Retail investors prop up half the market? Coinbase Q3 earnings breakdown

TechFlow Selected TechFlow Selected

Retail investors prop up half the market? Coinbase Q3 earnings breakdown

Coinbase's "full-category exchange" is accelerating its formation.

Author: KarenZ, Foresight News

On the last day of October, Coinbase released its Q3 2025 earnings report, demonstrating strong operational resilience and growth potential. The company achieved double-digit sequential growth in both revenue and profit, while making key progress across multiple dimensions including the advancement of its "Everything Exchange" strategy, breakthroughs in stablecoin and payment services, derivatives business expansion, and custodial service development.

Key Financial Highlights

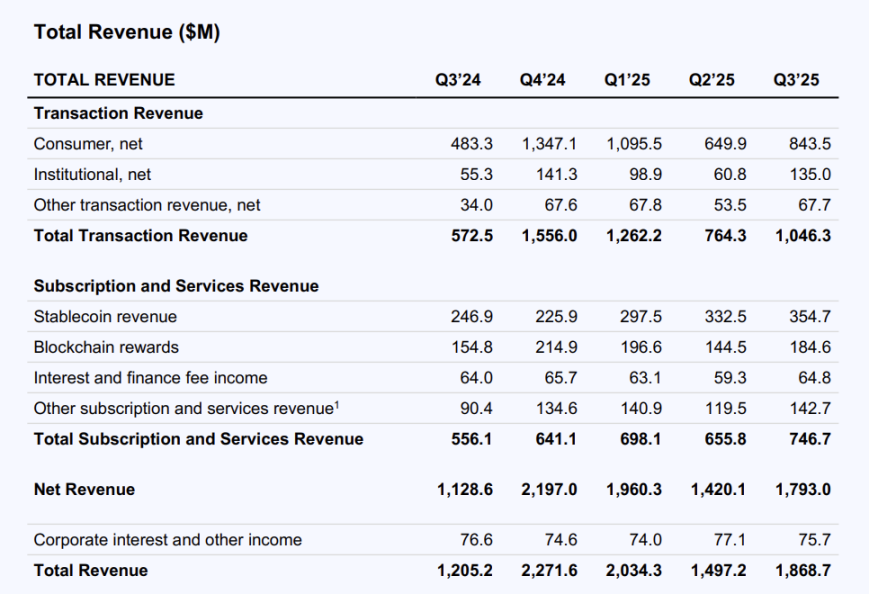

Revenue Structure: Q3 Total Revenue of $1.869 Billion, Trading Revenue Accounts for 56%

-

Total Q3 revenue reached $1.869 billion, a 25% increase quarter-over-quarter, primarily driven by the recovery in trading activity and steady growth in subscription services.

-

Trading revenue rose 82.7% year-over-year to $1.046 billion, up 37% sequentially. Retail user trading revenue amounted to $844 million, accounting for over 80% of total trading revenue; institutional trading revenue reached $135 million, surging 122% quarter-over-quarter, largely due to synergies following the Deribit acquisition.

-

Subscription and services revenue reached $747 million, up 14% sequentially, with diversified income streams such as stablecoin-related revenue ($355 million), blockchain rewards ($185 million), and interest and financial service fees ($64.8 million) continuing to contribute strongly.

Cost Optimization and Efficiency?

-

Operating costs decreased 9% sequentially to $1.388 billion, although core investments in technology development and marketing increased (including the Deribit acquisition).

-

Net income was $433 million, adjusted net income was $421 million, and adjusted EBITDA reached $801 million.

Crypto Holdings Increase

Coinbase acquired an additional 2,772 BTC and 11,933 ETH during Q3, increasing its total Bitcoin holdings to 14,458 BTC and Ethereum holdings to 148,715 ETH.

Platform Core Metrics

-

Platform Assets: Coinbase held or managed $516 billion in assets on behalf of customers, with custodied assets surpassing $300 billion for the first time, setting a new record. This growth is partly due to Coinbase serving as the primary custodian for most cryptocurrency ETFs.

-

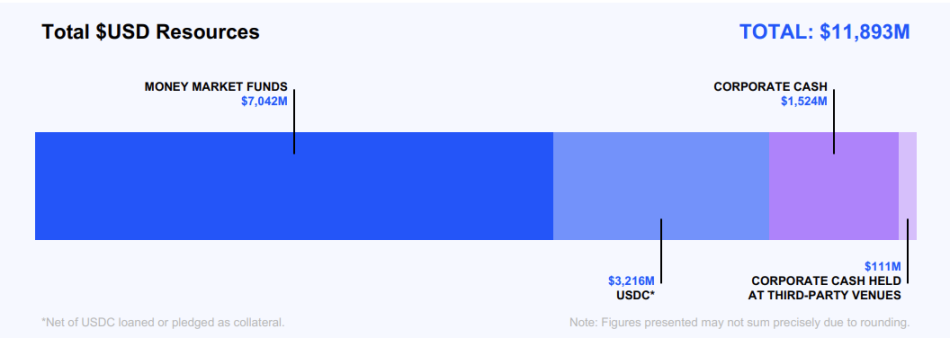

Liquidity Reserves: As of the end of Q3, Coinbase held $11.9 billion in USD-denominated assets (including $7.042 billion in money market funds, $1.524 billion in corporate cash, and $3.216 billion in USDC), a 28% increase quarter-over-quarter, driven mainly by a $3 billion convertible bond issuance and revenue growth. Including $2.6 billion in crypto assets used for investment and $1 billion in crypto collateral, total available resources reached $15.5 billion.

