Forbes Editorial Department: The Most Accurate Short Signal in the Crypto World?

TechFlow Selected TechFlow Selected

Forbes Editorial Department: The Most Accurate Short Signal in the Crypto World?

The cover is not the cause of the curse; it is a symptom of the bubble.

Author: Kuli, TechFlow

Bitcoin recently surged to $60,000—its highest level since the FTX collapse—and also posted its largest single-day drop since that event.

Michael Saylor’s company Strategy (formerly MicroStrategy) holds 713,000 BTC, with an average purchase price of $76,052. As of last night, its unrealized loss stood at $6.5 billion. Its stock price has plunged from a peak of $457 last year to just $110—a decline exceeding 75%.

Yet one year ago, Saylor graced the cover of Forbes magazine—the headline proclaimed:

The Bitcoin Alchemist. At the time, bitcoin traded near $104,000 and Saylor’s net worth totaled $9.4 billion.

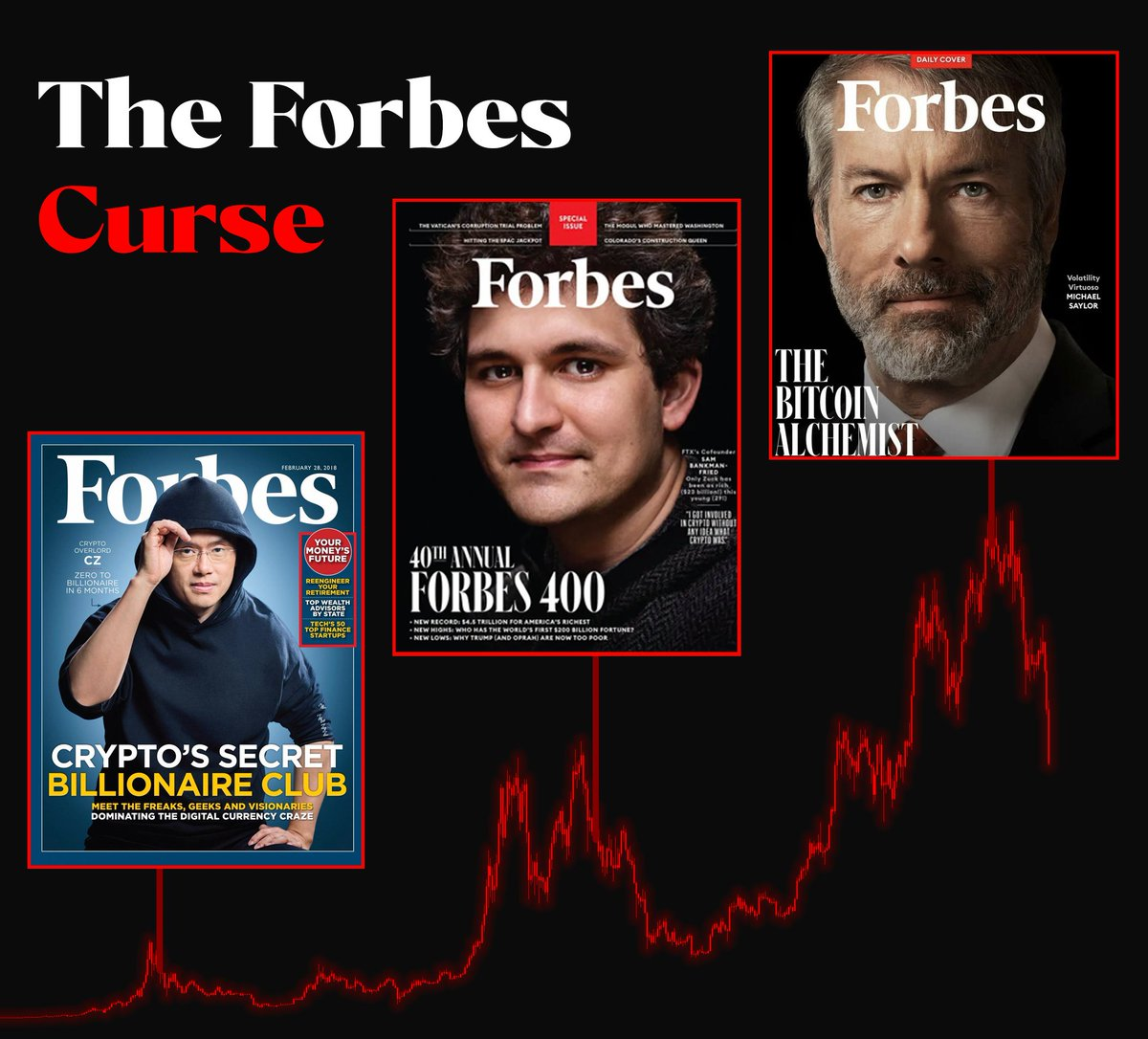

Now, a meme image circulating on X (formerly Twitter) juxtaposes three consecutive Forbes covers—each featuring a prominent crypto figure—with bitcoin’s price chart beneath. Strikingly, each cover was published precisely at the onset of a major crash.

And these three individuals? One has served prison time, one is currently incarcerated, and the third has just lost $6.5 billion.

