Gold vs. Bitcoin: 12 Years of Data Reveal the True Winner

TechFlow Selected TechFlow Selected

Gold vs. Bitcoin: 12 Years of Data Reveal the True Winner

Gold prices surged and then plummeted; Bitcoin continues its downward spiral—how should retail investors allocate their assets? When viewed over a longer time horizon, the answer may differ from what you expect.

Authors: Viee, Amelia | Biteye Content Team

On January 29, 2026, gold plunged 3% in a single day—the largest drop in recent memory. Just days earlier, gold had broken above $5,600 per ounce, hitting a new all-time high; silver followed suit, surging well beyond JPMorgan’s mid-December 2025 forecast—despite the year having just begun.

In contrast, Bitcoin remained stuck in a weak, post-correction sideways trading range, further widening the performance gap between traditional precious metals and Bitcoin. Though often dubbed “digital gold,” Bitcoin appears far from stable—especially during periods traditionally favorable for gold and silver, such as inflationary spikes or geopolitical conflicts—when it behaves more like a risk asset, moving with shifts in risk sentiment. Why is that?

If we fail to grasp Bitcoin’s actual role within today’s market structure, we cannot make sound asset allocation decisions.

This article therefore attempts to answer the following questions from multiple angles:

Why didn’t Bitcoin rally alongside gold and silver?

Why has Bitcoin performed so weakly over the past year?

Historically, how has Bitcoin behaved when gold was rising?

And for ordinary investors, how should they navigate this increasingly bifurcated market environment?

I. A Cycle-Across Battle: Gold, Silver, and Bitcoin Over Ten Years

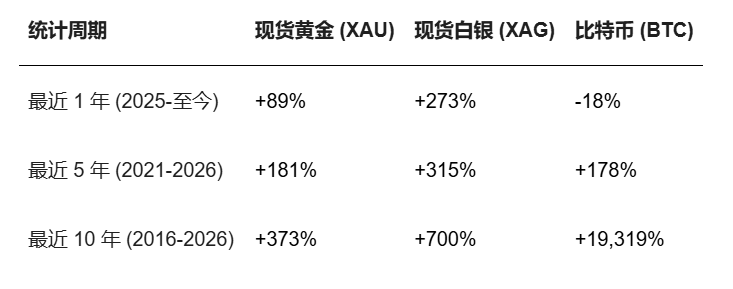

From a long-term perspective, Bitcoin remains one of the highest-returning assets. Yet over the past year, its performance has clearly lagged behind both gold and silver. The market trajectory from 2025 into early 2026 has exhibited an exceptionally sharp binary divergence: precious metals have entered what many call a “super cycle,” while Bitcoin has appeared comparatively lackluster. Below are comparative data across three key cycles:

Data Source: TradingView

This kind of divergence is nothing new. As early as Q1 2020, at the onset of the pandemic, gold and silver surged rapidly on safe-haven demand—while Bitcoin plummeted over 30% before rebounding. In 2017’s bull run, Bitcoin soared 1,359%, whereas gold rose only 7%; in the 2018 bear market, Bitcoin crashed 63% versus gold’s modest 5% decline; and in the 2022 bear market, Bitcoin fell 57% while gold edged up 1%. These patterns suggest Bitcoin’s price correlation with gold remains unstable—it sits at the intersection of traditional and new finance, possessing both tech-growth characteristics and sensitivity to liquidity conditions, making it fundamentally distinct from gold, the millennia-old ultimate safe haven.

So when we express surprise at “digital gold failing to rise while real gold explodes,” the real question is: Is Bitcoin genuinely perceived by the market as a safe-haven asset? Judging from current trading structures and dominant capital behavior, the answer may well be no. In the short term (1–2 years), gold and silver have indeed outperformed Bitcoin—but over the long term (10+ years), Bitcoin’s returns are 65 times higher than gold’s. Extending the timeframe, Bitcoin’s 213-fold return proves it may not be “digital gold,” but rather the most asymmetric investment opportunity of our era.

