A Book on Bitcoin from 8 Years Ago Is “Predicting” a Silver Crash?

TechFlow Selected TechFlow Selected

A Book on Bitcoin from 8 Years Ago Is “Predicting” a Silver Crash?

After reading this book, Michael Saylor decided to purchase $425 million worth of Bitcoin.

By David, TechFlow

In 2020, Michael Saylor, founder of MicroStrategy, read a book and decided to purchase $425 million worth of Bitcoin.

The book is titled The Bitcoin Standard, published in 2018. It has been translated into 39 languages, sold over one million copies, and is revered by Bitcoin maximalists as the “Bible.”

Author Saifedean Ammous holds a Ph.D. in Economics from Columbia University. His central thesis is simple:

Bitcoin is a “harder” form of hard money than gold.

On the book’s promotional page, Michael Saylor’s endorsement reads verbatim:

“This book is a masterpiece. After reading it, I decided to buy $425 million worth of Bitcoin. It has had the greatest influence on MicroStrategy’s mindset, shifting our balance sheet toward a Bitcoin standard.”

Yet one chapter in this book does not discuss Bitcoin at all—it explains why silver cannot become hard money.

Eight years later, silver has just surged to an all-time high of $117 per ounce. The precious metals investment frenzy continues unabated—Hyperliquid and numerous centralized exchanges (CEXs) have even launched precious metals futures contracts in various forms.

At times like these, someone always steps forward as a whistleblower or contrarian to sound the alarm on risks—especially when everything is rising except Bitcoin.

