No need to wait for Monday’s market open—Hyperliquid’s HIP-3 is becoming CME’s pricing reference.

TechFlow Selected TechFlow Selected

No need to wait for Monday’s market open—Hyperliquid’s HIP-3 is becoming CME’s pricing reference.

A deep comparison of Hyperliquid’s and traditional futures giant CME’s micro-level performance during extreme market conditions and weekend trading halts.

Author: Shaunda Devens, Blockworks Research

Compiled by: TechFlow

TechFlow Intro: With the advancement of HIP-3, Hyperliquid is accelerating its expansion beyond the cryptocurrency space into traditional finance (TradFi) assets. The recent sharp volatility in the silver market provided an ideal stress test for this decentralized derivatives protocol.

This article conducts an in-depth micro-level comparison of Hyperliquid and CME (Chicago Mercantile Exchange), the traditional futures giant, during extreme market conditions and weekend trading halts—using granular trade, quote, and order book data.

The analysis finds that while Hyperliquid still lags behind traditional incumbents in depth, it demonstrates unique competitive advantages in retail-scale order execution and “24/7 continuous price discovery”—even emerging as a key reference tool for Sunday reopening pricing.

Full text below:

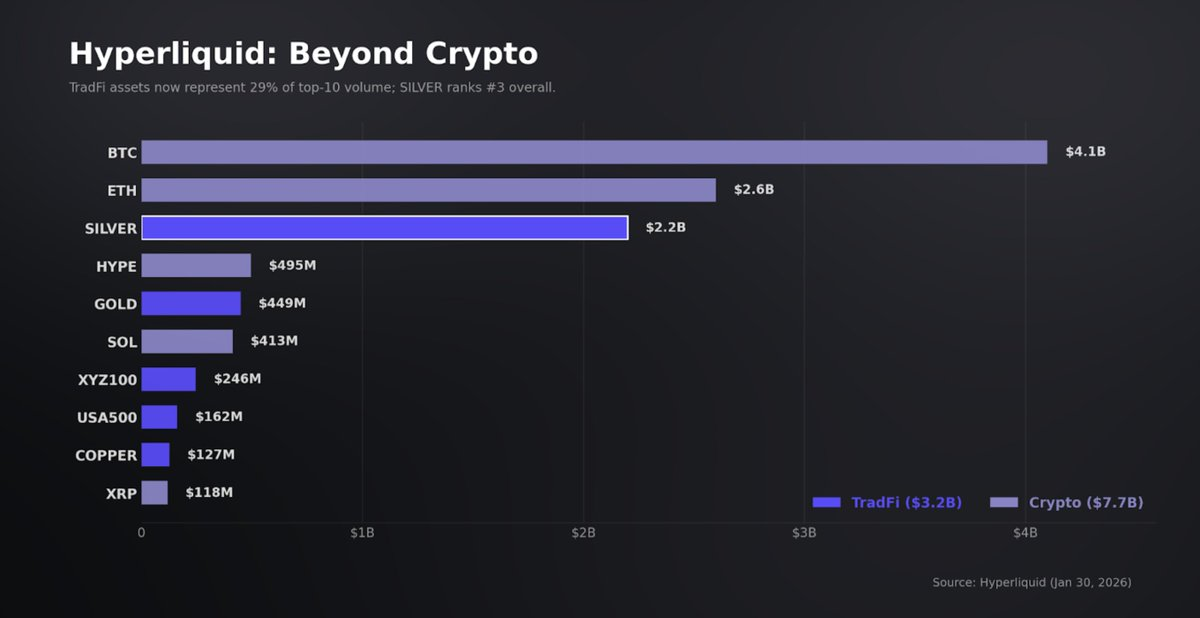

HIP-3 is pushing Hyperliquid beyond crypto; TradFi instruments now account for 31% of platform volume, with daily notional turnover exceeding $5 billion. Silver constitutes the largest share of these flows, and last Friday’s volatile episode served as a stress test for HIP-3’s market health.

Using high-frequency trade/quote/order book data—and benchmarking against CME/COMEX Micro Silver futures—we find that for smaller, retail-weighted orders, Hyperliquid Silver offered tighter spreads and better execution pre-crash. We also introduce a novel 24/7 use case: positioning and pricing ahead of Sunday’s reopening auction.

Key Findings:

- Pre-crash: At typical perpetual contract trade sizes, Hyperliquid is highly competitive at the top-of-book. Its median spread is 2.4 bps versus COMEX’s 3 bps; its median execution slippage is just 0.5 bps worse than the benchmark. Flows are retail-dominant (median trade size: $1,200), with solid but comparatively limited depth: Hyperliquid holds ~$230K within ±5 bps, versus COMEX’s ~$13M.

- During the crash: Performance deteriorated on both platforms, but Hyperliquid exhibited heavier execution tail risk. Its spread widened 2.1x, versus COMEX’s 1.6x. The market briefly deviated >400 bps from the benchmark before mean-reverting via funding rate adjustments. The main degradation occurred in execution quality: 1% of Hyperliquid trades executed >50 bps away from mid-price, whereas COMEX recorded zero such trades.

