Hotcoin Research | Review of Leading Perp DEXs: A Cool Reflection Amidst the Data Frenzy and Outlook for 2026

TechFlow Selected TechFlow Selected

Hotcoin Research | Review of Leading Perp DEXs: A Cool Reflection Amidst the Data Frenzy and Outlook for 2026

Conduct a comprehensive analysis of these five representative Perp DEX protocols across various dimensions, including background team, technical architecture and functionality, token economics, market data, and performance.

Author: Hotcoin Research

Introduction

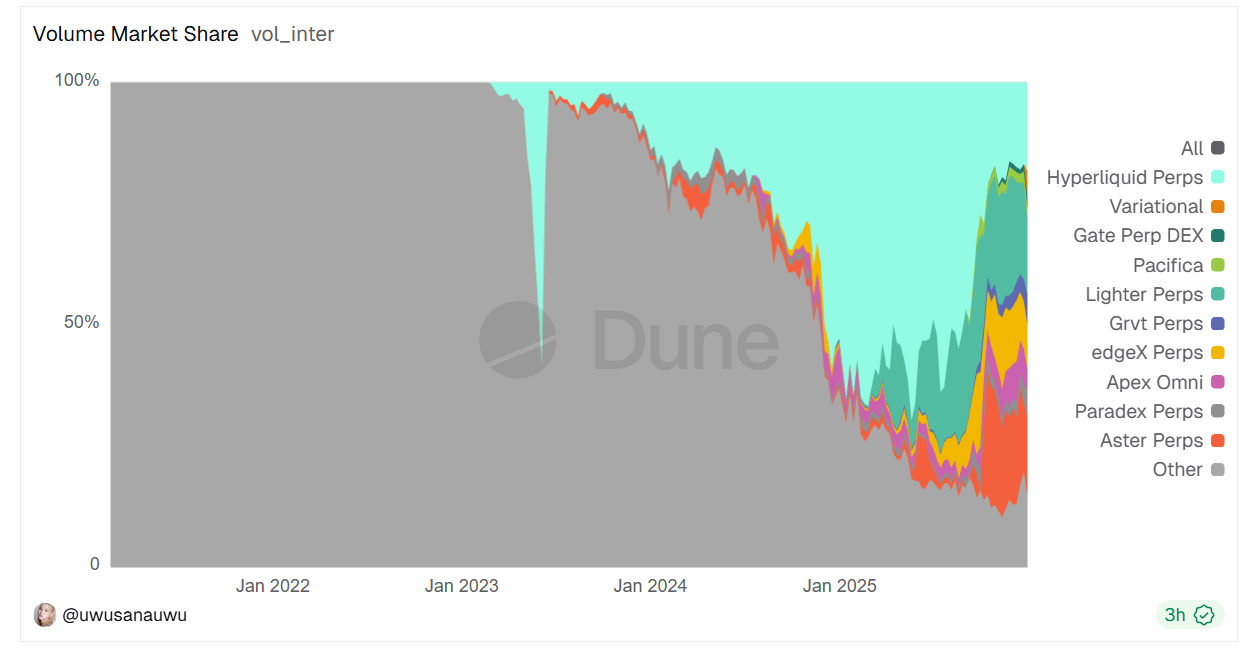

The TGE of Lighter on December 30, 2025, once again brought the Perp DEX track into the spotlight and marked the conclusion of the competition for on-chain perpetual contracts in 2025: at the beginning of the year, Hyperliquid dominated the market with over 70% market share; in the second half of the year, with the rise of new Perp DEXs with distinct features such as Aster, Lighter, and EdgeX, Hyperliquid's market share dropped to around 20%, entering a new stage of comprehensive competition involving technology, capital, incentives, and real demand.

This article will start from the background and development of the rise of the Perp DEX track, analyze the market landscape and key data performance in 2025, and review and analyze five representative Perp DEX protocols: Hyperliquid, Aster, Lighter, EdgeX, and Paradex. It will provide a comprehensive analysis of these five representative Perp DEX protocols from different dimensions such as background team, technical architecture and features, token economics, market data, and performance. Furthermore, it will explore the potential risks and opportunities of the track and look ahead to the trends in 2026.

