The claim of a $6 trillion deposit outflow has spooked the banking industry

TechFlow Selected TechFlow Selected

The claim of a $6 trillion deposit outflow has spooked the banking industry

History shows that technologies offering better solutions will ultimately be embraced by the market.

Author: Kolten

Translation: AididiaoJP, Foresight News

The U.S. CLARITY Act has sparked a debate about the future of money and banking. One of its key provisions bans digital asset service providers, such as cryptocurrency exchanges, from paying returns to customers solely for holding "payment stablecoins."

This restriction on third-party platforms extends the 2025 GENIUS Act, which already prohibits stablecoin issuers themselves from paying interest. Banks support these measures to protect their highly profitable "net interest margin" income.

In simple terms, the traditional banking model involves collecting deposits at low interest rates and then lending them out or investing in assets like government bonds at higher rates. The difference between the interest earned and paid is the bank's net interest margin (or spread).

This model is highly profitable. For example, in 2024, JPMorgan Chase generated $180.6 billion in revenue and $58.5 billion in net profit, with $92.6 billion in net interest income being the primary contributor.

Emerging fintech solutions offer savers direct access to higher yields, introducing long-avoided competitive pressure into banking. As a result, some large traditional banks are attempting to use regulation to protect their business models—a strategy that is both logical and historically precedented.

The Divide in Banking

As of early 2026, the average annualized interest rate on U.S. savings accounts was 0.47%, while major banks like JPMorgan Chase and Bank of America offered only 0.01% on basic savings accounts. In contrast, risk-free three-month U.S. Treasury bills yielded around 3.6%. This means large banks can collect deposits and invest in Treasuries, easily pocketing a spread of over 3.5%.

With approximately $2.4 trillion in deposits, JPMorgan Chase could theoretically generate more than $85 billion in income from this spread alone—though this is a simplified calculation, it effectively illustrates the point.

Since the global financial crisis, the banking sector has gradually split into two types of institutions:

- Low-rate banks: typically large traditional banks that rely on extensive branch networks and brand recognition to attract deposits from rate-insensitive customers.

- High-rate banks: such as Goldman Sachs’ Marcus and Ally Bank, mostly online banks that compete by offering deposit rates close to market levels.

Research shows that the interest rate gap among the top 25 U.S. banks has widened from 0.70% in 2006 to over 3.5% today.

The profitability of low-rate banks fundamentally depends on depositors who do not actively seek higher returns.

The "Six Trillion Dollar Deposit Drain" Argument

Banking groups claim that allowing stablecoins to pay interest could lead to a potential "deposit drain" of up to $6.6 trillion, pulling credit resources out of the economy. In a January 2026 meeting, the CEO of Bank of America stated: "Deposits are not just funding pipes—they are sources of credit. Deposit outflows would weaken banks' lending capacity and force them to rely more on expensive wholesale funding."

He argued that small and medium-sized enterprises would be hit first, while Bank of America itself would be "largely unaffected." This argument equates stablecoin deposit absorption with capital exiting the banking system—but that’s not always the case.

