The 2025 Perp DEX Battle: Hyperliquid, Aster, Lighter, and EdgeX Divide the Market—Which Is Your Best Choice?

TechFlow Selected TechFlow Selected

The 2025 Perp DEX Battle: Hyperliquid, Aster, Lighter, and EdgeX Divide the Market—Which Is Your Best Choice?

Hyperliquid targets professionals, Aster focuses on retail and Asian markets, Lighter emphasizes technology, and EdgeX concentrates on institutional users.

Author: Stacy Muur

Compiled by: TechFlow

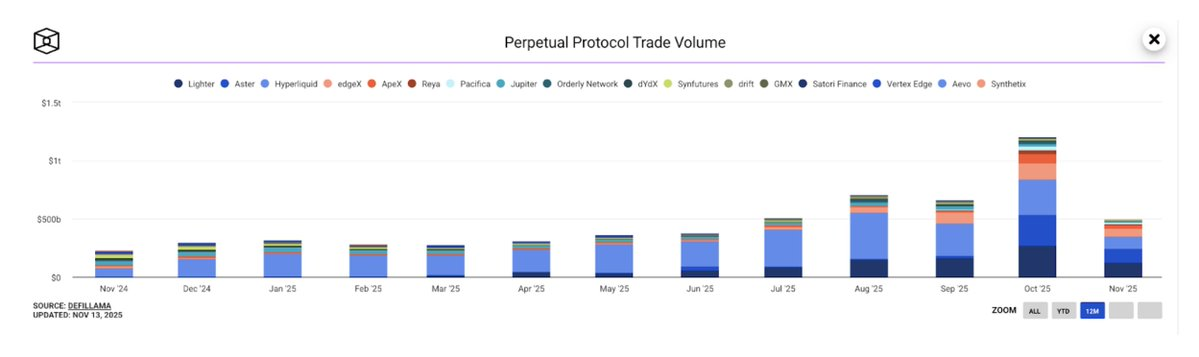

In 2025, the perpetual contract decentralized exchange (Perp DEX) market experienced explosive growth. In October, the market's monthly trading volume surpassed $1.2 trillion for the first time, drawing significant attention from retail traders, institutional investors, and venture capital firms.

