Delaware Divorce: Musk and Coinbase Make a Great Escape

TechFlow Selected TechFlow Selected

Delaware Divorce: Musk and Coinbase Make a Great Escape

The instinct for innovation will always rush toward that open field—barren though it may be—where one is allowed to run wild.

By Sleepy.txt, Beating

On the map, the United States remains a unified federation; but along the axis of business logic, we are witnessing America splitting into "two nations."

In early winter 2025, Coinbase, America's largest cryptocurrency exchange, officially began the process of relocating its registration from Delaware to Texas.

In the long narrative of American business history, it is difficult to ignore the resolute and tragic undertone behind this decision—it is far more than just a change of administrative address. It resembles a spiritual act of "patricide" and "heresy."

For the past century, Delaware has been the undisputed "Mecca" of American commercial civilization—the supreme totem of the industrial rationality era.

"Mecca" means it is not merely a geographical coordinate, but also a destination of faith. On this narrow peninsula of less than two thousand square miles resides over 66% of Fortune 500 companies in the U.S.

In the traditional narratives of Wall Street and Silicon Valley, a great company may be born in a California garage, but its soul (legal entity) must reside in Delaware.

Delaware boasts the nation’s oldest and most specialized Court of Chancery. For investors and professional managers of that era, Delaware represented an almost religious certainty—offering the most robust fiduciary duties, the most predictable case law repository, and a sense of security regarded as the bedrock of commerce.

But now, this rock that has carried a century of commercial faith is visibly cracking.

Coinbase's departure is no isolated incident. If you examine the list of this migration wave, you'll find it filled with today's most restless and audacious names.

Elon Musk is the prime mover of this exodus.

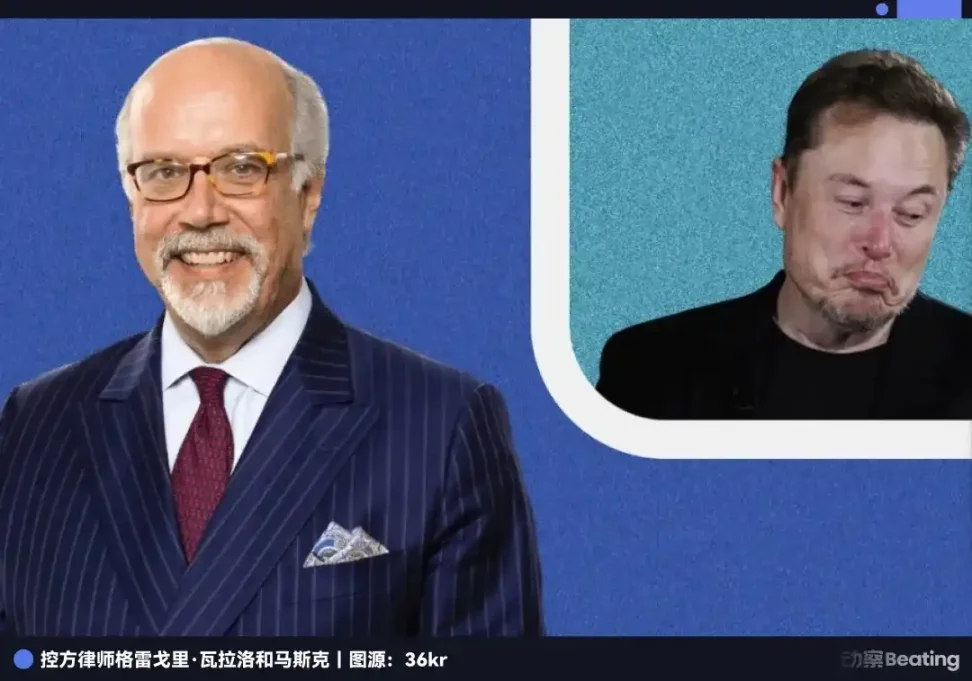

The spark came a year earlier. In a judgment that shocked the world, a Delaware judge ruled decisively to strip Musk of his $56 billion compensation package, earned over ten years. Even though he miraculously achieved performance targets once deemed impossible by Wall Street, pushing Tesla’s market cap to trillion-dollar heights, the judge still invalidated the results-based contract on grounds of an "insufficiently independent" board.

