Mobile First: Banks on the Path to Crypto Products

TechFlow Selected TechFlow Selected

Mobile First: Banks on the Path to Crypto Products

Consumer-grade DeFi, treasury managing banks.

By: Zuo Ye

Finance serves as a social mobilization tool in the West, effective only where there is separation or even opposition between "state and society." In contrast, in large Eastern nations with a family-state integrated structure, social mobilization relies on water conservancy projects and governance capabilities.

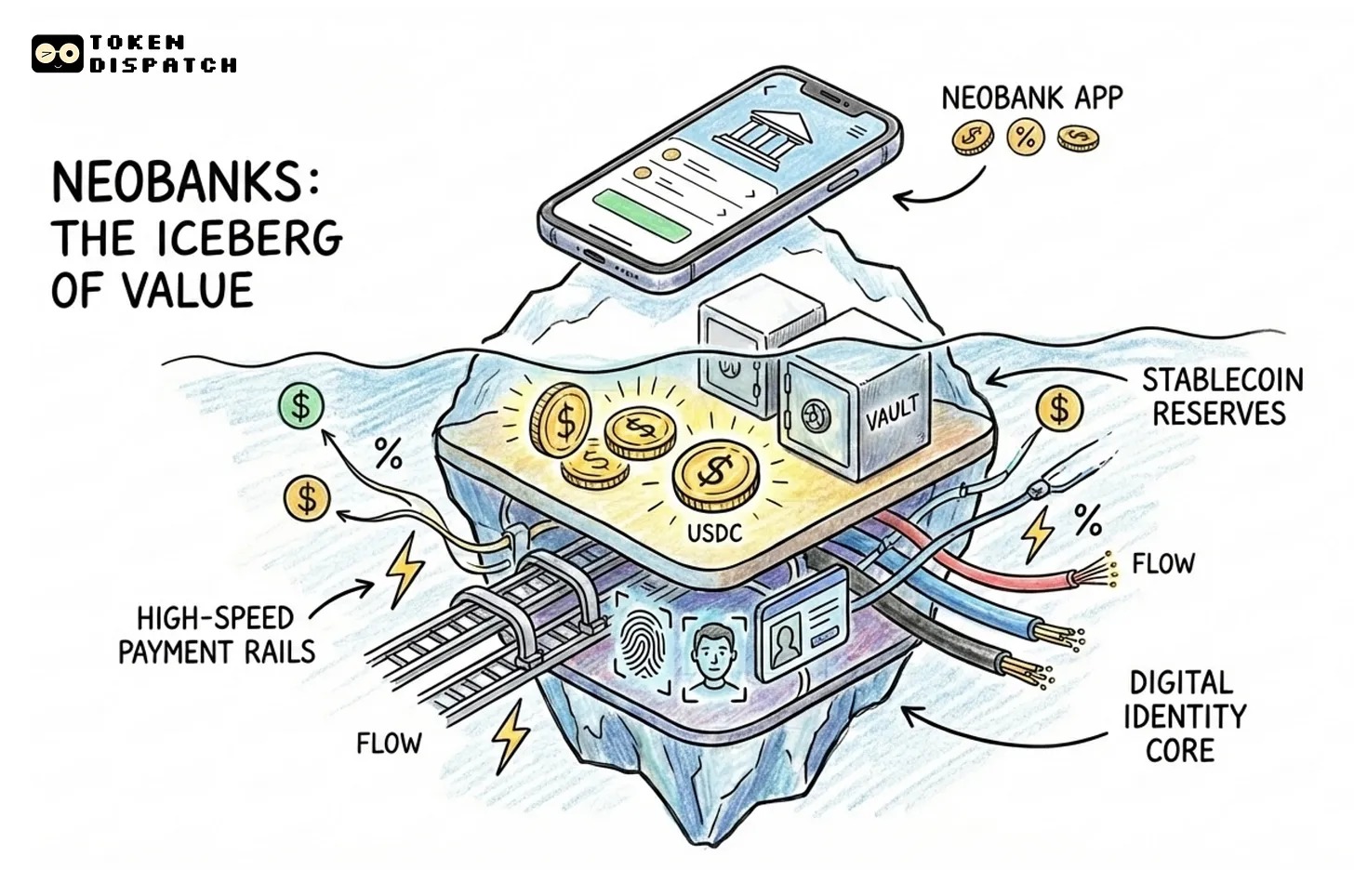

We begin here to discuss phenomena I've observed: after the messy conclusion of DeFi's 10-year narrative centered on Ethereum and dApps, it has shifted toward a mobile App race for Consumer DeFi resembling Apple Store models.

