Sui, having survived in the octagonal cage, has evolved from a single blockchain into a platform.

TechFlow Selected TechFlow Selected

Sui, having survived in the octagonal cage, has evolved from a single blockchain into a platform.

In 2025, we practiced a combo called the Sui Stack; in 2026, we’re preparing for a battle centered on “user experience.”

By TechFlow

During Token2049 in September 2024, Sui announced its appointment as the official blockchain partner of ONE Championship, the global mixed martial arts promotion.

This partnership covers broadcasts across more than 190 countries, placing the droplet-shaped Sui logo prominently on the ring’s perimeter fencing.

Looking back today, that image feels more like a metaphor.

In 2025, the public blockchain race itself has become an elimination contest. Markets have swung violently; numerous once-high-profile projects have fallen silent—some halted development entirely, others collapsed to zero. Few competitors remain actively in the ring.

Sui is one of them.

Within two and a half years—from planning through mainnet launch—Sui achieved a peak Total Value Locked (TVL) exceeding $2 billion, a peak daily active wallet count nearing 1.6 million, and a record single-month transaction volume surpassing 50 million.

Having ridden this rollercoaster for an entire year, if you’re a holder, you may feel lost; if you’ve been watching from the sidelines, you might be wondering—does Sui still warrant attention at this point?

To answer that question, we first need to understand one thing: What exactly has Sui been doing over the past year?

What techniques has this fighter—still standing inside the public blockchain octagon—been training in?

A Combo Punch Called the Sui Stack

When Sui launched its mainnet in 2023, it was, at its core, simply a high-performance Layer 1 blockchain: fast, low-cost, and capable of running smart contracts—everything expected of a modern L1, but little beyond that.

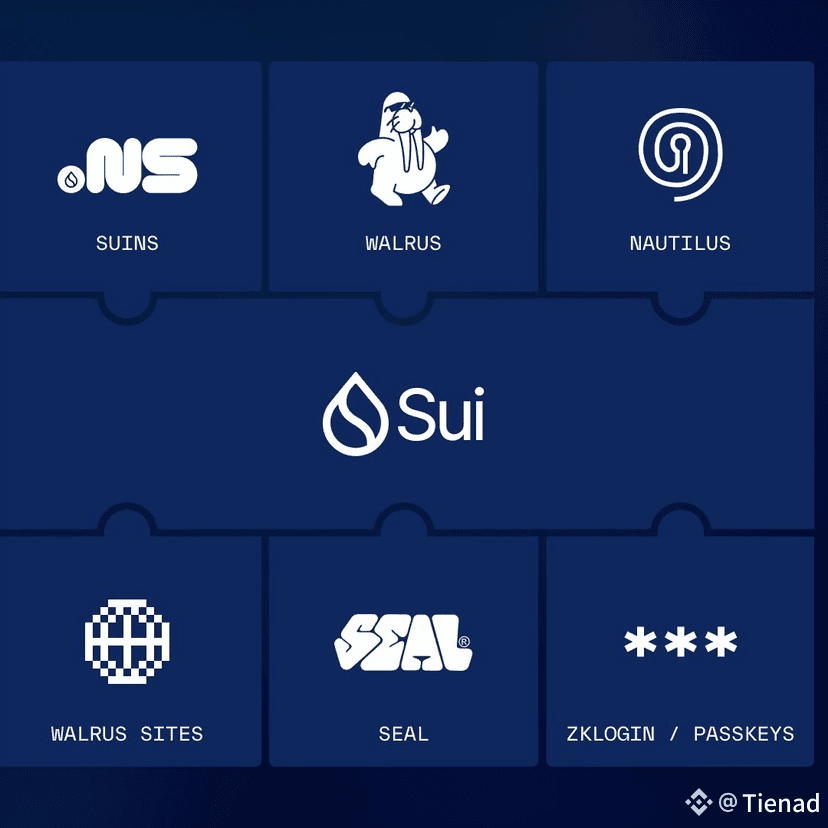

What changed in 2025 was Sui’s move to assemble a comprehensive suite called the “Sui Stack.”

This term has been repeatedly emphasized by Sui’s official channels this year.

The idea is clear: Sui no longer aims to be just a chain—it intends to become a full-fledged developer toolstack, building and natively integrating every layer—from execution and storage, to access control and off-chain computation—delivering everything out-of-the-box.

