Interview with Tom Lee: Gold Targets $8,900; ETH’s Bottom at $2,400; U.S. Equities May Correct 20% Mid-Year

TechFlow Selected TechFlow Selected

Interview with Tom Lee: Gold Targets $8,900; ETH’s Bottom at $2,400; U.S. Equities May Correct 20% Mid-Year

- For investors, a correction is a positive development, offering an opportunity to reallocate assets at lower prices.

Compiled & Translated by TechFlow

Guest: Tom Lee

Hosts: Josh Brown; Michael Batnick

Podcast Source: The Compound

Original Title: What Tom Lee's Worried About in 2026 | TCAF 227

Air Date: January 30, 2026

Key Takeaways

In this episode, Michael Batnick and Downtown Josh Brown welcome Tom Lee of Fundstrat to discuss: the challenges facing markets in 2026; why Tom remains bullish on markets; the upward trend in precious metals prices; the crypto bear market; Tesla’s major investments in robotics; and other compelling topics.

Highlights Summary

- Markets will likely perform strongly in the first half of the year, followed by a bear-like correction. However, we expect a swift rebound, with full-year gains potentially reaching 10% or more.

- Ethereum may fall to $2,400—a potential bottoming process that could mark the peak of the precious metals rally.

- In AI, the U.S. and China are likely to be the biggest winners.

- China’s AI capabilities are exceptionally strong. Moreover, China excels in electric vehicles and has made significant progress in healthcare and biotechnology.

- Energy and basic materials are our top sector recommendations for this year—but precious and other metals have outperformed our expectations.

- From October through year-end, certain cryptocurrencies corrected roughly 40%. One key trigger was a pricing glitch at a crypto exchange that triggered automatic deleveraging—rapidly escalating into the largest deleveraging event in crypto history, surpassing even the FTX collapse.

- Don’t fight the Fed.

- I believe precious metals—silver and gold—are currently hot assets. Investing in them is prudent, and their performance has indeed been remarkable.

- Gold could rise to $8,900.

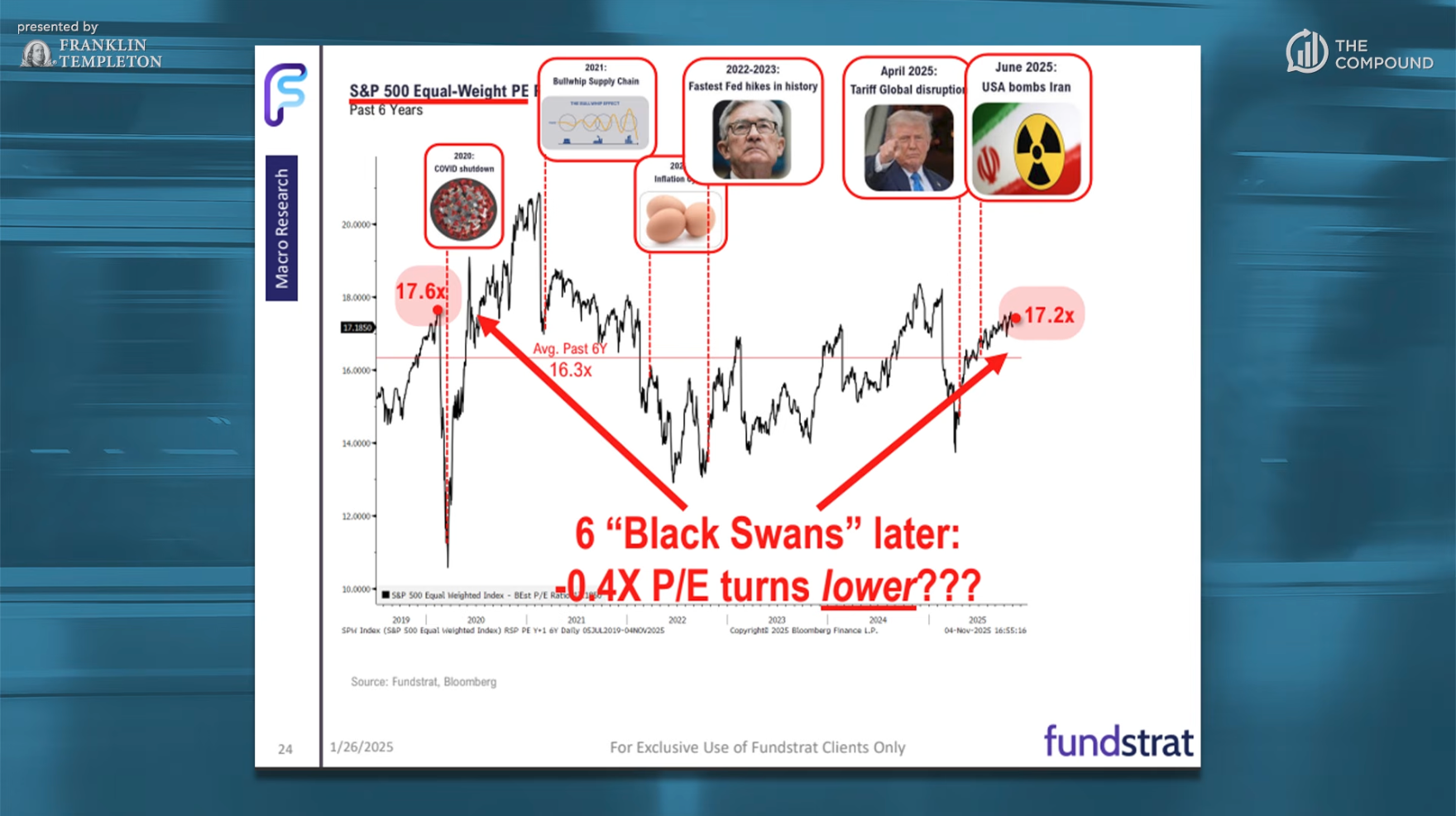

- When people say today’s valuations are “too high,” consider this: despite six “black swan” events, the market’s P/E ratio has remained stable.

- Confidence in U.S. corporate profitability far exceeds confidence in any elected official.

- I expect 2026’s market performance to resemble last year’s—fundamentals will improve, but one key difference is the Fed’s likely pivot from aggressive tightening toward a more dovish stance.

- If the market posts positive returns in its first week and first month, the probability of a full-year gain rises to 92%.

- For investors, corrections are beneficial—they offer an opportunity to redeploy capital at lower prices.

- The market is no longer fully dependent on the Magnificent Seven tech stocks; many investors are turning attention to non-U.S. markets.

- Now is an excellent time to invest in international large-cap equities.

- Wall Street once viewed blockchain and crypto as experiments—but financial institutions are now rebuilding settlement layers using blockchain.

- Larry Fink (BlackRock CEO) stated he believes the entire financial system will eventually run on a universal blockchain.

- Bitmine’s capital primarily comes from institutional investors—e.g., Morgan Stanley, Arc Asset, and Fidelity—who are Bitmine’s largest shareholders.

- People may stop working altogether, as robots generate such vast surplus value.

Is Tom Still Bullish? Outlook for 2026

Josh Brown: Are you still bullish on markets? I recall you mentioning early this year that “Q1 could be volatile.” Is that right?

Tom Lee:

Yes—we anticipate 2026’s market behavior will mirror last year’s. Our base case is that markets will perform strongly in the first half, then undergo a bear-like correction—but we expect a rapid rebound, with full-year gains potentially reaching 10% or more.

Josh Brown: How deep was last year’s correction? For example, March–April?

Tom Lee:

Last year’s correction reached 20%, effectively constituting a bear market—and it began from all-time highs. That’s relatively rare, which partly explains why the recovery was so swift. Yet this correction was driven largely by sentiment—not by fundamental economic deterioration.

Josh Brown: If a market decline occurs without a recession, it typically rebounds in a V-shape. So do you think this year’s correction might coincide with a recession—or not?

