When Silver Suffers a “Flash Crash” Once Every 275 Years: A Soul-Searching Reflection by a Former Bridgewater Trader

TechFlow Selected TechFlow Selected

When Silver Suffers a “Flash Crash” Once Every 275 Years: A Soul-Searching Reflection by a Former Bridgewater Trader

Deconstructing the mechanical principles behind silver’s 6-sigma (six-standard-deviation) decline.

Author: Alexander Campbell

Translated and edited by TechFlow

TechFlow Intro: Following a historic precious metals “washout” last Friday, former Bridgewater researcher Alexander Campbell penned this deeply reflective essay.

The piece dissects—not only from a financial engineering perspective—the mechanical drivers behind silver’s 6-sigma plunge, including short gamma effects, leveraged ETF rebalancing cascades, and pricing arbitrage between Shanghai and New York markets. More unusually, it lays bare the emotional tension a professional investor faces when torn between fiduciary responsibility to followers and rational decision-making.

Full text below:

Last Friday was a painful day.

This is my reflection.

In the second half of this article, we’ll follow our standard protocol to analyze this historic precious metals washout: What actually happened? Why? What impact did it have on portfolios? And where do we go from here?

But first—my reflection. Please forgive me if it gets a bit… philosophical.

The quote opening this article (Translator’s note: “Pain + Reflection = Progress”) is more than just a maxim to me—it’s a way of life. It’s one of the deepest lessons I learned during my time at Bridgewater, and a framework for contextualizing all pain in life.

Challenges lie along the path to any goal. Drawdowns are inevitable on the path to financial goals.

As for drawdowns, I’ve endured worse—perhaps not within a single day, but certainly over the course of a lifetime. Of course, things could get worse. Perhaps silver and gold’s volatility is the “canary in the coal mine,” signaling a cascade of liquidity-driven “scrambles” that depress asset prices while boosting demand for safe-haven assets like the U.S. dollar, bonds, and the Swiss franc. That’s entirely possible.

In the coming days, you’ll undoubtedly see legions of experts emerge from the woods declaring, “I told you so!”—peddling one view or another, slapping screenshots in your face. To some extent, I’ve done similar things myself when trades moved in my favor (upward), so I’m no different.

But reality is that nobody knows the future. There are always unknown variables; the world is chaotic and dynamic. While that chaos creates opportunity for edge, even the best investors win only 55–60% of the time. Gödel’s machine is never truly complete. That’s why diversification matters, why hedging matters—and why the finest investors maintain humility almost constantly—even if regulatory boilerplate sometimes makes their true intent hard to read.

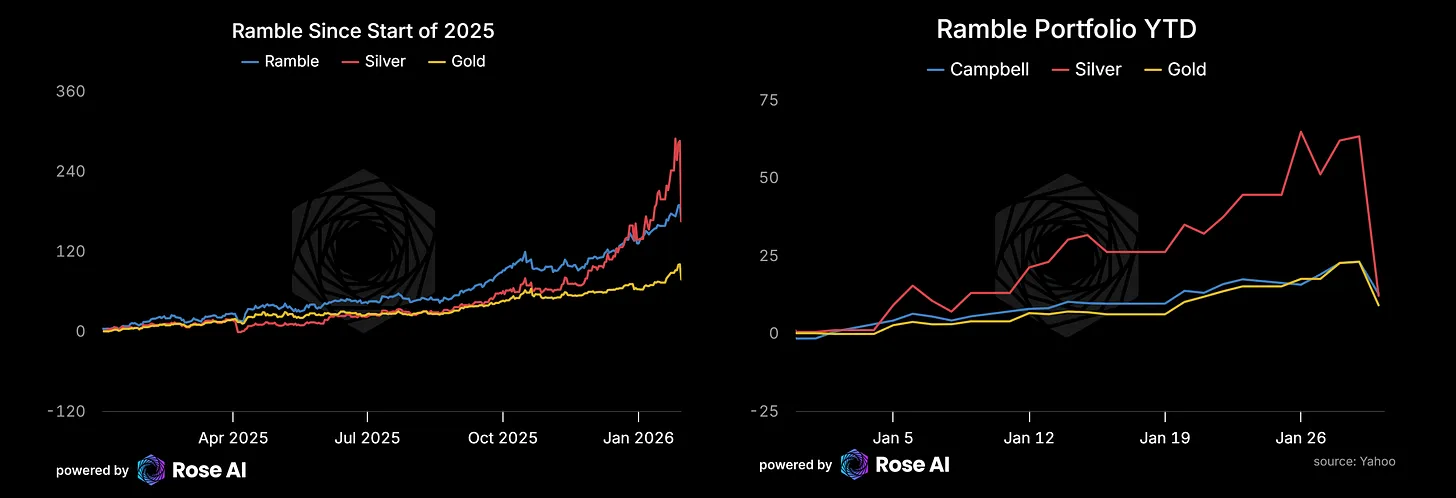

Nonetheless, I believe it’s vital to stare directly at your mistakes, diagnose what went wrong, and try to learn—not just about the world, but about yourself. Reflection is hard when you’re up 130% for the year. But when a portfolio with an expected annual volatility of 40% loses 10% in a single day, reflection becomes mandatory.

From Thursday night through Friday afternoon, many thoughts raced through my head. Later, we’ll discuss the rational process: tracking how the world evolved, piecing together the true narrative, analyzing causes, and assessing responses. But before that—I want to talk about the emotional side.

All professional investors—or at least those taking real risk in public markets—understand what I mean when I say “investing is often emotional.” There are two demons in your head: greed, telling you to press further, to squeeze more alpha from your outperformance; and fear—the awareness that “I might be wrong, and there’s much I don’t know.”

What struck me most was a new feeling that emerged from Thursday night into Friday: responsibility.

You see, many reading this blog now are newcomers. Eyes chase returns—price moves from $60 to $120 drew massive attention to these pages, and flooded my inbox with messages. Some thank me; others ask for my views. In my comment section, seemingly endless people demand minute-by-minute updates, support levels, and so on. This process may feel familiar to well-known public figures—but for me, it’s relatively fresh.

If you follow me on Twitter/X, you’ll know I try to adopt an irreverent tone. It’s a style I picked up during Oxford Union debating—walking the line between insouciant and incisive. It’s not pure performance; it’s a worldview: I usually strongly believe I’m right, yet also know I’m often full of shit—and those views evolve rapidly as new information arrives. I suspect this mindset resonates with many professional “shitposters” (as people call them).

When you go micro-viral, what changes is that—even while striving to retain that irreverent tone—the actual audience listening grows dramatically. You shift from friends, colleagues, and internet personalities to countless strangers reading your articles, interpreting them, interacting with you. Beyond knowing that context dilutes as reach expands (like the internet version of telephone game), there’s also a lag issue.

I began writing about the silver/solar relationship in 2023. Roughly 18 months ago, I started “banging the table” on it. My portfolio was then 100% long. As price rose—from $25 to $40, then $60 and $80—I gradually reduced that exposure: from “recklessly long” to “dangerously long,” then to “still quite long.” I sold some outright, or rolled options—locking in profits while maintaining exposure. The problem? As silver climbed, its volatility increased. So I still looked good. Critics would call this a red flag—and indeed it was (we’ll revisit “signs” later)—but the key point is: you end up in an awkward position. Though many got on board at $25 or $40, you realize—due to the lag between article publication and readership—that the eye-weighted average entry price may be as high as $90.

That puts you in an interesting spot. You feel guilt if you “cut and run” merely because your back starts tingling—like I did at certain moments over the past week. You feel you owe something to those who like your work—to hold the trade, to place yourself in their shoes.

From a risk management standpoint, that’s utterly foolish. You can tell yourself that if you managed other people’s money, you’d have cut everything Friday morning—when Chinese markets opened not with a rescue, but with massive gold selling. You can rationalize that if managing others’ money, you wouldn’t hold such large copper positions; you’d have exited risk Friday morning when copper spiked 10%. But ultimately—your P&L is your P&L.

One more thing before we reach the part you care about most.

Some of you subscribe because you like my views on silver and markets. Others because you enjoy my rambles.

Looking ahead, I’m considering separating them. Rambles—on philosophy, worldviews, process thinking—will remain free. If I begin publishing specific, actionable trade ideas with real-time updates, that may become a paid offering. That would create real accountability on my end—and real value on yours.