I. Background and Development of the Rise of Perp DEXs

The early on-chain derivatives market was very small in scale. Centralized exchanges (CEXs) long dominated derivatives trading, offering excellent user experience, deep liquidity, and one-stop services. However, their centralization also harbored risks: the industry turmoil of 2022-2023, particularly the successive collapses of giants like FTX, made users increasingly aware of custody risks and the dangers of opaque operations, prompting capital and traders to seek decentralized alternatives. This laid the demand foundation for the explosion of the Perp DEX track.

However, performance bottlenecks have always been a constraint on the development of on-chain perpetual contracts: on-chain matching and settlement are often limited by blockchain throughput and latency, leading to high slippage and insufficient depth. To overcome this, early projects explored various paths: for example, dYdX used an order book but relied on off-chain matching (now migrated to its own chain), while GMX adopted an on-chain multi-asset pool market-making model, offering perpetual trading but with liquidity constrained by pool size. Although these pioneers proved the feasibility of on-chain perpetuals, they failed to truly challenge CEXs in terms of trading experience and scale.

In recent years, the development of Ethereum Layer2 and application-specific chains has provided the foundation for high-performance contract exchanges, bringing latency and throughput to unprecedented levels. Hyperliquid built a dedicated Layer1 public chain designed for derivatives, while EdgeX, Paradex, and others leveraged Layer2 technologies like StarkWare to achieve on-chain trading experiences of seconds or even sub-seconds. Coupled with incentive mechanisms like trading mining and airdrop points to attract users,

the Perp DEX track entered a period of rapid iteration in 2024-25. In 2024, Hyperliquid gained popularity first, with its HYPE token airdrop and buyback plan driving a surge in its TVL and trading volume, once capturing 80% of the on-chain perpetual market share. In 2025, with the launch of several new platforms and aggressive market strategies, Hyperliquid's monopoly in the Perp DEX track was broken, officially entering a stage of fierce competition among multiple players.

II. Current State and Data Performance of the Track in 2025

The overall scale of on-chain perpetual contract trading achieved a leap in magnitude in 2025. Monthly perpetual contract trading volume exceeded $1 trillion, and its share of the crypto derivatives market rapidly increased. On-chain perpetual contract trading volume once reached 1/10th of that on centralized exchanges, beginning to pose a substantial challenge to the centralized giants. Notably, during extreme market conditions on October 11th, on-chain DEXs smoothly handled $19 billion in position liquidations within a short period. These data indicate that Perp DEXs have grown from niche experimental grounds into a component of the derivatives market that cannot be ignored.

Source: https://coinmarketcap.com/charts/derivatives-market/

In terms of market structure, Hyperliquid remained the leader in the first half of the year, accounting for about 70% of on-chain perpetual trading volume. However, with the entry of newcomers in the second half, its share declined continuously. According to analysis data on Dune, Hyperliquid's trading volume share across the network had dropped to 17% by the end of December. This was replaced by a new pattern of multiple strong players competing for dominance: Lighter rapidly attracted a large number of high-frequency traders with its zero-fee strategy, achieving a 20% volume share in December; Aster gained a 15% market share through continuous incentives and Binance support; EdgeX, focusing on stability and professionalism, also captured about 10% share. Additionally, latecomers like Paradex, GRVT, and Pacifica divided the remaining share, further weakening the leader's dominance. It can be said that competition between new and old platforms in the Perp DEX track for users and liquidity became white-hot in the second half of 2025.

