Bitcoin Reclaims $70,000: A Rally or a True Trap?

TechFlow Selected TechFlow Selected

Bitcoin Reclaims $70,000: A Rally or a True Trap?

The success or failure of the next test depends on the sequential occurrence of three conditions: sustained macro risk appetite, a slowdown or reversal in ETF outflows, and a return of derivatives sentiment to normal.

Author: CryptoSlate

Translation: TechFlow

Original Link:

TechFlow Intro:

After a violent rebound—from $60,000 to above $70,000 within 24 hours—Bitcoin appeared to have regained lost ground. Yet the underlying mechanics reveal this was not driven by strong spot buying, but rather by macro-driven forced rebalancing and short squeezes. This article delves into the causes behind February 2026’s “shocking volatility”: from liquidity contraction expectations following Donald Trump’s nomination of Kevin Warsh, to miners’ profitability hitting an all-time low. Though price has reclaimed the $70,000 level, options traders are heavily betting on a potential secondary drop to $50,000–$60,000 by late February—exposing the market’s fragile sentiment and complex financial dynamics beneath the surface of this “violent rebound.”

Bitcoin surged from $60,000 to above $70,000 in under 24 hours, erasing a brutal 14% decline that had tested every “buy-the-dip” narrative in the market.

This reversal speed—up 12% on the day and 17% from its intraday low—is so extreme it feels like the dust settling after a wave of liquidations. Yet the mechanism behind the rally tells another story: it reflects cross-asset stabilization and forced position rebalancing—not conviction-driven, large-scale spot demand.

Meanwhile, the derivatives market remains saturated with bearish protective positions, pricing in $70,000 as a likely waystation—not a true bottom.

Liquidation Wave Meets Macro Pressure

On February 5, markets opened near $73,100, briefly rallied, then collapsed sharply, closing at $62,600. According to CoinGlass, the single-day decline triggered roughly $1 billion in leveraged Bitcoin liquidations.

That figure alone signals a cascade of forced selling—but the broader environment was even worse.

CoinGlass data shows Bitcoin futures open interest dropped last week from ~$61 billion to $49 billion, indicating de-leveraging had already begun before the final shock hit.

The trigger wasn’t crypto-native. Media reports framed the sell-off as deteriorating risk sentiment, primarily driven by tech stock selloffs and precious metal volatility—silver plunged nearly 18% to ~$72.21, dragging down all correlated risk assets.

Deribit’s research confirms this spillover effect, noting derivatives sentiment turned extremely bearish: negative funding rates, inverted implied volatility term structure, and the 25-delta risk-reversal skew depressed to ~-13%.

This is the textbook “extreme fear” regime—where positioning amplifies bidirectional price swings.

Policy narratives poured fuel on the fire. Reuters reported markets reacted sharply to President-elect Donald Trump’s selection of Kevin Warsh for Fed Chair, interpreting it as a signal of future balance sheet contraction and liquidity tightening.

At the same time, miners faced severe profit pressure. Per TheMinerMag, the hash price fell below $32 per PH/s, and network difficulty is expected to drop ~13.37% in two days, per this report. But this relief mechanism hadn’t yet taken effect before price broke key support levels.

Bitcoin’s 48-hour price action, showing collapse from $73,000, stop-loss sweeps below $63,000, local bottoming near $60,000, and subsequent rebound above $70,000.

Macro Reversal & Squeeze Mechanics

Opening February 6 at the prior day’s close, Bitcoin then plunged to an intraday low near $60,000, before surging violently to a high of $71,422. After three failed attempts to break above that level, price retreated back below $70,000.

The catalyst did not originate within crypto—it was a sharp, cross-asset pivot. Wall Street rallied strongly: the S&P 500 rose 1.97%, the Nasdaq gained 2.18%, the Dow jumped 2.47%, and the Philadelphia Semiconductor Index (SOX) soared 5.7%.

Metals rebounded sharply—gold rose 3.9%, silver climbed 8.6%, while the U.S. Dollar Index fell 0.2%, signaling a loosening financial environment.

Bitcoin moved mechanically in lockstep with this shift. The correlation is unmistakable: when tech stocks stabilize and metals rebound, Bitcoin gets lifted via shared risk exposure.

Yet the violence of this rebound also reflects derivatives positioning. A skew near -13%, negative funding rates, and an inverted volatility structure created conditions where any macro tailwind could trigger short covering and forced rebalancing.

This rally was fundamentally liquidity-driven—and amplified by crowded short positions being unwound.

Nonetheless, forward-looking signals remain bearish. Derive data shows heavy put option open interest concentrated at strike prices between $60,000 and $50,000 for options expiring February 27.

Derive’s Sean Dawson told Reuters demand for downside protection is “extreme.” This isn’t hindsight bias—it’s active hedging against the next leg down, even amid the rebound.