For now, just know not every post will be about “rocks.” Some of you won’t like that. That’s fine.

With all that said—what actually happened?

How historic was this?

Before diving into itemized analysis, let’s place last Friday in context—because I don’t think people grasp how rare this magnitude of move really is.

That’s 275 years of daily silver returns. Last Friday’s move ranked among the largest single-day declines in the metal’s entire history. We’re talking volatility comparable to the end of bimetallism, the Hunt brothers’ collapse, and March 2020—except this occurred on an ordinary, unremarkable Friday in January.

The volatility surface (“vol surface”) pricing going into Friday priced a 3-sigma move as a tail event. What we got was roughly 6-sigma. According to historical distribution, this shouldn’t happen—but it does precisely when everyone’s positioned the same way and liquidity vanishes.

Breakdown

If you followed the narrative, the past few months—even before Friday—were wild. Silver opened November above $40, rallied 74% to ~$85 by year-end, then corrected 15% into December. As noted in our prior piece, bulls then defended the trend, launching another monster 65% rally—peaking Monday near $117 (note: NY market) before Western sellers stepped in, pushing price down another 15%.

Gold largely mirrored these moves—“sell in NY, buy in Shanghai, metal flows East”—a trend appearing intact.

Even as late as Thursday morning, news was dominated by copper’s overnight 10% surge. (Another warning sign—indicating things were getting slightly out of control—we’ll discuss in our upcoming “red metal” piece.)

Sensing this chop, I trimmed positions slightly and posted this tweet. It was mostly for myself. That 30% figure had been lingering in my mind—but dismissed as a voice of fear, not reason.

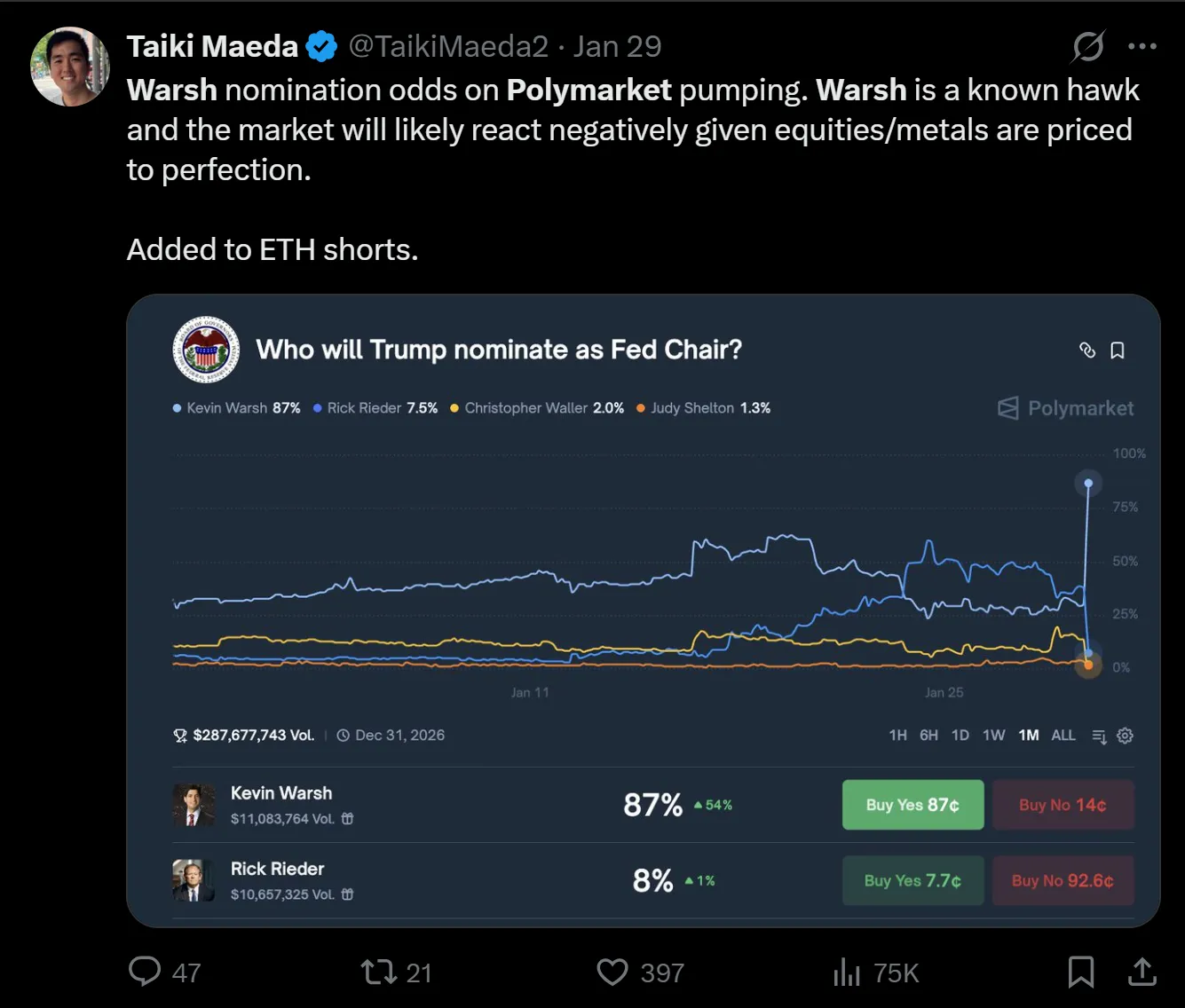

Later Thursday, Kevin Warsh entered the frame—confirmed/leaked on Polymarket as nominee for Fed Chair.

Warsh is viewed as somewhat of a “hard money” advocate—I took it calmly. You see, I briefly met him at Stanford a decade ago. Back then (~2011–2015), he was known for urging the Fed to normalize monetary policy after the massive post-crisis QE. At the time, he seemed more politician than economist—I always felt his hawkishness was a way to stand out amid oceans of easy-money advocates. After all, calling for rate hikes and balance sheet reduction is easy when you’re not behind the wheel.

