From 24 to 1 to 5: YC No Longer Invests in Crypto, but Crypto Has Not Disappeared

TechFlow Selected TechFlow Selected

From 24 to 1 to 5: YC No Longer Invests in Crypto, but Crypto Has Not Disappeared

Crypto is transforming from an independent industry into invisible infrastructure—the best applications are those users don’t even realize exist.

I’ve been in the crypto industry for six to seven years, and over the past two years, I’ve also immersed myself deeply in the AI space—living and working in Silicon Valley. Being active in both ecosystems, one striking observation stands out: within mainstream Silicon Valley circles, the word “crypto” is mentioned less and less—but the things crypto enables are being adopted more and more.

I want to bring back some signals from the AI side for crypto practitioners’ reference.

This misalignment is most evident at Y Combinator (YC).

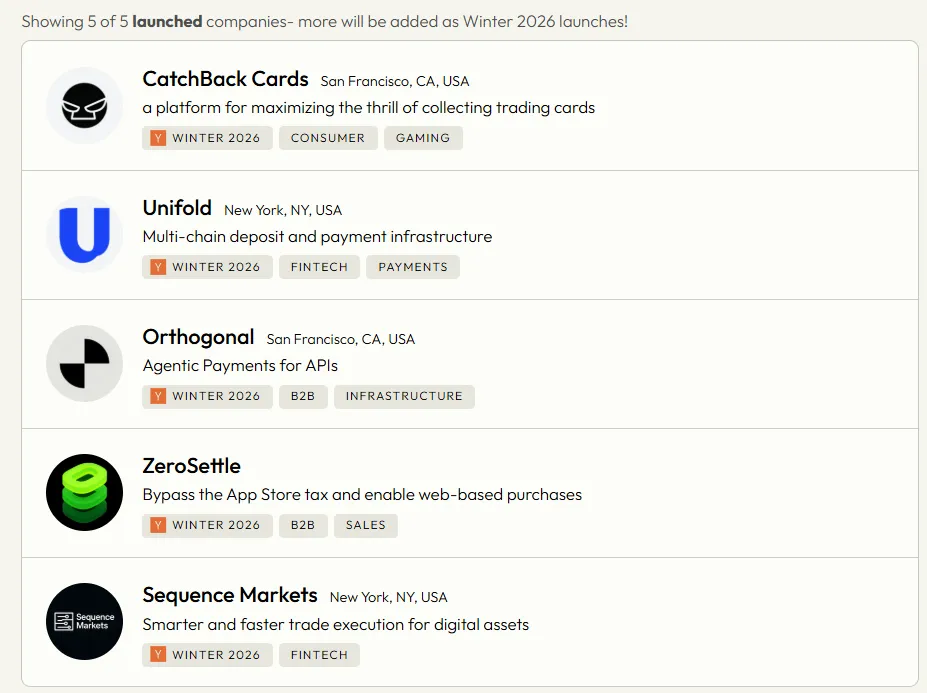

YC’s Winter 2026 batch has just been announced: among its 149 startups, five are crypto-related. That number may seem low—but if you dig into historical data, a clear story emerges behind those five.

A Set of Data

YC began investing in crypto projects in 2014—and to date, has backed 177 such companies. Pulling out the numbers by batch reveals an intuitive trend:

From 2018–2019, YC invested in 3–7 crypto startups per batch, steadily climbing. In 2020, it accelerated to 5–7 per batch. In 2021, that jumped sharply to 13–15 per batch. By 2022, it peaked—Winter alone funded 24 crypto startups; Summer added another 20—totaling 44 crypto companies in a single year.

Then came the cliff.

In 2023, YC still held steady at 10–13 per batch—for one year. In 2024, the collapse began—Winter: 7, Fall: 4, Summer: just 1. Over the entire summer, YC backed only one crypto startup.

Winter 2025 saw a brief rebound to 10—but Spring and Summer immediately fell back to just two per batch.

Now, Winter 2026: five.

If you’re a crypto practitioner, seeing “from 1 back to 5” might feel like a sign of recovery. But look closely at what those five actually do—and you’ll find they’re nearly alien species compared to the 24 funded in 2022.

What were YC’s 2022 crypto portfolio companies building? DeFi protocols, NFT infrastructure, DAO tooling, Layer-2 scaling solutions, on-chain games, social tokens.

What are these five 2026 companies building? Stablecoin deposit APIs, cross-border neobanks, trading execution engines, AI Agent payment gateways, attention exchanges.

Not a single one is building a blockchain. Not a single one is building a protocol. Not a single one operates in any traditional “crypto sector” with a recognizable name.

This isn’t a recovery—it’s a blood transfusion.