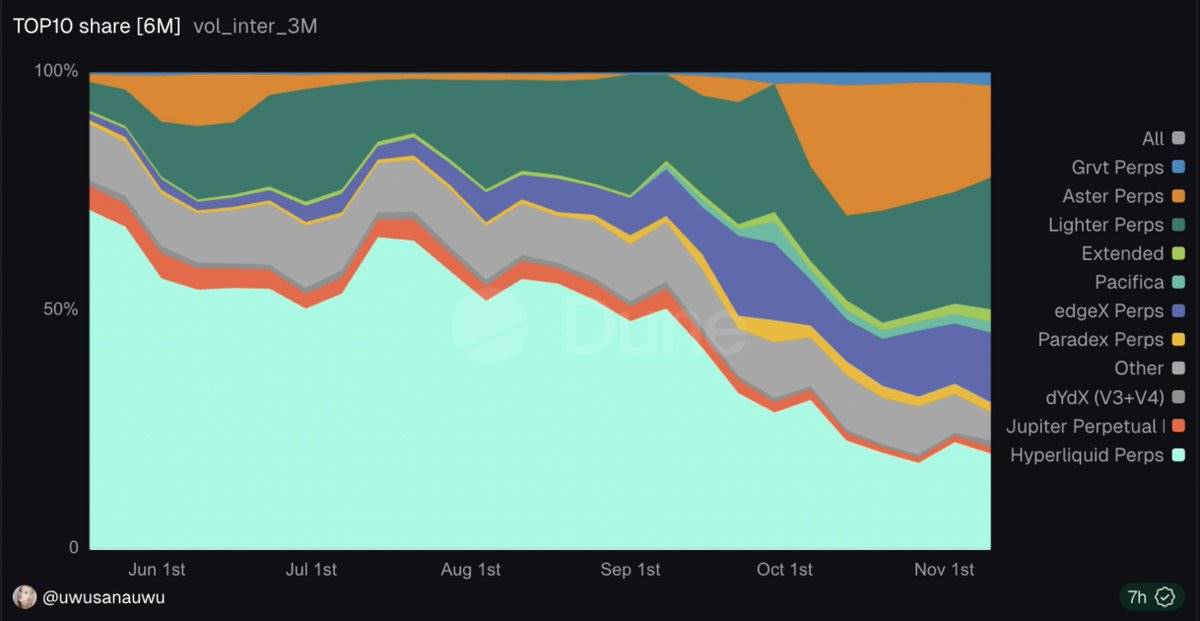

Over the past year, Hyperliquid has dominated the market, reaching a peak market share of 71% in May. However, by November, Hyperliquid’s market share had dropped sharply to 20%, while new competitors rapidly rose and began carving up the market:

-

Lighter: 27.7%

-

Aster: 19.3%

-

EdgeX: 14.6%

As this rapidly evolving ecosystem develops, four major players have emerged, fiercely competing for industry dominance:

-

@HyperliquidX – The established leader in on-chain perpetual contracts

-

@Aster_DEX – A rocket with massive volume but controversial practices

-

@Lighter_xyz – A disruptor with zero fees and native zk technology

-

@edgeX_exchange – A low-key, institution-friendly dark horse

This in-depth investigation analyzes these platforms across multiple dimensions—technology, data, controversies, and long-term viability—to help readers distinguish hype from reality.

Part 1: Hyperliquid – The Undisputed King

Why Did Hyperliquid Achieve Dominance?

Hyperliquid has established itself as the leading decentralized perpetual contract exchange, once capturing a peak market share of 71%. Despite competitors temporarily grabbing headlines with explosive trading volumes, Hyperliquid remains the core pillar of the Perp DEX ecosystem.

Technical Foundation

Hyperliquid’s dominance stems from its revolutionary architectural decision—building a custom Layer 1 blockchain specifically designed for derivatives trading. The platform uses the HyperBFT consensus mechanism, enabling sub-second order confirmation and processing up to 200,000 transactions per second, outperforming even many centralized exchanges.

The True Picture of Open Interest (OI)

While rivals often seize the spotlight with eye-catching 24-hour trading volume figures, the real indicator of capital deployment is open interest (OI)—the total value of outstanding perpetual contracts.

-

Volume reflects activity

-

Open Interest reflects long-term capital commitment

According to 21Shares data, in September 2025:

-

Aster accounted for ~70% of trading volume

-

Hyperliquid’s volume temporarily dropped to ~10%

However, this advantage is limited to volume—a metric most susceptible to manipulation through incentives, rebates, market maker churn, or wash trading.

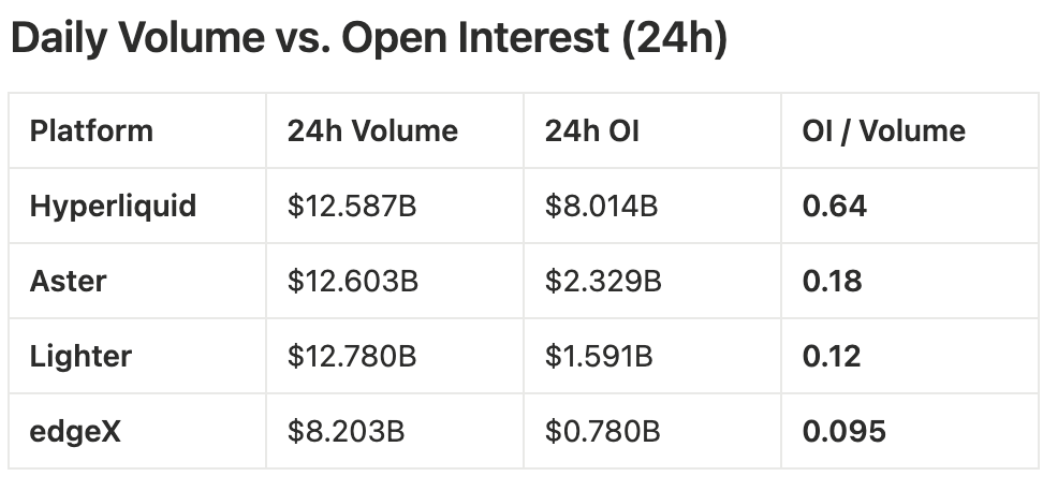

Latest 24-hour open interest data shows:

-

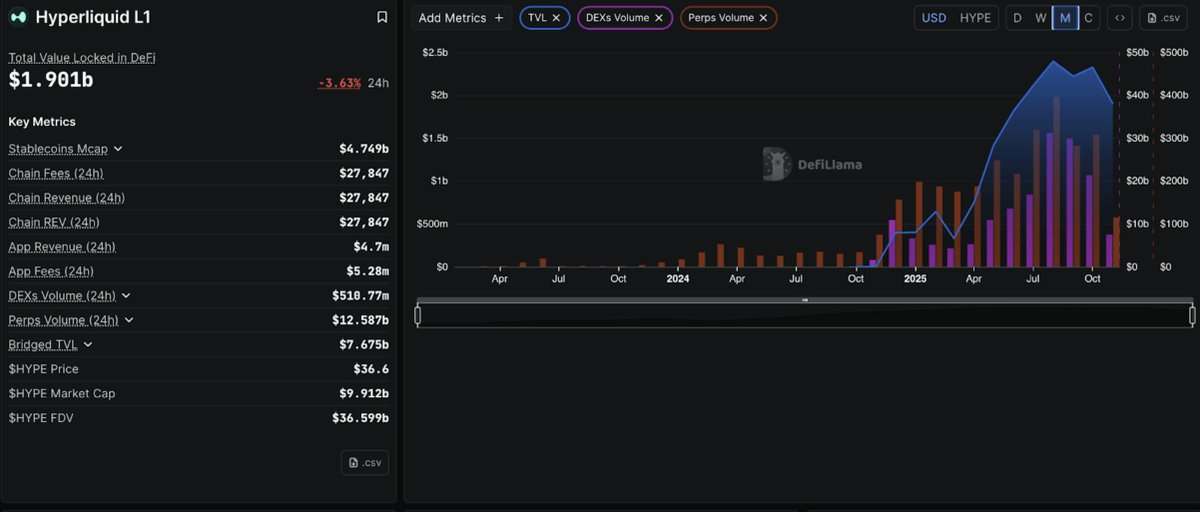

Hyperliquid: $8.014 billion

-

Aster: $2.329 billion

-

Lighter: $1.591 billion

-

EdgeX: $780.41 million

-

Total OI (Top 4): $12.714 billion

-

Hyperliquid market share: ~63%

This means Hyperliquid holds nearly two-thirds of outstanding positions among major perpetual platforms—more than Aster, Lighter, and EdgeX combined.

Open Interest Market Share (24-hour data)

-

Hyperliquid: 63.0%

-

Aster: 18.3%

-

Lighter: 12.5%

-

EdgeX: 6.1%

This metric reflects capital traders are willing to hold overnight—not just trade frequently or engage in wash trading for incentives.

-

Hyperliquid: High OI/Volume ratio (~0.64) indicates a large portion of trading flow translates into active, sustained positions.

-

Aster & Lighter: Low OI/Volume ratio (~0.18 and 0.12) indicate high turnover but less committed capital—typically a sign of incentive-driven activity rather than stable liquidity.

Comprehensive Analysis:

-

Volume (24h): Reflects short-term activity

-

Open Interest (24h): Reflects at-risk capital

-

OI/Volume Ratio (24h): Reveals authenticity of activity and incentive dependence

Based on all OI-based metrics, Hyperliquid is the structural leader:

-

Highest open interest

-

Largest share of committed capital

-

Strongest OI/Volume ratio

-

OI exceeds the sum of the other three top platforms

Volume rankings may fluctuate, but open interest reveals the true market leader—and that leader is Hyperliquid.

Proven in Real-World Stress

October 2025 Liquidation Event

During the October 2025 liquidation event, when over $19 billion in positions were liquidated, Hyperliquid maintained flawless operational stability despite massive transaction surges.