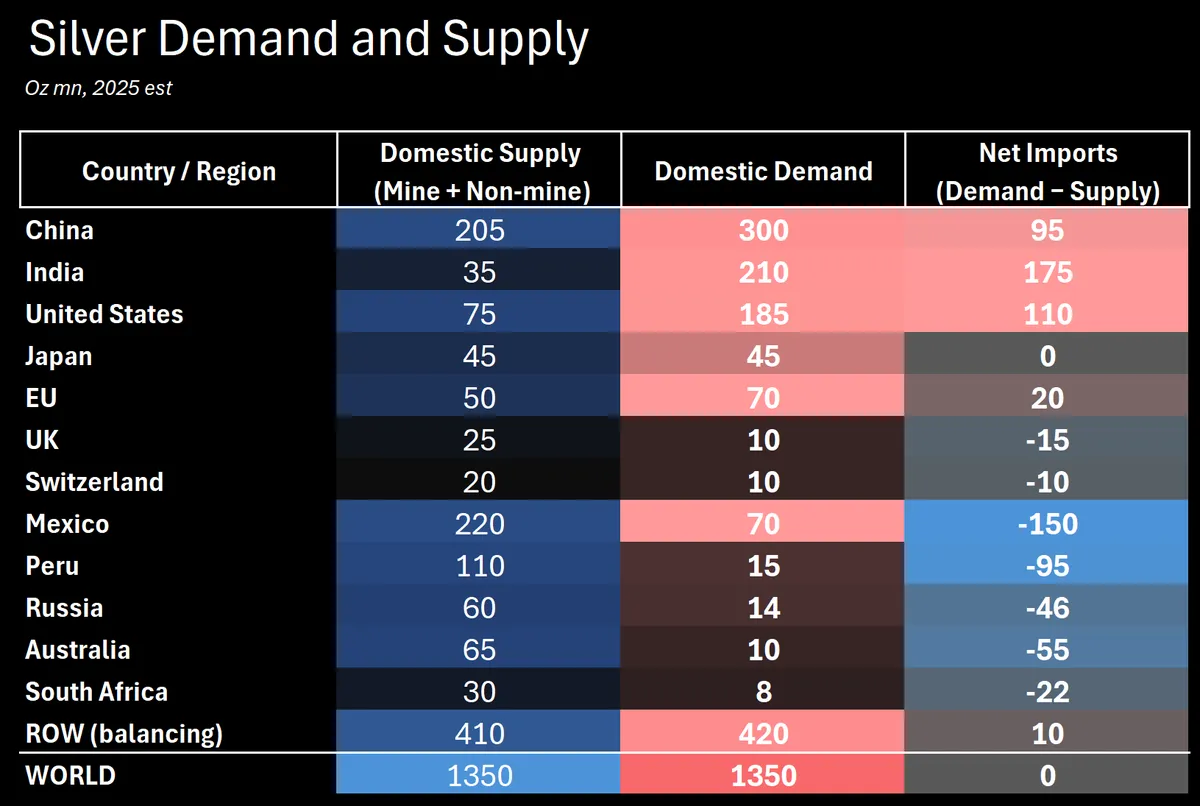

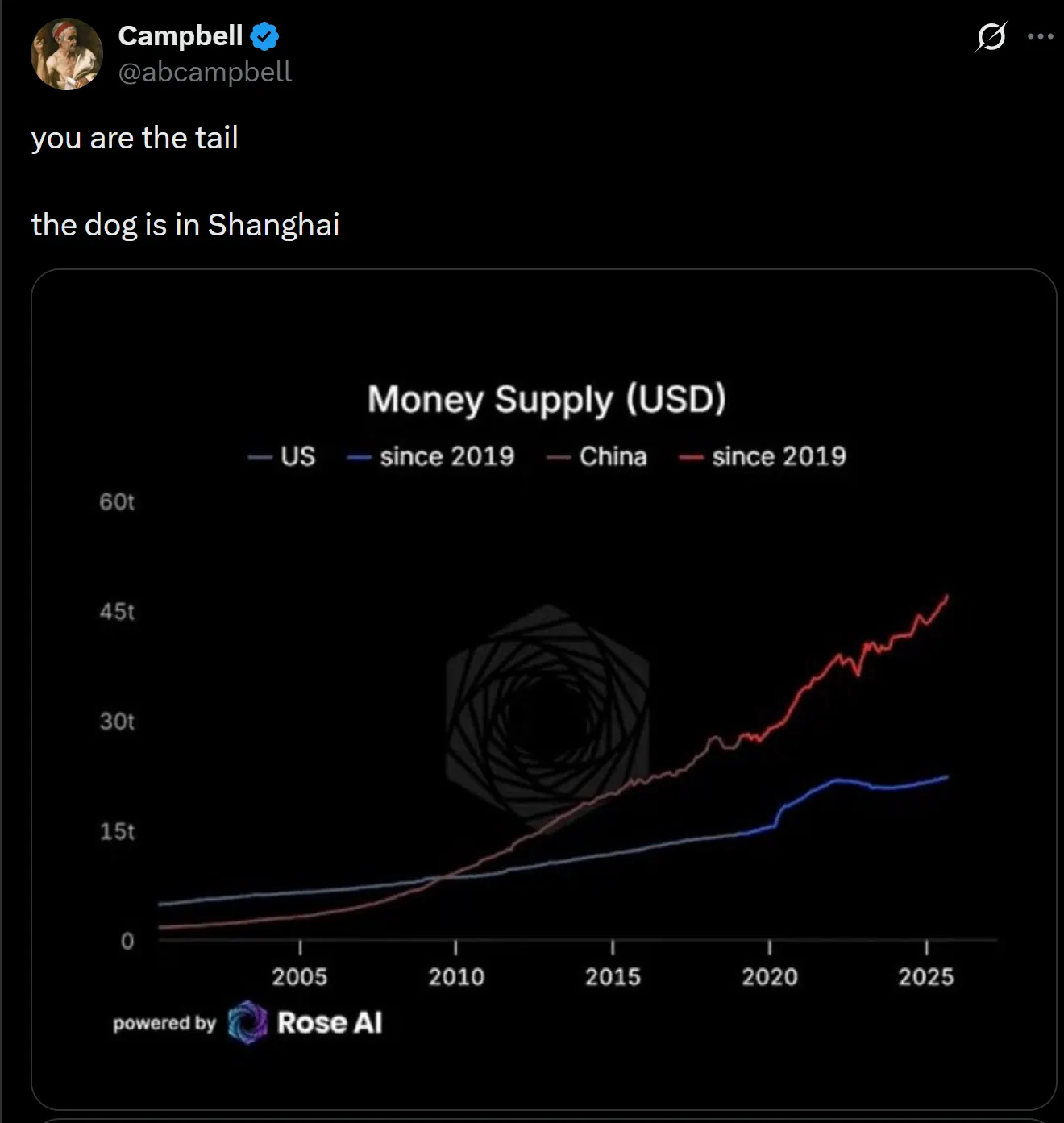

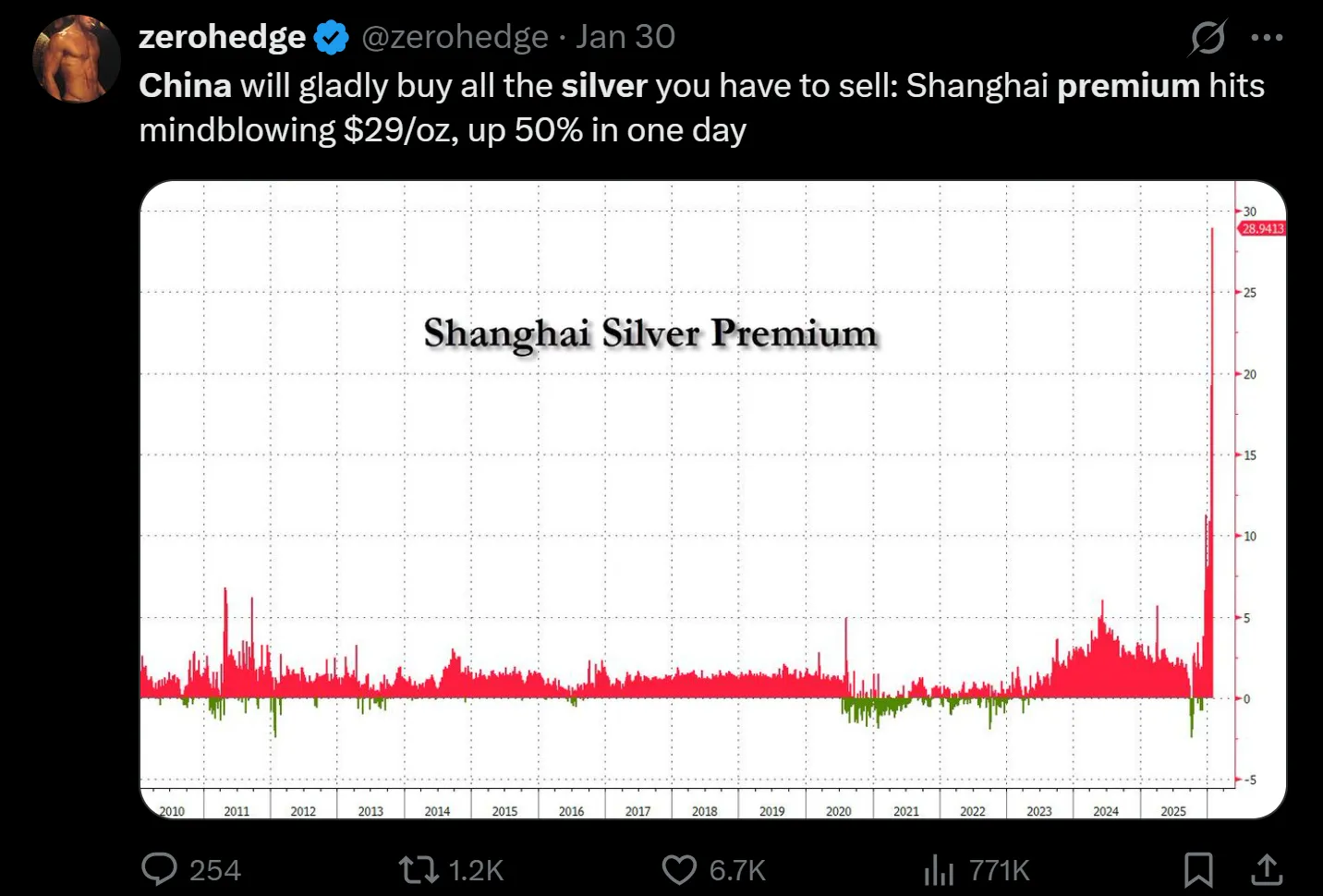

So though I held substantial commodity exposure (in fact, more copper and gold than silver), I assumed I’d take only light damage—and wait for Chinese markets to open. Reminder: as I’ve posted repeatedly over months, Western metals investors seem unaware that “you’re the tail—the dog is in Shanghai.” They underestimate:

a) How concentrated physical demand for these metals is in the East:

