Coinbase's Acquisition of Echo: Cobie's 13-Year Journey from a $200 Investment to Fame and Fortune

TechFlow Selected TechFlow Selected

Coinbase's Acquisition of Echo: Cobie's 13-Year Journey from a $200 Investment to Fame and Fortune

A person who constantly talks about failure ultimately secured nearly $400 million in investment.

By David, TechFlow

On October 21, 2025, Coinbase announced the acquisition of on-chain investment platform Echo for $375 million.

The day before, Coinbase had just spent $25 million to buy an NFT, solely to revive a podcast series. Two days, two deals, totaling $400 million—both pointing to one person:

Jordan "Cobie" Fish.

Who is Cobie?

If you follow the English-speaking crypto community, this name carries many labels: 800k Twitter followers, founder of Echo, host of the UpOnly crypto podcast, co-founder of Lido Finance… and also the whistleblower who once exposed Coinbase's insider trading with a single tweet.

In the world of crypto, he’s one of the few OGs who has survived since 2012 and remains active at the forefront of the market.

After the acquisition news broke, Cobie wrote on X: "I honestly didn’t expect Echo would be sold to Coinbase."

This sounds like a polite remark, but those who regularly follow his social media know it might actually be sincere. Because when he founded Echo two years ago, he also said:

"I thought there was a 95% chance it would fail."

Someone who constantly talks about failure ultimately secured nearly $400 million in proceeds. A frequent investor across various crypto projects, Cobie doesn't appear to lack money.

But that wasn't how the story began.

Like every crypto enthusiast chasing wealth, according to his own account, Cobie entered the space in 2012 as a student, buying some Bitcoin with $200.

From an unknown student to a crypto OG, Cobie’s journey mirrors almost the entire 13-year history of the industry: early idealism, ICO mania, DeFi’s rise, FTX’s collapse… he was present for all of them.

Critically, he wasn’t just present—he survived every bull and bear cycle.

In an industry where everyone dreams of quick riches, simply staying alive over the long term is a rare kind of luck for most, and an extremely difficult discipline to maintain.

$200 Entry, Building a Celebrity Coin That Went to Zero (2012–2014)

In 2012, Jordan Fish was studying at the University of Bristol in the UK.

A computer science student, he bought his first batch of Bitcoin at under $10 per coin. According to his later tweets, he started in crypto with only $200 in capital.

At $10 each, that amounted to roughly 20 Bitcoins at the time. He adopted the online alias CryptoCobain, later shortened to Cobie.

In 2013, Bitcoin surged from $13 to $1,000. That January, Cobie landed a job at a UK startup called CYOA as Chief Technology Officer.

Then, by a random twist of fate, Cobie developed a "celebrity coin," altering his trajectory.

Between 2011 and 2012, mainstream Western media rarely covered Bitcoin. The Keiser Report was one of the few early programs consistently discussing cryptocurrencies, playing a key role in shaping early community understanding.

The show’s host, Max Keiser, later became an advisor on Bitcoin to the president of El Salvador.

Keiser himself, having accurately predicted Bitcoin would surpass $1,000, along with his flamboyant style—like tearing up dollar bills on air—became crypto’s “mad prophet.”

At one point, Keiser jokingly tweeted that if a KeiserCoin failed to reach a $1 billion market cap within 90 days of launch, he’d appear naked on his show.

