The Ultimate Airdrop Guide for Perp DEX in 2026

TechFlow Selected TechFlow Selected

The Ultimate Airdrop Guide for Perp DEX in 2026

This guide covers 8 leading Perp DEXs with active points programs that are worth farming, along with proven strategies and tools.

Author: Stacy Muur

Translated by: TechFlow

TechFlow Intro: With Hyperliquid’s massive success, the decentralized perpetual exchange (Perp DEX) sector has entered an intensely competitive phase. Despite extreme volatility across crypto markets in 2025, trading volume in this space surpassed $1.2 trillion.

This article—authored by veteran researcher Stacy Muur—systematically outlines the eight most promising Perp DEX projects with active points programs to watch in 2026, and details a proven, low-risk strategy for farming trading volume and capturing airdrops via funding rate arbitrage. For investors aiming to capture value in the trillion-dollar derivatives赛道, this is an indispensable guide to avoiding pitfalls and uncovering opportunities.

Full Text Below:

This guide covers eight leading Perp DEXs with active points programs worth farming, along with validated strategies and tools. Ready? Let’s begin.

Introduction

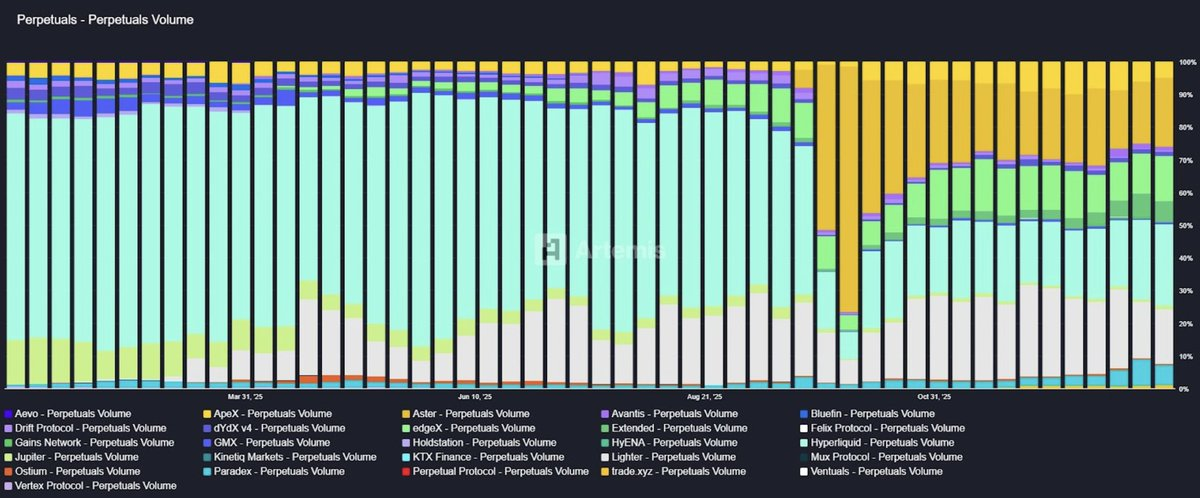

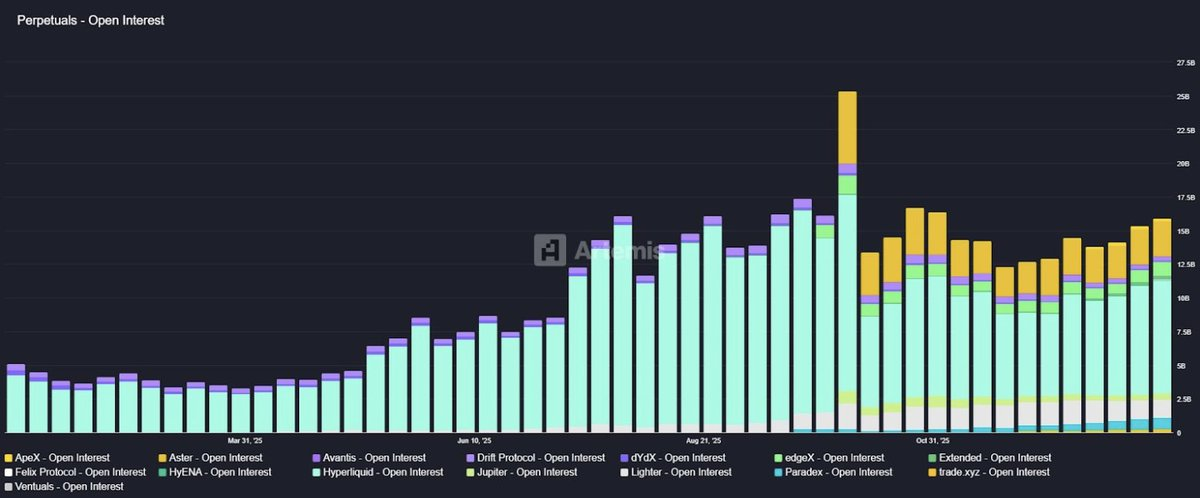

Since Hyperliquid’s launch, the Perp DEX landscape has become fiercely competitive. Trading volume in this sector surged from $64.76 billion in 2023 to over $1.2 trillion in 2025—even during the market crash of October 10–11, 2025, its share of global perpetual futures trading rose to 26%.

