The热闹 is for the “Epsteins”; Saylor just wants to accumulate Bitcoin.

TechFlow Selected TechFlow Selected

The热闹 is for the “Epsteins”; Saylor just wants to accumulate Bitcoin.

The man deemed too boring escaped history’s biggest sex scandal.

Author: Kuli, TechFlow

There’s a reason one person can accumulate 710,000 bitcoins.

Last Friday, the U.S. Department of Justice released documents related to the Jeffrey Epstein case—3 million pages in total. Politicians, billionaires, and celebrities all emerged from these files. Michael Saylor, founder of Strategy (formerly MicroStrategy), was among them.

Yet Saylor appeared in an unusual way—he was on the “unwanted” list.

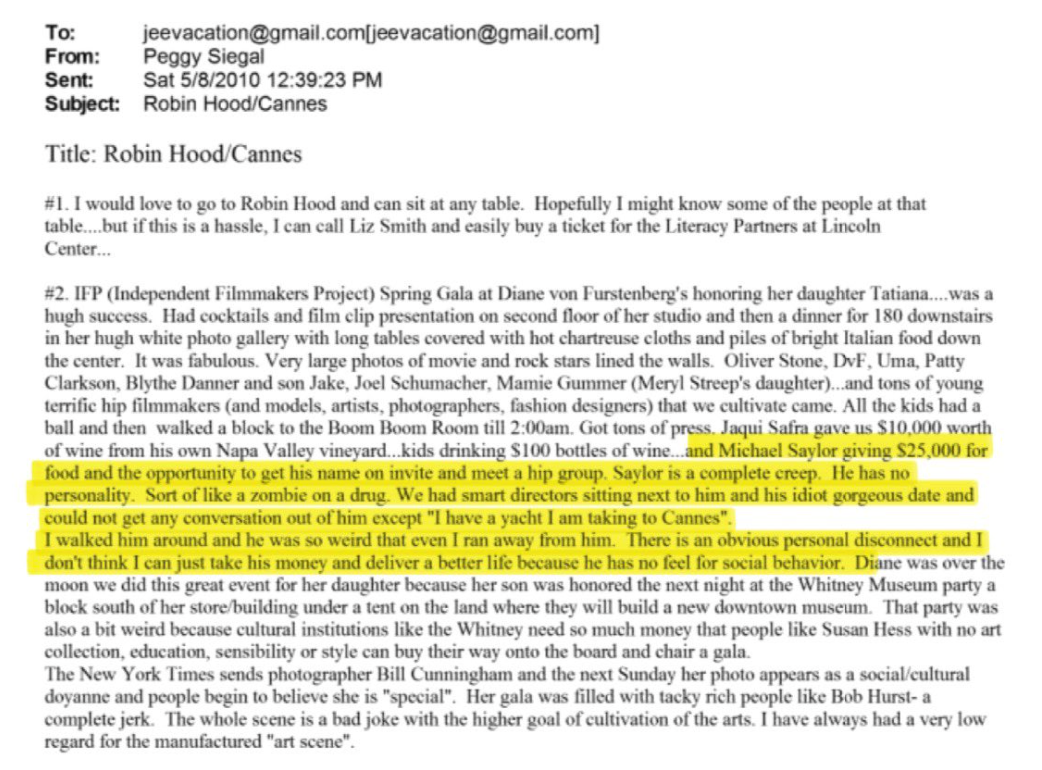

According to currently available information, in a private email from 2010, Epstein’s publicist Peggy Siegal wrote the following about him:

“A guy named Saylor paid $25,000 for a dinner ticket, and I was assigned to chaperone him socially. But he was completely impossible to talk to—like a drugged-up zombie—and I couldn’t take it anymore, so I left halfway through.”

Peggy’s day job was Hollywood film PR; her side gig was arranging dinners for Epstein—essentially scouting wealthy people to bring into his circle.

She helped wealthy people socialize, introduced them to the right people at parties and dinners, ensured they had fun, and spent money comfortably. After decades in the business, she’d seen every kind of billionaire imaginable.

But Saylor? She couldn’t handle him.

It wasn’t because he had poor character—it was because he was just too dull. He paid to get in, sat there, couldn’t engage in conversation, and showed zero interest in socializing.

Peggy’s exact words were: “I’m not even sure I can collect payment from him—I don’t know where to even begin trying to manage him… He has no personality and absolutely no grasp of social etiquette.”

Now that the Epstein case has exploded, those named are scrambling to distance themselves. Saylor, however, never even made it inside in the first place.

Being excessively boring and socially withdrawn ironically became his protective talisman.

But when this “boredom” is transplanted to another context, it becomes something else entirely.