Three Definitive Projects

Let’s quickly run through three relatively straightforward ones.

Unifold, based in New York, builds Stripe for crypto deposits. Its API + SDK lets any app integrate cross-chain, cross-token onchain deposits in under 10 lines of code. Co-founder Timothy Chung previously built Streambird (Wallet-as-a-Service, later acquired by MoonPay to become MoonPay Wallets) and worked at Polymarket and Instabase. Co-founder Hau Chu graduated from Cornell Tech. This is a classic developer-tool business—users don’t need to know the underlying tech is crypto.

SpotPay, based in San Francisco, is a stablecoin-powered cross-border neobank. CTO Thomas was previously at Google and was Brex’s fourth engineer. CEO Zsika also came from Google and holds a Stanford MBA; having grown up in the Caribbean and Latin America, he’s experienced firsthand how painful cross-border remittances can be. The product is simple: one account handles overseas receipts, local payments, global spending (with physical cards), and interest-bearing savings. Stablecoins power the backend—but the frontend is a pure fintech app, visually indistinguishable from crypto.

Sequence Markets, based in New York, is a five-person team building intelligent digital asset trading execution. It helps institutional investors route orders across exchanges intelligently—to secure better prices and lower slippage. Fully non-custodial, it never touches user assets—operating strictly at the technology layer. A textbook “selling shovels” model.

Their commonality is unmistakable: crypto is the pipe—not the pitch.