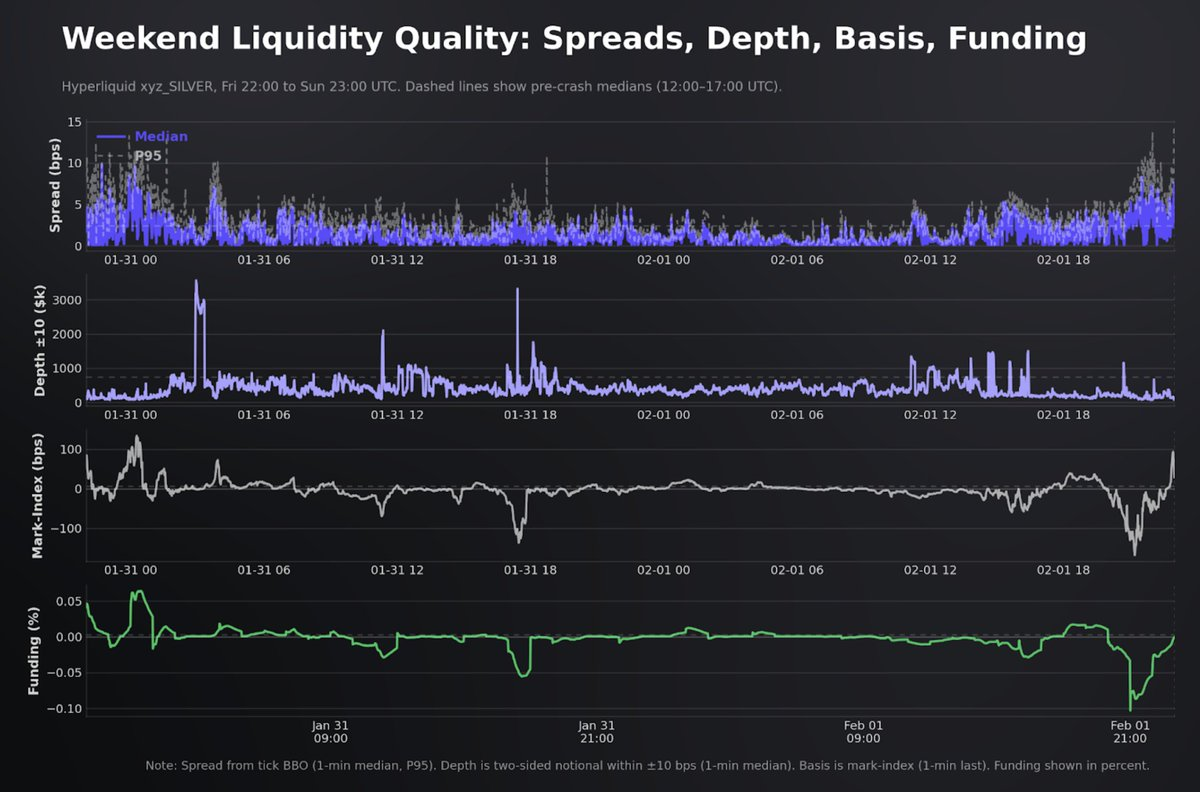

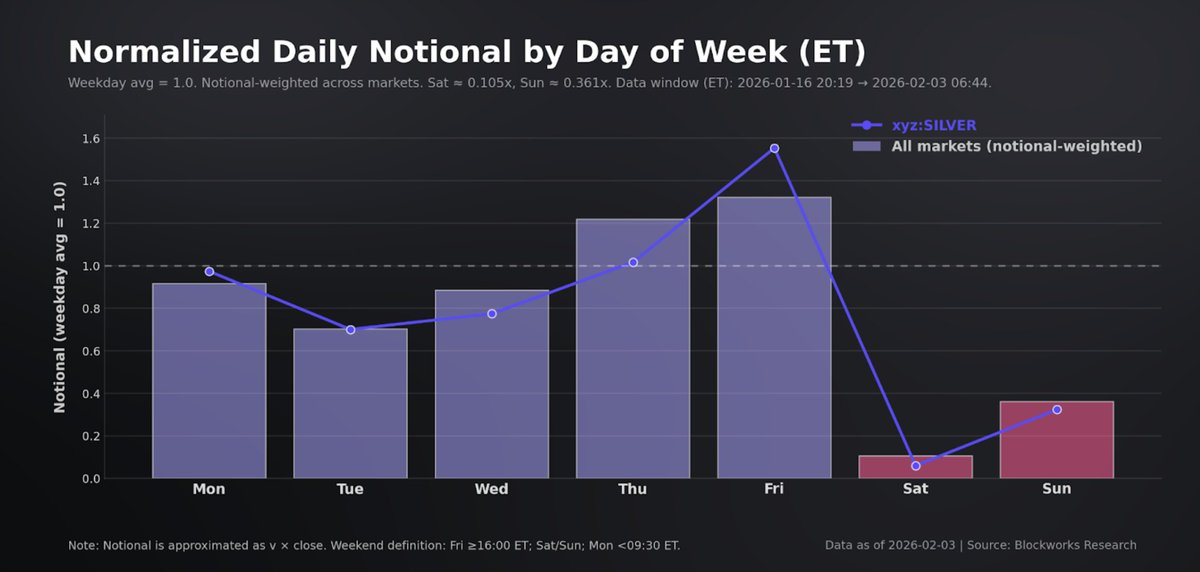

- Over the weekend: Hyperliquid was the only exchange-like, order-driven silver derivatives platform operating continuously while COMEX was closed. It processed 175K trades over 49 hours, with $257M in notional volume and a median spread compressed to 0.93 bps. However, HIP-3 weekend trading is structurally thin—volume dropped to just 0.31x of weekday levels.

- We believe pricing for reopening and staging hedges ahead of single-price auctions represent core 24/7 use cases. Yet, based on current Hyperliquid equity asset performance, pre-open price forecasts do not significantly outperform Friday’s close.

Hyperliquid: HIP-3 Captures Volume

Last week, the silver market faced a structural liquidity event. As retail, futures, and regional spot market liquidity demand surged simultaneously, silver prices underwent sharp repricing. Silver plunged ~17% from peak to trough on high volume; U.S. retail investors poured ~$170M into silver ETFs in a single day—the largest daily inflow on record and nearly double the peak of the 2021 “silver squeeze.” Meanwhile, COMEX activity spiked to multi-year highs, and Shanghai Gold Exchange prices traded at double-digit dollar premiums to London benchmarks.

For the crypto industry, a more significant development is that these flows did not remain confined to traditional finance platforms. As volatility rose and traditional commodity markets approached weekend closure, incremental demand for metal exposure migrated to 24/7 derivatives exchanges—where position adjustments and risk transfer could continue without time constraints.

On Hyperliquid, silver perpetuals settled billions in notional volume across the week. Stock and commodity perps under HIP-3 also hit new highs—daily volume expanded from $378M to $4.8B over 66 days. By Friday, TradFi-linked instruments accounted for ~31% of total platform volume. Silver vaulted into the top tier of most actively traded contracts on the platform, marking a substantive shift in activity composition: five of the top ten most active contracts on Friday were non-crypto assets.

We have consistently viewed HIP-3 as a scalable Delta-one wrapper. Its returns are linear, contracts have no expiry, and holding costs are expressed via funding rates and basis—not option-style time decay.

From an investment perspective, cross-asset platforms broaden differentiated, cyclical-insensitive revenue streams. This matters because Hyperliquid’s protocol revenue ranks among the most volatile—weekly revenue volatility averages ~40%. Moreover, implied analysis suggests that capturing even a small fraction of TradFi derivatives flows could more than double revenue—a viable path to step-change growth.

Yet scalability hinges on three implementation constraints: continuous and resilient oracle design, order book depth sufficient to maintain mark-price integrity, and reliable hedging pathways when underlying reference markets are intermittent. Within this framework, the silver event marked Hyperliquid’s first meaningful stress test of TradFi-linked perps—with COMEX as the benchmark.

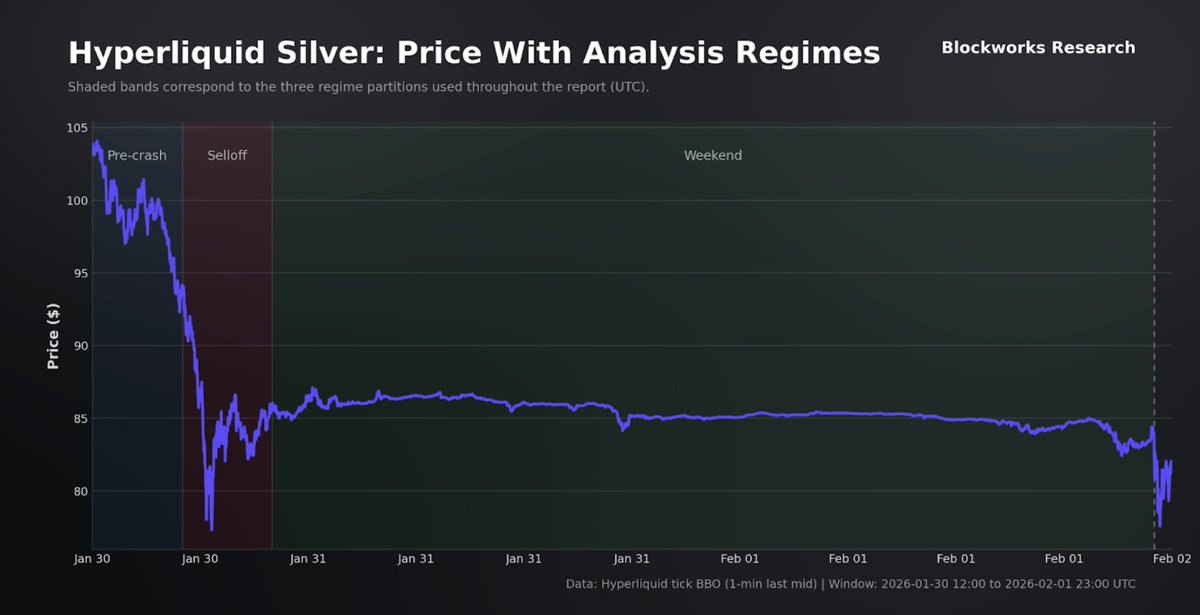

This report evaluates performance across three phases (pre-deviation, sell-off, weekend), measuring price integrity, liquidity resilience, and risk engine behavior when external markets are impaired or closed. We anchor our analysis by comparing Hyperliquid’s pricing, basis, and liquidity metrics against COMEX during overlapping trading hours, then quantify catch-up behavior using the “weekend-to-reopening” transition.

Ultimately, we aim to answer: Are Hyperliquid’s HIP-3 products fit for trading perpetual stock/commodity exposure—and has Hyperliquid built a high-performance 24/7 stock and commodity market?

Data

We use tick-level trade, quote, and order book data from Hyperliquid’s silver perpetual (XYZ100), benchmarked against COMEX (CME’s designated contract market) front-month silver futures (SILH6).

For Hyperliquid, we use the TradeXYZ-deployed market, which consistently carries the highest HIP-3 volume.

We compare Hyperliquid to COMEX Micro Silver (SILH6) because its contract size better aligns with the “retail-to-mid-size” order distribution on perpetuals. On crash day, SILH6 traded 641,926 contracts (~642M troy oz, ~$50–77B notional at $78–120/oz), whereas macro contracts (SIH6), though deeper, delivered mediocre spreads and slippage pre-crash. Since this report focuses on execution quality at typical perpetual trade sizes, SILH6 is the most relevant COMEX benchmark.

The dataset spans Jan 30–Feb 1, covering 540K Hyperliquid trades and 1.3M depth snapshots, benchmarked against 510K COMEX trades and full 10-level order book data on crash day. We segment analysis into three phases: pre-crash (Fri UTC 12:00–17:00), sell-off (UTC 17:00–22:00), and weekend (Fri close to Sun reopen).

Pre-Crash Market

We begin with the pre-crash baseline, when both COMEX and Hyperliquid were operating normally and external references remained intact.