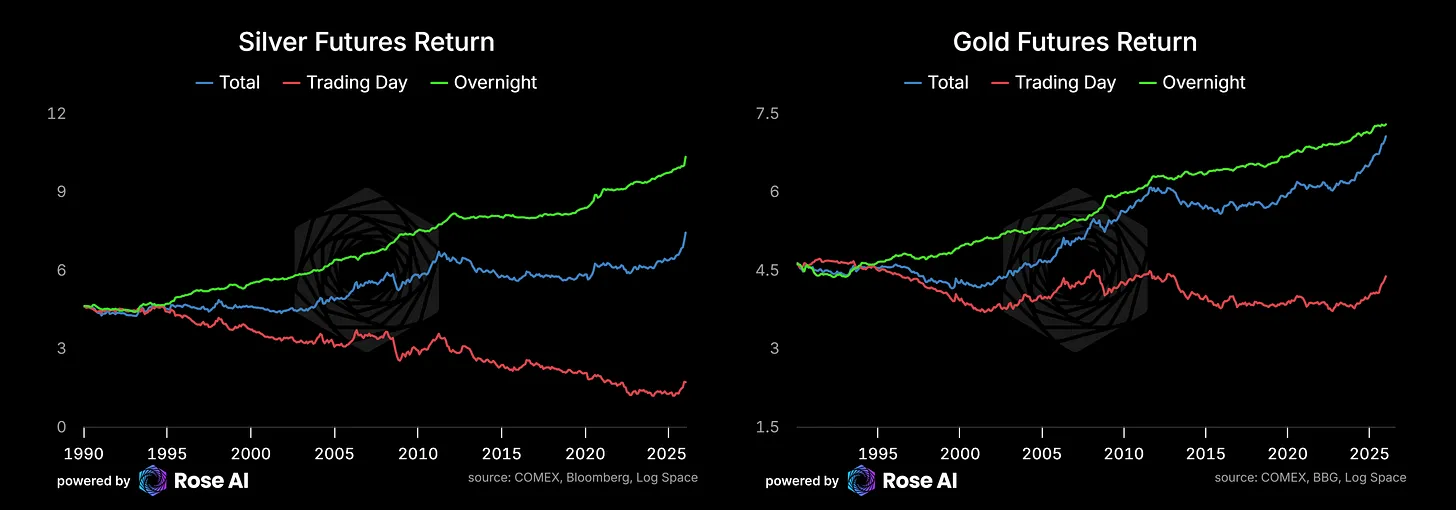

b) How much of these metals’ total return comes from “overnight” moves (measured as gain from prior close to next open):

c) How much capital China actually holds versus the West:

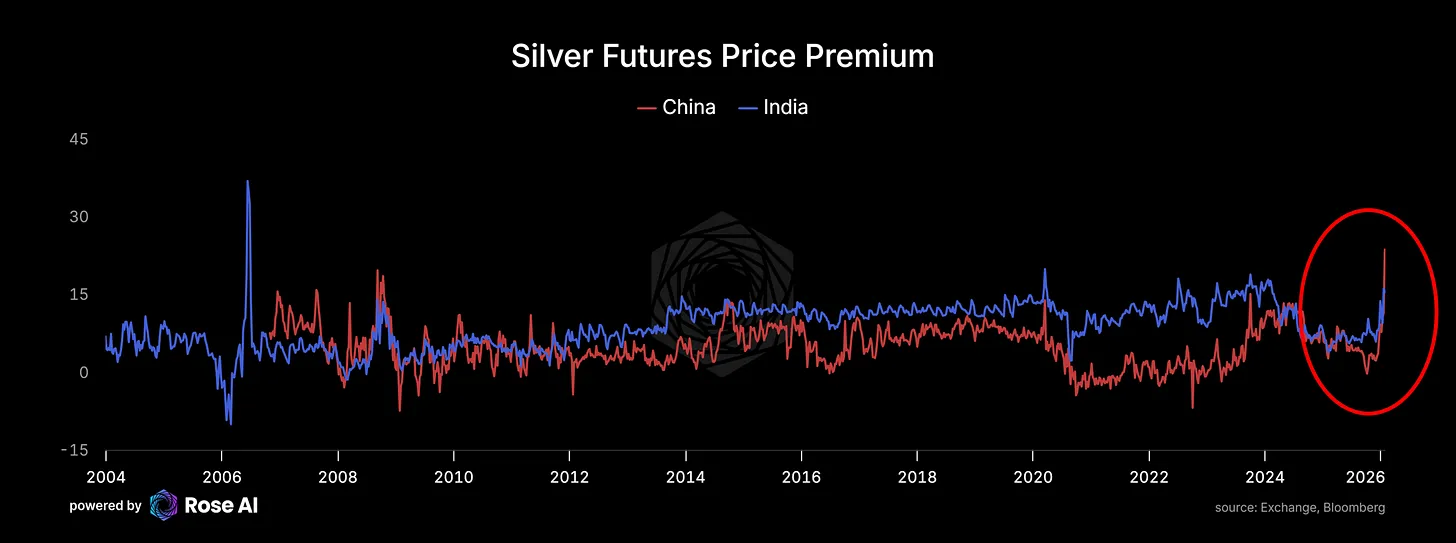

Yes, online there’s much confusion about how much of the “China premium” stems from VAT on retail physical delivery. Macro is messy—so instead of reaching for calculators, people toss charts at each other: bulls ignore it, bears weaponize it, sowing doubt in the “China is inflating prices” narrative. To me, this is a classic “look at changes, not levels” case—because clearly: a) this premium (or discount) has recently widened, and b) similar dynamics appear in India.