Tom Lee:

If I had to guess, I believe this year’s correction will stem more from policy shifts—such as White House initiatives—or from markets testing the new Fed chair’s policy direction. Of course, this is just speculation—but I suspect volatility will resemble last year’s, driven by investors reducing risk exposure—not by recession. Thus, we ultimately expect markets to recover robustly.

Josh Brown: We’ve already experienced two policy shocks recently—one involving health insurance adjustments, another capping credit card rates at 10%. I haven’t yet reviewed the insurer policy changes in detail. Do you know the specifics?

Tom Lee:

Yes—just two days ago. The policy adjustment involved Medicare reimbursement rates. Markets expected a 6–9% change, but the actual adjustment was only 0.9%. The future is uncertain—we can only make our best judgments based on data and experience.

Making “Right” Decisions

Josh Brown: So amid such uncertainty, how do you improve forecast accuracy? If you must hold a firm view—or if others rely on your judgment—how do you ensure your forecasts are more reliable? Though the future is unknowable, how do you increase reliability?

Tom Lee:

Thanks for the kind words. We enhance forecasting accuracy through data analysis and accumulated experience. Let me illustrate. Imagine you’re in a dark room—lights off—feeling your way around. Touch something furry, and you realize you’re in the living room; bump your toe on a sharp corner, and you know you’re in the kitchen. Market analysis is like navigating in darkness—we don’t always know exactly where we are, but we search for clues to understand the environment.

We achieve this via cross-market analysis—and by integrating current economic data to pinpoint our position within the business cycle. For instance, do current data resemble conditions from 1950 or 1970—or perhaps Hong Kong’s economy?

Josh Brown: You seem deeply focused on identifying our current cycle stage. Is this truly critical to you? Did you learn it from others—or discover it gradually yourself? Like, “This is a real signal—that’s what matters.”

Tom Lee:

Yes—in my early career, I heard several pivotal ideas. First: Don’t fight the Fed. Second: Demographics decisively shape economic outcomes.

Josh Brown: Applying these two principles, where do you see us today? Many argue “the higher it goes, the harder it falls,” “this rally has lasted too long,” “valuations are excessive,” etc.

Tom Lee:

A few points stand out. First, global corporate earnings are accelerating—not just in the U.S., but worldwide. This rarely signals the end of a cycle. Second, market breadth continues improving. Some call this a “rolling risk-on cycle,” yet numerous assets are rising—indicating broadening participation, even beyond U.S. borders.

Other reasons for cautious optimism include rapid advances in AI and blockchain. I closely followed Davos discussions—even without attending, I read reports and panel summaries. Clearly, traditional financial institutions now view blockchain as a key productivity tool. This is especially consequential in the U.S.—Fidelity’s recent stablecoin announcement is highly noteworthy.

Additionally, global trends like reshoring and defense buildup are fueling spending worldwide.

Materials, Energy, Gold & Silver

Josh Brown: Typically, materials stocks surge late in the cycle. Currently, the strongest U.S. bull market may be in energy, gold miners, and base metals firms. I even mentioned steel stocks today—they’re performing exceptionally well. Steel stocks rarely become market darlings—but we’re seeing multiple examples now.

What do you make of this? Does the surge in metals and oil reflect late-cycle dynamics—or more of a mid-cycle phenomenon?

Tom Lee:

I believe precious metals—silver and gold—are currently hot assets. If I were a retail investor, their performance has been remarkably strong for several consecutive weeks. Investing in them is prudent—their performance is truly eye-catching.

Tom Lee:

I discussed this today with Tom Demark, who believes precious metals still have substantial upside—far from exhausted—and even predicts gold could reach $8,900.

Josh Brown: If gold hits $8,900, the Fed’s balance sheet or Treasury finances could meaningfully improve—given the U.S.’s massive gold holdings. But who would buy next? Would it imply all capable central banks have already bought?

Tom Lee:

This ties to asset allocation. I briefly spoke with JP Morgan’s Joyce Chang, who noted that if high-net-worth individuals allocate just 0.5% of their portfolios to gold, it could push gold to $9,000. Even modest inflows can exert outsized impact.

Josh Brown: Does gold’s trajectory resemble a stock-market V-shaped rebound? Or can you envision a scenario—say, gold drops 15%, silver 25%—ending the current rally? How would you interpret such a correction?

Tom Lee:

Today exemplifies this. Gold fell sharply intraday but closed only down 1%. Silver swung widely intraday but ended nearly flat—buyers rushed in to support prices.

I’m rapidly learning commodity markets. Physical supply is extremely tight—so physical gold trades above financial-market prices. Tom Demark also notes this gold bull resembles 1979–1980—potentially forming a parabolic top.

Josh Brown: Are there historical precedents where gold and silver surged while equities rose simultaneously? This seems rare—for example, the early-1980s equity bull began only after gold/silver collapsed.

Tom Lee:

This time differs—it’s more like “everything up.” Some suggest it’s “everything except the dollar”—which holds merit.

Navigating “Black Swan” Events

Josh Brown: Regarding overall market performance, this chart shows six major shocks since late 2019. Though “black swan” may be overstated, these events impacted markets—COVID lockdowns, supply-chain disruptions, inflation, the Fed’s fastest-ever hiking cycle, tariffs, and U.S. strikes on Iran. What message does this chart convey? When juxtaposing valuations with these events, what do you want viewers to understand?

Tom Lee:

We can view the stock market as a company—if it withstands six major events that could severely impair profitability yet keeps growing earnings, it demonstrates extraordinary resilience—and warrants a higher valuation.

When people claim valuations are “too high” today, remember: despite six “black swan” events, the market’s P/E ratio has stayed stable.

Michael Batnick: Do you think the stock market is truly indestructible? I know nothing lasts forever—but is its resilience exceeding most people’s imagination?

Tom Lee:

Its durability surpasses many people’s awareness.

Josh Brown: Someone told me they couldn’t reconcile rising markets with perceived societal fragmentation. I replied, “Because people trust Apple CEO Tim Cook more than Congress.” That’s not contradictory—it reveals a truth: confidence in U.S. corporate profitability dwarfs confidence in any elected official.

Tom Lee:

Exactly. That’s why people prefer allocating capital to equities over alternatives. Roughly a decade ago, a survey found millennials trusted tech companies far more than government—so they shared personal data with tech firms, not agencies.