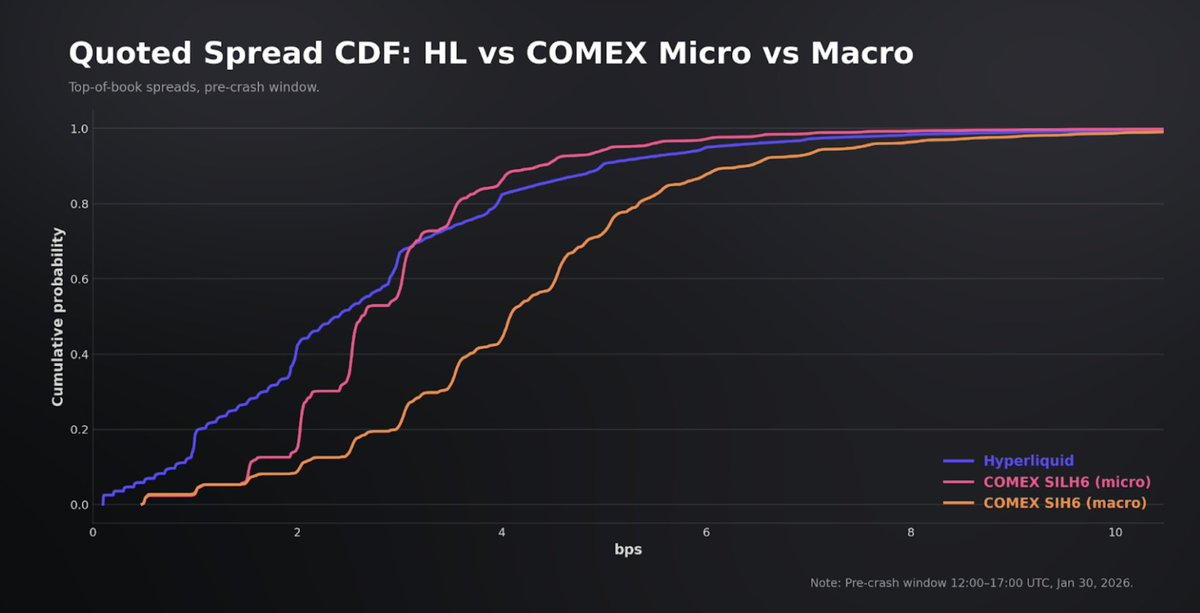

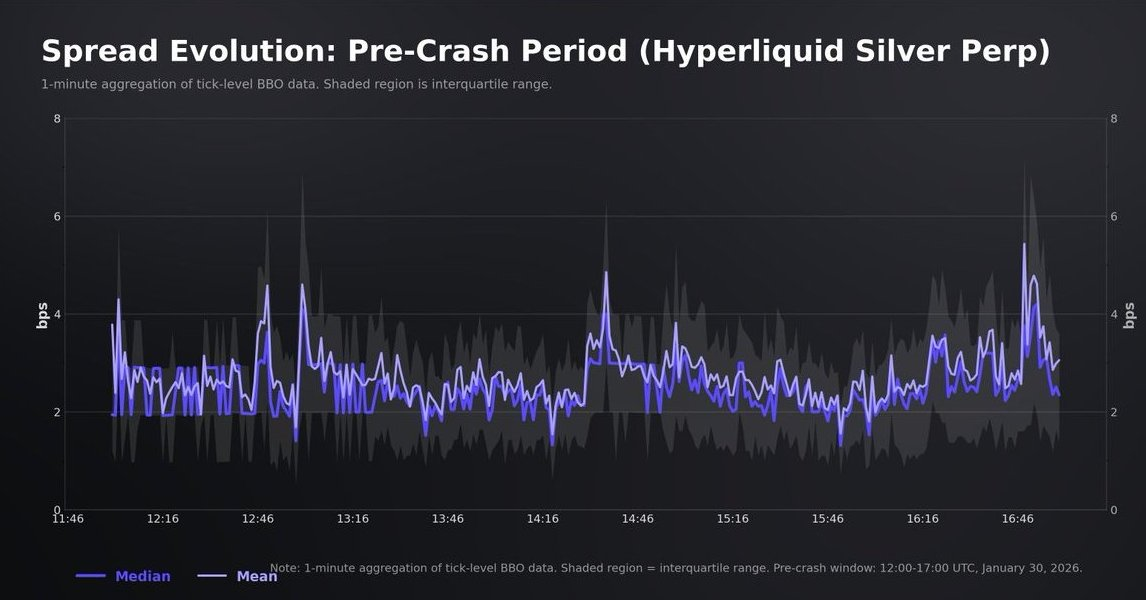

At first glance, Hyperliquid’s silver perpetual already resembles a mature market: quotes remain tight and activity is high. Bid-ask spread averages 2.7 bps (median: 2.4 bps); 90% of observations fall ≤5 bps.

The natural benchmark is COMEX front-month silver futures (SILH6)—the most liquid tradable reference during overlapping hours. Crucially, COMEX is structurally deeper and remains an institutional-grade liquidity venue. Our goal is not simple comparison, but rather to test whether Hyperliquid can deliver reliable price integrity and execution for its dominant trade sizes while tracking the underlying benchmark.

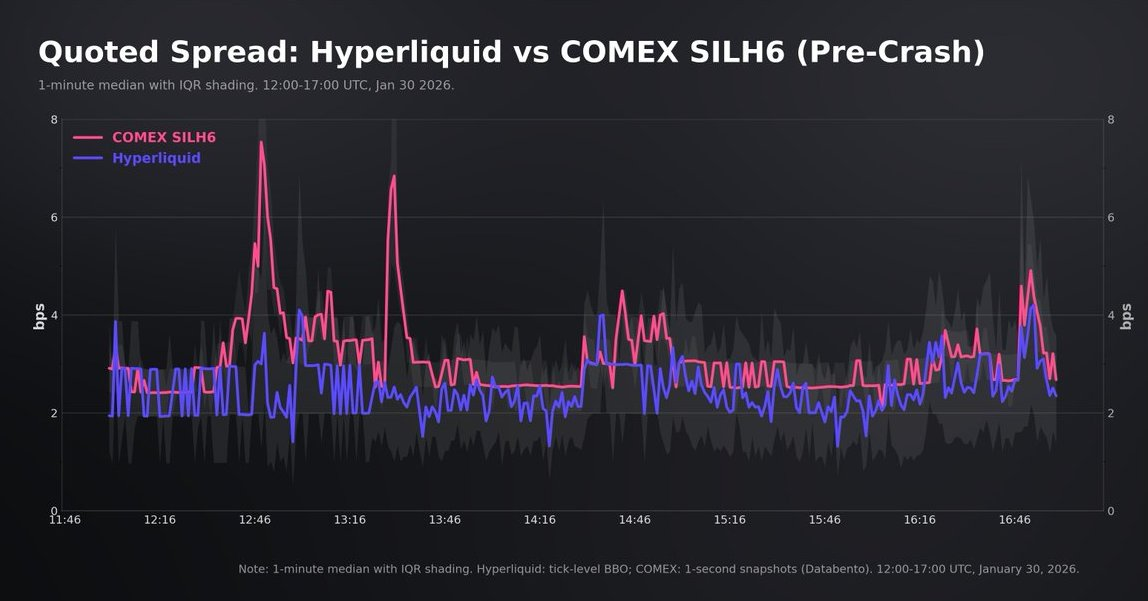

During UTC 12:00–17:00, COMEX’s notional volume was ~$85.5B versus Hyperliquid’s $679M. Despite this vast scale gap, median spreads are remarkably close: COMEX averaged ~3.1 bps, Hyperliquid slightly tighter.

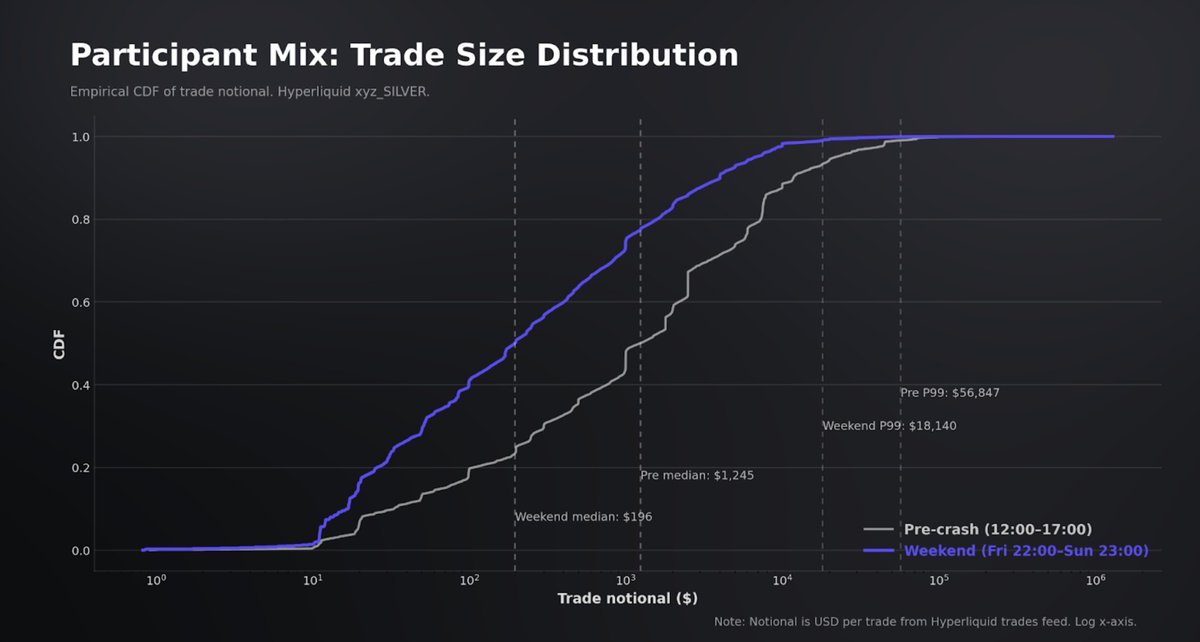

Nonetheless, COMEX’s spread distribution is tighter in the tails: 96% of observations fell within 5 bps, versus Hyperliquid’s 90%—consistent with deeper, more stable passive liquidity on major futures platforms. Also, Hyperliquid’s narrower quotes must be understood in context: its flows are more manageable and retail-skewed (average trade ~$5K, median $1,190), mechanically reducing “toxicity” at the top of the order book.