Two Projects Worth Deeper Discussion

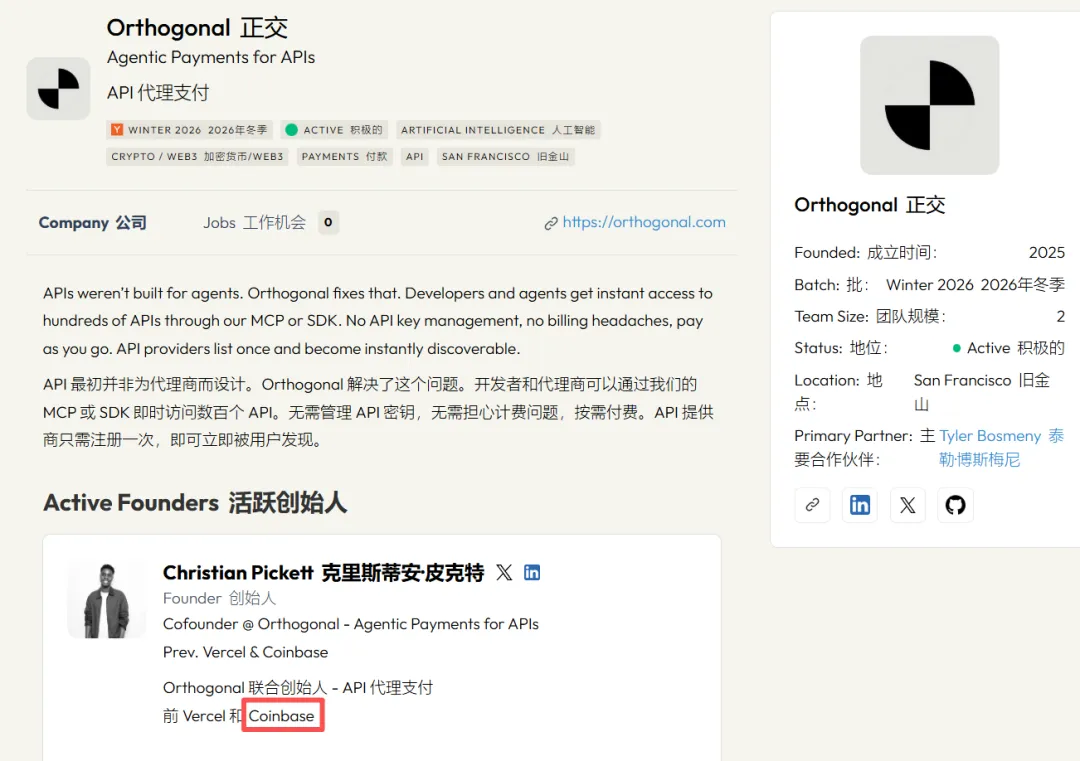

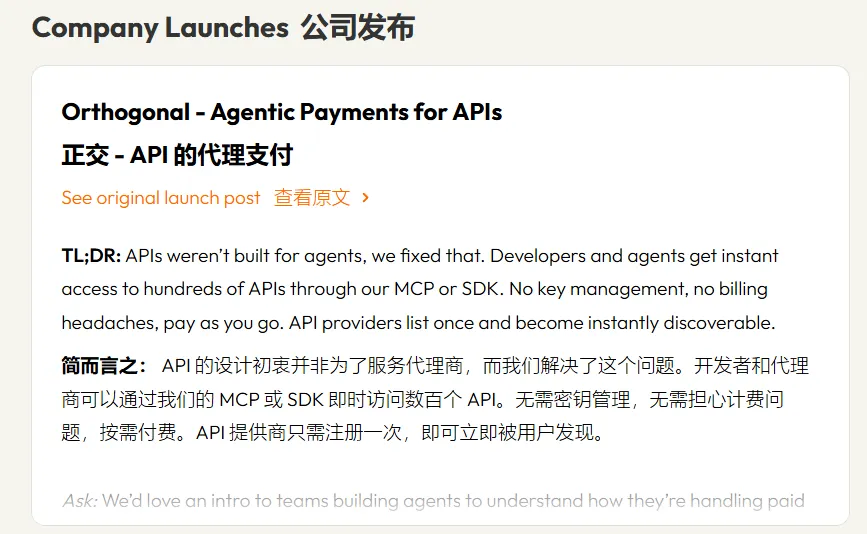

Orthogonal—When AI Agents Spend Money, They Use Crypto

This project deserves serious attention from crypto practitioners.

Founder Christian Pickett previously led payments at Coinbase and worked at Vercel. Co-founder Bera Sogut built reCAPTCHA and Maps APIs at Google and worked at Amazon Robotics; she’s also a two-time finalist in the ACM International Collegiate Programming Contest (ICPC) World Finals.

They’re tackling this problem: AI Agents are multiplying rapidly—and they need to call various paid APIs to complete tasks. But Agents have no credit cards, no bank accounts, and cannot follow human workflows like registration → card binding → payment. Today, developers pre-fund Agents or bind their own API keys. That works when there are few Agents—but collapses when thousands of Agents must autonomously call hundreds of paid services.

Orthogonal built a unified gateway: Agents connect via MCP or SDK, instantly accessing hundreds of paid APIs—pay-per-request, no API key management, no billing relationships required. API providers list once—and instantly become discoverable and callable by all Agents. Settlement happens onchain using crypto, supporting the x402 protocol—the onchain implementation of HTTP 402 Payment Required.

Why does this matter to the crypto industry? Because real-time, machine-to-machine micropayments are precisely where traditional finance falls short—credit cards impose fee thresholds; bank transfers suffer latency. Frictions tolerable in human transactions become hard constraints when Agents make thousands—or tens of thousands—of API calls daily. Crypto’s programmability, instant settlement, and permissionless nature make it a natural fit.

A notable timeline: In its Fall 2025 RFS (Request for Startups), YC highlighted “Infrastructure for Multi-Agent Systems” as a priority. Six months later, it funded Orthogonal. Early supporters include Precip (W24), Riveter (F24), Andi (W22), and Fiber AI (S23)—a cohort of YC alumni building Agent products—confirming this isn’t theoretical speculation but a live, urgent need.

An intriguing intersection: In Orange’s recent viral essay, “Agents Are the New Owners of Software,” SaaS shifts from B2B and B2C to B2A (business-to-Agent). If that thesis holds, inter-Agent payments become essential infrastructure—and Orthogonal bets crypto is the solution.

Forum—Turning “Attention” Into a Tradable Asset

This project has the greatest ambition—and highest risk.

Founder Owen Botkin previously traded long/short equities at Balyasny (one of the world’s top hedge funds). Co-founder Joseph Thomas engineered at NASA and DreamwaveAI. YC assigned Partner Jared Friedman—a core YC partner—to mentor Forum.

Forum aims to build “the first regulated attention exchange.” Specifically: it constructs indices from search engine, social media, and streaming platform data—quantifying how much attention a given topic, brand, or cultural phenomenon receives—and then allows users to go long or short on changes in that attention level.

For example: If you anticipate a PR crisis will cause a brand to lose public attention, you can short its attention index. If you believe a cultural trend is heating up fast, you can go long.

Their core argument: Attention is the primary driver of commercial success in the digital age—advertising, traffic, user growth—all ultimately monetize attention. Yet attention itself has never been directly priced or traded.

Forum’s current tags omit “crypto/Web3”—but “regulated exchange” plus “creating a new asset class” strongly suggests tokenization. Notably, YC’s Spring 2026 RFS introduced the phrase “new financial primitives” for the first time—and Forum fits squarely within that direction.

For the crypto industry, Forum points far beyond stablecoin payments—if tokenization targets not JPEGs or real estate shares, but “attention”—a previously unquantifiable concept—this is a fundamentally different narrative. Whether it succeeds remains too early to say.

Changes in the RFS

Beyond tracking what YC funds, it’s equally revealing to see what YC publicly says it wants to fund.