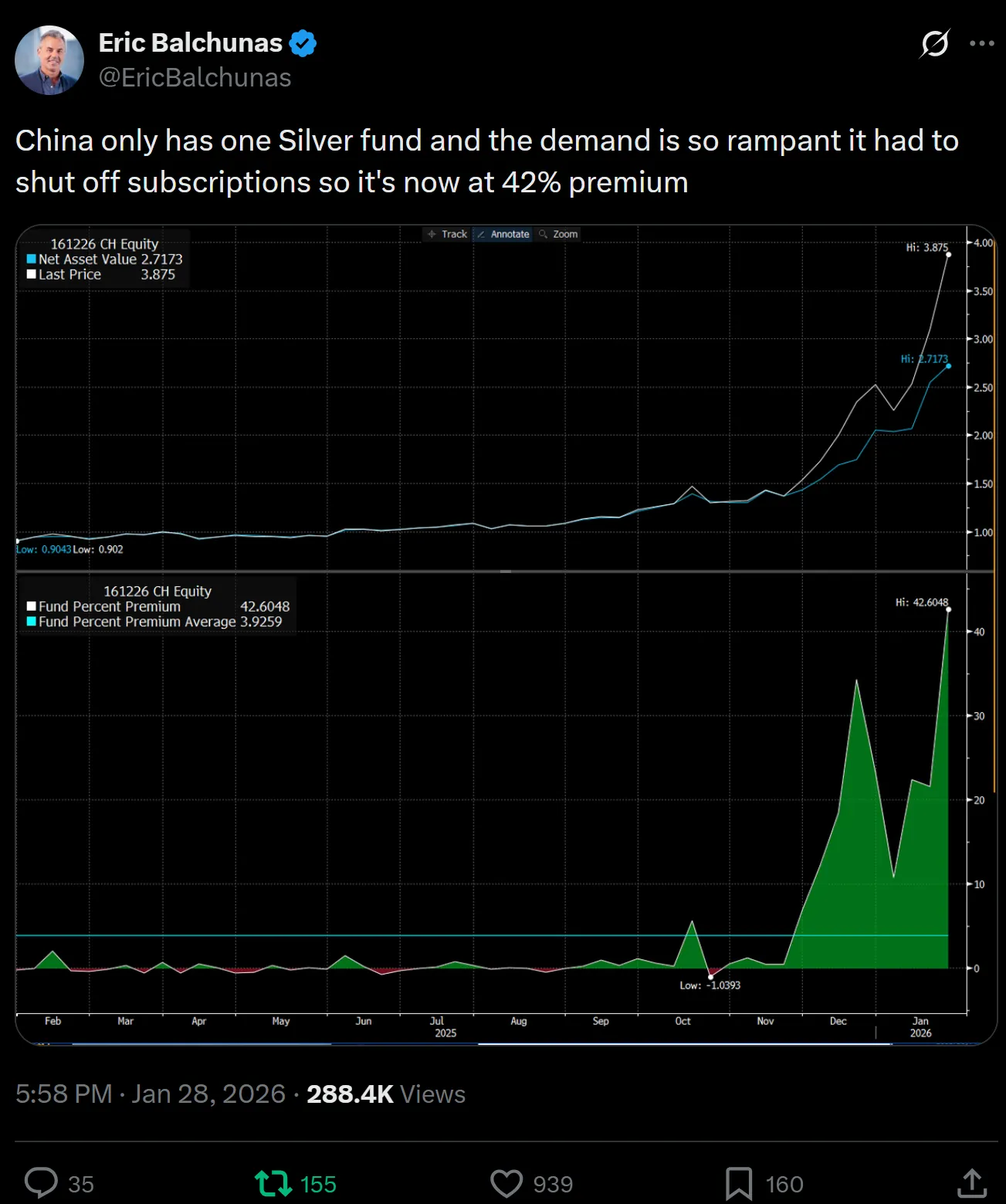

Yet I sensed the bear narrative gaining traction—even with demand evidence, like the absurd premium on China’s sole pure onshore silver fund.

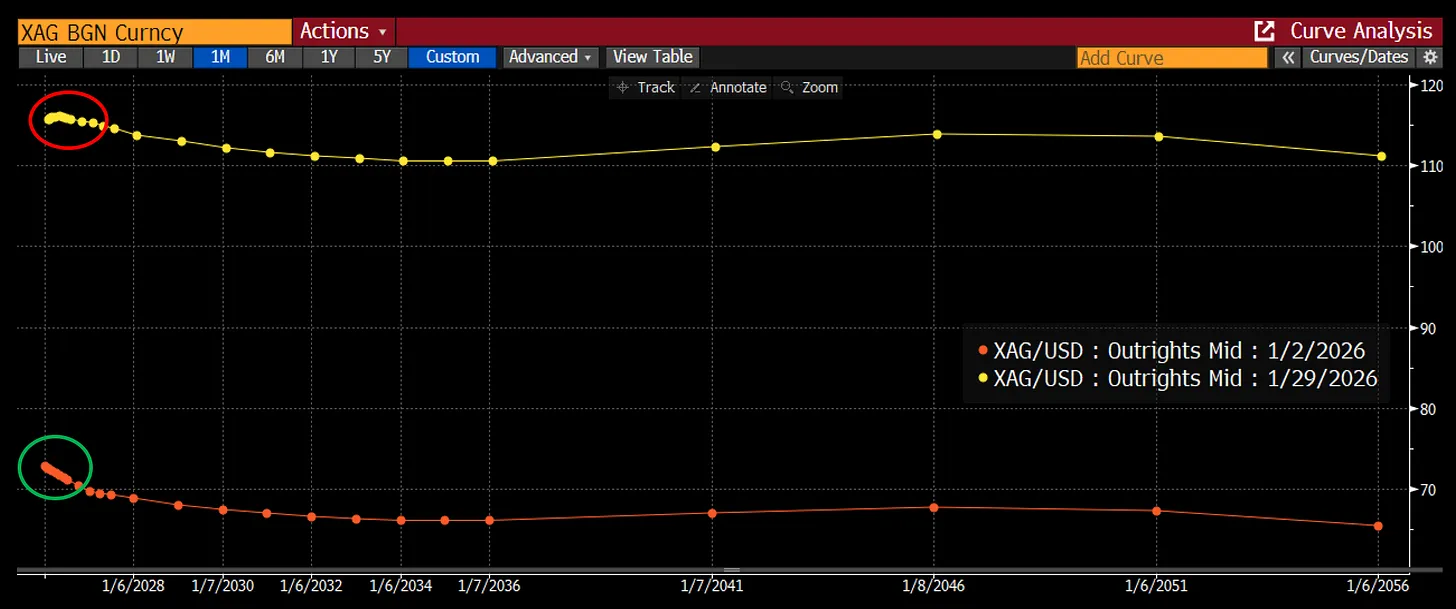

And indeed, some evidence suggested physical buying pressure had eased—the clearest signal being London silver’s front-end curve. Over the past month, its “spot backwardation” significantly narrowed.

I cut my delta nearly flat before bedtime—but thought, “Let’s wait for China to open.” That may have been my biggest mistake.

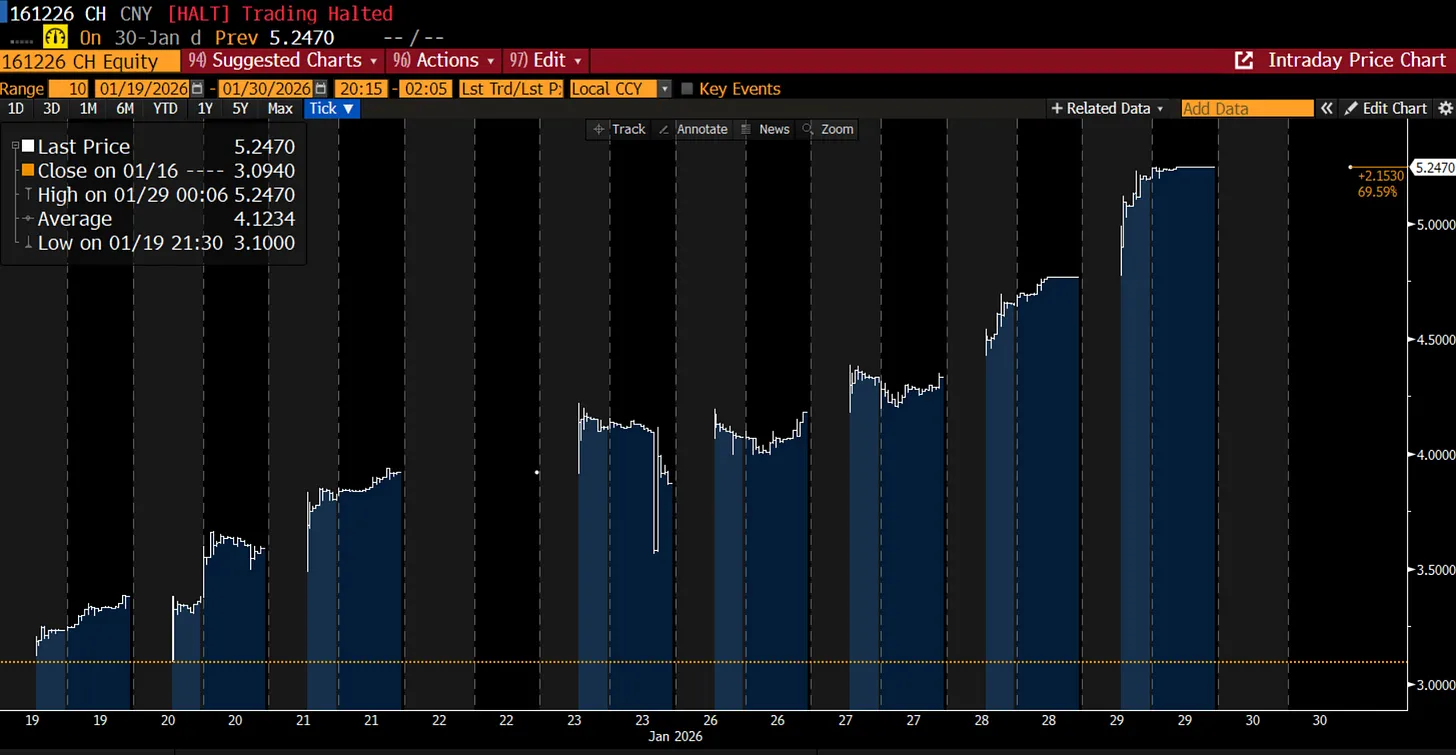

China opened—not with a counterattack, but with selling. Not just silver—gold fell 8%. First strike. I didn’t know it then, but local Chinese silver ETFs actually halted trading.