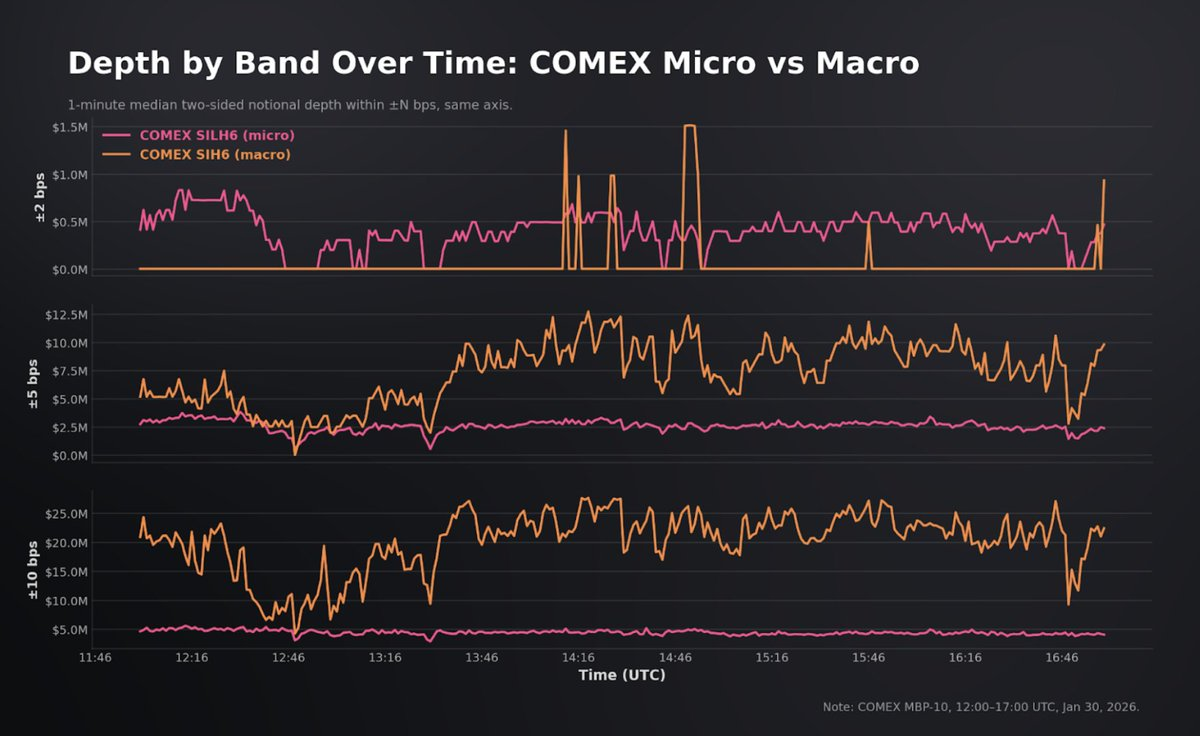

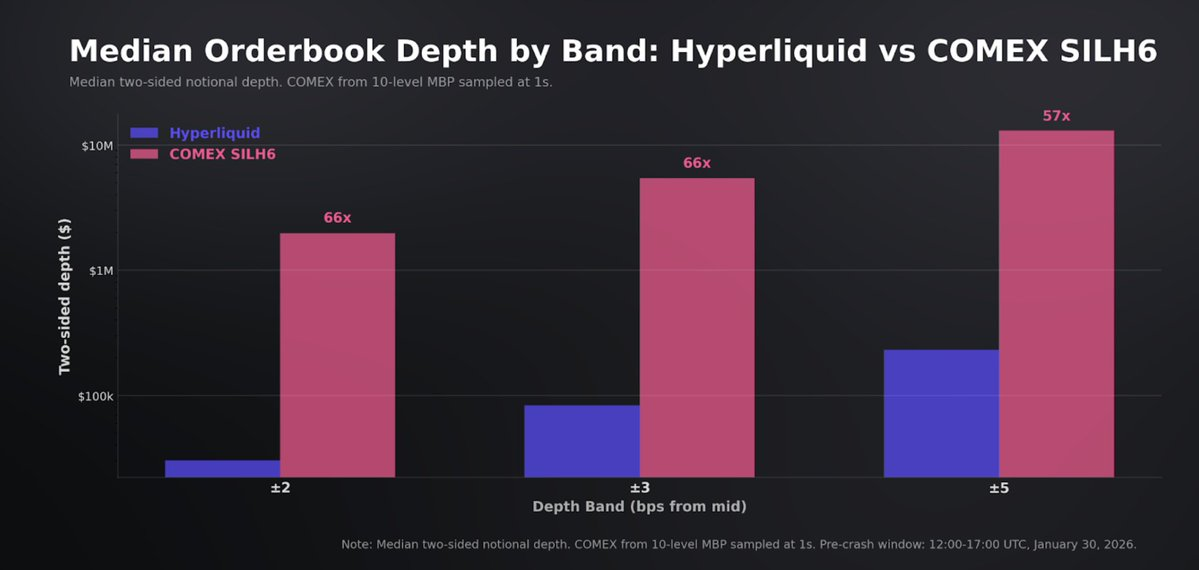

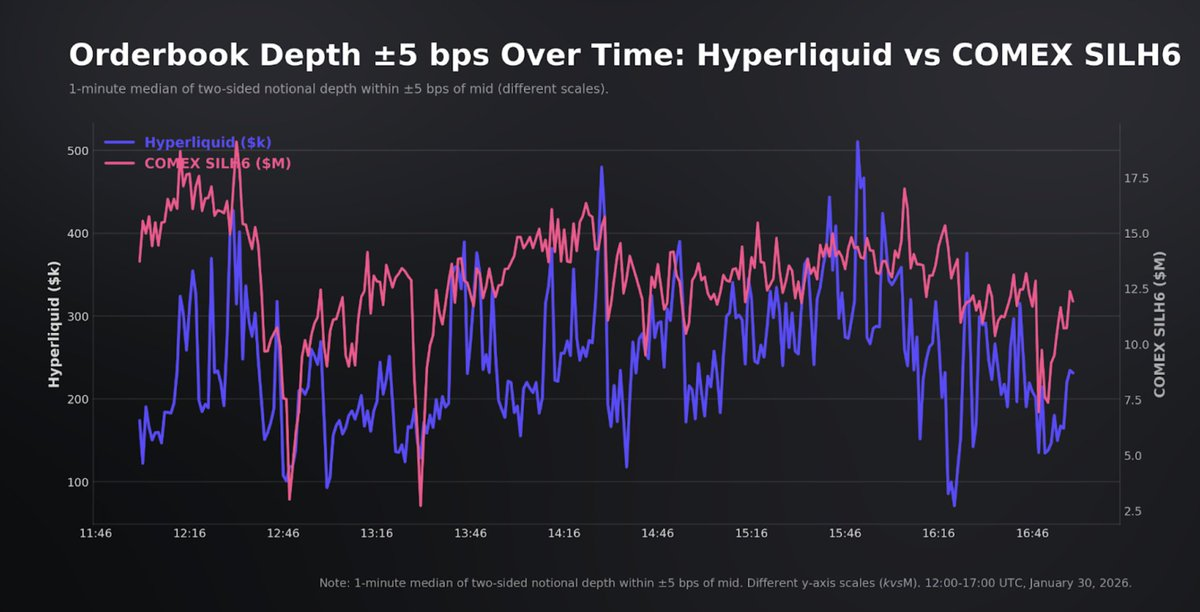

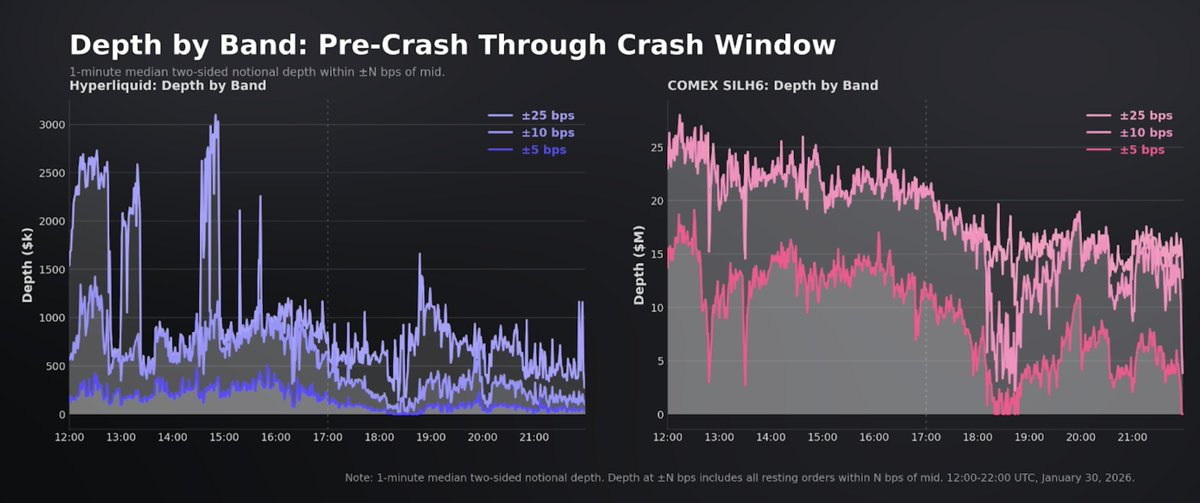

While top-of-book execution is comparable, liquidity depth is not. Within ±2 bps, COMEX holds $1.98M versus Hyperliquid’s $30K; within ±3 bps, COMEX holds $5.45M versus Hyperliquid’s $83K; within ±5 bps, COMEX holds $13M versus Hyperliquid’s $231K. For retail orders crossing the spread, tighter quotes are a tangible advantage. For trades exceeding $50K notional, depth gaps dictate realized cost.