Compared to exchanges and wallets that quickly launched on major app stores, DeFi—long confined to web interfaces—arrived late. Meanwhile, while virtual wallets and digital banks target low-income, unbanked populations, DeFi, unable to resolve credit systems, arrived too early.

In this tension, we even see narratives re-emerging about humanity transitioning once again from monetary banking back to fiscal money.

The Treasury Reclaims Control of Money

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

Consumer-grade DeFi begins with Aave and Coinbase-integrated Morpho directly serving end consumers. But to fully understand how DeFi Apps transcend DeFi dApps, we must first revisit the process of modern money issuance.

Gold and silver are not naturally money. When large-scale exchange became necessary, commodities emerged as general equivalents. Due to their inherent properties, gold and silver eventually gained universal acceptance across human societies.

Prior to the Industrial Revolution, regardless of political system or development level, metallic coinage dominated globally—essentially placing currency under fiscal department control.

What we now recognize as the "central bank–commercial bank" system is actually a very recent phenomenon. In early developed nations, central banks were typically established only out of necessity during banking crises—including the Federal Reserve, our most familiar example.

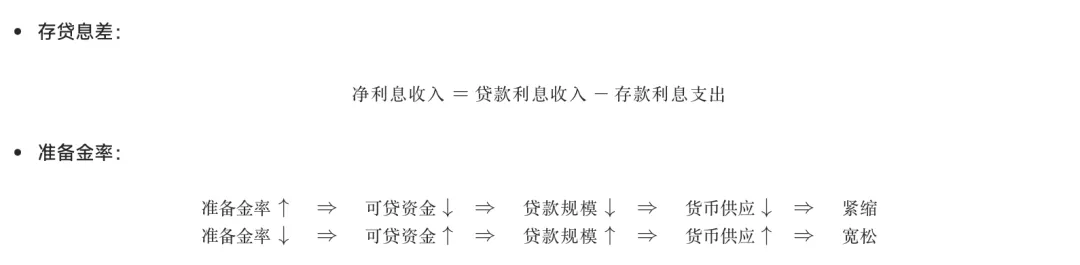

Throughout this history, fiscal authorities—as executive branches—have occupied an awkward position of diminishing power. Yet the "central bank–bank" model is far from perfect: commercial banks profit from interest rate spreads between deposits and loans, while central banks influence lending via reserve requirements.

Image caption: The role of deposit-loan spreads and reserve ratios. Image source: @zuoyeweb3

Of course, this is a simplified and outdated version.

The simplification omits the money multiplier mechanism: banks do not need 100% reserves to issue loans—leverage arises precisely because of fractional reserves. Central banks don't enforce full reserve compliance; instead, they use leverage to adjust overall money supply.

The only losers are users: deposits beyond required reserves lack rigid repayment guarantees. When neither central banks nor commercial banks wish to bear costs, users become the necessary sacrifice in monetary expansion and contraction.

The model is outdated because banks no longer fully obey central bank directives. Most notably, post-Plaza Accord Japan effectively initiated QE/QQE (quantitative easing, commonly known as money printing), driving interest rates to near-zero or negative levels. Under such conditions, banks cannot profit from traditional deposit-loan spreads and may simply "lie flat."

Thus, central banks directly enter markets to buy assets, bypassing banks entirely to inject liquidity—e.g., the Fed buying bonds, Japan’s central bank purchasing equities. This increasingly rigid system erodes the economy’s crucial clearing function: Japan’s army of zombie firms, America’s post-2008 TBTF (Too Big to Fail) Wall Street giants, and emergency interventions like those following Silicon Valley Bank’s collapse in 2023.

What does all this have to do with cryptocurrency?

The 2008 financial crisis directly gave rise to Bitcoin. Silicon Valley Bank’s 2023 collapse triggered a wave of opposition in the U.S. against CBDCs (central bank digital currencies). In May 2024, the House voted with unified Republican support against developing a CBDC, instead backing private-sector stablecoins.

The logic here is somewhat convoluted. One might assume that after SVB—a crypto-friendly bank—collapsed, triggering a significant de-peg of USDC, the U.S. would move toward supporting CBDCs. In reality, however, the Fed’s dollar stablecoin or CBDC stands in implicit conflict with Treasury- and Congress-led debt-backed stablecoins.

