LayerZero Secures Backing from Wall Street’s “Old Money” in a Single Day—As the Cross-Chain Leader Begins Telling the Story of the “Wall Street Blockchain”

TechFlow Selected TechFlow Selected

LayerZero Secures Backing from Wall Street’s “Old Money” in a Single Day—As the Cross-Chain Leader Begins Telling the Story of the “Wall Street Blockchain”

What LayerZero has obtained may be either a ticket to enter or merely an interview opportunity.

By TechFlow

On February 10, LayerZero launched Zero in New York.

This is an in-house-built Layer 1 blockchain designed to support institutional-grade financial market trading and settlement.

LayerZero dubs it the “decentralized multi-core world computer.” Let me translate that for you: a blockchain built specifically for Wall Street.

Simultaneously, major Wall Street institutions began openly endorsing the project—with some going straight to writing checks.

Citadel Securities made a strategic investment in the ZRO token.

The firm processes roughly one-third of all U.S. retail equity orders. CoinDesk explicitly noted in its coverage that direct purchases of crypto tokens are highly unusual for traditional Wall Street institutions like Citadel.

ARK Invest also acquired both equity stakes and tokens in LayerZero; Cathie Wood joined the project’s advisory board directly. On the same day, Tether announced a strategic investment in LayerZero Labs—though the amount remains undisclosed.

Beyond token purchases and equity investments, there’s a quieter signal at play.

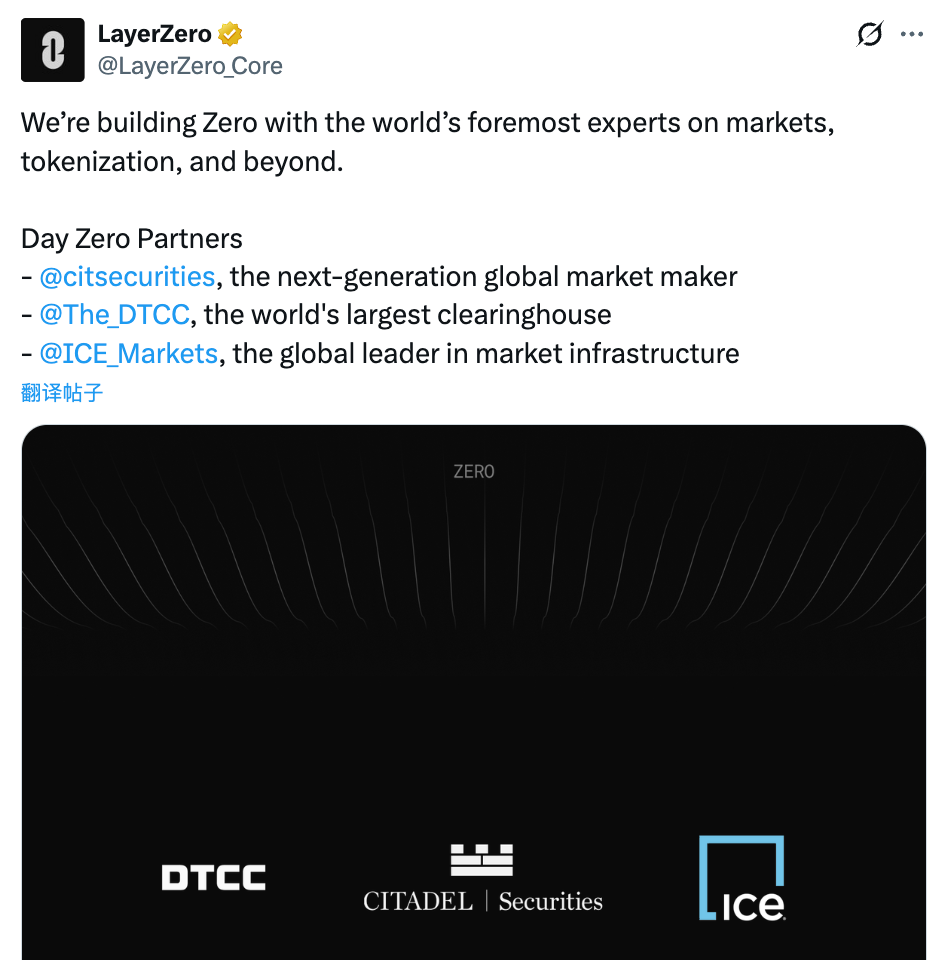

DTCC (the central securities depository and clearinghouse for U.S. equities), ICE (Intercontinental Exchange, parent company of the NYSE), and Google Cloud have all signed joint exploration agreements with LayerZero.

