Sharp Critique of DAI's 8% Deposit APY: The Overt Strategy of Stability and the Twilight of USDC

TechFlow Selected TechFlow Selected

Sharp Critique of DAI's 8% Deposit APY: The Overt Strategy of Stability and the Twilight of USDC

Adopting higher real yields, maximizing capital efficiency, and separating interest-bearing from transactional functions will be an inevitable path for on-chain stablecoins.

Author: Loki, Xinhuo Technology

Editor: Linke, Geek Web3

Introduction: Loki believes that MakerDAO's adjustment of Spark Protocol's DAI deposit APY (DSR) to 8% is essentially compensating users for the opportunity cost of holding ETH and traditional assets like USDC, while emerging stablecoins such as eUSD and DAI will continue to encroach on market share from established stablecoins like USDC through high interest rates. Meanwhile, the income-generating and circulation functions of DAI can be separated to improve capital efficiency within MakerDAO’s DSR.

1. Starting with DAI's Growth

First question: Why is MakerDAO offering an 8% high yield on DAI? The answer is clear—Maker aims to share its revenue by actively creating arbitrage opportunities for users/markets, using subsidies to drive DAI scale expansion.

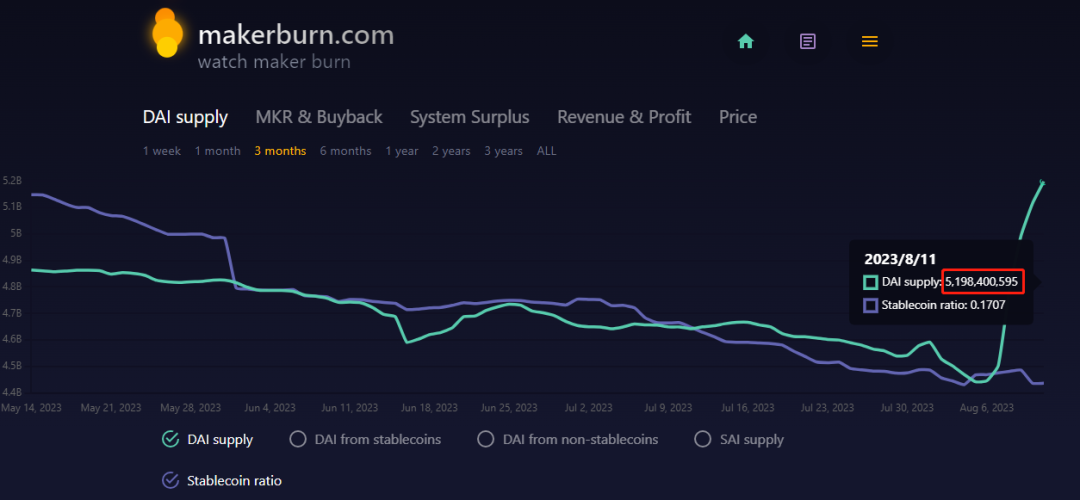

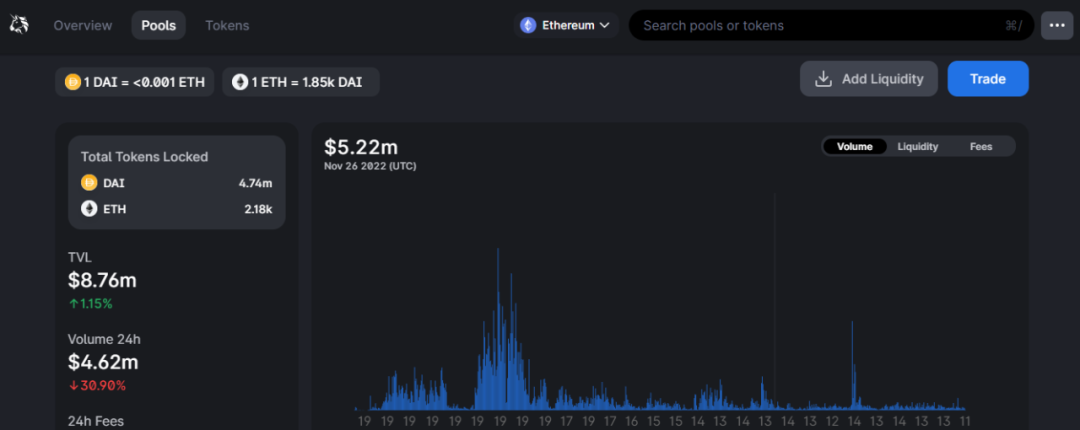

According to MakerBurn data, DAI supply increased from $4.4 billion to $5.2 billion over the past four days. Clearly, this growth was directly driven by DAI’s 8% high interest rate.

