$HYPE Axed—Who’s Behind It?

TechFlow Selected TechFlow Selected

$HYPE Axed—Who’s Behind It?

Discover how Wintermute executes large-scale arbitrage between centralized exchanges (CEXs) and on-chain markets—and why PURR DAT still holds hundreds of millions of dollars in “ammunition” ready to step in.

Author: Ericonomic

Translation & Editing: TechFlow

TechFlow Intro:

Over the past two months, Hyperliquid’s token HYPE has corrected from a high of $50 down to around $20, triggering widespread market panic and skepticism. Is this merely a healthy pullback early in a bull market—or does it signal cracks in the fundamentals? Senior researcher Ericonomic conducts an in-depth analysis using comprehensive on-chain data to dissect the three core drivers behind HYPE’s 50% price decline: the widely misunderstood team unlock, excessive leveraged liquidations, and the mysterious, mechanized dumping by a “Tornado Cash” whale cluster.

As these structural selling pressures near exhaustion, the market landscape is undergoing subtle yet meaningful shifts. This article reveals how Wintermute executes large-scale arbitrage between CEXs and on-chain venues—and why PURR DAT still holds hundreds of millions of dollars in “ammunition” ready to absorb supply. For investors tracking the Hyperliquid ecosystem, this is an essential guide to cutting through market fog and understanding capital dynamics.

Full Text Below:

Over the past two months, HYPE’s price has fallen from the $45–$50 range to approximately $20.

This move was neither random nor attributable solely to poor “market conditions.”

It resulted from three very specific sources of selling pressure—all clearly visible on-chain—and all either already resolved or nearing exhaustion.

This article analyzes precisely what happened—and why the structural setup today is fundamentally different from what it was two months ago.

HYPE/USDT Price Chart

Team Unlock: The Misunderstood “Ghost Selling Pressure”

One of the biggest misconceptions about HYPE concerns the team unlock.

Most data-tracking platforms still report ~9.9 million HYPE unlocking monthly—leading many market participants to assume a steady ~$200M of monthly selling pressure. This assumption is incorrect.

Unlocked ≠ Distributed.

Distributed ≠ Sold.

Sold ≠ Sold on public markets.

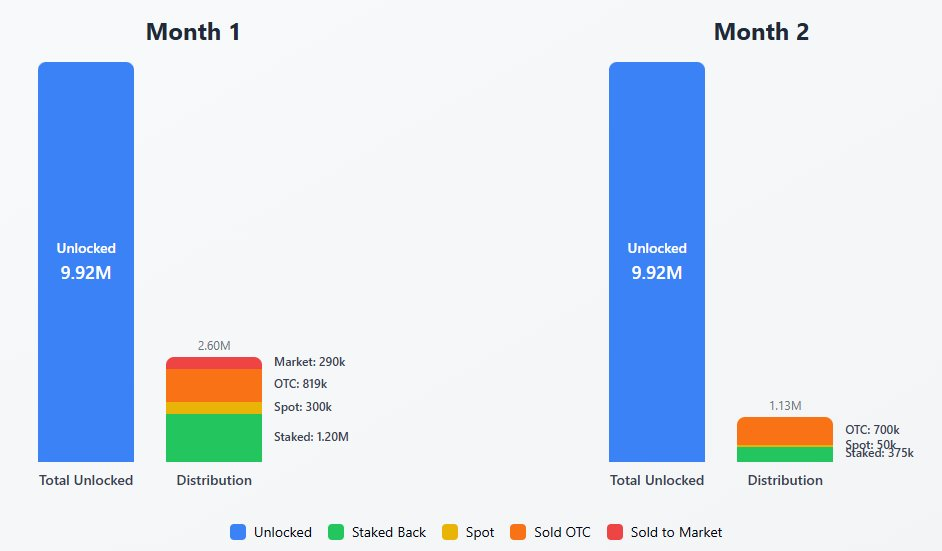

Reviewing the unlock data for the past two months (publicly tracked by @0x_greasemonkey):

Month 1:

- Unlocked: 9.92M HYPE

- Actually distributed: 2.6M

- Re-staked: ~1.2M

- Held in spot wallets: ~300K

- OTC sold: ~819K

- Direct public-market sell-offs: ~290K

Month 2:

- Unlocked: 9.92M HYPE

- Actually distributed: ~1.125M

- Re-staked: ~375K

- Held in spot wallets: ~50K

- OTC sold: ~700K

- Direct public-market sell-offs: 0

In both cases, only ~7–10% of the headline unlock volume translated into direct or indirect selling pressure.