Technology Divergence

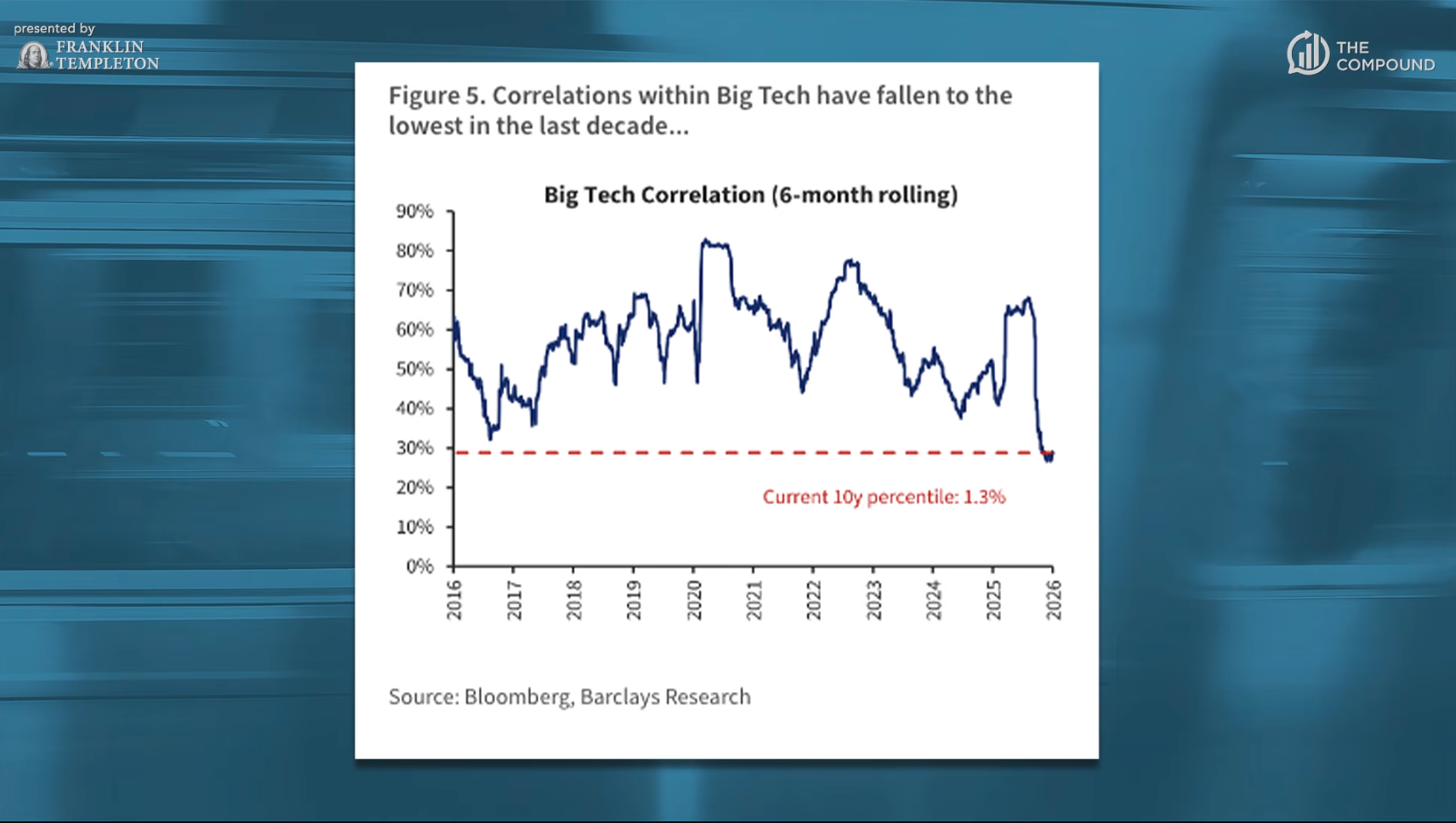

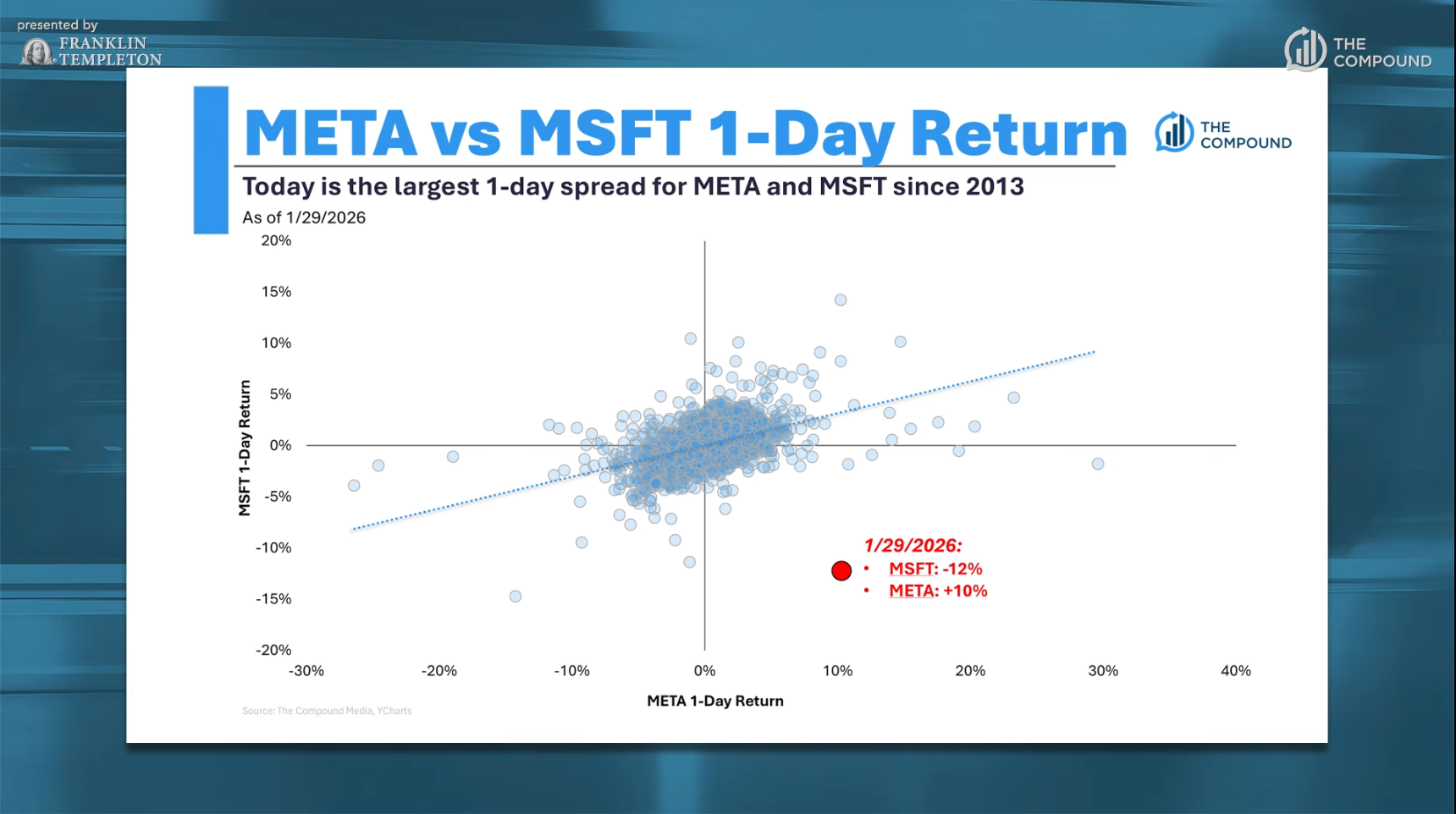

Michael Batnick: Let’s shift to Tom’s latest market outlook. One of the most intriguing developments is increasing market divergence—distinctions between “good” and “bad” companies are sharpening. Historically, tech stocks moved uniformly—up or down together. But over the past six months, that’s changed. As shown, correlation among mega-cap tech stocks is falling sharply. Our rolling six-month correlation analysis confirms this rapid decline.

Microsoft fell 12%, while Meta rose 10%. These stocks historically moved in lockstep—but not anymore. Intriguingly, both reported earnings yesterday and discussed capex. Markets fretted over Microsoft’s 45% unfulfilled orders tied to OpenAI—raising big questions. Meanwhile, Microsoft’s spending grew 66%. In contrast, though Meta’s spending doubled year-on-year, its Reels monetization impressed investors—triggering a positive reaction.

Tom Lee:

Yes—I hear many analysts cite concerns about Microsoft’s future revenue value—or AI redefining products like Excel and Teams. Perhaps this reflects ongoing AI-direction exploration—and a current perception that Microsoft trails in the AI race. But I suspect this concern is overblown.

Josh Brown:

Microsoft was similarly underestimated pre-2000—viewed merely as a software company—yet staged a powerful comeback.

Tom’s Outlook: What Happens in 2026?

Josh Brown: I’d like to dive deeper into your market outlook—how should we view 2026’s market performance?

