Strategy, STRC, and the Battle for Bitcoin's轨道: Who Will Control the Future Monetary Order?

TechFlow Selected TechFlow Selected

Strategy, STRC, and the Battle for Bitcoin's轨道: Who Will Control the Future Monetary Order?

Bitcoin is the battlefield, MicroStrategy is the signal, and this conflict is a direct clash between "financialists" and "sovereigntists."

Author: MarylandHODL

Translation: TechFlow

TechFlow Summary:

-

The Financialists' Rule: By controlling credit, price discovery mechanisms, and monetary transmission channels, the Financialists maintain a highly centralized system centered on fiat currency.

-

The Sovereignists' Counterattack: This camp consists of nations seeking monetary independence, institutions and corporations weary of the banking system, and individuals choosing Bitcoin as a store of wealth. They believe Bitcoin can break the monopoly of traditional money.

-

Significance of STRC: MicroStrategy's STRC is an innovative financial instrument that transforms fiat savings into real yield backed by Bitcoin, while reinforcing Bitcoin’s scarcity by tightening its circulating supply.

-

JPMorgan’s Response: JPMorgan quickly launched synthetic financial products linked to Bitcoin, attempting to pull Bitcoin exposure back into the traditional banking system—without involving actual Bitcoin at all.

-

Historical Parallel: The article compares the current Bitcoin revolution to the centralized restructuring during America’s industrial era from 1900–1920, noting this time the foundation is decentralized Bitcoin, not a debt-based fiat system.

Potential Impacts:

-

For Individuals: Bitcoin offers ordinary people a way to protect their wealth from inflation erosion and the possibility to bypass the traditional financial system.

-

For Society: If widely adopted, Bitcoin could realign money with social incentives, potentially triggering profound economic and ethical transformation.

-

For the Financial System: The rise of tools like Bitcoin and STRC may weaken the power of traditional financial institutions, leading to a split and reorganization of the monetary base.

Key Takeaways:

-

Bitcoin is not just an asset; it is a tool to break the monopoly of traditional money.

-

STRC is a critical innovation in the Bitcoin ecosystem, providing a legitimate and scalable capital market entry point for Bitcoin.

-

The current monetary war is not merely an economic struggle but a deep contest over future societal structures and values.

-

Once truth emerges, decentralized Bitcoin may rapidly transform existing financial and social orders.

TechFlow Note: Content summarized using GPT-4.0.

In my previous article, I painted a grand battlefield—the struggle over Bitcoin’s monetary architecture. Now, it’s time to delve into the underlying mechanics.

This follow-up piece aims to reveal the specific levers and structural dynamics explaining what’s unfolding before us. We will analyze how derivative systems and new financial products integrate into this emerging framework.

The full picture is gradually coming into view:

Bitcoin is the battlefield, MicroStrategy is the signal, and this conflict is a direct clash between “Financialists” and “Sovereignists.”

This isn’t merely a debate about asset allocation—it marks the early phase of a decades-long transformation, like tectonic plates slowly grinding beneath society until cracks finally appear.

Let us walk along this fault line and confront the truth.

I. Collision of Two Monetary Architectures

Matt @Macrominutes has provided the most powerful framework to date:

The Financialists

Since the secret backroom deal in 1913, the Financialists have fully controlled the rules of the game. This group includes:

-

The Federal Reserve,

-

JPMorgan and the U.S. banking cartel,

-

European banking dynasties,

-

Globalist elites,

-

An increasing number of controlled politicians,

-

And a derivatives-based framework that has supported global capital flows for over a century.

Their power rests on “synthetic monetary signals”—the ability to create credit, shape expectations, alter price discovery mechanisms, and control all major settlement forms.

Eurodollars, swaps, futures, repo facilities, and forward guidance—all are their tools. Their survival depends on controlling abstract layers that obscure the true nature of the underlying monetary base.

The Sovereignists

On the other side are the Sovereignists—those seeking less distortion and more sound money. This group is not always unified, composed of allies and adversaries, individuals and nations, diverse political leanings and ethical frameworks.

This camp includes:

-

Sovereign nations pursuing monetary independence,

-

Institutions and corporations frustrated by banking bottlenecks,

-

And individuals opting out of the credit-based system toward self-sovereignty.