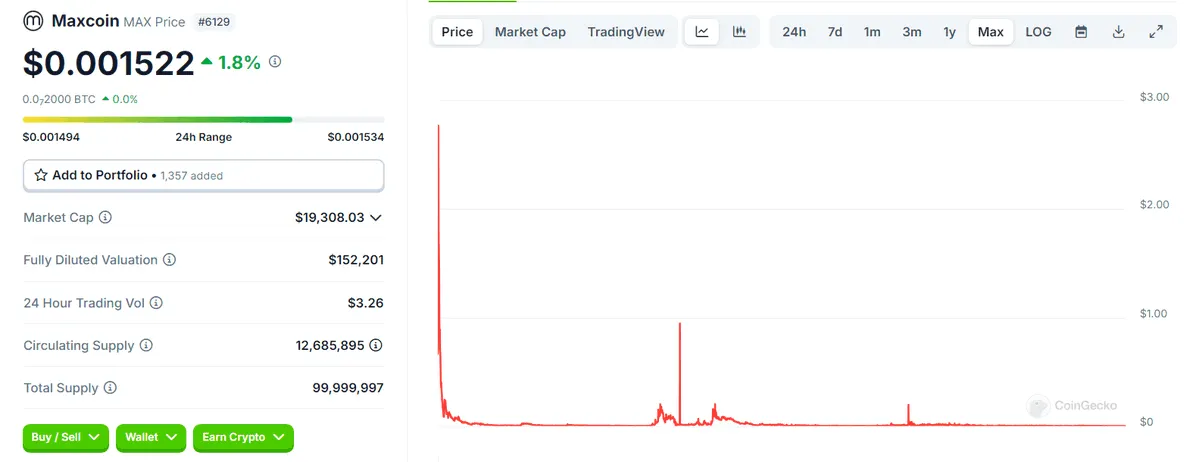

Cobie and another partner, Luke Mitchell, actually created a coin named MAX (Maxcoin), forking it from Bitcoin at the time. This may have been the first celebrity coin in crypto history to appear on television—over a decade before politicians and celebrities jumped on the trend.

On January 28, 2014, Episode 555 of Keiser Report, titled “Launch of Maxcoin,” aired. Keiser mined Maxcoin’s genesis block live in front of a global audience.

By February 14—Valentine’s Day—Maxcoin reached $3.11, with a market cap of $8.5 million. Cobie and Luke were invited onto Keiser’s show to discuss technical details.

Then reality hit. Aside from Keiser promoting it on his show, Maxcoin had no real utility. No merchants accepted it, no use cases existed. Worse, in February 2014, Mt. Gox collapsed, triggering a crash across the entire crypto market.

By December 31, 2014, Maxcoin closed at $0.00666—a 99.8% drop. Development halted, and even Keiser stopped mentioning the coin.

Cobie continued working at the UK tech startup until April 2015. As a developer, he publicly stated on Twitter that he never held any Maxcoin.

By then, Bitcoin had fallen from $1,000 to $200. Most people who entered in 2013 likely left crypto forever—but Cobie chose to stay, just differently.

Growth Work in Web2, KOL on Twitter (2015–2020)

In April 2015, Cobie stepped down as CTO at CYOA and joined Enki, a programming education startup, as Head of Growth.

The crypto market was lifeless. Bitcoin traded sideways between $200 and $400; most altcoins had gone to zero or near-zero. Maxcoin was completely forgotten.

Cobie could have treated his earlier coin experiment as youthful folly and moved on. On the surface, that’s exactly what he seemed to do.

In August 2017, he joined Monzo, then the hottest fintech unicorn in the UK. The digital bank championed a fully mobile banking experience, aiming to disrupt traditional banking.

That summer, Bitcoin had just surpassed $2,000, and the ICO boom was brewing. By December 2017, Bitcoin would peak near $20,000, sending the crypto world into frenzy.

But Cobie was still in Monzo’s office.

Outside, from 2017 to 2020, crypto experienced a full bull-bear cycle: the madness of late 2017, the crash of 2018, stagnation in 2019, and the March 2020 COVID plunge.

During these three years, public reports indicated he “earned enough at Monzo to go full-time into crypto.”

Meanwhile, he never stopped tweeting—commenting on Bitcoin prices, mocking ICO projects, analyzing DeFi protocols… He became a staple of Crypto Twitter, a constant voice always online with opinions.

By March 2020, in an interview, he revealed his asset allocation: only 5% in crypto, 95% in cash and traditional assets.

This shocked many—an influential crypto KOL holding almost no crypto.

Perhaps this explains why he could stay at Monzo for three years. He didn’t need to profit from trading; he had stable income and career growth.

But everything changed in the summer of 2020. DeFi exploded. Compound launched COMP tokens, starting liquidity mining. Uniswap airdropped UNI, making early users instant millionaires. Suddenly, those who had held on realized new opportunities were emerging.

In September 2020, Cobie left Monzo. He had spent over five years embedded in traditional tech.

But this time, he wasn’t just a junior programmer. His roles in product and growth brought both income and experience—and invaluable knowledge of the financial sector.

The former developer of a failed celebrity coin was about to become one of DeFi’s most successful early investors.

Betting on Lido, Launching a Podcast (2020–2022)

In October 2020, one month after going full-time back into crypto, Cobie made a life-changing investment.