Covers, Captured Amidst the Roar

The first crypto figure to land a Forbes cover was CZ.

In February 2018, Forbes ran a cover story titled “Crypto’s Secret Billionaire Club,” with CZ front and center—wearing a hoodie, exuding streetwise charisma. The subheading read:

From zero to billionaire in just six months.

At that time, bitcoin had just fallen from its late-2017 peak near $20,000 and was trading around $7,600. Forbes estimated CZ’s net worth at no less than $1.1 billion. Binance, launched only six months earlier, was already the world’s largest exchange by trading volume.

After the cover dropped, bitcoin briefly rebounded to $10,000—then stalled.

By December 2018, bitcoin had crashed to $3,156. From the day the issue hit newsstands, the decline was:

58%.

CZ’s subsequent journey is well known: In Forbes’ 2025 World’s Billionaires List, his net worth stands at $62.9 billion—the highest among all crypto executives.

Yet he hasn’t appeared on another Forbes cover since.

The second crypto figure to make the Forbes cover was Sam Bankman-Fried (SBF).

In October 2021, Forbes released its 40th annual Forbes 400 list—and SBF was the cover subject. Not yet 30, he boasted a $26.5 billion fortune, ranking as the 41st-richest person in the U.S.

On the cover, he wore his signature gray T-shirt and sported curly hair—resembling a college student who’d just pulled an all-nighter playing League of Legends.

That issue’s tone now reads surreal in hindsight. Forbes dubbed him “the most powerful person in crypto,” praising his dual role building an exchange while donating generously to charity—“a fusion of Wall Street and Silicon Valley.”

When the issue went live, bitcoin hovered near $60,000—just shy of its then-all-time high of $69,000.

Thirteen months later, FTX collapsed.

SBF had misappropriated over $8 billion in customer funds to cover losses at his other firm, Alameda Research. In November 2022, a wave of user withdrawals overwhelmed FTX, which failed to meet redemptions—and within a week, the world’s third-largest exchange filed for bankruptcy. Bitcoin plummeted from $20,000 to $16,000.

SBF was ultimately arrested at his luxury penthouse in the Bahamas.

Convicted on all seven criminal charges, he received a 25-year sentence. Forbes later created a special “30 Under 30 Hall of Shame”—with SBF prominently featured.

From cover to handcuffs:

13 months.

The third figure is Michael Saylor.

On January 30, 2025, Forbes ran a cover story titled “The Bitcoin Alchemist.” Bitcoin had just broken above $100,000, and Saylor’s net worth had soared from $1.9 billion the prior year to $9.4 billion—a nearly fivefold increase. His firm, MicroStrategy, saw its stock surge 700% over the year and had just been added to the Nasdaq-100 Index.

The Forbes article included a telling detail:

On New Year’s Eve, Saylor hosted a 500-person party at his Miami estate. Dancers waved orange LED orbs shaped like bitcoin logos; outside, a 154-foot yacht named Usher ferried institutional investors and crypto heavyweights to the event.

At the time, Saylor told Forbes:

“We’ve installed a crypto reactor at the center of our company—to suck in capital and spin it. Volatility drives everything.” This statement was sincere. Saylor’s alchemy boiled down to one tactic: issuing debt to buy bitcoin.

When the Forbes cover launched, bitcoin traded at $104,000. Six days after one full year later, it stands at $63,000—a decline of:

40%.

During a recent earnings call, Saylor described Strategy as having built a “digital fortress.”

The last crypto executive to dub his own company a “fortress” was SBF—in June 2022. Five months later, FTX collapsed.

Covers: Both Tribute and Curse

Wall Street has long recognized the “magazine cover indicator”: When a trend lands on the cover of a mainstream publication, that trend is often nearing its peak.

The logic is simple: Forbes editors aren’t prophets. Like retail investors, they notice a story only when it reaches maximum hype.

The moment a magazine deems “someone in this industry worthy of a cover” is almost always the precise moment market euphoria hits its zenith.

A cover isn’t the curse—it’s a symptom of the bubble.

Still, there was one brief exception.

In March last year, Justin Sun appeared on the Forbes cover under the headline “The Crypto Billionaire Who Helped the Trump Family Earn $400 Million.”

When the issue launched, bitcoin traded at $87,000—and instead of collapsing, it rallied further, reaching a new all-time high of $126,000 by October.

Did the curse fail?

Not quite. Sun’s cover came just two months after Saylor’s—January, then March. The fact that crypto figures were appearing back-to-back on mainstream magazine covers signaled that the entire industry’s narrative had become so overheated that even Forbes’ editors felt one issue wasn’t enough.

When covers start clustering, it’s worth reflecting: What might a bull-market top look like?

Forbes cover stories, taxi drivers chatting about crypto, relatives asking how to open an account… If two of these signs appear, it’s time to reevaluate your position size.

So the real question isn’t “How accurate is the Forbes cover?” but rather:

When everyone around you tells the same story—and that story is so compelling even non-crypto people have heard of it—and mainstream media begins canonizing industry figures…

Are you still buying—or are you already selling?

Bull markets don’t end in panic. They end on magazine covers.

True—but while the cover stars rotate, I’m always the one footing the bill during the long bear market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News