Misalignment: Ethereum bleeding, Hyperliquid stalling

TechFlow Selected TechFlow Selected

Misalignment: Ethereum bleeding, Hyperliquid stalling

The ecological rift of Hyperliquid.

Author: Zuoye

When fortune smiles, heaven and earth unite in support; when luck fades, even heroes lose their freedom.

Binance's attack on Hyperliquid’s OI and trading volume via Aster, followed by consecutive attacks on HLP by $JELLYJELLY and $POPCAT, are mere nuisances;

Beyond the booming HIP-3 Growth Mode, rumored BLP (lending protocol), and $USDH actively staking 1 million $HYPE as Aligned Quote Assets, cracks begin to show in Hyperliquid—HyperEVM ecosystem and $HYPE remain misaligned.

Alignment isn't complicated: under normal conditions, the HyperEVM ecosystem consumes $HYPE, while $HYPE supports the growth of HyperEVM.

But these are not normal times. The Hyperliquid Foundation remains focused on leveraging $HYPE within HyperCore’s spot, derivatives, and HIP-3 markets. HyperEVM ecosystem development remains a second-class priority.

An earlier third-party HIP-5 proposal sought to allocate part of the $HYPE buyback fund to support ecosystem projects, but faced widespread community skepticism and rejection—revealing a harsh truth: $HYPE’s current price is entirely sustained by buybacks from the HyperCore market, with no surplus capacity to support HyperEVM.

Lessons from Others: Ethereum’s Scaling Successes and Failures

L2s shifting toward Rollup didn’t satisfy ETH; third-party sequencers border on absurdity.

A blockchain’s development involves three key parties: the native token (BTC/ETH/HYPE), the foundation (DAO, spiritual leaders, company), and ecosystem project teams.

The interaction model between the native token and ecosystem projects determines the chain’s fate:

-

Native token ⇔ Ecosystem: bidirectional interaction is healthiest. Ecosystem growth requires the native token; the native token empowers ecosystem projects. SOL currently leads here.

-

Native token -> Ecosystem: one-way empowerment. After TGE, the native token abandons the ecosystem. Examples include Monad or Story.

-

Ecosystem -> Native token: the native token drains value from ecosystem projects, placing them in a competitive-cooperative dynamic.

Ethereum’s evolving relationship with its DeFi projects and L2s offers the clearest parallel, reflecting both HyperEVM’s current reality and potential paths forward.

According to 1kx research, the top 20 DeFi protocols generate around 70% of on-chain revenue, yet their valuations lag far behind the base layer. The “fat protocol” theory still holds sway—people trust Uniswap and stablecoins on Ethereum more than standalone entities like Hyperliquid and USDe.

Not to mention Vitalik’s long-standing ambivalence toward DeFi—he dislikes it yet can’t live without it, eventually awkwardly proposing low-risk DeFi frameworks. Many DeFi protocols have tried building independently: dYdX V4, MakerDAO’s 2023 EndGame plan, with technical choices spanning Cosmos and Solana-based AltVM systems.

Then came Vitalik’s public sell-off of $MKR, underscoring how people consistently underestimate the official legitimacy granted by a blockchain—especially the influence of its spiritual leader.

Vitalik and EF (Ethereum Foundation) long left DeFi to fend for itself, focusing instead on abstract philosophical ideals. While DeFi players fought, others profited—Solana’s rise in DeFi owes much to this vacuum. Eventually, Hyperliquid emerged in the form of exchange + blockchain, ushering in a new phase of chain competition.

Solana’s challenge drew heavy criticism toward Vitalik and EF. Yet beyond DeFi, the gains and losses of L2 scaling tell a more nuanced story. Technically, L2/Rollup wasn’t a failure—but siphoning revenue from L1 pushed ETH into a downtrend.