That may sound like vaporware—but several key components have indeed shipped this year.

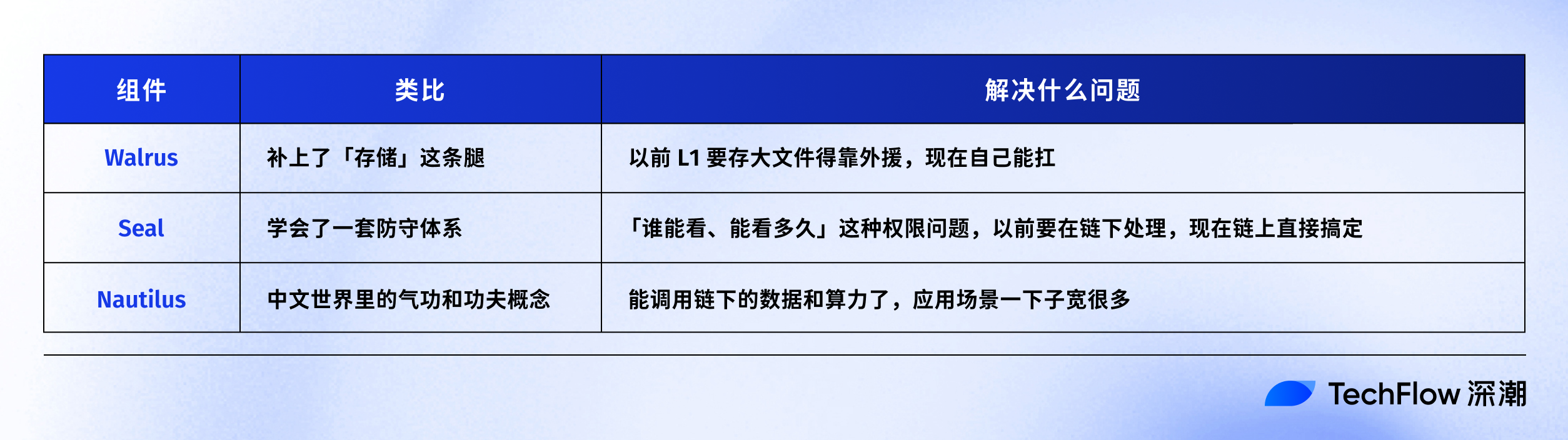

Let’s start with storage.

In the past, building even moderately complex applications on Sui—like NFT marketplaces or content platforms—raised a practical question: Where do you store images and videos?

On-chain storage wasn’t viable, forcing developers to integrate third-party solutions such as Arweave or IPFS. Functional, yes—but cumbersome. You had to learn another stack and manage compatibility across systems.

In March 2025, Sui launched Walrus.

Walrus is a decentralized storage layer capable of storing any data type—including data originating from other blockchains. As a native component of the Sui Stack, Walrus gives ecosystem developers maximum design flexibility without requiring external data systems. Just eight months after launch, Walrus is already approaching 300 TB of total storage capacity and counts prominent partners from AI, media, and entertainment among its users.

For a component launched less than a year ago, that’s solid traction.

Next: access control. This sounds highly technical—but it affects every user directly.

You hold encrypted assets on-chain. Who can see them? Who can use them? For how long?

There used to be no standard answers. Most projects either exposed everything publicly—or built custom, off-chain permission systems, which were complex and prone to vulnerabilities.

Sui’s Seal, launched last year, solves precisely this problem. It moves access-control logic on-chain, enabling developers to define “who can access what, under what conditions, and for how long”—directly within smart contracts.

I’d argue this serves as a foundational prerequisite for privacy—a theme recently underscored by both a16z and Vitalik:

If you want on-chain transfers to resemble bank transfers—visible only to transacting parties—you first need a robust cryptographic system for encryption, decryption, and authorization.

Finally, off-chain computation. Some tasks are ill-suited for smart contracts: they’re too expensive, too slow, or require access to off-chain data sources.

But if executed off-chain, how does the chain verify and trust the results?