So, a cross-chain bridge project pivoting into infrastructure has simultaneously secured collective backing from entities across the entire onchain finance stack—clearinghouses, exchanges, market makers, asset managers, stablecoin issuers, and cloud providers.

Traditional institutions now have yet another channel through which to deploy onchain financial infrastructure.

Following the announcement, ZRO surged over 20% intraday and currently trades near $2.30.

From Bridge to Pipeline?

LayerZero’s work over the past three years has been straightforward:

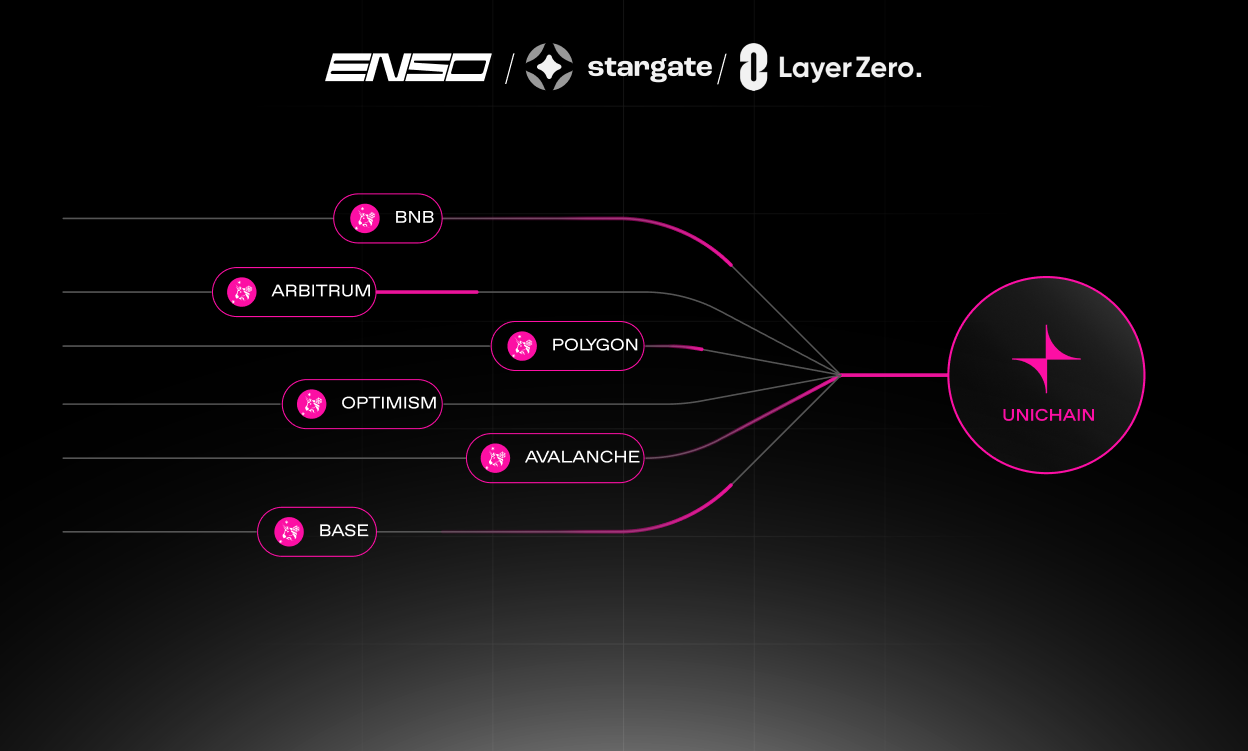

Moving tokens from one chain to another. Its cross-chain protocol currently connects over 165 blockchains. USDt0—the cross-chain version of Tether’s stablecoin—has processed over $70 billion in cross-chain transfers in under a year.

This is a mature business—but its ceiling is clearly visible.

A cross-chain bridge is fundamentally a utility: users pick whichever is cheaper or faster. Yet as the broader crypto market contracts and trading volumes decline, cross-chain bridging has become, in essence, a pseudo-need. LayerZero’s pivot is thus entirely understandable.

And it has capital to make the shift. a16z and Sequoia Capital have led funding rounds for the project, raising over $300 million in total—and at one point, LayerZero was valued at $3 billion.

The investor rosters of those two firms essentially double as Wall Street’s contact list. Citadel and DTCC’s willingness to step forward and publicly back LayerZero may owe much to who stands behind them.