The Fed originated from the chaos of the post-1907 "free banking" era. Established in 1913, it operated under a peculiar hybrid of "gold reserves + private banks," directly managing gold until transferring oversight to the Treasury in 1934. Until the collapse of Bretton Woods, gold remained a core reserve asset for the dollar.

After Bretton Woods, however, the dollar became fundamentally a fiat currency—or what could be called a "Treasury bond-backed stablecoin." This creates a conflict with the Treasury’s institutional identity. To the public, the dollar and Treasuries appear two sides of the same coin. To the Treasury, Treasuries *are* the true essence of the dollar, and the Fed’s quasi-private nature interferes with national interests.

Returning to crypto, especially stablecoins: Treasury-backed stablecoins allow executive departments like the Treasury to circumvent the Fed’s monopoly on money creation. This explains why Congress and the administration jointly oppose CBDC issuance.

Only through this lens can we understand Bitcoin’s appeal to Trump. Family interests are merely the surface justification; the real incentive lies in the profitability of ceding pricing power over financial assets to the executive branch.

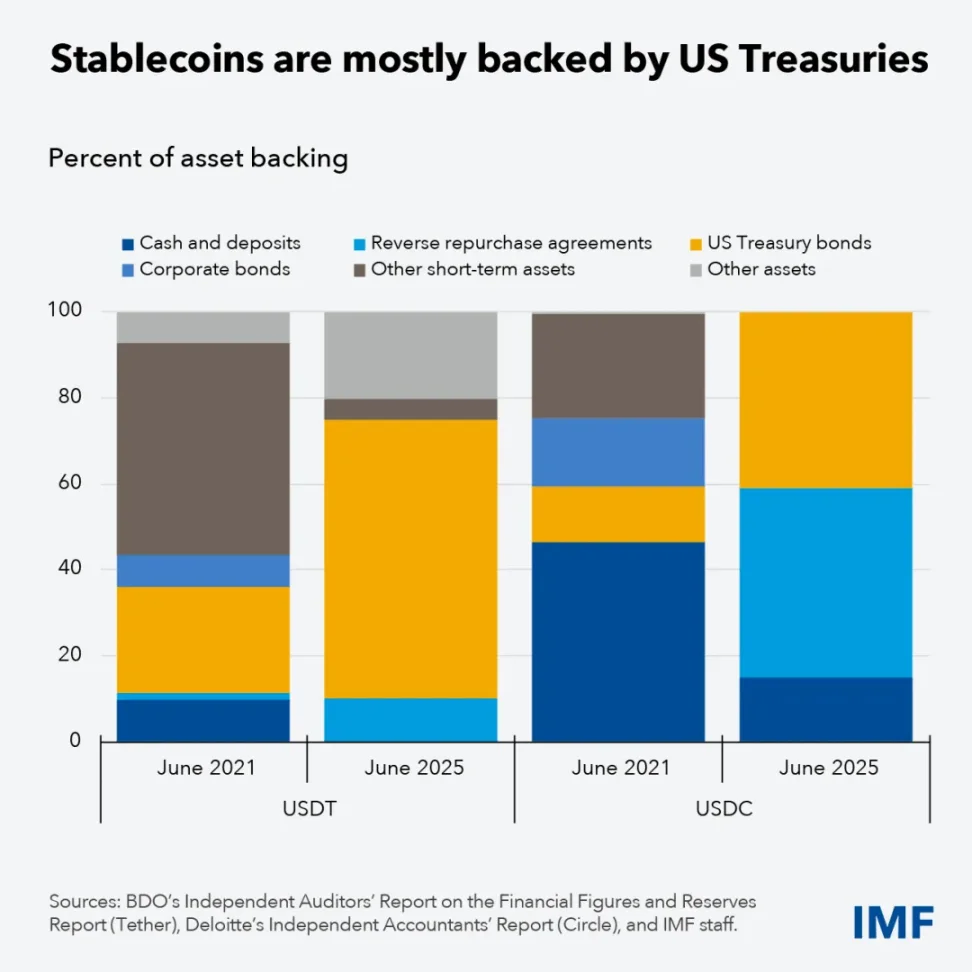

Image caption: Changes in USDT/USDC reserves. Image source: @IMFNews

Today’s dominant USD stablecoins are backed by cash, U.S. Treasuries, BTC/ETH, and other interest-bearing bonds (e.g., corporate debt). However, real-world USDT and USDC are reducing cash holdings and shifting heavily into Treasuries.

