Before Bottom-Fishing, Understand the Market’s Two Types of Drawdowns

TechFlow Selected TechFlow Selected

Before Bottom-Fishing, Understand the Market’s Two Types of Drawdowns

As AI impacts software stocks, investors must determine whether this is temporary market panic or a genuine erosion of moats.

Author: Todd Wenning

Translated and edited by TechFlow

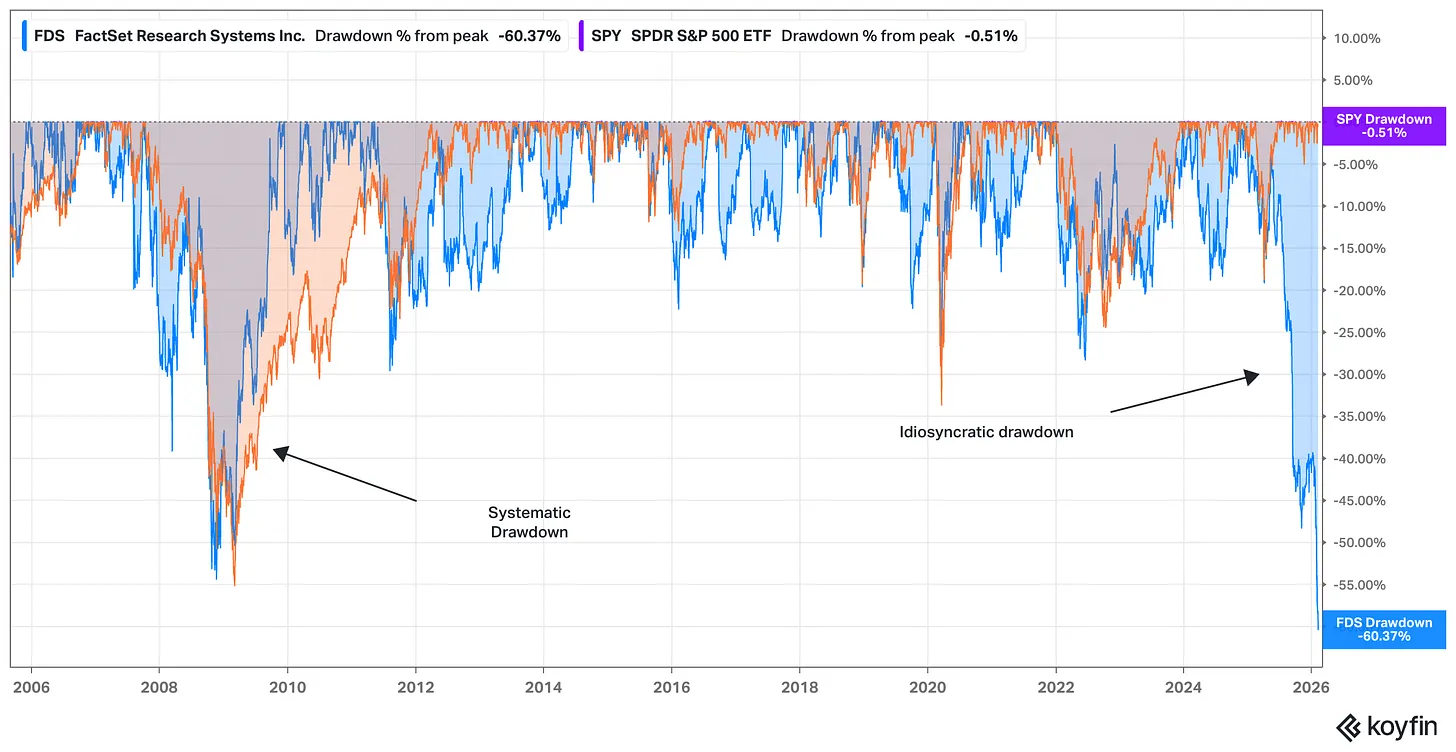

TechFlow Intro: Academic finance theory divides risk into systematic risk and idiosyncratic risk. Likewise, stock drawdowns fall into two categories: market-driven systematic drawdowns (e.g., the 2008 financial crisis) and company-specific idiosyncratic drawdowns (e.g., the current software-stock crash triggered by AI-related concerns).

