Decoding Strategy’s Latest Financial Report: After a $12.4 Billion Loss, How Long Can the Bitcoin Flywheel Keep Spinning?

TechFlow Selected TechFlow Selected

Decoding Strategy’s Latest Financial Report: After a $12.4 Billion Loss, How Long Can the Bitcoin Flywheel Keep Spinning?

When earnings reports become electrocardiograms of Bitcoin’s price, Strategy is not merely a company—it’s an experiment testing whether faith can overcome gravity.

Strategy is becoming the first publicly traded company in global capital markets whose survival hinges entirely on the price of a decentralized asset.

On February 5, the company reported a figure that would send any traditional enterprise into immediate collapse: a $12.4 billion net loss for the quarter.

Yet what truly matters is not the $12.4 billion itself—but what it reveals: Strategy is no longer a company that can be measured by “profit” or “loss.”

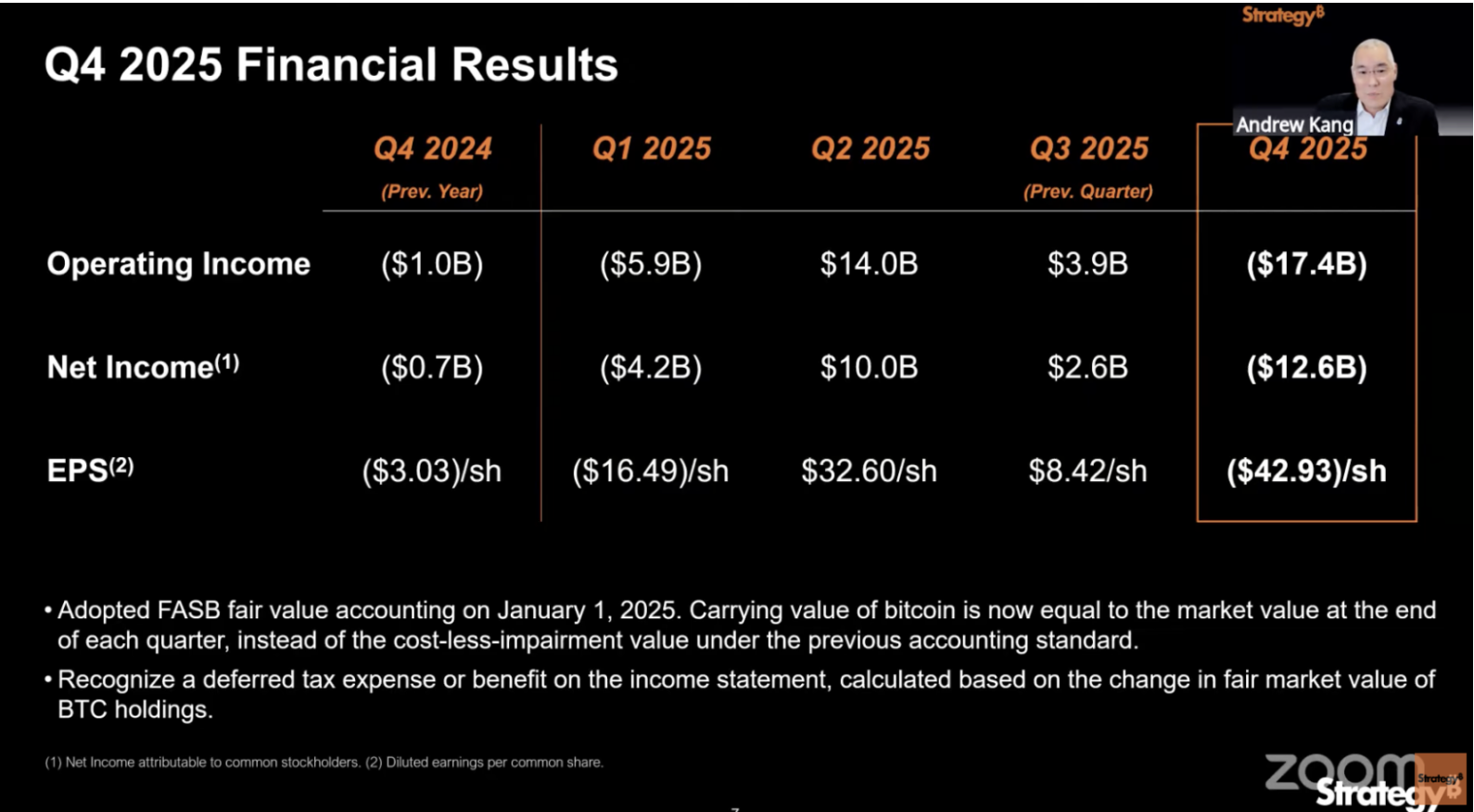

The earnings report shows an operating loss of $17.4 billion, with gross margin slipping from 71.7% year-on-year to 66.1%. Nearly all of this $17.4 billion operating loss stems from a single source: unrealized impairment losses triggered by Bitcoin’s price decline in Q4.

