Interview with Jeff Park: We Are in a Bear Market, Quantitative Easing Is No Longer Effective, and Silver—Like Altcoins—Will Crash

TechFlow Selected TechFlow Selected

Interview with Jeff Park: We Are in a Bear Market, Quantitative Easing Is No Longer Effective, and Silver—Like Altcoins—Will Crash

“Positively correlated Bitcoin” may be the truly important direction for the future—Bitcoin rises when interest rates rise.

Compiled & Translated by TechFlow

Guest: Jeff Park, Partner and CIO at ProCap Financial

Host: Anthony Pompliano

Podcast Source: Anthony Pompliano

Original Title: Why the Bitcoin Narrative Is Shifting Right Now

Air Date: February 5, 2026

Key Takeaways

Jeff Park is a Partner and Chief Investment Officer at ProCap Financial. In this conversation, we examine Bitcoin’s recent price correction, assess whether the market has truly entered a bear market, and discuss the current interest-rate environment and the Federal Reserve’s role in the economy. We also explore the possibility of Kevin Warsh being nominated as Fed Chair, Jeff’s outlook on the precious metals market, and his warning to investors about a specific class of assets they should avoid.

Highlights of Key Insights

- We are in a bear market. Even if policy becomes more accommodative, it may not propel us into a bull market.

- If you’ve already realized solid gains from silver investments, now may be the time to reallocate capital into Bitcoin.

- “Positively correlated Bitcoin”—where Bitcoin rises alongside rising interest rates—may be the truly important direction going forward.

- We originally chose Bitcoin because we believed scarcity could solve the problem of centrally manipulated money supply.

- I remain highly bullish on Bitcoin—not primarily due to macroeconomic tailwinds, but because I believe government roles will become increasingly centralized, making Bitcoin the ultimate hedge against such a system.

- The Fed Chair position should not be held by a socialist or nationalist. What we need is a technically proficient official who is also pragmatic—qualities embodied by both Warsh and Bessant.

- If rate cuts do materialize and liquidity expands further, I expect volatility in the precious metals market to intensify.

- Silver’s outlook is unattractive. Its behavior in the precious metals space closely mirrors that of altcoins in the crypto market.

- Kevin Warsh firmly believes blockchain technology is not magic—it’s a practical tool for solving real-world problems and improving efficiency—and Bitcoin is an integral part of that technological culture.

Is Bitcoin’s Sell-Off Sustainable?

Anthony Pompliano:

Jeff, Bitcoin has been declining recently. Personally, I think markets may continue to oscillate—or even decline further—and that we may have already entered a bear market. Bitcoin’s 40% drawdown has drawn considerable attention. What’s your take? Are we in a bear market? And is this decline sustainable?

Jeff Park:

