Kyle Resigns and Slams Hyperliquid Four Days Later; Arthur Hayes Responds with a $100,000 Bet

TechFlow Selected TechFlow Selected

Kyle Resigns and Slams Hyperliquid Four Days Later; Arthur Hayes Responds with a $100,000 Bet

A $100,000 bet—and an absent opponent.

Author: David, TechFlow

There aren’t many projects worth highlighting amid this downturn—Hyperliquid is one of them.

$HYPE has nearly doubled since its January lows. Regardless of how you view the project, the market is voting. Yet Kyle Samani, former co-founder of Multicoin, cast a dissenting vote.

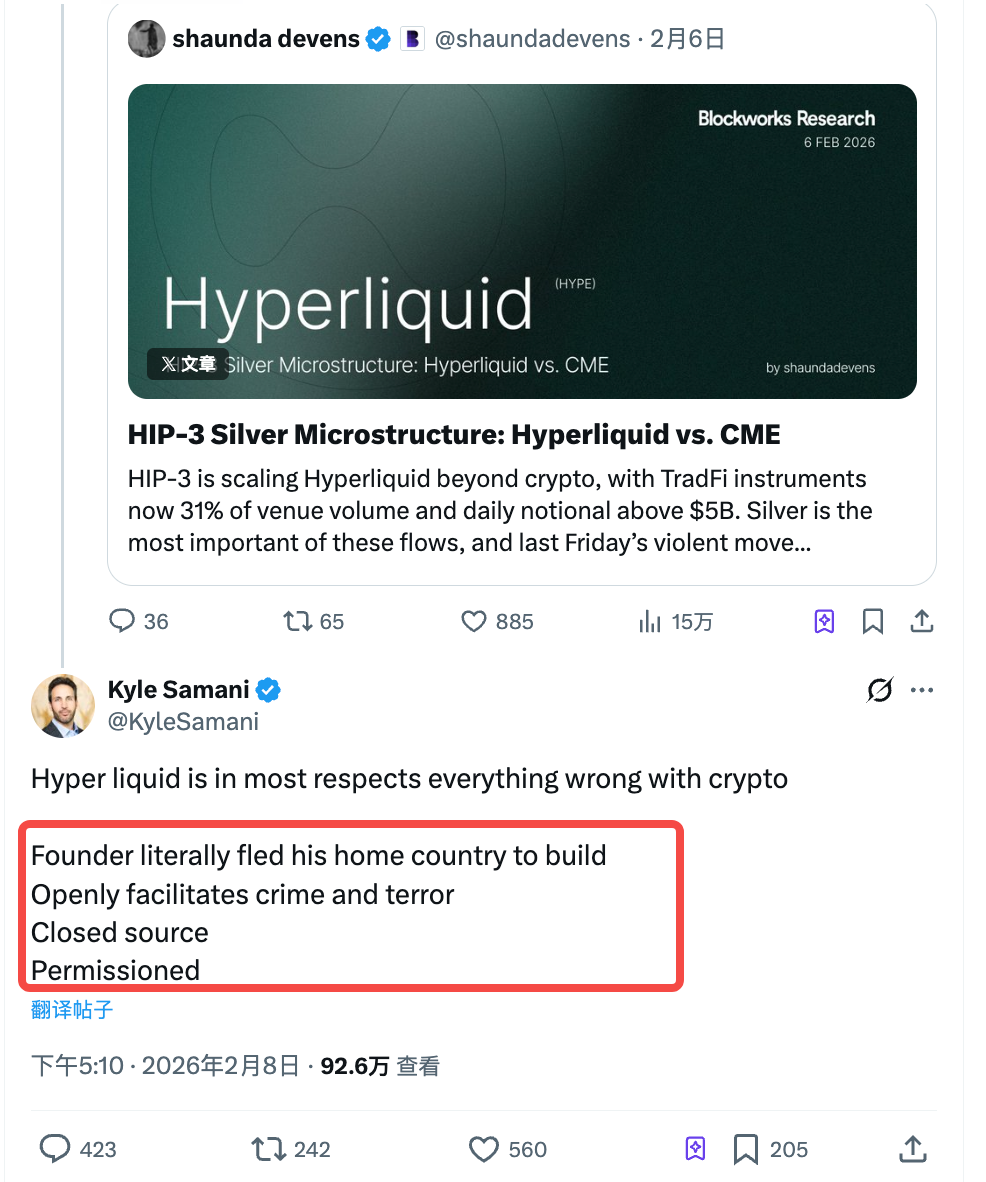

On February 8, Blockworks Research published a research report stating that Hyperliquid’s silver perpetual contracts are now competing head-to-head with traditional futures exchanges like CME on both spread and execution efficiency.

Many in the industry shared the report, interpreting it as a signal that onchain finance is finally encroaching upon traditional finance’s turf.

But Kyle poured cold water on the enthusiasm.

He argued that Hyperliquid embodies classic problems across the crypto industry:

- The founders fled their home country to build the project.

- The platform openly facilitates crime and terrorism.

- The codebase is closed-source.

- The product operates under permissioned access—not fully open.

In prior cycles, such statements would simply be typical “CT-style” project mudslinging common across crypto Twitter.

Yet recall that just four days earlier, Kyle had announced his departure from Multicoin Capital (See: “Kyle Left Crypto—and I’m a Little Sad”). And before the official announcement, he posted (and then immediately deleted) a tweet stating:

“Cryptocurrency isn’t as interesting as many people—including myself—once imagined.”

