From All-in to Perpetual: Decoding MicroStrategy's $1.44 Billion Cash Reserves

TechFlow Selected TechFlow Selected

From All-in to Perpetual: Decoding MicroStrategy's $1.44 Billion Cash Reserves

What impact will it have on the market when the largest BTC holders are not buying, but even selling BTC?

By Umbrella, TechFlow

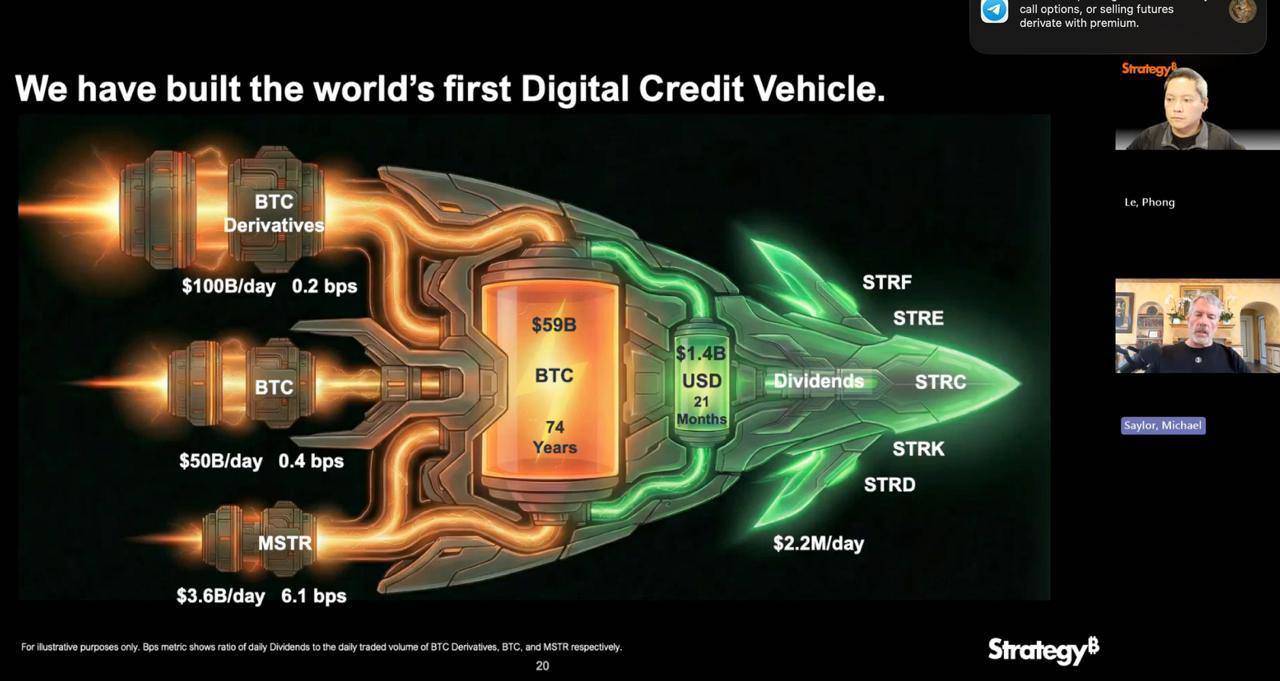

As the public company holding the largest amount of BTC globally, Strategy announced on December 1, 2025, that it had raised funds through the sale of Class A common stock to establish a $1.44 billion reserve.

The official statement indicated this move aims to support payments for preferred stock dividends and interest on outstanding debt over the next 21 to 24 months, reinforcing its commitments to credit investors and shareholders.

This firm, widely regarded as a "BTC shadow ETF," has pursued an extremely simple and aggressive core strategy over recent years: raise capital at the lowest possible cost and convert it into bitcoin immediately upon receipt.

Under Michael Saylor's grand narrative of "Cash is Trash," Strategy typically holds only the minimum amount of fiat currency on its balance sheet necessary for daily operations.

This clearly contradicts its current announcement. Against the backdrop of BTC prices recently pulling back from highs and market volatility intensifying, Strategy’s move has once again unsettled the market. What impact will it have when the largest BTC holder stops buying—or even begins selling?

Strategic Turnaround

The most significant aspect of this event is that it marks the first time Strategy has publicly acknowledged the possibility of selling its held BTC.

Company founder and Executive Chairman Michael Saylor has long been hailed as a staunch evangelist for bitcoin, with his core strategy centered on "buy and hold forever." However, CEO Phong Le explicitly stated in a podcast interview that if the company's mNAV metric (enterprise value relative to the value of its crypto holdings) falls below 1 and the company cannot secure financing through other means, it would sell bitcoin to replenish its U.S. dollar reserves.

This shift breaks the market’s perception of Strategy as an all-in bet on BTC and is interpreted as a major strategic turning point, raising concerns about the sustainability of its business model.