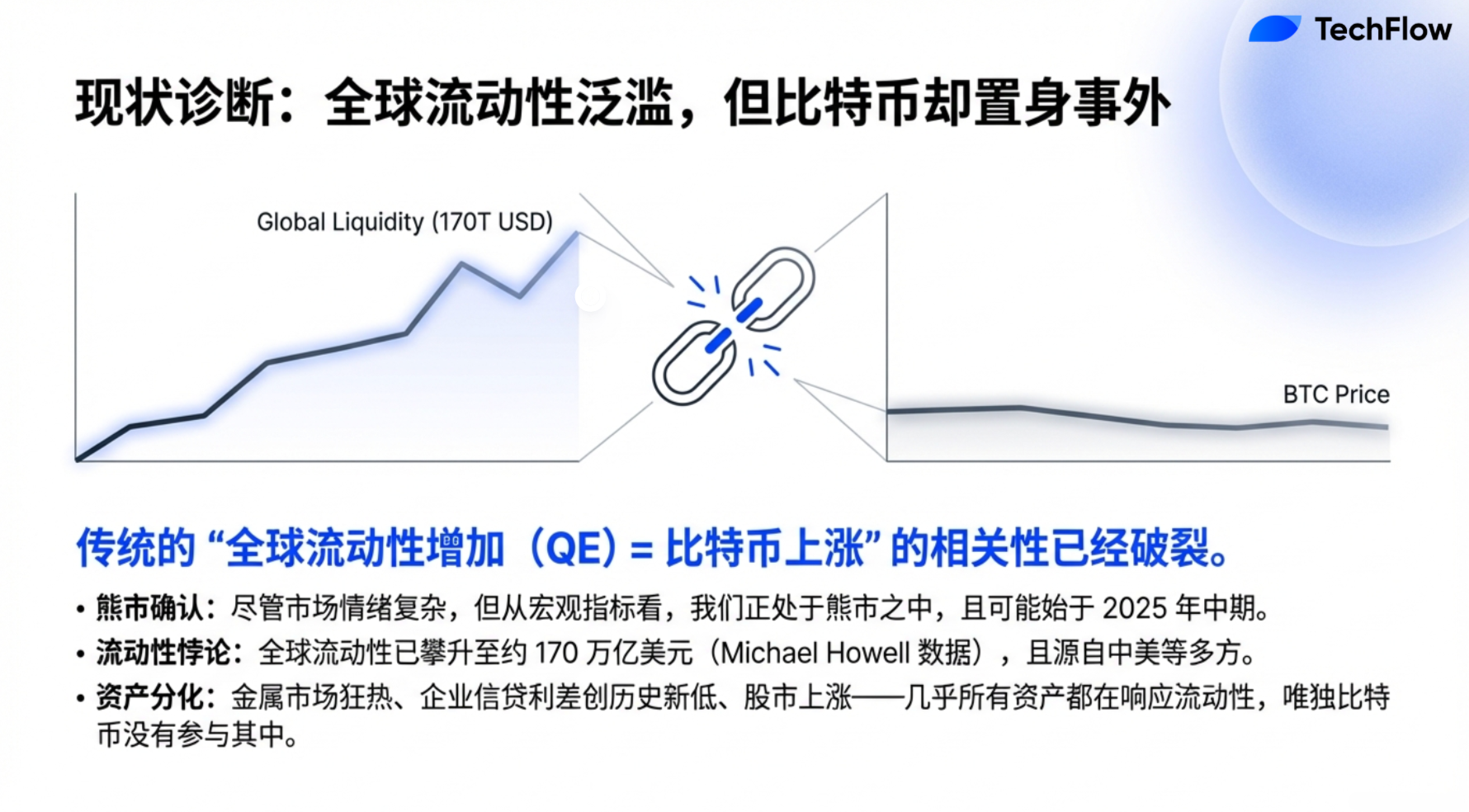

I believe we are indeed in a bear market, and have been for some time. One key point to remember is that Bitcoin was historically viewed as a hedge—a positively correlated asset with global liquidity. That is, increased global liquidity usually benefited Bitcoin. However, that relationship has long since broken down.

In crypto, we often assume history simply repeats itself—an example of behavioral bias. We assume altcoins always follow Bitcoin’s lead, or that the “four-year cycle” holds, or that quantitative easing (QE) and low interest rates inevitably boost Bitcoin. But the world evolves, and many conditions today differ significantly from the past. One critical assumption we must re-examine is whether QE, expanding global liquidity, and low interest rates truly benefit Bitcoin. While this held true in prior cycles, it may no longer apply.

Currently, global liquidity is steadily increasing. According to Michael Howell’s tracking data, global liquidity reached approximately $170 trillion by 2025, driven by China and the U.S., with potential acceleration ahead. This trend manifests across asset prices: robust rebounds in metal markets and corporate credit spreads hitting historic lows all signal broad-based liquidity expansion. Bitcoin should logically participate in such a rally—but it hasn’t. This suggests fundamental mechanisms may have shifted. Therefore, I believe we’re in a bear market—and likely entered it as early as mid-2025, when the Fed began shrinking its balance sheet and the Treasury started rebuilding the General Account (TGA).

Looking ahead, we may need to accept a new reality: even more accommodative policy may not catalyze a bull market. Paradoxically, this makes me cautiously optimistic about Bitcoin’s future upside catalysts.