Source: https://dune.com/uwusanauwu/perps

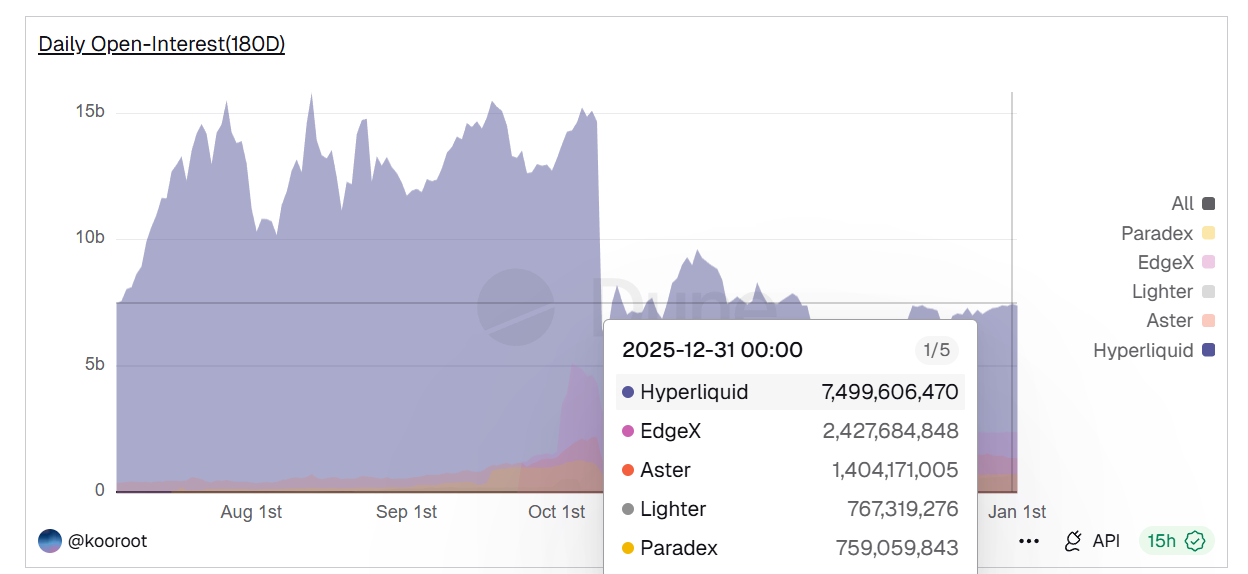

However, looking at the Open Interest (OI) metric, data up to the end of December indicates that Hyperliquid remains the undisputed leader in terms of OI. Its open interest size is approximately $7.5 billion, accounting for 49% of the total OI of the top four platforms, indicating that nearly half of the real on-chain positions remain on Hyperliquid. This shows that Hyperliquid still holds a structurally leading position in trading depth and capital accumulation, while a significant portion of the huge trading volume of later entrants like Aster and Lighter is driven by frequent wash trading due to incentives, rather than long-term capital investment.

Source: https://dune.com/kooroot/top5-perpdex-comparison

In terms of revenue and profitability, the differentiation within the track is also evident. Since many new platforms adopt zero-fee or significant rebate strategies, real fee income better reflects "self-sustaining" capability. Apart from Hyperliquid, EdgeX is one of the few projects that has achieved sustainable high revenue: its monthly fee income exceeded $20 million, annualized at about $250 million, second only to Hyperliquid. Platforms like Paradex and Extended also show certain revenue potential. However, models like Lighter's zero-fee strategy to capture market share generate almost no fee income; although its short-term trading volume tops the charts, the protocol's revenue is zero, and its profit model remains to be verified after the airdrop. It is clear that some new platforms are trading capital for market share, and whether they can truly establish commercial sustainability remains questionable.

III. Review of Representative Perp DEX Protocols

Based on trading volume and open interest rankings, the current Top 5 protocols in the Perp DEX track include Hyperliquid, Aster, Lighter, EdgeX, and Paradex. Below, we will analyze the performance of these five representative Perp DEX protocols from different dimensions such as background team, technical architecture and features, token economics, market data, and performance.