Still, for a platform without designated market makers (DMMs), Hyperliquid’s depth is nontrivial. The order book is largely symmetric, with buy/sell depth ratios near 1 across levels—expanding from ~$231K within ±5 bps to ~$814K within ±10 bps and ~$1.5M within ±25 bps.

However, Hyperliquid’s depth compares poorly to traditional futures platforms when measuring “robust execution.” Matching occurs on-chain via a CLOB (central limit order book) with block-level ordering, where order cancellations take priority over resting orders within the same block. Thus, execution priority depends partly on order type—not solely arrival time—undermining the link between “visible depth = guaranteed fill” found in continuously offline matching engines like CME’s.

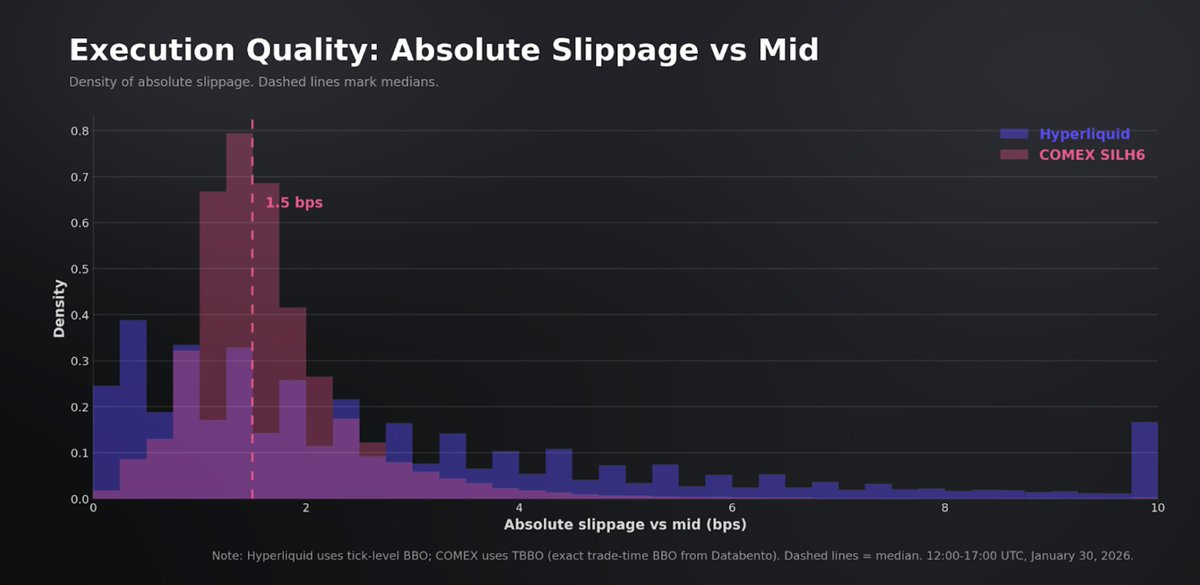

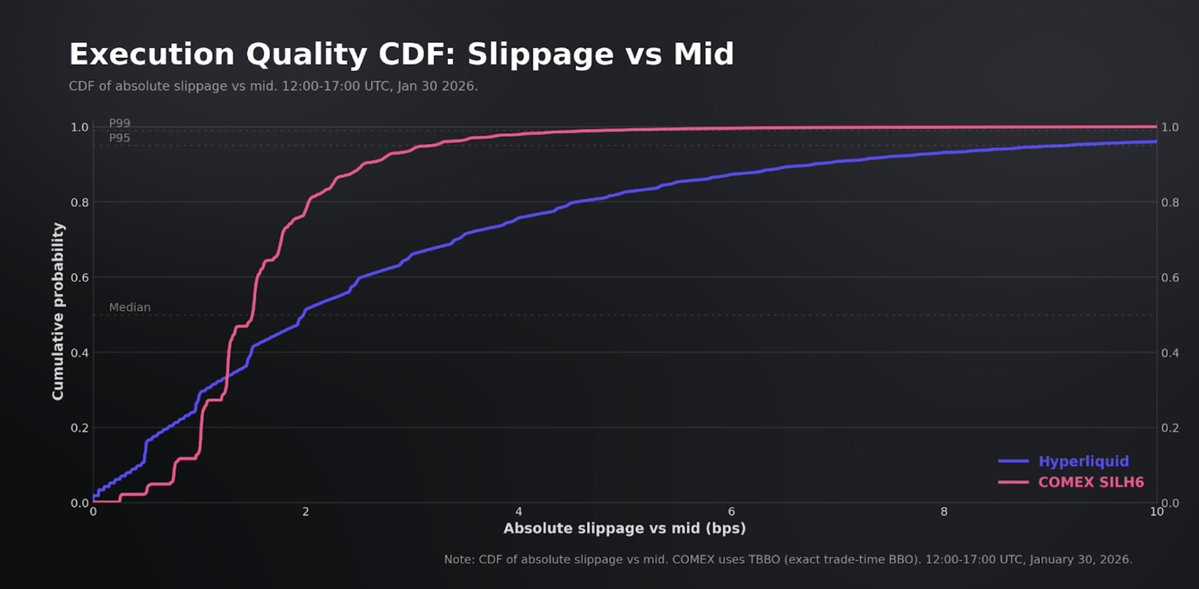

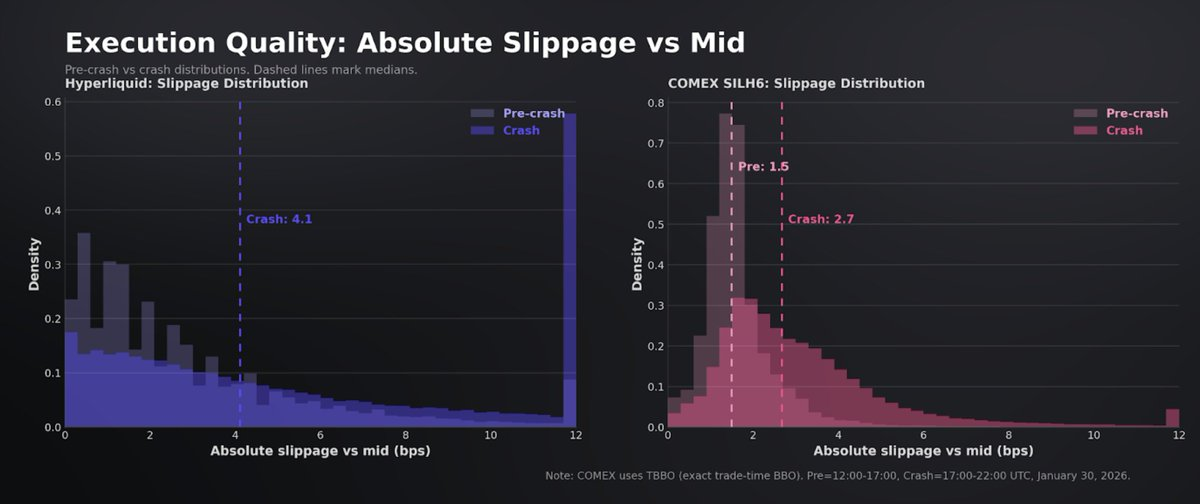

Execution quality adds information beyond spreads and depth. Using best bid/offer (BBO) at trade time, median slippage relative to mid-price is 1.5 bps on COMEX and 2.0 bps on Hyperliquid. COMEX execution is exceptionally tight—99% of trades execute within ±5 bps of mid. Hyperliquid’s distribution is broader: 83% within ±5 bps, 96% within ±10 bps, with occasional trades >±20 bps—consistent with intermittent order book gaps and thinner capacity.

Slippage rises modestly with trade size (COMEX: ~1.5 bps at 1 lot, ~1.6 bps at 2–5 lots), consistent with deep order books. On Hyperliquid, the slope is steeper—rising from ~1.9 bps below $1K to ~2.8 bps above $50K. Notably, the execution gap between platforms is far narrower than the depth ratio suggests. For Hyperliquid’s median trade (~$1,200), execution cost differs from COMEX’s median by only ~0.5 bps—even though COMEX’s median trade size is substantially larger.

Finally, interpreting execution requires considering oracle and mark-price design, as traders may fill against a deep but misaligned mark order book. Under HIP-3, oracles are non-trading references published by deployers, fixed in cadence and clamped; the mark price—governing funding, margin, and liquidations—is a robust aggregation of oracle and local order book signals, similarly clamped to prevent violent swings. This separation allows trade prices to sustain persistent premiums/discounts without mechanically triggering immediate liquidations, anchoring risk management to slower-moving reference prices while enabling continuous order-book-driven price discovery.