This isn’t a short-term yield play—it’s a coordinated shift aligning with the broader transition from dollar-backed to Treasury-backed stablecoins. USDT’s internationalization essentially means buying more gold.

The future stablecoin landscape will feature a three-way contest between Treasury-backed, gold-backed, and BTC/ETH-backed stablecoins—not a battle between USD vs non-USD stablecoins. Surely no one seriously believes euro-backed stablecoins will go mainstream?

Treasury-backed stablecoins enable the Treasury to reclaim monetary issuance authority. But stablecoins cannot directly replace banks’ money-multiplier or leveraged issuance mechanisms.

Treating Banks as DeFi Products

Physics has never truly existed; nor has money’s commodity nature.

Theoretically, the Federal Reserve should have ended its mission after the collapse of Bretton Woods, just like the First and Second Banks of the United States. Hence, new roles—price stabilization, financial market regulation—were gradually added to justify its continued existence.

As previously noted, under inflationary pressure, central banks can no longer rely on reserve ratios to control money supply. Instead, they directly purchase asset portfolios. This leveraged mechanism is not only inefficient but also fails to clear bad assets.

DeFi offers both progress and crisis—an alternative path that allows crises to occur, which itself functions as a market-clearing mechanism. The result is a framework where the "invisible hand" (DeFi) manages leverage cycles, while the "visible hand" (Treasury-backed stablecoins) ensures foundational stability.

In short, moving assets on-chain enhances regulatory oversight—information technology pierces through the veil of ignorance.

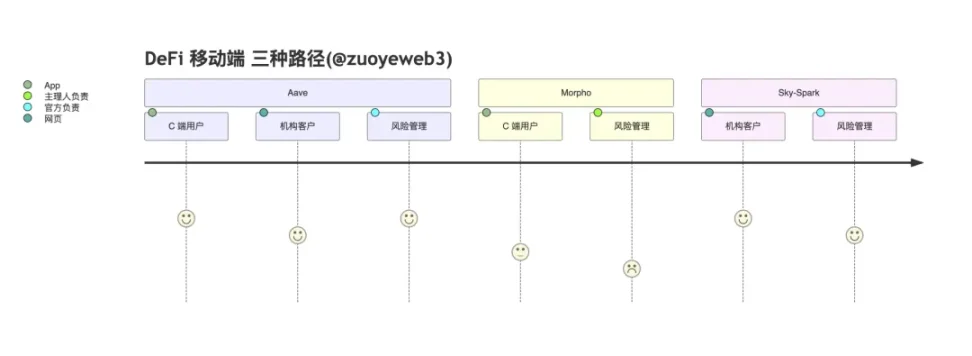

In practical implementation, Aave builds its own C-end app to connect directly with users; Morpho uses a B2B2C model via Coinbase; Spark within the Sky ecosystem abandons mobile apps altogether, focusing exclusively on institutional clients.

Breaking these down further: Aave combines retail users, institutional clients (Horizon), and centralized risk management; Morpho delegates risk control to vault managers while outsourcing front-end operations to Coinbase; Spark, a sub-DAO of Sky forked from Aave, primarily targets institutions and on-chain markets—effectively avoiding direct competition with Aave.

Sky is unique: as an on-chain stablecoin issuer (DAI → USDS), it seeks to expand usage scope, differing fundamentally from pure lending protocols like Aave and Morpho. Open lending protocols must remain maximally accessible to attract diverse assets—hence Aave’s GHO has limited prospects.

Sky must balance USDS issuance with lending openness.

After Aave voted to reject USDS as a reserve asset, it was surprising to find that Spark—their own protocol—also offered little support for USDS, while actively embracing PYUSD issued by PayPal.

Although Sky aims to use different sub-DAOs to mediate this tension, the inherent conflict between being a stablecoin issuer and hosting an open lending protocol will persist throughout Sky’s evolution.

In contrast, Ethena acts decisively: partnering with Hyperliquid’s frontend product Based to promote HYPE/USDe spot trading and rebates, it embraces existing ecosystems like Hyperliquid rather than building its own chain or ecosystem, focusing solely on becoming a single-purpose stablecoin issuer.

Currently, Aave comes closest to a full-featured DeFi App at near-bank grade. Starting from wealth management/Yield products, engaging directly with retail users, it hopes to migrate traditional mainstream customers on-chain using its brand and risk management expertise. Morpho, meanwhile, emulates the USDC model—binding tightly with Coinbase to amplify its intermediary role and foster deeper collaboration between vault managers and Coinbase.