1. Hyperliquid — The King of On-Chain Derivatives

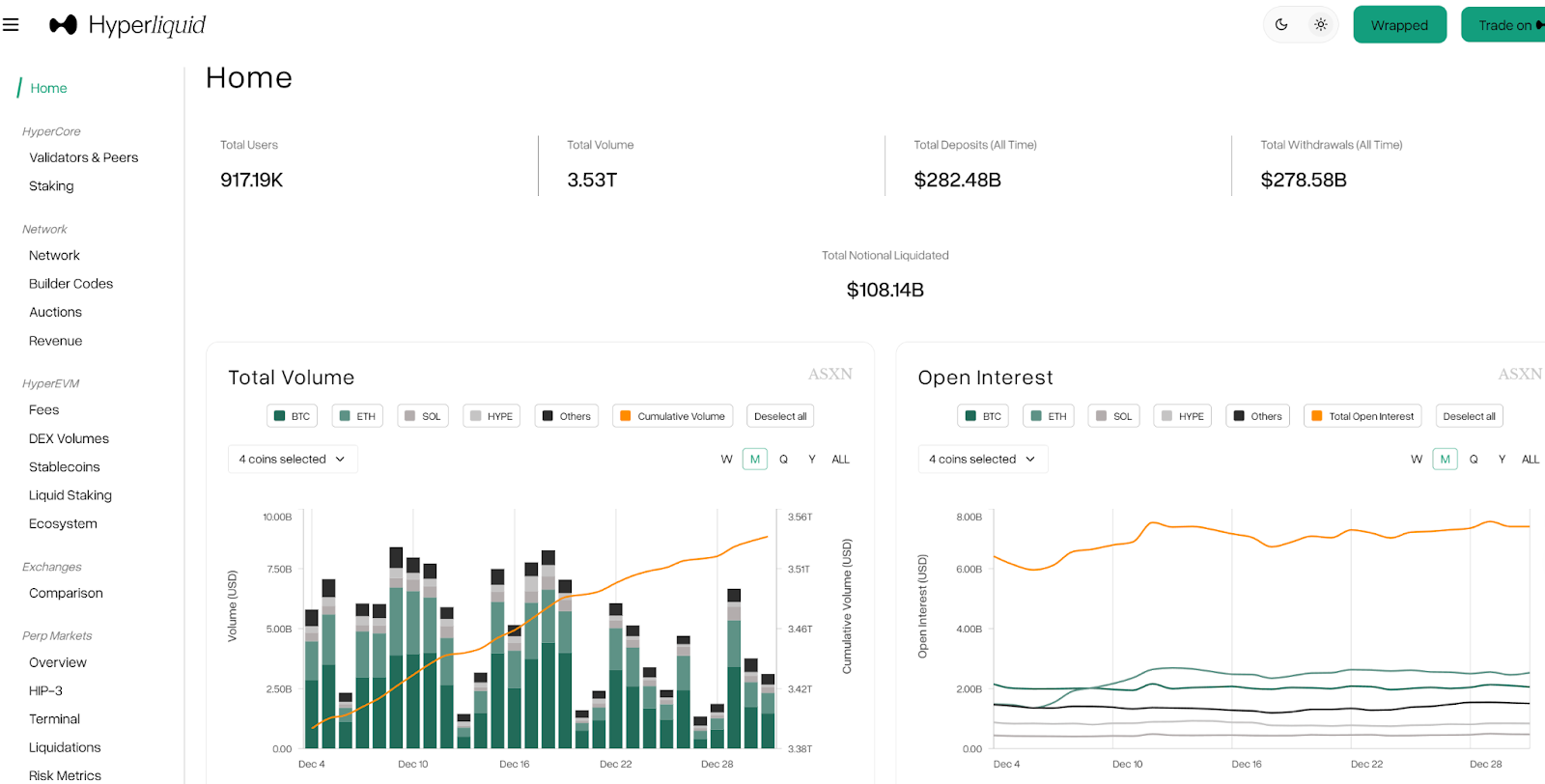

Source: https://wrapped.hyperscreener.asxn.xyz/summary

Background and Team: Hyperliquid was founded in 2023 by Jeff Yan. The initial team had only 11 members but built an on-chain "phenomenal" derivatives platform in less than two years. Hyperliquid was entirely self-funded at launch and adhered to a community-driven path. This self-reliant development approach is rare in the crypto space but earned Hyperliquid a reputation for being "decentralization-native." The project didn't engage in excessive market hype when it launched in July 2023, only gradually entering the public eye in 2024 through a large-scale airdrop and impressive data.

Product Features and Technology: Hyperliquid's biggest differentiation lies in its self-developed dedicated blockchain, with theoretical performance reaching 200,000 transactions per second and sub-second order confirmation latency. Hyperliquid deploys core modules like Central Limit Order Book (CLOB) matching and settlement entirely on this high-performance chain. Users experience a front-end interface and matching efficiency similar to Binance, but the underlying settlement is fully decentralized and requires no KYC. Additionally, Hyperliquid plans to launch the HyperEVM, a general-purpose smart contract platform, to host more applications. The officially promoted HLP Vault plays a market-making role for the platform: acting as a counterparty in a large number of transactions and earning a portion of fees, funding fees, and liquidation profits. Its current TVL exceeds $390 million. This model effectively enhances platform liquidity and user stickiness, creating a win-win cycle for retail users and market-making capital.

Token Economics and Incentives: Hyperliquid's governance token HYPE was introduced via an airdrop in early 2024. The distribution heavily favors the community, with 70% of tokens allocated to the community (airdrops, mining, etc.). The platform also commits to using all fee revenue to buy back and burn HYPE, directly converting protocol growth into token value support. This model led to HYPE's market cap rapidly expanding after launch. As of the end of 2025, the circulating market cap of HYPE is approximately $8.2 billion, ranking 15th among cryptocurrencies.