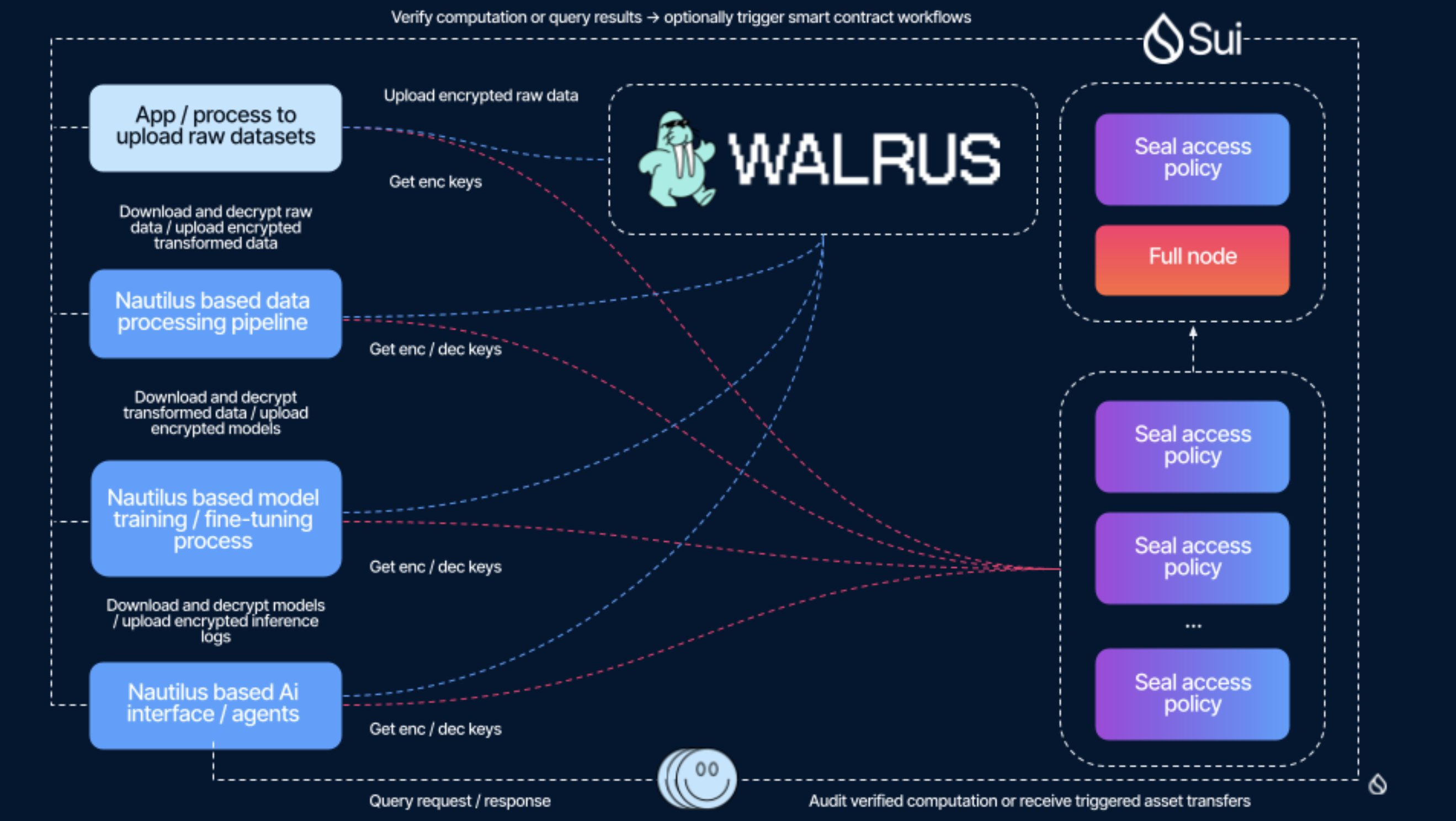

Nautilus is Sui’s answer—and forms another critical layer of the Sui Stack. It leverages Trusted Execution Environments (TEEs) to perform off-chain computations, then submits verifiable proofs back to the chain. Off-chain compute, on-chain verification—no mutual trust required, secured purely by cryptography.

Walrus, Seal, Nautilus—and the Sui mainnet itself—constitute the foundational pillars of today’s Sui Stack.

If all this still feels dense and abstract, here’s a simplified visual summary to help clarify Sui’s combo punch:

In just one year, Sui has quietly evolved from “a chain” into “a platform.”

