Market Plunges, HYPE Shines Alone: Understanding Hyperliquid’s HIP-4 Upgrade into Prediction Markets

TechFlow Selected TechFlow Selected

Market Plunges, HYPE Shines Alone: Understanding Hyperliquid’s HIP-4 Upgrade into Prediction Markets

When a perpetual futures DEX begins to evolve, the valuation logic may change.

Author: David, TechFlow

In 2025, the global prediction market trading volume reached $44 billion.

Polymarket accounted for $33.4 billion; Kalshi, $43.1 billion. One is an on-chain “truth engine”; the other, a CFTC-regulated “event exchange.” They competed all year—from U.S. presidential elections to Venezuela’s political upheaval, from Super Bowl outcomes to Fed interest-rate hikes. By year-end, even ICE—the parent company of the NYSE—invested $2 billion in Polymarket.

Prediction markets became one of the fastest-growing crypto sectors in 2025.

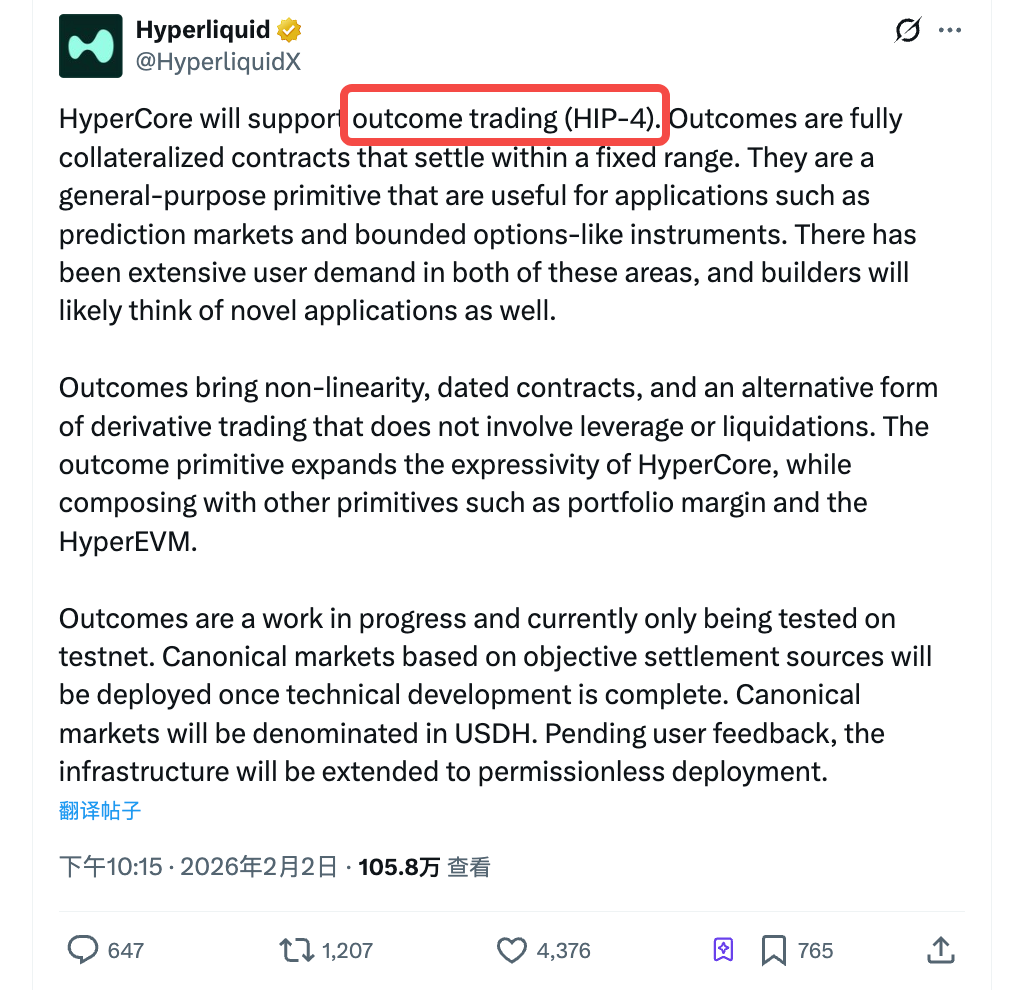

On February 2, Hyperliquid announced the launch of HIP-4 on testnet. Officially termed “outcome trading,” these are fully collateralized contracts settled within a fixed price range—designed for prediction markets and option-like products.

Upon the announcement, $HYPE rose 10%. Over the past week, it surged over 40%—while BTC dipped to $75,000 during the same period.