Data and Performance: Although Hyperliquid faced challenges in trading volume share in the second half of 2025, it remains firmly in the top tier based on key quality metrics. The platform's 24-hour trading volume typically ranges between $3-10 billion; its open interest size has long accounted for over half of the entire network. In terms of trading depth and liquidity, Hyperliquid's BTC perpetual can accommodate about $5 million in positions within a ±0.01% price spread. Regarding stability, the Hyperliquid platform has not experienced any major technical incidents to date, remaining operational even during the liquidation peak in October. Overall, Hyperliquid demonstrated deep-rooted dominance in 2025: despite being overtaken in trading volume by newcomers, its solid technology, real liquidity, and healthy economic model keep its king position unshaken.

2. Aster — The Soaring Dark Horse and Trust Crisis

Source: https://www.asterdex.com/

Background and Team: Aster is a multi-chain perpetual contract exchange that launched in early 2025, formed from the merger of Asterus and APX Finance. YZi Labs participated in early support, and CZ repeatedly endorsed Aster on social media. This gave Aster a halo from its inception. Its goal is to build a high-speed derivatives platform supporting deployment on multiple chains like BNB Chain, Ethereum, Arbitrum, and Solana, allowing users to trade assets from different chains without cumbersome cross-chain processes.

Product Features and Technology: Aster has commendable aspects in its product. First is multi-chain deployment: it provides trading access on chains like BNB Chain, Ethereum, Arbitrum, and Solana. Users can trade cross-chain through a unified account without the need for complex chain transfers. Secondly, Aster offers an astonishing leverage of up to 1001x and advanced features like hidden orders, catering to high-risk preference users. Additionally, its planned Aster Chain is a dedicated chain based on zero-knowledge proofs, which is expected to enhance transaction privacy and efficiency. Furthermore, Aster allows users to earn yield on a portion of their collateral, and position margins can also accrue interest, improving capital efficiency.

Token Economics and Incentives: The total supply of the ASTER token is 8 billion. The airdrop allocation is as high as 53.5%, with 30% for the ecosystem and community, and 5% for the team. The original design involved monthly ecosystem unlocks, leading to continuous selling pressure from the increasing circulating supply. In October, the Aster team announced modifications to the tokenomics, delaying a large portion of tokens originally scheduled for unlocking in 2025 to the summer of 2026 or even 2035, but the market seemed unconvinced. Currently, the ASTER token price fluctuates around $0.7, significantly down from its peak.

Data Performance and Controversy: In September 2025, Aster launched its mainnet and the ASTER token. The token price surged from an issuance price of $0.08 to $2.42 within a week, a gain of 2800%. The platform's daily trading volume also climbed to $70 billion in a short time. From late September to early October, with frenzied trading activity, Aster briefly captured over 50% market share, becoming a true dark horse. Many investors viewed Aster as the next Hyperliquid, hoping it would replicate the former's success story. However, on October 5th, the authoritative data aggregator DeFiLlama announced the delisting of Aster's data, citing "discovery that its trading volume was almost completely synchronized with Binance, indicating serious anomalies." Additionally, Aster refused to provide backend trading data to DeFiLlama to prove its innocence. On-chain tracking revealed that 96% of ASTER tokens were concentrated in 6 wallets, and its trading volume/OI ratio was as high as 58, clearly indicating frequent wash trading to inflate volume. After the news broke, the ASTER price plunged over 10% that day, and its brand credibility was questioned.