Caption: Data source — Artemis

At that time, Hyperliquid accomplished what many deemed impossible: it built a truly viable challenger to Binance—and captured over 70% of decentralized perpetual contract trading volume.

Yet new Perp DEXs are now emerging daily.

But why are we seeing so many onchain perps today? Is it solely due to Hyperliquid’s success?

While that’s certainly true—and Perp DEXs have indeed become a highly profitable sector—the fundamental reason lies deeper: prior to 2025, competition among Perp DEXs centered almost exclusively on technology—faster L1s, more advanced ZK proof systems, higher-throughput DA (data availability) layers. In 2025, however, competition shifted decisively from technology to incentives.

The current state of the industry reveals mounting pressure from emerging Perp DEXs offering comparable latency, lower fees, and compelling incentive programs.

Caption: Data source — Artemis

Today, Hyperliquid’s market share has fallen to roughly 20%, and new platforms pose a real threat. For example, Variational not only attracts users through airdrops and points programs but also draws attention—and users—via loss refunds.

In October 2025, trading volume hit a record $1.2 trillion—nearly double the previous month’s total. This surge was driven overwhelmingly by incentives: points programs and airdrops. This sector has become one of the most successful narratives in the airdrop game. Protocols are preparing to distribute millions of dollars in airdrops to bootstrap liquidity and user engagement.

This article analyzes opportunities across the Perp DEX landscape and highlights practical farming strategies.

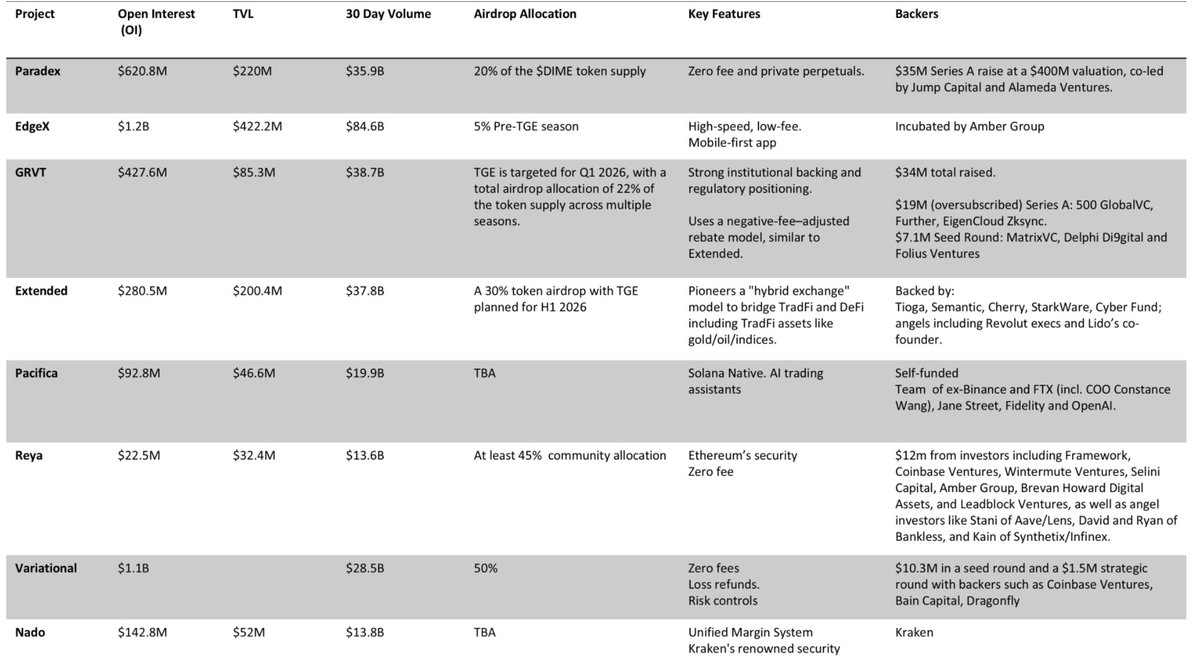

Eight Promising Perp DEXs

The primary risk associated with Perp DEXs is that some platforms have no intention of issuing tokens, while others may ultimately prove worthless and unworthy of your time (e.g., projects designed purely to extract trading fees from users). Thus, the core question is never “Can I farm it?”—but rather, “Is it worth farming?”

