LayerZero strikes first, Wormhole raises the stakes—who will claim Stargate?

TechFlow Selected TechFlow Selected

LayerZero strikes first, Wormhole raises the stakes—who will claim Stargate?

Wormhole aims to block LayerZero's acquisition of Stargate, marking the first M&A battle in the cross-chain sector.

By ChandlerZ, Foresight News

A high-stakes deal is unfolding in cross-chain infrastructure.

In early August, the LayerZero Foundation proposed acquiring the Stargate cross-chain bridge and its STG token for $110 million. The proposal includes retiring the STG token, allowing STG holders to exchange their tokens for LayerZero's native token ZRO at a rate of 1 STG for 0.08634 ZRO—equivalent to $0.1675 per STG and $1.94 per ZRO. Additionally, Stargate will be integrated into the LayerZero Foundation, and its DAO will be dissolved.

On August 18, voting began on the LayerZero Foundation’s acquisition proposal for Stargate. As of publication on the 21st, support stood at 88.65%, with voting set to conclude on August 24.

Shortly after, the Wormhole Foundation voiced concerns in the community, arguing that the offer undervalues Stargate’s assets and operations. It announced plans to submit a higher bid and requested a five-workday pause on the ongoing Snapshot vote. This triggered intense debate within the community, bringing into focus the question of ownership over the cross-chain messaging layer versus unified liquidity pools.

What Is Stargate

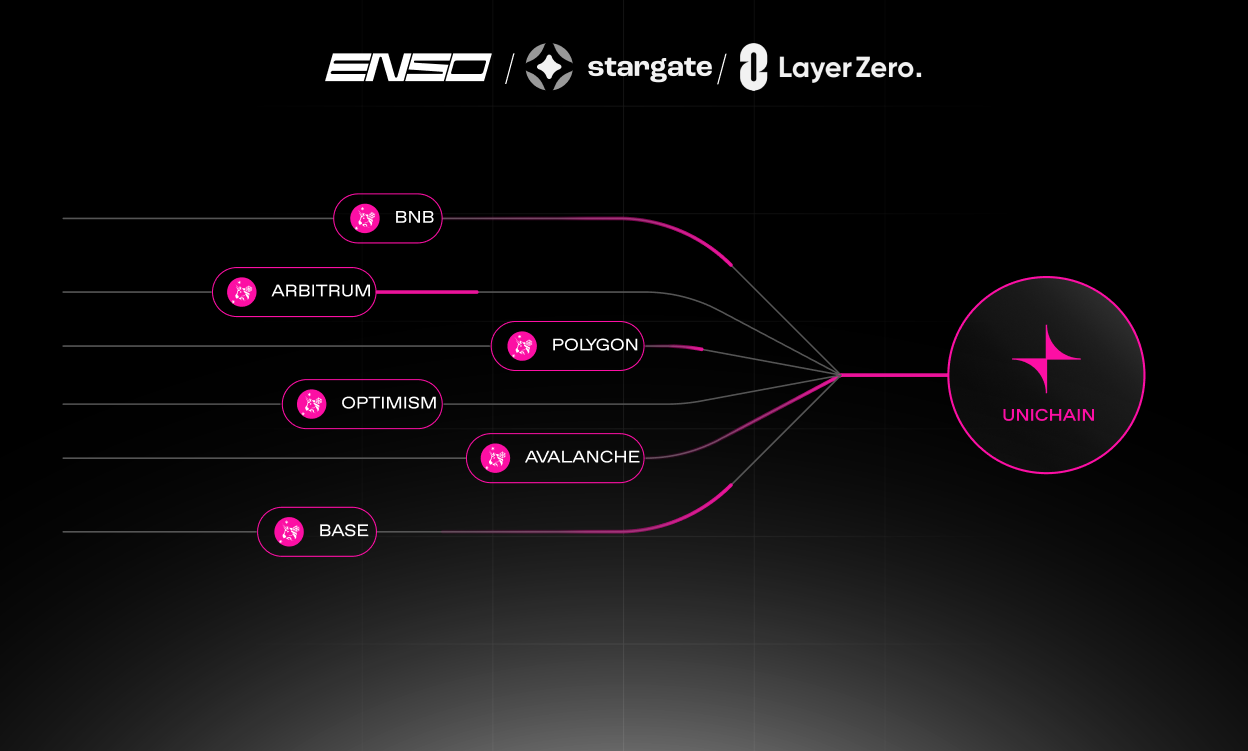

Stargate Finance is a cross-chain asset transfer protocol featuring unified liquidity pools and instant finality guarantees, enabling users to complete cross-chain transfers in a single transaction without complex multi-step swaps. Since launching in 2022, Stargate has been a major player in the cross-chain bridge space, providing stable cross-chain liquidity across networks including Ethereum, Arbitrum, BNB Chain, Avalanche, Polygon, and Optimism.

The relationship between Stargate and LayerZero is deeply intertwined. Stargate’s whitepaper was co-authored by LayerZero’s three co-founders, development teams overlap, and Stargate relied almost entirely on LayerZero’s message-passing functionality during its early operation. LayerZero Labs’ founding team—Bryan Pellegrino, Ryan Zarick, and Caleb Banister—all graduated from the University of New Hampshire with degrees in computer science and had previously collaborated on multiple startups, accumulating extensive engineering and management experience. Additionally, 0xMaki, co-founder of Sushiswap, joined the team as a strategic advisor.

