9 Major Public Blockchain Insights: Is the King of Blockchains About to Change?

TechFlow Selected TechFlow Selected

9 Major Public Blockchain Insights: Is the King of Blockchains About to Change?

Solana's retreat and BSC's strong rise.

By: Frank, PANews

In the fall of 2025, the competitive landscape in the public blockchain sector is undergoing dramatic shifts, with an intensifying battle for users, capital, and ecosystem momentum. Solana, once the dominant leader, faces renewed challenges from a receding wave of traffic, while BNB Chain is launching a strong "siphoning effect" through robust new ecosystems and technological upgrades. Meanwhile, Ethereum's mainnet continues steady growth beneath the noise, and the Layer2 sector presents a complex picture of stark contrasts.

PANews will conduct an in-depth analysis of the latest data across major public blockchains to uncover the underlying drivers and future trends behind this migration of traffic.

Solana: Declining Metrics Signal Challenges from Outflows

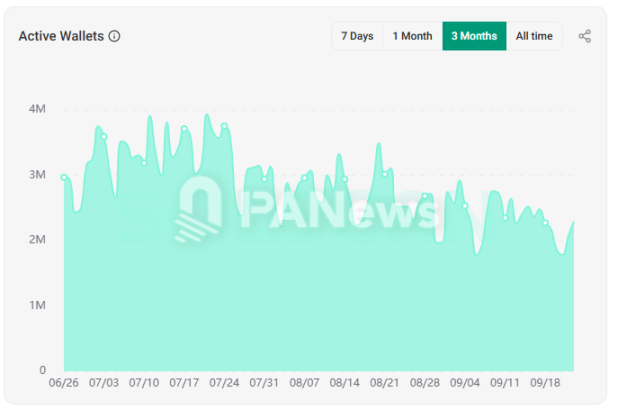

Solana has shown declining performance over the past three months, losing its leading position across multiple key indicators—most notably in active addresses and new token issuance. As of September 24, Solana’s network had 2.19 million active wallets, down 63.5% from 6 million in June. This level of activity is even lower than the热度 seen before August 2024, and this decline is not isolated. In terms of new token creation, current figures stand at around 31,000, a sharp drop from the peak of over 80,000 tokens created daily in January. The majority of this decline occurred recently; on September 15, the daily count of new tokens was still around 50,000.