II. Root-Cause Analysis: Why Have Gold and Silver Outperformed BTC Recently?

The repeated record highs for gold and silver—and Bitcoin’s narrative stagnation—reflect more than just divergent price action. They signal a deeper structural rift in asset attributes, market perception, and macro logic. We can understand the watershed between “digital gold” and “traditional gold” through four lenses:

2.1 Central Banks Lead the Charge Amid a Crisis of Trust

In an era marked by strong expectations of currency depreciation, who keeps buying determines long-term price trajectories. From 2022 through 2024, central banks worldwide purchased gold aggressively for three consecutive years, net-buying over 1,000 tons annually. Whether emerging economies like China and Poland, or resource-rich nations like Kazakhstan and Brazil, all turned to gold as their core reserve asset to hedge against dollar risk. Crucially, central banks bought even more as prices rose—a “the higher the price, the more we buy” pattern revealing unwavering conviction in gold’s status as the ultimate reserve asset. Bitcoin lacks central bank recognition—a structural limitation: gold embodies a 5,000-year consensus, requiring no sovereign backing; Bitcoin depends on electricity, internet infrastructure, and private keys—making large-scale central bank adoption too risky.

2.2 Gold and Silver Return to “Physical-First” Principles

As global geopolitical tensions escalate and financial sanctions multiply, asset security hinges on whether holdings can be physically realized. After the U.S. inaugurated its new administration in 2025, policies including steep tariffs and export restrictions disrupted global markets—making gold the sole ultimate asset independent of foreign credit. Meanwhile, silver’s industrial value began to shine: expanding sectors—including clean energy, AI data centers, and photovoltaic manufacturing—boosted silver’s industrial demand, underpinned by genuine supply-demand imbalances. In this context, silver speculation and fundamentals converged, fueling stronger gains than gold.

2.3 Bitcoin’s Structural Dilemma: From “Safe-Haven Asset” to “Leveraged Tech Stock”

Bitcoin was once viewed as a hedge against central bank monetary debasement. But with ETF approvals and institutional entry, its funding structure underwent a fundamental shift. Wall Street institutions now include Bitcoin in portfolios primarily as a “high-beta risk asset.” Data confirms this: in H2 2025, Bitcoin’s correlation with U.S. tech stocks reached 0.8—the highest ever recorded—indicating Bitcoin increasingly behaves like a leveraged tech stock. When risks emerge, institutions prefer selling Bitcoin for cash—not buying it like gold. A telling example occurred on October 10, 2025: $19 billion in leveraged positions were liquidated in one fell swoop. Rather than exhibiting safe-haven properties, Bitcoin collapsed under its own high-leverage architecture.

2.4 Why Is Bitcoin Still Falling?

Beyond structural constraints, three deeper factors explain Bitcoin’s persistent weakness:

Truth #1: Crypto Ecosystem Stagnation—AI Is Stealing Its Thunder

Crypto ecosystem development has severely lagged. While AI attracts massive capital inflows, crypto “innovation” remains stuck in meme coin territory—lacking killer applications, real-world demand, and offering only speculation.

Truth #2: The Quantum Computing Shadow

The quantum computing threat is no fantasy. Although practical quantum decryption remains years away, the narrative alone deters some institutions. Google’s Willow chip has already demonstrated quantum advantage. While the Bitcoin community explores post-quantum signature schemes, upgrading requires broad consensus—slowing implementation, yet paradoxically enhancing network robustness.

Truth #3: Early Adopters Are Selling

Many original Bitcoin holders are exiting. They feel Bitcoin has “lost its soul”—evolving from a decentralized idealist currency into a Wall Street speculative instrument. Post-ETF approval, Bitcoin’s spiritual core seems gone. Institutional holdings—by MicroStrategy, BlackRock, Fidelity, etc.—have grown dramatically, shifting price determination from retail traders to institutional balance sheets. This is both a blessing (liquidity) and a curse (loss of original ethos).

III. Deep-Dive Analysis: Historical Correlation Between Bitcoin and Gold

Reviewing Bitcoin’s historical relationship with gold reveals extremely limited price correlation during major economic events—and frequent divergence. So why does the “digital gold” label persist? Perhaps not because Bitcoin truly resembles gold, but because markets need a familiar reference point.