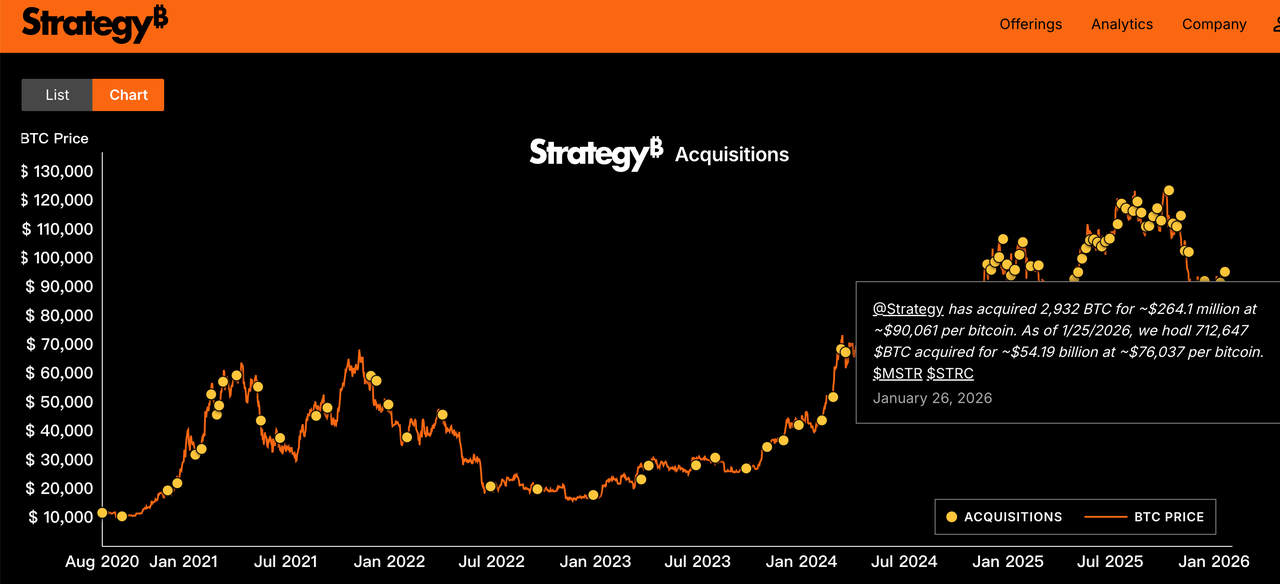

Saylor’s company, Strategy (formerly MicroStrategy), holds more bitcoin than any other publicly traded company. In January this year—while bitcoin was still oscillating around $90,000—the company purchased over 37,000 additional bitcoins for $3.5 billion.

They buy nearly every week—without fail.

As of now, Strategy holds 712,647 bitcoins, with an average cost basis of $76,037. Bitcoin has just dipped below $76,000—meaning Saylor’s position sits precisely at the breakeven point.

The market fear index has hit a 20-week high, and the crypto community is reeling. Strategy’s stock price has fallen 60% from its peak.

Yet Saylor tweeted “More Orange,” implying he’ll continue buying next week.

Back then, Peggy called him a zombie. Now, perhaps accumulating bitcoin truly requires a zombie.

No explanations, no timing, no selling out. Utterly impervious to external noise—and feeling perfectly fine about it.

Back then, Peggy complained she didn’t know how to spend his money. Now, Saylor clearly found his own way: buy nothing but bitcoin.

From that email, it’s clear Saylor was an outsider in elite social circles—unable to sit still, unable to converse, and leaving after one evening as if he’d never been there at all. Yet in trading, he’s the opposite: he can sit still.

No schmoozing, no relationship management, no second-guessing others’ intentions—just fixating on one thing, buying weekly, and never selling.

Dull, uninteresting, indifferent to external stimuli—these traits are liabilities in social settings, but might just be superpowers when accumulating bitcoin.

After this story spread, classic memes surfaced on Twitter—essentially saying Saylor has zero interest in underage girls, but is utterly obsessed with “underage assets.”

In hindsight, this exposure has arguably burnished Saylor’s image.

After the Epstein scandal broke in 2019, Peggy—who handled his PR—lost contracts with Netflix, FX, and others, effectively ending her PR career. Meanwhile, Saylor is now one of the world’s largest bitcoin holders.

The man who was rejected keeps buying bitcoin; the woman who rejected him has already dropped out.

That said, Saylor’s current situation isn’t exactly easy.

The new Federal Reserve Chair, Warsh, leans hawkish, and markets expect he won’t aggressively cut rates upon taking office. A shift in rate expectations has put pressure on global asset classes.

Gold fell. Silver fell. Bitcoin fell even harder.

Add trade tensions and strained U.S.-EU relations, and capital is fleeing toward traditional safe-haven assets. Bitcoin’s “digital gold” narrative is fading.

If bitcoin continues falling, Strategy’s ability to raise capital via new share issuances will weaken further, potentially turning its “bitcoin–stock flywheel” into a death spiral.

Yet Saylor appears genuinely unfazed—perhaps that’s boredom’s other side.

Ordinary investors can’t emulate Saylor—not because they lack funds, but because they’re too “normal.” Normal people read the news, study charts, and listen to what others say. When the fear index spikes, their hands itch and their hearts ache.

They make decisions daily—each decision draining mental energy.

Saylor’s strategy seems to have no “decision-making” step at all. Buying is the sole action; not selling, the only principle.

In his own words: “Bitcoin is the best asset ever invented by humankind—why would I sell?”

You could call this faith—or obsession. But operationally, the greatest advantage of this system is:

It doesn’t require intelligence—only boredom.

Of course, this isn’t advice to copy him. Saylor’s confidence rests on having a publicly traded company—able to issue stock or borrow debt. Ordinary people lack those tools; imitating his approach will likely only lead to losses.

But one thing may be worth adopting.

In investing, “fun” is often the source of losses.

Frequent trading, chasing trends, reacting to rumors, using leverage—these “fun” behaviors are precisely what undermine returns.

Truly profitable strategies, by contrast, are so boring they put you to sleep.

Saylor’s case is extreme—but the logic holds. In a noisy market, boredom may be the rarest skill of all.

Those who once dazzled at parties are now either distancing themselves, under investigation, or gone entirely.

Perhaps accumulating bitcoin—and living life—follows the same principle:

Don’t linger where it’s loud—do what’s boring, long-term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News