Institutional Recognition

21 Shares has filed an application with the U.S. Securities and Exchange Commission (SEC) for a Hyperliquid-related product (ticker: HYPE) and has already listed a regulated HYPE ETP (exchange-traded product) on the SIX Swiss Exchange. These developments, reported by CoinMarketCap and other market data trackers, signal growing institutional access to HYPE. Meanwhile, the HyperEVM ecosystem is expanding, although public data has not yet verified claims of “180+ projects” or “$4.1 billion TVL.”

Conclusion: Based on current filings, exchange listings, and ecosystem growth reported by platforms like CoinMarketCap, Hyperliquid demonstrates strong momentum and increasing institutional recognition, further solidifying its position as the leading decentralized derivatives platform.

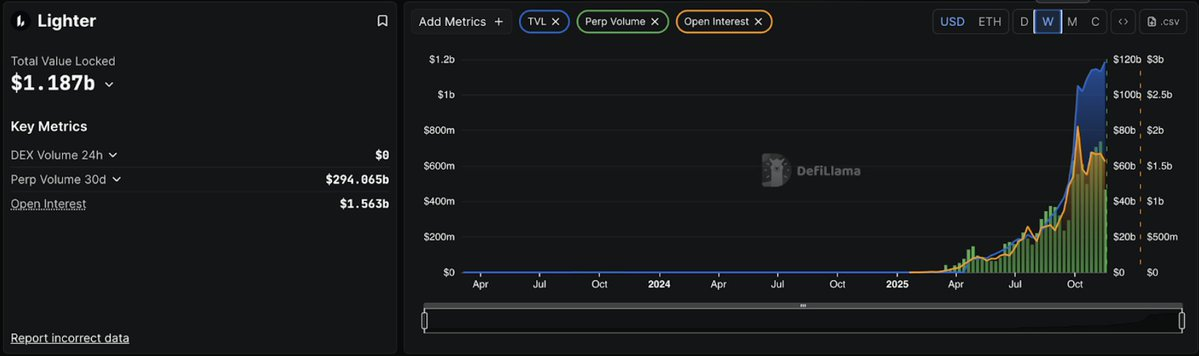

Part 2: Lighter – Technological Potential, Questionable Data

Technical Advantages

Lighter’s technical pedigree is impressive: founded by former Citadel engineers, backed by Peter Thiel, a16z, and Lightspeed, raising $68 million at a $1.5 billion valuation. It employs zero-knowledge proofs (ZKPs) to cryptographically verify every transaction, ensuring transparency and security.

As an Ethereum Layer 2 (L2), Lighter inherits Ethereum’s security and offers users a “escape hatch” mechanism—allowing fund recovery via smart contracts even if the platform fails. This safety net is typically absent on app-specific Layer 1 chains.

Launched on October 2, 2025, Lighter reached $1.1 billion in total value locked (TVL) within weeks, with daily trading volume stabilizing at $700–800 million and over 56,000 users.

Zero Fees = Aggressive Strategy

Lighter charges 0% fees for both makers and takers—completely free. This strategy is irresistible to fee-sensitive traders and instantly makes competing platforms less attractive.

The strategy is simple: capture market share through unsustainable economics, build user loyalty, then monetize later.

The Test on October 11

Ten days after mainnet launch, the largest liquidation event in crypto history occurred, clearing $19 billion in positions.

Positives:

-

The system remained operational during five hours of market chaos.

-

LLP (liquidity pool) provided support when competitors pulled back.

Negatives:

-

The database crashed after five hours, causing a four-hour outage.

Concerns:

-

LLP incurred losses, while Hyperliquid’s HLP and EdgeX’s eLP remained profitable.

Founder Vlad Novakovski’s explanation: A database upgrade was planned for Sunday, but Friday’s market volatility caused the old system to fail prematurely.

Volume Concerns:

Data suggests clear signs of points farming:

-

24h Volume: $12.78 billion

-

Open Interest: $1.591 billion

-

Volume/OI Ratio: 8.03

Healthy ratio: Typically below 3; above 5 is concerning; 8.03 is extreme.