First, Bitcoin–gold correlation was never rooted in shared safe-haven resonance.

In Bitcoin’s infancy—still confined to niche tech circles—its market cap and visibility were negligible. During Cyprus’ 2013 banking crisis, capital controls triggered a ~15% retreat in gold from its peak; simultaneously, Bitcoin surged past $1,000. Some interpreted this as capital flight and safe-haven inflows into Bitcoin. Yet in hindsight, the 2013 rally stemmed more from speculation and early euphoria—not broad acceptance of Bitcoin’s safe-haven status. That year, gold fell sharply while Bitcoin soared, yielding near-zero monthly return correlation (0.08).

Second, true synchronicity occurred only during liquidity-fueled booms.

Post-pandemic in 2020, central banks unleashed unprecedented monetary easing. Investor anxiety over fiat overprinting and inflation drove both gold and Bitcoin upward. Gold hit a then-record high above $2,000 in August 2020; Bitcoin breached $20,000 by year-end and accelerated to over $60,000 in 2021. Many argued Bitcoin was finally fulfilling its “inflation-hedge digital gold” role—benefiting alongside gold from global monetary expansion. Yet crucially, it was the loose liquidity environment—not intrinsic similarity—that nurtured both. Bitcoin’s volatility vastly exceeds gold’s (annualized 72% vs. 16%).

Third, Bitcoin–gold correlation remains chronically unstable—“digital gold” remains unproven.

Data shows Bitcoin–gold correlation fluctuates widely over time, remaining inherently unstable. Especially post-2020, although both sometimes rise together, correlation hasn’t meaningfully strengthened—and negative correlations frequently emerge. This confirms Bitcoin hasn’t solidified its role as “digital gold”; its price action is driven more by independent market logic.

Retrospective analysis reveals gold is a historically validated safe-haven asset, whereas Bitcoin functions more as an unconventional hedge—effective only under specific narratives. When crises strike, markets still prioritize certainty over speculative potential.

Data Source: Newhedge

IV. Bitcoin’s Essence: Not Digital Gold—But Digital Liquidity

Let’s reframe the question: What role *should* Bitcoin serve? Was it ever truly designed to become “digital gold”?

First, Bitcoin’s foundational attributes differ intrinsically from gold’s. Gold is physically scarce—requiring no network, no system, and functioning as a true “doomsday asset.” In a geopolitical crisis, gold enables immediate physical settlement—the ultimate safe haven. Bitcoin, by contrast, relies on electricity, internet connectivity, computational power, private-key ownership, and network functionality.

Second, Bitcoin’s market behavior increasingly mirrors a high-beta tech asset. It typically leads rallies during liquidity abundance and rising risk appetite—but faces institutional selling amid rising rates and heightened safe-haven sentiment. Markets currently view Bitcoin as still unproven as a safe-haven asset. It exhibits both high-growth/high-volatility ambition *and* uncertainty-resistance potential. This “risk–safe-haven ambiguity” may only resolve after more market cycles—and more crises. Until then, markets treat Bitcoin as a high-risk, high-return speculative asset—correlating its performance with tech stocks.

Perhaps only when Bitcoin demonstrates gold-like stability in preserving value will this perception shift. Yet Bitcoin won’t lose long-term value: it retains scarcity, global transferability, and decentralized institutional advantages. Today, however, its positioning is more complex—serving simultaneously as a pricing anchor, a tradable asset, and a speculative instrument.

Defining the Roles: Gold is an inflation-hedge safe-haven asset; Bitcoin is a higher-yield growth asset.

Gold suits preservation during economic uncertainty—low volatility (16%), small maximum drawdown (-18%)—acting as portfolio “ballast.” Bitcoin suits allocation during liquidity abundance and rising risk appetite—offering high annualized returns (60.6%), but with high volatility (72%) and extreme drawdown potential (-76%). This isn’t an either/or choice—it’s about strategic portfolio construction.

V. KOL Perspectives Summarized

Amid this macro re-pricing, gold and Bitcoin are assuming distinct roles. Gold serves as the “shield”—deflecting external shocks like war, inflation, and sovereign risk—while Bitcoin acts as the “spear,” capturing upside from technological transformation.