I previously introduced the concepts of “negatively correlated Bitcoin” and “positively correlated Bitcoin.” The familiar “negatively correlated Bitcoin” refers to Bitcoin rising in low-rate, accommodative environments, alongside other risk assets. But another possibility exists: “positively correlated Bitcoin,” which I consider the ultimate goal—Bitcoin rising as interest rates increase. This contradicts traditional QE theory and rests on questioning the reliability of the risk-free rate. It implies the risk-free rate is no longer truly risk-free, and dollar hegemony is no longer absolute. We can no longer price yield curves using historical frameworks. Instead, we may need entirely new paradigms—such as commodity-backed currency baskets—with Bitcoin potentially serving as the core hedge.

Hence, I believe “positively correlated Bitcoin” may be the most important direction going forward. Flaws in the current monetary and financial architecture are evident. It’s also clear the Fed and Treasury’s collaborative capacity falls short of advancing national security priorities. All of this leads me to conclude that for Bitcoin to break out of its current slump, we must discard outdated assumptions and return to Bitcoin’s foundational value proposition: we adopted Bitcoin initially because we believed scarcity could resolve the problem of human-manipulated money supply. Thus, despite rising global liquidity, it is not Bitcoin’s ally.

Fed vs. White House: Is Bitcoin Forward-Looking or Backward-Looking?

Anthony Pompliano:

Jeff, I see two distinct lenses for analyzing today’s economic landscape.

First, historically, monetary policy has been seen as the primary driver of economic activity and asset prices. Yet today, the current U.S. administration appears to be wresting control of the economy from the Fed. It does so via deregulation, tax cuts, tariffs, and attempts to weaken the dollar—all while riding the AI growth wave. Meanwhile, the Fed seems reactive—whether voluntarily or not—trying to interpret shifting economic trends and determine appropriate responses.

So the economy now appears caught in a dynamic power balance between the Fed and the White House. We need to discern which institution is actually steering economic policy.

Second, I’m also pondering whether Bitcoin’s market behavior is fundamentally forward-looking—or instead reflects current or past economic conditions. When you described Bitcoin holders’ psychology as “driving while only checking the rearview mirror,” you highlighted how many assume the four-year cycle inevitably repeats—so there’s no need to look ahead, only backward. To me, your perspective is more like “looking through the windshield”—a far better analytical approach.

So the question is: Does Bitcoin’s performance reflect present conditions—or forecast the future? For instance, in 2020, many investors bought Bitcoin and gold anticipating inflation—the market was clearly forward-looking. If Bitcoin is falling now, does that signal heightened deflationary risk—or warn of other latent issues? How do you view the power balance between the Fed and the White House? And is Bitcoin looking forward—or backward? How should we interpret current price action within this broader context?

Jeff Park:

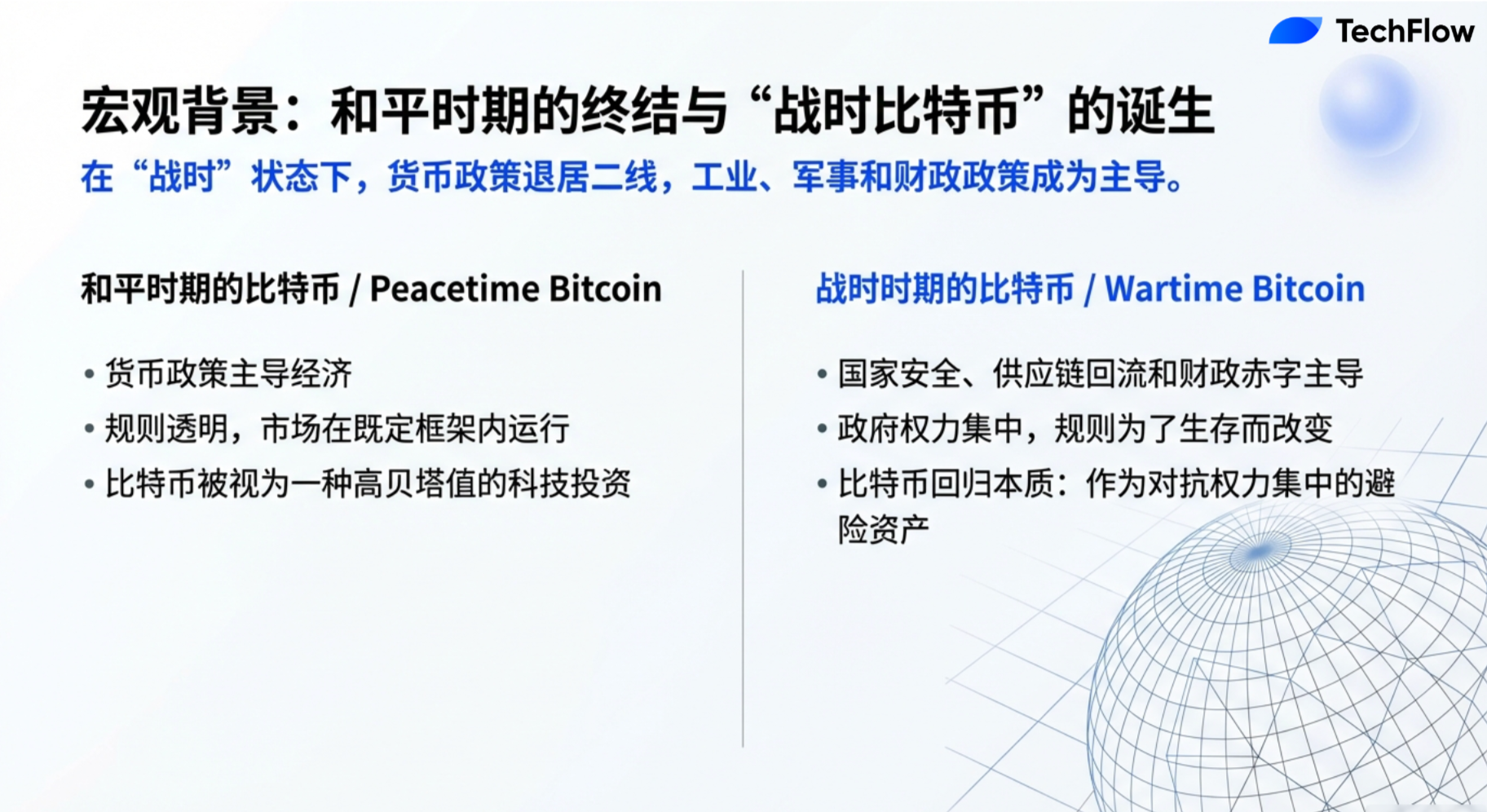

An excellent question. A concept I find intriguing is what I call “peacetime Bitcoin” and “wartime Bitcoin.” During peace and prosperity, we expect the monetary system to function smoothly, and investment frameworks operate conventionally. This is “peacetime Bitcoin”—tied more closely to inflation and used as an inflation hedge.

“Wartime Bitcoin,” however, is entirely different. In wartime, the main engines of growth shift from monetary policy to a combination of industrial, military, and fiscal policy. History offers precedents—during crises between democracies and more authoritarian regimes, monetary policy often yields priority to geopolitical power struggles.

Thus, your framing of Bitcoin’s future orientation is accurate. Partly, this stems from the Trump era, during which the world grew more centralized. Previously, decentralization inspired idealism—we saw distributed resources and checks-and-balances as virtues, and Bitcoin and crypto embodied those ideals. Yet close examination of recent U.S. crypto policy reveals a pronounced centralizing trend: stablecoins channel banks into centralized yield generation; tokenization leans toward equities rather than long-tail assets; and the Trump administration’s own centralizing tendencies infuse Bitcoin with “centralized energy.”

Bitcoin’s enduring value lies in decentralization and censorship resistance—it represents “free money.” U.S. investors have many alternatives: silver, metals, AI-themed investments, etc. Those who truly need Bitcoin are people living under oppression and capital controls. If you believe the world will grow more fractured, chaotic, and subject to tighter capital controls, Bitcoin’s importance escalates.

