Bitcoin ETF Redemptions and the AI Narrative Rotation: Who Is Siphoning Liquidity from the Crypto Market?

TechFlow Selected TechFlow Selected

Bitcoin ETF Redemptions and the AI Narrative Rotation: Who Is Siphoning Liquidity from the Crypto Market?

The AI narrative is absorbing capital that previously flowed into Bitcoin—and even software stocks.

Author: Michael Ebiekutan

Compiled by: TechFlow

TechFlow Insight: Since Bitcoin hit its all-time high of $126,000 in October 2025, the crypto market has experienced its most severe correction since 2022. Wintermute, a leading market maker, notes in its latest report that, beyond net ETF outflows totaling $6.2 billion, capital is rotating en masse into the AI sector. The report delves into why Coinbase Premium, ETF flows, and basis rates will serve as key indicators for this structural recovery.

Full Report Below:

- Bitcoin ETFs have become the primary driver behind the broader crypto market decline, with net outflows exceeding $6.2 billion since last November.

- The AI narrative is absorbing capital previously allocated to Bitcoin—and even software stocks.

- Bitcoin may struggle to emerge from its current trough until Coinbase Premium turns positive, ETF inflows resume consistently, and basis rates stabilize.

According to Wintermute, Bitcoin’s (BTC) recent downtrend—triggered by the leveraged liquidation event on October 10, 2025—has been primarily driven by persistent ETF outflows and capital rotation toward the AI narrative.

In a report released on Tuesday, the market maker noted that Bitcoin has erased all gains accumulated since former U.S. President Donald Trump’s election victory in November 2024. Over the past several months, the top cryptocurrency has undergone its largest capital outflow since 2022, dropping from its October peak of $126,000 to approximately $60,000 last Friday—a decline exceeding 50%.

The report states that following the sharp declines in October and November, Bitcoin traded mostly sideways throughout December and January. However, accumulated leverage during that period was wiped out over the past week amid roughly $2.7 billion in liquidations.

Wintermute emphasizes that downward pressure originates predominantly from the U.S. market—a trend corroborated by the negative trajectory of Coinbase Premium since December and heavy selling by U.S.-based counterparties in over-the-counter (OTC) trading last week.

Additionally, the report highlights that U.S. spot exchange-traded funds (ETFs) have witnessed $6.2 billion in net outflows since November—the longest sustained outflow period in their history. Notably, BlackRock’s IBIT recorded nominal trading volume of approximately $10 billion during Thursday’s market crash.

Jasper De Maere, Wintermute’s Head of Desk Strategy, wrote: “A self-reinforcing feedback loop emerges when redemptions force sponsors to sell spot BTC amid falling prices.”

However, last week’s decline extended beyond cryptocurrencies. Broader markets also weakened, with both precious metals and equities pulling back. On the surface, crypto once again demonstrated its negative skew—underperforming major asset classes during downturns (just as it tends to outperform them during rallies)—a pattern consistent with bear market behavior, according to Wintermute.

The AI Narrative Is Gaining Momentum at the Expense of Crypto and Software Stocks

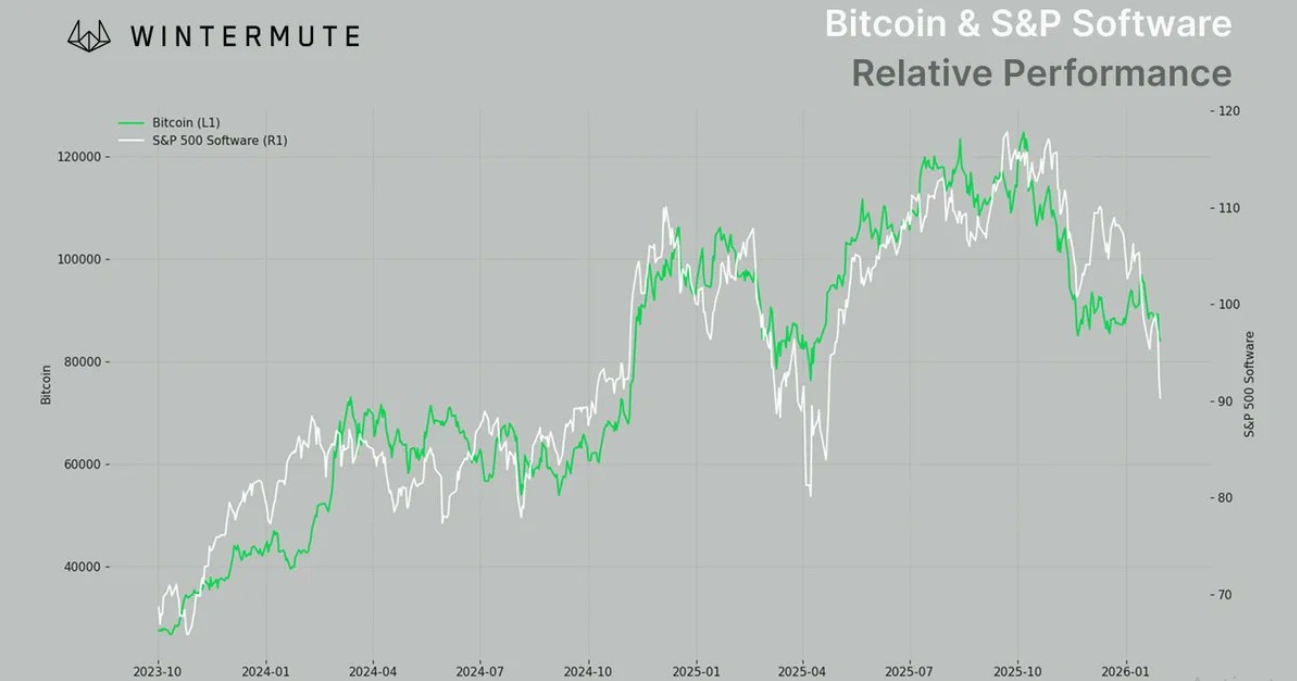

The firm’s further analysis shows that equity indices’ resilience during both market rallies and corrections owes largely to capital rotation into the AI narrative—not broad-based strength across the entire stock market. Wintermute points out that Bitcoin and software companies within the S&P 500 have exhibited highly correlated trading patterns over the past two years.

De Maere writes: “The real story is that, for months, AI has absorbed available capital at the expense of virtually every other asset class… Remove AI stocks from the Nasdaq index, and crypto’s negative skew effectively disappears.”

He adds: “For crypto to outperform again, the AI trade must de-lever. Microsoft’s weak earnings print initiated this process—but additional catalysts are needed.”

Bitcoin vs. S&P Software Index Performance

Source: Wintermute

The report also underscores that spot demand—the essential ingredient for initiating a structural recovery—remains weak. Digital Asset Treasuries (DATs), which were among the primary sources of buying pressure over the past year, now hold unrealized losses totaling up to $25 billion, as prices have fallen below their average acquisition cost. This contraction in net asset value (NAV) premiums constrains their ability to raise new capital and sustain demand.

Wintermute notes: “It will be difficult to see sustained upside until Coinbase Premium turns positive, ETF flows reverse, and basis rates stabilize.”

As of Tuesday’s publication, Bitcoin was trading at approximately $69,700, down 0.3% over the past 24 hours.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News