Wall Street's Wild Woman, Vance's Staff, and a Century-Old Bank Lead Bank

TechFlow Selected TechFlow Selected

Wall Street's Wild Woman, Vance's Staff, and a Century-Old Bank Lead Bank

The most radical innovation may not come from destroying the old world, but from the old world's self-awakening.

Author: Kaori, BlockBeats

At the end of last year, JPMorgan Chase froze accounts related to two YC-backed stablecoin payment startups, BlindPay and Kontigo. Focused on Latin American markets, these companies triggered banks' sanctions and compliance red lines due to their operations in high-risk jurisdictions such as Venezuela.

Similarly, Lead Bank—a financial institution long regarded as crypto-friendly—has recently tightened its cooperation with certain stablecoin payment firms, introducing stricter customer identity verification processes and extending both transaction settlement times and account opening durations.

As compliance becomes non-negotiable, many entrepreneurs in the payments and stablecoin sectors are realizing that they aren’t truly dealing with the broader banking system, but rather with a small number of banks willing—and able—to keep their doors open.

However, Lead Bank differs fundamentally from JPMorgan Chase. As one of the first two banks participating in Visa’s USDC settlement on the Solana blockchain, Lead Bank has not taken a blanket approach to cutting off services for startups. Instead, it aims to leapfrog traditional competitors by offering native support for crypto-native enterprises.

The Rise and Fall of Garden City Bank

To understand Lead Bank today, we must first revisit its past.

In 1928, just before the Great Depression cast its shadow over America, a small institution named Garden City Bank was founded in Cass County, Missouri.

It was an era defined by handshakes and credit based on reputation. As a quintessential community bank, its fate was closely tied to local farmland, livestock, and family-run businesses. Over the following decades, it weathered the boom and bust cycles of American agricultural economics and survived the devastating 1930s depression—an extraordinary feat when thousands of similar institutions across the country collapsed.

For the next 77 years, the bank lived quietly, much like the town of Garden City itself.

In 2005, Garden City Bank faced its first major turning point.

Landon H. Rowland, a business legend from Kansas City located 80 kilometers away, retired with his wife Sarah and decided to acquire the sleepy rural bank. Landon Rowland was no ordinary banker—he was the former chairman and CEO of Kansas City Southern Industries. During his tenure, he expanded the railroad company into Mexico and spun off two financial giants: Janus Capital and DST Systems.

Motivated by old-school commercial idealism, Landon purchased the dormant rural bank, recognizing the power of infrastructure—whether rail tracks or financial rails—both designed fundamentally to connect and enable flow.

In 2010, the Rowland family rebranded the bank as Lead Bank. The name signaled ambition: no longer confined to the geographical limits of Garden City, but aiming to lead the industry.

Soon after, Landon’s son Josh Rowland took over as CEO. A lawyer with deep humanistic influences, Josh disliked the cold, bureaucratic counter designs typical of traditional banks. He questioned why a bank couldn't be more like Starbucks or a public library—a third space for the community.

To realize this vision, Josh realized the bank needed to leave its rural comfort zone and move into the heart of economic activity. In 2015, Lead Bank made a bold decision: relocating its headquarters to the Crossroads Arts District in downtown Kansas City.

Once a derelict industrial warehouse district, the Crossroads had been revitalized in the early 2000s by artists, galleries, and tech startups, becoming the innovation hub of Kansas City. In this avant-garde neighborhood, Lead Bank created an unconventional space.

No bulletproof glass, no queue ropes—Josh even commissioned students from the Kansas City Art Institute to host art exhibitions in the lobby and designed a rooftop terrace suitable for yoga classes and cocktail parties.

During this period, while Lead Bank looked modern on the outside, at its core it remained a traditional community bank serving local small business owners through warm, personal networks.

The Woman from Silicon Valley

While the Rowland family reshaped Lead Bank’s physical form, Jackie Reses, a powerful figure in finance, was grappling with profound frustration.

Jackie Reses’s career reads like a textbook on capital efficiency. She spent seven years at Goldman Sachs, specializing in mergers and private equity investments, honing world-class deal-making instincts.