The market clearly views HIP-4 as bullish. But if you interpret HIP-4 merely as “Hyperliquid entering prediction markets,” you may underestimate its strategic intent—and misjudge Hyperliquid’s current role in the broader crypto ecosystem.

First, what is HIP-4?

Hyperliquid’s core business has been perpetual futures (“perps”): contracts with no expiry, leverage, and liquidation risk. This remains the largest category of on-chain derivatives volume—and Hyperliquid’s primary revenue driver.

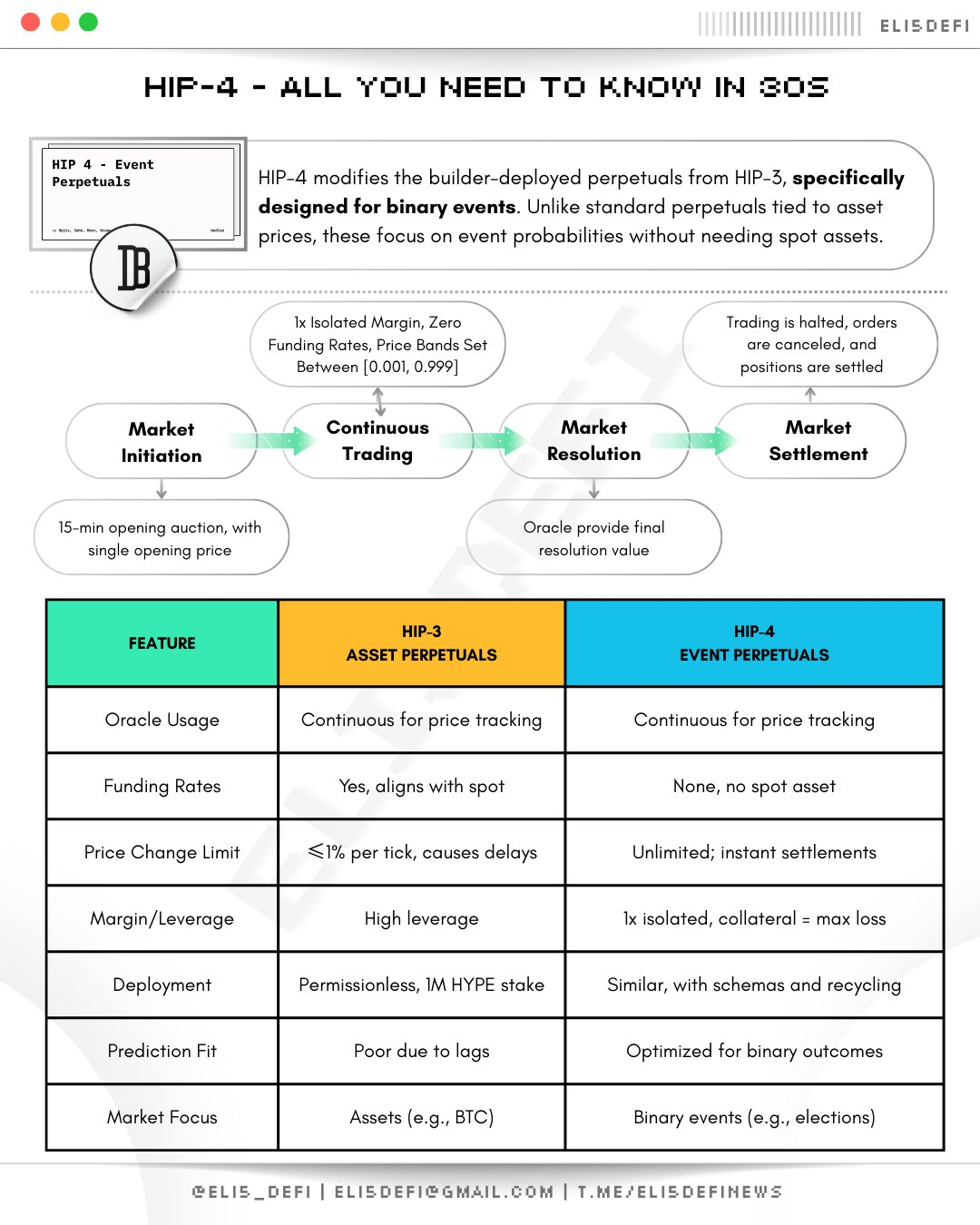

HIP-4’s outcome contracts, however, are nearly the inverse.

They have expiry dates, require full collateralization, offer no leverage, and eliminate liquidation risk. Settlement occurs within a predefined price range: buyers can lose only their initial capital—never owe money to the platform.

