Coinbase CEO’s Davos Interview Highlights: Three Major Crypto Trends for 2026 and Progress on Bank Partnerships

TechFlow Selected TechFlow Selected

Coinbase CEO’s Davos Interview Highlights: Three Major Crypto Trends for 2026 and Progress on Bank Partnerships

The crypto industry is expanding from simple asset trading to entirely new financial application scenarios.

Compiled & Translated by TechFlow

Guests: Brian Armstrong, CEO of Coinbase; Andrew Feldman, CEO of Cerebras; Jake Loosararian, CEO of Gecko

Host: Jason Calacanis

Podcast Source: All-In Podcast

Original Title: Coinbase CEO’s Top 3 Crypto Trends for 2026 + More from Davos!

Air Date: January 24, 2026

Key Takeaways

This episode focuses exclusively on the conversation with Brian Armstrong, CEO of Coinbase, covering cryptocurrency adoption, global crypto regulation, stablecoin legislation, and future crypto trends.

Highlights Summary

Shifting Bank Attitudes

- Five of the world’s top 20 banks now use Coinbase infrastructure; JPMorgan Chase and PNC Bank have publicly announced partnerships.

- A CEO of a top-10 global bank stated directly: “Cryptocurrency is our #1 priority—it’s critical to our future, and we’re going all-in.”

Policy & Regulation

- Assessment of Biden and Trump administrations: “An illegal attempt to stifle the crypto industry.” Trump deserves credit—he pledged during his campaign to make the U.S. the global crypto capital, and he delivered.

- The Genius Act has passed: U.S.-regulated stablecoins must hold 100% reserves in short-term U.S. Treasury bills maturing within 30 days.

- Some banking trade groups are attempting to repeal the Act—but Brian calls this “a non-negotiable red line.”

Tether Controversy

- Brian holds a favorable personal impression of the Tether team, crediting them for meeting real dollar demand in high-inflation emerging markets.

- However, Tether currently fails to comply with the Genius Act—so a bifurcated future is likely: a U.S.-compliant version and an offshore version.

Tokenization Progress

- BlackRock and Apollo have publicly committed to tokenizing all their products.

- Coinbase launched Coinbase Tokenize, enabling funds and real estate projects to tokenize.

- Four billion adults globally lack brokerage accounts—tokenization offers them access to high-quality assets.

AI & Crypto Convergence

- AI agents need payment capabilities—but traditional finance is KYC-based. Future AI agents may therefore rely on stablecoins and crypto wallets.

- Coinbase built an internal, hosted AI model integrating Slack, Google Docs, Salesforce, etc. Brian uses it to uncover team misalignments and analyze his own time allocation.

Personal Choice

- Three years ago, Brian moved from California to Austin, citing disillusionment with social issues—and even concerns that California might go bankrupt.

Davos Goals & Global Bank Partnerships

Jason Calacanis: Today we’re joined by Brian Armstrong, CEO of Coinbase—and a longtime friend of the show. You came to Davos not for networking, but to advance global crypto regulation, right?

Brian Armstrong:

Yes—the primary goal of this Davos trip was to advance market structure legislation for crypto. That said, there’s definitely plenty of networking too. We held numerous business meetings—for example, five of the world’s top 20 banks are already using Coinbase, integrating crypto infrastructure into their products. We also met with leaders of several countries to discuss how crypto can promote economic freedom and upgrade their financial systems. So it’s been a very productive trip.

Jason: You just mentioned bank partnerships—does this resemble a white-label solution, allowing banks to offer crypto services to their customers? Which banks are involved, and how does it work?

Brian:

Several banks have gone public—including our announced partnerships with JPMorgan Chase and PNC Bank. Others remain confidential for now, but five of the top 20 global banks are actively using Coinbase. We’re also partnering with BlackRock, which plans to tokenize all its funds—and more and more financial institutions are entering the blockchain space.

Biden vs. Trump Crypto Policy

Jason: On my way here, I reflected on your past decade of engagement with regulators—you’ve faced many challenges. I recall that during the Biden administration, you proactively went to Washington D.C. hoping to engage—but they refused to meet with you. Now, some people hold different views of Donald Trump, but one thing he did well was engage directly with business—and take crypto regulation seriously. What’s changed for you over the past year?

