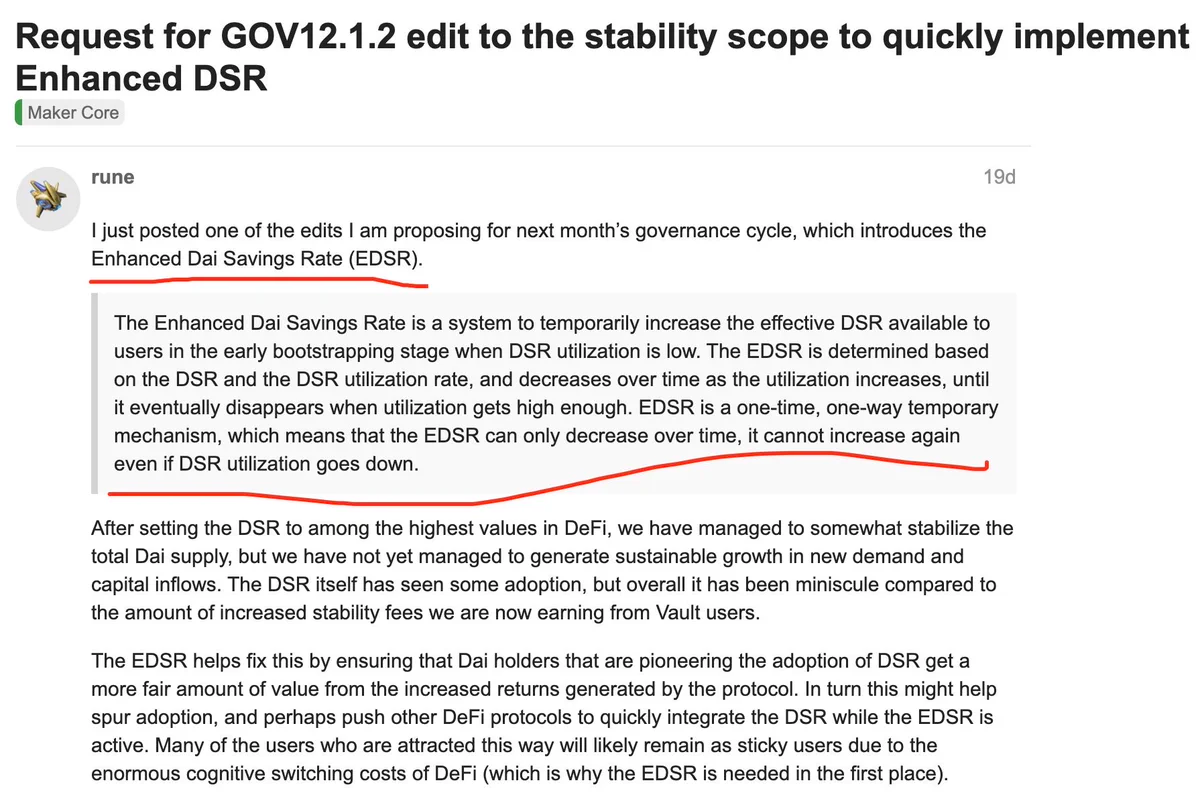

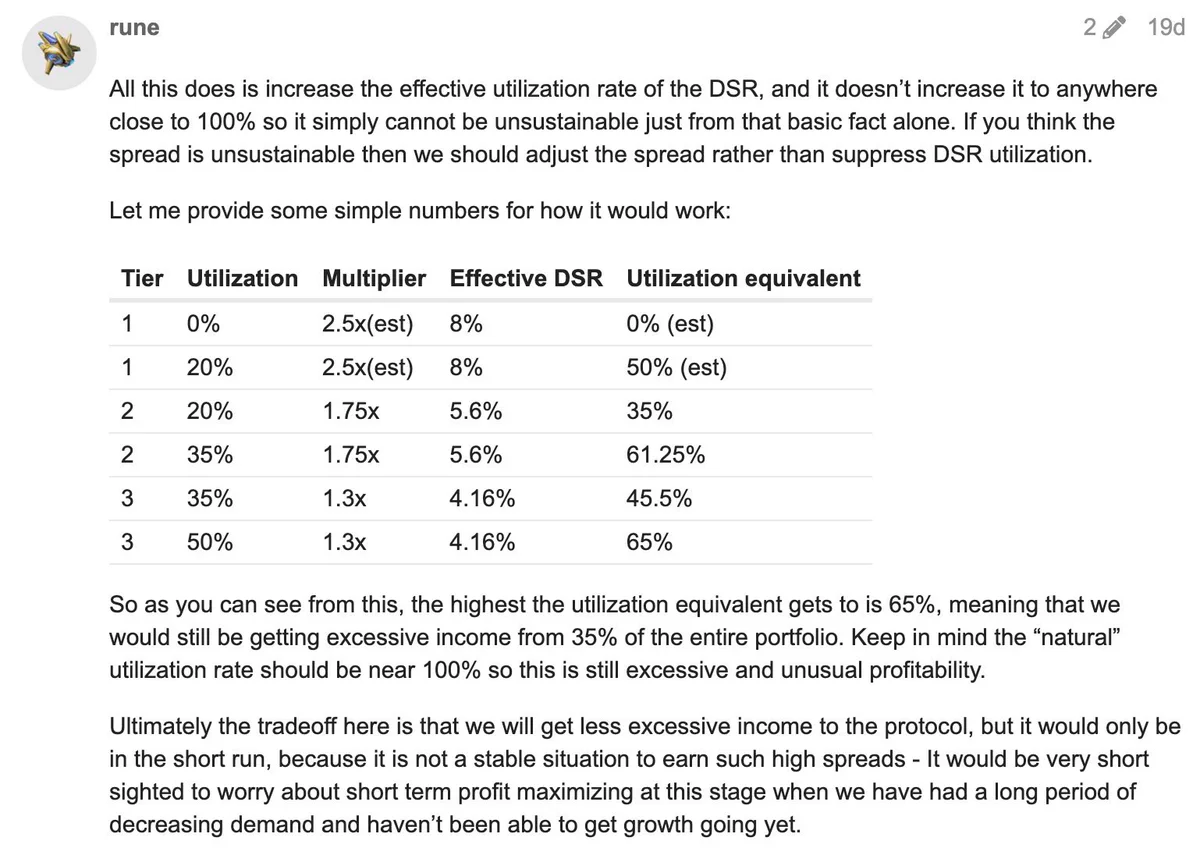

Short answer: No, it is not sustainable. The current 8% rate is essentially a one-time “promotional campaign.” As discussed in the proposal to raise the DSR rate, Rune introduced a new mechanism: the Enhanced Dai Savings Rate (EDSR)—a temporary measure designed to boost the effective DSR during the early stages when DSR utilization is low.

In plain terms: Few people are using DSR to earn interest early on, so offer a temporary high rate to attract users. The EDSR adjusts based on DSR utilization and gradually decreases as usage increases, eventually disappearing once utilization reaches a sufficient level. EDSR is a one-time, unidirectional, temporary mechanism—meaning it can only decrease over time and cannot be reinstated even if DSR utilization drops later.

In other words, this 8% rate is a one-way, one-time “promotion.” As more DAI is deposited into DSR and a certain threshold is reached, the rate will irreversibly decline. According to Rune, once DSR utilization hits 50%, the excess rate will vanish—and MakerDAO will never operate at a loss. Put simply, MakerDAO is sharing part of its protocol revenue with DAI holders.

To summarize: MakerDAO spent heavily to acquire RWA assets and generate strong returns. It then raised the interest rate to 8%, redistributing part of its profits to DAI holders to boost DAI demand and user engagement. Once enough users start earning interest, the rate will drop back to normal levels—permanently.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News