This ruling enraged Silicon Valley's new elite. The "Iron Man," furious, then moved Tesla and SpaceX southward like the famed Mayflower. Now, Coinbase and TripAdvisor, among other unicorns, are following closely behind.

This series of departing silhouettes marks the twilight of an old era.

Once, large corporations stayed in Delaware for protection, because it symbolized mature and rational rule of law. Today, however, top-tier firms believe they must flee Delaware to survive and grow wildly.

To Gain Freedom, Blood Must Be Shed

In the brutal laws of the business world, freedom has never been free. But for Musk and Coinbase, the price of freedom is staggering.

In public perception, changing a company’s registration seems like a simple administrative task—filling out a few forms, updating an address. But this is no mere move achievable with tens of thousands in fees. Giants must pay a suffocating bill.

First, they must hire top-tier law firms. Elite firms like Wachtell, Lipton, Rosen & Katz or Sullivan & Cromwell charge partner rates exceeding $2,000 per hour. Just drafting the hundreds of pages required for an SEC-compliant Proxy Statement can easily generate bills surpassing $5 million.

Next come expensive proxy battles. To persuade skeptical institutional shareholders like BlackRock and Vanguard, companies must hire professional proxy solicitors. For mega-cap stocks like Tesla, this single "vote-buying" cost can reach millions of dollars, requiring months of campaigning and lobbying akin to a U.S. presidential race.

Most critical is the risk of potential default. Legal teams must work around the clock reviewing tens of thousands of contracts, because a change of registration could instantly trigger "change of control" clauses in many bond agreements.

To obtain creditor waivers, companies often have to pay extra fees. By market convention, these fees typically range from 0.25% to 0.5% of the bond’s total value. For giants with massive existing debt, this means tens or even hundreds of millions in cash flow evaporate overnight—funds originally meant for R&D or share buybacks now become huge sunk costs.

If the cost is so high, why do they leave at such a painful sacrifice?

The answer lies in the shadow beneath Delaware’s polished legal facade.

For today’s tech giants, Delaware is no longer a safe harbor, but a hunting ground littered with traps. Here thrives a vast, hidden, and greedy ecosystem—the plaintiff attorney industry complex ("The Plaintiffs’ Bar").

On Wall Street, it’s jokingly called a "merger tax." Statistics show that during peak periods over the past decade, over 90% of merger deals worth more than $100 million faced litigation in Delaware. These lawyers care little about corporate governance. Like sharks smelling blood, they need only hold one share of stock. Once a company announces major news, they immediately file class-action lawsuits alleging "inadequate disclosure."

This has evolved into a standardized "extortion assembly line": sue, block the deal, force a settlement. Most companies, unwilling to delay transactions, end up paying this "toll," often amounting to tens or even hundreds of millions of dollars.

Dell, Activision Blizzard, Match Group… Flip through Delaware case records, and countless big companies have been "extorted." Here, corporations are no longer clients protected by law, but fat lambs legally hunted.

This bloodsucking reached absurd heights in the Tesla pay case.

After the Delaware judge invalidated Musk’s pay package, the plaintiff attorneys petitioned the court for 29.4 million Tesla shares as their victory fee. At prevailing prices, that amounted to $5.6 billion.

$5.6 billion—enough to outright purchase Macy’s, America’s largest department store chain.

At that moment, the mask was off.

This was no longer justice under law, but naked plunder of wealth creators. This final blow shattered Musk’s last hope and sent chills down Coinbase’s spine.

Coinbase’s leadership knows clearly: although the knife hasn’t yet fallen on them, staying in this old world teeming with "professional plaintiffs" and "astronomical legal fees" means eventual harvest is only a matter of time.

The giants did the math. Current legal, administrative, and PR fees, while running into tens or hundreds of millions, are short-term pain. But remaining in Delaware means, within this legal ecosystem, losing control of their companies and enduring endless litigation extortion—an incurable "cancer."

To gain freedom, blood must be shed.

The Old World’s Ruler Cannot Measure the New World’s Ambition

If the exorbitant "ransom" only made Musk and others flinch, the fundamental conflict in Delaware’s legal philosophy is what truly suffocates them.