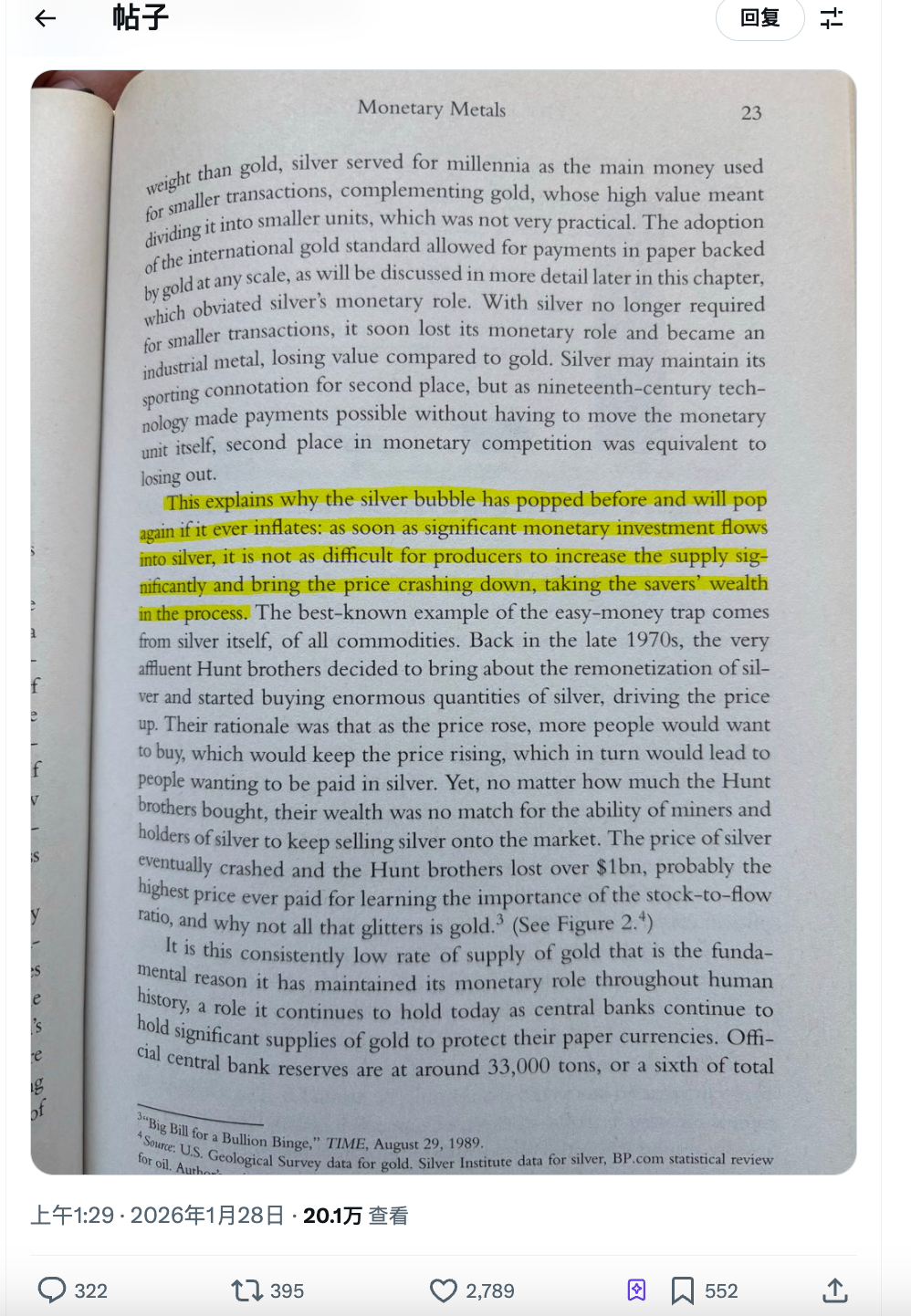

For instance, a widely circulated post on crypto Twitter today cites page 23 of this book, highlighting the passage that reads:

Every silver bubble bursts—and the next one will be no exception.

A History of Silver Speculation

Before rushing to dismiss this claim, let’s examine its core argument.

The book’s central concept is stock-to-flow—the ratio of existing stock to annual new supply. Longtime Bitcoiners are likely familiar with this theory.

Put simply, for something to qualify as “hard money,”its supply must be extremely difficult to increase.

Gold is hard to mine. Global above-ground gold stock stands at roughly 200,000 metric tons, with annual new production under 3,500 tons. Even if gold prices double, miners cannot suddenly produce twice as much gold. This is called “supply inelasticity.”

Bitcoin is even more extreme. Its total supply is capped at 21 million coins, halving every four years, with the code immutable by design—scarcity engineered algorithmically.

What about silver?

The highlighted passage essentially states:Silver bubbles have burst before—and they will burst again. Because once large capital flows into silver, miners can easily ramp up supply, crushing the price and evaporating savers’ wealth.

The author also cites the Hunt brothers as an example.

In the late 1970s, Texas oil tycoons Nelson Bunker Hunt and William Herbert Hunt attempted to corner the silver market. They purchased billions of dollars’ worth of physical silver and silver futures, driving the price from $6 to $50—an all-time high at the time.

Then what happened? Miners flooded the market with supply; exchanges raised margin requirements; and silver prices collapsed. The Hunt brothers lost over $1 billion and ultimately declared bankruptcy.

Thus, the author concludes:

Silver’s supply elasticity is too high for it to ever serve as a reliable store of value. Every attempt to hoard it as “hard money” invites market punishment via increased production.

When this logic was written in 2018, silver traded at $15 per ounce—few paid attention.

Is This Silver Rally Different?

For the above logic to hold, one key assumption must be true: silver price increases must trigger corresponding supply growth.