Market Reaction

Strategy’s strategic adjustment immediately triggered a sharp negative chain reaction in the market.

After the CEO hinted at a potential BTC sale, Strategy’s stock price plunged 12.2% intraday, reflecting investor panic over the strategic shift.

Following the announcement, BTC prices also dropped more than 4%. While this decline may not be entirely attributable to Strategy’s actions, the dangerous signal that the biggest buyer might pause aggressive purchases was clearly picked up by the market.

This expectation of major capital shifting into观望 mode amplified market risk-off corrections.

Beyond the "surface crises" of stock and BTC prices, deeper concerns stem from institutional investor sentiment.

Data shows that in Q3 2025, several top-tier investment firms including Capital International, Vanguard, and BlackRock actively reduced their exposure to MSTR, collectively cutting positions worth approximately $5.4 billion.

This indicates that with the emergence of more direct and compliant investment vehicles like spot BTC ETFs, Wall Street is gradually abandoning the old logic of viewing "MSTR as a proxy for BTC."

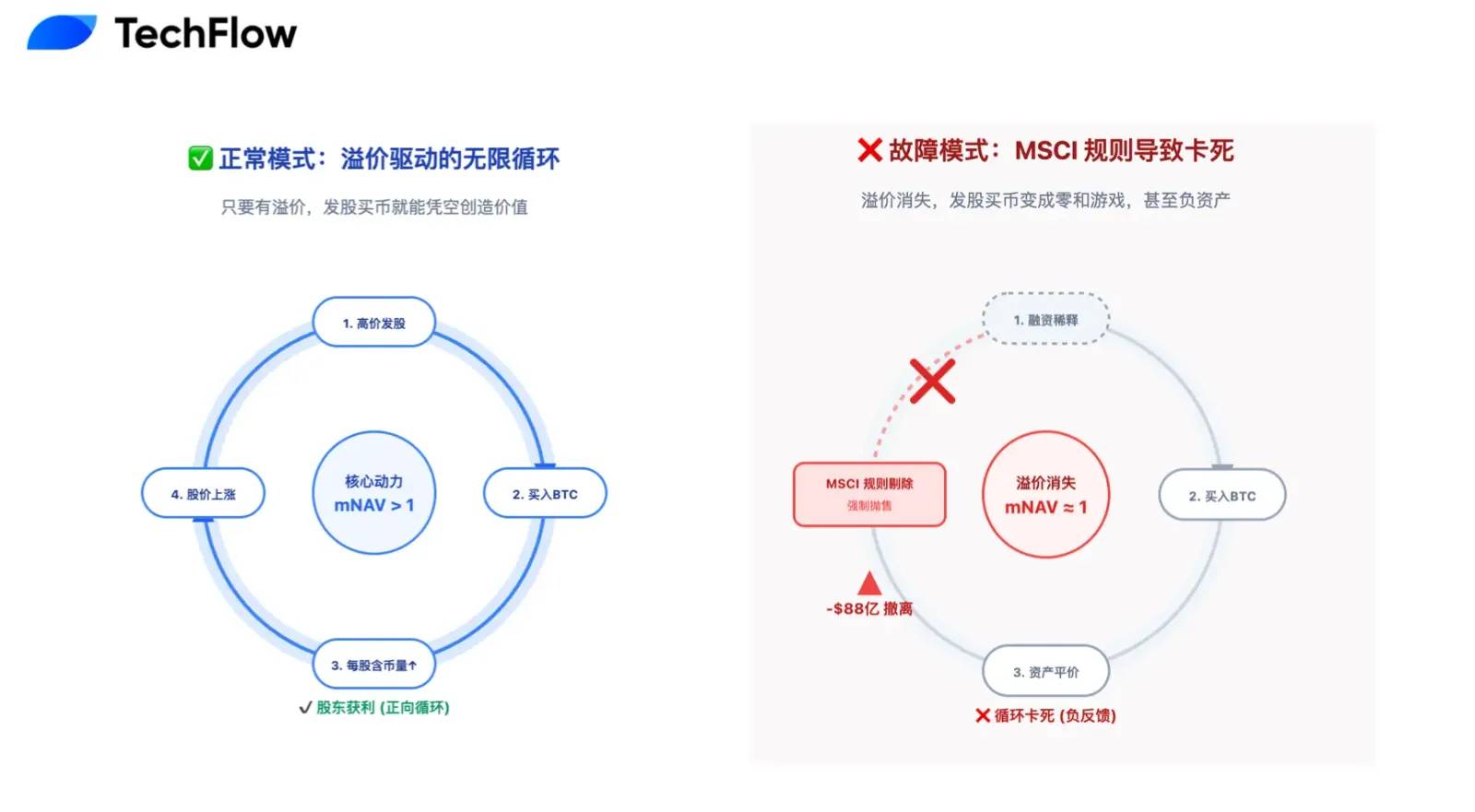

Among DAT companies, mNAV is the key metric for understanding their business models.