For example:

If you believe BTC will surpass $100,000 by end-March, you can buy the corresponding outcome contract. At expiry, if BTC indeed exceeds $100,000, the contract settles at the upper bound—and you profit. If not, it settles at the lower bound—and you lose only your initial investment. No margin calls. No overnight liquidations.

This structure naturally fits two use cases: prediction markets (betting on event outcomes) and option-like products (expressing directional views within a bounded range).

Betting on “Will Trump win re-election?” on Polymarket follows the same logic: full collateralization and binary settlement.

HIP-4 generalizes this logic into a universal primitive—not limited to yes/no binaries, but supporting continuous price ranges.

(Source: @Eli5defi)

Currently, HIP-4 remains on testnet.

Upon mainnet launch, the first set of markets will be curated by the official team and denominated in USDH—the native stablecoin of Hyperliquid. Later, permissionless deployment will open up, allowing anyone to create outcome markets.

Does this sound like “Polymarket—but built on Hyperliquid”?

It’s not that simple.

Composability: Overused—but Most Valuable

Polymarket operates as a standalone prediction market platform.

Contracts purchased there bear no relation to your Aave positions, Uniswap liquidity, or any other protocol’s holdings. Kalshi faces the same limitation. Each contract lives on its own island.

HIP-4 is different. Outcome contracts run natively on HyperCore—sharing the same trading engine and unified margin system as perpetuals.

Ignas, a prominent DeFi researcher, highlighted a classic scenario following HIP-4’s announcement:

You can go long ETH perpetuals while simultaneously buying an outcome contract that pays out if ETH falls below a specified price at expiry. Both positions reside in the same margin account, automatically offsetting each other—reducing net risk exposure and freeing up excess margin.

In plain terms:

You express directionality with one position—and hedging protection with another. Together, they consume less capital than either would alone.

In traditional finance, this is called a structured product.

Investment banks charge hefty fees building such combinations for institutional clients. Hyperliquid aims to enable this natively on-chain—no intermediaries required, with automatic cross-contract hedge recognition.

Polymarket can’t do this. Neither can Kalshi. They’re isolated event exchanges—not derivative engines.

So HIP-4’s outcome contracts are less a standalone product—and more a foundational primitive enhancing Hyperliquid itself: a Lego brick designed to interlock with other components.

Prediction markets are simply the most intuitive application of this brick.