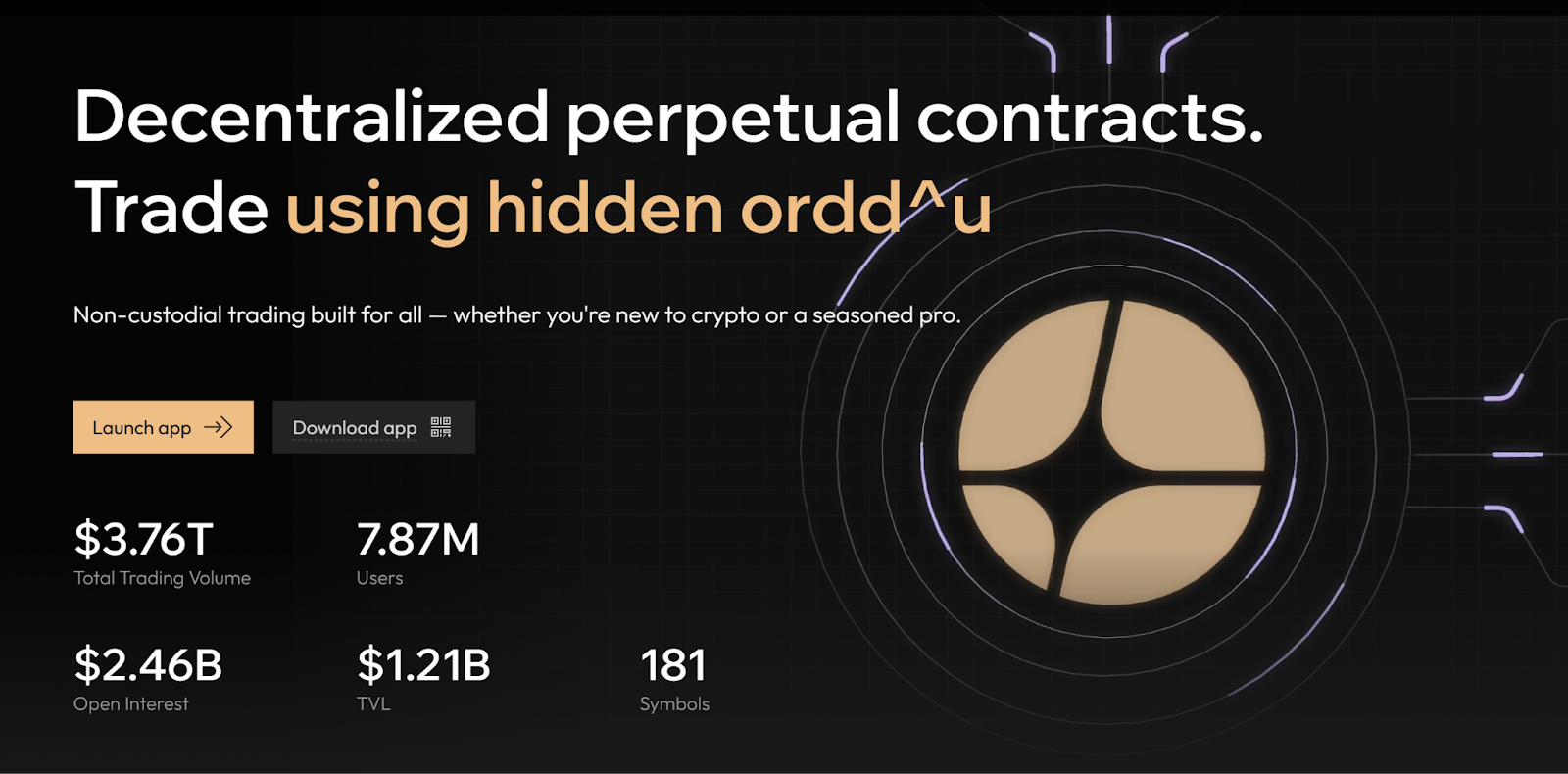

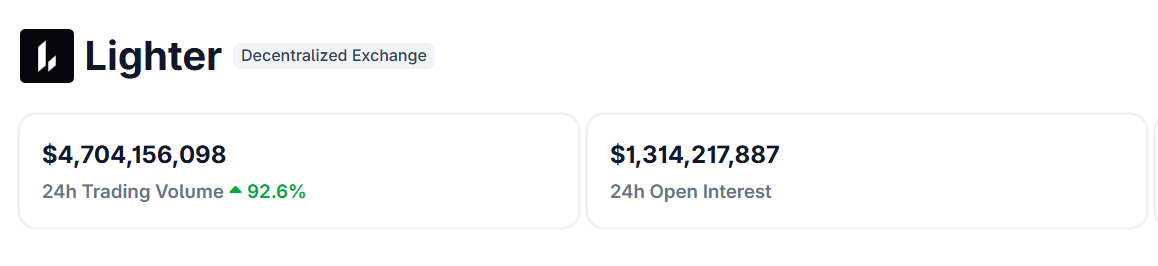

3. Lighter — The Zero-Fee Technology Disruptor

Source: https://www.coingecko.com/en/exchanges/lighter

Background and Funding: Lighter is a dark horse that entered the on-chain perpetual track in 2025. The core team was created by former Citadel hedge fund engineers and is backed by top-tier investment institutions like Peter Thiel, a16z, and Lightspeed. It raised $68 million in a seed round, with a post-money valuation as high as $1.5 billion. Strong capital backing also gave Lighter ample development resources initially. Lighter officially launched on October 2, 2025. The name "Lighter" implies "a lighter and faster trading experience," reflecting the team's technical strength and ambition.