Comparison:

-

Hyperliquid: 1.57 (organic trading)

-

EdgeX: 2.7 (moderate)

-

Aster: 5.4 (concerning)

-

Lighter: 8.03 (clear farming behavior)

Traders generate $8 in volume for every $1 deployed—rapidly flipping positions to earn points, not holding real exposure.

30-day data confirms: Cumulative volume $294 billion vs cumulative OI $47 billion = ratio of 6.25, still far above reasonable levels.

Airdrop Questions

Lighter’s points program is highly aggressive. User points will convert to LITER tokens at the token generation event (TGE), expected in Q4 2025 or Q1 2026. Currently, over-the-counter markets price points between $5 and over $100. Given potential airdrop values reaching tens of thousands of dollars, the explosive volume is understandable.

Key question: What happens after TGE? Will users stay, or will volume collapse?

Conclusion

Strengths:

✅ Top-tier tech (ZK verification works)

✅ Zero fees = real competitive edge

✅ Inherits Ethereum security

✅ Elite team and backers

Concerns:

⚠️ Volume/OI ratio of 8.03 = intense farming behavior

⚠️ LLP lost money under stress test

⚠️ Four-hour outage raises questions

⚠️ Post-airdrop user retention unproven

Bottom line: Lighter has world-class technology, but its data metrics are worrying. Can it turn “farmers” into real users? Technically yes, but historical precedent suggests low probability.

-

For farmers: A solid opportunity pre-TGE.

-

For investors: Wait 2–3 months post-TGE to see if volume holds.

Probability forecast:

-

40% chance of becoming a top-three platform

-

60% chance of being just a technically advanced points farm

Part 3: EdgeX – The Institutional-Grade Platform

Amber Group Advantage

EdgeX operates uniquely. As a project incubated by Amber Group (managing $5 billion in assets), it brings professionals from Morgan Stanley, Barclays, Goldman Sachs, and Bybit. This isn’t crypto natives learning finance—it’s traditional finance (TradFi) experts bringing institutional experience into DeFi.

Amber Group’s market-making DNA directly translates into EdgeX’s core strengths: deep liquidity, tight spreads, and execution quality rivaling centralized exchanges (CEX). Launched in September 2024, EdgeX aims to deliver CEX-level performance while preserving user self-custody.

Built on StarkEx (StarkWare’s mature ZK engine), EdgeX processes 200,000 orders per second with sub-10ms latency—on par with Binance.

Lower Fees Than Hyperliquid

EdgeX beats Hyperliquid on fees across the board:

-

Fee comparison:

-

EdgeX Maker: 0.012% vs Hyperliquid: 0.015%

-

EdgeX Taker: 0.038% vs Hyperliquid: 0.045%

-

For a trader with $10 million monthly volume, this saves $7,000–10,000 annually compared to Hyperliquid.

Additionally, EdgeX performs better in retail order liquidity (<$6M)—tighter spreads, less slippage—outperforming competitors.

Sustainable Revenue & Healthy Metrics

Unlike Lighter’s zero-fee model, EdgeX generates real, sustainable revenue:

-

Current data:

-

Total Value Locked (TVL): $489.7 million

-

24h Volume: $8.2 billion

-

Open Interest (OI): $780 million

-

30-day revenue: $41.72 million (up 147% from Q2)

-

Annualized revenue: $509 million (second only to Hyperliquid)

-

Volume/OI ratio: 10.51 (concerning at first glance, but requires deeper analysis)

-

At first glance, a 10.51 Volume/OI ratio seems poor. But considering EdgeX launched liquidity via an aggressive points program, this ratio is steadily improving as the platform matures. More importantly, EdgeX maintains healthy revenue throughout—proving it attracts real traders, not just speculators.

October Stress Test

During the October 11 market crash ($19B liquidations), EdgeX performed exceptionally:

✅ No downtime (vs Lighter’s 4-hour outage)

✅ eLP (EdgeX Liquidity Pool) remained profitable (vs LLR losses at Lighter)

✅ Offered LPs 57% annualized yield (highest in industry)

eLP demonstrated superior risk management during extreme volatility, remaining profitable while competitors struggled.