This section identifies Perp DEXs worthy of your time based on trading volume, open interest, user growth, and fee economics—as of January 16, 2026—using data from DefiLlama.

1. Paradex V2

Paradex is a privacy-focused Perp DEX built on Starknet’s first application chain. It offers zero trading fees, deep liquidity across hundreds of crypto assets and pre-market assets, atomic settlement, and institutional-grade privacy features via a mobile-optimized interface.

Architecturally, it is designed as a unified DeFi ecosystem (the Paradex Ecosystem), comprising the Paradex exchange, Paradex Chain, and XUSD—a native synthetic dollar backed by the $DIME token.

Core Features:

- Leverage up to 50x across multiple markets

- Low fees: 0.02% for makers, 0.05% for takers

- Unified margin functionality

- ZK-Rollup technology delivering Ethereum-level security

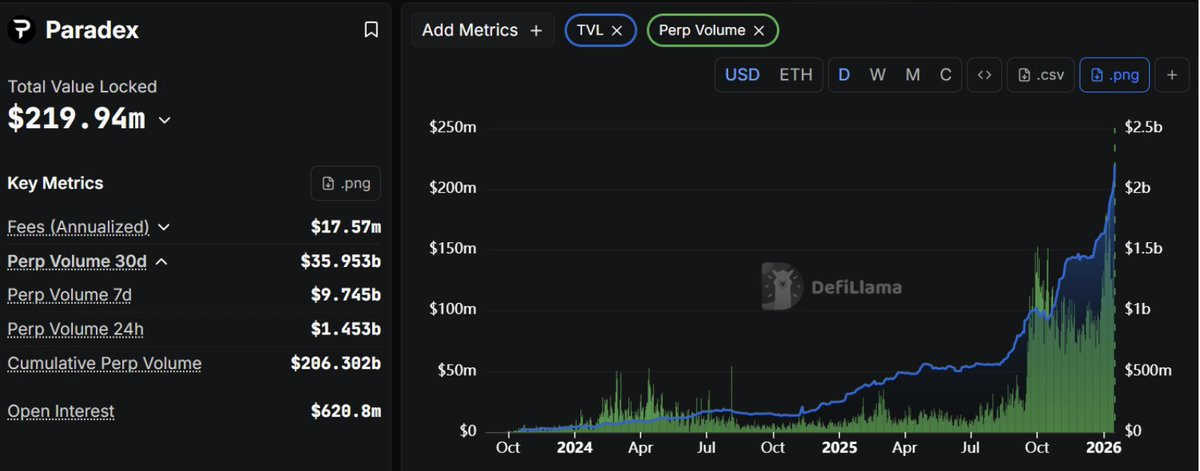

Caption: Source — Defillama

Paradex has demonstrated impressive growth to date:

- TVL: ~$220 million (nearly 6x increase from $25 million at the start of 2025)

- Cumulative trading volume: $206 billion

- Open interest: ~$620 million

- 30-day trading volume: $36 billion

Points Program:

The Paradex Foundation decided to extend Season 2 of its points program by up to six months to ensure optimal conditions for the $DIME token launch. This extension supports the rollout of spot trading, periodic options, pre-market trading, and yield-bearing synthetic dollars (XUSD).

The Airdrop Warm-up and Season 1 ran from February 1, 2024, to January 2, 2025. Paradex is now in Season 2, distributing 4 million XP (points) weekly to active traders every Friday.

How to Participate:

- Register and set up an account on Paradex, then connect an EVM-compatible wallet.

- Set a nickname. Link X/Discord for Sybil resistance and community XP boosts.

- Deposit USDC and begin trading.

- Earn XP for holding positions (“Position XP”), paying fees (“Fee XP”), and even liquidations (“Liquidation XP”).

- Earn Treasury XP by depositing USDC into the treasury to provide liquidity.

- Share your referral link to earn 10% of your referrals’ XP. Referees receive a 5% XP bonus.