This new demand manifests in two ways:

1) Re-staking LSDs. Since DSR offers a high APY of 8% on DAI, while minting DAI with wstETH yields only 3.19%, an arbitrage opportunity emerges. If someone stakes ETH and then uses wstETH as collateral to mint DAI, depositing it into Spark DSR, assuming $200 worth of ETH mints $100 DAI, the resulting yield would be:

3.7% + (8% - 3.19%) / 200% = 6.18%

This clearly outperforms direct staking or other low-risk, single-asset, liquid alternatives available on the market. Therefore, stETH holders are incentivized to exploit this arbitrage, driving up DAI circulation.

2) Exchanging other stablecoins for DAI. How can players without ETH or stETH participate? Simple—swap USDT/USDC for DAI and deposit into DSR. After all, 8% is attractive both on-chain and off-chain. This growing demand requires more DAI issuance, indirectly boosting DAI circulation.

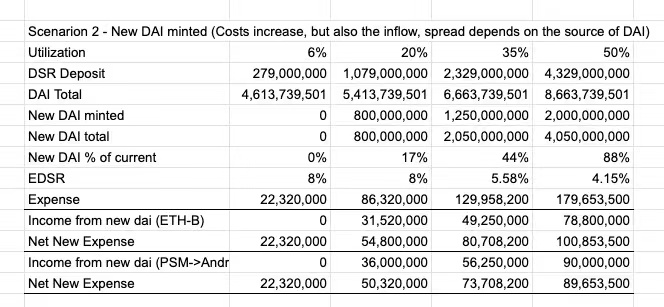

As DAI grows, EDSR (Enhanced DAI Savings Rate) estimates show a net increase of $90M in "Income from new DAI."

This means as DAI circulation expands, the protocol accumulates more USDC, which can then be exchanged for USD to purchase additional RWA assets and generate more real yield, creating a flywheel effect.

2. Where Does Arbitrage End?

The second question: where does DAI growth end? Answer: when arbitrage opportunities shrink sufficiently. To understand this, one must recognize that the EDSR (Enhanced DAI Savings Rate) mechanism fundamentally creates deliberate arbitrage opportunities for users.

For stETH/rETH stakers, these tokens have limited utility beyond serving as collateral to mint DAI. As long as EDSR rates exceed the cost of minting DAI, profit remains possible.

USDT/USDC users face a more complex situation. Unlike ETH-based assets, USDC/USDT don’t require collateralization—they can be directly swapped for DAI on DEXs. From a user perspective, holding USDC on AAVE might yield ~2%, whereas converting to DAI and depositing into DSR yields 8%—a compelling incentive. Thus, continuous conversion is expected.

Here arises a key point: if Maker continues converting deposited USDT/USDC into RWAs (while maintaining stable DSR rates), DSR returns should have a floor above the on-chain risk-free yields of USDC/USDT. This implies this type of arbitrage could persist for a long time, allowing DAI to steadily absorb USDT/USDC market share.

3. Common Ground Between RWA Yields and On-Chain Staking Stablecoins: Eroding Traditional Stablecoins

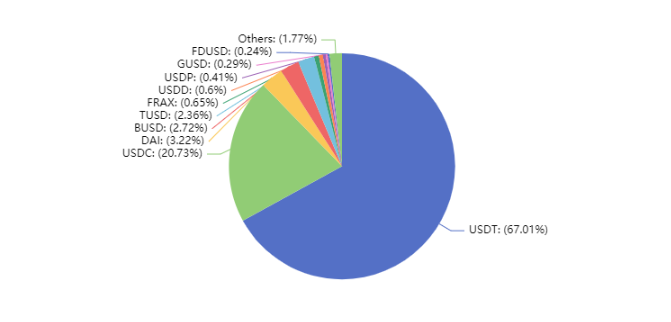

Of course, DAI’s path to overtaking Tether/Circle may not be smooth—DAI has its own shortcomings (e.g., RWA security concerns) and currently lags in scale. But remember, DAI isn’t the only player trying to capture USDT/USDC market share. Beyond DAI, there are crvUSD, GHO, eUSD, Frax, and even Huobi and Bybit launching their own RWA-backed assets.

A factional divide among stablecoins emerges: where does underlying yield come from?

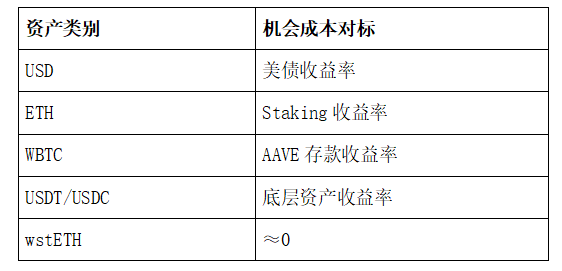

One camp, exemplified by Huobi/Bybit, derives yield entirely from RWA returns—essentially returning profits previously captured by Tether/Circle back to users. The other includes purely on-chain staking stablecoins like crvUSD and eUSD, whose yields originate from staking rewards of collateral across protocols (and may expand to other use cases like debt notes as collateral). DAI blends both models.