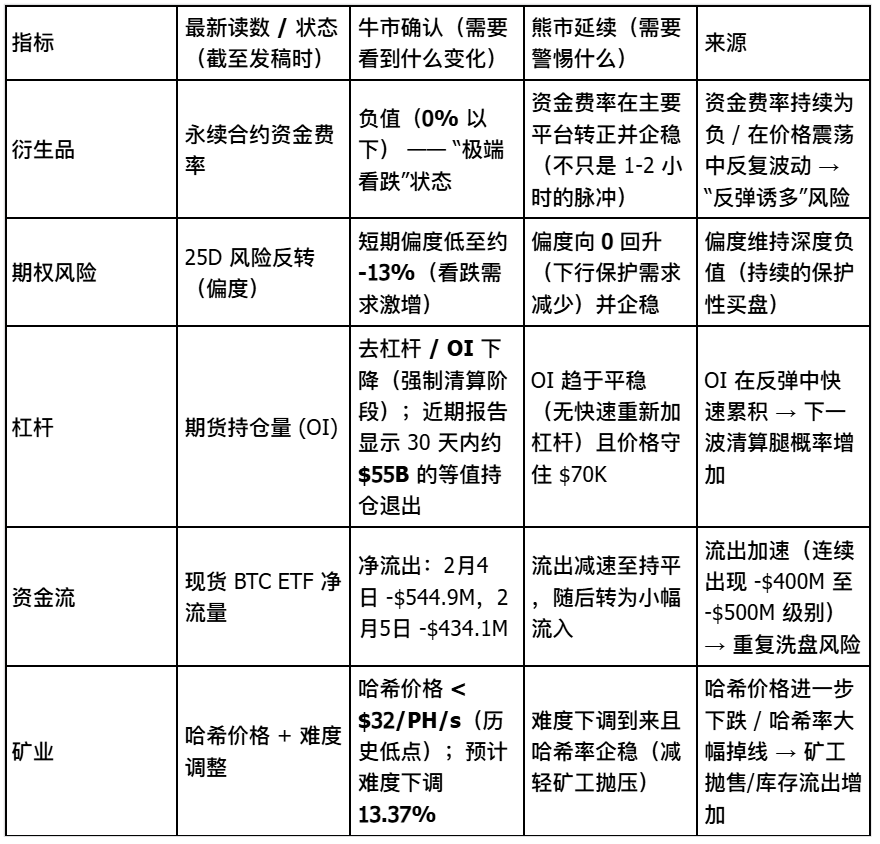

Bitcoin de-leveraging chart, showing surge in liquidations, open interest reset from $62B to $49B, negative funding rates, and skew hitting -13%.

Can $70,000 Hold? Analytical Framework

Holding $70,000 hinges on three conditions.

First, the macro rebound must persist—tech stocks continue stabilizing, Treasury yields and the dollar avoid re-tightening. This rally was explicitly cross-asset; if U.S. equities turn bearish again, Bitcoin won’t be immune.

Second, leverage must keep cooling—and no new forced selling events must emerge. Open interest has dropped significantly, lowering the risk of a “vacuum-style” collapse.

Third, miner pressure must ease meaningfully once the difficulty adjustment takes effect. If price holds during the adjustment window, the anticipated 13.37% difficulty reduction should reduce marginal selling pressure and stabilize hash rate.

Conversely, three arguments support the case for another washout:

First, options positioning remains skewed bearish. The largest put open interest for late February expires at $60,000–$50,000—a forward-looking signal embedded in market-implied probabilities, not lagging sentiment.

Second, derivatives signals remain fragile. Extreme skew, recurring negative funding rates, and an inverted volatility structure align more closely with a “relief rally” under fear regimes—not a structural trend reversal.

Third, ETF flow data shows persistent outflows. As of February 5, Bitcoin ETFs posted $690 million in monthly net outflows. While February 6 data is pending, current patterns suggest institutional allocators haven’t shifted from “de-risking” to “re-engagement.”

Signal Dashboard

The Real Meaning of $70,000

This level holds no magic. Its significance lies in sitting just above Glassnode’s identified on-chain absorption cluster of $66,900–$70,600.

Holding $70,000 implies that cluster absorbed sufficient supply to temporarily stabilize price. Yet sustainability requires more than technical support—it demands renewed spot demand, unwinding of derivatives hedges, and stabilization of institutional flows.

The rebound from $60,000 is real—but its composition matters critically. Should macro conditions shift, cross-asset stability will reverse too.

Forced-position unwinding generated a mechanical rebound—not necessarily one that translates into sustained momentum. Options traders continue pricing in a material probability of a move toward $50,000–$60,000 over the next three weeks.

Bitcoin reclaimed $70,000—but is now consolidating below it. This suggests a pause before the next test, whose outcome depends on the sequential fulfillment of three conditions: sustained macro risk appetite, slowing or reversing ETF outflows, and normalization of derivatives sentiment.

The market delivered a violent retest—but the forward curve and flow data indicate traders aren’t yet betting on its durability. $70,000 isn’t the endgame—it’s simply the baseline determining which narrative wins the next phase.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News