Decoding Coinbase’s Q4 Earnings Report: $7.2 Billion in Annual Revenue, Growth Slows to Just 9%—Is the Exchange’s Golden Era Over?

TechFlow Selected TechFlow Selected

Decoding Coinbase’s Q4 Earnings Report: $7.2 Billion in Annual Revenue, Growth Slows to Just 9%—Is the Exchange’s Golden Era Over?

A financial report filled with historical highs, paired with a stock price at its 52-week low.

By David, TechFlow

After U.S. market hours on February 12, Coinbase released its Q4 and full-year 2025 financial results.

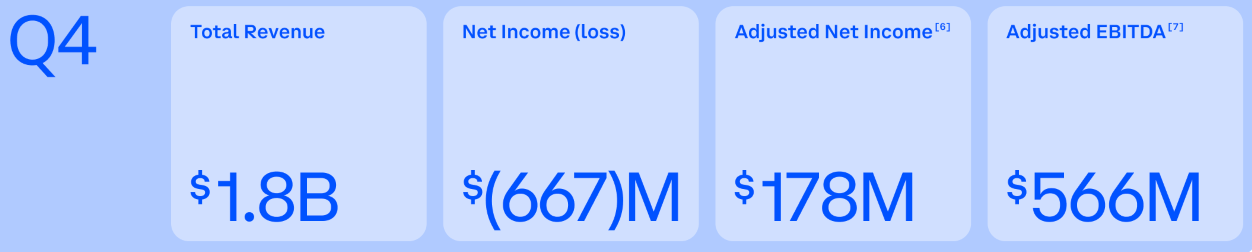

Full-year revenue totaled $7.2 billion, up 9% year-on-year—a seemingly solid figure, but last year’s growth rate was 115%. Q4 revenue came in at $1.78 billion, down 21.6% year-on-year and below Wall Street’s expectation of $1.85 billion. Earnings per share (EPS) stood at $0.66, versus the market’s consensus estimate of $1.05—a shortfall of 37%.

The market’s expectations for this earnings report were already priced into the stock.

COIN closed at $141 that day—down 68% from its July 2025 high of $445—and dipped to $134 after hours, hitting a new 52-week low.