The ambition is unmistakable—but ambition alone doesn’t guarantee success. How well do these solutions actually perform? Can they withstand rigorous technical scrutiny?

These questions remain unanswered in 2025. But the boxing techniques have been drilled, and the “full-stack” strategy—the game plan for stepping into the ring—is now fully formed.

Full-Stack—So What Does It Mean for Me?

So what?

What does this Sui Stack mean for me as an ordinary user?

Honestly? Very little direct impact. You won’t rush to trade on Sui tomorrow just because Walrus launched. These infrastructure-level updates are largely imperceptible to end users.

Yet the indirect impact is substantial.

The logic goes like this: Lowering developer barriers attracts more teams to build on Sui; more applications mean more choices for users—and competition pushes product experience upward; better experiences attract more users, creating a virtuous cycle.

Of course, all this assumes broader improvement in crypto market conditions. Still, even amid today’s environment, this isn’t pure speculation.

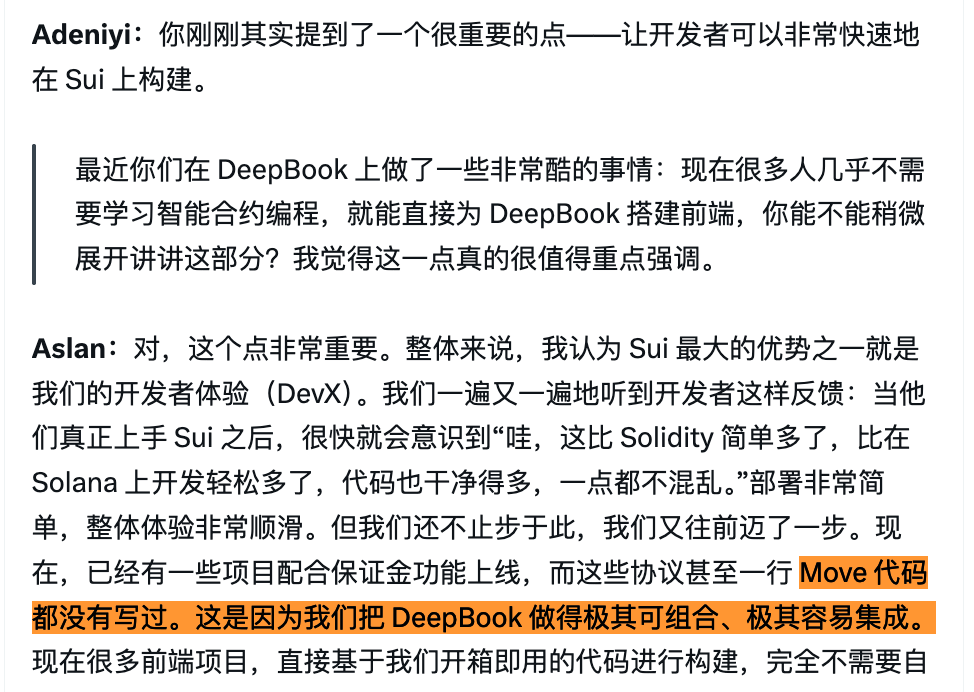

Take DeepBook—the native on-chain order book protocol on Sui. Its core developer, Aslan Tashtanov, shared a telling detail during a live stream:

Teams are already building margin trading frontends on DeepBook—“without writing a single line of Move code.”

With sufficiently mature base modules, developers can focus solely on product design. That means even a three- to five-person team can now build what previously required dozens.

Does that evoke Vibe Coding? More teams, more apps—and ultimately, better outcomes for users.

Another impact lies in institutional partnerships—often seen as strong positive signals by the broader community.

You may have noticed a wave of traditional financial institutions deploying on Sui in 2025:

Grayscale launched a Sui trust product; VanEck issued an ETN; Franklin Templeton tokenized funds on Sui; and 21Shares is pursuing related products.

When institutions choose a chain, technical maturity is a critical factor. “Full-stack” may sound like a developer-centric concept—but it signals infrastructure completeness, which translates directly to institutional confidence.

So while you don’t need to understand what the Sui Stack is, it will shape—behind the scenes—what services you’ll eventually access on Sui, how smooth your experience will be, and how many others join you on the network.

Infrastructure is like plumbing: when it works, nobody notices; when it fails, everyone complains. Yet it remains the bedrock of everything.