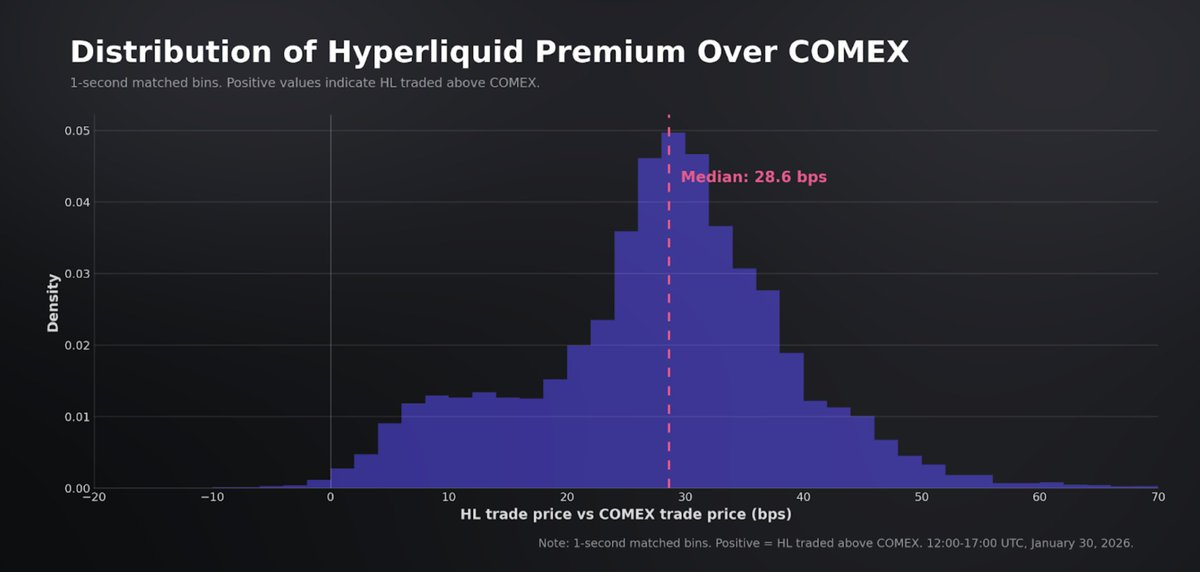

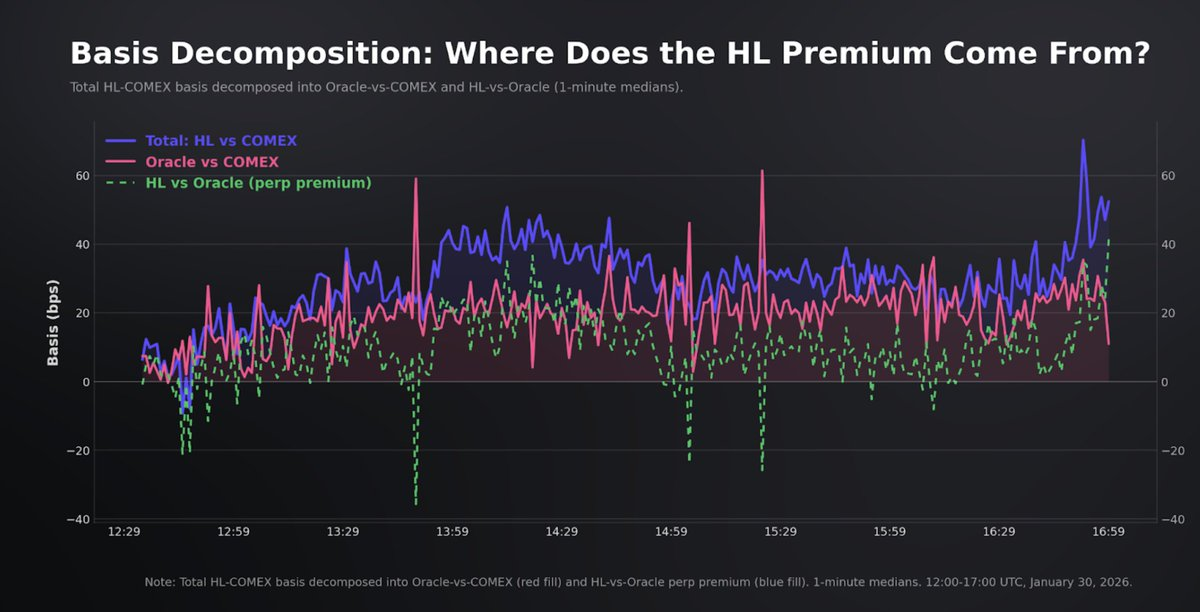

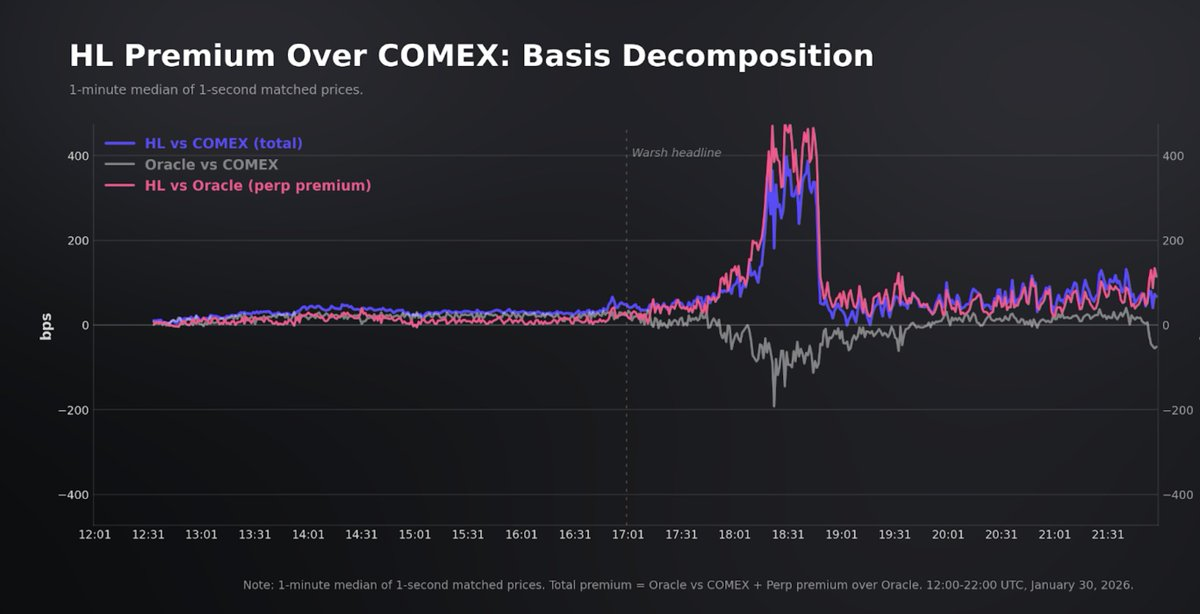

During the pre-crash window, Hyperliquid maintained a persistent ~29 bps premium over COMEX. This decomposes into: oracle vs. COMEX (~18 bps, reflecting differences between the oracle’s underlying basket and front-month futures) and perpetual vs. oracle premium (~9 bps, reflecting net long demand and funding pressure). The premium was highly stable, rarely inverted.

Comparing execution against the oracle shows a median premium of ~+9 bps.

In summary, the pre-crash baseline shows the platform delivers clear settlement for retail and mid-size flows—given its scale and participant profile. Though Hyperliquid’s depth is markedly thinner across all tiers, its smaller flow size enables highly competitive spreads, with median trade execution differing from the institutional benchmark by <0.5 bps.

The depth gap is real and economically material for large trades and extremes. But given typical market trade sizes, Hyperliquid was already operating at surprisingly high market quality before dislocation began.

Crash-Period Market

At ~17:00 UTC on Friday, Jan 30, reports emerged that Trump intended to nominate former Fed governor Kevin Warsh to succeed Powell—widely perceived as hawkish, triggering sharp silver repricing and its largest single-day drop since March 1980. Silver fell ~31% from Thursday’s near-$120/oz high to a session low near $78/oz. Leveraged long positions in futures, ETFs, and perps simultaneously faced margin pressure, making forced liquidations a major component of the tape.

For perpetual platforms, this feedback loop can be self-reinforcing. As reference prices fall, market makers short perps, and losing positions get liquidated into the order book. If liquidity withdrawal outpaces liquidation settlement speed, executions may skip multiple price levels—widening basis and increasing tail slippage.

