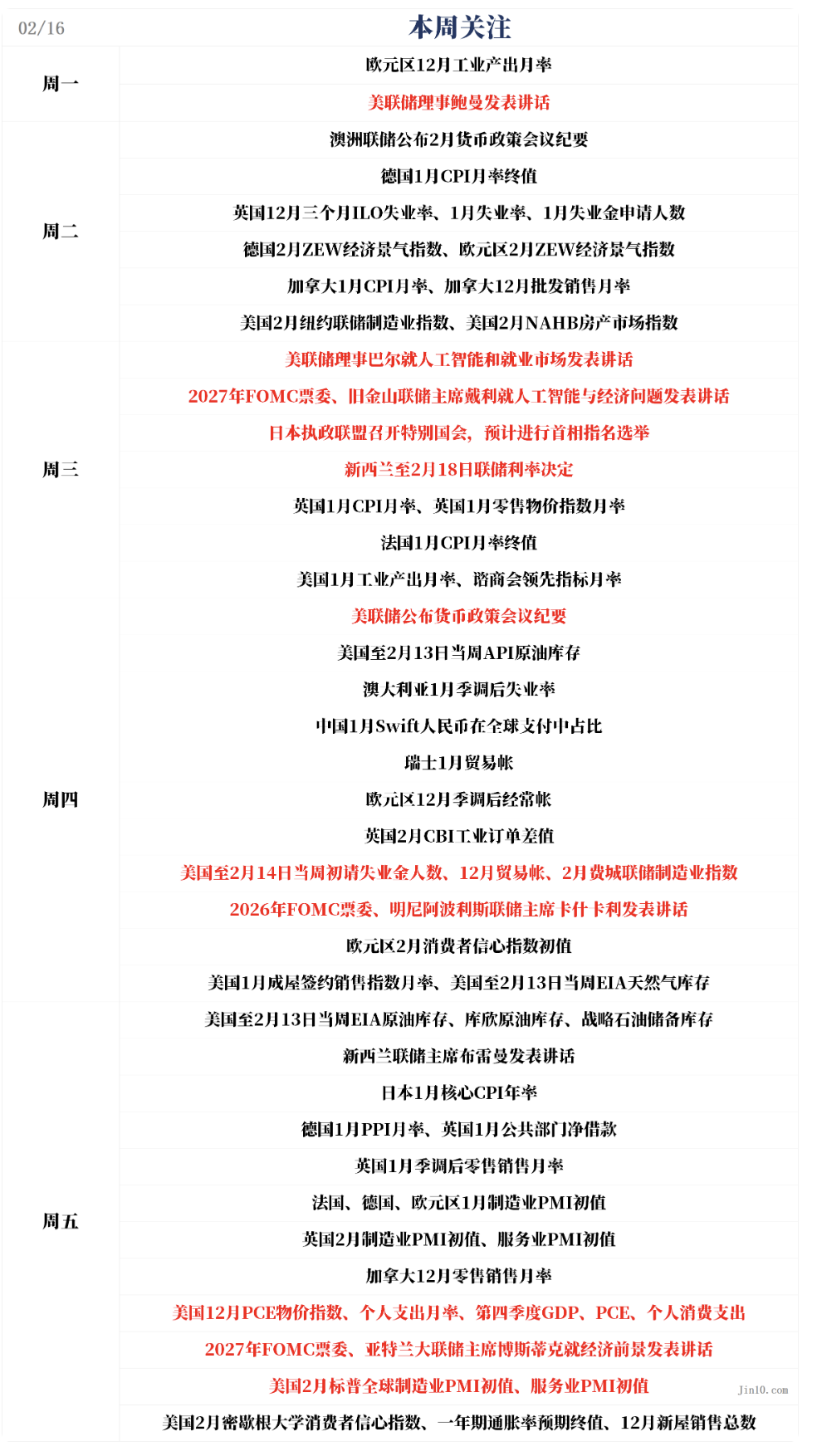

TechFlow News: On February 15, according to JIN10, global markets are set to enter a “data-heavy” week next week. The U.S. Federal Reserve will release the minutes of its January monetary policy meeting on Thursday at 03:00 UTC, offering further clues about its interest rate cut path for 2026. On Friday at 21:30 UTC, the advance estimate of U.S. Q4 GDP and the core Personal Consumption Expenditures (PCE) price index—the Fed’s preferred inflation gauge—will be published. A higher-than-expected PCE reading could influence the pace of policy easing this year.

On the central bank front, multiple Fed officials will deliver speeches in quick succession; the Reserve Bank of Australia (RBA) will publish its meeting minutes; and the Reserve Bank of New Zealand (RBNZ) will announce its interest rate decision. Markets broadly expect the RBNZ to hold rates steady, while the RBA may emphasize upside risks to inflation.

In terms of asset performance, spot gold has remained range-bound near elevated levels, rallying after a sharp intra-week pullback to close higher for the week. Crude oil prices surged then retreated, amid reports that OPEC+ may resume output increases as early as April. The U.S. dollar’s trajectory remains a key variable: if it fails to reach new lows, it may retain relative strength ahead of upcoming tariff rulings. Meanwhile, demand for U.S. Treasuries is rising, potentially triggering a fresh wave of asset reallocation.

On the major events front, the Supreme Court of the United States will issue opinions on February 20, including a ruling on the case concerning former President Trump’s “Liberation Day” tariff policy. An adverse ruling could significantly impact related tariff measures and ripple across global trade and market sentiment.

At the corporate level, earnings season is nearing its conclusion. Walmart will report its fiscal Q4 results, with markets closely watching key metrics—including e-commerce growth, AI adoption, and tariff-related impacts. Its forward guidance could significantly influence retail sector sentiment and broader market outlooks.