OKX CEO Star Xu (@star_okx) stresses that gold embodies legacy trust, whereas Bitcoin represents the new foundation of future trust. Choosing gold in 2026, he argues, is betting on a failing system. Bitget CEO @GracyBitget acknowledges inevitable market volatility but affirms Bitcoin’s unchanged long-term fundamentals—and maintains bullish conviction. KOL @KKaWSB cites Polymarket prediction data forecasting Bitcoin will outperform both gold and the S&P 500 in 2026, expecting value realization soon.

KOL @BeiDao_98 offers an intriguing technical perspective: Bitcoin’s RSI relative to gold has again dropped below 30—an historical signal consistently preceding Bitcoin bull markets. Veteran trader Vida (@Vida_BWE) analyzes short-term capital sentiment, noting that after gold and silver led explosive rallies, markets are urgently seeking the next “dollar-alternative asset.” He thus took a small BTC position, betting on FOMO-driven capital rotation over the coming weeks.

KOL @chengzi_95330 proposes a broader narrative arc: Traditional hard assets like gold and silver first absorb the credibility shock from currency devaluation; only after they fulfill this role does Bitcoin enter the spotlight. This “traditional-first, digital-second” sequence may well reflect the story unfolding in today’s market.

VI. Three Practical Recommendations for Retail Investors

Faced with Bitcoin’s underperformance versus gold and silver, retail investors commonly ask: “Which should I invest in?” There’s no universal answer—but here are three actionable recommendations:

Recommendation #1: Understand Each Asset’s Role—and Clarify Your Allocation Goal.

Gold and silver retain strong “hedging” properties amid macro uncertainty—ideal for defensive allocation. Bitcoin, meanwhile, suits periods of elevated risk appetite and dominant tech-growth narratives—but avoid using gold to chase overnight riches. Want inflation protection and safety? Buy gold. Seeking long-term high returns? Buy Bitcoin—but brace for -70% drawdowns.

Recommendation #2: Don’t Assume Bitcoin Will Always Outperform Everything.

Bitcoin’s growth stems from technological narratives, capital consensus, and institutional breakthroughs—not linear return models. It won’t beat gold, the Nasdaq, or oil every year—but its decentralized nature retains enduring value. Don’t dismiss it entirely during short-term corrections—or blindly go “all in” during rallies.

Recommendation #3: Build a Diversified Portfolio—Accept That Different Assets Shine in Different Cycles.

If you’re less sensitive to global liquidity shifts—or have limited risk tolerance—consider combining gold ETFs with a small Bitcoin allocation to cover diverse macro scenarios. If you’re more risk-tolerant, layer in ETH, AI-related assets, or real-world asset (RWA) tokens to build a higher-volatility portfolio.

Recommendation #4: Can You Still Buy Gold and Silver Now? Tread Carefully—Prioritize Buying on Dips.

Long-term, gold remains favored by global central banks; silver benefits from added industrial utility—both retain allocational appeal during turbulent cycles. Short-term, however, their substantial gains create technical headwinds—evidenced by gold’s 3% single-day plunge on January 29. Long-term investors might wait for pullbacks—e.g., gold below $5,000 or silver below $100—before gradually building positions. Short-term speculators should time entries carefully—avoid chasing momentum at peak euphoria. Bitcoin, though underperforming, may offer a rare low-entry window if liquidity expectations improve. Focus on timing—not chasing highs or selling lows—is the core defensive strategy for ordinary investors.

Final Thoughts: Understanding Positioning Is Key to Survival!

Gold’s rally doesn’t undermine Bitcoin’s value; Bitcoin’s dip doesn’t prove gold is the sole answer. In this era of value-anchor reconstruction, no single asset satisfies all needs.

Gold and silver led in 2024–2025. But zoom out to 12 years—and Bitcoin’s 213-fold return proves: it may not be “digital gold,” but it is the greatest asymmetric investment opportunity of our time. Last night’s gold selloff may mark the end of a short-term correction—or the start of a larger one.

For ordinary traders, what truly matters is understanding each asset’s underlying role—and building your own cyclical survival logic.

Good luck!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry risk—invest with caution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News