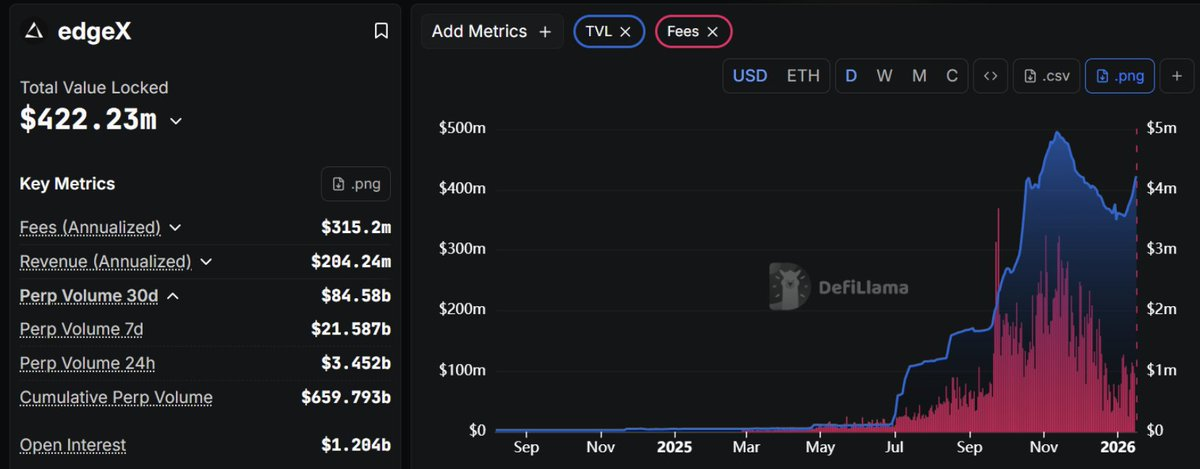

2. edgeX

edgeX is a Layer-2 (L2) exchange offering both perpetual and spot trading. Initially incubated by Amber Group on StarkEx ZK-rollup as a ZK-rollup-based Perp DEX, it is now transitioning to EDGE Chain—a purpose-built Ethereum L2 optimized for high-throughput financial applications.

Core Features:

- Built on StarkNet (zk-Rollup), enabling fast settlement

- Leverage up to 50x

- Maker fee 0.02% / Taker fee 0.05% (among the cheapest Perp DEXs)

- Central Limit Order Book (CLOB) model

Market Performance:

- Weekly trading volume: $21.59 billion

- 30-day trading volume: $84.58 billion (consistently top 5)

- Open interest: $1.2 billion

- TVL: $422 million

Points Program: edgeX recently concluded its 27-week “Open Season” points program. The Pre-TGE season launched on January 7, 2026, rewarding organic platform usage with XP. XP is distributed weekly until TGE (expected by March 31 or earlier).

How to Participate:

- Create your own trading account: https://pro.edgex.exchange/referral/MUUR

- Deposit and begin trading. Prioritize spot trading for a 3x volume-to-XP multiplier.

- Trade directly via the edgeX mobile app for a 1.2x XP boost.

- Holding MARU tokens unlocks an additional 1.05x–1.15x XP multiplier. Registering as a Messenger grants a 1.05x–1.1x XP boost.

- Perpetual contract losses contribute 10% of XP distribution. Increase overall trading volume, which accounts for 60% of weekly XP allocation.

3. GRVT

GRVT (pronounced “Gravity”) is a Perp DEX founded in 2023, built within the zkSync ecosystem using a modular ZK Stack architecture. It operates as an L3 Validium application chain, optimized for high-performance perpetual contract trading while inheriting Ethereum-level security via zero-knowledge proofs.

Core Features:

- Privacy-focused exchange

- Combines self-custodial Layer-2 (ZK/Validium) settlement with an off-chain CLOB

- ZKsync Atlas enables high-performance perpetual contracts compatible with Ethereum composability

- L3 design prioritizes throughput and latency without sacrificing cryptographic proof integrity

Growth Metrics:

- TVL: ~$85 million

- Cumulative trading volume: $214.21 billion

- Open interest: ~$427 million

- 30-day trading volume: $38.7 billion

Points Program: After an extended development period, GRVT officially launched its points incentive system in 2024 and is currently in Season 1, rewarding users who contribute to trading activity, liquidity, and open interest.

How to Participate:

- Register an account and deposit funds.

- Open positions to earn points—with increased weight given to maintaining open positions.

- Join the referral program to earn additional fee rebates.

4. Extended

Extended (formerly X10) is a high-performance perpetual contract DEX on Starknet, built by former Revolut team members. Though initially focused on perpetuals, the protocol is expanding toward a unified margin model supporting spot trading and integrated lending.

Core Features:

- Hybrid architecture: Off-chain CLOB for matching and risk management + On-chain settlement

- Leverage up to 100x on both crypto and traditional finance (TradFi) assets

- Unified margin enabled via XVS treasury shares, integrating lending and liquidity

- Markets include synthetic TradFi assets

Market Performance:

- TVL: $200 million

- 30-day trading volume: $37.8 billion

- Open interest: $280 million (45.2% YTD growth)

Points Program: Extended launched its points program on April 30, 2025, distributing 1.2 million points weekly between traders and liquidity providers (LPs).