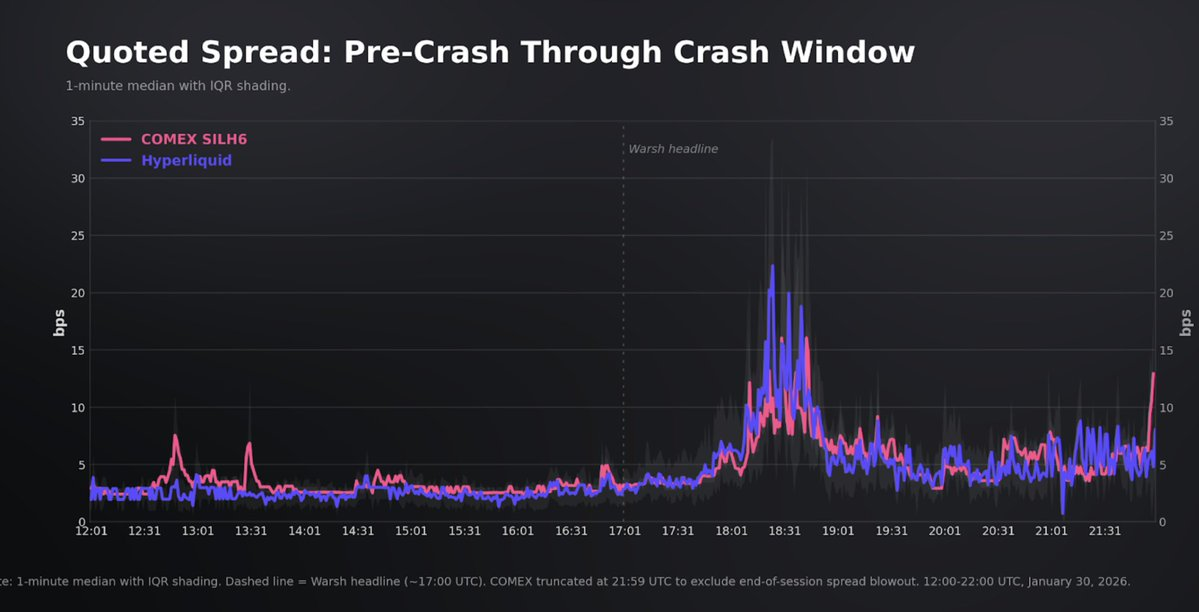

Both platforms’ quoted spreads deteriorated, with Hyperliquid exhibiting larger tail reactions. On Hyperliquid, median spread widened from 2.4 bps pre-crash to 5.1 bps during the crash (2.1x). P95 rose from 6.0 bps to 18.2 bps, with only 49.5% of observations ≤5 bps (vs. 90.5% pre-crash).

In the worst 5-minute window near 18:20 UTC, median spread peaked at 17 bps. COMEX also widened—from median 3.0 bps to 4.8 bps (P95: 12.7 bps)—and retained a tighter overall distribution. Its worst 5-minute window hit 10.1 bps at 18:20.

Likewise, depth contraction reflected liquidity retreat. On Hyperliquid, depth within ±5 bps fell from ~$231K pre-crash to $65K across the crash window—and median depth hit zero during peak stress—largely because spreads themselves had blown past ±5 bps.

At wider levels, liquidity persisted even under peak stress: $542K within ±25 bps, ~$1.07M within ±50 bps. COMEX showed the same mechanical pattern at narrow levels (±2 and ±3 bps often zeroed during peaks), but absolute capacity remained an order of magnitude higher. Under peak stress, COMEX held ~$1.16M within ±5 bps versus Hyperliquid’s ~zero.

Execution quality declined at both platforms’ medians, but tail behavior diverged. Hyperliquid’s median slippage vs. mid rose from 2.0 bps to 4.1 bps (~2x); COMEX rose from 1.5 bps to 2.7 bps (~1.8x). COMEX retained execution compactness, while Hyperliquid developed a heavy tail: ~1,900 Hyperliquid trades (1% of crash volume, ~$21M notional) executed >50 bps from mid—versus zero on COMEX.

Due to lower liquidity and liquidation flows, Hyperliquid’s mark price ultimately diverged from the oracle. HL-COMEX basis peaked at 463 bps at 18:30 UTC—but spent only 95 seconds >400 bps, falling below 50 bps within 19 minutes of the peak. Spreads followed a similar trajectory.

Overall, Hyperliquid’s spread widened more and execution distribution developed a heavy tail—consistent with thin order books under liquidation flows. Yet this deviation was transient. Amid volatility unseen in decades, Hyperliquid maintained continuous tradability and remained broadly anchored to the benchmark—the primary degradation concentrated in tail execution during rapid moves.

Market Closure

At 22:00 UTC Friday, COMEX closed—pausing the traditional institutional reference cycle for silver price formation. Hyperliquid remained open. For HIP-3 perps, this marks a special phase where external oracle updates become unavailable, and the platform shifts from “external anchoring” to “constrained internal guidance.”

Deployers continue publishing indices, but advance them using order-book-derived impact prices, filtered through a slow EMA. The mark price—governing margin and liquidations—is a robust blend of index, short-horizon basis filters, and local order book signals, bounded by maximum leverage constraints (e.g., ~5% range for silver).

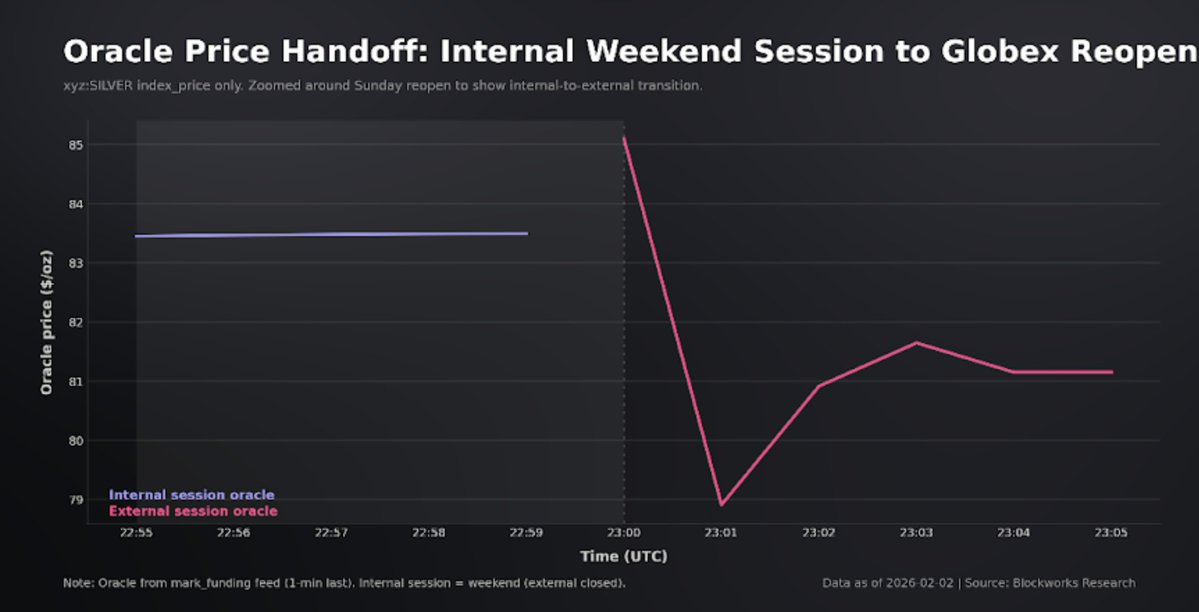

The weekend mechanism theoretically enables price discovery during non-trading hours. When external oracles resume Monday, this internal price is pulled back toward the external reference—but this interim window lets traders position ahead of the opening auction based on Friday’s anchor level.

Trading continuity over the entire weekend was high: 175K trades, $257M notional. Participant composition shifted sharply toward retail. Median trade size fell to $196 (from $1,245), and the 99th percentile fell to $18.1K.

On this dimension, quote liquidity tightened significantly. Weekend median bid-ask spread was 0.93 bps versus 2.40 bps on normal trading days. Depth declined but remained stable and two-sided. Median two-way depth within ±10 bps was $358K. Execution followed the same pattern.

Using mid-price at execution time, weekend median slippage was 0.87 bps versus 1.98 bps during normal hours. In other words, for trade sizes dominating weekend flows, crossing-the-spread cost was lower than on weekdays—despite weaker absolute depth capacity.

Price behavior showed substantial movement—not stagnation. Silver fell from $85.76 to $83.70 ahead of reopening, generating a live, evolving reference from 24/7 trading.

Globex reopening provided the clearest cross-platform check on whether weekend trading generated a usable reference level. At 23:00:00 UTC, COMEX’s first print was ~97 bps above Hyperliquid’s mid-price. By 23:00:01, the gap compressed to ~10 bps. Hyperliquid’s continuous weekend market produced a price level highly similar to COMEX’s opening auction. Impressively, Sunday’s final internal price was closer to Monday’s open than Friday’s close.

Across all HIP-3 xyz markets, weekend trading is structurally low-engagement—even though trading is continuous. Analyzing 32 xyz markets using 5-minute candles (defining weekend as Fri 4 PM ET to Mon 9:30 AM ET), we find: on a weekday-notional-weighted basis, nominal value per 5-minute candle dropped to 0.31x weekday levels (69% decline); on equal-weighted average, it fell to 0.33x (67% decline).

Volatility also contracted—but less sharply than volume. On a notional-weighted basis, 5-minute realized volatility fell to 0.75x weekday levels (25% decline); median market decline was 36%. A small subset of markets showed limited contraction—or even higher weekend volatility—primarily due to timing differences in underlying reference market hours and the fact that Sunday’s reopening dynamics are still classified as “weekend” by definition.

Silver fully conforms to this pattern. xyz:SILVER’s nominal value per 5-minute candle fell 72%, while 5-minute realized volatility dropped only 21%. Tighter spreads and stable execution medians coexist with lower overall participation and reduced depth away from the touch. In other words, weekend trading is optimized for continuity and small-clip execution—not institutional-scale capacity. Despite a sharp volume drop, Hyperliquid still delivers tight execution quality for the small-clip flows dominating that period.