Brian:

Objectively speaking, I believe the Biden administration did try to illegally stifle the crypto industry—while Donald Trump deserves credit: he promised during his campaign to make the U.S. the global crypto capital, and he delivered. He pushed hard for clear rules and regulations so U.S. companies could thrive—and U.S. consumers could benefit from higher returns via crypto. He also recognized this as a major political issue. Roughly 52 million Americans have used crypto—and they want clear rules and better financial services available domestically.

Stablecoin Legislation: The Genius Act & Banking System

Jason: China recently announced interest payments on its central bank digital currency (CBDC), while many of the world’s largest stablecoin issuers still operate offshore—and President Trump wants to bring that capital back to the U.S. That makes me think: in our industry, rules sometimes need reinterpretation. Like Airbnb and Uber, which broke through legacy rules—crypto is doing the same. Rules are now evolving. For you, the most critical rule may be stablecoin regulation. You partner with many banks—but also compete with them in certain areas, right?

Brian:

Yes—but we’re primarily collaborators. Many bank CEOs I’ve met here are deeply interested in crypto—and already integrating crypto services. For instance, yesterday I met with the CEO of one of the world’s top 10 banks, who told me: “Crypto is our #1 priority—it’s critical to our future, and we’re going all-in.”

Jason: Why is crypto so important to these banks—and what’s your take?

Brian:

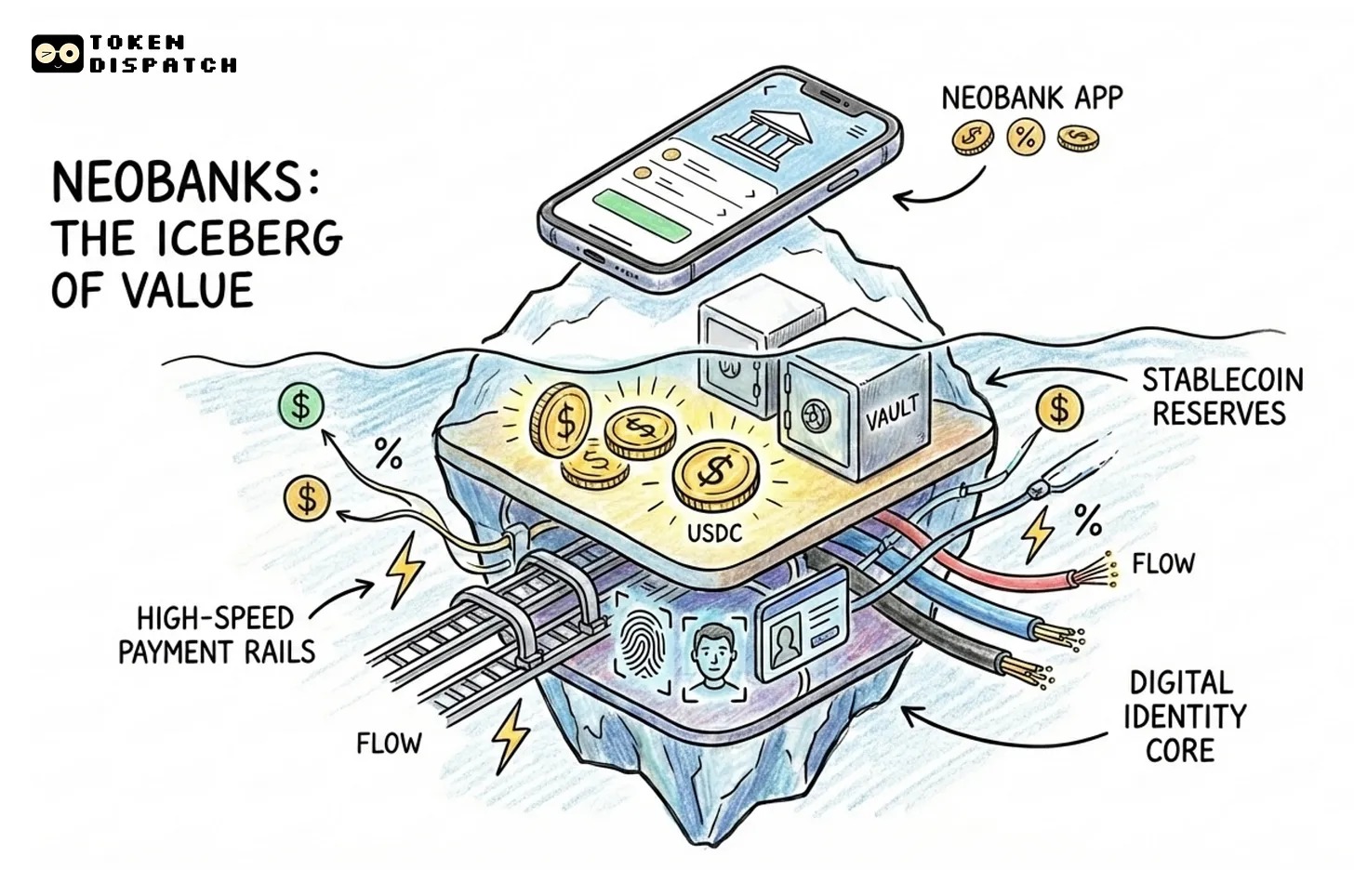

It’s like the rise of the internet—think Amazon versus Barnes & Noble, or blogs versus print media. When the world changes, you can either embrace opportunity—or treat it as a threat and bury your head in the sand. But crypto’s impact is massive: ~500 million people globally have used it; Bitcoin has been the best-performing asset class over the last decade; and now the world’s largest financial institutions are integrating crypto. So pretending it doesn’t exist is foolish. And the U.S. has already passed the Genius Act—stablecoin regulation is now law, and irreversible.

Jason: That’s hugely important—my friend David Sacks spearheaded this legislation, and he emphasized that stablecoins must be audited, compliant, and immune to bank-run risk. People worried about Tether—and indeed, it paid substantial fines. Now the law explicitly requires stablecoin assets to be held in Treasuries, correct?

Brian:

Exactly. Under the Genius Act, U.S.-regulated stablecoins must hold 100% of assets in short-term U.S. Treasuries—with a maximum maturity of 30 days. That’s essentially the safest option possible—you only need to trust that the U.S. government won’t default within 30 days, which is an extremely safe bet.

I’ve long stressed that traditional banks operate under fractional-reserve lending: they don’t hold all customer deposits—they lend out portions. This demands heavy regulatory oversight because bank runs are possible. In contrast, stablecoins operate on a 100%-reserve model—no bank charter needed, and inherently safer. Consider Silicon Valley Bank (SVB): its Treasury timing misstep triggered a bank run. I remember being at a board meeting when I got urgent messages to withdraw funds immediately—I insisted on pulling out at least half to ensure payroll coverage. By that evening, SVB had collapsed. So the core question is the stablecoin business model. Stablecoins can deliver yield to users—which matters greatly—but legally, it’s not “interest”; it’s a rewards program, carefully negotiated during the Genius Act’s passage.

Jason: How exactly do these rewards differ? Can we think of them like American Express points?

Brian:

Yes—many credit cards offer similar rewards. But legally, rewards can’t be based solely on balance holdings. Users must perform other activities—like making payments, trading, or subscribing to Coinbase services. When they do, we return nearly all the economic benefit to them—and this is a key driver of our growth.

In essence, this mirrors the choice between money-market funds and bank deposits in traditional finance. Crypto doesn’t change that dynamic—it simply adds another option. Some worry crypto will disrupt lending markets, but I think that concern is overblown. Money markets are already a trillion-dollar market—and banks offer high-yield checking accounts. Yet tech-driven crypto firms are pressuring banks, which may explain their nervousness.

Jason: My sense is some banks are nervous—but others see opportunity, right?