EdgeX’s Unique Strengths

-

Multi-chain flexibility:

Supports Ethereum L1, Arbitrum, and BNB Chain;

Accepts USDT and USDC as collateral;

Enables cross-chain deposits/withdrawals (unlike Hyperliquid, which only supports Arbitrum).

-

Best mobile experience:

Offers official iOS and Android apps (Hyperliquid does not);

Clean UI for managing positions anytime, anywhere.

-

Focus on Asian markets:

Strategically entering Korea and broader Asia through localized support and events like Korea Blockchain Week;

Targets underserved regions ignored by Western rivals, avoiding overcrowded competition.

-

Transparent points program:

-

60% from trading volume

-

20% from referrals

-

10% from TVL/liquidity provision

-

10% from liquidations/OI — Explicitly states: “We do not reward wash trading.” Data confirms this—the Volume/OI ratio is improving, not worsening like pure farming models.

-

Challenges

-

Market share: EdgeX currently holds only 5.5% of the Perp DEX open interest market. Further growth requires aggressive incentives (risking farming) or major partnerships.

-

No killer feature: EdgeX excels across the board but lacks a standout innovation. It’s more of a “business class” option—solid but not disruptive.

-

Fees not compelling enough: Lighter’s zero fees make EdgeX’s “lower than Hyperliquid” pricing less attractive.

-

Late TGE: EdgeX expects TGE in Q4 2025, missing the early airdrop frenzy of competitors.

Final Verdict

Strengths:

✅ Institutional backing: Amber Group ensures liquidity support

✅ Real revenue: $509 million annualized

✅ Best LP returns: 57% annualized yield, profitable even during crashes

✅ Fees: Lower than Hyperliquid

✅ Clean data: No wash trading scandals

✅ Multi-chain + great mobile app: Best overall UX

Risks:

⚠️ Small market share: Only 5.5% of OI market

⚠️ Volume/OI ratio: 10.51 (improving but still high)

⚠️ No unique differentiation: No killer feature

⚠️ Fees not competitive: Can’t match zero-fee platforms

Best for:

-

Asian traders: Users seeking localized support

-

Institutional users: Professionals relying on Amber liquidity

-

Conservative traders: Risk-aware users

-

Mobile-first users: Traders needing on-the-go position management

-

LP investors: Seekers of stable returns

Summary:

EdgeX doesn’t aim to challenge Hyperliquid’s dominance but focuses on serving Asian markets, institutions, and conservative traders, targeting 10–15% market share. It’s building a sustainable, profitable niche.

Think of EdgeX as the “Kraken” of Perp DEXs—not the biggest or flashiest, but steady, professional, and trusted by mature users who value execution quality.

-

For farmers: Moderate opportunity with less competition.

-

For investors: Suitable for small, diversified allocations—low risk, stable returns.