Two Russian developers were building a project called Lido, offering liquid staking: users could stake any amount of ETH and receive stETH as a tradable token.

Most people probably didn’t grasp its significance. But Cobie did. He not only invested but helped secure audits, promoted it on Twitter, and introduced it to other investors. He became one of Lido’s earliest and most active supporters.

By the end of 2021, Lido became Ethereum’s largest staking provider. By 2024, it managed over $30 billion in assets, with LDO token市值 exceeding $2 billion.

Cobie’s early investment returned over 1000x. According to multiple international media reports, this single deal earned him “several million dollars.”

But what truly elevated Cobie from a Twitter KOL to an industry influencer was a podcast.

In April 2021, Cobie co-founded the UpOnly podcast with another crypto KOL, Ledger.

The timing was perfect. It was the height of the bull market; everyone wanted to learn about crypto, but most podcasts were either too technical or too superficial. UpOnly struck a balance:

Talking about deep topics in a relaxed way.

Industry heavyweights like Vitalik, Michael Saylor, Do Kwon, SBF, and CZ appeared on his show, willing to spend one to two hours chatting with two podcasters.

Cobie and Ledger didn’t pretend to know everything—they asked naive questions, cracked jokes, admitted ignorance. This put seasoned guests at ease, leading them to share things they wouldn’t say elsewhere.

The podcast’s business model was also innovative. They issued NFTs (UpOnly NFTs) as membership cards, granting holders access to recordings, Q&A sessions, and exclusive content.

These NFTs later traded for over 10 ETH on secondary markets. Just days ago, Coinbase acquired this NFT collection for $25 million.

Ironically, UpOnly’s biggest sponsor was FTX. SBF’s exchange sponsored the podcast for a long time—until its sudden collapse in November 2022.

On the day of the crash, Cobie was live-streaming, tracking suspicious fund movements worth $400 million. Analyzing on-chain data in real time, he explained what was happening. This stream later became a key record of FTX’s downfall.