Therefore, I remain highly bullish on Bitcoin—not primarily due to macroeconomic tailwinds, but because I believe government roles will become increasingly centralized, making Bitcoin the ultimate hedge against such a system.

Kevin Warsh and the Fed’s Future

Anthony Pompliano:

You mentioned Kevin Warsh—he’s clearly the leading nominee for Fed Chair. He’s expressed strongly positive views on Bitcoin, seeing it not as competing with the dollar but as occupying a unique role in portfolios. What’s your assessment of his potential as Fed Chair—and how might he influence Bitcoin’s trajectory?

Jeff Park:

To be honest, I greatly admire Kevin because he possesses deep, operational understanding. He grasps that sometimes breaking existing patterns is essential to progress—and that solutions require precise diagnosis rooted in first principles. You cannot change for change’s sake. Those who truly understand systems often hesitate to disrupt them; embracing transformative thinking demands immense courage—and Kevin embodies precisely that.

Moreover, he is an exceptional technocrat. In one conversation, I vividly recall his enthusiasm for crypto. He observed that many “hypocrites” treat technology as magical—betting blindly without grasping fundamentals or sound rationale. By contrast, Kevin firmly believes blockchain is not magic, but a practical tool solving real problems and enhancing efficiency—and Bitcoin is a vital component of that technological culture.

This is crucial, because many technologists don’t fully grasp how technology operates in practice. Imagining innovation space feels counterintuitive to them. For example, when discussing productivity gains, the Fed may miss AI’s deflationary impact—a cognitive gap arising because few possess Kevin Warsh’s ability to envision futures radically divergent from the past. Hence, I view him first and foremost as a technocrat—and this quality is indispensable today. In monetary policy, we urgently need leaders with such technical foresight.

Additionally, Kevin brings extensive Fed experience. Studying his track record reveals genuine belief in the Fed as an institution. He doesn’t advocate ending its independence—but understands why that independence faces challenges and knows how to rebuild public trust. His memorable statement—“Inflation is a choice.”—contrasts sharply with current Chair Powell and others, who habitually externalize inflation causes: “It’s tariffs!” or “It’s the Ukraine war!” They rarely acknowledge inflation as a deliberate policy choice—one core to the Fed’s mandate.

Another critical clarification: inflation and nominal price changes are distinct. Many conflate them—assuming a 5% price rise equals inflation. But that’s merely a price change, possibly triggered by war or tariffs. True inflation is a dynamic, long-term trend in price-change rates—not isolated fluctuations. The Fed’s job isn’t tracking monthly price shifts, but managing the long-term trajectory of those changes—a nuance frequently overlooked.

Kevin Warsh’s assertion that “inflation is a choice” resonates deeply—because the Fed possesses full tools to control inflation, provided it chooses to act.

Anthony Pompliano:

Interestingly, two seemingly contradictory realities can coexist. People constantly seek simple answers: inflation or deflation? High or low? Yet economic systems are profoundly complex—and Bitcoin appears to simplify these intricate relationships. You don’t need to master all complex economics—just grasp supply and demand: if more people want something, its price rises; if demand falls, price drops. Bitcoin’s ethos seems to reimagine the monetary system. If so, are they trying to make it simpler? To distill this complex economic machine into something anyone can intuitively understand?

Jeff Park:

Yes, the system is inherently complex—I’m uncertain it can ever become truly simple. However, I believe it should become more transparent and honest. Americans’ waning confidence in the monetary system stems not just from complexity, but from opacity. One of Kevin Warsh’s key missions would be transforming how the Fed uses its balance sheet—and addressing glaring transparency gaps in the current system.

For instance, at the January Fed meeting, someone asked Powell about the relationship between the dollar’s value and interest-rate setting. With the dollar strengthening markedly, this was clearly pivotal—since interest rates hinge on the benchmark currency’s value, directly affecting long-term yields. Yet Powell replied: “We don’t focus on the dollar level when making policy.” In part, he may have sought simplification—this isn’t his specialty. However, this ignores a critical reality: the dollar’s value is intrinsically linked to interest-rate policy. Yet both can be managed simultaneously.