In plain terms: Bitcoin’s closing price on December 31 was lower than its closing price on September 30.

2025 marks the first full year Strategy applies fair value accounting—a rule under which every heartbeat of Bitcoin’s price directly flows onto the income statement. In Q3, Bitcoin rose, yielding $8.42 per share in profit—everyone celebrated. In Q4, Bitcoin fell, and losses flooded in.

Reading Strategy’s financial statements feels more like reviewing a quarterly health checkup for Bitcoin’s price—not an operational performance report for a business.

And therein lies the real problem.

Two Ledgers, Two 2025s

After reading Strategy’s Q4 earnings report, I realized there’s a fundamental reading barrier:

No matter which standard you apply, the numbers in its financial statements are inherently misleading.

First, consider the company’s own metric. Strategy invented a measure called “BTC Yield,” tracking how many Bitcoins each MSTR share represents—and how that number has grown.

For the full year 2025, BTC Yield stands at 22.8%—a seemingly impressive figure.

But this metric counts only Bitcoin quantity—not price. If the company raised equity when Bitcoin traded at $100,000 and bought coins at $80,000, BTC Yield remains positive—even though shareholders’ actual wealth has shrunk.

Similarly, the reported $8.9 billion “BTC USD gain” suffers from the same flaw.

This figure is calculated using Bitcoin’s year-end price of approximately $89,000. On the day the report was released, Bitcoin had already fallen below $65,000. That December 31 snapshot is now outdated—introducing material lag.

Now consider U.S. Generally Accepted Accounting Principles (GAAP)—the mandatory accounting framework for all U.S.-listed companies.

Under GAAP, Q4’s loss was $12.4 billion, and the full-year loss totaled $4.2 billion. The numbers are alarming—but equally unreliable.

2025 is Strategy’s first year applying fair value accounting to its Bitcoin holdings. Simply put: At each quarter-end, Bitcoin’s market price is observed. A rise is booked as profit; a fall, as loss—regardless of whether any coins were sold.

In Q3, Bitcoin rose to $114,000—generating massive paper gains. In Q4, it fell back to $89,000—triggering a $17.4 billion paper loss. Not a single dollar actually left the company.

So the true state of this report is this:

Strategy’s proprietary metrics ignore price risk, while GAAP’s massive losses exaggerate real danger. Once you grasp this, Strategy’s 2025 execution becomes clear.

It acquired roughly 225,000 Bitcoins over the year—holding 3.4% of global circulating supply. It launched five series of preferred stock products and held $2.3 billion in cash—the highest ever. As a capital-market maneuver, 2025 was textbook-perfect.

Yet all these achievements point to one outcome: Strategy is even more dependent on Bitcoin’s price trajectory than it was a year ago.

Thus, the more Strategy accomplished in 2025, the stronger Bitcoin’s rally must be in 2026 to justify it. Right now, however, Bitcoin’s persistent decline clearly falls short of Strategy’s expectations.

$25.3 Billion Spent on Bitcoin—Yet an $888 Million Annual Bill

In 2025, Strategy raised $25.3 billion—making it the largest equity issuer in the U.S. for the second consecutive year.

A company generating just $120 million in quarterly software revenue raised capital equivalent to over 200 times its software revenue. Almost all of it went straight into Bitcoin purchases.

How did it raise the money?