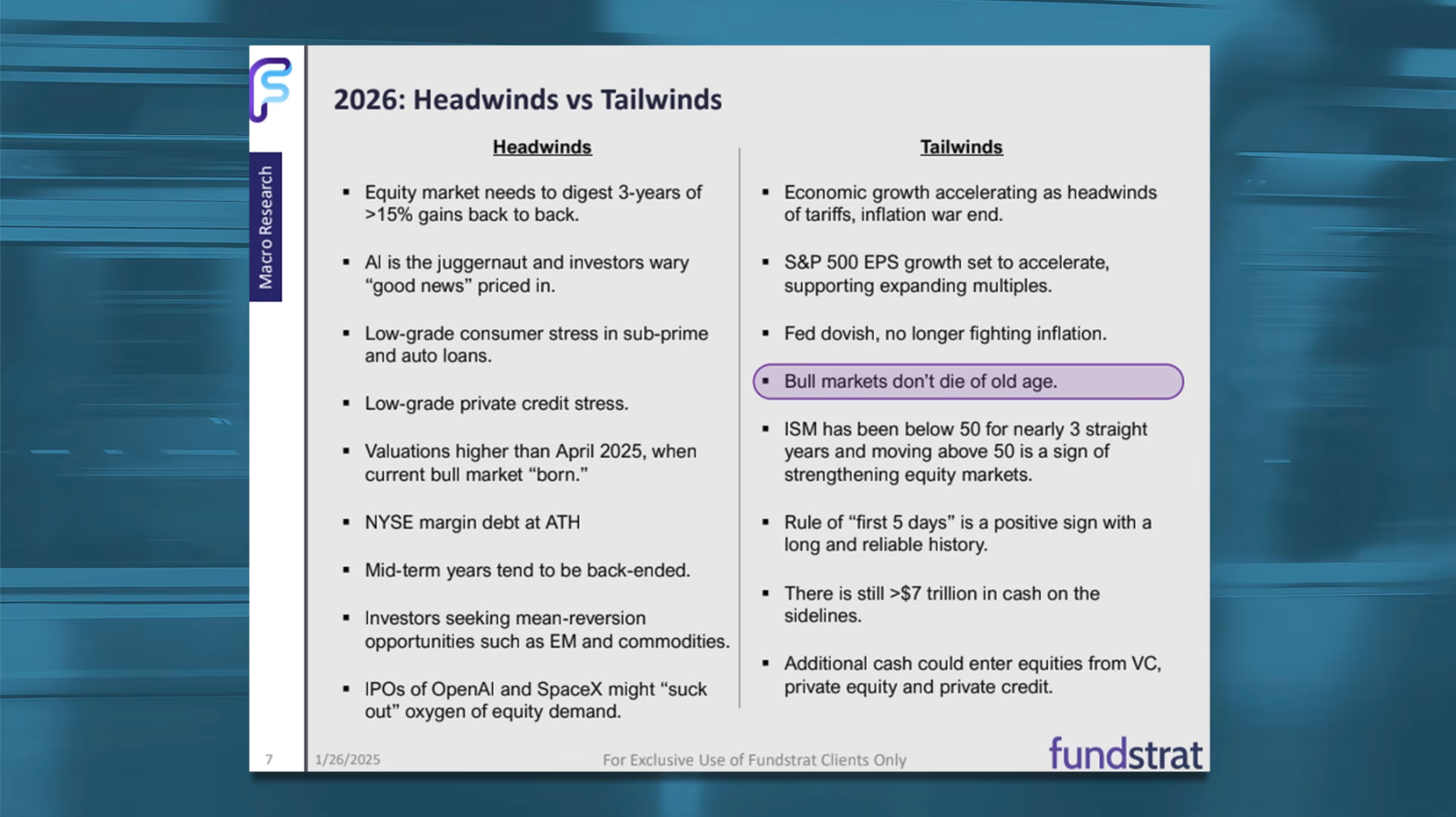

Tom Lee:

I expect 2026’s market performance to mirror last year’s—fundamentals will improve, but a key difference is the Fed’s likely pivot from aggressive hikes to a more dovish stance, given the new Fed chair’s reluctance to continue tightening. This is a positive factor.

Of course, headwinds remain—high rates pressure consumers and private credit. Additionally, three consecutive years of gains have elevated valuations. I anticipate more policy shocks—e.g., bolder White House initiatives. I don’t know if this stems from wanting to accomplish things before midterm elections, but it’s plausible.

This erodes investor confidence in holding assets—so I expect a major correction, similar to last year’s. But positives exist—the “Rule of First 5 Days” (right-side chart) shows a strong start this year.

We’ve conducted additional research: If the first week is positive and the first month is positive, the probability of a full-year gain jumps to 92%.

Josh Brown: Really? I knew this pattern existed—but didn’t expect such a high probability. It sounds random, yet 92% is formidable. Which years constitute the 8% exceptions? Have you studied them?

Tom Lee:

This draws on 75 years of history—so the sample size is 75, lending credibility.

Josh Brown: You cited many headwinds. Clearly, rich valuations are problematic due to sustained price gains. Also, low-income consumers face mounting stress on subprime loans and auto loans. While we haven’t analyzed individual firms, those targeting low-income consumers feel pressure. Yet giants like Apple remain unaffected—major corporations seem oblivious.

Could this spark the next market correction—or is that unlikely?

Tom Lee:

I view this more as a social issue. Inflation burdens low-income consumers—and pressures leaders, possibly affecting elections.

Economically, low-income consumers contribute far less to GDP than high-income ones, explaining why markets ignore this. It’s political—not a market issue.

Josh Brown: Yes—but it may ultimately become a market issue. E.g., government-imposed credit-card rate caps. If the current administration loses the House, voters may blame economic hardship on them. Immigration-policy chaos could also matter. I’m not endorsing these views—just noting polling trends.

Josh Brown:

As you noted, these aren’t primary market issues today—but a “blue wave” (Democratic House sweep) would surely impact markets. After all, part of today’s bull market stems from deregulation—and such policies stall when votes are required.

Tom Lee:

That’s why policies like capping medical costs, lowering gas prices, and limiting credit-card rates make sense—they alleviate burdens for many.

Michael Batnick: By the way, I’m not claiming low-income consumer conditions have improved—but if subprime auto-loan defaults peaked in 2022, we may have passed the worst.

Josh Brown: NYSE margin debt hit an all-time high. Michael and I may lack your expertise—but we associate this with record-high equities. Margin debt correlates closely with total market cap. You list this as a headwind—is there deeper significance?

Tom Lee:

It does signal something—we may write a dedicated margin-debt analysis later. As of November, margin debt stood at $1.214 trillion—a record high. For context, it was $710 billion in July 2023—nearly doubling in 2.5 years.

What does this signal? We find when year-over-year margin-debt growth exceeds 38%, it’s typically negative for equities. Current growth stands at 36%—near that threshold—suggesting market gains heavily rely on leverage. Over the past 30 years, when this metric hit its top decile, positive market returns dropped from 70% to 40%. We may be nearing a resistance point.

Josh Brown: If a correction reduces margin debt—and markets return to lower leverage—most would deem this a healthy reset. Your view?

Tom Lee:

For investors, corrections are beneficial—they offer opportunities to redeploy capital at lower prices.

