Micron to Build $24 Billion Factory in Singapore—but Your RAM Stick Is Still Not in the Plan

TechFlow Selected TechFlow Selected

Micron to Build $24 Billion Factory in Singapore—but Your RAM Stick Is Still Not in the Plan

The three major memory manufacturers have collectively shifted their production capacity toward the AI market, with Micron being the latest to make its move.

By David, TechFlow

This time last year, a 16GB DDR4 memory module cost over RMB 200. Today, the same model sells for RMB 600—and some variants approach RMB 700.

The immediate cause of this price surge is tightening supply. The three major memory manufacturers have collectively shifted production capacity toward the AI market. Micron is the latest to make this pivot explicit.

On January 27, Micron Technology announced a USD 24 billion (approximately SGD 31 billion) investment to build an advanced NAND (flash memory chip) wafer fabrication plant in Singapore. The investment will be phased over ten years, with volume shipments scheduled to begin in the second half of 2028. Singapore’s Deputy Prime Minister Gan Kim Yong attended the groundbreaking ceremony.

This marks Micron’s second major investment in Singapore.

In January 2025, Micron broke ground on a USD 7 billion advanced HBM (High Bandwidth Memory) packaging facility at the same industrial park, with operations slated to commence in 2027. Combined, these two projects represent over USD 30 billion in new investment by Micron in Singapore.

Image source: Lianhe Zaobao, photo by Tang Jiahong

Yet just two months earlier, that same company announced it would discontinue Crucial—the consumer brand you’d find on JD.com and Taobao—ending its 29-year run selling memory modules and SSDs to end users.

One hand pours money into new factories; the other shuts down consumer-facing operations. Both moves point to the same underlying driver: insatiable AI-driven demand for memory.

Capacity Reallocation After China Market Contraction

Micron’s intensified investment in Singapore has clear geopolitical underpinnings.

In May 2023, China’s Cyberspace Administration announced that Micron products failed cybersecurity reviews, instructing critical information infrastructure operators in China to halt procurement. In fiscal year 2018, mainland China contributed 58% of Micron’s revenue (approximately USD 17.36 billion). By fiscal year 2022, that share had plummeted to 10.8% (roughly USD 3.31 billion).

That capacity needed a new outlet.

Micron currently operates three 3D NAND manufacturing plants and multiple assembly and test facilities in Singapore, employing approximately 9,000 people and producing 98% of Micron’s flash memory chips.

In its most recent statement, Micron said the HBM factory is expected to make a “significant contribution” to supply starting in 2027—and noted that integrating HBM production into its Singapore manufacturing operations will generate “synergies” with NAND and DRAM (Dynamic Random-Access Memory, i.e., standard memory chips) production.

But the priority order behind that “synergy” is unambiguous: HBM capacity is fully booked through 2026; data center customer demand remains unmet; and the consumer brand is being shuttered concurrently.

Within the same industrial park, consumer-grade production lines are making way for AI-focused lines.

The Business Logic Behind Exiting the Consumer Market

On December 3, 2025, Micron announced via its official website its complete exit from the Crucial consumer business—including memory modules and SSDs sold globally through retailers, e-commerce platforms, and distributors.

Shipments will continue until the end of February 2026, after which this brand—founded in 1996—will withdraw entirely from the retail market.

In the announcement, Micron Executive Vice President Sanjay Mehrotra stated that surging memory and storage demand driven by AI-powered data centers prompted the company’s “difficult decision” to exit the Crucial consumer business, enabling more effective supply and support for large strategic customers in high-growth segments.

Data supports this rationale.

Micron’s HBM product revenue for fiscal Q3 2025 reached USD 1.98 billion, implying an annualized revenue of nearly USD 8 billion. According to TrendForce, the unit price of HBM memory required for AI servers is roughly eight times that of conventional servers.

Micron forecasts the HBM market will grow from approximately USD 35 billion in 2025 to around USD 100 billion by 2028—surpassing the entire DRAM market’s size in 2024.

In contrast, consumer storage is a low-margin, fiercely competitive business.

Micron’s exit reduces the number of major global consumer DRAM manufacturers from three—Samsung, SK hynix, and Micron—to two.