They see Bitcoin as the antidote to centralized monetary power. Even if many don’t yet grasp its full significance, they intuitively recognize a core truth: Bitcoin breaks the monopoly on monetary reality.

And this is something the Financialists cannot tolerate.

The Trigger Point: Conversion Rails

The current war centers on conversion rails—systems that convert fiat into Bitcoin and Bitcoin into credit.

Whoever controls these rails will control:

-

Price signals,

-

Collateral base,

-

Yield curves,

-

Liquidity pathways,

-

And ultimately, the new monetary order rising from the old system.

@FoundInBlocks

This battle is no longer theoretical. It has arrived… and appears to be accelerating.

II. The Last Similar Transformation (1900–1920)

We’ve seen something like this before… though back then, the protagonist wasn’t Bitcoin, but a disruptive technological shift that forced a complete rebuilding of America’s financial, governance, and social structures.

Between 1900 and 1920, American industrial elites faced:

-

Populist anger,

-

Antitrust pressure,

-

Political hostility,

-

And the threat of their monopoly system collapsing.

Their response was not retreat, but centralization.

These efforts still deeply influence social structures today:

Healthcare

The 1910 Flexner Report standardized medical education, dismantling millennia-old alternative therapies and giving rise to the Rockefeller-dominated healthcare system—the foundation of modern Big Pharma’s power in the U.S.

Education

Industrial magnates funded a standardized school system designed to produce workers compliant with centralized industrial production. This framework persists today, now optimized for services rather than manufacturing.

Food and Agriculture

The consolidation of agribusiness created a cheap, high-calorie, low-nutrition food system filled with preservatives and chemical additives. This system reshaped American health, incentives, and political economy over the past century.

Monetary Architecture

In December 1913, the Federal Reserve Act introduced Europe’s central banking model to the U.S.

Ten months earlier, the federal income tax (a 1% levy on incomes over $3,000, equivalent to about $90,000 in 2025) created a permanent revenue stream to service federal debt.

A debt-based fiat system was born.

This was the last major turning point in American power—a silent reorganization around a centralized monetary core, controlled by an institution independent of elected government and governed by opaque mandates.

Today, we are experiencing the next such shift.

But this time, the foundation is decentralized… and incorruptible.

That foundation is Bitcoin.

The players remain familiar: echoes of industrial titans on one side, Jeffersonian populists on the other. But this time, the stakes are higher. The Financialists possess a century of synthetic suppression tools and narrative control, while the Sovereignists, though fragmented, are deploying tools the old system never anticipated.

For the first time since 1913, this struggle has spilled into the streets.

III. STRC: The Great Conversion Mechanism

In July this year, MicroStrategy launched STRC (“Stretch”). Most observers dismissed it as another odd invention from Saylor—an eccentric corporate borrowing tool or fleeting attention stunt.

Yet they missed STRC’s true significance.

“STRC is the great conversion mechanism of capital markets. It is the first key tool for reshaping incentives.”

STRC is the first scalable, regulation-compliant mechanism that:

-

Exists within the existing financial system,

-

Natively interfaces with capital markets,

-

Converts yield-starved fiat savings into real returns backed by Bitcoin.

When Saylor called STRC “MicroStrategy’s iPhone moment,” many scoffed.

But viewed through the lens of conversion rails?

STRC might actually be Bitcoin’s iPhone moment—the node where Bitcoin’s price dynamics achieve reflexive equilibrium, laying a stable foundation for the unveiling of a new monetary order.

STRC connects: Bitcoin as an asset → collateral base → credit and yield driven by Bitcoin.

This matters because in an inflationary and depreciating monetary system, value silently drains from unsuspecting hands. Those aware of the current state gain access to **“flawless collateral”**—a way to store and protect their life energy and accumulated wealth across time and space.

Eventually, when trust collapses, people instinctively seek truth… and Bitcoin represents mathematical truth. (If this doesn’t resonate yet, it simply means you haven’t begun descending the rabbit hole.)

When trust collapses, people seek truth… and Bitcoin embodies mathematical truth. STRC transforms this principle into a financial engine.

It doesn’t just offer yield—it channels suppressed fiat liquidity into a spiraling upward cycle of Bitcoin-backed collateral.

The Financialists feel threatened. Some among them may already realize just how dangerous this is to their exploitative system.

They vaguely sense what would happen if this cycle scales.