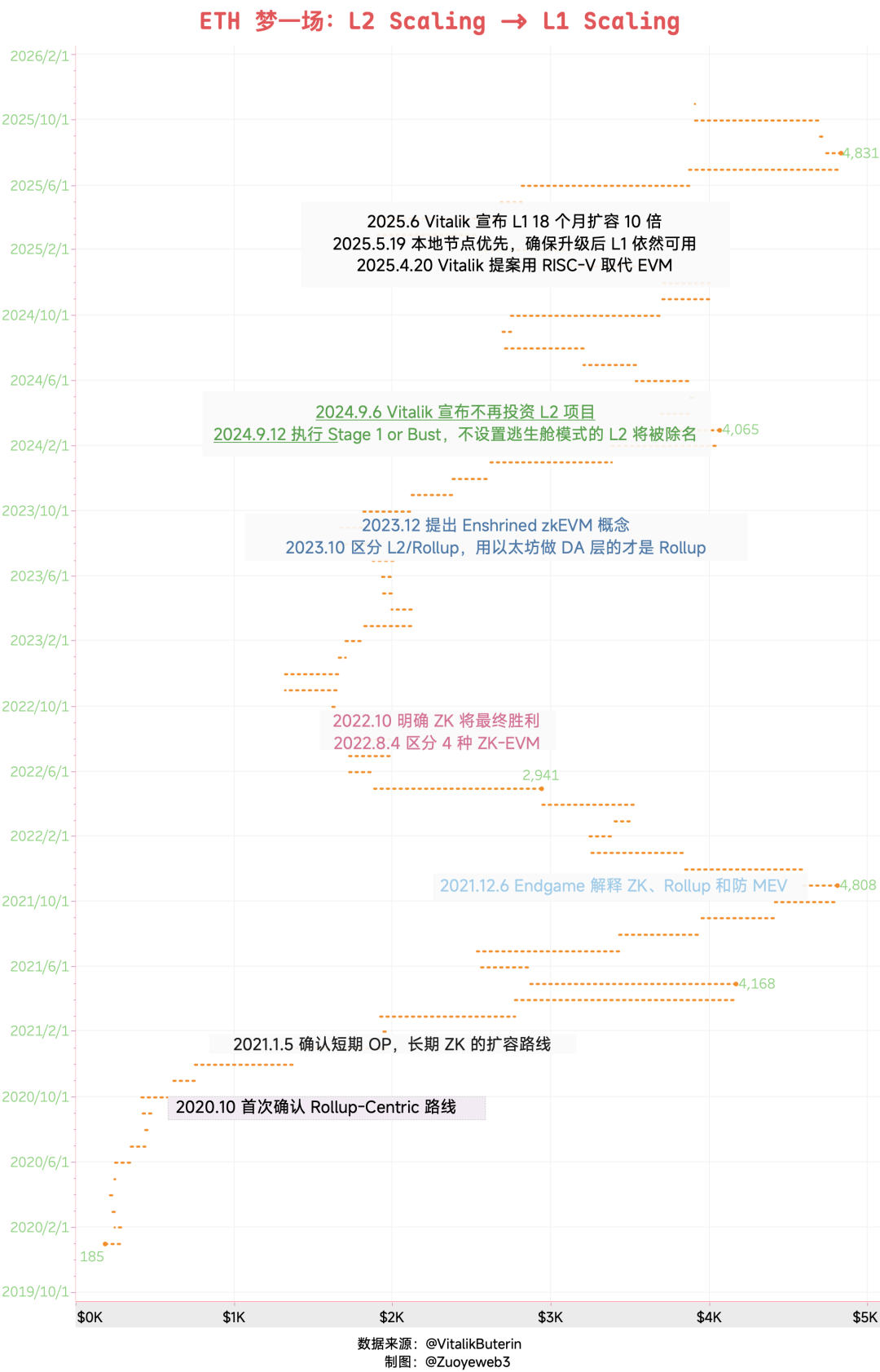

Image caption: ETH’s dream ends: L2 Scaling -> L1 Scaling

Image source: @zuoyeweb3

When Ethereum L1 faced surging scalability demands after the DeFi boom, Vitalik decreed a Rollup-centric roadmap, doubling down on ZK’s long-term value. This sparked industry-wide FOMO around ZK Rollups from 2020 to 2024, generating countless fortunes—and tragedies.

Yet one fact remains: DeFi serves real C-end users. Each new L2 launched essentially consumed Ethereum L1’s infrastructure, fragmenting ETH’s value capture. By 2024, the L2/Rollup era had reached its end, and 2025 saw a return to L1 Scaling.

After four years away, they return to L1 dominance.