This is why I’m optimistic about the potential for a new Fed-Treasury accord. Bessant and Warsh have a chance to redefine this agreement. The core issue circles back to the Triffin Dilemma: the dollar’s dual role as global reserve currency creates inherent tension—meeting international reserve demand while ensuring domestic economic stability.

Thus, what we need isn’t absolute Fed independence, but functional interdependence between the Fed and Treasury. We must move beyond viewing Fed independence as “under threat,” and instead embrace “functional collaboration” between the two institutions to craft sounder policies. Achieving this would mark a major step forward—and restore public trust in the Fed’s role.

Anthony Pompliano:

What’s your view on Warsh and Bessant’s backgrounds? Both emerged from the same system, trained under the same mentor—sharing similar mindsets and work philosophies. Perhaps they’re among the greatest risk-takers in history.

Jeff Park:

This excites me immensely—I’ve publicly stated this repeatedly online. Since last year, I’ve insisted Warsh must become Fed Chair. This is historic: finding two individuals who trust each other implicitly—and who both trained under arguably the greatest market practitioner ever—now poised to drive real change. At this level, trust is irreplaceable.

This reminds me of earlier moments: Warsh was a candidate, then Hassett appeared, then Rick Reer—but throughout, I kept thinking: “You’re missing the bigger picture.”

This may appear to be Trump’s decision—but ultimately, who steers it? Bessant. Whom will he choose to partner with? Whom does he trust? Who can execute his vision for national transformation? The answer has always been Warsh alone. Recognizing this reveals a remarkably clear, powerful moment—enabling achievements on the global stage previously impossible. I’m thrilled.

Of course, many harbor biases against billionaires—assuming they serve only self-interest, ignoring ordinary citizens. I hold the opposite view: we should expect resource-rich individuals to undertake meaningful action. Because if they don’t drive reform, malevolent actors may seize control. Better to let those who no longer need to earn more money improve the system. I believe for Bessant and Warsh, earning more money is their least concern—they’re focused on repairing the entire system.

That’s why I’m highly optimistic. They possess profound market insight—having operated within capital markets themselves. They recognize the Fed’s merits—and its flaws. Their intelligence, integrity, and clarity of communication make them an ideal reform coalition.

In my view, the Fed Chair position shouldn’t go to a socialist or nationalist. We need a technocrat—but one grounded in pragmatism. Warsh and Bessant embody exactly that—and I’m eagerly anticipating their future impact.

Anthony Pompliano:

What fascinates me is Warsh and Bessant’s partnership. They deeply understand America’s financial system—and possess global perspective. For example, Bessant’s actions in Argentina—controversial at the time, questioned as wasteful—proved prescient in hindsight.

America has always been adventurous—embracing “let’s build it.” Yet from a monetary-policy lens, it’s also trimming excess spending and enacting reforms. Such a mindset requires people who truly grasp probability and risk. I suspect this is your core point: these individuals have spent lifetimes studying precisely these questions, right?

When Bessant was nominated, I doubt many predicted his exceptional performance. People likely saw him as intelligent—but not necessarily consensus-best. Yet objectively reviewing his tenure, he may be among the finest Treasury Secretaries I’ve witnessed. Warsh complements his gaps—creating a “1+1>3” effect. Warsh served as a Fed Governor during the Global Financial Crisis, intimately understanding internal Fed mechanics. Later, he applied that knowledge as a trader. Now returning to the system, he brings fresh perspective and experience—while their mutual trust bridges differences.

Jeff Park:

Yes—I believe a key point you raised is that leaders need systemic thinking capability. In economic policy, actions in one domain ripple across others. Understanding such probabilistic interactions requires recognizing that monetary policy isn’t isolated—it’s deeply entwined with fiscal policy and industrial policy. For instance, Trump aims to reshore manufacturing and boost semiconductor investment. These three domains function like a symphony orchestra—requiring coordination to achieve shared goals, demanding multidimensional thinking.