How to Participate:

- Deposit and open positions to generate trading volume.

- Provide liquidity to the treasury to earn APY plus an extra 20% in points.

- Unlock your referral link after reaching $10,000 in trading volume, earning 10% commission and 2.5% points from referrals.

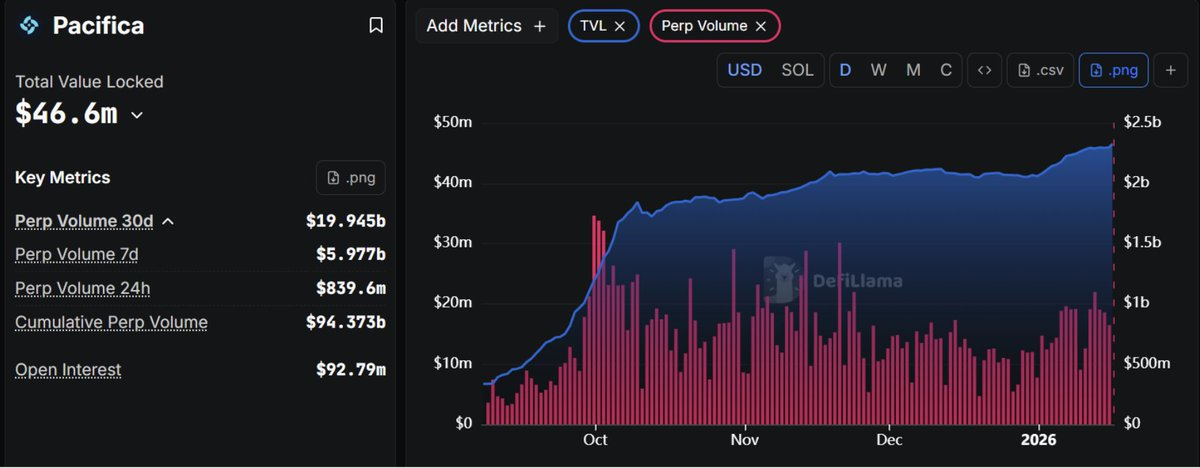

5. Pacifica

Pacifica is a Solana-native hybrid Perp DEX currently in closed beta testing. Despite its early stage, it has already attracted massive trading volume—sometimes exceeding mature Solana DEXs like Jupiter and Drift.

Given that prior Solana perpetual protocols (e.g., Drift and Zeta) delivered strong airdrops—and Pacifica is self-funded—the likelihood of a meaningful airdrop here is above average.

Core Features:

- Hybrid architecture: Off-chain CLOB + On-chain Solana settlement

- Leverage up to 50x

- AI-powered trading assistant

- Liquidation care points receive a bonus

Market Performance:

- 24-hour trading volume: $839 million

- 30-day trading volume: $19.95 billion

- Open interest: $92.8 million

Points Program: Pacifica launched its Continuous Trading Points Bonus on January 2, 2026, offering up to 23% extra points. The bonus increases by 2% daily after five consecutive days of trading, capping at 10%.

How to Participate:

- Enter closed beta using an invite code.

- Connect your wallet, deposit funds, and open positions.

- Join the referral program to obtain your own access code.

6. Reya

Reya, developed by Reya Labs, is a trading-optimized modular L2 built on a custom implementation of Arbitrum Orbit. Reya is more than just a single DEX—it’s a foundational execution layer with shared liquidity, enabling multiple trading frontends to build atop it.

By centralizing liquidity at the network layer, Reya aims to solve liquidity fragmentation.

Core Features:

- Dedicated ZK Rollup built specifically for trading

- Strong security via ZK proofs ensuring verifiable order execution and settlement

- rUSD (yield-bearing stablecoin), powered by Reya’s unified liquidity framework

Market Performance:

- 30-day trading volume: $13.7 billion

- Cumulative trading volume: $95.7 billion

- TVL: $32.4 million

Points Program: Reya Chain Points (RCP) track contributions and will convert to $REYA at TGE (token generation event). Trading activity typically earns the highest rewards; points are distributed every Monday at noon GMT.

How to Participate:

- Deposit or bridge USDC.

- Use the “Stake” tab to deposit liquidity into the LP treasury, converting rUSD to srUSD and locking funds to earn loyalty points and 4.8% APY.

- Open trading positions to increase volume and maximize points.