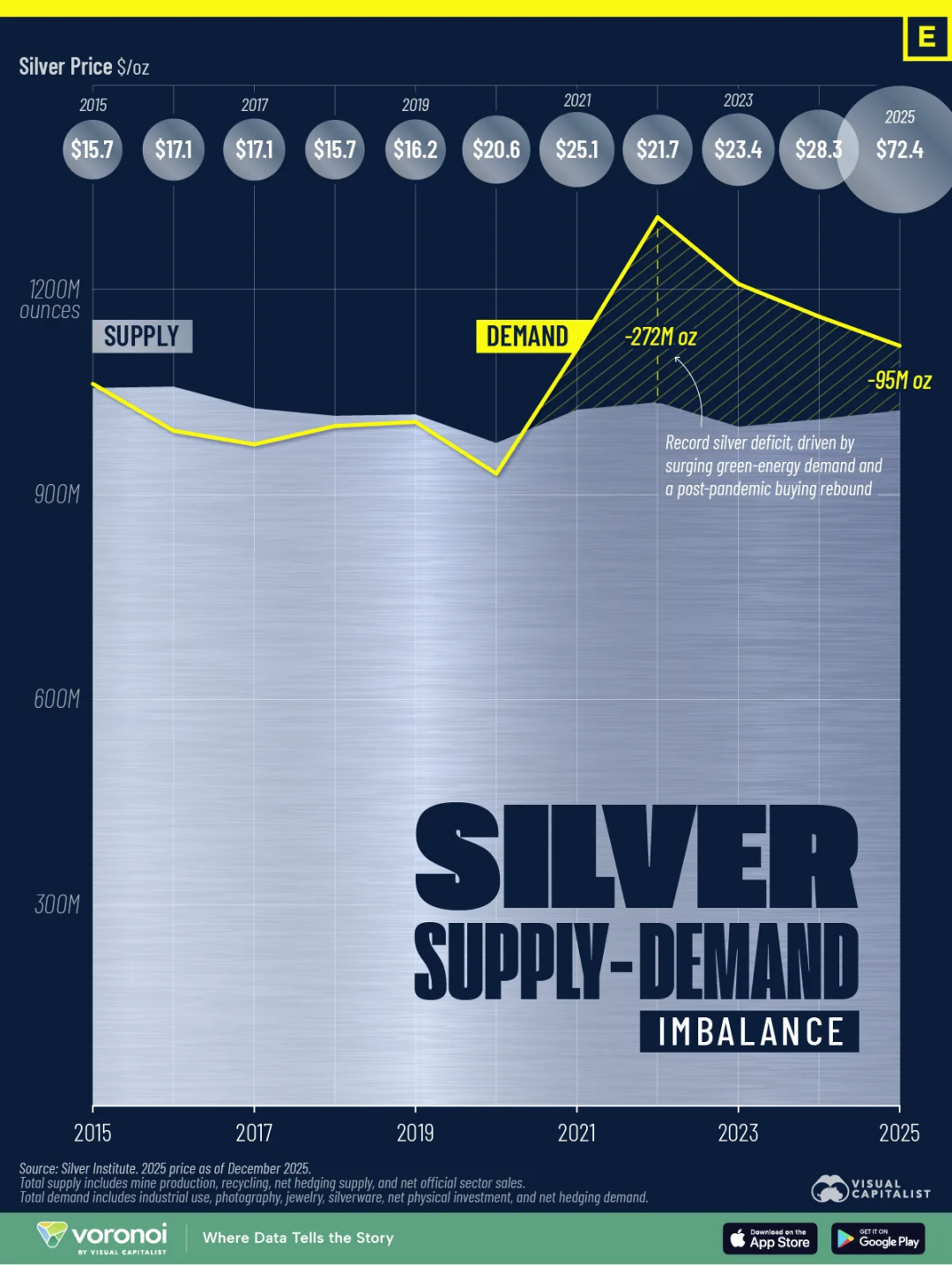

However, 25 years of data tell a different story.

Global silver mine production peaked in 2016 at approximately 900 million troy ounces. By 2025, it had declined to 835 million troy ounces—despite a sevenfold price increase, output fell by 7%.

Why has the “higher prices → more supply” logic failed?

One structural reason is that roughly 75% of silver is produced as a byproduct of mining copper, zinc, and lead. Mining decisions are driven by base metal prices—not silver prices. If silver doubles but copper remains flat, mines won’t increase output.

Another factor is time. New mining projects take 8–12 years from exploration to production. Even if new projects begin immediately, no meaningful new supply will arrive before 2030.

The result? Five consecutive years of supply deficits. According to the Silver Institute, global silver deficits accumulated from 2021 to 2025 totaled nearly 820 million troy ounces—equivalent to nearly an entire year’s global mine production.

Meanwhile, silver inventories are dwindling. The London Bullion Market Association’s (LBMA) deliverable silver inventory has fallen to just 155 million troy ounces. Silver lease rates have spiked from their normal range of 0.3%–0.5% to 8%, meaning some market participants are willing to pay an 8% annualized cost just to secure physical delivery.

A new variable has also emerged: effective January 1, 2026, China imposed export restrictions on refined silver, granting export licenses only to state-owned smelters with annual capacity exceeding 80 metric tons. Smaller exporters are effectively barred.

In the Hunt brothers’ era, miners and holders could crush prices through increased supply and selling pressure.

This time, the supply-side ammunition may already be exhausted.

Speculation—and Real Demand

When the Hunt brothers hoarded silver, it was purely monetary speculation—buyers expected price appreciation and held for resale.

The 2025 silver rally is driven by entirely different forces.