How Is Sui Betting Against the Rest?

Now that we’ve covered what Sui is building, the natural next question is: How does it differ from other public blockchains?

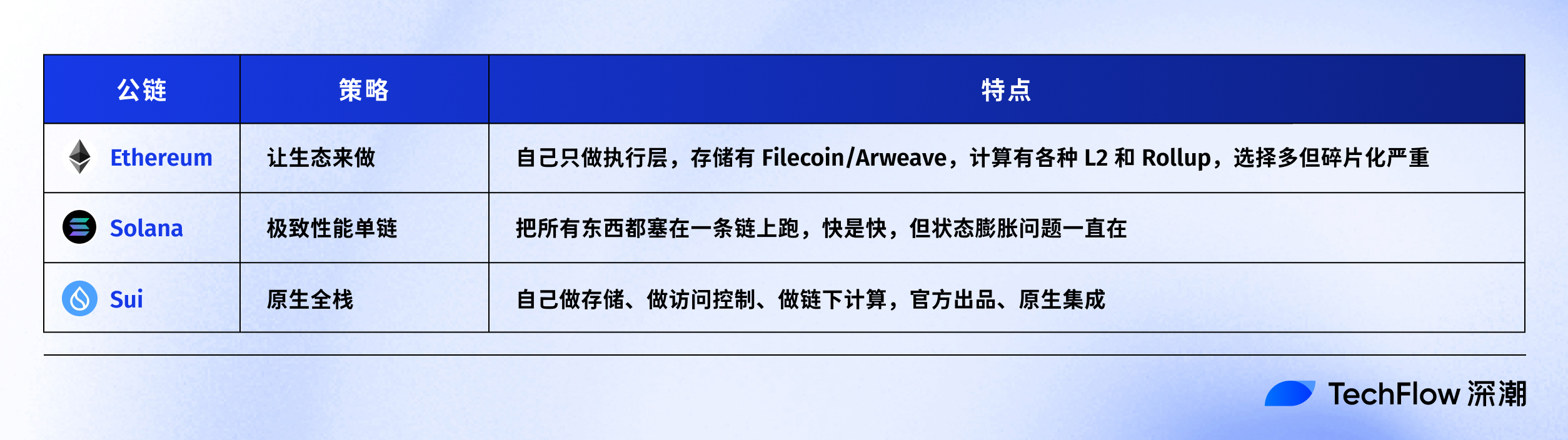

Let’s start with Ethereum.

Ethereum’s strategy can be summed up in four words: “Let the ecosystem do it.”

Ethereum focuses solely on execution and consensus layers; everything else is delegated to third parties—storage via Filecoin or Arweave, scaling via L2s like Arbitrum, Optimism, and Base, wallets via MetaMask, oracles via Chainlink.

This model fosters rich ecosystem diversity—but also severe fragmentation.

To build a complete application, you might need to integrate with seven or eight different projects—each with distinct documentation styles, update rhythms, and unclear support channels when things go wrong.

Then there’s Solana.

Solana pursues the opposite extreme: “Handle everything ourselves.” No sharding, no L2s—just one chain pushed to peak performance.

The upside? Unified, blazing-fast user experience—immediately perceptible. The downside? All pressure falls on the mainnet. State bloat remains a long-term concern, and historical outages have occurred multiple times. Moreover, because everything is internally owned, failure in any single component leaves no fallback.

Sui chose a third path.

It avoids Ethereum’s hands-off approach—and Solana’s monolithic “do-it-all” model. Instead, Sui builds core components in-house—but modularizes them. They’re official, yet retain meaningful independence.

Walrus is an independent storage layer—but shares validator nodes with Sui. Seal is an independent access-control protocol—but runs natively within Sui smart contracts. Nautilus is an independent off-chain computation platform—but outputs are natively verifiable by Sui. They form a family—not a monolith.

This strategy bets squarely on “developer experience.” Not who achieves the highest TPS, nor who hosts the most ecosystem projects—but who enables developers to ship complete applications fastest, with minimal cognitive overhead.

At its core, this is a deliberate tradeoff: Sui prioritizes “integration depth,” sacrificing some “flexibility” and “ecosystem diversity.”

Whether this calculus pays off remains to be proven—but it’s the direction Sui is unambiguously betting on.

