The hidden battle in the wallet sector: Is racing to integrate with Hyperliquid a good business?

TechFlow Selected TechFlow Selected

The hidden battle in the wallet sector: Is racing to integrate with Hyperliquid a good business?

Integrating third-party Perps is mostly a low-ROI business, as it doesn't make for a good deal in terms of user growth returns, platform commissions, or stable investment.

Author: Shijun

Hyperliquid is undoubtedly the highlight of the year. This time, let's take an insider’s look, connect the dots, and see how wallets, exchanges, DEXs, and AI trading are battling it out here!

1. Background

In 2025, I’ve basically studied every Perps-type (perpetual futures trading platform) on the market, witnessing the hype market grow fivefold and then peak before halving (9 → 50+ → 25).

Amid all these ups and downs, has it truly fallen behind competitors? Or is there underlying concern that its hip3 and builder fee developments have reduced platform revenue?

The Perps sector itself is seeing new rivals emerge—recently Aster, Lighter, and even Sun entering with sunPerps, shaking up the赛道. The promotional Twitter Space even set a new record for concurrent viewership in a Web3 product launch.

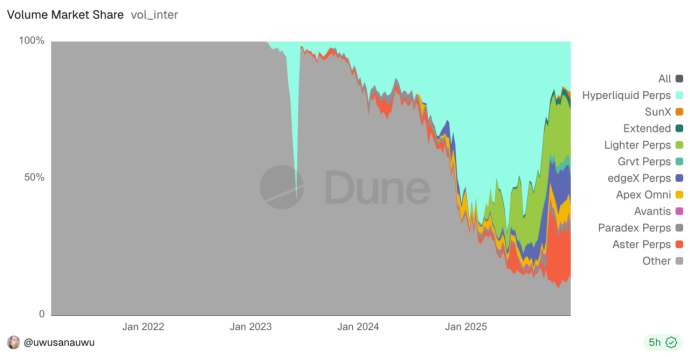

The chart below illustrates this chaotic battle. Interestingly, this is one of the rare ongoing cases where an established market is being divided.

Recall the DeFi Summer when all DEXs competed—Uniswap, Balancer, Curve, and numerous Uniswap forks like PancakeSwap.

The current state of Perps mirrors that moment in DeFi Summer. Some aim to build platforms, some want to aggregate others, some challenge the leader, while others just want to grab scraps.

Over this past year, various wallets raced to integrate perpetual trading at their DEX entry points. Metamask and Phantom led the way. Last week, Bitget also announced integration news. Other startup products like Axiom, BasedApp, xyz (via hip3), and multiple AI trading platforms are all sharing the pie through integrations.

Thus, the wallet space is now entering a new round of quiet warfare.

Everyone is rushing to integrate Hyperliquid’s perpetual trading capabilities. Behind this—is it the dividend of technical openness, the lure of referral commissions, or simply genuine market demand? Why do some top-tier platforms remain inactive? Have early movers secured market dominance?

2. Ecosystem Origins: Builder Fee & Referral Mechanism

Hyperliquid’s referral mechanism mainly combines Builder Fee with Referral (commission).

I've always believed this to be a groundbreaking mechanism. It allows DeFi builders (developers, quant teams, aggregators) to collect additional fees as service income when placing orders on behalf of users. The total transaction fee remains unchanged whether users trade via these platforms or directly on the official site.

This concept is similar to Uniswap V4’s hook mechanism—both treat their order books (or liquidity pools) as infrastructure accessible by upstream platforms. This makes it easier to attract diverse user bases, while traffic-driving platforms (wallets) gain more comprehensive ecosystem offerings to serve varied user needs.

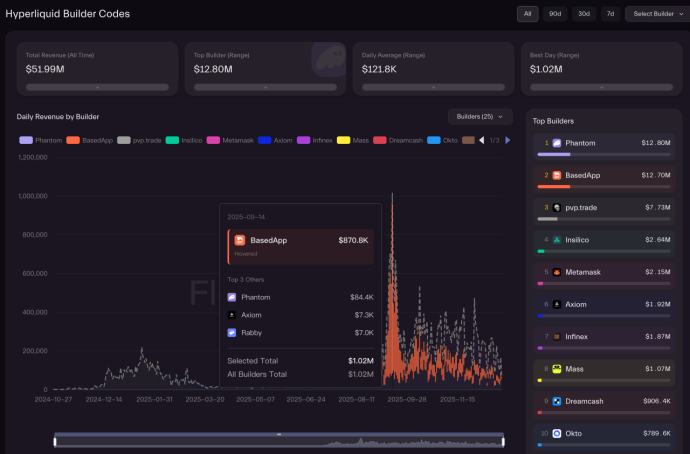

This mechanism brought some projects over $10 million in distribution earnings upon initial launch—showing strong early results—but performance declined afterward.

The chart reveals several thought-provoking insights:

• Why does Metamask, despite having no less user volume than Phantom, show a 5x difference in integration earnings?

• Why are basedApp and Axiom so far apart in earnings? Where is Jupiter?