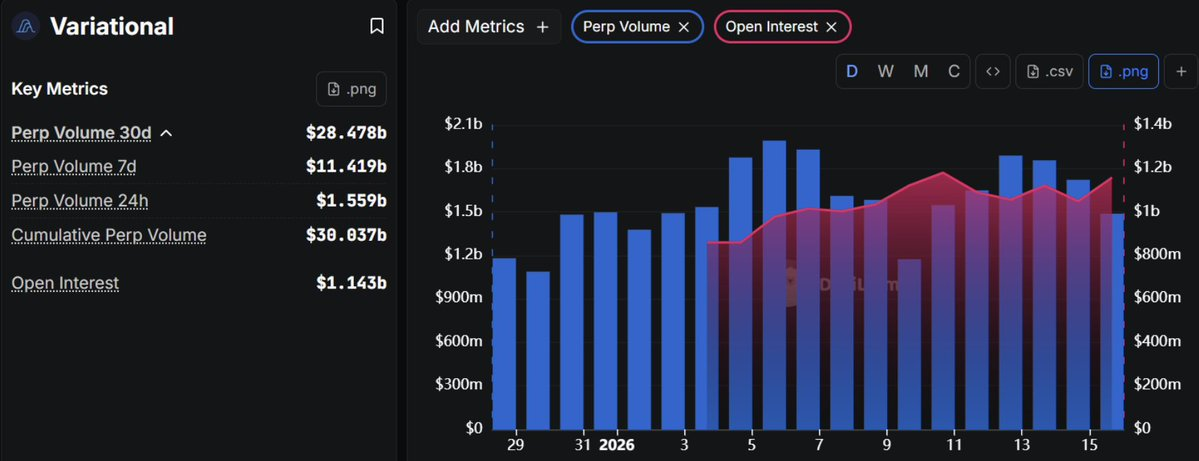

7. Variational

Variational is a peer-to-peer perpetual and generalized derivatives trading protocol built on Arbitrum. It automates the full cycle—from trade execution to liquidation.

Variational operates two main applications: Omni (a leveraged perpetual trading platform for retail users) and Pro (an advanced trading platform for non-linear derivatives).

Core Features:

- RFQ (Request-for-Quote) model instead of order book

- Vertically integrated market makers named Omni Liquidity Providers (OLPs)

- Zero trading fees

- Loss refunds

In 2026, Omni evolved from testnet to one of crypto’s largest tick-by-tick platforms, gaining traction largely due to its loss refund feature.

Growth Metrics:

- Cumulative trading volume: $30 billion

- Weekly trading volume: $11.4 billion

- Open interest: $1.1 billion (top 5 among Perp DEXs)

Points Program: Variational Omni has officially launched its loyalty program. Users earn base points based on activity. Points are distributed every Friday at 00:00 UTC.

How to Participate:

- Register an account and deposit funds.

- Farm points by generating trading volume.

- Reward tiers—based on the past 30 days’ activity—offer benefits including enhanced loss refund probability and point multipliers.