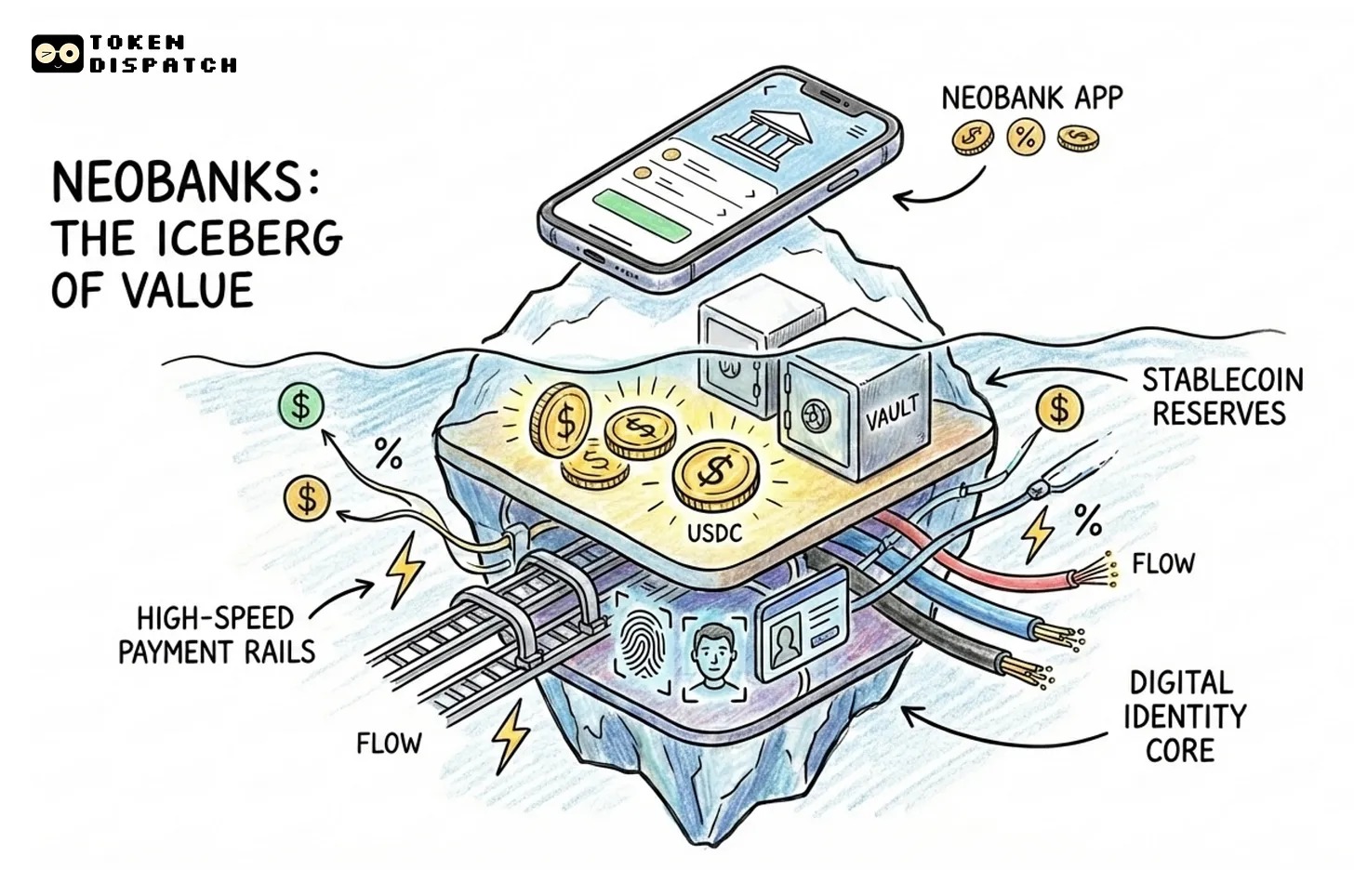

When customers buy stablecoins, dollars move into the issuer’s reserve accounts. For instance, USDC reserves are managed by BlackRock and held in cash and short-term U.S. Treasuries. These assets remain within the traditional financial system—total deposits may not shrink, but simply shift from individual accounts to issuer accounts.

The Real Concern

What banks truly fear is deposits moving from their low-interest accounts to higher-yielding alternatives—such as Coinbase’s USDC rewards or DeFi products like Aave, which offer returns far exceeding most banks. For customers, the choice becomes clear: earn 0.01% at a big bank or over 4% via stablecoins? That’s a difference of more than 400 times in yield.

This trend is already reshaping saver behavior: funds are shifting from transactional accounts to interest-bearing ones, and depositors are becoming increasingly rate-sensitive. A fintech analyst noted: "Banks’ real competitors aren't stablecoins—they're other banks. Stablecoins merely accelerate competition among banks, ultimately benefiting consumers."

Studies confirm that when market rates rise, deposits flow from low-rate to high-rate banks. High-rate banks are now expanding personal and commercial lending—similar effects could emerge from stablecoin-driven capital flows, directing funds toward more competitive institutions.

History Repeats Itself

Today’s debate over stablecoin yields closely mirrors the 20th-century controversy surrounding Regulation Q, which imposed interest rate caps on bank deposits to prevent "excessive competition." During the high-inflation, high-interest environment of the 1970s, market rates far exceeded these caps, harming savers.

In 1971, the first money market fund was launched, enabling savers to earn market-based returns and even write checks. Similarly, today’s protocols like Aave allow users to earn yields without going through banks. Money market fund assets surged from $45 billion in 1979 to $180 billion just two years later, and now exceed $8 trillion.

Banks and regulators initially resisted money market funds, but the interest rate cap was eventually repealed due to its unfairness to depositors.

The Rise of Stablecoins

The stablecoin market is also growing rapidly: total market capitalization has skyrocketed from $4 billion in early 2020 to over $300 billion in 2026. The largest stablecoin, USDT, surpassed $186 billion in market cap in 2026. This reflects strong demand for "freely transferable digital dollars that can also generate yield."

The debate over stablecoin yields is essentially a modern version of the money market fund controversy. The banks opposing stablecoin yields are primarily the low-rate traditional institutions that benefit from the current system. Their goal is to protect their business models, even though this new technology clearly offers greater value to consumers.

History shows that technologies offering better solutions will ultimately be embraced by the market. Regulators now face a choice: facilitate this transformation or slow it down.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News