Caption: Detailed breakdown of HYPE team unlocks

If this pattern continues, team unlocks are not a persistent shock—they’re a gradually diminishing trickle, not a cliff-edge dump.

The sole variable lies in execution: if this supply is sold OTC to entities like PURR DAT (executed via Flowdesk), it reduces their need to buy on public markets. That affects *where* demand appears—not whether demand exists. We’ll return to this point shortly.

Net effect: Widely misinterpreted by the market—and largely digested at this stage.

Derivatives & Leveraged Liquidations

Entering Q4, HYPE’s derivatives structure was structurally unhealthy.

On the Hyperliquid platform, long positions dominated overwhelmingly. This discouraged new buyers and incentivized others to front-run liquidations—and they were right to do so.

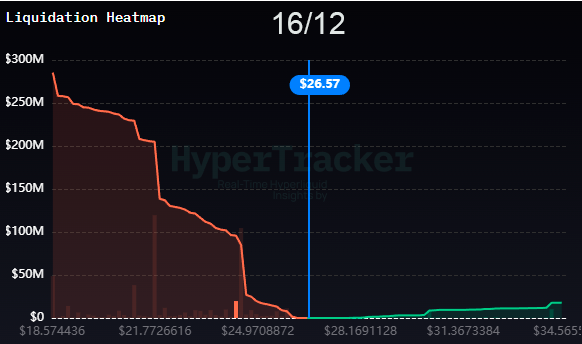

Caption: HYPE liquidation heatmap on HyperCore as of Dec 16

The resulting situation was brutal:

- Multi-million-dollar long liquidations occurred across major exchanges.

- Money-market positions triggered additional forced selling: users collateralized HYPE to borrow USDC, then used that USDC to buy more HYPE.

These money-market liquidations don’t appear clearly on public heatmaps—but their impact is real. Even absent large-scale liquidations, many users were forced to sell HYPE preemptively—to repay loans or add collateral.

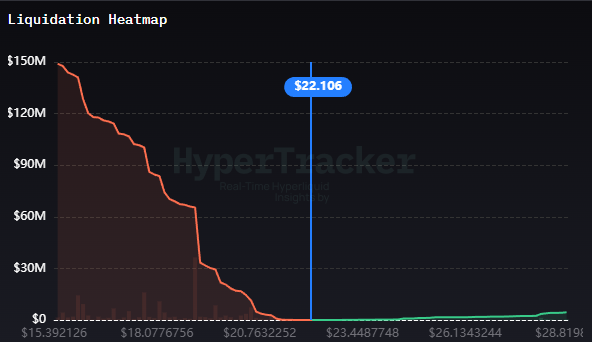

Today, the leverage regime has changed significantly:

Caption: HYPE liquidation heatmap on HyperCore as of Jan 26

- Though over $150M in longs remain vulnerable at $15, most aggressive longs have exited.

- Liquidations are now more evenly distributed across Binance, OKX, and Hyperliquid.

- The downward pressure generated by leverage has been largely exhausted.

This alone doesn’t imply bullishness. But it is a necessary precondition for any future bullish move.