• Is $12M in dividends high or low? Short-term spike or sustainable long-term?

• Are platforms that lightly integrate HypeEVM or native coins at a disadvantage?

• Why are Binance, OKX, etc., absent from this picture?

3. PerpDex Open Strategy

To answer these questions, we must first understand how different platforms integrate.

3.1 Open API Integration Method

Most Perps platforms offer comprehensive APIs, each with slightly different definitions, but generally providing modules for: queries (account status, positions, orders, market data, K-lines), trading (placing/canceling/modifying orders, leverage adjustment, withdrawals), and subscriptions (WS real-time price feeds, order book updates, position changes).

These APIs were originally built for market makers, and user-facing functions are essentially just directional changes. However, unlike market makers who can be contacted directly, retail users require stricter controls.

Hence, rate-limiting mechanisms are essential. Hyperliquid uses dual rate-limiting based on address + IP, dynamically adjusting thresholds according to trading volume. During high concurrency, throttling challenges may arise.

The advantage of official APIs is fast integration without needing self-hosted nodes, low data latency, and good state consistency.

But disadvantages are clear: possible IP/geographic restrictions, susceptibility to rate limits. While manageable per individual user, scaling becomes difficult for platforms due to unpredictable user growth and complex dynamic expansion.

There's also the issue of updates—app code modifications require version releases. If official APIs change or impose new limits, apps lose control. Beyond acting as traffic referrers, they must also bear customer complaints and risks.

3.2 Read-Only Node Integration Method

Hyperliquid uses a dual-chain structure: EVM and Core chain, bundled into one closed-source program, making external reading nearly impossible. Official support only extends to project deployments of read-only nodes (which can fetch orders, K-lines, trade data, but cannot send transactions).

Full historical data isn’t open either. Data volume is massive—adding over 1TB every two days. Without archiving, storage costs become unsustainable over a year.

Projects can deploy read-only nodes to reduce reliance on official APIs and avoid throttling—a method officially recommended.

However, technical hurdles remain: occasional block lag, enormous storage demands, missing historical data, and required node data method modifications.

In my view, the biggest problem lies in partial openness causing consistency issues.

For example, if I use K-line data from a read-only node to place an order, but the node has inherent delays (a probabilistic occurrence), yet I must submit the order via the non-delayed official API—the data discrepancy could lead to market orders executing at unwanted prices.

Who bears responsibility? Can platform profits cover such payouts? What cost would ensure stability? Is shifting blame appropriate?

3.3 Market Choices

Divergence emerges here, with platforms adopting different approaches.

• Metamask, representing typical tool-focused wallets, adopted frontend API integration—even open-sourcing integration code. This brute-force approach enabled rapid deployment. Rarely have I seen such a traditionally conservative top-tier wallet act so swiftly.

• Rabby, Axiom, and BasedApp followed the same path.

• Trust Wallet also integrated Perps, but connected to Binance’s Aster platform—clearly giving preference to in-house products. Internal commission structures remain unclear.

• Phantom, rising from Solana’s meme wave, prioritizes user experience. It uses read-only node integration, routing even order submissions through backend relays instead of letting clients call official APIs directly.

Some other innovative products made unique strategic choices:

Trade.xyz currently leads Hip3 in trading volume—not joining the red-ocean Perps fight, but pioneering stock trading features.

VOOI Light is technically impressive—an intent-based cross-chain perpetual DEX that integrates multiple Perps DEXs simultaneously, engineering-wise tackling multiple integration paths at once. However, it struggles with complexity in multi-platform reserve management, resulting in suboptimal UX.

Recently, I’ve tested several AI trading platforms—all using open API integration combined with backend connections to multiple Perps platforms. The experience feels cutting-edge: some use pure LLM text interaction, others combine AI decision-making with trader-following models (with underlying links to Privy-like TEE custody solutions), enabling AI-assisted Perps trading without handing private keys to third parties.

For details on the private key custody battle, see: The Hidden Battle of Blockchain Wallets in 2025: What Are They Really Competing On?

Different integration methods yield varying experiences, partly explaining differences in final referral earnings.

4. Reflections

Earlier social logins only solve recovery issues, not automated trading.

4.1 Reserve Complexity

This aspect is often overlooked. Hyperliquid’s complexity exceeds expectations—it’s far from “plug-and-play.”

Many platforms initially approached integration with a DEX-aggregator mindset, ignoring that it’s not a Lego model. Once integrated, what happens during market downturns? Will features stay? How many wallets have already delisted former inscription protocols? And if removed, will users migrate back to the official platform?

If Hyperliquid loses steam while Aster or Lighter rise, will platforms migrate again? With inconsistent APIs across platforms, how feasible is migration or parallel operation?

Smoothing these transitions inevitably increases UX complexity.

Ultimately, if users need a full-featured gateway, why not use the official platform directly?

Frontend integration offers quick deployment and coverage, but Metamask seems to have gained little financially—effectively giving away user traffic.