The Future of 24/7 Trading

Given this structure, one of the most practical use cases for Hyperliquid’s 24/7 perps is pricing COMEX’s Sunday reopening auction. On COMEX, Sunday opening is a single-price call auction: orders accumulate during the pre-open, a reference opening price is published, and a brief non-cancelable window locks the order book before continuous matching resumes. The opening price is chosen to maximize executable volume, then minimize residual imbalance—with tiebreakers referencing prior settlement prices and other benchmarks. This works well for clearing backlog, but concentrates information, hedging demand, and stop-loss flows into a discrete price point.

A continuously trading venue like Hyperliquid changes the execution problem—it allows participants to express and transfer risk *before* the auction compresses the spread. Traders need not passively accept the final auction price; instead, they can stage positions at real-time order book prices over the weekend. Effectively, Hyperliquid provides a tradable weekend reference price—and a path-dependent execution plan for size, timing, and price limits—unavailable while the COMEX order book is closed.

As shown in the oracle handover chart, traders can transact against internal pricing ahead of the auction. When external reference pricing resumes, this anchor is pulled back to the oracle—creating economic incentives for traders to price this gap. The subtlety lies in the fact that this advantage depends on weekend liquidity and notional capacity; but when those constraints are met, Hyperliquid demonstrates execution superiority.

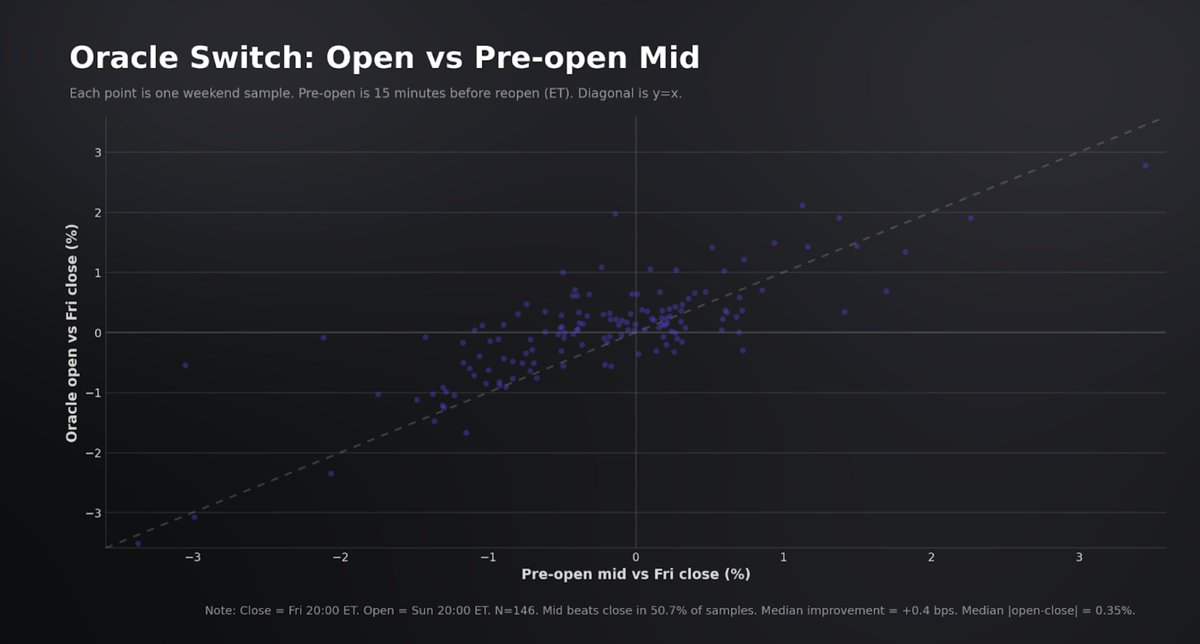

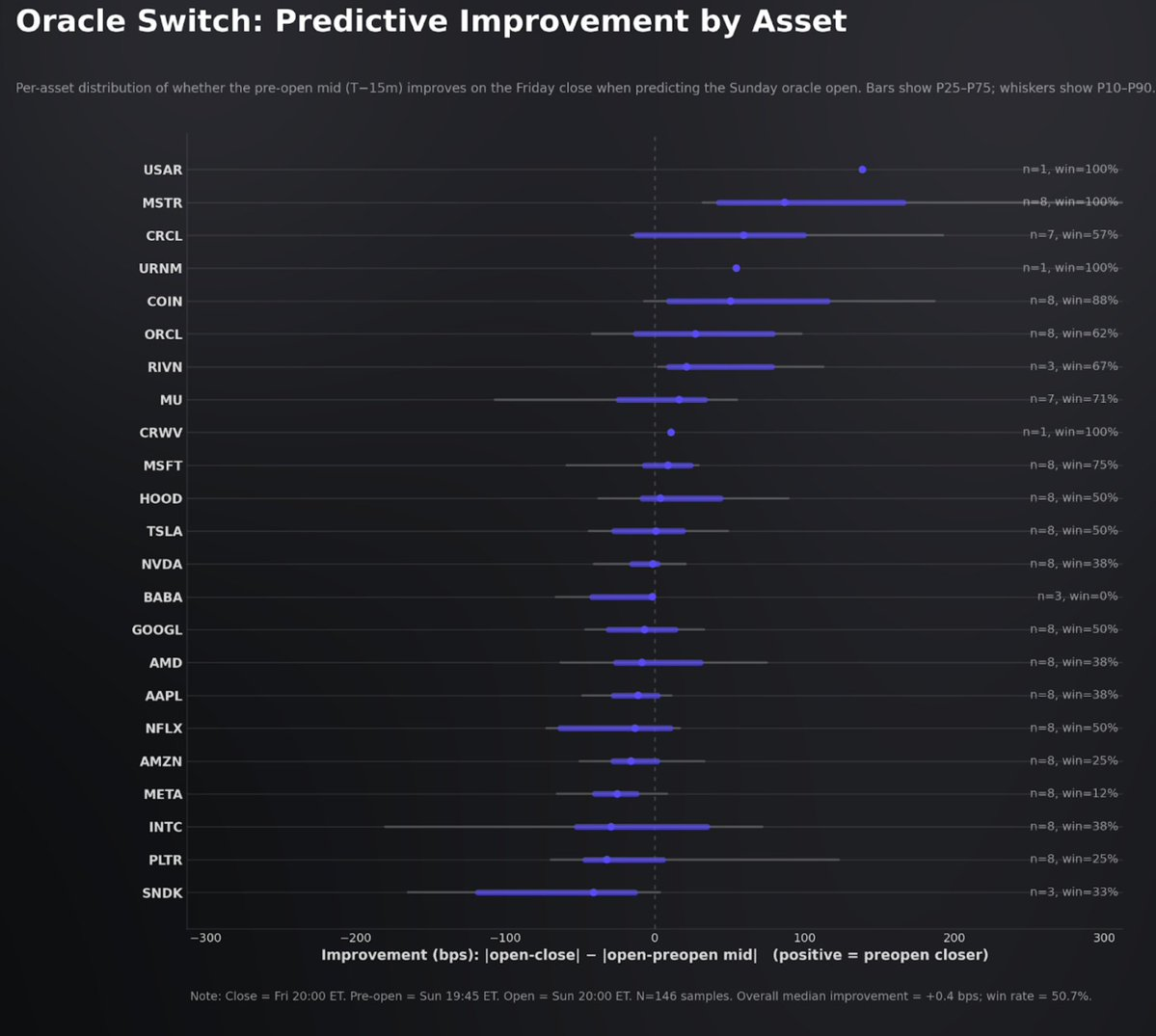

Across all xyz stock HIP-3 markets, we tested whether internal-period pricing provided incremental price discovery ahead of Sunday oracle reopening. Methodology: compare the oracle’s opening move vs. Friday’s close against the move observed in the mid-price over the 15 minutes preceding reopening (both measured as % of Friday’s close).

In the current sample (23 markets; 191 weekend samples, 146 with valid pre-open mid-price snapshots), evidence for incremental weekend price discovery at the oracle level is weak. In 50.7% of observations, the pre-open mid was closer to the oracle open than Friday’s close—median improvement was +0.4 bps, negligible.

In other words, for these markets, the oracle open remains largely anchored to Friday’s close—and deviations in the internal-period mid do not persist upon external oracle resumption. This suggests that, at least for stocks under current HIP-3 configurations and liquidity mechanisms, weekend trading has yet to produce a robust, strongly referenceable tradable benchmark. Still, as liquidity and depth build, we expect the internal period to become a more reliable pricing reference ahead of reopening.

Conclusion

Hyperliquid’s HIP-3 silver perpetual successfully cleared and settled through volatility unseen in decades—without downtime—and delivered tight top-of-book pricing for mainstream retail and mid-size flows. Market quality degraded as expected under stress—especially in tail execution—but imbalances were transient: basis rapidly mean-reverted, and price formation remained broadly anchored to the institutional benchmark. Yet HIP-3’s limitation is capacity: the platform handles small-to-mid-size orders well, but large-order execution remains materially constrained relative to COMEX’s depth.

Beyond standard perpetual advantages, the weekend mode represents the product’s most strategic value. Hyperliquid provides a continuous price path when traditional markets close—transforming what would otherwise be a discrete reopening gap into a tradable reference, creating advantages for rebalancing and opening price discovery ahead of the auction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News