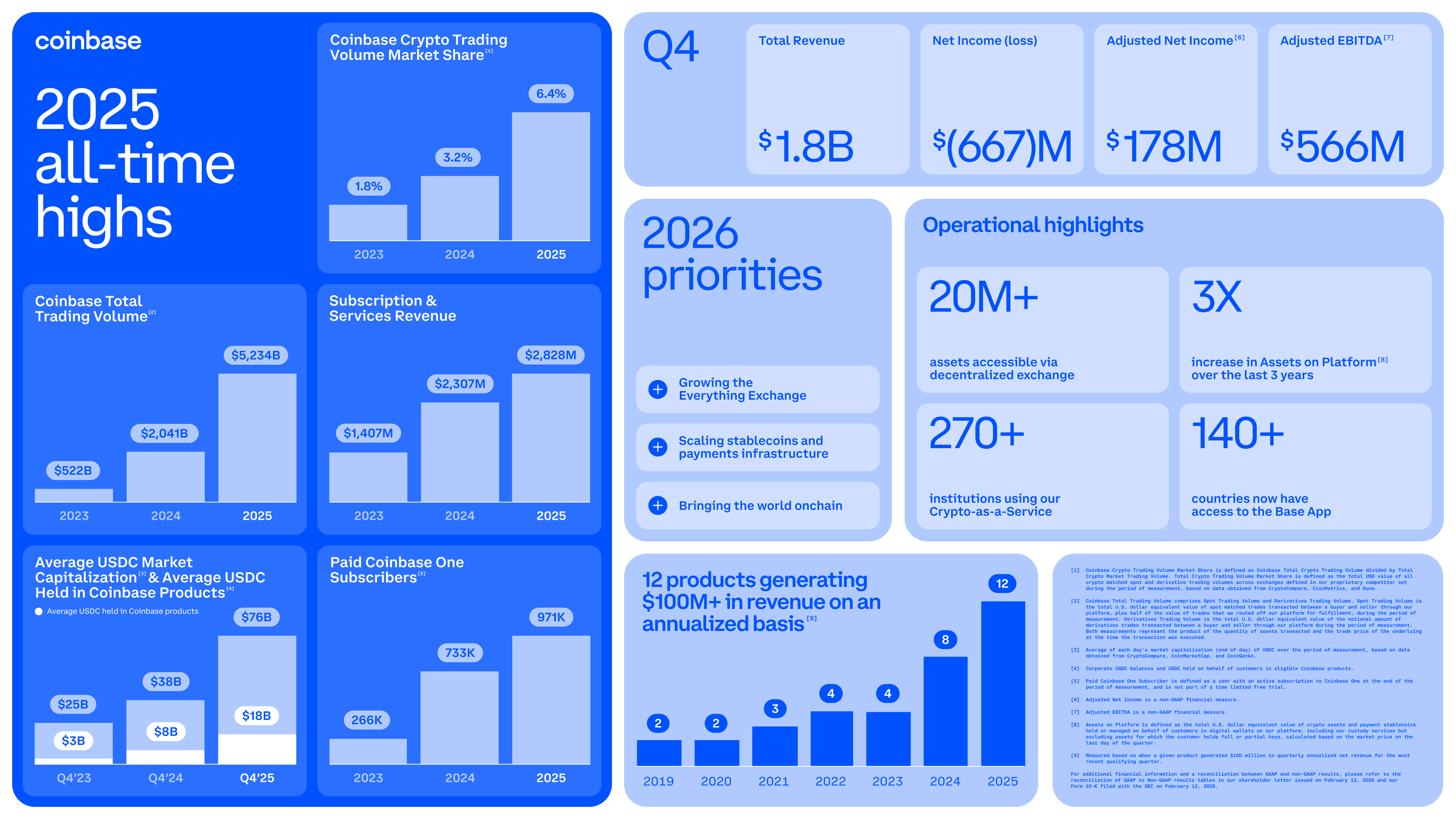

Yet on the same day, Coinbase’s shareholder letter brimmed with references to “all-time highs”:

Annual trading volume doubled; crypto trading market share doubled; USDC holdings hit a record; paid subscription users approached one million.

CEO Brian Armstrong declared 2025 a “strong year” on the earnings call, stating that Coinbase has secured a pivotal position.

However, on the same day as the earnings release, Coinbase experienced a technical outage, leaving some users unable to trade or transfer funds for several hours. The company confirmed it was investigating the issue and assured users their assets remained secure—but timing the incident to coincide with earnings day was awkward, to say the least.

A financial report bursting with “all-time highs,” paired with a stock price at a 52-week low. Coinbase’s 2025 presented two starkly contrasting faces—side by side.

We’ve dissected this contradictory performance report by synthesizing Coinbase’s shareholder letter, the earnings call transcript, and public market data.

Trading volume doubled—but revenue fell

The contradiction begins with trading volume.