At least in terms of strategic positioning, Sui differentiates itself from Ethereum and Solana—not competing head-on along the same dimensions.

Three chains. Three philosophies. Three distinct experiments. Which—if any—is “right”? We’ll likely need another two or three years to tell.

We Listened In: Sui’s 2026 Roadmap

So far, we’ve covered what Sui has built. Based on those foundations, what’s exciting coming up?

On December 23, 2025, Sui hosted a year-end livestream.

Key founders—including CEO Evan, CPO Adeniyi, Chief Cryptographer Kostas, and DeepBook lead Aslan—joined for nearly an hour to reflect on 2025 and preview 2026.

Such streams invite two common interpretations: one sees them as PR-driven “roadmap theater,” best taken lightly; the other views them as rare windows into genuine team priorities.

Regardless of your stance, I watched closely—and extracted several key signals worth highlighting.

The first signal is “The Year of Experience.”

Aslan stated outright that 2026’s focus shifts from institutions to everyday users.

His exact phrasing: “I want everything you can do on Robinhood to be possible on Sui DeFi—simple onboarding, seamless payments, and truly on-chain daily financial life.”

This sounds like boilerplate rhetoric common to all blockchains. But Sui made a concrete commitment: In 2026, stablecoin transfers on Sui will be completely gas-free.

No gas fees—not subsidized by wallets, but engineered at the protocol level. If delivered, this gives Sui a powerful, tangible advantage in payment use cases: free transfers.

The second signal remains privacy.

Adeniyi revealed during the stream that Sui will introduce native, protocol-level privacy transactions in 2026—not as a private feature limited to specific wallets, but as a chain-wide capability.

Chief Cryptographer Kostas shared a real-world example: While in Dubai, he met a local resident who wished to donate to charity—but refused on-chain transfers, fearing his real balance would become publicly visible.

“That wouldn’t work here.”

Privacy isn’t a “nice-to-have”—it’s a prerequisite for mass adoption. Seal’s 2025 launch was explicitly designed to lay the groundwork for this step.

The third signal is “Product-Grade Protocols.”

This is a concept CEO Evan repeatedly stressed. He explained that 2026’s priority is to “abstract away” the underlying technical complexity—so developers can build products at higher levels of abstraction, without mastering every low-level primitive.

That may sound abstract—so here’s a simpler analogy: You don’t need to understand engine mechanics to drive a car. Sui aims to cleanly separate “building engines” from “driving cars.”

Toward the end of the stream, Evan closed with this statement:

“Don’t ask us when we’ll launch specific features. Just watch what we do.”

That line alone reveals their posture. One thing is certain: The team treats 2026 as a pivotal year—the moment when three years of infrastructure investment convert into real-world products.

Later, Adeniyi published a long-form Twitter thread titled “2026: Building for What’s Inevitable.”

He outlined five trends he considers “already locked in”:

Stablecoins becoming the default payment rail, DeFi absorbing traditional finance, privacy becoming table stakes, automation becoming the default operational mode, and gaming driving mainstream adoption of digital ownership.

He then argued that no single L1 can accommodate the convergence of all these trends—only a complete, integrated tech stack can.

That’s the foundational logic behind the Sui Stack: anticipate inevitable macro-trends, then reverse-engineer the infrastructure needed to support them.

Of course, predicting inevitability and witnessing actual inevitability are two very different things. What 2026 holds remains uncertain. But based on this livestream and Adeniyi’s essay, Sui’s leadership clearly knows what it’s betting on.

Finally, Adeniyi framed those five “locked-in” trends not as predictions—but as directional certainties, inevitable developments.

This narrative is compelling.

Yet “inevitability” is a heavy word. Back in 2021, many declared NFT mania and the metaverse “inevitable.” We all know how that unfolded.

This isn’t to say Sui’s judgment is necessarily wrong—only that when a team tells you, “We’re preparing for inevitability,” you have every right to ask:

Why is this inevitable?

That question has no ready-made answer—and an execution-focused team doesn’t intend to answer it with words.

Returning to our opening octagon metaphor: Sui remains in the ring, throwing punches.

In 2025, it trained a combo called the Sui Stack. In 2026, it’s preparing for a fight centered on “experience.”

Will it win? Unknown. But at least it knows exactly what fight it’s in.

The rest is up to time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News