That meant Chinese retail wasn’t rescuing anything.

This should’ve been the retreat signal. I checked my book, drafted a position list, and felt satisfied—most of my long exposure was in options, so a full washout would hurt, but wouldn’t blow me up. Second strike. Not just because I should’ve sold futures outright (GLD and SLV hadn’t opened yet, and I harbor aversion to futures—having forgotten to roll them several times in past years when not trading full-time), but because I should’ve committed to cutting risk immediately at market open. Yes, I had back-to-back meetings that day—making unwinding a 20-option position impractical—but I didn’t want to sneak away like a dog fleeing in the dark, knowing so many were long alongside me. Third strike—perhaps my worst decision.

The rest you likely know. U.S. open—sharp drop, then relentless decline. Selling was merciless. By the time I grasped what was happening, it was too late—my fourth strike materialized instantly as the day progressed.

We were in a “short gamma” market.

This is what shorting volatility feels like

“Short vol” isn’t just some mystical state—it’s a mechanical process where market moves amplify themselves via algorithmic behavior.

The clearest example is 1987, when portfolio insurance put markets in short-vol (or “short gamma” in options terms), forcing ever-increasing futures sales as spot prices deteriorated.

Retroactively, it’s wild that I was already familiar with this dynamic—having suffered it in October when GLD and SLV breached the floor strikes of my expiring options.

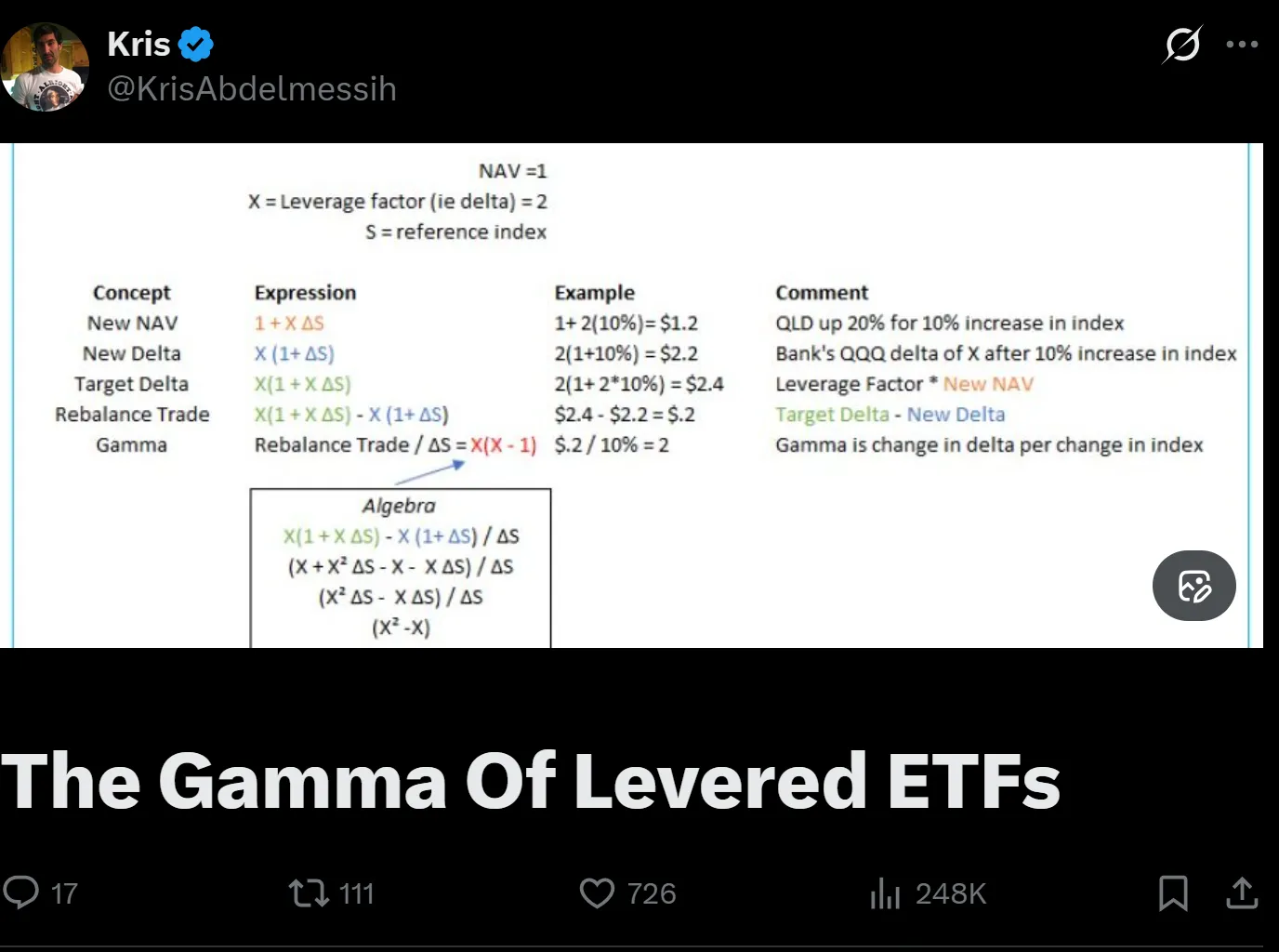

Briefly, the mechanism works like this: You and I buy call options. The seller typically hedges—not betting directionally, but betting the premium you paid exceeds their expected loss from “delta hedging” the other side. They sell calls and buy the underlying stock as hedge. If price rises above strike, the option’s delta increases, forcing them to buy more stock. Conversely, if price falls below strike, delta decreases—leaving them long excess stock, forcing them to sell into a falling market.

This behavior is nearly mechanical—and often visible in asset price action that seems to have no bottom. Markets are especially vulnerable to short gamma near monthly or quarterly option expiries. Check flash crash histories—I’d bet most occurred near or around those dates.

This occurs in options markets—and via leverage. When investors buy assets on margin, they pledge collateral. When price drops, exchanges or market makers demand “margin calls”—more cash. When leverage is excessive, they must sell assets to raise that cash—effectively placing them short volatility.