Product Features and Technology: Lighter chose to build on a ZK Rollup, leveraging the security of the Ethereum mainnet while achieving scaling through Layer2. A key technical highlight is that each transaction uses zero-knowledge proofs for encrypted verification to ensure transaction data privacy and validity. StarkWare's solution is used to accelerate proof generation, enabling the platform to achieve high-frequency matching while ensuring security. Additionally, Lighter designed a unique "escape hatch" mechanism: if the L2 platform itself fails, users can withdraw funds back to the mainnet through pre-deployed smart contracts, avoiding funds being trapped for extended periods. Overall, Lighter's technology roadmap is quite bold, aiming for a significant leap in performance without compromising on security and decentralization.

Token Economics and Incentives: The token $LIT had its TGE on December 30, 2025. 50% is allocated to the ecosystem (of which 25% was directly airdropped, converted from points at a 1:20 ratio), and the other 50% goes to the team and investors (with vesting schedules). Protocol revenue will be used to buy back LIT or for ecosystem incentives, aiming to align community and project interests in the long term. The latest price on January 3, 2026, is $2.50, with a circulating market cap of $650 million and an FDV of $2.6 billion.

Market Performance and Controversy: Lighter adopted an aggressive zero-fee strategy to attract users externally, charging 0% trading fees for both makers and takers, with protocol revenue entirely coming from HFTs and market makers. The results show that Lighter's zero-fee strategy worked: within just a few weeks of launch, user numbers surged to over 56,000, and daily trading volume stabilized at $7-8 billion. A large number of arbitrageurs and quantitative teams flooded in to trade, making it the top on-chain DEX by trading volume. However, Lighter's Vol/OI ratio once exceeded 8, meaning most capital was frequently recycled through opening and closing positions rather than being held for long periods. Once the airdrop ends, this speculative flow could recede instantly. The highly aggressive expansion also tested Lighter's system stability. In mid-October, the platform was down for about 4 hours, during which users could not place orders or withdraw. Lighter's LLP fund pool suffered approximately a 10% loss, exposing shortcomings in system stability and risk control under extreme market conditions. Additionally, the platform experienced UI lag and minor bug reports during peak hours, somewhat affecting user experience.