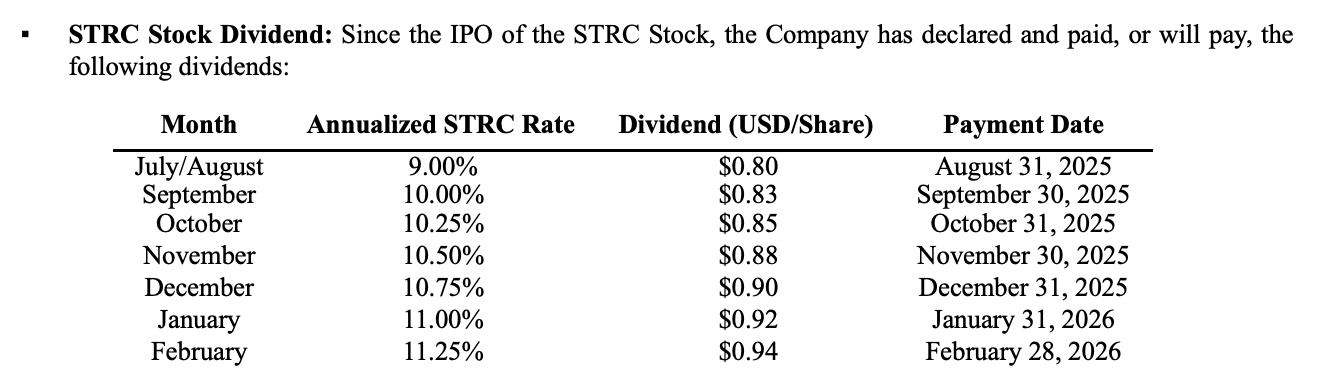

In the past, it was simple: issue shares for cash. In 2025, Strategy added a new step—launching five series of preferred stock products. These effectively repackage Bitcoin as fixed-income financial instruments, targeting institutional investors seeking stable returns.

Bitcoin itself yields no interest—but Strategy engineered a product line offering fixed yields ranging from 8% to 11.25%.

What’s the cost?

As of year-end, interest obligations from these preferred shares plus debt total approximately $888 million annually—fixed, non-negotiable expenses. Strategy’s full-year software revenue was $477 million—less than half the required outlay.

Management’s response? In Q4, it set aside a $2.25 billion cash reserve—claiming it covers two-and-a-half years of payments.

But this cash itself came from dilutive equity issuances at depressed prices. During the earnings call, Saylor admitted that several weeks of early-year share issuance actually reduced the number of Bitcoins per share—diluting shareholder holdings.

He stated he does not intend to repeat such actions—“unless it’s to defend the company’s credit.” And “defending credit” means paying that $888 million bill.

This is the core structural weakness of Strategy’s capital model:

Raising funds to buy Bitcoin requires maintaining a stock premium; maintaining that premium requires strong BTC Yield; and strong BTC Yield requires continuous Bitcoin purchases.

When Bitcoin rises, the cycle reinforces itself. When it falls, every link reverses. Now, an additional $888 million in fixed annual costs must be serviced—regardless of Bitcoin’s price movement.

$9 Billion in Unrealized Losses—Yet No Immediate Crisis

As of the February 5 earnings release, Bitcoin had fallen to ~$64,000. Strategy’s average acquisition cost stands at $76,052.

Its 713,502 Bitcoins cost $54.26 billion in total and have a current market value of ~$45.7 billion. This marks the first time since Strategy began buying Bitcoin in 2020 that its entire position carries an unrealized loss.

Just four months earlier, Bitcoin traded near its all-time high of ~$126,000—when this same holding generated over $30 billion in unrealized gains.

Still, unrealized losses do not equal crisis.

Strategy faces no forced liquidation mechanisms—unlike leveraged long positions wiped out on crypto exchanges. With $2.25 billion in cash on hand and $888 million in annual fixed costs, it can survive two-and-a-half to three years without raising new capital.

Yet “surviving without fundraising” is precisely the scenario Strategy can least afford.

As noted earlier, this machine runs only on continuous capital raises to buy Bitcoin. If that stops, BTC Yield drops to zero—and Strategy devolves into a passive Bitcoin fund with no management fee but burdened by high dividend obligations.

Passive funds don’t trade at premiums. Investors can simply buy spot ETFs—lower-fee, more transparent alternatives.

Hence, Strategy’s bankruptcy risk is far smaller than the risk of its “flywheel” stalling.

When could that flywheel be forced to stop? There’s a hard deadline.

Strategy holds ~$8.2 billion in convertible bonds, with a weighted average maturity of 4.4 years. The earliest put option window for investors opens in Q3 2027. If Bitcoin remains depressed then, bondholders may demand early redemption.

In the worst case, Strategy may need to sell large amounts of Bitcoin—or scramble for funds—at precisely the worst possible market moment.

That window is still about 18 months away.

Whether the $2.25 billion cash reserve lasts until then isn’t the question. The real question is: What happens after that—if Bitcoin hasn’t recovered above Strategy’s cost basis?

The Price of Faith

The previous section argued Strategy won’t die anytime soon. Yet markets clearly disagree.

MSTR has plunged from its November 2024 peak of $457 to ~$107 today—a drop exceeding 76%. Over the same period, Bitcoin fell from $126,000 to $65,000—a 48% decline.

MSTR’s share price decline is 1.6x Bitcoin’s—its premium evaporating rapidly.

Nonetheless, Saylor shows no signs of retrenchment.

On the earnings call, he acknowledged the cash reserve may be used to cover convertible bond redemptions and dividend payments—but reiterated there are no plans to sell Bitcoin.

As long as Bitcoin rises, this capital machine reinforces itself—even appearing perpetual. But if Bitcoin stagnates or declines long-term, Strategy will face capital markets’ most basic judgment for the first time:

Historically, no financial structure has ever defied gravity indefinitely through sheer force of will. Will Strategy be different?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News