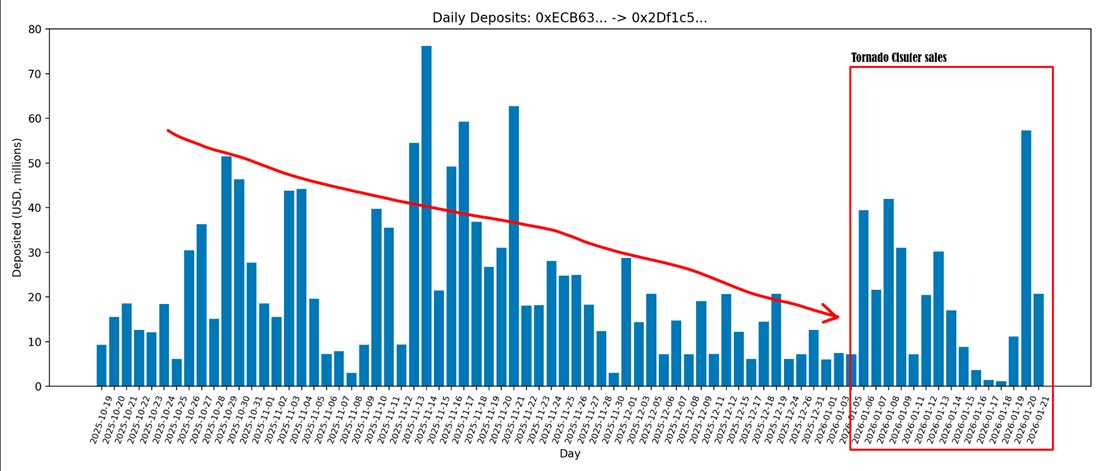

Tornado Cash Cluster & Anonymous CEX Buyers

This was the single most damaging factor for price action—not because of the absolute size of its sales, but because many participants front-ran it: selling outright, shorting, or simply refusing to bid.

A cluster of 16 addresses, originally funded via Tornado Cash, accumulated ~4.4M HYPE at an average cost of ~$8.8.

This cluster has been publicly tracked by accounts including @lookonchain and dashboards maintained by @m_l_m_0.

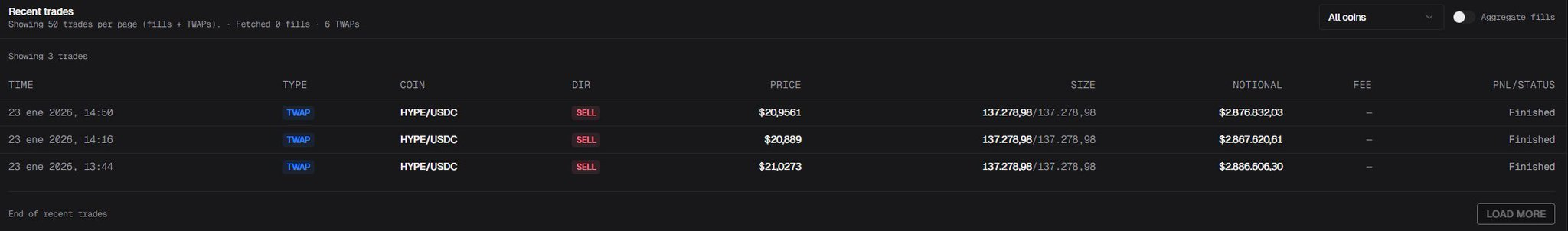

Starting in early January, the entity executed a highly mechanized liquidation strategy:

- Approximately one wallet unstaked per day.

- Immediate TWAP (time-weighted average price) sale post-unstake.

- No observable attempt to optimize execution price.

In total, this represented over $80M in supply. Under normal circumstances, this should have pushed HYPE below $10.

Yet it didn’t. This is where the story pivots.

Caption: Example of one cluster wallet selling 400K HYPE within one hour

When the Tornado-funded cluster dumped aggressively on HyperCore, a clear pattern emerged.

Nearly instantaneously, Wintermute began arbitraging this flow:

- The Tornado cluster sold on HyperCore.

- Wintermute bought on HyperCore.

- Wintermute transferred HYPE to Bybit’s exchange address (0xe401A6A38024d8f5aB88f1B08cad476cCaCA45E8).

- Wintermute sold HYPE to an anonymous buyer on Bybit.

Such operations aren’t novel—Wintermute has run similar arbitrage loops across multiple assets on Hyperliquid for over a year.

What changed was intensity.

Once the Tornado cluster initiated its unwind, this flow accelerated sharply.

Caption: Wintermute’s deposit activity on Hyperliquid

Critically, Wintermute is not a directional buyer.

Its role is to move inventory from on-chain sellers to large, persistent off-chain buyers—absorbing supply that would otherwise overwhelm HyperCore’s liquidity.