Later, she joined Yahoo, where she led its most important and complex asset management initiative—the Alibaba shares held by Yahoo. Through intricate negotiations and structural design, Reses unlocked over $50 billion in value, cementing her status as a top-tier dealmaker.

In 2015, Jack Dorsey, co-founder of Twitter, brought her to Square’s payment processing arm to lead Square Capital—the company’s 18-month-old small business lending division. This unit aimed to use merchant transaction data to provide loans to millions of micro-enterprises. It should have been a perfect business loop, but U.S. regulations strictly barred tech companies from entering banking.

To comply with lending rules, Square had to adopt a “rent-a-charter” model, partnering with Utah industrial banks like Celtic Bank. Loans were issued under the bank’s name and then bought back by Square.

In an interview, Reses said collaborating with traditional banks was extremely difficult. Most lacked software engineers and operated on rigid, patchwork legacy systems, making it hard for user-experience-driven fintechs to customize transaction workflows. Launching any new product required lengthy battles between bank compliance and technology departments.

This dependent existence was deeply frustrating. After leaving Square in 2020, Jackie Reses resolved to own her own bank. When selecting a target, she avoided crowded hubs like California and New York and set her sights on Lead Bank in Kansas City.

Thanks to the Rowland family’s prudent management, Lead Bank had a clean balance sheet and an innovation-ready leadership team. More importantly, Reses didn’t want to spend her days networking with CEOs—she wanted access to real small business owners, precisely Lead Bank’s core clientele.

On August 1, 2022, the acquisition closed. It was a rare transaction swiftly approved by regulators including the Federal Reserve and the Missouri Division of Finance, largely thanks to Reses’s strong regulatory relationships.

An often-overlooked factor is that Reses’s younger brother, Jacob Reses, a rising political star, served as chief of staff to Senator JD Vance. With JD Vance assuming the vice presidency in early 2025, Jacob continued as a key aide, emerging as one of the central figures shaping White House policy.

This discreet channel to Washington’s power center may not be a get-out-of-jail-free card, but under the intense regulatory pressure of Chokepoint 2.0, it significantly reduces miscommunication risks and ensures smooth dialogue—enabling Lead Bank to venture into innovative areas other banks avoid.

Reses envisioned building atop Lead Bank—an existing community bank in Kansas City—by adding a fintech layer: a bank infrastructure platform that could be sold to other fintech companies.

At the time, Lead Bank attracted notable fintech clients like Affirm and began engaging with crypto-sector clients. Despite the fintech winter, Lead Bank’s growth accelerated. In Q3 2023, revenue rose 9% quarter-on-quarter to $37 million; net profit surged 50% to $5 million. Total assets reached $951 million, up more than $100 million from the previous year.

After the BaaS Industry Earthquake

Jackie Reses brought more than Wall Street capital and Washington connections to Lead Bank—she essentially transplanted a core team directly from Square.

This included CTO Ronak Vyas, General Counsel Erica Khalili, Chief Product Officer Homam Maalouf, and Albert Song, former design director at Meta. Together, they covered the full stack—from底层 code development and compliance risk management to front-end user experience—giving Lead Bank the internal capability to build financial products independently, without relying on external vendors.

When Vyas first reviewed traditional bank core systems, he was stunned by their outdated nature. Most U.S. banks still run on mainframes from the 1970s, built using COBOL. These systems operate batch processing: if you swipe your card today, the bank only updates balances after closing hours. For fintech companies demanding millisecond-level responses, this feels like prehistoric technology.

Upon taking office, Vyas made a radical decision: build everything in-house, nothing off-the-shelf. This proprietary system runs directly on AWS cloud infrastructure and Snowflake databases, acting as a parallel ledger and risk orchestration layer—reducing reliance on opaque intermediaries and enabling true real-time accounting.

While others patched old systems with middleware, Lead Bank transformed itself into a tech company wearing a bank charter. Though criticized initially as inefficient, time soon proved Reses and Vyas right.

In 2024, the famous middleware provider Synapse collapsed, triggering a chain reaction across the BaaS industry.