Software Sector Correction

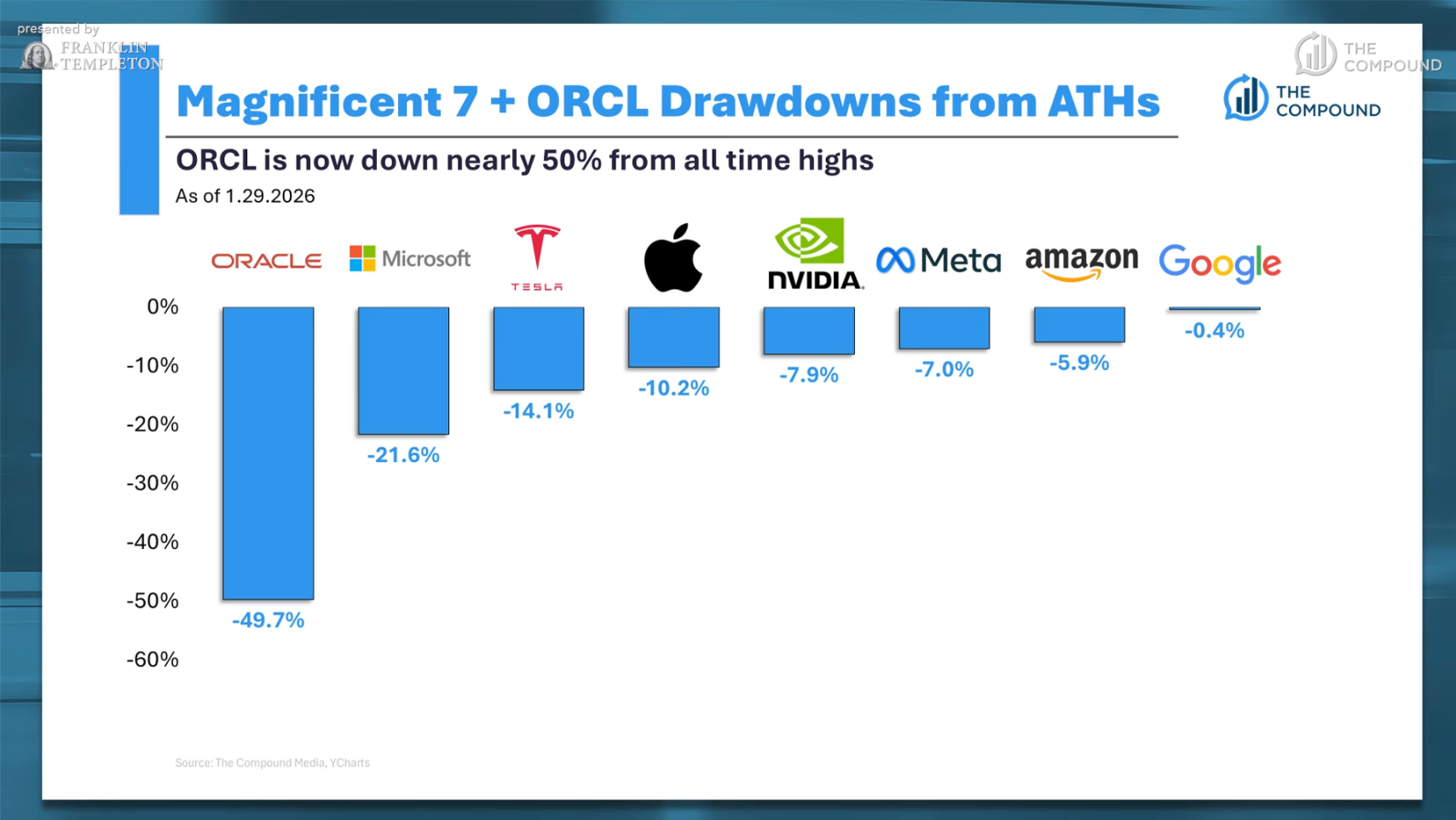

Josh Brown: Is a quiet correction underway? Oracle’s stock halved, Microsoft entered a bear market, Tesla fell 14%, Apple dropped 10%. Do these moves signal divergence? Will future rallies require the “Magnificent Seven” (Mag 7) again?

Tom Lee:

For me—as an investor—if I haven’t bought Microsoft yet, now may be a good entry point.

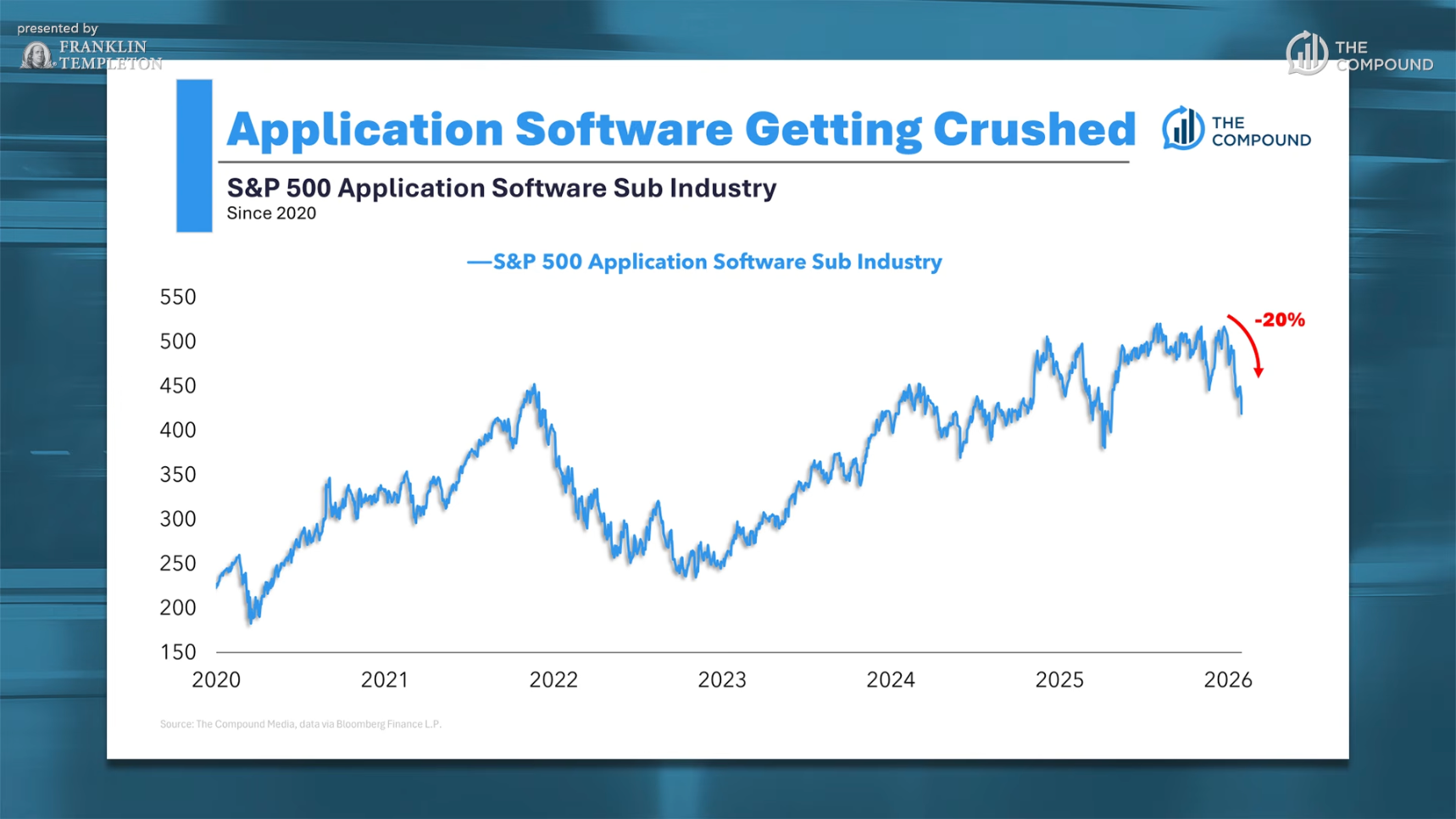

Josh Brown: Let’s broaden this to the software sector—not just Microsoft. The software ETF (IGV) has corrected 25%—a notable pullback. Nearly all related firms declined sharply—effectively a bear market in application software.

I raise this because, despite your AI optimism, AI is currently pressuring equities. The AI theme hasn’t boosted valuations—at least not in software stocks. While some capital flowed into utilities, can we confirm AI benefits investors—or is it a drag?

Tom Lee:

Sometimes losers are easier to spot than winners. Software appears a loser now—AI writes code, replaces subscriptions, and tech employment is falling—signaling industry transformation. Past advice was “learn to code,” but now “study art history” may be wiser.

Michael Batnick: Is the market’s software-sector punishment justified?

Tom Lee:

Typically, stock prices signal sentiment. If bad news doesn’t trigger further declines, the market has digested it—but if prices keep falling on bad news, sentiment remains negative.

Michael Batnick:

What if good news triggers declines? E.g., ServiceNow posted stellar earnings—but shares plunged. If good news still causes drops, sentiment is deeply negative.