IV. The Financialists’ Worst Nightmare: A Positive Feedback Loop

As the U.S. attempts to escape fiscal dominance via “economic growth” (monetary expansion and yield curve control), savers will chase real returns amid inflationary resurgence.

Yet traditional channels cannot deliver these returns:

-

Banks can’t,

-

Bonds can’t,

-

Money market funds can’t. But Bitcoin can.

MicroStrategy has built an enterprise-grade monetary loop:

-

Bitcoin appreciates

-

MicroStrategy’s collateral base strengthens

-

Borrowing capacity expands

-

Cost of capital decreases

-

STRC offers attractive Bitcoin-backed yield

-

Capital flows from fiat → STRC → Bitcoin collateral

-

Bitcoin’s circulating supply tightens

-

The cycle repeats at a higher level

This is the “Scarcity Engine”—a system that grows stronger as fiat weakens.

The arbitrage space (ARB) between suppressed fiat returns and Bitcoin’s structural internal rate of return (IRR) is becoming a monetary black hole.

If STRC scales, the Financialists risk losing control over:

-

Interest rates,

-

Collateral scarcity,

-

Monetary transmission mechanisms,

-

Liquidity channels,

-

And the cost of capital itself.

This is the backdrop of the first attack.

V. Coordinated Suppression Campaign

(This is pattern recognition, not conclusive evidence.)

After Bitcoin peaked on October 6:

-

BTC dropped from 126k to lows near 80k,

-

MSTR fell from the 360 USD range to the high 100s,

-

STRC remained stable amid broader crypto market turmoil,

-

Until November 13, when a sudden liquidity vacuum caused STRC to crack.

Days later, the narrative of MSCI “delisting” resurfaced, directly targeting MSTR.

This sequence does not appear natural. It bears clear signs of being the first coordinated strike against the conversion rail. (Again, this is pattern recognition, not proof—but the pattern is hard to ignore.)

While STRC held steady, it revealed what a functioning Bitcoin-backed credit engine might look like.

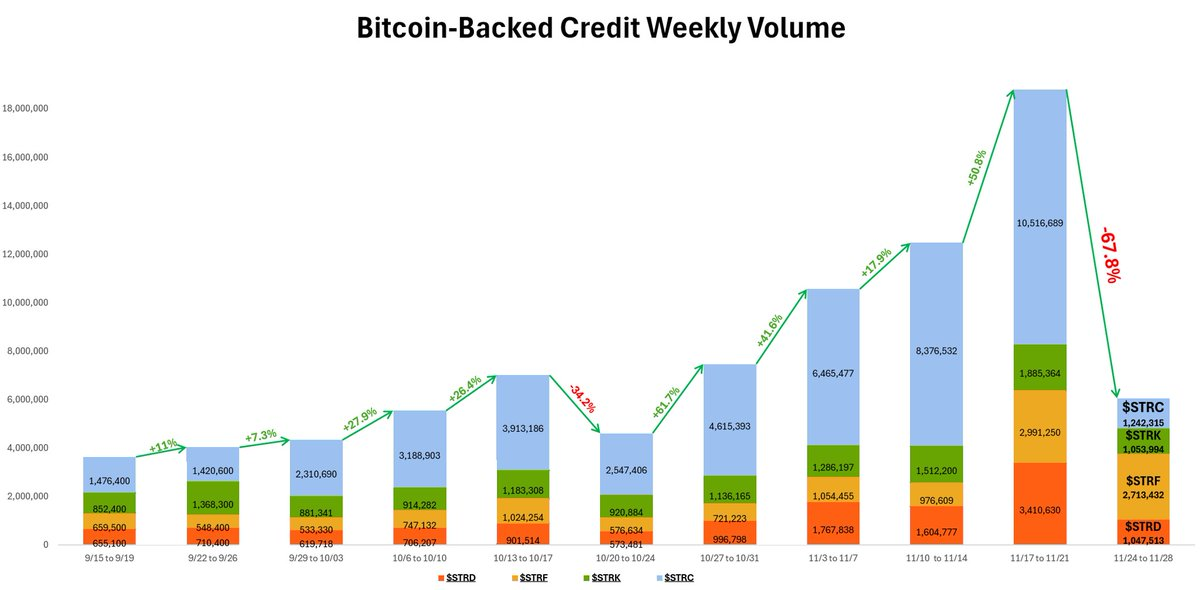

Though the initial data covered only two weeks and small scale, its implications were massive:

-

Nov 3–9: Purchased $26.2 million BTC from $6.4 billion in volume;

-

Nov 10–16: Purchased $131.4 million BTC from $8.3 billion in volume.

