The Economist: The real threat of cryptocurrency to traditional banks

TechFlow Selected TechFlow Selected

The Economist: The real threat of cryptocurrency to traditional banks

The industry is replacing Wall Street's privileged position within the American right-wing.

Source: The Economist

Translation: Chopper, Foresight News

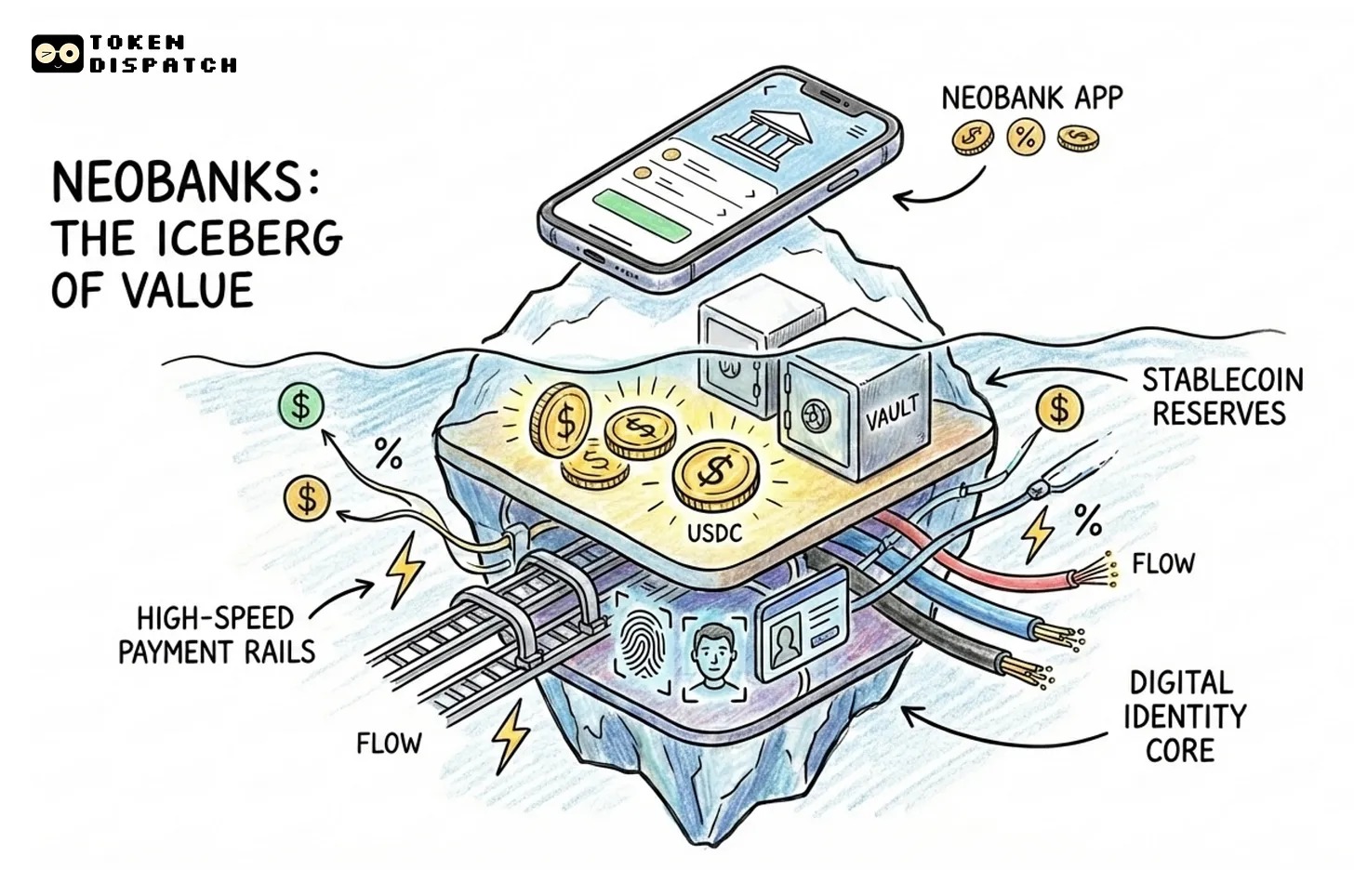

"First they ignore you, then they laugh at you, then they fight you, then you win." This quote is often attributed to Mahatma Gandhi, though the Indian independence leader never actually said it. Nevertheless, this fabricated maxim has become a popular mantra in the cryptocurrency industry. Pioneers of digital finance, once met with arrogance, mockery, and disdain from Wall Street elites, are now stronger than ever. Over the past year, both bankers and digital asset professionals have enjoyed a boom period. The crypto industry's solidification owes much to the GENIUS Act passed in July, which established clear legal standing for stablecoins. Since Donald Trump’s election victory, expectations of lighter regulation have lifted bank stocks by 35%. Even those bankers who dislike Trump for other reasons rarely favor the regulatory regime seen during Joe Biden’s administration. Nonetheless, tensions between old and new financial powers are escalating, and the threat posed by cryptocurrencies is far more serious than many bankers once imagined. While banks benefit from deregulation, their privileged status as the Republican Party’s "financial aristocracy" is now under threat. Sharing that status with the new elite of the crypto industry poses a long-term danger to traditional banking. Bankers’ most immediate concern centers on stablecoin regulation. The GENIUS Act explicitly prohibits stablecoin issuers from paying interest to buyers—a compromise designed to prevent stablecoins from diverting demand away from bank deposits and weakening lending capacity. However, the market has found a workaround: firms like Circle, issuer of USDC, share earnings with crypto exchanges such as Coinbase, which then offer “rewards” to users who purchase stablecoins. Traditional banks are demanding that this regulatory loophole be closed. Interest payments are not the only area of conflict. In other domains, cryptocurrencies are also challenging traditional financial gatekeeping. In October, Christopher Waller, a Federal Reserve governor and potential future chair, suggested allowing more institutions access to the Fed’s payment system—sparking alarm among bankers. Waller later walked back his comments, clarifying that applicants for such Fed accounts would still