Josh Brown:

Similarly, Microsoft’s situation isn’t promising. Its report held no major negatives—just slightly higher spending and Azure growth dipping from 39% to 38%—yet the market reacted violently.

Such overreaction erased $400B from Microsoft’s market cap in a day—clearly unhealthy. While specific, it reveals fragile tech-stock sentiment.

Michael Batnick:

Yet for long-term investors, this may be a buying opportunity. Can both be true? Microsoft fell 12%—market sentiment is clearly weak—yet investors are proactively exiting AI bubbles. Long-term, this risk caution is commendable.

Tom Lee:

Yes. Later this year, major IPOs like OpenAI and SpaceX will launch. Their listings will reduce market mystique—enabling trading based on fundamentals—enhancing transparency.

Upcoming Mega IPOs

Michael Batnick: Could mega IPOs cause oversupply? Historically, have they signaled market peaks?

Tom Lee:

Potentially. Mega IPOs absorb market liquidity—increasing supply pressure and weighing on markets.

Josh Brown:

I recall Blackstone’s 2007 IPO—epitomizing real-estate boom investments in hot areas like emerging markets (especially China). Liquidity alternatives and investment revolutions weren’t yet discussed. Back then, this approach was deemed optimal. Blackstone acquired Equity Office Properties from Sam Zell at the real-estate peak—the IPO massively impacted markets.

Blackstone wasn’t a conventional corporation but a partnership—meaning clients needed K-1 tax forms alongside reporting losses. Since then, I view mega IPOs (like upcoming OpenAI and SpaceX) as market-cycle endpoints—not beginnings, requiring hundreds of billions in funding.

Tom Lee:

This time may differ. SpaceX’s IPO could be a massive wealth-creation event. Early investors may reap huge returns—I know people who invested $50K in seed rounds now hold $150M stakes. This resembles a large-scale U.S. tax refund—wealth re-entering the economy to boost consumption and investment.

Josh Brown:

Of course, IPO investors face six-month lockups—preventing immediate sales.

Tom Lee:

True—but they may access liquidity earlier via margin accounts or other means. Many VC funds’ valuations hinge almost entirely on SpaceX. When exits finally occur, this capital floods back into the economy—creating broad distributional effects.

Market Breadth Expansion

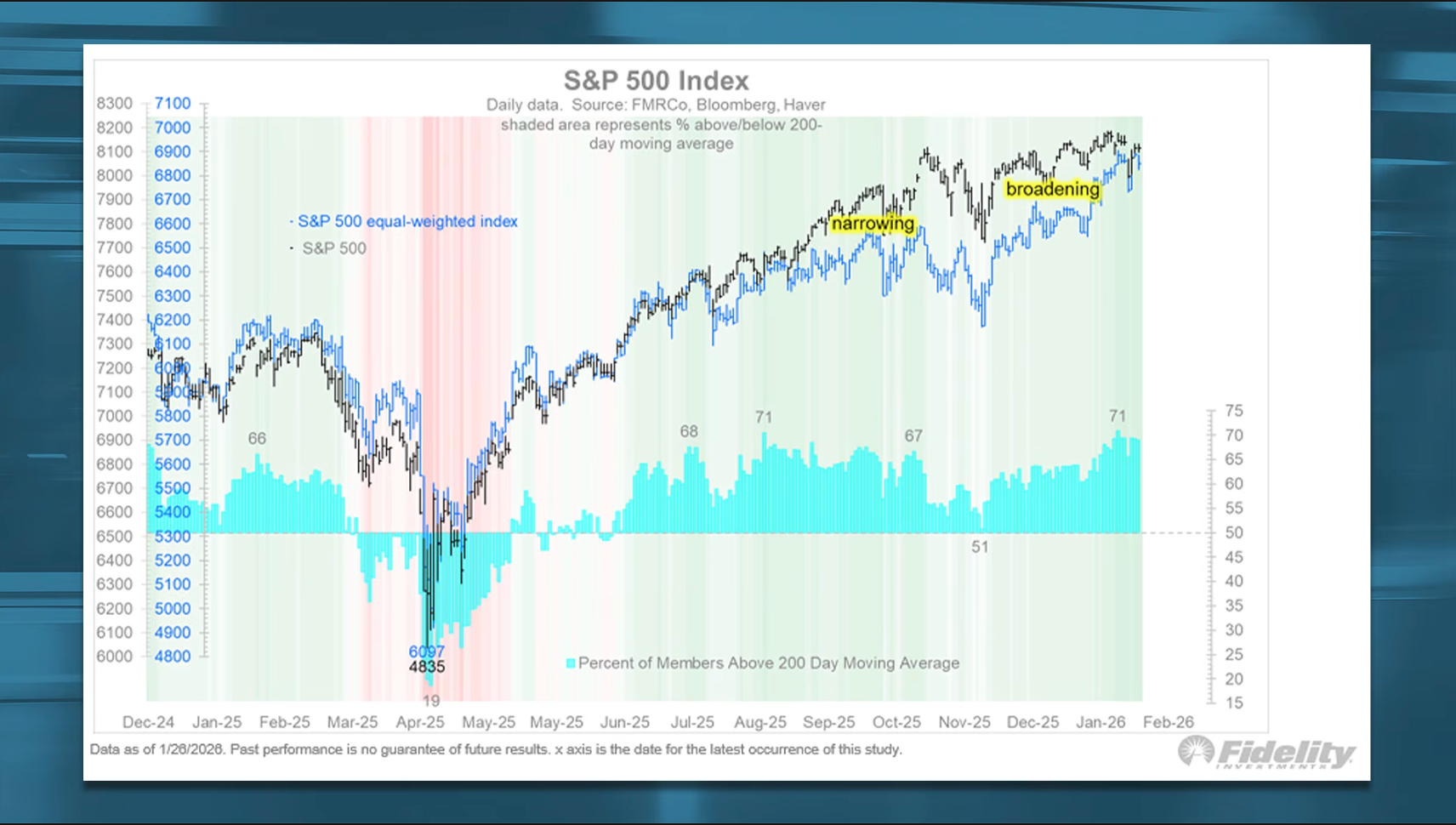

Michael Batnick: Market investment is shifting from concentration to broader coverage. Today, Microsoft fell 12%, yet the tech ETF dropped only 2%, and Nasdaq 100 fell 0.96%. Conversely, the equal-weight S&P 500 fell just 0.02%—nearly flat—indicating expansion. Concentration spiked late last year, but now breadth is widening. Cap-weighted S&P 500 is stable, while equal-weight breaks out—an optimistic sign. A full Mag 7 collapse would be alarming, as they lead markets. But aside from Microsoft’s anomaly, most trade sideways—expansion is positive.

Josh Brown: Is this a key reason you’re bullish this year? Will more stocks break new highs?

Tom Lee:

Yes—breadth expansion confirms a bull market, benefiting institutional investors unable to overweight the Mag 7. Through prime brokerage, institutions can use leverage to buy during corrections—broadening opportunities.

Josh Brown: How are your clients reacting?

Tom Lee:

They’re finally breathing easier—markets no longer depend solely on the Mag 7. Especially long-short investors now see more opportunities. Many are eyeing non-U.S. markets. I increasingly understand why global investors look abroad. In AI, the U.S. and China are likely the biggest winners.

China’s AI prowess is formidable. Plus, China leads in EVs—and has made strides in healthcare and biotech. Indeed, many European drugs are licensed from Chinese labs—suggesting China and neighboring nations benefit from these advances—a positive signal for global investors.

Josh Brown:

International markets tell a fascinating story. Last year, they rose 20–30% despite no earnings growth—driven by mindset shifts. Many countries mimicked U.S. post-pandemic recovery strategies, supporting capital markets. This re-rating sparked positive ripple effects—rising consumption, stronger corporate confidence, and increased investment.

This year, these nations are achieving earnings growth—explaining last year’s re-rating. This trend may persist for years—not just short-term. Now is an excellent time to invest in international large-caps.