Todd Wenning uses FactSet as an example to illustrate: During systematic drawdowns, you can leverage a behavioral edge—patience while waiting for markets to recover. But during idiosyncratic drawdowns, you need an analytical edge—to envision the company’s prospects ten years ahead more accurately than the market does.

In today’s AI-driven software-stock selloff, investors must ask: Is this merely temporary market panic—or is the moat genuinely eroding?

Don’t apply blunt behavioral solutions to problems that demand nuanced analysis.

Full text below:

Academic finance theory identifies two types of risk: systematic and idiosyncratic.

- Systematic risk is unavoidable market risk. It cannot be diversified away, and it is the only type of risk for which you are compensated.

- Idiosyncratic risk, on the other hand, is company-specific. Because you can cheaply construct a diversified portfolio of uncorrelated businesses, you are not compensated for bearing this type of risk.

We can revisit modern portfolio theory another day—but the systematic-idiosyncratic framework is highly useful for understanding different types of drawdowns (i.e., the percentage decline from an investment’s peak to its trough) and how we, as investors, should assess opportunities.

From the moment we pick up our first value-investing book, we’re taught to take advantage of Mr. Market’s despair during stock sell-offs. If we remain calm when he loses his senses, we prove ourselves resilient value investors.

Yet not all drawdowns are alike. Some are market-driven (systematic), while others are company-specific (idiosyncratic). Before acting, you need to know which type you’re observing.

Generated by Gemini

The recent software-stock selloff driven by AI concerns illustrates this point. Consider the 20-year drawdown history of FactSet (FDS, blue) versus the S&P 500 (measured via the SPY ETF, orange).

Source: Koyfin, as of February 12, 2026

FactSet’s drawdown during the financial crisis was primarily systematic. In 2008/09, the entire market worried about the financial system’s durability—and FactSet wasn’t immune to those concerns, especially given its customer base of financial professionals.

At that time, the stock’s drawdown had little to do with FactSet’s economic moat—and far more to do with whether that moat would even matter if the financial system collapsed.

FactSet’s drawdown in 2025/26 is the opposite case. Here, concerns center almost entirely on FactSet’s moat and growth potential—and on broader fears that accelerating AI capabilities will disrupt pricing power across the software industry.

In systematic drawdowns, time-arbitrage bets become more justifiable. History shows markets tend to rebound—and companies with intact moats may even emerge stronger. So if you’re willing and able to stay patient while others panic, you can capitalize on your strong stomach to exploit a behavioral edge.

Photo by Walker Fenton on Unsplash

In contrast, during idiosyncratic drawdowns, the market tells you something is fundamentally wrong with the business itself—specifically, that its terminal value is growing increasingly uncertain.

Therefore, if you wish to capitalize on an idiosyncratic drawdown, you need not only a behavioral edge but also an analytical edge.

To succeed, you must hold a more accurate vision of what the company will look like ten years from now than the current market price implies.

Even if you know a company well, achieving this is no easy feat. Stocks rarely decline 50% relative to the market without cause. Such steep drops typically require many formerly stable holders—even some investors you respect for their deep research—to capitulate.

If you intend to step in as a buyer during an idiosyncratic drawdown, you must have an answer explaining why these previously informed and thoughtful investors were wrong to sell—and why your vision is right.

There’s a fine line between conviction and arrogance.

Whether you’re holding a stock in drawdown or considering initiating a new position within one, it’s vital to understand the nature of the bet you’re making.

Idiosyncratic drawdowns may tempt value investors to start hunting for opportunities. Before taking the plunge, ensure you’re not applying a blunt behavioral solution to a problem demanding careful, nuanced analysis.

Stay patient. Stay focused.

Todd

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News