In terms of governance, Stargate is jointly managed by the Stargate Foundation and its DAO. DAO members hold STG tokens and can lock them to receive veSTG, which grants voting rights and revenue-sharing privileges.

LayerZero Proposal Highlights: Exchange Ratio, Governance Arrangement, and Transition Period Allocation

LayerZero’s plan is straightforward. If approved, STG will be exchanged at a fixed rate of 1 STG : 0.08634 ZRO, with valuation anchored to ZRO’s market price at the time of proposal; Stargate’s operations and assets will be assumed by the LayerZero Foundation, and the DAO will cease to play a governance role. The governance process is structured as follows: 7 days of forum discussion, followed by a 3-day Snapshot vote, requiring a minimum participation of 1.2M veSTG and at least 70% approval.

If approved, STG holders will be informed of the process to exchange their tokens for ZRO. The LayerZero Foundation will assume full ownership and operational responsibility for all aspects of Stargate Finance. Stargate will continue operating without interruption; users of the Stargate bridge will experience no downtime or functional changes during the transition period.

Furthermore, STG will no longer participate in the operation of Stargate Finance. Each STG token will be redeemable via a fixed-rate contract for 0.08634 ZRO, based on ZRO’s market price of $1.94 at the time of proposal. This swap contract will remain valid indefinitely.

Following community feedback, the proposal added provisions for locked token holders: veSTG will continue to receive 50% of the protocol’s “top-level revenue” for six months post-merger, while the remaining 50% will fund ZRO buybacks. After this six-month period, all net proceeds will go toward ZRO repurchases. This amendment directly addresses concerns about long-term stakers taking on disproportionate risk, aiming to ease voting tensions.

Wormhole’s Move: Request to Delay Vote and Offer Higher Valuation

The Wormhole Foundation sent a clear signal on the Stargate forum: it intends to submit a “higher” offer and requests a five-workday suspension of the current Snapshot vote to finalize the bid and conduct additional due diligence. Their valuation breakdown includes DAO treasury and business metrics: approximately $76.47 million in stablecoins, $15.9 million in ETH, $55 million in STG holdings, and $5.24 million in other assets. On the protocol side, July saw around $4 billion in bridged volume, $345 million in TVL, estimated annual revenue of $2 million, and integration across 80+ chains.

Based on these figures, a $110 million valuation amounts to only a slight premium over treasury assets while capturing all future cash flows—an unattractive deal, according to Wormhole.

The crux of the debate centers on valuation scope. Wormhole argues that net asset value is close to $90 million; factoring in brand, codebase, team, and existing cash flow justifies a significantly higher acquisition premium. In contrast, LayerZero’s pricing model leans on endorsement value and market price, adding modest premium plus expected ZRO buybacks to shift value from STG to ZRO.

This divergence in valuation frameworks directly affects how different stakeholders perceive value. Over the past three months, Stargate distributed about $939,000 in revenue to stakers—a tangible income stream that forms the basis of many objections. Once the deal closes, this distribution channel will merge into the ZRO buyback pool after the six-month transition.

Implications for the Market

LayerZero’s acquisition proposal and Wormhole’s potential counteroffer have reignited community discussions about Stargate’s independence and future direction. In calls and forum posts, the Stargate Foundation acknowledged team and budget constraints, emphasizing that the merger would secure future development resources. However, some community members worry about undervaluation and hope for more bidders to emerge.

LayerZero provides cross-chain messaging, positioning itself at the foundational communication layer. Wormhole occupies a similar space, wielding influence through broad ecosystem coverage and partnerships. This acquisition touches on control over both messaging and liquidity: if LayerZero acquires Stargate, messaging and capital pools become tightly coupled; if Wormhole wins, the liquidity pool attaches to another messaging network, creating a new competitive dynamic. These shifts affect fee structures, routing preferences, partner integrations, and security models—ultimately impacting end users and developers.

For circulating STG holders, the core issue is “token swap.” If the proposal passes, STG will exit the stage, with value migrating to ZRO. Short-term impact hinges on the fixed exchange rate; long-term value depends on ZRO’s buyback strength, unlock schedule, and LayerZero’s execution on Stargate’s roadmap. For veSTG holders, the six-month extension preserves current revenue sharing temporarily, but they face eventual termination of the distribution mechanism. For ZRO, successful integration means stronger buyback funding and a more unified governance narrative—but also greater pressure to deliver results and manage public perception.

Known elements from LayerZero include the fixed exchange rate, DAO dissolution, six-month veSTG revenue share post-closing, and subsequent funneling of profits into ZRO buybacks. Unknowns include the scale and timing of ZRO repurchases, team integration pace, and resource allocation on the roadmap. From Wormhole, we know of its intent to offer a higher price, request for delay, and due diligence list; unknowns include the bid structure and governance commitments—such as whether certain revenue rights will be preserved, whether additional compensation will be offered to locked holders, or whether a transitional governance phase will be established. These details will shape voting behavior across different groups and determine post-deal sentiment.

Summary

Based on figures provided by Wormhole in its forum post, Stargate recorded approximately $4 billion in cross-chain volume in July, with $345 million in TVL and an estimated $2 million in annualized revenue. These numbers reflect usage intensity and capital capacity, but their relevance to valuation still depends on fee models, competitor pricing strategies, and future product development.

If valued based on book assets plus operating cash flow, LayerZero’s offer resembles a defensive bid—one that reserves core growth upside for ZRO and the consolidated entity. If the goal is expanding the overall ecosystem footprint, a unified narrative supports better resource integration. These two approaches are incompatible, and the vote will reveal community preference.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News