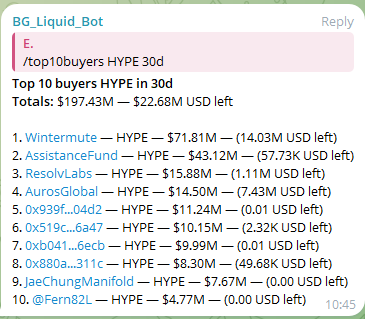

Within just the past 30 days, Wintermute arbitrated over $70M worth of HYPE—exceeding even the Assistance Fund’s net buy volume during the same period.

Caption: Top HYPE buyers on HyperCore over the past 30 days, data provided by @HyperliquidData bot

If you’re curious about who bought HYPE on HyperCore over the past 30 days (per the chart above), here’s what I found:

- Top 3: @CumberlandSays, running neutral positions.

- Top 4: @AntAlphaGroup, acting as market makers with no directional exposure.

- Top 5, 6, 7: Anonymous buyers with directional exposure (at least on HyperCore).

- Top 8: Likely @AurosGlobal, neutral position.

- Top 9: Likely @Presto_Labs (or its founder Jae Chung), engaged in market-making but appearing directionally biased toward buying.

- Top 10: Likely @The_K_S_K, an early Hyperliquid supporter, exhibiting directional buying behavior.

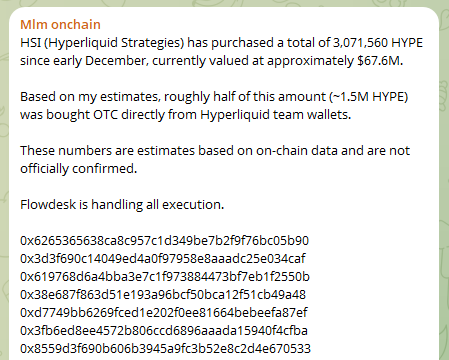

Beyond this, @m_l_m_0 identified another cluster likely belonging to PURR DAT:

Caption: Message posted in the MLM Telegram channel

Since this message, numerous new addresses following the same pattern (staking 700–900 HYPE) have emerged—indicating PURR DAT continues accumulating.

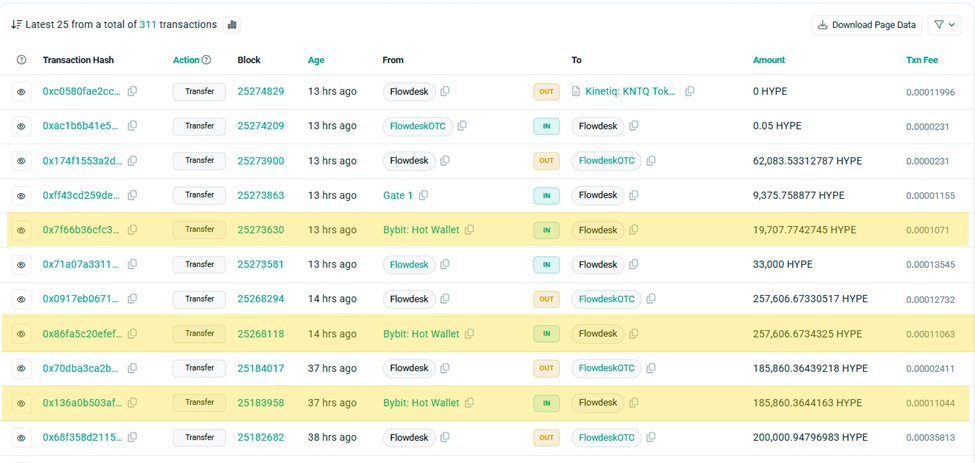

This entity’s execution is handled by Flowdesk, with HYPE sourced from Bybit—making it highly probable that the anonymous CEX buyer absorbing Wintermute’s flow is PURR itself.

Caption: Flowdesk withdrawal records of HYPE from Bybit

Selling pressure extended beyond the Tornado cluster. Continue Capital also emerged as a major seller, offloading ~1.3M HYPE (~$28M) over roughly two weeks. (They still hold nearly 800K staked HYPE—but it remains staked for now.)

These sales followed the same steady execution pattern—with no apparent effort to optimize price. Additionally, our Trove team sold the 500K HYPE they had purchased several months earlier.

Despite this confluence of selling pressure, price held firm.