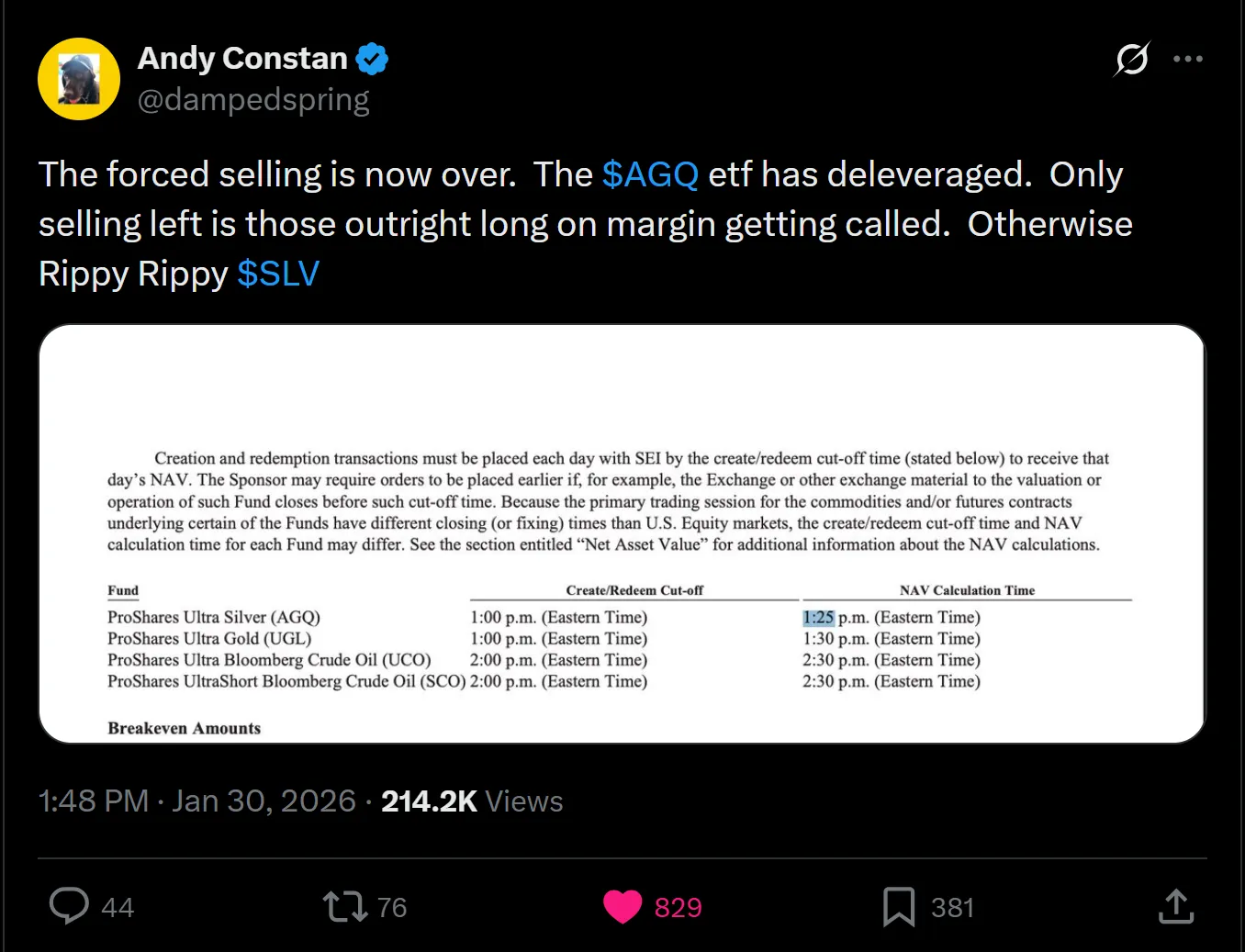

A third way this market turned short-vol surprised me. I hadn’t realized the double-leveraged silver ETF AGQ had amassed $5B in AUM—meaning it holds $10B in silver (via futures). The fund rebalances daily—so when people woke to silver down 15%, the fund effectively lost 20% × $10B = $2B. Its pre-redemption value dropped to $3B—its new delta became $6B, forcing it to sell $4B in silver!

Kris, an options expert, outlined this dynamic here:

My friend Andy Constan reminded me of this dynamic—and noted rebalancing occurs at 1:30 PM ET.

Minutes earlier, after waiting for tentative signs of a bottom, I bought SLV at $71—and doubled my position via stock purchases, call options, and selling lower-strike put spreads. Even if I couldn’t beat my own work, I’d profit via alpha from market relationships.

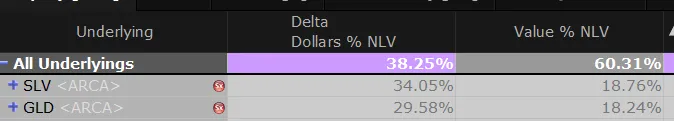

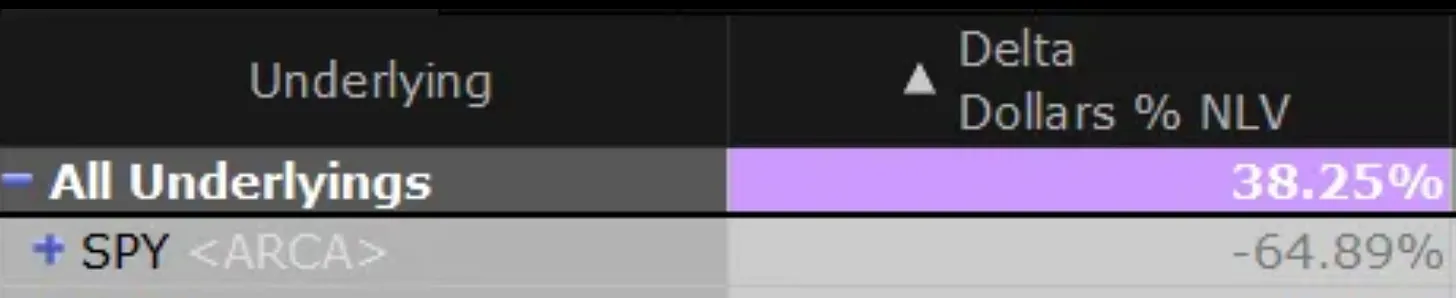

Actually, I had a fourth short-vol channel. Because I favor call spreads and flies, I’d been rolling my options upward as strikes rose—giving me false security. By day’s end, I lost 2% on silver, 2% on gold. With copper and other positions, we dropped 8% overall—wounded but not down. That left our YTD return at 12.6%, and cumulative return since Jan 25 at 165%.

Alright—if you’re still reading, we now understand why silver got destroyed, and have a mechanism—short volatility—operating across three channels: excessive leverage, short option gamma, and leveraged ETFs.

But where do we go from here?

Fog of war

First, we must lift the fog of war. Since Chinese markets closed before the worst U.S. moves, current “China premium” estimates are completely disconnected.

The same applies to claims that “SLV trades below NAV.”

This appears driven by SLV using London’s settlement price for NAV calculation—while London was already closed during the worst moves. Intraday Friday, the ETF tracked futures closely.

Currently, beyond a potential Monday bounce, the real question is: “How will China open Sunday night?” If online rumors hold, physical prices in the East remain at $136—suggesting +5–10% Monday gains.

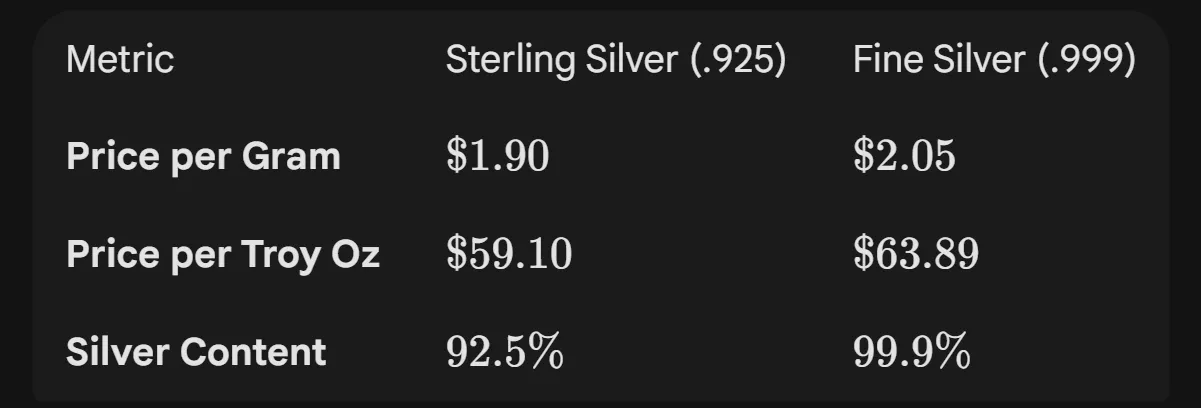

My fiancée is currently hiking—and reports Western jewelers still sell 925 silver (92% purity) at $1.90/gram (≈$64/oz pure silver). So the basic picture remains: silver cheap in the West, expensive in China.