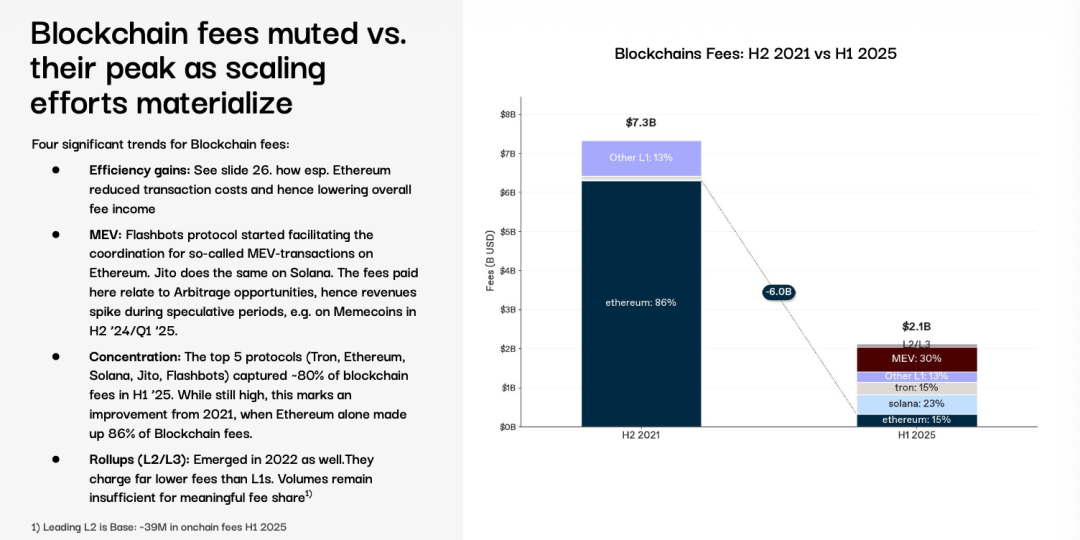

Image caption: Speed-up and fee-cut hurt own revenue

Image source: @1kxnetwork

Technically, ZK and L2/Rollup significantly offloaded L1 congestion. Faster speeds and lower fees benefited all participants. But beyond the blockchain<>DeFi (application) dynamic, economically, a complex triangle—blockchain<>L2<>application—emerged, ultimately leading to a triple loss.

Ethereum lost income to L2s, L2 wealth effects scattered too thin, and applications exhausted themselves expanding across multiple L2s.

In the end, Hyperliquid ended the chaos with a unified stance: “the chain is the app, the app is trading.” Even Vitalik bowed his proud head, reorganizing EF to refocus on user experience.

During the shift from L2 back to L1, certain technical bets—like Scroll’s reverence for four types of ZK EVM, or Espresso’s bet on decentralized L2 sequencers—were ultimately proven wrong. Meanwhile, Brevis recently gained attention because Vitalik renewed emphasis on ZK for privacy—a use case now unrelated to Rollup.

A project’s fate depends not only on effort but also on historical momentum.

Amid dazzling victories, Hyperliquid now faces the same dilemma as Ethereum: how should it manage the relationship between its native token and ecosystem?

Stimulating Discussion: Alignment Options for HyperEVM

BSC is an appendage of Binance; HyperEVM has yet to define its role within Hyperliquid—the team hasn’t figured it out.

In the article "Riding the Wave of HyperEVM," we introduced Hyperliquid’s unique path: first build the controlled HyperCore, then open up HyperEVM, linking both through $HYPE.

Recent developments show the Hyperliquid Foundation remains committed to a token economy centered on empowering $HYPE, prioritizing HyperCore while allowing diverse HyperEVM ecosystems to coexist.

This leads to the core question: how can HyperEVM forge its own distinctive path?

BSC exists as an extension of Binance’s main platform and $BNB. Projects like PancakeSwap and ListaDAO follow Binance’s lead, so there’s no competitive tension between BNB and BNB Chain.

Even Ethereum struggles to balance ETH’s interests with ecosystem prosperity. In comparison, Hyperliquid’s current issues break down as follows:

-

No synergistic relationship established between HyperEVM and HyperCore—HyperEVM occupies an awkward position

-

$HYPE is the sole focus of the Hyperliquid Foundation, leaving HyperEVM project teams directionless

Before answering, consider the current state of HyperEVM: clearly, ecosystem projects cannot keep pace with Hyperliquid’s vision.