As mentioned earlier, most fintechs lack banking licenses and cannot interface directly with antiquated mainframe systems. Synapse acted as a bridge—offering simple APIs to fintechs while managing complex backend bookkeeping for banks. Before its collapse, Synapse supported over 100 fintechs, indirectly managing accounts for 18 million users, with annualized transaction volume reaching $76 billion.

Its failure exposed a terrifying black box: sub-ledgers maintained by the middleware frequently failed to reconcile with actual bank-held funds. Tens of millions of dollars vanished overnight; thousands of depositors couldn’t withdraw money. Shortly after, Evolve Bank, Blue Ridge Bank, and other aggressively expanding BaaS banks received severe penalties from regulators and were forced to halt new business.

Panic swept the industry. Fintech founders realized their supposedly solid banking partners stood on shifting sands.

This was exactly the moment Reses had been waiting for. Because Lead Bank never used middleware and built its core system in-house, it emerged unscathed from the crisis.

Traumatized unicorn companies began seeking safe harbors. Revolut, one of the world’s largest digital banks, migrated its entire U.S. operation to Lead Bank. Ramp, a corporate spending management giant, abandoned its old partner and joined Lead Bank.

More importantly, this combination of hardcore technology and full banking licenses won狂热追捧 from capital markets. In September 2025, Lead Bank closed a $70 million Series B round led by ICONIQ and Greycroft, with participation from top-tier VCs including a16z and Ribbit Capital. Its valuation soared to $1.47 billion, making it one of the few banking unicorns.