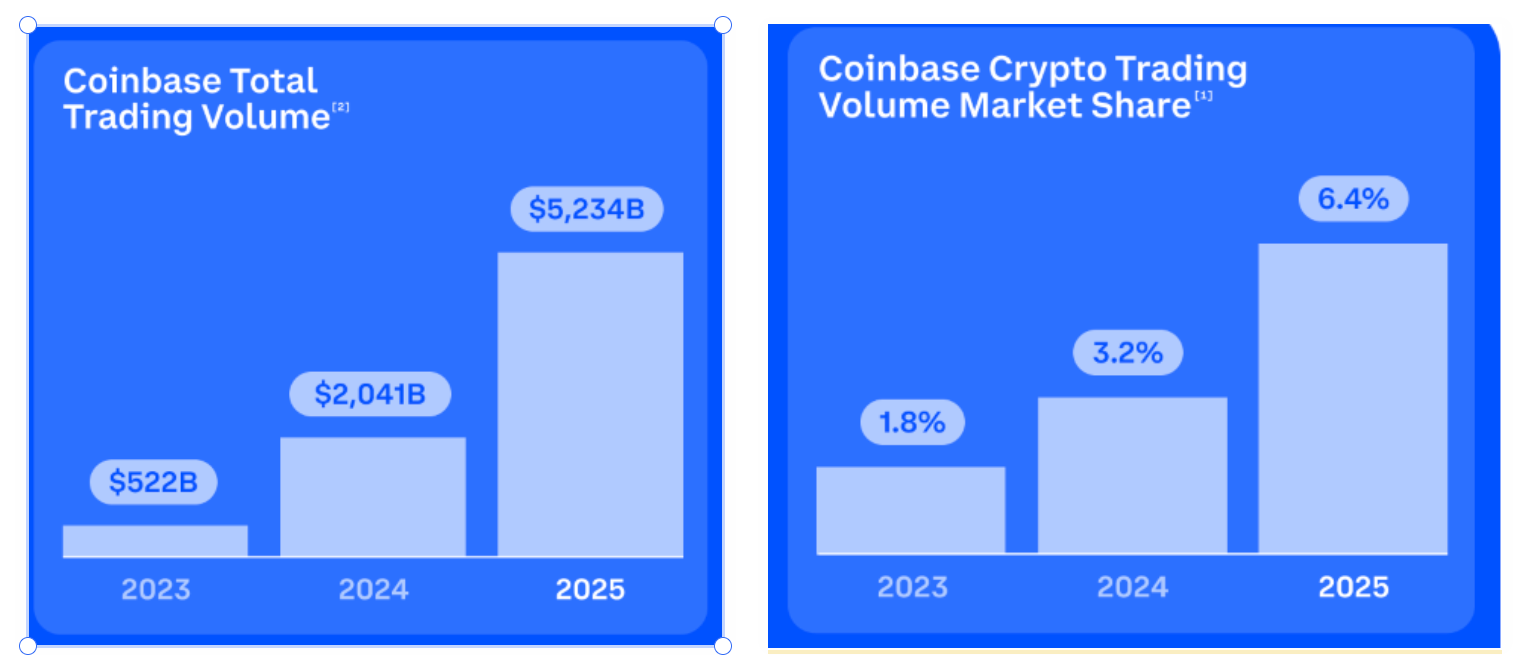

In 2025, total platform trading volume reached $5.2 trillion—up 156% year-on-year. Its crypto trading market share rose from 3.2% to 6.4%. Both figures represent all-time highs since the company’s IPO.

Yet trading revenue amounted to only $4.1 billion—up just 2% year-on-year.

Volume more than doubled, yet revenue barely budged—because average fees per trade declined.

In August 2025, Coinbase completed its acquisition of Deribit for $2.9 billion—the largest M&A deal in crypto history. Deribit is the world’s largest crypto options exchange, contributing massive derivatives trading volume—but derivatives carry significantly lower per-trade fees than spot trading.

In other words, the “all-time high” in trading volume is diluted. The pie got bigger—but margins shrank.

Looking at Q4 alone: trading revenue fell to $983 million—the first time in six quarters it dropped below $1 billion—and declined 36.8% year-on-year. This occurred against the backdrop of BTC falling from its October 2025 all-time high of ~$126,000 to ~$90,000 by quarter-end.

The downtrend accelerated into 2026, with BTC briefly dipping below $60,000 in early February.

Crypto’s overall market capitalization contracted 11% quarter-on-quarter in Q4, volatility declined, and retail trading activity visibly contracted.

Per Zacks data, Q4 retail spot trading volume stood at $5.9 billion, while institutional volume reached $23.7 billion. Institutions held volume steady—but retail users exited.