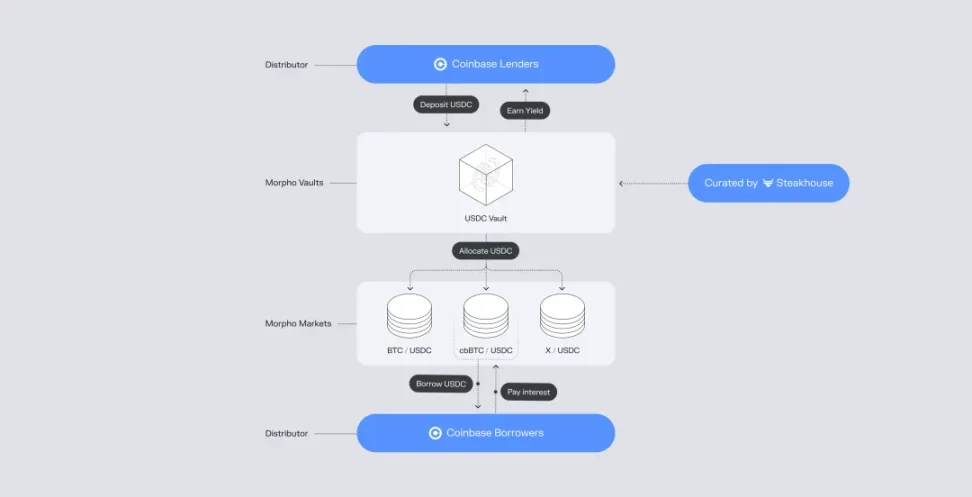

Image caption: Morpho and Coinbase collaboration model. Image source: @Morpho

Morpho represents an extreme openness strategy: USDC + Morpho + Base → Coinbase. Behind its $1 billion loan volume lies the additional mission of challenging USDT and blocking USDe/USDS via Yield products—Coinbase, after all, is the biggest beneficiary of USDC.

What does this have to do with Treasury-backed stablecoins?

For the first time, the entire cycle—from stablecoin yields on-chain to user acquisition off-chain—bypasses the central role of banks. This doesn’t mean banks are irrelevant, but rather that they’re increasingly reduced to middleware for deposits and withdrawals. Despite unresolved issues like DeFi’s inability to build credit systems, capital inefficiency due to over-collateralization, and risks tied to vault manager competence,

permissionless DeFi stacks *can* perform leveraged cycling, and vault failures *can* serve as market-clearing events.

Under the traditional "central bank–bank" system, third- and fourth-party payment providers—or dominant large banks—may conduct secondary settlements, undermining the central bank’s ability to monitor transactions and distorting economic understanding.

Under the modern "stablecoin–lending protocol" system, no matter how many times credit is recycled or how risky vault managers become, exposures remain quantifiable and transparent. The key is avoiding additional trust assumptions—such as pre-emptive off-chain negotiations or legal interventions—which reduce capital efficiency.

In other words, DeFi won’t triumph over banks through permissionless regulatory arbitrage, but through superior capital efficiency.

A century after central banks claimed dominance over money issuance, the Treasury system is finally bypassing its historical fixation on gold and reconsidering reclaiming monetary leadership. Meanwhile, DeFi will shoulder new responsibilities in reissuing money and clearing assets.

There will no longer be distinctions between M0/M1/M2—only a binary split between Treasury-backed stablecoins and DeFi utilization rates.

Conclusion

Crypto sends greetings to all friends, wishing them to witness a historic bull run after enduring a long, grueling bear market—while the overly hasty banking industry fades before them.

The Fed proposes Skinny Master Accounts for stablecoin issuers; the OCC attempts to calm banking sector fears over stablecoins siphoning deposits. These are signs of banking anxiety and institutional self-preservation.

Imagine an extreme scenario: if 100% of U.S. Treasuries were tokenized into stablecoins, if 100% of those stablecoin yields were distributed to users, and if 100% of those returns were reinvested into more Treasuries—would MMT (Modern Monetary Theory) ultimately succeed or fail?

Perhaps this is the meaning Crypto brings us. In an age dominated by AI, we must once again follow Satoshi Nakamoto’s footsteps to rethink economics, attempting to map the real-world significance of cryptocurrency—rather than blindly playing house with Vitalik.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News