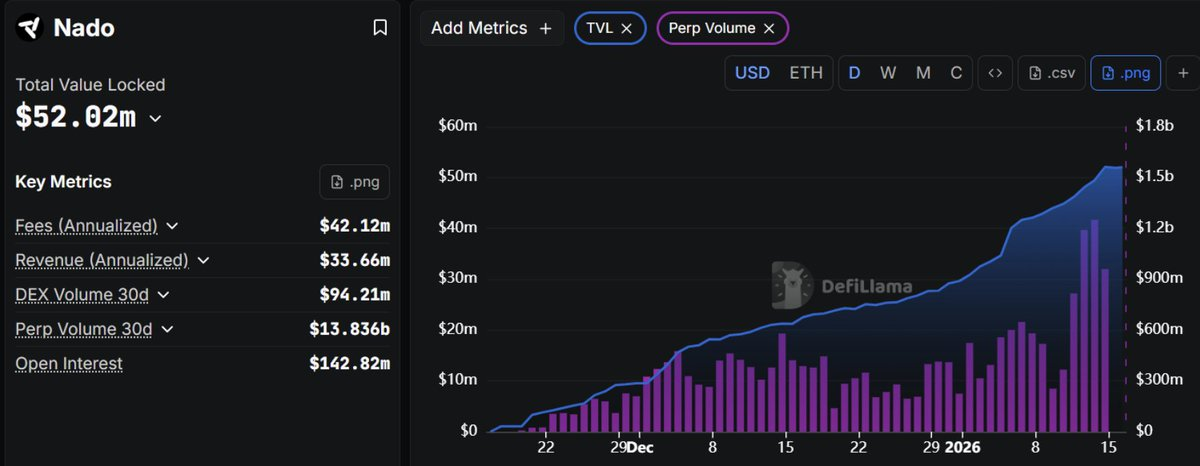

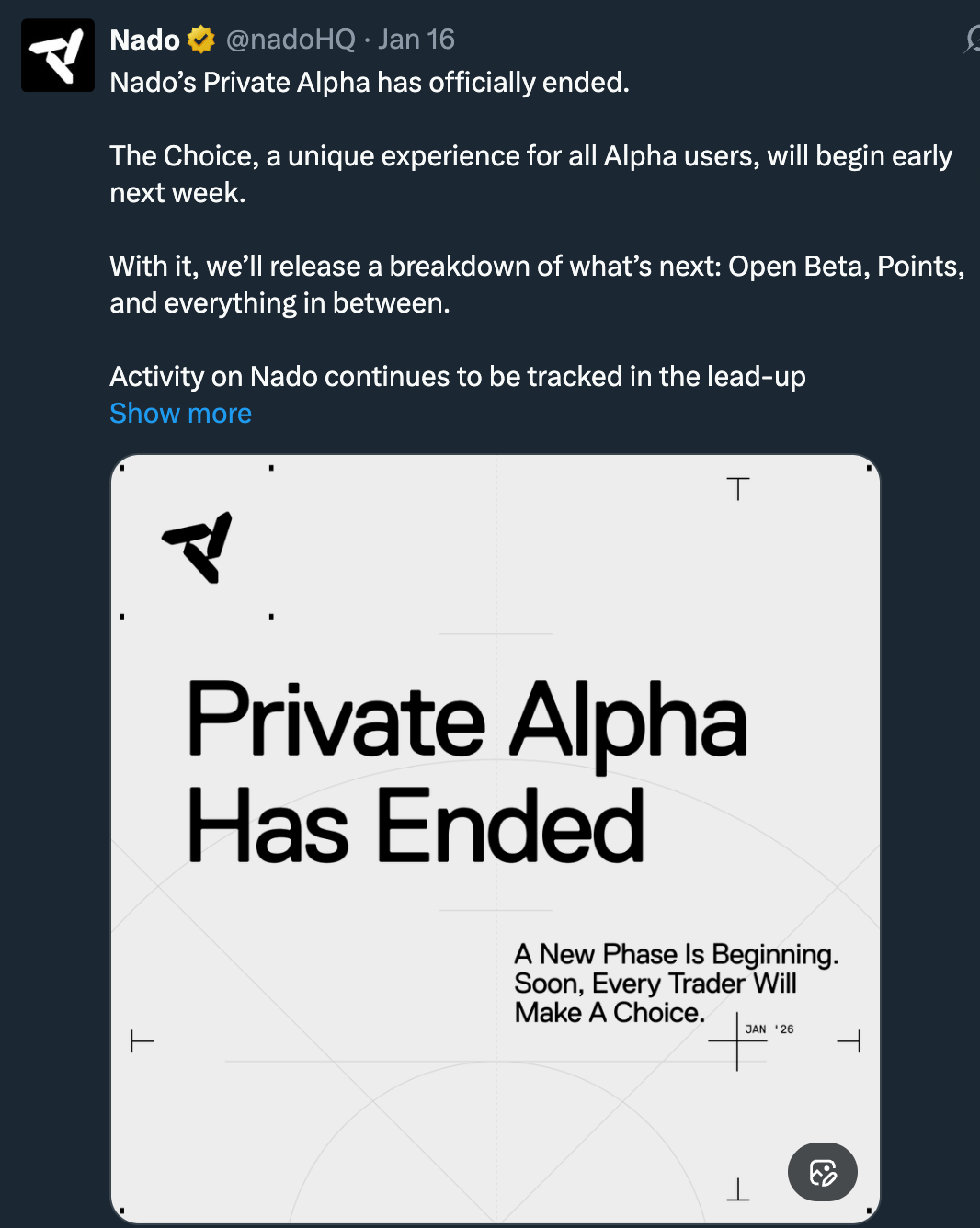

8. Nado

Nado is a full-featured CLOB DEX built on Ink (Kraken’s Ethereum L2), unifying spot, perpetuals, and money markets. Currently in private alpha, access is invitation-only.

Core Features:

- Integrated spot and perpetual trading under a unified margin model

- Nado’s liquidity providers (NLPs) deploy idle capital into the order book to earn APY

- Order matching time: only 5–15 milliseconds

Market Performance:

- 30-day trading volume: $13.8 billion

- TVL: $52 million

- Open interest: $142 million

Points Program: An airdrop will be launched following the conclusion of private alpha.