While suboptimal, this must be viewed correctly: letting these clusters sell in the $20–$25 range is materially better than allowing them to sell above $50—because PURR DAT would then need to spend far more capital to absorb the same supply.

This selling pressure has now ended—or is nearly exhausted. There may be no large active sellers left in the market.

Note: At time of publication, the cluster still held ~300K HYPE. By the time you read this, that balance may be lower—or fully depleted.

What Has Changed?

With the primary sources of forced supply resolved, the question shifts from “Who’s selling?” to “How much remains to absorb?”

PURR DAT’s Remaining Firepower

Based on public estimates, PURR DAT retains ample available capital after absorbing the Tornado cluster’s and Continue Capital’s sales.

MLM calculated $67.6M spent across the identified cluster. Recently, new addresses following the same pattern have continued emerging:

- 0x5f4...9f5e: 117K HYPE

- 0x69e...b985: 124K HYPE

- 0x05b...d761: 103K HYPE

- 0x7ea...f901: 85K HYPE

- 0x0ad...8eec: 100K HYPE

Assuming an average price of $21, these new positions represent ~$11M—bringing the total to $78.6M.

To estimate remaining “firepower”:

- Add a buffer—assume $90M already spent on HYPE purchases.

- Assume $30M more will be spent this year to repurchase shares.

This leaves ~$170M in cash available to buy HYPE.

This doesn’t imply aggressive spot pumps or guaranteed upside—but it does mean residual selling pressure (e.g., remaining team unlocks) can be absorbed—not amplified by the market.

Perps Market

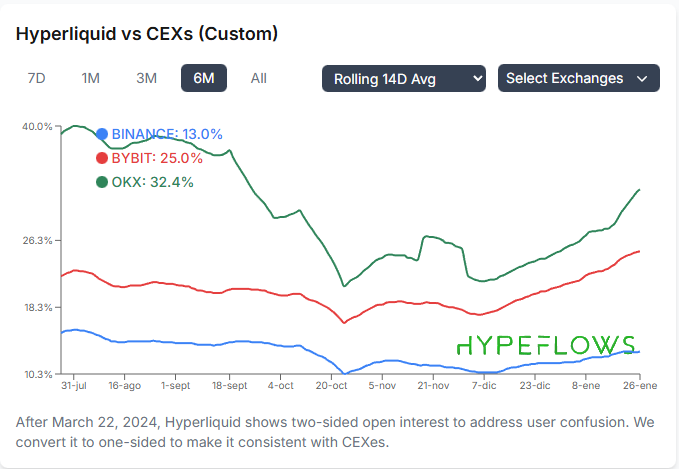

Although absolute trading volume remains below all-time highs (ATH), Hyperliquid’s perpetual futures (Perps) market share relative to CEXs is rising again.

Open interest has surpassed prior relative historical highs versus platforms like Bybit.

Caption: Hyperliquid vs. CEXs open interest comparison

Market share drives revenue—and revenue fuels the Assistance Fund.