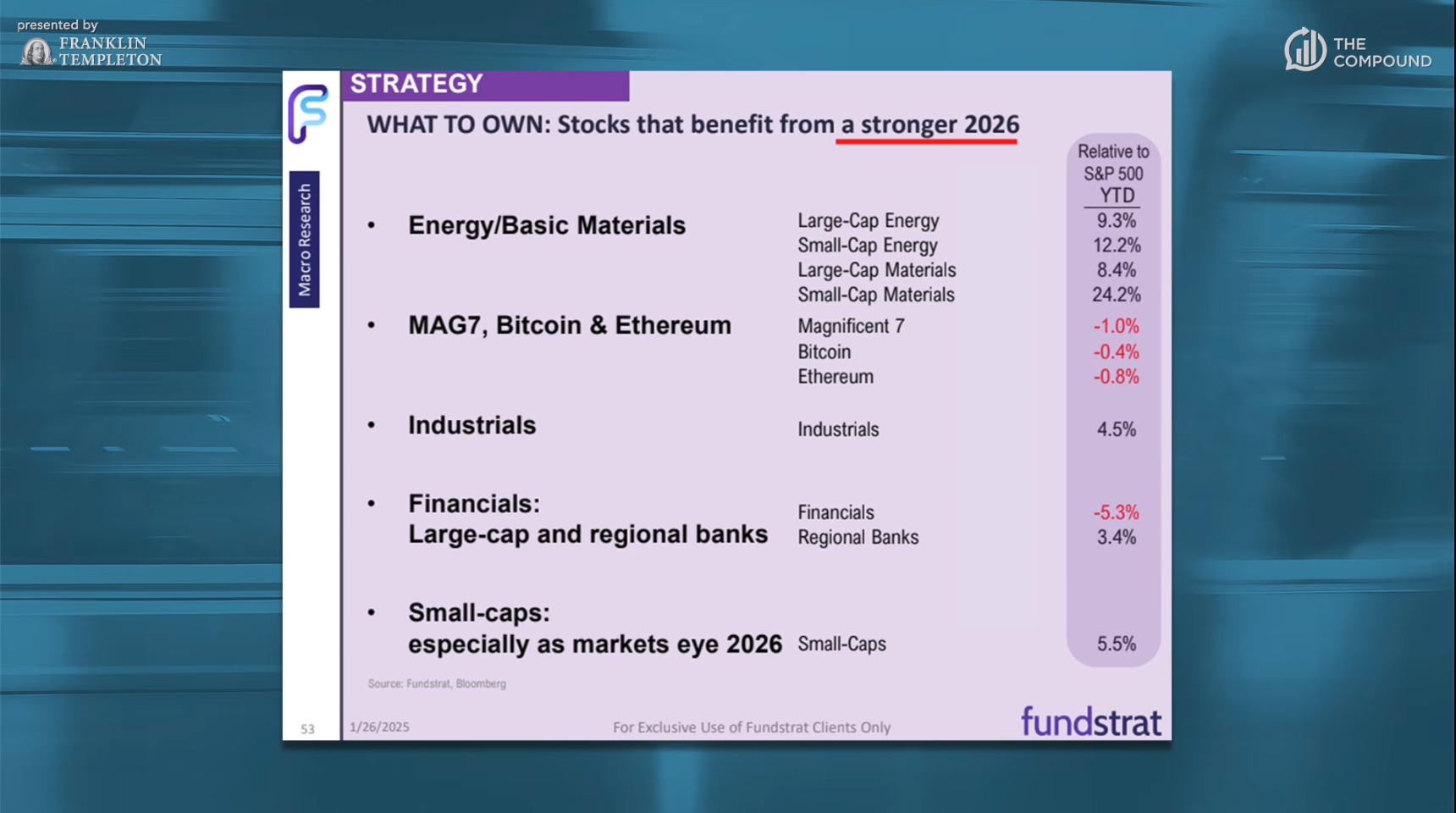

What Assets to Hold in 2026

Josh Brown: In 2026, what assets should we hold? Which stocks benefit from strong economic recovery?

Tom Lee:

Energy and basic materials are our top sector picks this year—but precious and other metals have outperformed expectations. This stems from three years of underperformance—the worst in 75 years.

We measure this via Z-score—a statistic gauging deviation from historical averages. Current Z-scores align closely with historical lows (e.g., 2000).

Josh Brown: Does energy show similar dynamics?

Tom Lee:

Yes—energy has barely moved over five years. Hence, we prioritize energy and basic materials.

Josh Brown:

Your analysis seems sound. These stocks show strong trends—being heavily bought. I doubt this reverses easily.

Crypto, Bitcoin & Ethereum

Josh Brown: You mentioned Bitcoin and Ethereum—unsurprising. Tom, what’s happening now? Bitcoin plunged today. Can you update us on crypto’s past 3–4 months? How do you view recent crypto doldrums?

Markets were hot earlier—logic clear. The White House supports crypto; the SEC acknowledges it. Bipartisan lawmakers compete for crypto-lobbyist funds—suggesting regulatory acceptance and broad embrace. Products launched, users grew, funds attracted capital—but then markets hit a wall.

Tom Lee:

Yes—crypto performed superbly pre-October, rising ~36%. But from October to year-end, select cryptos corrected ~40%. A key trigger was massive deleveraging: a pricing glitch at a crypto exchange triggered automatic deleveraging—spreading rapidly across exchanges, culminating in crypto’s largest deleveraging ever—worse than FTX’s collapse.

Josh Brown: So what happened specifically? Were leveraged traders forced to liquidate—disrupting trends?

Tom Lee:

Exactly. This event stemmed from a pricing error—but ultimately triggered liquidations across >2 million accounts globally, with ~1/3 of market-makers exiting—critical players akin to crypto’s central banks. Many exchanges’ balance sheets suffered severe damage.

Josh Brown:

Coinbase’s stock fell 50%—its second-largest drop since listing. As an industry giant, imagine smaller private firms’ plight.

Companies like Coinbase likely retain solid balance sheets. What about weaker ones? Has this ended?

Tom Lee:

In 2022, risk appetite took 8–12 weeks to recover. Now, we’ve likely exceeded that window—but recovery signs remain elusive.

Michael Batnick:

Solana hit a new low today; Bitcoin fell 6%; Ethereum dropped 7%—and this seems to accelerate, contrasting sharply with gold—Bitcoin’s supposed “digital gold.”

Tom Lee:

On Bitcoin, holders are shifting. Bitcoin is 14 years old—early crypto enthusiasts (young fans) have matured and grown wealthy—many now selling Bitcoin.

Also, quantum computing poses risks—mainly to Bitcoin. Quantum tech advances rapidly—and ~1/3 of Bitcoin wallets can’t upgrade, making them vulnerable to quantum attacks.

Michael Batnick: If quantum computing cracks Bitcoin’s blockchain, why not attack central banks or Chase accounts directly? Why prioritize Bitcoin?

Tom Lee:

Quantum computing resembles ASICs—brute-forcing repeated calculations to break encryption. Bitcoin’s algorithm is crackable. You’re right—quantum computing breaks many algorithms—but banks upgrade customer passwords, enforcing stronger encryption to evade threats. Bitcoin wallets—like Satoshi’s—never upgraded.

Josh Brown: How do you upgrade wallets to protect blockchains from quantum attacks?

Tom Lee:

This requires a Bitcoin fork—or contacting holders to upgrade wallets (e.g., Ledger or other hardware wallets).

Josh Brown:

So upgrading your wallet may safeguard your Bitcoin—but price may still fall.

I’m no expert—but if nodes exit en masse due to risk fears—or an influential figure declares, “I know a quantum computer is cracking Bitcoin’s blockchain”—price may drop regardless of upgrades.

Tom Lee:

First, anyone developing quantum-breaking tech won’t publicize it. A nation might quietly steal 1/3 of Bitcoin until noticed. Ethereum upgrades twice yearly—and is developing quantum-resistant tech. Many blockchains are becoming quantum-resistant, like banks upgrading encryption.