It remains unclear whether Nado will conduct a platform-specific airdrop—but early users will certainly qualify for Ink airdrop points.

Practical Strategy: Funding Rate Arbitrage

Perpetual markets have become crypto’s highest-volume financial markets. Weekly open interest (OI) regularly exceeds $5 billion.

When farming Perp DEXs, consider using lower-market-cap altcoins to generate higher reward points per dollar traded—though this carries added risk.

For inexperienced users—or those unwilling to take active trading risks solely for airdrops—funding rate arbitrage is a proven strategy to generate volume while staying profitable or at least break-even.

What Is Funding Rate Arbitrage?

Funding rate arbitrage is a common form of cash-and-carry trade in perpetual futures markets.

Funding rates represent the cost of holding a position. When funding is positive, longs pay shorts; when negative, shorts pay longs. In most perpetual markets, funding rates remain positive.

How the Strategy Works:

- Open a long position on one DEX.

- Open an equivalent short position on another DEX.

- Capture the funding rate differential.

- Simultaneously generate continuous trading volume for points accumulation and rewards.

Simplified Example:

- BTC spot price: $50,000

- BTC perpetual price: $50,100

- Funding rate: +0.01% every 8 hours (positive)

Action Required:

Go long $10,000 BTC on one DEX and short $10,000 BTC on another DEX.

This hedges your exposure: gains and losses offset regardless of BTC’s price direction. Yet because the funding rate is +0.01%, your short position receives funding every 8 hours:

$10,000 × 0.01% = $1 (every 8 hours).

If the rate stays constant: $3/day, $90/month—entirely insulated from BTC’s price volatility.

Using different DEXs—not the same platform—for long and short positions avoids Sybil detection and potential blacklisting. Funding rate arbitrage allows users to “farm” across Perp DEXs without relying on price movement.

This strategy is highly effective because it generates profit even at modest leverage—and traders avoid worrying about market volatility while easily accumulating consistent volume for points.

Key Risks You Must Understand:

Although funding rate arbitrage reduces directional risk, it is not risk-free. Certain risks—like short-side liquidation or funding turning negative—are unavoidable. Therefore, these concrete steps are essential to further mitigate risk:

- Monitor positions continuously: Actively manage open positions to avoid liquidation.

- Set stop-loss (SL) and take-profit (TP): These are hard safeguards against liquidation—especially critical for short positions.

- Avoid high leverage.

Funding Rate Bots & Tools:

Tracking funding rates manually is labor-intensive. Technical farmers often use bots—but even less-experienced airdrop hunters can benefit from these tools, which visualize optimal cross-DEX funding rate arbitrage opportunities.

For instance, they display annualized percentage returns (APR) and specify exact actions required (e.g., go long on Exchange A, short on Exchange B).

- @LorisTools: A comprehensive dashboard and filter aggregating funding rates across CEXs and DEXs—highly effective for identifying cross-exchange arbitrage.

- @Arbitraxdexs: Still in development, but useful for viewing token APRs, spreads, and inter-exchange funding rate differentials.

- @cexchange_sh: Features a built-in funding rate arbitrage aggregator focused on DEX-to-DEX pair strategies.

- @fundingviewapp: A funding rate arbitrage strategy searcher that helps identify historically profitable arbitrage pairs and calculates average APR across multiple timeframes.

- @p2p_army_here: Another arbitrage scanner with integrated analytics, identifying funding rate spreads across exchanges—including real-time spread scanning, historical rate tables, and alerting features.

- @dextrabot: An automation platform focused on airdrop points farming and copy-trading across Perp DEXs—including Lighter, Aster, Hyperliquid, Extended, and Variational—emphasizing delta-neutral bots and grid trading for low-cost execution.

Conclusion

2025 was a pivotal year for Perp traders and exchanges across the board. From successful airdrops to the October 10–11 market crash—one of crypto’s largest single-day collapses—automatic deleveraging (ADL) cycles were triggered, inflicting heavy losses even on funding rate arbitrageurs.

Yet Perp DEXs continue rising—but this time, traders must exercise greater caution. The core lesson is: where you trade matters just as much as what you trade. Carefully read documentation for any new exchange to avoid falling victim to predatory platforms.

This article equips you with the tools needed to begin your Perp DEX farming journey. Beyond that, experience and discipline will be your compass.

Critics often argue that most emerging protocols simply aim to be “the next Hyperliquid.” Personally, I don’t see this as a problem. Perp DEXs aren’t competing against each other—they’re competing against centralized exchanges (CEXs). As Perp DEXs keep growing, opportunities remain—but the bar rises steadily over time.

Remember: the biggest regret in crypto is “fading trends.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News