Brian:

Yes—I’d say it’s mostly the latter. We want everyone to win. While I can’t speak for the President, his comments suggest he wants all U.S. businesses to succeed. It’s a win-win. But if anyone tries to undermine the newly passed Genius Act, I’m confident he won’t stand by.

Jason: Are banks now trying to renegotiate this Act?

Brian:

I’ll answer carefully. Some banking trade groups are indeed trying to repeal the Genius Act—but it became law four months ago, and for us, it’s a non-negotiable red line. I’ve spoken with many industry peers, and they agree: it’s a firm floor. While banks and crypto firms may compete in this new environment, I believe both can find win-win opportunities in this new world.

Stablecoin Landscape: USDC’s Compliance Edge & Tether’s Status

Jason: You collaborate closely with Jeremy Allaire of Circle—he’s an old friend of mine. Is Circle Coinbase’s default stablecoin partner? How do you view that relationship?

Brian:

Yes—we have a very close relationship with Circle. USDC is currently the largest regulated stablecoin because it complies with the Genius Act—and also meets other frameworks like Europe’s Markets in Crypto-Assets Regulation (MiCA). Other stablecoins are adjusting to meet regulatory requirements—that’s essential to participate in the market.

Jason: So the future may feature two versions of Tether: one compliant with U.S. regulation, and another operating offshore. Is that what you’re hearing too?

Brian:

Yes—we have no exclusive agreement with Circle, and our platform lists multiple stablecoins.

We support certain Tether features—especially for users wishing to convert Tether. We also support PayPal’s stablecoin—and remain open to listing others. So we don’t exclusively favor USDC.

Jason: So you allow users to withdraw funds from Tether—but do you allow deposits into Tether? How does it work operationally?

Brian:

It varies by country—in permitted jurisdictions, we do support Tether.

Jason: Do you—or have you ever—worried about Tether? Its regulatory and trading practices seem loose. Though I say that, listing it on your platform may draw greater regulatory scrutiny. For years, people feared it could collapse and trigger a run. Is that risk worth taking?

Brian:

We’ve received those questions. Personally, I hold a positive impression of the Tether team—I think they’ve done significant good globally. In countries with 70–100% inflation, dollar demand is immense—and Tether’s distribution across many emerging markets is extensive. I believe they’ve contributed meaningfully to the world. However, Tether currently fails to meet the Genius Act’s requirements—it lacks 100% reserves and doesn’t hold assets in short-term Treasuries. I expect other nations will adopt similar regulatory approaches.

Jason: Is there any objective rating system for consumers in crypto today? As a platform, do you bear responsibility—or have the opportunity—to help users understand these distinctions? For example: one project meets high standards and compliance; another falls short; and some—like “meme” coins or “Wild West” tokens—are pure casino-style speculation.

Brian:

We do set baseline listing criteria. If we assess a project as posing cybersecurity risks—e.g., developers might rug-pull—or as illegal from a compliance standpoint, we evaluate accordingly. Once a project clears the minimum bar, we list it and let customers decide whether to invest. I don’t believe our role is to recommend investments—just as AAA-rated bonds in traditional finance can be politically influenced (see the film *The Big Short*). So I prefer to think of our model as analogous to an app store or Amazon—we aim to be a “general store,” where all legal assets can trade. Perhaps user reviews could be added later—like Amazon’s star ratings: you can still buy a 2-star product, but you’re informed. We tried introducing user ratings, but it didn’t work well—people vote based on personal preference or “talk up their own positions.” So our current mechanism is disclosure plus minimum standards.

2026 Outlook: Crypto’s Three Core Trends

Jason: What crypto projects excite you most right now? Bittensor? Or technical solutions like distributed computing? Those seem fascinating.

Brian:

Yes—people are tokenizing data centers and oil reserves. I see three dominant trends in crypto today: First, becoming a “general exchange”—not just crypto, but stocks too; prediction markets are also surging.

I was an early angel investor in Robinhood—and they’re doing well. Polymarket is our favorite, and we’re in active discussions with them. We could launch our own prediction market too. The biggest trend is all assets trading on-chain, prediction markets growing rapidly, and stablecoin payments scaling quickly—those are crypto’s three biggest trends right now.