Returning to LayerZero’s newly launched L1, Zero—it’s clearly not built for DeFi degens or meme traders.

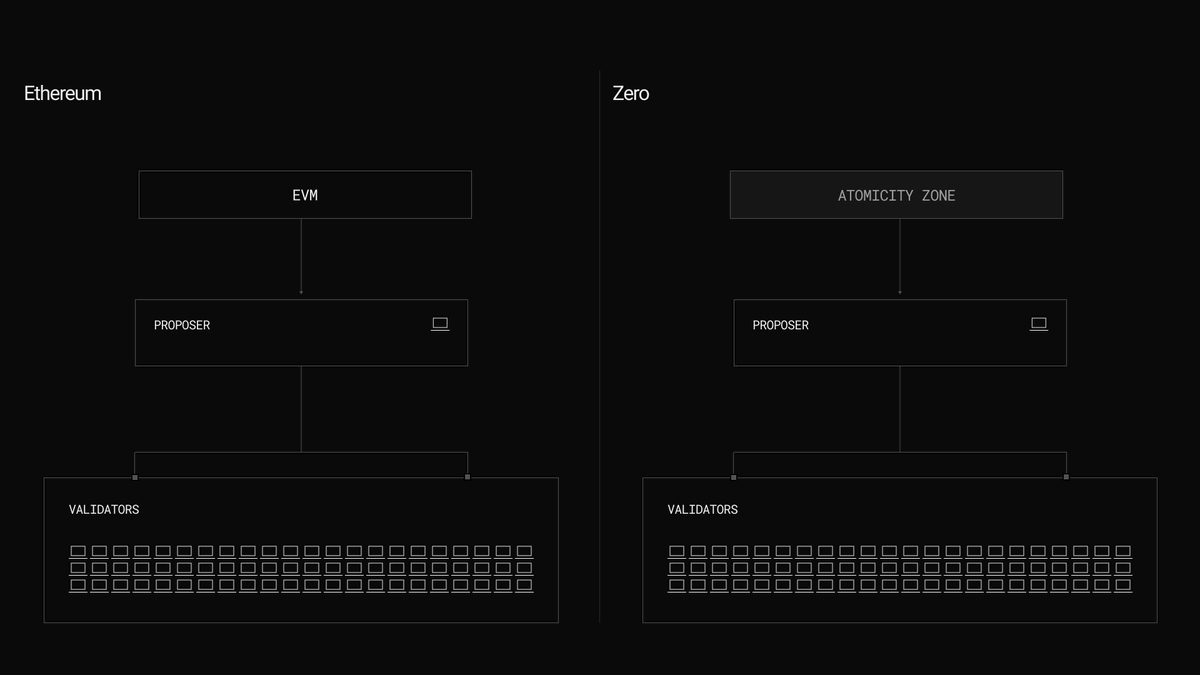

Zero’s architecture diverges significantly from existing public blockchains. Most chains run everything on a single lane; Zero partitions the chain into multiple independently operating zones, which LayerZero calls Zones.

Each Zone can be individually optimized for specific use cases—without interfering with others.

At launch, three Zones went live: one EVM-compatible general-purpose environment, one privacy-focused payment system, and one dedicated trading-matching environment.

These three Zones correspond directly to three distinct customer segments.

The general EVM environment retains existing crypto developers with low migration costs. The privacy payment system tackles a long-standing institutional pain point: on Ethereum, counterparties can see your positions and strategies—large players don’t want to swim naked.

The trading-dedicated Zone targets a more direct need: matching and settlement for tokenized securities.

Revisiting the participant list clarifies the intent. DTCC clears trillions of dollars’ worth of securities transactions annually—it wants to know whether settlement can be accelerated. ICE operates the NYSE, where equity markets open only on weekdays—it’s exploring 24/7 trading. Citadel handles massive order flows, where every millisecond shaved off post-trade processing translates directly into revenue.

In short, these aren’t crypto-native demands—they’re Wall Street’s own pain points.

Bryan Pellegrino, LayerZero’s CEO, put it plainly in a public interview:

“It’s not that existing systems aren’t good enough—it’s that the real-world use cases requiring 2 million transactions per second belong to the future global economy.”

Incidentally, Zero claims a testnet throughput of 2 million TPS—sufficient to meet production-grade requirements of traditional finance. Still, performance narratives around public blockchains have long since been overplayed; truly staggering throughput figures no longer surprise us.