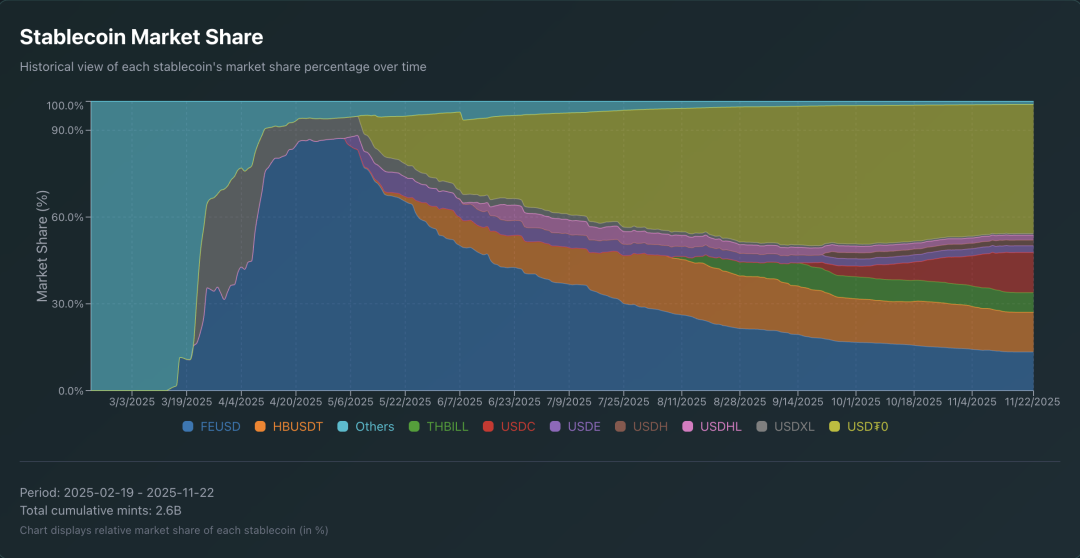

Image caption: HyperEVM stablecoin market share

Image source: @AIC_Hugo

The USDH team election triggered FOMO among stablecoin teams, yet existing HyperEVM stablecoin projects hold no clear advantage. BLP may conflict with current lending protocols. Most telling was the HIP-5 proposal, which received almost no support for using $HYPE to empower ecosystem projects.

$ATOM is a sore point for the Cosmos team; $HYPE is a mirage for ecosystem builders—no matter how hard they work, they’re just expendable fuel.

A classic dilemma faces every HyperEVM project: what if Hyperliquid builds it themselves?