Jason: When do you expect enterprises to start using stablecoins for payments? For example, reducing friction—like paying a designer $25,000 in stablecoins for a new Coinbase logo. When will consumers use stablecoins—say, settling poker debts via Coinbase accounts?

Brian:

The fastest-growing area over the past year has been cross-border B2B payments. Companies buying goods in Asia or Europe and selling in Brazilian stores face seven-day settlement delays and exorbitant FX fees—these costs are staggering. Growth here is strong. We launched Coinbase Business, offering SMEs cross-border payments, invoicing, tax, and accounting services.

Jason: How do you find these customers? Are they a unique cohort—or do they come to you?

Brian:

They come to us organically. We actually have a massive waitlist—and we’re hiring more staff to handle demand. We also launched the Coinbase Developer Platform—similar to AWS—enabling enterprises to white-label wallets, trading, payments, staking, financing, and more.

Tokenization: Private Markets & Capital Formation’s Future

Jason: You mentioned tokenization—I spoke with Vlad about a small experiment: why not tokenize OpenAI shares? Sam Altman wasn’t thrilled. As a private-market investor, I’d love to list my early Robinhood or Uber stakes on secondary markets once valuations surge. That would be fascinating for VCs and angels—what’s your take?

Brian:

This requires company permission. As a private company, you wouldn’t want employees cashing out after one year—hence vesting schedules, designed to retain talent and align incentives until IPO. Early secondary sales have derailed startups—so it’s a bad outcome. In crypto, the private-market shift should be: first, make on-chain capital formation easier—especially for private companies. We’re discussing registration with the SEC and others. Currently, U.S. fundraising is limited to accredited investors. I know you share this view: we want to broaden the path to accreditation. A bill is advancing that would require the SEC to create a certification exam—but the SEC moves slowly and often ignores mandates. Still, I see this bill as fairer. Otherwise, it’s regressive taxation—only the wealthy get richer via private investing. Ultimately, on-chain capital formation is a huge opportunity for private companies. I even believe firms could go fully on-chain—creating highly liquid markets.

Jason: This slashes costs, reduces friction, and democratizes wealth creation. Recall when you were private—massive demand existed, with people scrambling to buy shares via backdoor deals or sketchy SPVs (special-purpose vehicles). Have you watched the SPV market evolve? It’s become a boiler-room trading hub—not Chris Sacca’s orderly Twitter fundraise, nor Elon’s disciplined SpaceX raises every six months. Now dentists and HNWIs raise funds for SpaceX or Andreessen Horowitz stakes.

Brian:

Demand is intense for large private firms—another unintended consequence of heavy regulation. Laws like Sarbanes-Oxley extend the pre-IPO private stage—so Uber and Airbnb profits flowed entirely to private/qualified investors, while post-IPO performance disappointed.

Jason: Yes—Airbnb and Uber faced five-year “digestion periods” post-IPO. Instacart’s valuation dropped from $30B to $10B—an unintended consequence of inflated valuations, since no one could reasonably price these companies.

What about funds? I constantly get proposals from offshore investors suggesting putting my next seed fund (e.g., $50M) on-chain. If I’m your LP needing liquidity, I can sell my stake instantly. Or if I’m a Sequoia LP, I can sell my interest to you—pull out our wallets, and transact in seconds.

Brian:

This absolutely will happen. Coinbase launched Coinbase Tokenize—helping any fund or real estate project tokenize. This broadens participation, boosts demand, cuts massive back-office costs, and eliminates settlement risk—since on-chain trades settle instantly. Top-tier funds like BlackRock and Apollo have publicly declared intentions to tokenize every product they manage—and it’s happening now.

Jason: How do they maintain control? High liquidity brings second- and third-order effects. Have you considered implications—e.g., if a VC fund or REIT runs on-chain?

Brian:

We’ve considered it. Funds vary—some serve only institutions or accredited investors; others target retail. For retail, you could attract millions of global investors overnight, averaging $100–$1,000 per investment—dramatically democratizing access. Our recent report highlights the “unbanked.”