-

Trading Volume: Global spot crypto trading volume on Coinbase increased 38% quarter-over-quarter, while U.S. spot crypto trading volume grew 29%, reaching a total of $295 billion. Retail spot trading volume rose 37% to $59 billion, reflecting significantly improved activity.

-

USDC-Related Scale: USDC market cap hit a historic high of $74 billion in Q3. Average USDC balance on the Coinbase platform reached $15 billion during the quarter, up 9% sequentially.

-

Customer Scale: The number of active clients in institutional financing services achieved double-digit quarterly growth, with average loan balances reaching $1.2 billion, a new high.

-

Employee Count: Full-time employee count increased 12% sequentially to 4,795.

Strategy Execution: Accelerating the "Everything Exchange" Blueprint

Coinbase continued advancing its "Everything Exchange" strategy in Q3, accelerating the construction of a comprehensive financial services platform through expanded asset coverage, business extension, and ecosystem enhancement.

Dual Breakthroughs in Asset Coverage and Derivatives Business

-

Spot asset offerings continued to expand, including integration with DEXs on Base to meet diverse investment demands.

-

The derivatives business achieved milestone growth with the completion of the Deribit acquisition and the launch of compliant perpetual futures and 24/7 trading services in the U.S.

The earnings report showed that Coinbase's institutional trading revenue reached $135 million in Q3, a significant 22% increase quarter-over-quarter, with Deribit contributing $52 million—nearly 39% of institutional trading revenue—primarily from sustained growth in options trading. Post-acquisition, Deribit has significantly boosted Coinbase’s notional derivatives trading volume in the global crypto options market, with the combined entity achieving over $840 billion in notional derivatives trading volume in Q3.

Moreover, Deribit's integration has directly elevated Coinbase’s market share in core derivatives markets. Based on Q3 performance, Deribit has transitioned from an "acquisition target" to a "strategic asset": delivering short-term gains in revenue and market share, strengthening business ecosystem synergy through product and customer integration in the medium term, and building long-term competitive moats in regulated derivatives markets. With continued institutional demand growth for crypto options, Deribit is poised to become one of Coinbase’s core growth engines over the next 1–2 years.

Accelerated Penetration in Stablecoin and Payment Use Cases

-

In Q3, Coinbase users held an average of $15 billion in USDC.

-

Payment use cases continue to expand: Coinbase launched its Payment API and B2B Payment UI/API, enabling enterprises to embed stablecoin settlements and 24-hour payments via USDC on the Base chain.

-

Coinbase One Card integrates cryptocurrency rewards into fiat payments, with cumulative spending exceeding $100 million.

-

Advancing the x402 Protocol: This protocol enables attaching stablecoin payments to any web request and has already attracted partners such as CloudFlare, Vercel, and Google. Coinbase also released the open-source Agent Kit, enabling AI agents to integrate stablecoin wallets, positioning itself at the forefront of internet and AI agent payment innovation.

Base Upgrades and Ecosystem Expansion

-

Following the Flashblocks mainnet launch, Base further reduced block confirmation time to 200 milliseconds, enhancing transaction efficiency.

-

Base introduced cross-chain functionality between Base and Solana on testnet, allowing easier asset transfers for users and developers, with mainnet support scheduled for Q4.

-

The Base App entered testing in Q3, integrating trading, social, and payment features with embedded wallets to lower user onboarding barriers.

Captial Formation: Acquiring Echo to Expand Upstream

In late October, Coinbase announced the completion of its acquisition of Echo for approximately $375 million, paid in a combination of cash and stock.

Brian Armstrong, co-founder and CEO of Coinbase, emphasized during the Q3 earnings call Q&A that crypto technology will revolutionize the financial system, and capital formation is a critical component. He stated that acquiring Echo positions Coinbase firmly within the capital formation space.

Brian Armstrong added that Echo makes fundraising accessible to anyone, while Coinbase’s platform holds over $500 billion in assets and serves a large base of retail, institutional, and accredited investors eager to invest in unique assets. Together, they form a powerful two-sided market that makes capital formation more efficient and inclusive.

Emilie Choi, President and COO of Coinbase, noted that Echo’s management team excels at identifying promising companies and tokens. If Echo successfully launches these high-potential projects, it will enable Coinbase to move upstream into the pre-exchange token issuance phase—an effective vertical integration that benefits Coinbase’s entire product ecosystem.

Summary

Coinbase’s Q3 performance sends several important signals: first, growth in stablecoins, institutional financing, and custodial services indicates expanding institutional demand. Second, Coinbase’s diversification strategy is working. While trading revenue remains a major portion, the rising pace of subscription and service revenue suggests Coinbase is building a more stable revenue foundation.

According to Coinbase’s earnings report, the company will continue deepening its full-spectrum trading offerings across “spot, derivatives, equities, prediction markets, and commodities,” leverage Echo’s strengths to strengthen its position in capital formation, enhance Base chain’s ecosystem aggregation capabilities, and expand compliance operations in emerging markets like Brazil and India to grow its global market share.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News