Don’t focus on the dollar figures—the mechanism itself is what matters.

Once scaled, the Financialists’ reaction becomes obvious.

If STRC scales:

-

Money markets lose relevance,

-

Repo markets lose dominance,

-

Derivatives-based price suppression weakens,

-

Bank-generated yields collapse,

-

Capital flows bypass the banking system,

-

Treasuries lose control over domestic savings,

-

The dollar’s monetary base begins to fracture.

MicroStrategy didn’t just launch a product—it is building a new conversion rail.

And JPMorgan responded swiftly.

VI. JPMorgan’s Counterattack: The Synthetic Shadow

(This is pattern recognition, not conclusive evidence.)

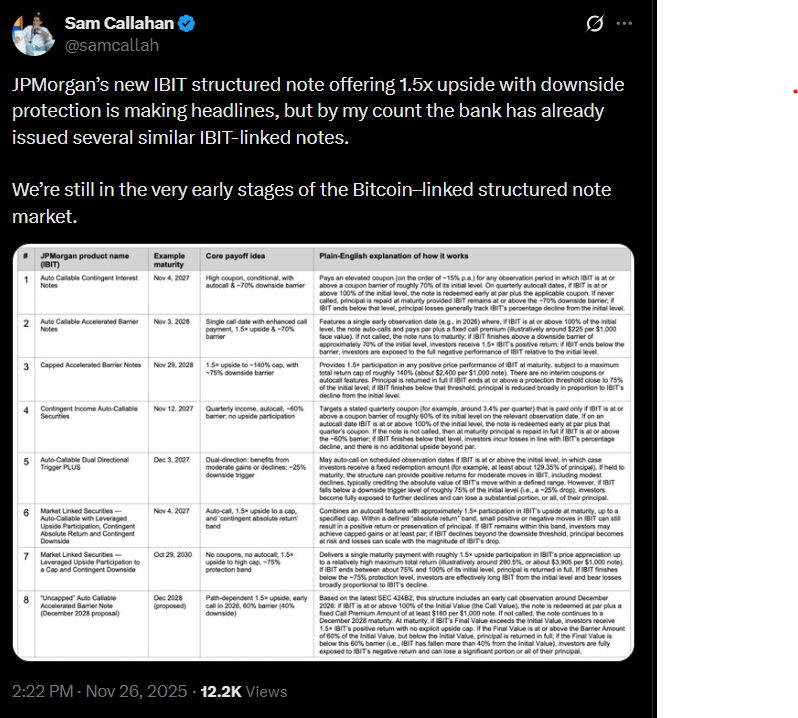

During a holiday-shortened trading week—an ideal window for quiet structural adjustments—JPMorgan publicly launched a “Bitcoin-linked” structured note.

Its design appears almost a confession:

-

Linked to IBIT, not spot price,

-

Cash-settled,

-

No Bitcoin purchased,

-

No reduction in Bitcoin circulation,

-

Capped upside,

-

Convex gains retained by the bank,

-

Downside risk passed to clients.

Yet, as @Samcallah revealed, the deeper intent is even more sinister: JPMorgan recently rolled out a series of structured products tied to IBIT.

This isn’t innovation—it’s the old playbook of centralization: profits privatized, losses socialized.

It’s an attempt to “recapture”—to pull Bitcoin exposure back into the banking system without touching real Bitcoin.

This is the rebirth of the “paper gold” system, where: “Synthetic shadow” = undetectable paper Bitcoin supply.

In contrast:

-

STRC requires real Bitcoin,

-

STRC tightens Bitcoin’s circulation,

-

STRC strengthens the “Scarcity Engine.”

Two products, two paradigms—one belonging to the future, one to the past.

VII. Why MicroStrategy Was the First Target

(This is pattern recognition, not conclusive evidence.)

MicroStrategy threatens the Financialists’ model because it is:

-

The company with the largest public Bitcoin balance sheet,

-

The first corporate “bank” to adopt Bitcoin as a reserve asset,

-

The only firm monetizing Bitcoin collateral at institutional scale,

-

The only regulated entity offering real Bitcoin-backed yield,

-

The only bridge bypassing all synthetic exposure channels.