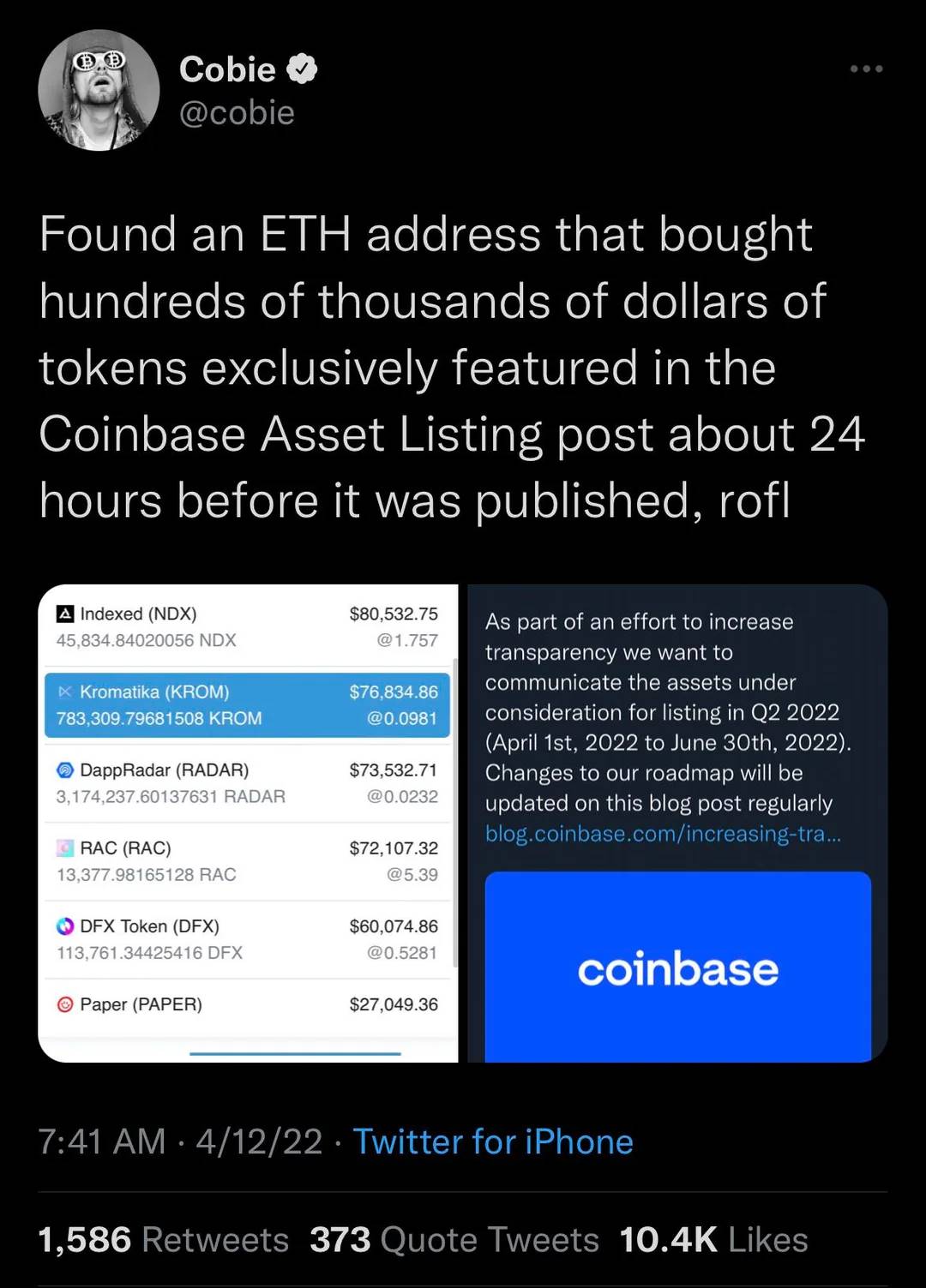

Another irony: Cobie became the whistleblower exposing insider trading at Coinbase.

In December 2022, Cobie tweeted about a wallet address buying large quantities of tokens shortly before Coinbase listings. This wasn’t a one-off—it was a repeated pattern.

Within hours, the tweet was shared tens of thousands of times. Media picked it up. Regulators launched investigations.

Eventually, the U.S. Department of Justice charged Ishan Wahi, a former Coinbase product manager, marking the first criminal case of crypto insider trading in U.S. history.

Coinbase was forced to respond publicly and improve its listing process. The entire industry began discussing transparency. And Cobie—the once-failed celebrity coin developer—had become an industry watchdog.

By the end of 2022, his influence peaked. With over 800k Twitter followers, he was one of the most powerful voices in the English-speaking crypto world. UpOnly had become one of the most popular crypto podcasts.

More importantly, he built a unique persona:

Both an insider—with roots as an early adopter, technical background, and successful investments—and a critic who mocks hype and exposes wrongdoing, maintaining a certain distance. In his own words:

"I’m still a cynic (Cobain), just now with money."

Yet Cobie likely knew KOL fame is fleeting, and podcasts can fade. He needed to build something more enduring.

Echo: Possibly His Final Startup (2023–2025)

In early 2023, the crypto market was still at its bearish bottom. The aftermath of FTX’s collapse lingered. Cobie posted a cryptic tweet:

"The best time to build is when everyone thinks there’s no hope."