Backend integration delivers superior UX—the core reason Phantom earns the most—but comes with significant costs. Only Phantom knows whether ROI justifies the investment.

4.2 Why Can't Total Revenue Break Higher?

Reflecting on our own preferences (as advanced Perps users), we still favor complete official interfaces, primarily operating on PC for intuitive access to stop-loss/take-profit settings, chart monitoring, margin modes—advanced features critical in this high-end player-dominated space.

Mobile usage focuses on “monitoring market changes anytime, anywhere, managing position risk and pricing—not complex analysis.”

Phantom’s edge diminishes after initial user acquisition because its focus remains mobile.

Platforms like BasedApp, offering both app and web access, capture both segments. Yet, web competition from the official interface caps their ceiling.

Moreover, Hyperliquid will soon launch its own app, further narrowing this market.

In short, architectural differences define integration value, but actual value depends on depth. Ultimately, the ceiling of this model stems from internal competition—users referred by gateway platforms struggle to remain loyal.

If wallets offered advanced mobile features (advanced charting, alerts, notification systems, auto-trading), true differentiation would exist. Phantom’s rapid updates adding advanced features aim precisely at user retention.

Beyond lies potential in AI trading, auto-trading (modes not offered officially), and multi-Perps aggregation—paths DEXs once took. But challenges persist: multi-platform reserve allocation, inefficient AI loss control. Even with industry-standard private key custody (Privy, TurnKey), it remains: those who get it will use it; others won’t learn.

4.3 User Growth & Niche Complementarity

Many platforms accept low profitability—after all, earning via fee-sharing is scraping crumbs. But attracting Perps users or fulfilling existing demand serves as valuable niche supplementation.

We can verify this by analyzing on-chain HL data, given this user group is actually small.

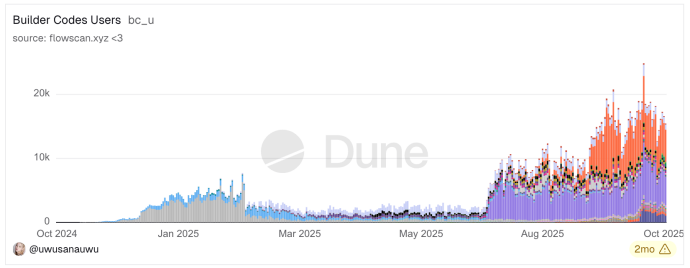

As shown below, daily active users per integration reach only thousands—combined under 10K–20K.

Looking at Hyperliquid’s monthly active users, its revenue stems from a whale-centric service model—classic Matthew effect and inverted pyramid capital structure.

Currently, HL has ~1.1M wallet addresses, 217K monthly active, 50K daily active. Crucially—top 5% generate over 90% of OI and Volume, forming a classic pyramid.

The top 0.23% (over $1M capital, ~500 users) control 70% of open interest ($5.4B). Over 100 elite users average $33M per position, with OI ratio 920x their user share.

In contrast, bottom 72.77% (~150K users) contribute just 0.2% of contract volume, averaging $75 per position.

This structure shows Perps markets are fundamentally arenas for professional institutions and high-net-worth individuals. While retail forms the user base and activity, their capital weight is negligible.

This counterintuitive structure explains Hyperliquid’s high revenue—becoming one of the most profitable exchanges within a year.

Yet, this revenue originates from elite whales driven by motives like censorship resistance, transparency, or algorithmic trading.

Integration efforts bring mostly regular users. Long-term user education is needed to shift CEX-based Perps players toward competitive Web3 Perps alternatives.

5. Final Thoughts: Is Integrating Perps Really a Good Business?

Typically, projects adapt to the market. But when a platform reaches peak popularity, the market adapts to it. Hyperliquid now enjoys this privilege—but may not retain it. Although current spikes in competitor volumes can be attributed to anticipated airdrops rather than genuine trading activity.

HL has taken relatively correct steps compared to past platforms that tried doing everything themselves and capturing all benefits. I call out OpenSea for inventing mandatory royalties, forcing the market to follow its lead. Fixed high costs per transaction disrupted asset flow, distorted true market pricing, turning countless NFTs into heirlooms.

In contrast, HL opened its EVM and all DEX Perps APIs, quickly spawning numerous derivatives.

RWA assets, especially US stocks and gold, are becoming new traffic gateways and differentiation points in the Perp DEX space. TradeXYZ has accumulated $19.1B in Perp volume—weekly average $320M, daily $45.7M—proving this trend.

Hyperliquid’s generosity is evident in airdrops and buybacks. Often, staking HYPE for ADL profits yields promising returns.

Ultimately, battles for leadership can be left to a few major platforms. Regarding this year’s quiet war among wallet integrations, connecting third-party Perps is mostly a low-ROI endeavor—whether measured by user growth, commission income, or stability investments. It’s hardly a good business.

After seeing actual returns post-integration, many platforms will still cling to Perps’ perceived红利, moving toward self-development and aggressive user acquisition campaigns. The race isn’t over—it’ll burn hot for another year. But only new users drawn from outside CEX truly count as effective users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News