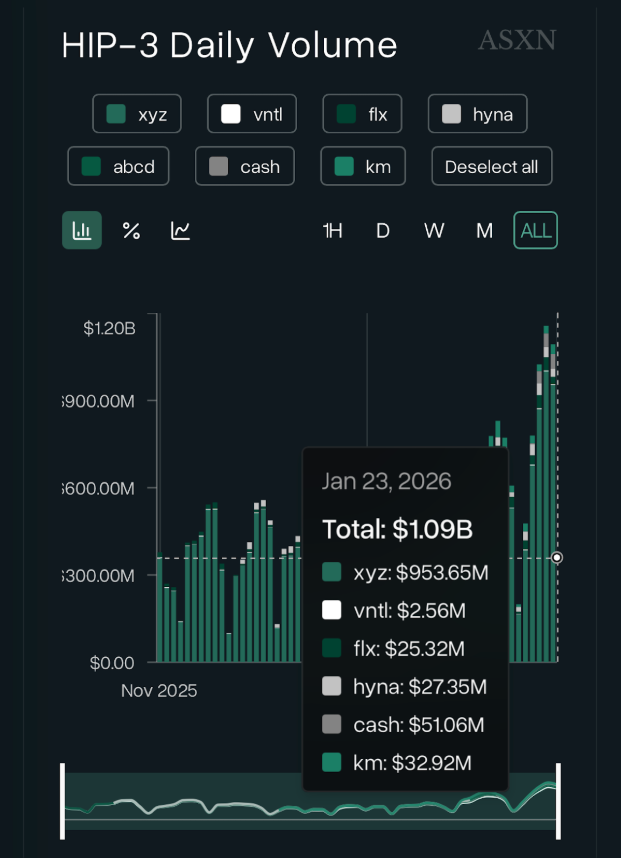

HIP-3 Trading Volume

With the launch of @TradeXYZ, HIP-3 trading volume accelerated markedly—introducing novel exotic markets such as crude oil and U.S. Treasuries. Recent weekday HIP-3 daily volume has exceeded $1B.

TradeXYZ remains the primary contributor, generating >$10M annualized revenue

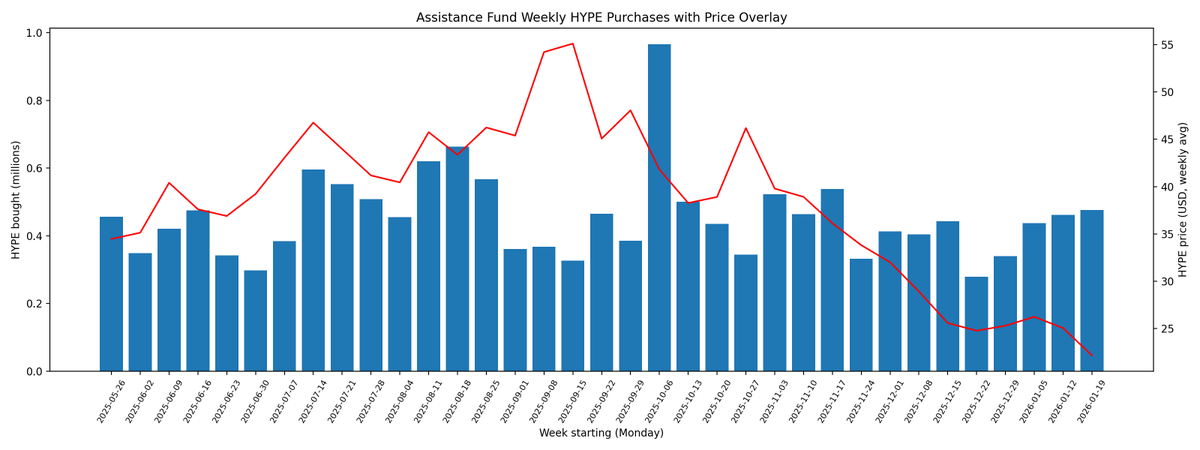

Assistance Fund

The Assistance Fund is currently underwater, with an average cost basis of ~$23.6. Historically, this has often coincided with cyclical bottoms.

Recent data shows:

- Daily stable purchase volume exceeds 60K HYPE.

- Some days exceed 100K HYPE/day.

Caption: Weekly HYPE purchases by the Assistance Fund

Note: This doesn’t guarantee an uptrend. Rather, it means the Assistance Fund is burning millions of dollars’ worth of HYPE daily—and the burn rate increases as price falls.

Portfolio Margin

The Portfolio Margin feature will unlock the ability to use a broader set of assets as collateral.

Caption: Bybit’s market share before and after launching Portfolio Margin

This will meaningfully improve capital efficiency—making delta-neutral strategies more effective and enabling professional traders and market makers to deploy larger positions with the same capital base.

Potential outcomes include structurally higher open interest, driving higher volume, higher revenue, and greater HYPE buybacks.

Summary

Two months ago, HYPE’s pricing embedded expectations of:

- Unclear unlock behavior

- Excessive leverage

- Large sellers awaiting liquidation

Today’s reality is:

- Unlock mechanics are now understood

- Leverage has been reset

- The Tornado cluster and other large entities have exited—or are nearly done

- Large-scale selling is highly likely to be absorbed over the coming period

This doesn’t mean price must rise tomorrow—but it does mean the structural drivers of the prior decline have dissipated.

The HYPE/BTC trend appears to be turning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News