Josh Brown: Aside from FTX, have you seen such pessimism? Crypto seems utterly abandoned. I know it’s odd—it could rebound 15% tomorrow—but now it looks dire, near multi-month support levels—very grim.

Tom Lee:

Technically, crypto aligns with Tom Demark’s forecasts. He advises Bitmine—and told us Thursday was pivotal. Today proved pivotal—crypto plunged—but this likely marks selling exhaustion—not a new downtrend.

Josh Brown: So you don’t expect further declines?

Tom Lee:

For instance, Ethereum may fall to $2,400—a bottoming process marking the bottom—and possibly the peak of precious metals. Recall—precious metals attracted risk and speculative capital formerly in crypto. Six months ago, no one foresaw this.

Josh Brown:

I’ve heard crypto traders shifted to gold/silver—better performers—telling themselves it’s conservative investing. But crypto insiders argue: if Bitcoin once served as a dollar-alternative store of value, stablecoins’ widespread adoption—and banking’s full embrace—plus pending legislation letting stablecoin holders earn interest—what’s Bitcoin’s role?

If Bitcoin once escaped fiat or traditional finance, it’s now embedded within it. Its volatility renders it unfit as a store of value—but useful for transactions. Stablecoins excel as stores of value—they’re dollars, always dollars. Do Circle and other stablecoins erode Bitcoin’s utility? Fidelity launched a stablecoin this week. Does this diminish Bitcoin’s use cases?

Tom Lee:

A major blockchain story remains: Wall Street once viewed blockchain/crypto as experiments—but financial institutions now rebuild settlement layers using blockchain, per Standard Chartered at Davos. UBS’s CEO says digital and traditional finance will converge soon—blockchain offers finality and enhanced security—and Larry Fink (BlackRock CEO) states he believes the entire financial system will run on a universal blockchain.

Tom Lee:

Ethereum is highly practical—enabling future financial infrastructure. Stablecoins mostly build on Ethereum—leveraging smart contracts to lock information and prevent tampering. E.g., you can store a million-page legal document on Ethereum’s blockchain. Alter any punctuation, and hash verification fails—preserving integrity. Plus, Ethereum boasts 100% uptime—a key factor for Wall Street building future systems around Ethereum-like smart contracts—great news for Ethereum.

Josh Brown:

You mention building entire systems—what’s the timeline? Currently, 99.99% of finance has zero blockchain link. In 10 years—50%? Or just 5%? For example, on Wall Street alone, how much trading settlement runs on Ethereum?

Tom Lee:

Take stablecoins: Tether tokenized ~$160B in USD assets—less than 1% of M1, excluding risk assets or tokenized credit/stocks—but Tether may earn $20–24B this year from Treasury interest backing stablecoins. With overcollateralization, they hold ~$30B in gold or equivalents.

Assuming $20–24B profits, Tether ranks among the world’s top-five most profitable banks—surpassing Goldman Sachs or Morgan Stanley. With just 300 staff and a single-A product line, major institutions now vie for this profit pool—JPMorgan and Fidelity plan internal stablecoins, refusing to cede control.

This is just one product—you can tokenize stock trading on blockchain, as Vlad and others propose—another promising avenue.

Josh Brown:

Tom, let’s discuss DATs. These provide leveraged crypto exposure—if Bitcoin rises 2%, returns vastly exceed that—but DATs are down 70%. Bitmine faces similar issues—few hold underlying assets. If these strategies/assets near bottoms, why use digital asset trusts instead of holding underlying assets directly?

Tom Lee:

Only two digital asset trusts truly succeeded. Data shows only MicroStrategy and Bitmine bought >$2B in crypto since last October. Bitmine now earns income from Ethereum staking—holding ~$1B cash and earning ~$400M this year from staking rewards, plus $40M from cash holdings. It’s highly profitable.

Josh Brown: Does it trade below underlying asset value—or no longer at a discount?

Tom Lee:

It trades slightly above underlying value—but as net income, it’s the U.S.’s 780th-most-profitable company.

Josh Brown:

Have you studied Ethereum price vs. Bitmine stock correlation? How much of Bitmine’s decline stems from underlying asset price changes? I know it’s dynamic—but it’s almost entirely due to underlying price changes, right? If crypto stabilizes and rises, why choose digital asset trusts?

Tom Lee:

Digital asset trusts may yield higher returns—offering beta on price declines—but when prices rebound, trusts can quickly raise more capital—unlocking greater upside. Plus, Bitmine has “moonshot” investments—e.g., Beast Industries—where it’s now a top shareholder.

Our values align closely—he’s highly ethical, prioritizing kindness. There may never be another Mr. Beast. With a billion followers, his early abilities were extraordinary.

Josh Brown:

So you’re making such investments—unlinked to Ethereum’s price but still subject to its fluctuations.

Tom Lee:

Yes—but this creates Ethereum’s “on-ramp.” Mr. Beast’s audience spans Gen Alpha, Gen Z, and millennials—the next generation of financial consumers. So Beast Financial will clearly succeed.

Josh Brown: Where do you source funds to keep buying Ethereum amid falling markets?

Tom Lee:

Funding comes mainly from institutional investors—e.g., Morgan Stanley, Arc Asset, and Fidelity—who are Bitmine’s largest shareholders.

Josh Brown: Do you publicly forecast timing for targets? If achieved, will you raise them—or declare “mission accomplished: we’re Ethereum’s treasury”?

Tom Lee:

No concrete forecast yet—but possibly later this year. Note: hitting the 5% target yields ~$500M annual net income—and if Ethereum recovers to its highest historical BTC ratio (~$12,000 per ETH), annual net income nears $2B.

Tom’s Concerns

Josh Brown: Let’s discuss equities. Look at SPY’s bullish candle today—fantastic. Is it a hammer? I love the current market—approaching all-time highs with zero pullbacks—pure bull market. What’s your team’s technical strategist saying?

Tom Lee:

He’s optimistic on near-term equity performance. But he expects a significant mid-year correction—perhaps 20%—from higher levels. If the market sits at 7,300, it could fall 1,400 points—to ~5,900. Painful for investors.

How Robots Will Transform Work

Josh Brown: Could robots drive the next bull market?

Tom Lee:

Robots could indeed have massive impact. As productivity multipliers, they’ll dramatically boost efficiency—even enabling superhuman output.

If robots pay taxes, we still benefit. Taxing robots is one solution—at least robot manufacturers would pay taxes. We list labor shortages as an investment theme—robots can replace or fill labor gaps.

Structural labor shortages loom over the next decade—so robots have real applications. Autonomous robots in the real world would operate with extreme efficiency—generating massive GDP and tax revenue—possibly eliminating personal income tax. You might not need to work at all.

Josh Brown: Then what? How does society function?

Tom Lee:

People may stop working—robots create such vast surplus value. Robots pay taxes—levies on their activities, akin to micro-taxes.

Josh Brown: Aren’t you worried at all about AI-robot convergence? Will we become zoo animals—robots visiting us? Are you completely unpessimistic?

Tom Lee:

I’m confident the U.S. and China will win. Every American today will benefit from robot-generated surplus value. For example, pre-1935 frozen-food tech, 30% of Americans worked in agriculture. Post-tech, household food spending fell from 20% to 5%, and farm employment dropped from 30% to 5%. A 1935 economist predicting 90% agricultural job loss in 20 years would sound terrifying—people might fear depression—but it actually spurred prosperity.

Josh Brown:

This reminds me of Steinbeck’s *East of Eden*, where farmers adopt frozen-food tech and refrigerated railcars—set in your described era. Don’t you worry about the transition—people feeling lost for years before tech’s benefits emerge? Currently, benefits concentrate in the top 50% of households—the bottom 50% own no assets—this imbalance may worsen.

Tom Lee:

Social policy needs adjustment. Hopefully, extra leisure time boosts productivity—perhaps everyone enjoys more free time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News