Plus, 4 billion adults lack brokerage accounts—meaning they can’t access quality assets. Capitalism’s wealth engine is inaccessible to them. They earn wages—but with $100 or $1,000, they’d love to allocate 10% to the S&P 500, Coinbase stock, NVIDIA, or other quality assets. Yet they can’t.

Jason: They invest via Prize Picks or similar—but funds leak elsewhere. Why not give them access? E.g., an HR professional hears about LinkedIn internally. A $75K/year employee may grasp LinkedIn or Indeed’s prospects—and invest $1,000 for life-changing returns.

Brian:

This also ties to financial literacy. AI agents are advancing rapidly. We’ve integrated one into the Coinbase app—teaching dollar-cost averaging or tax-loss harvesting—part of financial education. We also want broader access to quality investments—not just wealth democratization, but poverty alleviation. That’s powerful.

Leaving California: Views on U.S. Governance

Jason: Globally, things are complex—but focusing on the U.S., many are dissatisfied. We’ve discussed socialism’s rise in New York and California. Not sure if you’re still a California resident—but have you considered alternatives?

Brian:

Two years ago, I moved to Austin—actually three years ago, I decided to leave California. I felt disillusioned by social issues—I saw trends unfolding, and even thought California might go bankrupt.

Jason: I never imagined they’d reach wealth taxes or asset seizures. How do you view these issues? This morning, I read an article: those who left California (perhaps 20% of billionaires) created a $10B tax shortfall—even if they tried taxing remaining residents, the gap remains.

I feel conflicted—there’s always a choice: stay and fix things from within—or leave, like you did. On one hand, I love California; on the other, it’s become an “abusive relationship”—new problems keep arising. Once you leave, motivation to fix it fades. You may prefer seeing builders and top talent relocate to places welcoming business and talent.

Jason: Yes—many don’t realize how easy it is for global operators to leave a place. I travel to four continents annually. What matters is whether my wife and kids are happy—and we love Austin. I’ve found your biggest challenge at Coinbase is employee housing costs. E.g., recruiting a family of four needing private schools and a home—how high is their cost of living?

Brian:

Yes—it’s extremely high. I love your phrase “cost-of-living burden”—it’s a major barrier. Whenever we extend offers in California—or recruit for our biotech firm New Limit—candidates say: “My cost of living will double—I need higher pay.” That ultimately increases our operational costs.

Jason: Yes—San Francisco’s income-based tax policy is hostile to financial services. Stripe left under this pressure—and I think Mark Benioff regrets supporting it.

Brian:

Fair point—he wanted to fund homelessness initiatives. But those programs haven’t reduced homelessness. The root cause isn’t housing—it’s drug addiction. Providing homes doesn’t solve it.

Jason:

I think people would pay higher taxes if they believed they worked. Yet California’s budget soared over the past decade—while services deteriorated. This creates perverse incentives: the more we spend on homelessness, the more homeless people there are. Waste and fraud are rampant.

Davos Observations: From ESG Back to Business Fundamentals

Jason: Returning from Davos—what’s your view of the global landscape? Everyone seems to talk about ESG (environmental, social, governance) and DEI (diversity, equity, inclusion).

But over the past two years, these topics have shifted toward tangible deals—between nations and corporations. It’s becoming a business forum—not the prior globalization-vs.-nationalism debate. What’s your view of the world in 2026—and your interactions with regulators and officials?

Brian:

I’ve attended Davos only once before—then, it was about advancing globalization, ESG, and DEI. Now, those topics are rarely mentioned. Partly, that’s due to Larry Fink’s influence—he’s become a de facto leader. Also, Trump reshaped the game. The U.S. excels in GDP growth, low inflation, and business climate—emphasizing how prosperity lifts everyone—even the poorest. In high-economic-freedom nations, lives improve. Economic growth solves many problems.

Jason: Absolutely. Growth is extraordinary—we’ve never seen such GDP expansion. 5.6% is astonishing—and hopefully sustainable. Unemployment is reasonable at 4.6%, among the lowest in our lifetimes. Inflation hovers near 3% (target: 2%), averaging 2.8–2.9%. Not yet at target—but closing in. Crucially, growth isn’t driven by government spending, right?