Regrettably, most academics—and those who’ve never worked in profit-driven sectors—lack this systemic perspective. Nonprofit operations don’t prioritize assessing multi-variable antifragility, let alone building complex systems. In fact, I’d argue top-down, centralized government models mechanically execute orders and allocate resources—without accountability mechanisms. They spend freely—yet never rigorously evaluate whether expenditures yield tangible outcomes. Such reflective capacity and critical thinking typically emerge only from profit-sector practice—and frankly, require substantial self-awareness.

Repeating past approaches won’t solve future challenges—we must forge a new path. Doing so requires leaders with sufficient credibility—credibility derived from authority as systemic thinkers. It cannot be cultivated within closed, rigid institutions. Warsh and Bessant’s pairing fills me with optimism. They’re not just technocratic leaders—they’re pragmatic, market-seasoned, understand market mechanics, know the Fed’s strengths and weaknesses, and can drive change through clear communication and integrity. This combination is ideal. In my view, the Fed Chair shouldn’t be ideologically extreme. You need a leader who’s both technically adept and pragmatic—and Warsh and Bessant fit that perfectly.

Why Are Precious Metals Soaring?

Anthony Pompliano:

Precious metals—gold, silver, copper, platinum—have surged recently, exhibiting sharp rallies followed by modest pullbacks, then renewed gains. What’s driving this?

Jeff Park:

This reflects market euphoria—and underscores why we must re-evaluate Bitcoin’s investment thesis. Though Bitcoin hasn’t yet caught this wave, the phenomenon is especially pronounced across precious metals. Why? Because global liquidity conditions are extremely loose. Frankly, if rate cuts materialize and liquidity expands further, I expect precious metals’ price volatility to intensify. Some capital may flow into Bitcoin—but not necessarily. The key is that this phenomenon is already underway.

Especially silver: I see it as the primary target for retail investors—a dynamic reminiscent of the altcoin market. Indeed, silver shares many similarities with altcoins: its role in precious metals parallels Ethereum’s role in crypto. I don’t intend offense to the Ethereum community—but this analogy holds merit.

Analyzing most commodity price movements boils down to two fundamentals: supply and demand. On the supply side, silver is largely a byproduct of mining other metals. Few realize there are virtually no dedicated silver mines worldwide—most silver is extracted incidentally while mining zinc or copper, essentially “thrown in for free.” In crypto terms, this resembles yield farming: you invest in Ethereum, but participating in certain on-chain activities earns random tokens as bonuses—like silver, these are incidental rewards.

Thus, miners don’t mine silver specifically due to its price—it’s purely a byproduct of other metal extraction. From this angle, silver supply is abundant. Unlike Bitcoin’s scarcity, silver’s supply is relatively plentiful. Ultimately, markets will discover silver’s fair price—and given its status as a byproduct, oversupply may suppress prices.

On the demand side, while some cite silver’s industrial applications in AI and solar panels, silver remains substitutable. Though prized for high conductivity, copper’s conductivity is only ~5% lower. So while silver performs well, its premium price doesn’t justify exclusivity. In fact, rising silver prices have already prompted many solar panel manufacturers to replace silver with copper.

Moreover, silver isn’t a reserve asset—no central bank buys it. And from a supply perspective, silver production isn’t dictated by its market price, but by other metals’ extraction economics. Thus, overall, I view silver’s outlook as unattractive.

This reminds me of the altcoin market. Silver exhibits high volatility and strong correlation with gold—similar to how altcoins often ride Bitcoin’s momentum. Yet ultimately, most altcoins revert to supply-demand equilibrium. Crypto investors from recent years can learn from this: silver’s behavior in precious metals mirrors altcoins’ behavior in crypto.

Anthony Pompliano:

So you’re suggesting silver may face a significant correction?

Jeff Park:

Yes—if you’ve already captured solid returns from silver, now may be the time to reallocate into Bitcoin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News