Subscription revenue is 5.5× the prior bull-market peak—but growth is slowing

The good news lies elsewhere.

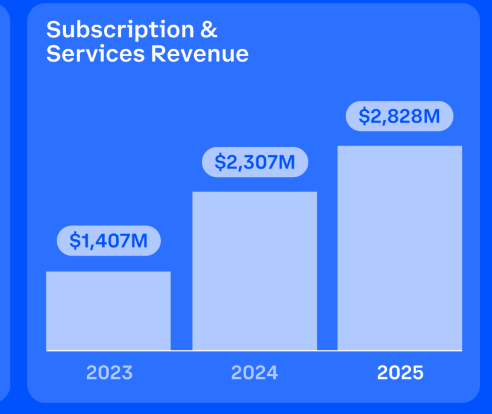

Subscription and services revenue totaled $2.8 billion for the full year—up 23% year-on-year and 5.5× the peak level seen during the 2021 bull market. This segment now accounts for 41% of net revenue.

Breaking it down, stablecoin-related revenue was the largest contributor.

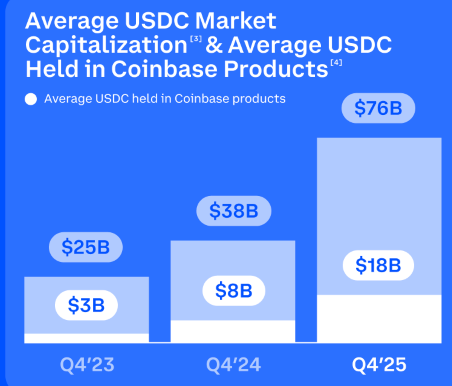

In Q4, stablecoin-related revenue reached $364 million—up 61.2% year-on-year. Average USDC holdings on the platform hit $17.8 billion, while USDC’s average market cap for the quarter stood at ~$76 billion.

Coinbase earns revenue from interest income and circulation fees on USDC—a model independent of user trading activity, akin to “earning interest on deposits.”

Coinbase One paid subscriptions neared 971,000 users by end-2025—a threefold increase over three years. Twelve products generated annualized revenue exceeding $100 million each, six exceeded $250 million, and two surpassed $1 billion.

Yet Q4 subscription and services revenue was $727 million—a 3% sequential decline. Management also offered a less optimistic outlook for future subscription revenue.

On the earnings call, CFO Alesia Haas projected Q1 2026 subscription and services revenue between $550 million and $630 million—lower than Q4’s $727 million.

She cited two reasons: the Fed’s 25-basis-point rate cuts in October and December 2025, which compressed USDC’s yield; and recent declines in crypto asset prices, which weighed on staking-related revenue.

Armstrong also noted on the call that Coinbase is building an “Everything Exchange”—a platform capable of trading anything.

Subscription revenue is the new pillar of this narrative. But under the stress of a crypto winter, even this pillar is wobbling.

A massive accounting loss—but not due to poor business performance

Under U.S. GAAP, Coinbase reported a Q4 net loss of $667 million—versus a $1.3 billion profit in the prior-year period.

The bulk of this loss did not stem from core operations. Two unrealized investment losses dominated the P&L.

The first was a $718 million unrealized loss on its crypto investment portfolio.

Coinbase aggressively accumulated BTC throughout 2025—doubling its BTC holdings over the year and buying weekly. In a quarter where BTC halved from its peak, this strategy incurred significant paper losses.

The second was a $395 million strategic investment loss—largely attributable to Coinbase’s stake in Circle, the issuer of USDC and one of Coinbase’s most critical partners.

Circle’s stock fell roughly 40% in Q4, dragging down Coinbase’s investment valuation.

Combined, these two items totaled over $1.1 billion. Crucially, both are “unrealized” losses—meaning the assets remain unsold and were merely revalued at current market prices. If BTC rebounds, these losses will reverse.