Memory Stocks Ride the AI Wave

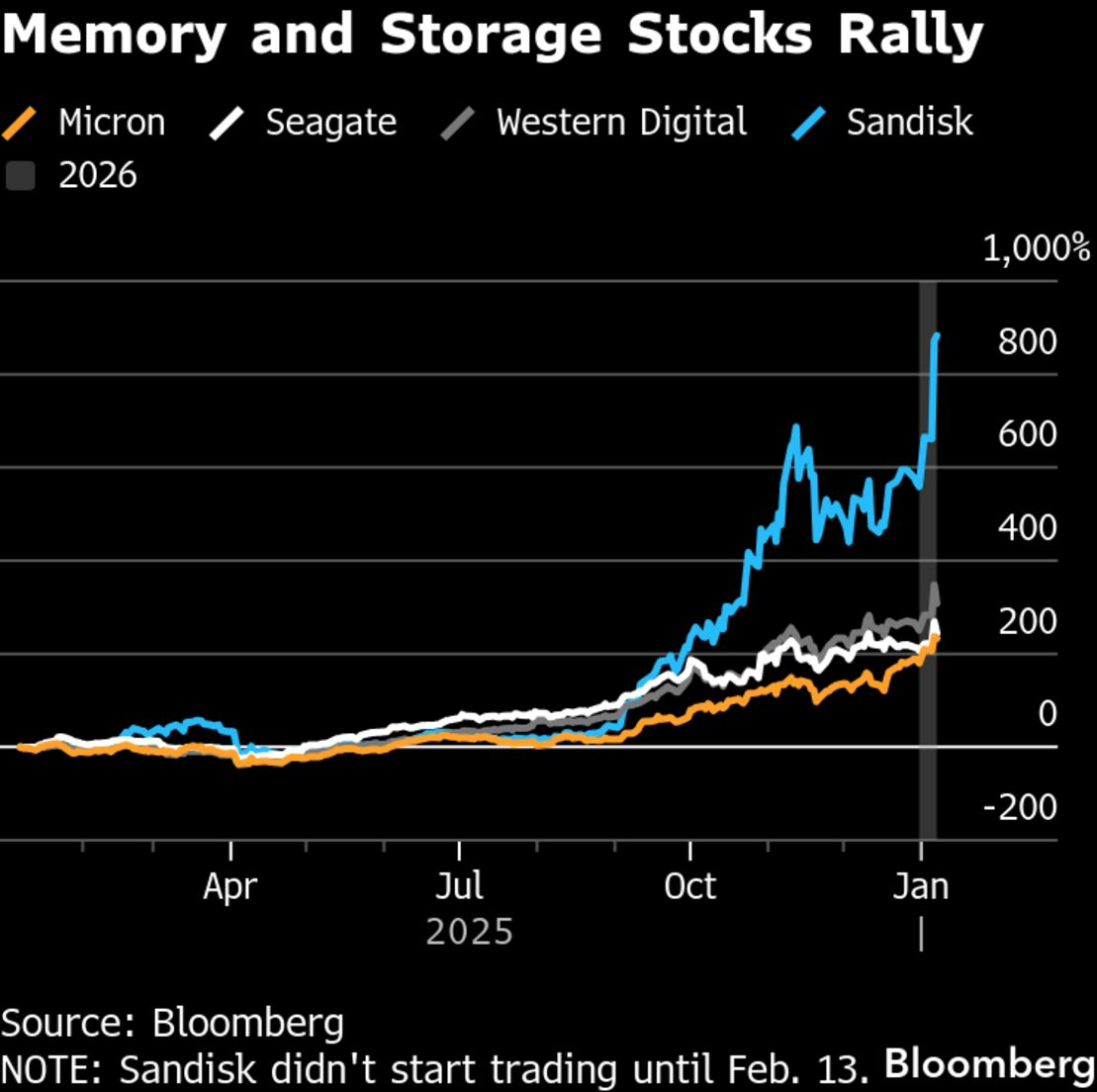

The capital markets have already priced in this strategic shift.

According to reports from Every Day Economic News, memory stocks claimed the top four spots on the U.S. stock market’s annual gain leaderboard in 2025:

SanDisk rose 577%, becoming the S&P 500’s top-performing stock for the year; Western Digital rose 281%; Micron rose 236%; and Seagate rose 216%.

By comparison, NVIDIA rose 39%—ranking 71st.

Reports indicate that tech giants including Google and Amazon issued “unlimited purchase orders” to Micron in October 2025. Micron CEO Sanjay Mehrotra revealed on the earnings call that the company’s entire HBM supply for fiscal year 2026 has been fully committed—and it can currently fulfill only 50–67% of key customers’ requirements.

Micron’s latest financial report shows revenue of USD 13.6 billion for September–November 2025, up 57% year-on-year, with DRAM revenue totaling USD 10.8 billion, up 69% year-on-year.

Consumer Segment: Price Increases Likely to Persist

Samsung, SK hynix, and Micron all previously announced plans to phase out DDR4 production gradually between late 2025 and early 2026. Micron issued its DDR4/LPDDR4 End-of-Life notice in June.

Although Samsung and SK hynix later extended DDR4 production to the end of 2026 due to soaring prices, the overall trend of tightening supply remains unchanged.

Price reactions have been sharp. According to TrendForce, spot prices for DDR5 memory chips have surged over 300% since 2025, while DDR4 prices have risen over 150%. DDR4 has even experienced “price inversion,” with certain specifications now commanding higher prices than DDR5.

ADATA Chairman Chen Li-Bai publicly stated that shortages and price hikes across all four major storage categories—DRAM, NAND, SSD, and HDD—represent a situation he has never witnessed in his more than 30 years in the industry.

If you’re upgrading memory for an older PC or building a new desktop, costs remain prohibitively high. Because AI needs computing power—and computing power needs memory—your aging PC likely ranks behind AI demand in the supply queue.

Memory stocks have surged—and so have memory module prices.

One represents an investment opportunity; the other is the price you pay for that opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News