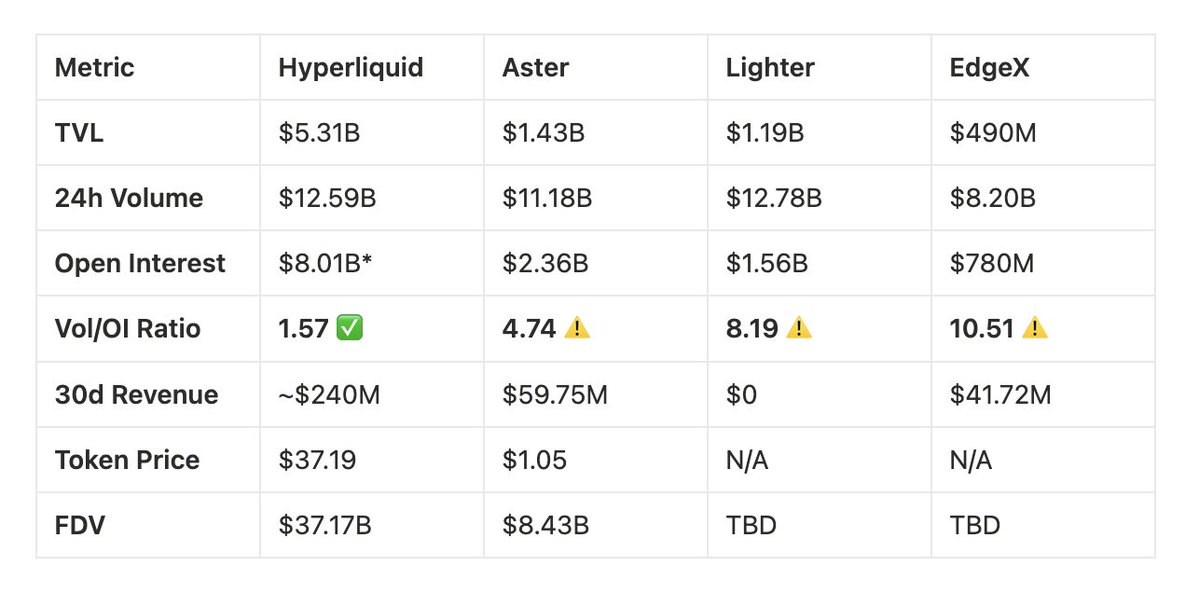

Market Comparison of Perpetual DEXs

Figure: Projections based on publicly available data

Volume/OI Ratio Analysis

Industry standard: Healthy ratio ≤ 3

-

Hyperliquid: 1.57 ✅ Indicates strong organic trading

-

Aster: 4.74 ⚠️ High ratio, reflects heavy incentives

-

Lighter: 8.19 ⚠️ High ratio signals points-driven behavior

-

EdgeX: 10.51 ⚠️ Clear impact from points program, but improving

Market Share: Open Interest Distribution

Total market size: ~$13 billion in open interest

-

Hyperliquid: 62% – Market leader

-

Aster: 18% – Strong second place

-

Lighter: 12% – Growing presence

-

EdgeX: 6% – Focused on niche

Platform Overview

Hyperliquid – The Leader

-

Market share: 62%, stable metrics

-

Annualized revenue: $2.9 billion, active buyback program

-

Community-owned: Proven track record

-

Strengths: Market dominance, sustainable economics

-

Rating: A+

Lighter – The Tech Pioneer

-

Zero-fee model: Attracts high-frequency traders

-

Technical innovation: Advanced ZK verification

-

Premier backing: Investors include Thiel, a16z, Lightspeed

-

Launch timing: TGE expected Q1 2026, limited performance data so far

-

Strengths: Technical innovation, Ethereum L2 security

-

Watchouts: Business model sustainability, post-airdrop retention

-

Rating: Pending (awaiting TGE performance)

EdgeX – The Institution-Focused

-

Institutional backing: Amber Group provides liquidity

-

Annualized revenue: $509 million, stable LP performance

-

Strategy: Focus on Asia, mobile-first

-

Strengths: Institutional credibility, steady growth

-

Watchouts: Smaller market share, competitive positioning

-

Rating: B

Investment Recommendations

Exchange Selection:

-

Hyperliquid: Deepest liquidity, reliable performance

-

Lighter: Zero fees benefit high-frequency traders

-

EdgeX: Lower fees than Hyperliquid, superior mobile experience

-

Aster: Multi-chain flexibility, BNB ecosystem support

Token Investment Timeline:

-

HYPE: Already listed, current price $37.19

-

ASTER: Trading at $1.05, monitor future developments

-

LITER: TGE expected Q1 2026, assess post-launch performance

-

EGX: TGE expected Q4 2025, observe initial performance

Key Conclusions

-

Market Maturity: The Perp DEX space now shows clear differentiation, with Hyperliquid establishing leadership through sustainable metrics and community alignment.

-

Growth Strategies: Platforms target distinct user segments—Hyperliquid for professionals, Aster for retail and Asian markets, Lighter for tech-focused users, EdgeX for institutions.

-

Key Metrics: Volume/OI ratio and revenue generation offer clearer insights than volume alone.

-

Outlook: Post-TGE performance of Lighter and EdgeX will determine their long-term competitiveness; Aster’s future depends on resolving transparency issues and maintaining ecosystem support.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News