Excluding such investment volatility, Coinbase’s adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization—a common proxy for core operating profitability) stood at $566 million, and adjusted net income at $178 million.

By this measure, Coinbase hasmaintained profitability for 12 consecutive quarters.

This reveals a structural tension: Coinbase operates both as an exchange and as an asset holder—with large BTC and crypto-related investments sitting directly on its balance sheet.

In bull markets, this acts as a profit amplifier: much of its $1.3 billion profit in 2024 stemmed from investment gains. In bear markets, the same logic works in reverse.

CFO Haas addressed this head-on on the call, stating Coinbase “slightly increased its weekly BTC purchase amount” in the current price environment.

Translation: “It’s falling—but we’re buying more.”

This stance mirrors Strategy’s (formerly MicroStrategy) approach—both use corporate balance sheets to bet on BTC’s long-term value.

The difference? Strategy treats it as its core business; Coinbase treats it as a sideline. Yet when BTC falls nearly 50%, even a sideline can materially distort earnings perception.

Finally, the report shows Coinbase ended the year with $11.3 billion in cash and equivalents. It’s well-capitalized—but ongoing BTC purchases amid mounting paper losses are cause for concern.

What, exactly, does Coinbase want to become?

Crypto exchanges face an inescapable fate:

They earn handsomely in bull markets—and see revenues halve in bear markets. Over its four years as a public company, every Coinbase earnings report has repeated this rhythm.

In 2025, management attempted to rewrite the script.

Armstrong repeatedly invoked one phrase on the earnings call:“Everything Exchange.” He envisions Coinbase evolving beyond a crypto-only trading venue into a platform where any asset class can be traded.

In fact, several initiatives have already launched.

Last Q4, Coinbase rolled out prediction markets to all users—enabling bets on real-world outcomes like sports events and political elections. In February 2026, the platform plans to list nearly 10,000 U.S. equities.

Armstrong noted on the call that prediction market and gold/silver trading volumes both set records in Q1 2026.

The significance of these new categories? Their volumes don’t move in lockstep with crypto markets.

If BTC drops 50%, users can still trade Tesla stock or wager on the Super Bowl on Coinbase. The more diversified the revenue streams, the less dependent Coinbase becomes on crypto cycles.

Another major move was the Deribit acquisition.

On the derivatives front, Coinbase acquired Deribit for $2.9 billion in August 2025—capturing ~80% of the global crypto options market. Combined with its existing futures and perpetual contracts business, Coinbase now offers a full suite of derivatives products.

Stablecoins, meanwhile, are Armstrong’s “second killer app.” USDC holdings on the platform hit an all-time high in Q4, and stablecoin-related revenue grew over 61% year-on-year.

He even floated a longer-term vision:

In the future, AI agents may adopt stablecoins as their default payment method—and Coinbase’s Base chain could serve as the gateway.

Equities, derivatives, prediction markets, stablecoins, AI infrastructure: in 2025, Coinbase entered virtually every viable vertical—completing 10 acquisitions or talent-driven deals over the year.

The blueprint for the “Everything Exchange” is now drawn—but bear markets are the ultimate test of transformation. A detail you may have missed:

Shortly before and after the earnings release, Monness Crespi Hardt downgraded Coinbase from “Buy” to “Sell,”citing underestimation of the crypto bear market’s duration.

Yet among 35 analysts covering the stock, 23 still maintain a “Buy” rating, with a consensus target price of $326—implying over 100% upside from current levels.

Bulls and bears are betting on the same question: Can Coinbase’s transformation outpace the cycle?

The exchange’s golden era may not be over—but the days of doubling revenue and earning passively are almost certainly gone. Coinbase knows this, which is why it’s sprinting toward the Everything Exchange.

When crypto prices halve, retail users exit, and trading fees decline—do these new verticals represent genuine revenue engines, or merely decorative embellishments for bull-market narratives?

The answer may only emerge after the next two or three quarterly reports.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News