Brian:

Exactly—that’s the key. The idea that government spending drives growth is fundamentally flawed. Real growth comes from cutting red tape, lowering energy costs, empowering private markets—and giving them clear rules on what’s allowed and prohibited. Then foster a level playing field where everyone competes. Consumers, companies, workers, and shareholders all benefit. Someone recently articulated this brilliantly. U.S. private enterprise is thriving—if businesses prosper, they hire more, pay more taxes, and fuel virtuous cycles.

AI & the Future: Job Displacement & Crypto Integration

Jason: Let’s discuss AI—I’m curious: When will AI truly arrive? Has it arrived—or is it still coming? Young people struggle to find jobs—but unemployment remains low. Meanwhile, voices like Elon and Bernie Sanders warn AI will displace vast numbers of jobs. What’s your view?

I focus on Amazon—because in the era of Optimus robots, autonomous taxis, and Whimo, asking humans to drive trucks or pack boxes seems absurd. These jobs are vanishing. How do you view job displacement—and what’s the most AI-first employee profile you’re seeing at Coinbase?

Brian:

Broadly, I see crypto and AI as the world’s two most critical technological trends. Interestingly, most people overlook how they converge. AI agents need to perform tasks—and they need to pay. Traditional finance is KYC-based, requiring human identity behind each transaction. So I believe future AI agents will use stablecoins and crypto wallets. We may need “Know Your Agent”—or perhaps not even know the agent’s identity. This is a major trend we’re advancing.

On job displacement, I lean slightly techno-optimistic. Historically, in 1900, 80% of Americans worked in agriculture—grueling physical labor. Automation reduced that to ~3% today—a 30-year transition. If people then saw us chatting at Davos, they’d call it “not real work”—to them, real work meant field labor, while ours feels like vacation. Yet we consider office typing a job—stressful, yes, but far preferable to digging ditches in the sun. So job displacement isn’t inherently bad—if it enables new work types, it’s positive. There’ll be transition pain—but overall, if AI develops as expected—including robotics—it will displace jobs, yet usher in abundance. People will pursue new roles—streaming video games on YouTube or writing profound philosophy—freed from packing boxes. So I’m optimistic: it’s a net positive.

Jason:

I’m optimistic too. Watching autonomous taxi progress—and Uber’s 12-year story—I think it’ll happen in six years. It’s accelerating fast. I’ve seen protests: “We’ll limit autonomous taxi licenses.” I expect this to become a defining class conflict in coming years.

What about internal staffing? Can you describe your AI-first employees? Is your headcount similar to years ago? Did you overhire? How do you approach hiring/training young talent amid automation and AI adoption? Are employees using Claude or other AI tools—not just engineers, but knowledge workers?

Brian:

Last year, we undertook a major initiative: building our own internally hosted AI model, connected to all our data sources—Slack messages, Google Docs, Salesforce, Confluence, etc. Now, all data lives in one system—and every team uses it, including legal and finance. It’s Coinbase’s “oracle.”

As CEO, I query these AI agents—not just for memo drafting, but asking: “What should I know about the company that I don’t know?” It tells me, e.g., “A team disagrees on strategy”—which I’d missed entirely, as it reads every Slack message and Google Doc. I ask other questions too—like “What did I change my mind on most last year?” It reports insights—e.g., I planned to spend 20% of my time on a task but actually spent 32%. It even flags topics I should ponder more—acting like a mentor or coach to help me become a better CEO.

Jason:

I’ve tested something similar recently. Have you tried Claude Code? I played with Claude Opus 4.5 and Co-Work—it works exactly as you described. You describe a task, and it guides you step-by-step like a tutor. It’s brilliant. I connected my Notion, Slack, and Google Docs—and it does the same. I asked: “Tell me something about myself.” It replied: “You should spend more time with high-performing founders—and less with internal teams.” It analyzed my team dynamics—fascinating. I think this is the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News