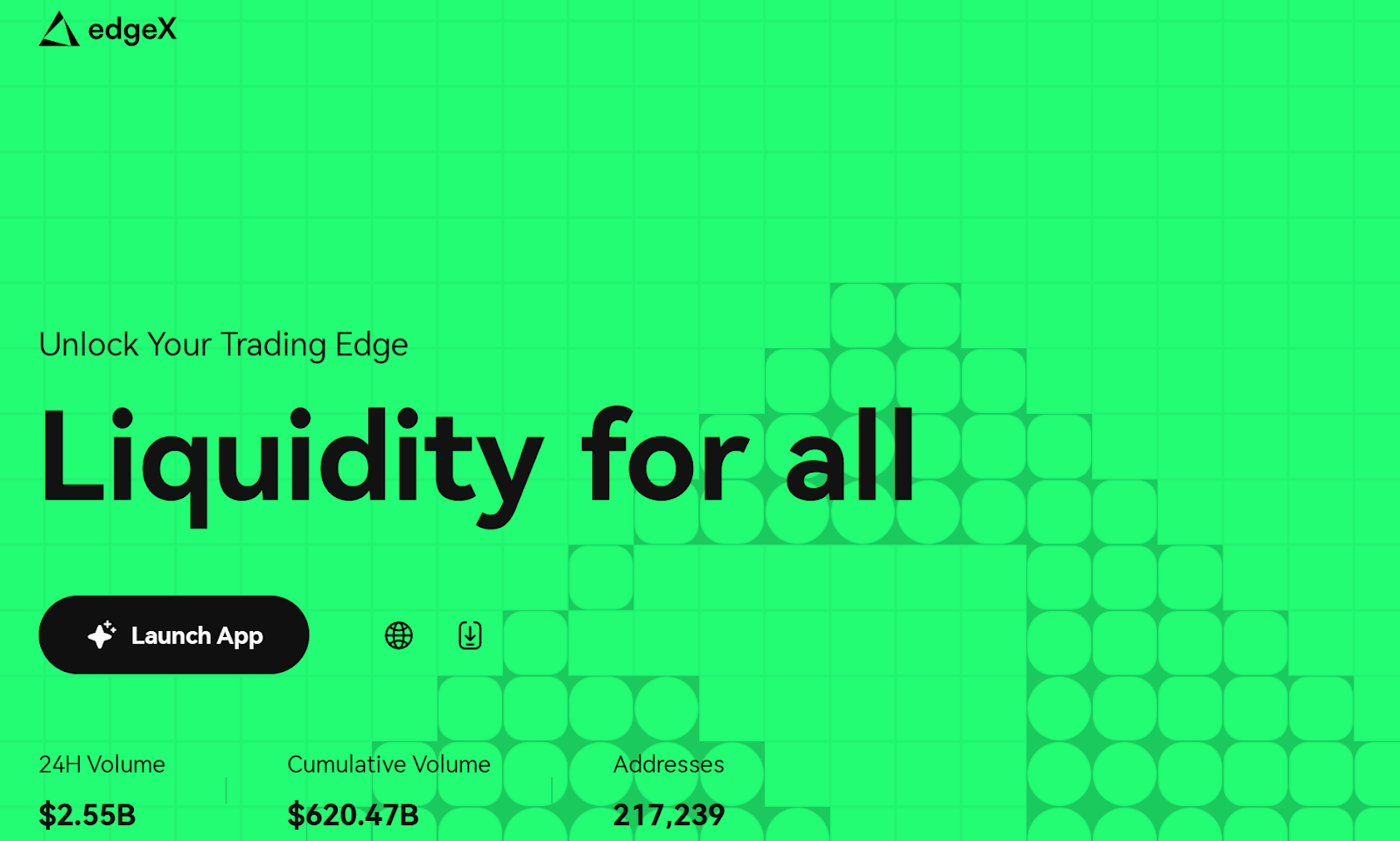

4. EdgeX — The Institutional-Grade Stable Exchange

Source: https://www.edgex.exchange/

Background and Team: EdgeX is a professional perpetual contract platform incubated by Amber Group, a top Asian crypto financial institution, launched in September 2024. EdgeX carries TradFi genes, built by a team of experts proficient in institutional services. Amber Group, as a veteran market maker managing around $5 billion in assets, not only provided seed funding but also infused EdgeX with deep liquidity support and market operational capabilities, drawing attention from institutional circles and the Asian market upon launch.

Product Features and Technology: EdgeX is built on StarkWare's StarkEx engine, adopting a hybrid model of centralized matching + decentralized settlement: order matching is executed on StarkEx, and transaction results are batched on-chain. EdgeX's main selling points are low fees + deep liquidity. Its fee rates are comprehensively slightly lower than Hyperliquid's: maker fee 0.012% (HL: 0.015%), taker fee 0.038% (HL: 0.045%). In terms of liquidity, thanks to Amber Group's support, the order book depth and spreads on the EdgeX platform are excellent. Data shows that within a ±0.01% range, EdgeX's BTC perpetual can accommodate $6 million in positions (better than HL's $5 million), and slippage for various mainstream trading pairs is generally lower than competitors. Additionally, EdgeX places great emphasis on mobile experience: the official iOS/Android APP is well-developed, integrating technologies like MPC wallets, allowing users to use it without memorizing seed phrases, significantly lowering the barrier to entry.

Token Economics and Incentives: EdgeX has not yet issued a platform token EGX. To compensate for the lack of a token, EdgeX also designed a trading points reward mechanism, but it is relatively transparent and restrained. The source of points distribution is clear: 60% from trading volume, 20% from referrals, 10% from TVL/LP, 10% from liquidation/OI, and it publicly states that it does not reward wash trading. User expectations for a future EGX token are also relatively rational. The community predicts that EdgeX will allocate about 20-35% of tokens to points holders during TGE.

Market Data and Performance: EdgeX's performance in 2025 is commendable, aptly described as "stable with growth." According to CoinGecko data, EdgeX's 24H trading volume is about $2.5 billion, and OI is about $1.3 billion, ranking fourth among Perp DEX platforms. Although its trading volume market share is only 5-6%, EdgeX's annualized revenue is about $500 million, second only to Hyperliquid. In summary, EdgeX excels in stability and professionalism, performing well in all aspects without absolute standout features. Its token issuance is later, and how it will attract attention after missing the airdrop frenzy remains to be seen by the

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News