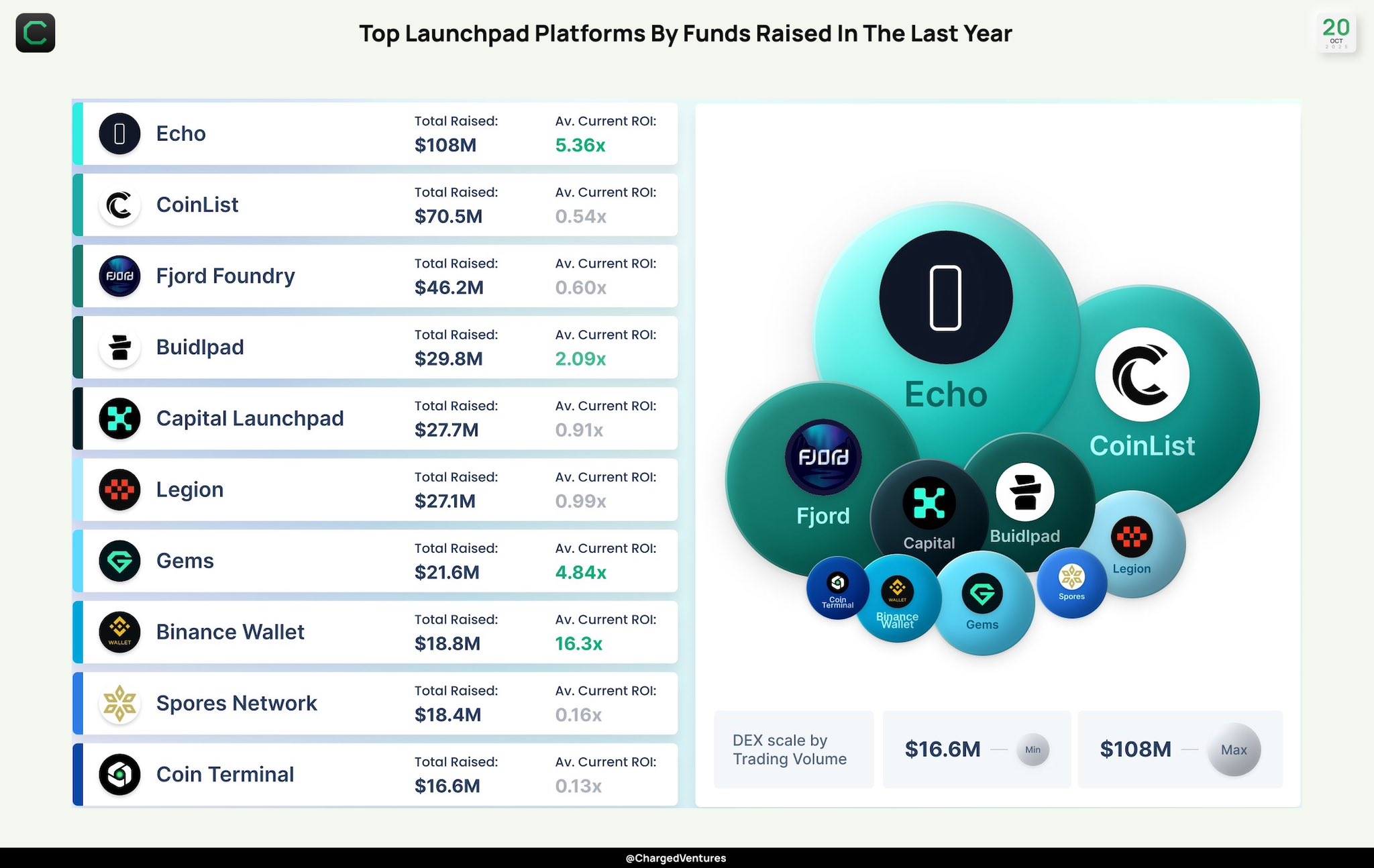

Months later, Echo quietly launched.

Unlike the flashy debut of his celebrity coin Maxcoin, Echo had no launch event, no whitepaper, not even an official announcement. Just a simple website with a straightforward function: helping projects raise funds from early investors.

Specifically, Echo does two things.

First, enabling crypto projects to sell tokens via private sales to qualified investors. Second, using a tool called Sonar to let ordinary users participate in certain public sales. All processes are on-chain, non-custodial, and transparent.

Initially, it hardly resembled a proper product—minimal interface, limited functionality, essentially just a tool for signing SAFTs (token purchase agreements) between projects and investors. Yet the first project arrived quickly: Ethena.

Why did Ethena choose this unknown, newly launched platform? The answer is simple: Cobie.

Ethena’s founder, Guy Young, was a regular guest on the UpOnly podcast and personally close to Cobie. More importantly, Cobie didn’t just offer the platform—he personally invested in Ethena and publicly endorsed it on Twitter. For a new project, Cobie’s endorsement was priceless.

Ethena completed its seed round through Echo. Months later, when Ethena became one of 2024’s hottest DeFi protocols, Echo instantly gained credibility.

Soon after, major projects like MegaETH, Initia, and Plasma launched fundraising rounds on Echo. By mid-2024, Echo’s operating model was mature. A typical flow looked like this:

A project approaches Echo. The Echo team conducts basic due diligence. The project sets funding terms and issues tokens via Echo’s smart contracts.

Investors (institutions or individuals) invest through the platform, with funds and tokens flowing transparently on-chain.

Critically, Echo itself doesn’t hold custody of funds or provide investment advice—it only offers tools and connections.

Cobie’s role went far beyond being the platform’s founder. He was effectively Echo’s top BD (business development). Every time he interviewed a founder on his podcast, it could turn into a potential client. Every time he commented on a project on Twitter, it served as free advertising for Echo.