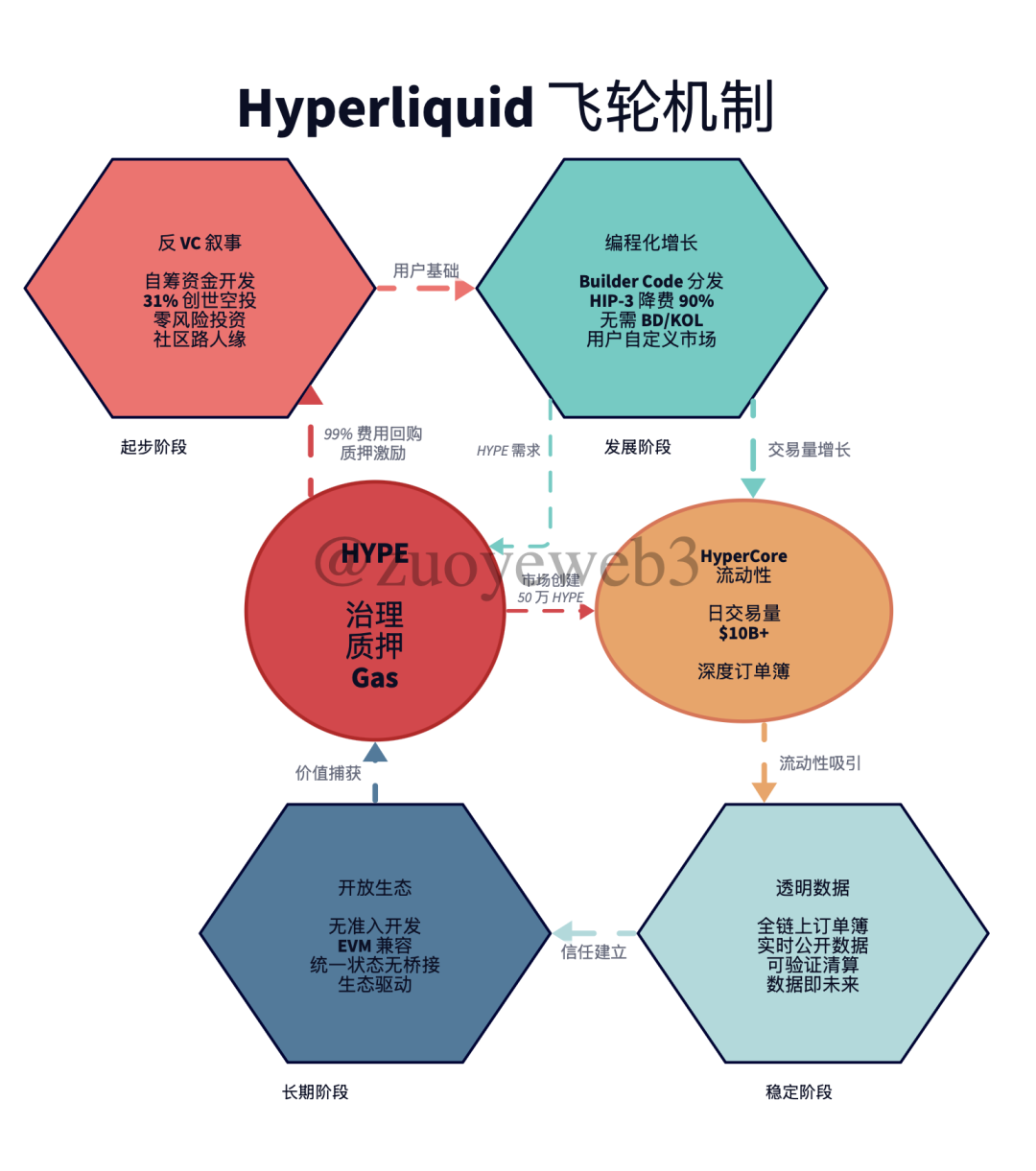

Image caption: Hyperliquid flywheel

Image source: @zuoyeweb3

Looking at Hyperliquid’s consistent strategy, they excel at striking during industry crises to build anti-fragility. During downturns, recruitment costs drop and counter-marketing their robustness strengthens over time, forging tight community consensus.

-

Early-stage anti-VC narrative: emphasized self-funded market making and bootstrapping. Though they still ally with market makers and allow VC token purchases, their public image attracted early seed users.

-

Growth-phase marketing: instead of BD-driven KOL rebates, they programmatically encoded incentives (Builder Code / HIP-3 Growth Mode), fully customizable by users.

-

Stability-phase maximum transparency: Hyperliquid’s latest contribution to blockchain, beyond decentralization (few nodes, centralized control, corporate governance), is championing transparent data as the future of on-chain.

-

Long-term HyperEVM openness: don’t build ecosystems based on trust in individuals, but drive growth through permissionless mechanisms.

The problem lies in long-term thinking. The Hyperliquid Foundation and $HYPE share identical interests. Yet, to some extent, HyperEVM projects naturally desire to prioritize their own tokens and ecosystems—a reasonable ambition, since on-chain growth is always about trading liquidity for expansion.

Governance mechanisms lag behind technological innovation. From Satoshi’s silent departure, to Vitalik’s embrace and later disillusionment with DAOs, to the current foundation model—blockchain governance remains experimental.

In a sense, Vault Curators reflect the tension between technology and mechanism. As real-world governance structures flood on-chain, lawyers, executives, and BDs bring corporate bloat worse than anything seen in Silicon Valley or Zhongguancun.

At least, Hyperliquid aligns more closely with blockchain’s technical nature through “everything programmable.” On-chain is inherently trustless—don’t waste energy building trust models. Still, even on HyperCore, extra push is needed, such as manual management of HLP, which could easily revert to manual intervention in crises.

For now, HyperEVM hasn’t truly achieved “permissionless” status in governance and liquidity—not due to technical restrictions, but because legitimacy hasn’t been fully opened to the entire community.

We will soon witness, amid an approaching bear market, either the co-evolution of HyperEVM and $HYPE—or Hyperliquid’s regression into a Perp DEX.

Conclusion

Our ETH, Hyperliquid’s problem.

Ethereum’s health bar is incredibly thick. Despite PoW to PoS, L2 Scaling to L1 Scaling shifts, and challenges from Solana in DeFi and Hyperliquid in DEX, it maintains an unshakable market position.

Moreover, $ETH has already weathered full bull-bear cycles, but $HYPE hasn’t faced a true bear test. Sentiment is precious consensus—time is running short for $HYPE and HyperEVM to achieve alignment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News