YC publishes a quarterly Request for Startups (RFS)—its official “topic guide.” Here’s a summary of crypto-relevant content from the last three editions:

Summer 2025: 14 focus areas—zero mention of crypto. Even “AI for Personal Finance,” a track covering investment and tax optimization, made no reference to crypto. YC’s attention was fully consumed by AI.

Fall 2025: Still no dedicated crypto track—but two directions planted seeds: “AI-Native Hedge Funds” (digital asset markets operate 24/7 with open data—naturally suited to AI-driven quant strategies), and “Infrastructure for Multi-Agent Systems” (exactly the niche Orthogonal entered).

Spring 2026: Change arrives. Daivik Goel explicitly wrote “Stablecoin Financial Services,” naming the U.S. GENIUS Act and CLARITY Act—two landmark stablecoin bills—and noting stablecoins occupy a regulatory gray zone between DeFi and TradFi. His exact words: “The regulatory window is open. The rails are being laid.”

The same RFS introduction also debuted the phrase “new financial primitives,” listed alongside AI-native workflows and modern industrial systems.

This marks YC’s first time in two years dedicating a standalone RFS track to crypto-related themes. The wording is precise—not “blockchain” or “Web3,” but “stablecoin financial services”—and specifies concrete directions: yield-bearing accounts, tokenized real-world assets, and cross-border payment infrastructure.

My Take

As someone straddling both crypto and AI, I believe this data is actually good news for crypto practitioners—though perhaps not in the way many expect.

YC hasn’t abandoned crypto—but it has redefined what kind of crypto company is worth funding.

In one sentence: YC no longer invests in crypto companies. YC invests in companies that use crypto.

What’s the difference? The former’s value proposition is “I’m building the crypto ecosystem.” The latter’s is “I’m solving a real problem—and crypto happens to be the best tool for it.”

The former requires users to understand wallets, gas fees, onchain interactions. The latter’s users don’t even know they’re using crypto—SpotPay users think they’re using a banking app; Unifold’s customers think they’re integrating a payments SDK; Orthogonal’s Agents don’t “think” at all.

What does this mean for us?

First, the good news: Stablecoin payments have evolved from an in-crowd consensus into a mainstream Silicon Valley consensus. YC spotlighted it in its RFS; the GENIUS and CLARITY Acts advance; Stripe acquired Bridge—these signals converge, signaling that stablecoin’s compliance path is materializing. For teams deeply entrenched in this space, fundraising conditions and market awareness are improving.

Second, new opportunity: Agent payments emerged organically from within the AI industry—and crypto practitioners hold a natural advantage in capturing it. Real-time, machine-to-machine micropayments, programmable money, permissionless settlement—concepts we’ve championed for years—now have their most concrete application in the Agent economy. This isn’t us hunting for use cases—it’s the use case knocking on our door.

Of course, realities demand attention: Competitor profiles have shifted. SpotPay’s CTO was Brex’s fourth engineer; Orthogonal’s founders came from Coinbase and Google—these aren’t crypto natives, but they bring engineering rigor and product discipline from legacy tech companies. To compete, crypto practitioners must move beyond chain expertise—and master product experience and engineering excellence.

Also, let’s be clear: L1/L2s, DeFi protocols, NFTs, DAO tooling—these aren’t inherently worthless. But in the eyes of mainstream Silicon Valley accelerators and VCs, they’ve dropped off the priority list. That doesn’t mean these areas are dead—but if you’re building here, your fundraising strategy and narrative framing may need adjustment.

Finally, the “24 → 1 → 5” trajectory is best interpreted not as “crypto recovering” nor “crypto declining”—but as crypto being redefined.

It took YC two years to crystallize one insight: crypto’s greatest value may lie not in becoming a standalone industry—but in becoming infrastructure for other industries. Whether this is correct remains to be proven. But as someone living in both worlds, I see abundant opportunity for crypto practitioners—provided we’re willing to shift perspective.

Crypto doesn’t need to disappear—but its best products may make crypto itself invisible to users.

This isn’t compromise. It may be the biggest win yet.

You’re free to disagree—but this is the stance expressed, in real dollars, by Silicon Valley’s most influential startup accelerator.

Data sources: YC Directory (Crypto/Web3 tag, all batches totaling 177 companies), YC Winter 2026 Launch List (149 companies), YC Request for Startups (Summer 2025 / Fall 2025 / Spring 2026). Details on the five crypto-related projects come from YC’s official website and each company’s public materials.

Author: aiwatch. Six+ years in crypto, deepening AI immersion over the past two years, based in Silicon Valley, focused on GenAI product analysis and the Crypto × AI intersection.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News