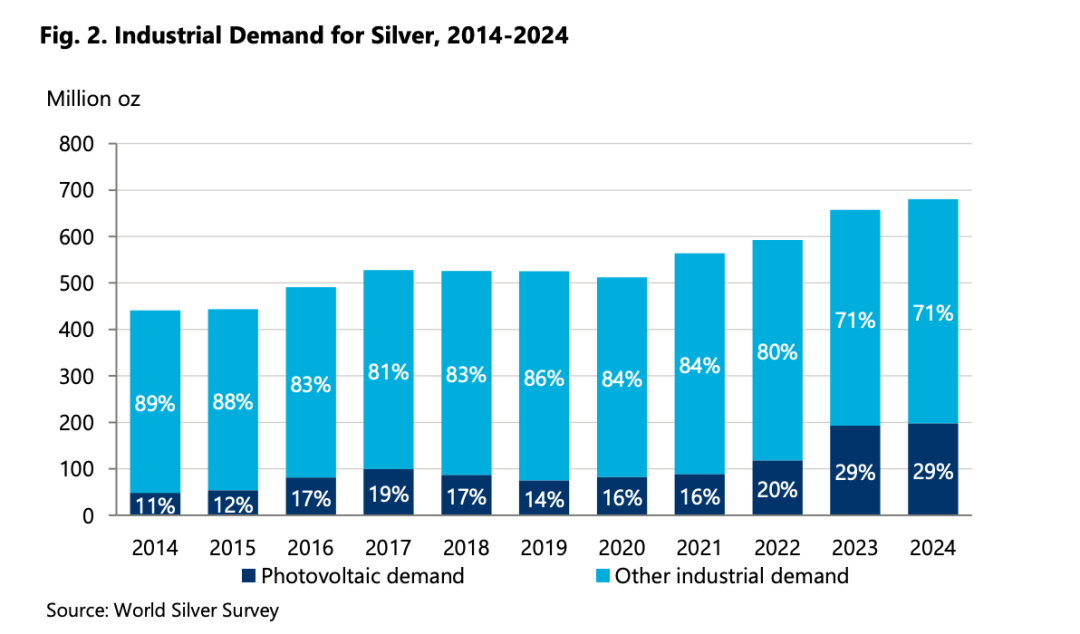

Consider this data point: according to the World Silver Survey 2025, industrial demand for silver reached 680.5 million troy ounces in 2024—a record high, accounting for over 60% of total global demand.

What drives industrial demand?

Solar photovoltaics (PV). Each solar panel requires silver paste for conductive layers. The International Energy Agency forecasts global PV installed capacity will quadruple by 2030. The solar industry is now silver’s largest single industrial buyer.

Electric vehicles (EVs). A conventional internal combustion engine vehicle uses ~15–28 grams of silver; an EV uses ~25–50 grams—with premium models using even more. Silver is essential in battery management systems, motor controllers, and charging interfaces.

AI and data centers. Silver’s unmatched electrical and thermal conductivity make it indispensable in servers, chip packaging, and high-frequency connectors. Demand in this segment accelerated sharply in 2024, prompting the Silver Institute to create a dedicated “AI-related applications” category in its report.

In 2025, the U.S. Department of the Interior added silver to its “Critical Minerals” list—the last update included lithium and rare earth elements.

Of course, persistently high silver prices drive “silver-saving” efforts—some PV manufacturers are already reducing silver paste usage per panel. Yet the Silver Institute projects that even after accounting for such efficiency gains, industrial demand will remain near record levels over the next 1–2 years.

This is genuine structural demand—the very variable Saifedean may not have foreseen when writing The Bitcoin Standard.

A Book Can Also Serve as Psychological Comfort

Bitcoin’s “digital gold” narrative has recently gone silent in the face of real gold and silver.

Markets have dubbed this year the “debasement trade”: weakening dollar, rising inflation expectations, and geopolitical tensions have driven capital into hard assets for safe-haven purposes—but this wave favored gold and silver, not Bitcoin.

For Bitcoin maximalists, this demands explanation.

Hence, the aforementioned book serves as both scriptural citation and ideological defense: silver’s rally is merely a bubble; once it bursts, everyone will see who was right all along.

This is less analysis and more narrative self-rescue.

When your holdings underperform the market for an entire year, you need a framework to explain why “you’re still right.”

Short-term price movements don’t matter—only long-term logic does. Silver’s logic is flawed; Bitcoin’s is sound—so Bitcoin must inevitably outperform. It’s only a matter of time.

Is this logic internally consistent? Yes. Is it falsifiable? Extremely difficult.

Because you can always say, “Time hasn’t been long enough yet.”

The problem is, reality waits for no one. Bitcoin and altcoin holders deeply embedded in the crypto ecosystem are genuinely anxious.

An eight-year-old Bitcoin theory cannot automatically override eight years of stagnant performance.

Silver keeps surging—and we sincerely wish Bitcoin good luck.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News