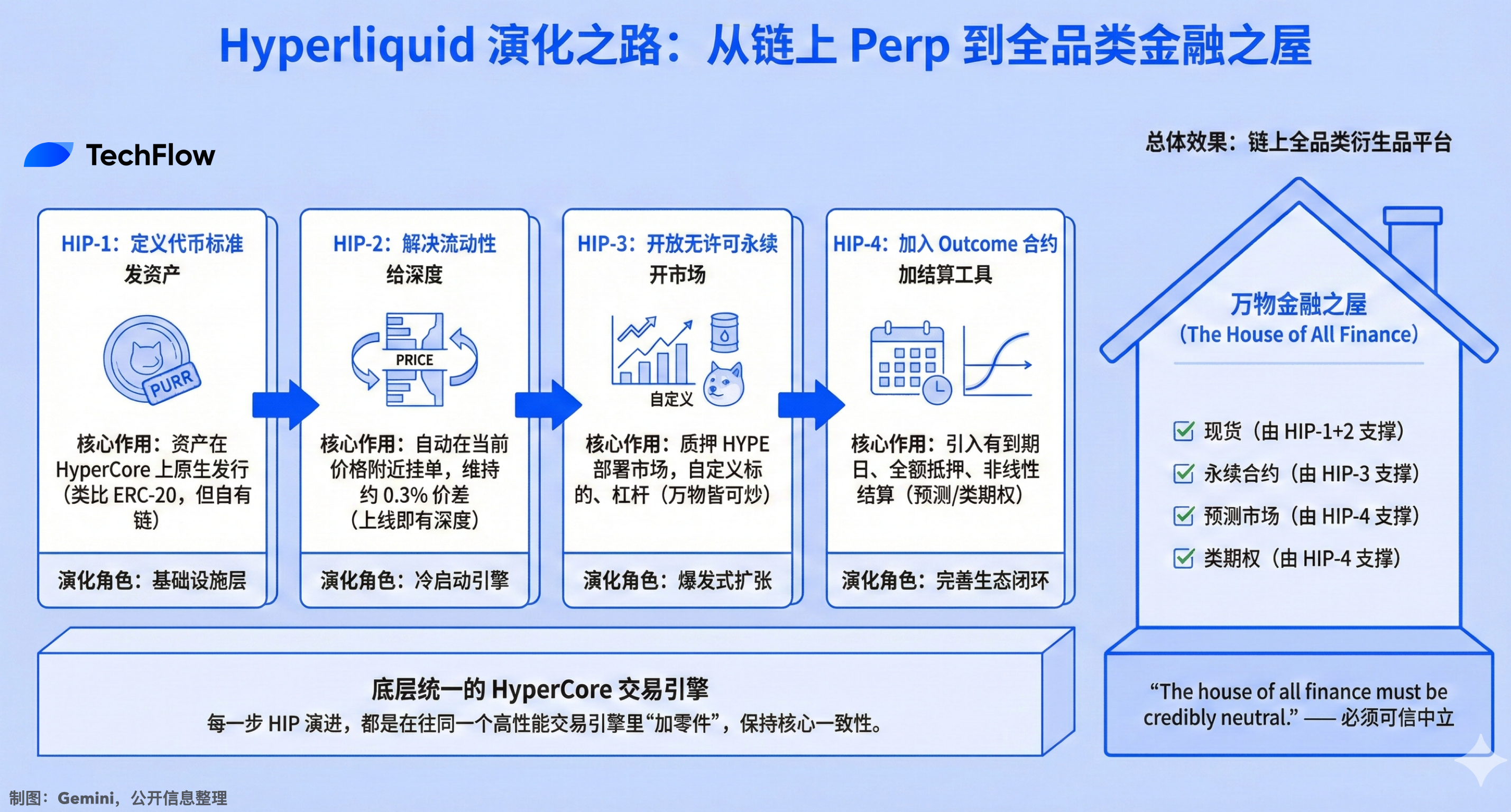

From HIP-1 to HIP-4: Hyperliquid’s Four-Step On-Chain Perp Evolution

Placing HIP-4 in context of Hyperliquid’s product evolution clarifies its significance.

HIP-1 defines the token standard.

Launched in 2024, it enables native issuance of any asset on HyperCore—the first token minted under this standard was PURR. Think of it as ERC-20—but running natively on Hyperliquid’s chain.

HIP-2 solves liquidity.

It automatically places bid/ask orders near the current market price—maintaining ~0.3% spread. Tokens gain depth the moment they launch—no waiting for market makers.

HIP-3 enables permissionless perpetual markets.

Anyone staking 500,000 $HYPE can deploy their own perpetual market—customizing underlying assets, oracles, leverage, and collateral types. Since launch, cumulative trading volume has approached $42 billion, with open interest exceeding $1 billion. Markets span equities, commodities, and meme coins.

HIP-4 introduces outcome contracts.

With expiry, full collateralization, and non-linear settlement.

Viewed sequentially, these four steps mirror the iterative growth of a mature internet product: launch assets → provide liquidity → open markets → add settlement tools.

Thus, Hyperliquid has evolved from a perpetual DEX into a full-stack on-chain derivatives platform—covering spot, perps, prediction markets, and option-like instruments.

Each step adds another component to the same trading engine.

Jeff Yan, Hyperliquid’s founder, once said:

“The house of all finance must be credibly neutral.”

The four HIPs represent the four walls of that house.