The story may remain unchanged—but the audience has shifted. This time, it’s the old money’s turn.

Wall Street Wants Trading on Chain—but Ethereum Can’t Handle It

The institutional stampede into LayerZero isn’t riding a crypto bull market—it’s driven by Wall Street’s own push toward tokenization.

BlackRock’s BUIDL fund launched last year on Ethereum, raising over $500 million. JPMorgan’s Onyx platform, built atop Ethereum technology, has already processed repurchase agreement transactions totaling over $1 trillion.

Wall Street used Ethereum for proof-of-concept demonstrations—validating tokenization’s feasibility. The next step is finding infrastructure capable of handling production-scale workloads.

Zero’s three Zones were designed precisely to fill this gap. EVM compatibility means assets and smart contracts deployed on Ethereum can migrate seamlessly.

This may represent the true divergence between LayerZero and Ethereum.

Ethereum is currently racing to define standards like ERC-8004—to issue onchain identities for AI agents and set rules for tomorrow’s onchain economy…

LayerZero, by contrast, isn’t debating definitions—it’s building pipes. It’s telling institutions: “Run your transactions here.”

One is drafting the rulebook; the other is laying pipe. Their bets are fundamentally different.

Ethereum bets on its irreplaceability as a trust layer—backed by TVL scale, a mature security audit ecosystem, and institutional recognition. LayerZero bets on demand for an execution layer alternative: Wall Street needs speed, privacy, and throughput—and will adopt whoever delivers first.

Whether these paths ultimately converge remains unclear. But capital flows have already signaled a directional preference.

What Does This Mean for $ZRO?

ZRO’s prior role was simple: the governance token for LayerZero’s cross-chain protocol. With a fixed supply of 1 billion tokens, it served solely for voting and staking.

With Zero’s launch, ZRO’s narrative has shifted.

ZRO is now the native token of the Zero chain—anchored to network governance and security. If Zero truly becomes institutional-grade financial infrastructure, ZRO’s valuation logic shifts away from “how much volume flows across the bridge,” toward “how many assets run on this chain.”

You understand the difference between those two valuation anchors—the ceiling differs by several orders of magnitude. But narrative aside, several hard variables will determine ZRO’s trajectory ahead.

Supply side: 80% of tokens remain locked.

ZRO’s current circulating supply stands at roughly 200 million tokens—just over 20% of the total supply. According to CoinGecko, approximately 25.71 million ZRO tokens—worth ~$50 million, or 2.6% of total supply—will unlock on February 20, allocated to core contributors and strategic partners. The full vesting schedule extends through 2027.

This February 20 unlock marks the first supply shock following the announcement—a critical litmus test for short-term market sentiment.

Demand side: Fee mechanism remains inactive.

ZRO currently lacks any direct value-capture mechanism. A governance vote last December proposed charging fees per cross-chain message, with proceeds used to buy back and burn ZRO—but the proposal failed due to insufficient participation. The next vote is scheduled for June.

If approved, ZRO gains a burn mechanism akin to ETH’s—each transaction reduces circulating supply. If it fails again, ZRO’s “governance rights” reduce to mere voting power—devoid of cash-flow backing.

Thus, for investors eyeing ZRO, three key dates merit close attention:

1. June: Second vote on enabling fee collection. Its outcome directly determines whether ZRO develops organic demand.

2. This fall: Zero mainnet launch.

3. Through 2027: Full ZRO token unlock schedule. Until then, each unlock round poses downward pressure—compounded by the current crypto bear market, meaning even positive news may fail to lift ZRO’s price.

Finally, LayerZero brands Zero as the “decentralized multi-core world computer”—a clear nod to Ethereum’s “world computer” moniker, positioning itself as a more critical settlement layer, especially for financial settlement, while deliberately distancing itself from its thin “cross-chain bridge” origin story.

Still, official statements from key partners warrant careful reading.

Citadel describes its involvement as “evaluating how the architecture supports high-throughput workflows”; DTCC frames its engagement as “exploring scalability for tokenization and collateral use cases.”

In plain terms: “We think this might be useful—but we haven’t committed yet.”

Wall Street money is sharp—so sharp that it places many small bets simultaneously, watching closely to see which pays off first. So when a project attracts coordinated backing from star-studded institutions, it signals short-term catalyst potential—not ironclad, long-term alignment.

What LayerZero has secured may be nothing more than a ticket to the table—or merely a chance to interview.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News