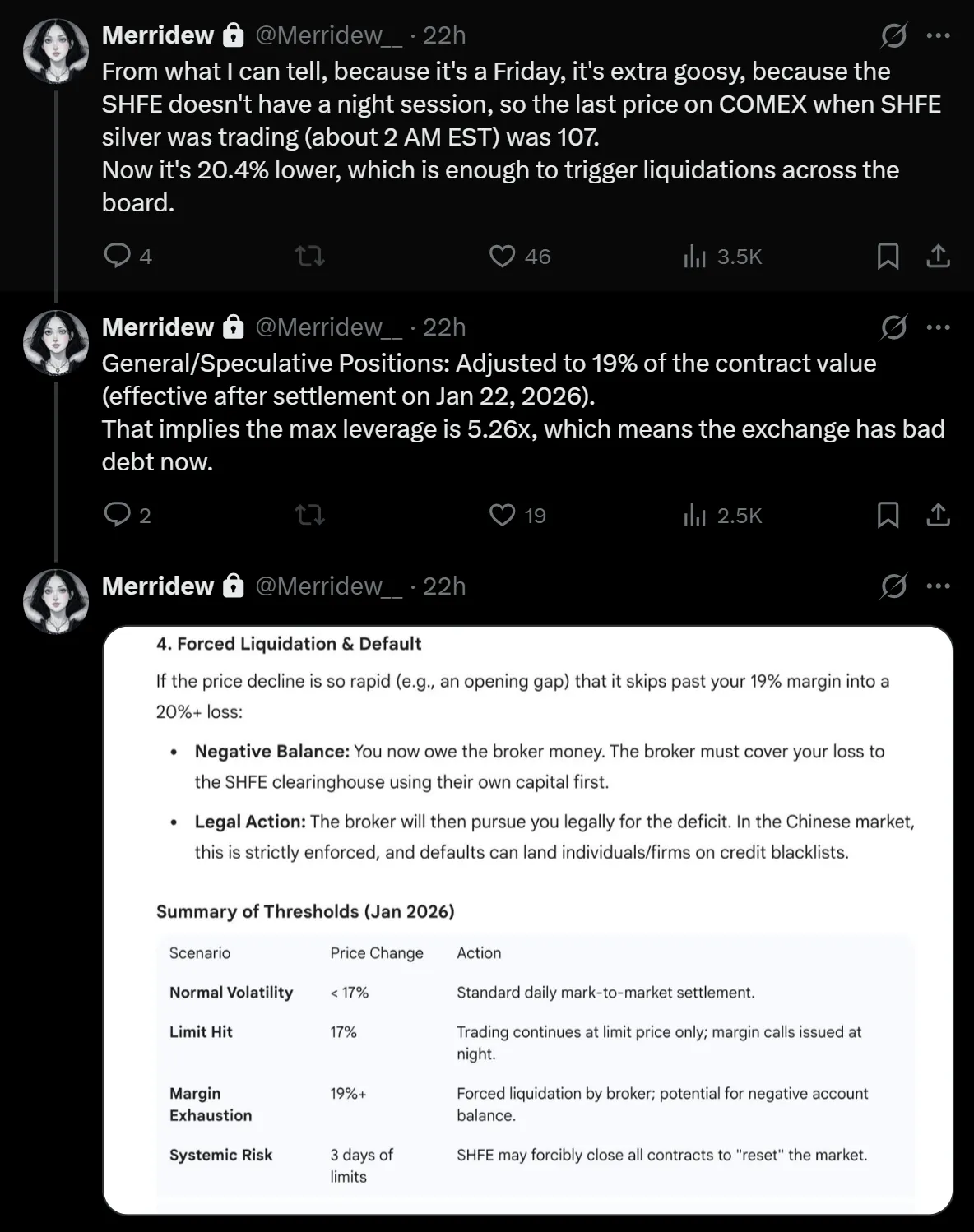

Whether this lifts prices depends on local conditions. As Merridew notes, Chinese leveraged investors are highly likely to face forced liquidations Sunday night/Monday morning.

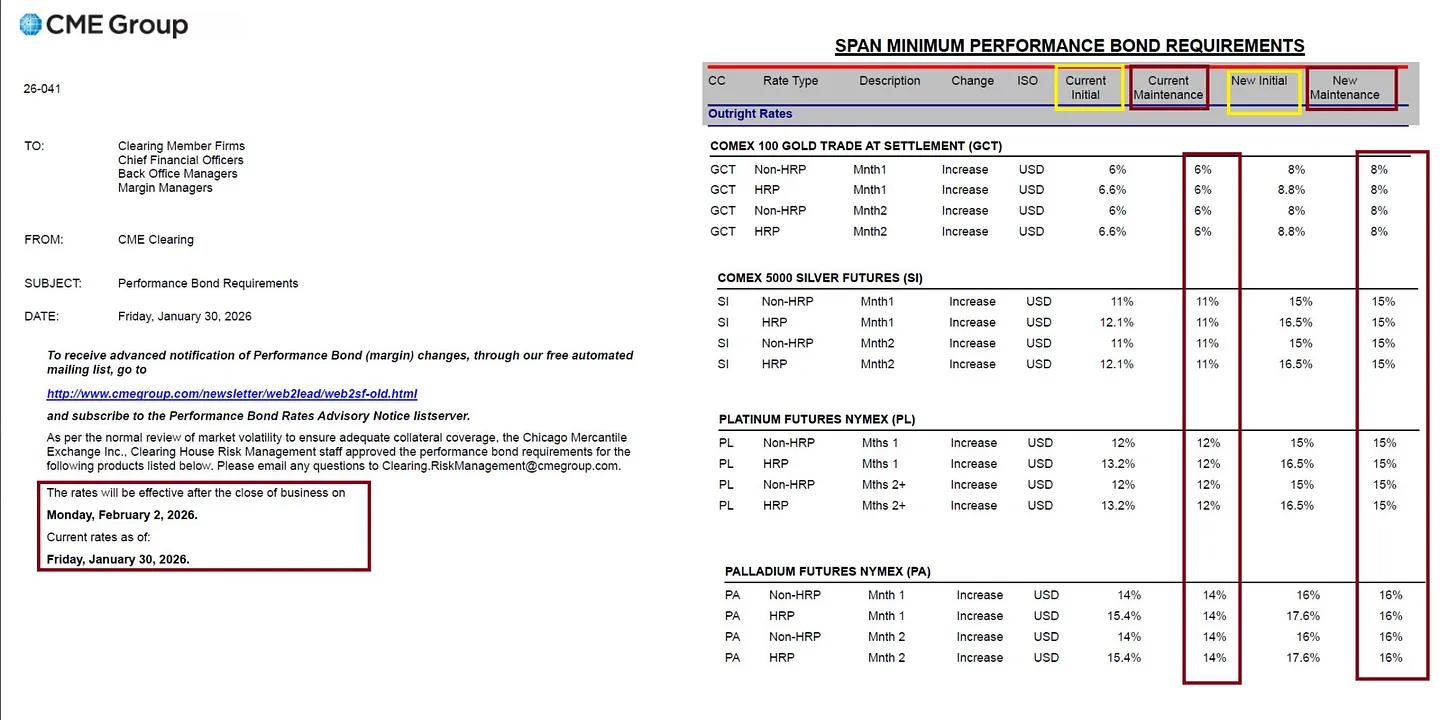

CME raised margins again Friday—but remember: with prices down ~30%, higher margins mean minimal net cash extraction for longs. Margin per unit silver rose sharply, but total futures margin remained roughly unchanged.

Source:@profitsplusid

Bitcoin’s pricing isn’t bullish here—and appears driven by forced selling, persistent quantum computing concerns, and anticipation of MSTR-related issues.

Based on our 14-month-old analysis of its uniquely odd business model, we still hold short positions.

Why bullish?

First, SLV’s price had already begun declining before Friday’s crash—meaning nominal exposure had already fallen substantially.

Unless extreme de-leveraging hits Chinese markets Sunday night, AGQ’s selling wave is over. Any meaningful rebound will act inversely—like a short call option—forcing those players to buy back shares as price rises. As for me, I’m betting China won’t fall all the way. And if forced liquidations truly occur, equities likely won’t escape unscathed.

One final note—geopolitical backdrop hasn’t calmed. If anything, signals from Tehran suggest we’re closer—not farther—to some confrontation. Historically, precious metals thrive in such environments—even if the path to success grows extremely messy. Given all these potential de-leveraging forces, treat current positions as highly tactical. I reserve the right to fully flatten or turn negative delta across the entire commodity curve as conditions evolve.

Perhaps I’m over-positioned short—but I’m increasingly concerned about a substantive equity drawdown, as markets begin pricing the “air gap” between cash flow required to build AI data centers and actual corporate revenues. Yes, the AI agent era is coming. Yes, Moltbook (an AI tool) is genuinely intriguing (if used properly, it consumes vast tokens). Yet deploying AI in enterprises still faces huge logistical, compliance, and operational hurdles. Most workflow-revolution content you see on Twitter/X comes from independent hackers, creators, or small firms with flexible, easily revamped business processes. My estimate remains: agents roll out enterprise-wide mainly late Q2, followed by revenue. This leaves U.S. equities highly vulnerable to the same dynamic that hammered Microsoft last week.

So on relative value, I remain bullish on metals—but willing to admit error and respond more nimbly to market conditions.

It all began with that maxim about pain and reflection. Friday delivered abundant pain—and this article is my attempt at reflection. The core thesis hasn’t changed—solar demand, Chinese capital flight, supply constraints. What changed is price, positioning—and my realization that even in a market that felt like it could only go up, so much short gamma risk was hiding in plain sight.

Pain + Reflection = Progress. Let’s see what form that progress takes when Chinese markets open Sunday night. Good trading—and stay safe. See you next time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News