He didn’t even need to actively sell. When you’re one of the most influential voices in crypto, people come to you. By the time of the acquisition in October 2025, Echo had processed over $200 million in transactions across approximately 300 investments.

In a sense, Coinbase didn’t just acquire the Echo platform—it acquired the entire ecosystem Cobie had built. This explains why Coinbase paid $375 million: they bought the key to entering this network.

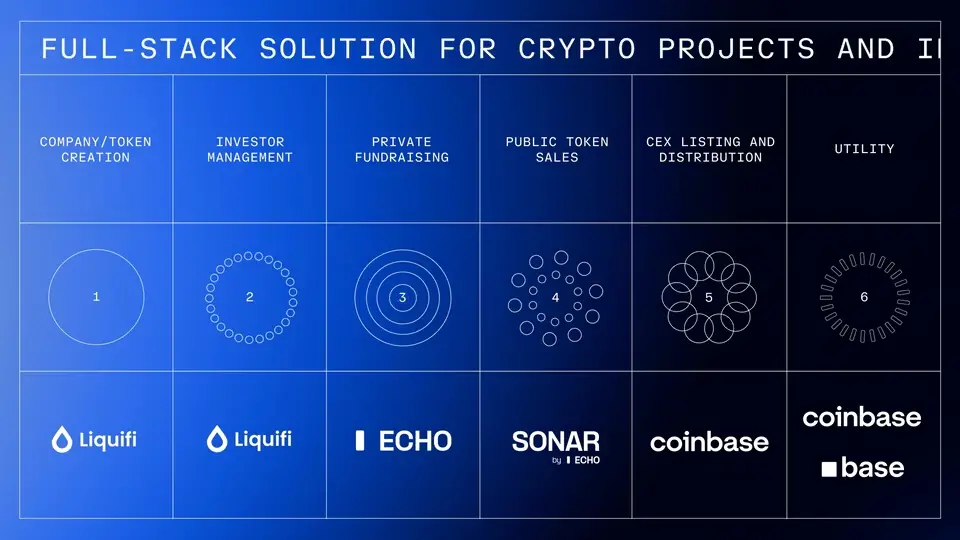

The deal structure wasn’t all cash—it included Coinbase stock, meaning Cobie is now also a shareholder of Coinbase. The Echo team will join Coinbase, though the brand will remain independently operated for now. The Sonar tool will be integrated into Coinbase’s product suite.

From Coinbase’s perspective, the rationale is clear.

In July 2025, they acquired LiquiFi, a token management platform. Now they’ve acquired Echo. LiquiFi handles post-token-launch operations, Echo manages fundraising, and combined with Coinbase’s core exchange business, this creates a complete pipeline from primary to secondary markets.

Community reactions to the acquisition were interesting.

Some said Cobie sold too early—Echo could have become an independent unicorn. Others saw it as proof that KOL-led startups can succeed. Some dug up old 2014 posts, contrasting Maxcoin’s failure with Echo’s exit, reflecting on “a decade of persistence”—as long as you stay at the table, you always have a chance.

But Cobie himself doesn’t seem ready to rest. He immediately announced he’s joining Paradigm as an advisor, “focusing on liquidity markets, trading, and DeFi trends.”

The Last OG

In crypto, 13 years is an unimaginably long time.

Most early participants from 2012 have either retired or vanished after being wiped out in a previous cycle. Exchanges have cycled through generations, blockchains have evolved multiple times, and even the definition of decentralization has shifted repeatedly.

But Cobie is still here.

He has witnessed every cycle, participated in every bubble, and survived every crash.

He’s not the richest, certainly not the most famous, nor even the most successful entrepreneur in crypto. But he might be the most complete crypto practitioner:

Traded coins, lost money; started companies, failed; invested, succeeded; been a KOL, influenced markets, built products, executed exits.

From Jordan Fish to CryptoCobain, from a college student who bought $10 worth of Bitcoin to a founder acquired by Coinbase—this story spanned 13 long years.

What kept him going? In his own words, perhaps it’s understanding the difference between luck and skill, and the ability to navigate between them:

"I was very lucky early on—I made some good altcoin trades early, putting me in a profitable position. I thought I was really good at this thing called crypto trading.

But anyone who thinks they’re naturally good at it right away is wrong. If you happen to enter during a bull market and successfully trade altcoins, that doesn’t mean you’re skilled."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News