This explains the pressure pattern against it:

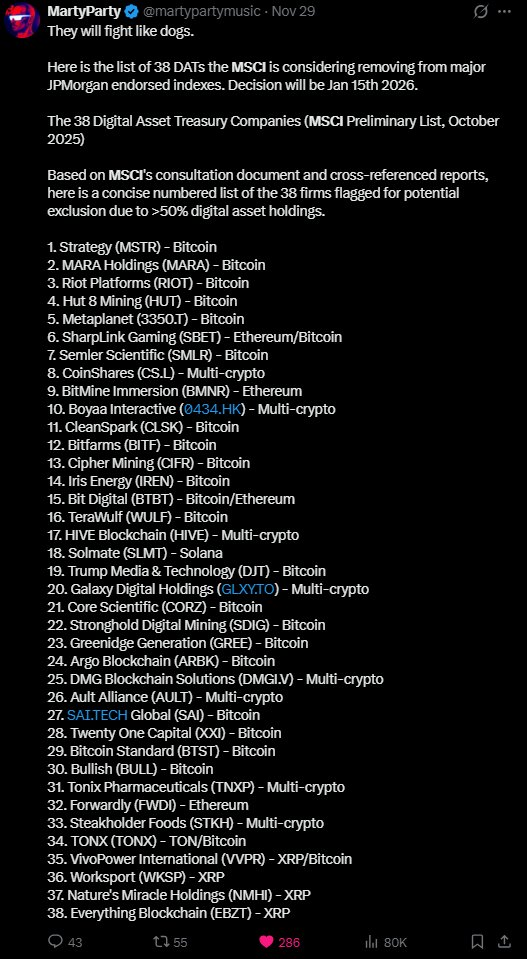

MSCI penalizes companies with significant Bitcoin holdings—see @martypartymusic’s thread:

Source:@martypartymusic

(Note how they conveniently avoided Coinbase, Tesla, or Block.)

-

Credit rating agencies (creations of Wall Street) barely rate MicroStrategy’s preferred shares, yet “cleverly” target Tether—both aiming to undermine sound money as legitimate collateral.

-

Rumors of JPMorgan blocking MicroStrategy stock transfers.

-

Synchronized drops in BTC and MicroStrategy (MSTR) share price alongside MSCI-related reports.

-

Sudden policy-maker attention, both positive and negative.

-

Banks rushing to rebuild synthetic Bitcoin exposure to pull demand back into the traditional system.

MicroStrategy is attacked not because of Michael Saylor personally, but because its balance sheet structure breaks the Financialists’ system.

Still, it’s a pattern (not proof)—but the signals bear striking similarities.

VIII. The Sovereign Layer—The Final Destination

Zooming out, the overall architecture becomes clear:

-

Stablecoins will dominate the front end of the yield curve,

-

BitBonds will stabilize the long end,

-

Bitcoin reserves will become the core anchor of sovereign balance sheets.

MicroStrategy is the prototype of a Bitcoin reserve bank at the capital market level.

The Sovereignists may not have articulated this plan explicitly, but they are gradually moving toward it.

And STRC is the upstream catalyst for this process.

Because STRC is not really a debt or equity product. STRC is an “escape mechanism.”

It is a derivative capable of triggering a powerful chain reaction, dissolving fiat in scarcity.

It breaks monopolies over:

-

Yield,

-

Collateral,

-

And monetary transmission mechanisms.

More importantly, it operates from within the traditional system, using the system’s own regulatory framework as leverage.

IX. The Moment We Are In

Right now, the embedded depreciation logic of fiat has become a simple, undeniable mathematical fact—and it is increasingly recognized by more people.

If Bitcoin is leveraged by the Sovereignists as a tool, the Financialists’ architecture could collapse as swiftly as the Berlin Wall.

Because in the end, once truth emerges, it always prevails quickly.

Bitcoin is the battlefield of this fight.

MicroStrategy is the signal of this fight.

STRC is the bridge connecting them.

This war—public, visible, undeniable—is about the conversion rails between fiat and Bitcoin.

This war will define the entire 21st century.

And for the first time in 110 years, both sides are beginning to show their hands.

To live in such an era is extraordinary.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News