This isn't merely a dispute over legal clauses—it’s the ultimate clash between two commercial civilizations.

For the past century, Delaware’s dominance rested on an unspoken golden covenant with corporate America—the Business Judgment Rule.

Its implication: as long as the board doesn’t embezzle or break laws, judges won’t interfere with how you run your business. This was the ultimate respect for entrepreneurial spirit and the foundation of American commercial prosperity.

But in recent years, this ruler has warped under time’s erosion. As institutional investors gained overwhelming influence, Delaware’s gavel increasingly swung toward another extreme—the Entire Fairness Standard.

This is a term that makes every Silicon Valley founder shiver. Its implication: "I don’t care if you’ve created a business miracle. If your process doesn’t meet my standards, your success means nothing."

Musk’s erased $56 billion pay package was precisely the victim of this microscopic scrutiny.

In that lawsuit, despite Tesla achieving the most explosive growth in business history and shareholders reaping enormous gains, the Delaware judge coldly ruled Musk’s pay invalid—solely because board members were too close to him, rendering the process insufficiently "perfectly independent."

This arrogance of "process over results" may serve as a safety guardrail for traditional, professionally managed firms like Coca-Cola. But for new species like Coinbase and Tesla, which depend on founders to drive exponential growth, it is a deadly shackle.

The old world’s ruler can no longer measure the new world’s ambition.

Delaware’s judges understand steel, oil, and railroads—but struggle to grasp why Musk’s personal IP is worth $50 billion.

While Delaware indulges in moral scrutiny, Texas pragmatically offers an ambitious "partnership agreement."

This is no empty slogan of "Texas welcomes you." In September 2024, the Texas Business Court officially opened for business. This isn’t just a new institution—it’s a precise strike targeting Delaware’s pain points.

It handles only high-value cases. By law, it has jurisdiction over commercial disputes exceeding $5 million; for public companies, only cases involving over $10 million qualify. This automatically bars nuisance suits by small shareholders.

Even more disruptive is the judicial appointment process. Unlike Delaware’s justices—appointed for 12-year terms and often from legal dynasties—Texas Business Court judges are directly appointed by Governor Greg Abbott, with terms lasting only two years.

This creates unprecedented alignment between judicial and executive branches on the goal of economic growth. If a judge’s rulings harm the business climate, they may lose their job in two years. Texas sends a blunt signal: "Here, we don’t teach you morality. No paternalism. We protect contracts. As long as you bring jobs and growth, we’ll protect you."

The "founder model" represented by Coinbase and Musk refuses to bow to the "manager model" embodied by Delaware. They’re tired of being treated as dangerous beasts to be restrained. So they pack their bags, leaving that refined yet suffocating greenhouse for a rugged frontier where wild growth is allowed.

American Drift

This may not spell Delaware’s doom. For a long time to come, it will remain home to Coca-Cola, Walmart, and General Electric.

For these "old aristocrats" who prioritize stable dividends, ESG scores, and professional management, Delaware’s intricate and meticulous rules remain the best seatbelt.

But for another group, the air there has grown too thin to breathe.

We are witnessing America split into "two nations."

One represented by Delaware and New York. It values distribution, balance, political correctness—a polished museum, orderly, yet exuding stale, aging air.

One represented by Texas and the new frontier. It values growth, efficiency, and even a kind of savage vitality—dangerous, yet full of possibility.

The departures of Coinbase and Musk are only the beginning. They are like canaries in a coal mine, using their acute senses to detect tremors deep underground before anyone else.

Of course, this migration carries risks.

Texas’s newly established business court hasn’t undergone stress tests during a major economic crisis. Its power grid remains fragile during snowstorms. No one dares guarantee it will birth the next century’s business legends.

But this is precisely what makes business so fascinating and ruthless—it never promises certainty. It rewards only those bold enough to bet amid uncertainty.

In this high-stakes gamble over the future, capital has cast its most honest vote with its feet. It tells us that when the old world’s order hardens into constraint, the instinct for innovation will always sprint toward open plains—even if barren—as long as they allow unrestrained speed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News