need a banking license. Finally, on December 12, the cryptocurrency industry successfully breached the gates of the U.S. federal banking system. A U.S. banking regulator approved national trust bank charters for five digital finance companies, including Circle and Ripple. While these charters do not permit deposit-taking or lending, they allow nationwide asset custody services without requiring separate state-by-state approvals. Previously, banks had lobbied fiercely against granting such charters. Individually, each development—a speech, a banking license, a regulatory workaround by stablecoin issuers—may seem minor. But collectively, they represent a serious threat to traditional banks. In fact, their core dominance in lending and trading brokerage has already been eroded by private credit firms and emerging market makers operating outside the banking system. They have no desire to lose further ground. Crypto firms argue that preferential policies for traditional banks create an uneven playing field and harm competition—an argument with some merit. Yet offering interest under the guise of “rewards” is clearly a brazen regulatory evasion. And the fact that lawmakers who voted just months ago to ban interest payments on stablecoins have taken no action to stop such practices reveals the true predicament facing traditional banks: their political influence has significantly declined. Traditional banks are no longer the dominant financial force within the Republican coalition. Instead, the cryptocurrency industry has firmly embedded itself within the right-wing “anti-establishment, anti-elite” political movement in the United States. Its largest political action committee commands hundreds of millions of dollars, ready to deploy in the 2026 midterm elections—because money remains a powerful weapon in politics. Today, when the interests of traditional banks clash with those of the crypto elite, the outcome is no longer certain, and may no longer favor the incumbents. Not long ago, bankers complained bitterly about the Biden administration’s strict regulations. Ironically, they now find themselves dependent on support from a group of Democratic senators. These Democrats are more concerned about the risks of disguised interest payments through stablecoins and associated money laundering threats. On the issue of blocking crypto firms from obtaining bank charters, America’s largest banks have formed an unlikely alliance with labor unions and center-left think tanks. Much like another quote falsely attributed to Gandhi: “The enemy of my enemy is my friend.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News