Yet all paths lead to the same destination—reducing opportunity cost, or rather, compensating users for their forgone returns (for example, holding USDC means users surrender yield to Circle, who invests in Treasuries and similar instruments).

If you mint DAI with wstETH, you still earn staking rewards—you don't sacrifice any of your rightful APY. If you mint eUSD with ETH, Lybra charges a small fee, but most of the staking APY stays with you. But when you buy USDT/USDC with USD, the 4%-5% RWA yield goes to Tether/Circle.

Tether reported a net profit of $1.48 billion in Q1 2023 alone. If DAI fully replaced Tether/Circle, it could bring $5–10 billion in real annual income to the crypto market. We often criticize crypto for lacking real yield opportunities, yet overlook the biggest one—the simplest: return the yield, the opportunity cost, back to currency holders. (For instance, Spark offers up to 8% DAI deposit rates, effectively returning to users the opportunity cost they bear due to inflation.)

In my view, whether embracing RWA or decoupling from it, staying decentralized or complying with regulations—different approaches may coexist, but the trend toward eroding centralized stablecoin market share is clear. As long as Spark or Lybra maintain their APY advantage, USDC/USDT market share will keep shrinking. In this regard, algorithmic stablecoins backed by RWA collateral and those backed by native on-chain assets share common ground.

4. A More Efficient Future: Separating Yield and Circulation

Spark DSR in MakerDAO also faces an issue: depositing into DSR means exiting circulation; thus, growth in circulation doesn’t truly benefit real-world usage but becomes a game of financial recycling. So we must ask: is there a better solution? My answer: separate yield generation from circulation.

Implementation ideas:

(1) Detaching DAI’s Yield Function

Currently, when DAI is deposited into Spark, it becomes sDAI, with DSR earnings accumulating on sDAI. For example, depositing 100 DAI initially gives you 100 sDAI. Over time, as DSR accrues, redeeming your 100 sDAI later may give you 101 DAI—the extra 1 DAI being your yield.

The flaw is obvious: earning yield and enabling circulation present a trade-off. Once DAI enters DSR, it loses liquidity—this becomes a financial loop with no productive output.

Suppose instead users don’t deposit directly into Spark, but first go through another protocol (call it Xpark). Users deposit DAI into Xpark, which then deposits all DAI into Spark to earn yield. Xpark issues xDAI to users. Xpark maintains a strict 1:1 redeemability between xDAI and DAI. However, DSR yield is distributed only based on actual DAI deposits—holders of xDAI receive no yield.

The benefit? xDAI can circulate freely—as transaction medium, margin, payment method, or LP token on DEXs. Since xDAI is fully backed and redeemable for DAI, treating it as equivalent to $1 poses no issue. (Ideally, xDAI would be issued by Spark or MakerDAO itself.)

A potential concern: if xDAI adoption is too low, can it gain enough trust as a circulating asset? There’s a solution: in DEX scenarios, virtual liquidity pools (or superfluid staking) can be used:

1) The protocol forms a pool with $1M ETH and $1M DAI, where 80% of DAI is deposited into DSR, and 20% DAI paired with ETH for liquidity

2) Users swap against the remaining 20% liquidity; if DAI ratio deviates beyond thresholds (e.g., 15%/25%), the LP rebalances by withdrawing from or depositing into DSR.

3) Assuming normal trading fees yield 10% APY for LPs and DSR yields 5%, using virtual liquidity pools allows LPs to achieve:

10% + 50% × 80% × 5% = 12% APY, achieving a 20% improvement in capital efficiency.

(2) A More Radical Separation

Imagine a scenario: a stablecoin’s collateral includes Treasury RWAs, ETH, WBTC, USDC, and USDT. The optimal way to maximize APY is to let RWAs earn dollar yields, ETH earn staking rewards, WBTC earn AAVE lending yields, and USDT-USDC earn Curve LP fees—in short, maximize yield across all collateral types.

Based on this, suppose a stablecoin called XUSD is issued. XUSD itself cannot earn yield; all collateral-generated returns are distributed to XUSD minters according to minted amount and collateral type. This differs from the earlier Xpark concept by separating yield and circulation functions from inception, maximizing capital utilization from day one.

Certainly, the vision of XUSD seems distant—even xDAI doesn’t exist yet—but the emergence of a tradable DAI DSR receipt is inevitable. If MakerDAO/Spark doesn’t build it, third parties surely will. Meanwhile, Lybra v2 plans exactly this complete separation: peUSD as the circulating currency, and redeemed eUSD as the yield-bearing asset.

In summary, while xDAI or XUSD may seem far off, incorporating higher real yields, maximizing capital efficiency, and separating yield from circulation will become essential for on-chain stablecoins—and along this path, the twilight of USDC-like giants looms faintly ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News