Arthur Hayes—the veteran crypto trader—clearly disagrees. Immediately after Kyle’s remarks, he publicly expressed confidence in $HYPE:

“Since you think $HYPE is so terrible, let’s make a bet: From February 10 to July 31, $HYPE outperforms any single cryptocurrency you choose—with a market cap over $1 billion. The loser donates $100,000 to a charity selected by the winner. You pick the coin—I’ll only bet on $HYPE winning.”

Critique—and Leaving the Table

As of publication, Kyle has not accepted Arthur’s wager—and most likely won’t.

A person who just declared, “Crypto isn’t that interesting anymore,” is unlikely to rejoin the table to compete over which token appreciates more.

Still, Kyle’s specific allegations against Hyperliquid merit discussion.

Take the claim that “the founders fled their home country.” Hyperliquid’s founder, Jeff Yan, grew up in Palo Alto, California; graduated from Harvard; and previously worked as a quant at high-frequency trading firm Hudson River Trading.

The team is headquartered in Singapore, the company is incorporated in the Cayman Islands, and the platform blocks U.S. users.

This structure is standard industry practice—from Binance to dYdX. Having spent nearly a decade in crypto, Kyle surely knows this is standard offshore compliance protocol.

Labeling it “fleeing one’s homeland” feels deliberately provocative—especially for someone raised in Palo Alto.

The criticisms regarding closed-source code, permissioned access, and facilitation of illicit activity hold some validity—but Kyle wouldn’t necessarily have voiced these publicly before. During his tenure at Multicoin, his job was to source, invest in, and promote projects; such gray areas were tacit industry costs everyone understood.

The change? Kyle is no longer in that role.

Once someone leaves the table, what they see looks fundamentally different than when they sat at it.

Pump It—No Explanation Needed

Meanwhile, Arthur Hayes didn’t refute any of Kyle’s accusations. He offered no defense of Hyperliquid’s closed-source nature, nor did he explain why Jeff Yan relocated to Singapore.

His response was purely a price-based wager.

This reflects a familiar crypto logic: a pump equals a good product. Choosing price as the sole response underscores a reality for full-time industry participants: price is the only language that matters.

You say Hyperliquid has moral flaws; he says $HYPE will outperform any large-cap altcoin in five months.

These two statements may appear to address the same topic—but they operate on entirely separate planes.

Kyle speaks to “ought”—normative judgment. Hayes speaks to “will”—empirical outcome.

This “talking past each other” recurs in every crypto cycle. Mid-to-late bull markets—or bear markets—inevitably trigger a wave of critics rising to declare systemic problems, while those still seated respond with one phrase:

“Just look at the price.”

Token price remains the most convenient weapon for active players—because as long as it rises, all criticism can be temporarily shelved.

The complication? Kyle may no longer be an active player. For a fund co-founder to publicly express disillusionment with the entire industry shortly before formal departure is awkward in any field.

The tweet was deleted—but the sentiment remains.

His current broadside against Hyperliquid carries a tone of finality—not merely criticizing a project, but rather cutting ties with certain aspects of his own past eight years.

Yet while he can sever personal ties, Multicoin itself remains firmly in the game.

Starting January 22, onchain analysts identified wallet activity linked to Multicoin depositing approximately 87,000 ETH into Galaxy Digital. The following day, the same entity began purchasing $HYPE in 17 separate transactions totaling roughly $46 million.

In other words, around the time Kyle departed Multicoin, his former fund was aggressively accumulating the very project he’d just condemned.

Those 17 staggered purchases strongly suggest internal deliberation and conviction within Multicoin.

Kyle sees Hyperliquid as embodying crypto’s deepest flaws—but at least one person inside Multicoin believes it merits real-money support. Holding is itself a statement.

Kyle left—but his former employer’s capital may have just taken a seat. And notably, it sat down at the very table Kyle disdains most.

Beyond the Arthur–Kyle exchange, community reactions are also revealing.

A Hyperliquid community member named Max unearthed an old post he made in September 2024. At the time, others were questioning Multicoin’s operational practices—and Max criticized Multicoin, saying:

“You’re always trying to chase beta returns on your own top holdings using LP capital—and conveniently boosting your portfolio’s valuation along the way.”

Now, 18 months later, Kyle criticizes Hyperliquid—and Max observes the playbook hasn’t changed:

Kyle remains Kyle: criticism always filtered through positionality. He defended Solana yesterday; today he disparages Hyperliquid—all rooted in Multicoin’s ecosystem interests and competitive anxiety.

Kyle couldn’t resist replying with a quintessentially crypto-style flex: “The amount I’ve personally invested directly in crypto exceeds your lifetime net worth—at least tenfold.”

Max delivered the perfect counterpunch: “Last September, your net worth was probably 30 times mine…”

Between September 2025 and February 2026, markets cycled repeatedly. Multicoin’s crypto assets—represented by Kyle—clearly shrank significantly. Meanwhile, Hyperliquid held relatively steady.

Position always shapes perspective.

When a project begins threatening an incumbent ecosystem’s traffic and valuations, criticism is swiftly branded “conflicted.” Conversely, defenders fire back with “you’re just jealous.”

This round saw Kyle attempt a moral and decentralization-purity critique of Hyperliquid—only for opponents to effortlessly drag the debate back into the jungle law of “who profits, wins.”

In the end, rational discourse drowned in tribal celebration—leaving behind only screenshots and memes.

Every cycle repeats this pattern: some sit down; others stand up. Those seated talk price; those standing preach ethics.

But whether disillusionment preceded recognition of problems—or vice versa—is impossible to untangle.

Regardless of whether $HYPE rises or falls in five months, Kyle likely won’t care. He’s already moved on to something else.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News