A Crypto-Friendly Bank for the New Cycle

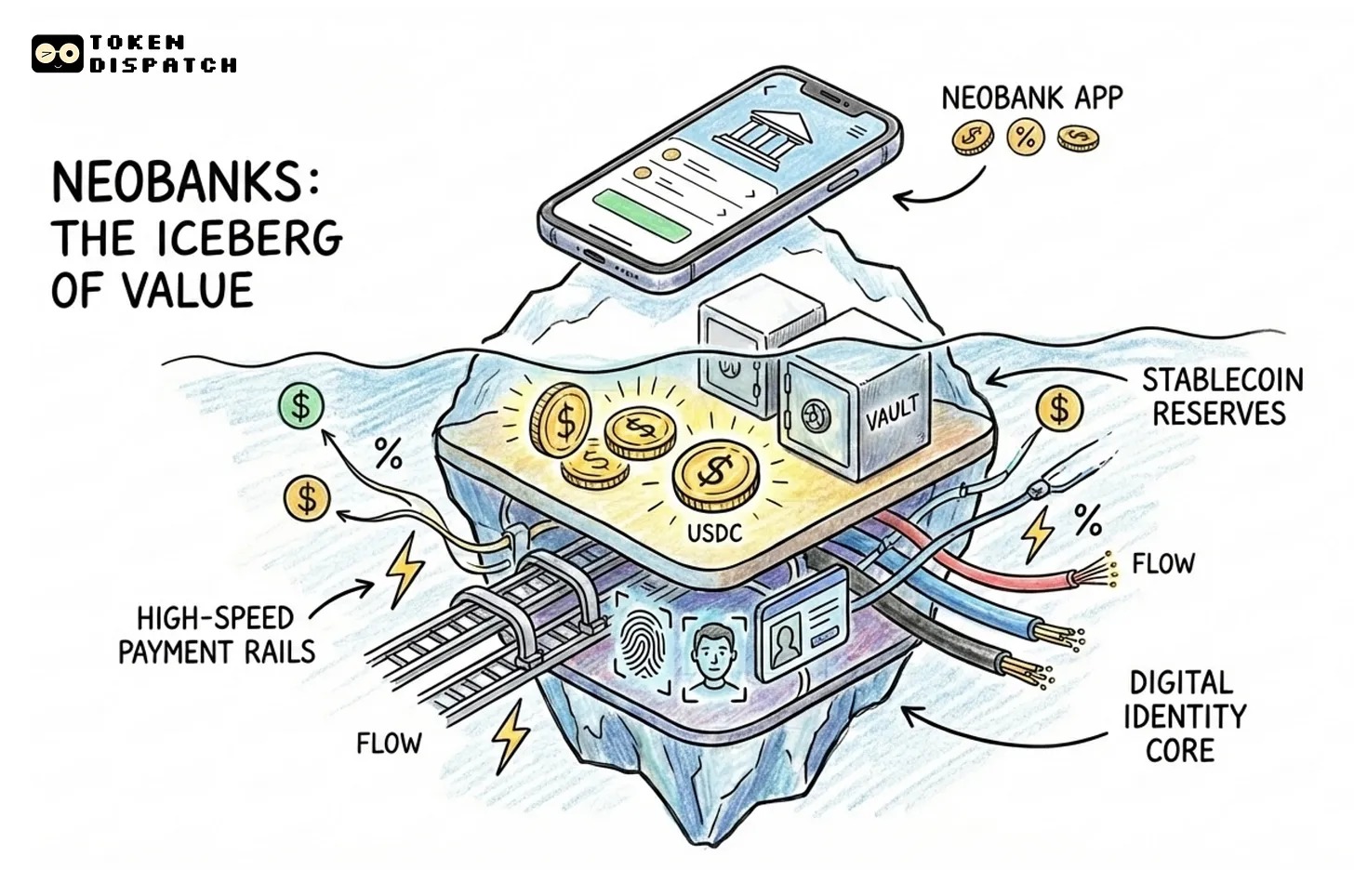

Viewing Lead Bank merely as a fintech partner would underestimate Jackie Reses’s ambitions. The bank is quietly becoming a critical gateway between the crypto economy and the fiat world.

After the collapses of Silvergate and Signature Bank, the crypto industry lost two major pillars for dollar settlements. Lead Bank swiftly stepped in—but with a smarter, more discreet strategy than its predecessors.

By the end of 2025, Visa announced USDC stablecoin settlement on the Solana blockchain—with Lead Bank serving as one of the two launch partner banks behind the scenes. This means that when you use a Visa card anywhere in the world, the underlying fund transfer might bypass the slow SWIFT network entirely, settling in seconds via Lead Bank’s account using USDC.

Lead Bank does more than just hold money for crypto firms—it maps fiat accounts to on-chain addresses. Through its API, compliant crypto enterprises can achieve 7x24 real-time fiat inflows and outflows.

Examining Lead Bank’s financial statements reveals a growth logic utterly different from traditional community banks.

As of Q3 2025, Lead Bank’s total assets had surged to $1.97 billion—more than double pre-acquisition levels. The key lies in its transformed deposit structure. Traditional banks beg individuals to make fixed deposits, paying 4%-5% interest.

Lead Bank, by serving fintech and crypto clients, accumulates vast amounts of commercial demand deposits—funds parked temporarily for payment settlements, insensitive to interest rates. This gives Lead Bank exceptionally low funding costs on the liability side.

On the asset side, Lead Bank exercises remarkable discipline. Unlike Silicon Valley Bank, it doesn’t use short-term deposits to buy long-dated Treasuries, nor does it aggressively issue risky commercial loans. Instead, it allocates significant capital to highly liquid short-term assets or channels funds rapidly through fintech partners into fast-turnaround short-term credit.

Data from 2024 shows non-interest income—primarily from payment processing fees, API usage charges, and card issuance commissions—grew 39%, far outpacing traditional interest income growth.

This creates a flywheel: low-cost settlement funds flow in, generate risk-free fee income, and turn over quickly—a transaction-based revenue model rather than the traditional interest-spread model.

By now, it should be clear: during this turbulent transition in finance and crypto, the languages of regulation, banking, and tech rarely align. Each misalignment carries the risk of suddenly becoming a cease-and-desist order.

Lead Bank proves that in the age of AI and blockchain, the most radical innovation may not come from destroying the old world, but from its self-awakening. By fusing百年-old banking credibility with Silicon Valley engineering prowess and modern art’s humanistic spirit, Lead Bank hasn’t just survived—it has redefined what a 21st-century bank can be.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News