During bull markets, the market willingly paid a high premium for MSTR (mNAV far exceeding 1, peaking at 2.5), enabling it to create value through a flywheel mechanism: "issuing shares → buying bitcoin → rising share price due to premium."

However, as the market cools, its mNAV premium has largely disappeared, falling close to 1.

This means issuing new shares to buy bitcoin has become a zero-sum game that no longer enhances shareholder value—its core growth engine may have already stalled.

The Collapse of the Perpetual Motion Narrative

From a short-term, rational financial perspective, the current bearish sentiment toward Strategy is not unfounded.

This $1.44 billion cash reserve effectively宣告s the end of the once globally captivating "perpetual BTC-buying machine" narrative. The previously beloved logic of "issuing shares to buy BTC" relied on the optimistic assumption that the stock price would always remain above the conversion price of convertible bonds.

Strategy currently carries $8.2 billion in convertible bonds. S&P Global has explicitly assigned it a "B-" junk rating, warning of potential liquidity risks.

The core issue lies in the fact that if the stock price remains depressed, bondholders at maturity may refuse to convert (as converting into shares would lead to greater losses) and instead demand full cash repayment of principal. In particular, a $1.01 billion tranche could face redemption as early as 2027, creating a clear and rigid mid-term cash flow obligation.

In this context, establishing the reserve is not merely about paying interest—it's also about preparing for potential "bank runs." But with mNAV premiums now at zero, such funds primarily come from diluting existing shareholders.

In other words, the company is eroding shareholder value to fill past debt gaps.

If debt pressure is a chronic illness, then removal from the MSCI index could be a potentially fatal acute condition.

Due to Strategy’s increasingly aggressive accumulation over the past two years, the proportion of BTC in its total assets has surged to over 77%, far exceeding the 50% threshold set by index providers like MSCI.

Related reading: $8.8 Billion Exodus Countdown: MSTR Becoming the Outcast of Global Index Funds

This raises a critical classification issue: MSCI is considering reclassifying Strategy from an "operating company" to an "investment fund." Such an administrative reclassification could trigger catastrophic ripple effects.

If categorized as a fund, MSTR would be removed from major equity indices, triggering mandatory liquidations across trillions of dollars in index-tracking funds.

According to JPMorgan estimates, this mechanism could spark passive sell-offs totaling up to $8.8 billion. For MSTR, which has a daily trading volume of only several billion dollars, such a level of selling would create a liquidity black hole, likely causing a cliff-like collapse in its stock price—with no fundamental buying support to stabilize it.

An Expensive but Necessary Premium

In the crypto industry, which operates on cycles, extending the time horizon reveals that Strategy’s seemingly self-sabotaging defensive measures may actually represent an expensive but necessary insurance premium paid for ultimate survival.

"Staying in the game is what matters most."

Past bull and bear cycles have proven this: what causes investors to go to zero is not falling coin prices, but reckless "all-in" bets that result in being forced out of the game by sudden shocks—leaving no chance for recovery.

From this perspective, Strategy’s establishment of a $1.44 billion cash reserve ensures it can remain in the game at the lowest possible cost.

By sacrificing short-term shareholder value and market premiums, it secures autonomy for the next two years—a form of strategic wisdom. Before the storm hits, lower the sails. When the next wave of liquidity arrives and skies clear again, Strategy, holding 650,000 BTC, will still stand as the irreplaceable "blue-chip of crypto."

Ultimate victory doesn’t go to those who live most spectacularly, but to those who survive the longest.

Beyond mere survival, Strategy’s deeper significance lies in paving a viable compliance path for all future DAT companies.

If Strategy had continued its previous "all-in" approach, it would very likely have faced collapse, thereby completely disproving the entire narrative of "public companies holding cryptocurrencies"—triggering what could be an unprecedented bearish storm in the crypto world.

Conversely, if it succeeds in using traditional finance mechanisms like a "reserve system" to balance BTC’s high volatility with corporate financial stability, it won’t just be another coin hoarder—it will have forged an entirely new path.

This transformation is, in essence, Strategy’s declaration to S&P, MSCI, and traditional Wall Street capital: we possess not only fervent belief, but also professional risk management capabilities under extreme conditions.

Such mature strategy may be the ticket for it to eventually gain acceptance into mainstream indices and access cheaper financing.

Strategy’s vessel carries immense hope and capital from the crypto industry. More important than how fast it sails in calm weather is whether it can withstand the storm.

This $1.44 billion reserve is both a correction of its past one-way betting strategy and a pledge made in the face of future uncertainty.

In the short term, this transition brings intense pain: the disappearance of mNAV premiums, passive equity dilution, and the temporary halt of its growth flywheel—all unavoidable growing pains.

But in the long run, this is a hurdle that Strategy and countless future DAT companies must overcome.

To reach heaven, one must first ensure their feet are firmly on solid ground.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News