Valuing $HYPE

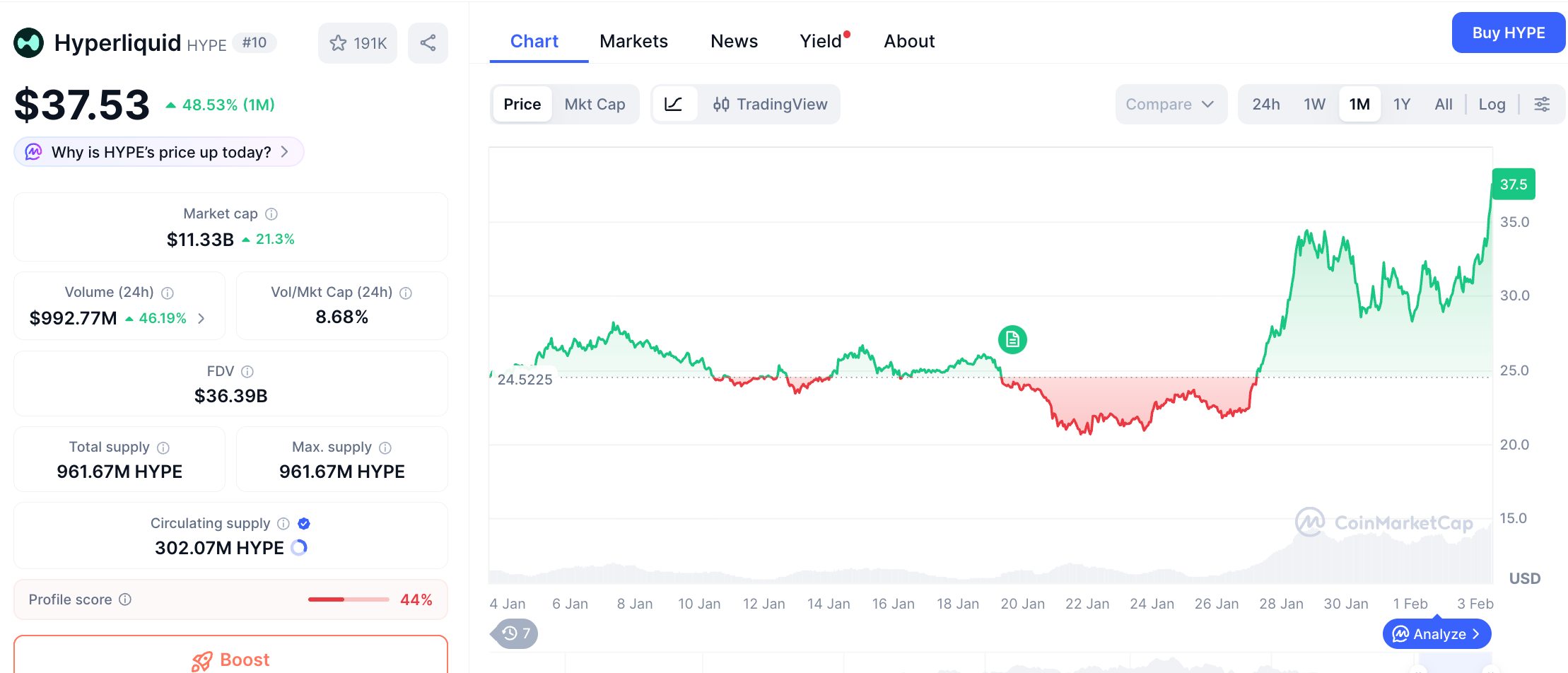

$HYPE rose over 40% last week—even as broader markets bled.

This surge isn’t solely attributable to HIP-4.

Several concurrent catalysts have been unfolding: HIP-3’s permissionless perpetual markets continue scaling rapidly; precious metals trading has generated strong metrics; and $HYPE’s buyback mechanism remains active—97% of platform trading fees are used to repurchase $HYPE.

Yet HIP-4’s announcement triggered a 10% spike in $HYPE—suggesting the market assigns real value to this development.

We emphasize USDH’s pivotal role.

All HIP-4 outcome contracts settle in USDH—the native stablecoin of Hyperliquid, issued by Felix Protocol and backed by short-term U.S. Treasuries. Its yield funds $HYPE buybacks and incentivizes DeFi activity across the ecosystem.

This strengthens Hyperliquid’s existing flywheel:

More product types launched (HIP-3 perps + HIP-4 outcomes) → Higher trading volume → More fee revenue → More $HYPE buybacks → Greater USDH adoption & demand → USDH Treasury yield further fuels $HYPE buybacks → $HYPE price rises → Higher effective barrier to entry for HIP-3 market creators → Attracts stronger builders to deploy new markets.

The cycle continues—provided Hyperliquid sustains trading volume growth. Yet both macro crypto conditions and prediction-market competition remain fierce.

Outcome contract settlement relies on external data sources. Who won the election? What was BTC’s price at expiry? Did a given event occur? This information must be delivered to on-chain contracts accurately and immutably.

Hyperliquid states it will use “objective settlement data sources”—but hasn’t disclosed which oracles it’ll use, nor how manipulation will be prevented. Historically, oracle disputes have been the most common trigger for prediction-market collapses.

Regulation remains another variable.

In January 2026, a Massachusetts judge issued an injunction against Kalshi—deeming its sports betting contracts illegal gambling under CFTC oversight. Even compliant exchanges aren’t immune to state-level litigation; decentralized protocols won’t stay outside regulators’ reach forever.

A more fundamental question lingers: How large is the actual prediction-demand market?

Of the $44 billion total, over 90% on Kalshi comes from sports betting; Polymarket’s volume concentrates on mega-events like elections and geopolitical crises. Liquidity for everyday prediction markets remains thin. Will HIP-4 attract net-new users—or simply add another button for existing traders? There’s no clear answer yet.

But Hyperliquid clearly isn’t aiming to become “the next Polymarket.” Instead, it seeks to embed prediction as a native capability of its existing trading engine—as foundational and seamless as perpetuals themselves.

When a perp DEX begins evolving, valuation logic may well shift.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News