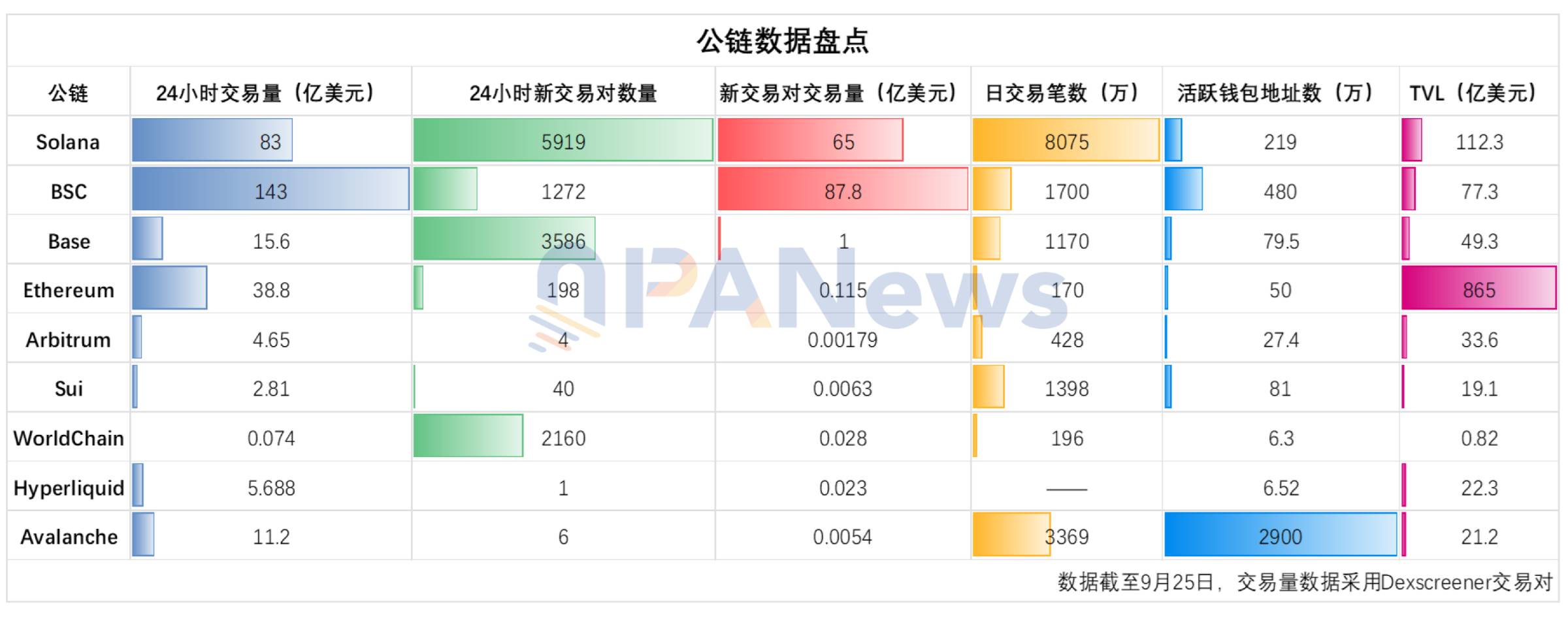

Regarding DEX trading volume, according to Dexscreener, BSC recorded approximately $14.3 billion in on-chain trading volume in the last 24 hours, compared to Solana’s $8.3 billion. Solana is no longer the most actively traded public chain. However, Solana still leads in newly created trading pairs, with 5,919 generated in the past 24 hours.

On the capital front, Solana has experienced significant outflows recently, with a net outflow of about $63.4 million in the past week.

According to deBridge data, BSC has become the primary destination for Solana’s outflows. In the past week, approximately $47 million flowed from Solana to BSC, while only $28 million returned. From this perspective, BSC is indeed siphoning traffic from Solana. Although Solana has positive catalysts ahead, including ETF prospects and several DAT companies, and recently passed the Alpenglow upgrade proposal in September, these have failed to revive ecosystem热度.

BSC: Strong Rise, Surging Traffic Aims at Solana’s Throne

BNB Chain has been on an upward trajectory over recent months, showing clear signs of surpassing Solana. In terms of active wallet addresses, as of September 25, BSC’s daily active addresses reached approximately 4.8 million, exceeding Solana’s 2.19 million. In April, this figure was only 2.6 million—a rise of about 84.6%. Daily transaction counts have also seen a notable increase, currently averaging around 17 million per day. On August 30, this number was only about 10 million, marking a 70% increase in the past month alone—nearly six times the average daily volume of 3 million seen at the beginning of the year.

In terms of capital flows, BSC saw a net inflow of approximately $73.5 million in the past week, ranking third among all chains. According to deBridge, the main sources of inflow were Solana, Arbitrum, and Ethereum mainnet.

The driving forces behind these changes include the wealth effect from Alpha earlier this year and the recent surge in Aster. On September 25, Aster’s daily fees reached an astonishing $12.92 million, second only to Tether. Its contract trading volume hit $35.8 billion, surpassing Hyperliquid.

On September 23, BNB Chain announced on X that validators are proposing to reduce the minimum gas price on the BNB Smart Chain from 0.1 Gwei to 0.05 Gwei, while accelerating block intervals from 750 milliseconds to 450 milliseconds, aiming to remain competitive with the fastest blockchains in the crypto space. Once this upgrade is complete, BSC will be nearly on par with Solana in performance. Clearly, BSC’s current offensive against Solana goes far beyond the previous meme-driven Four.me campaign.

Ethereum: Steady Growth Amidst the Noise

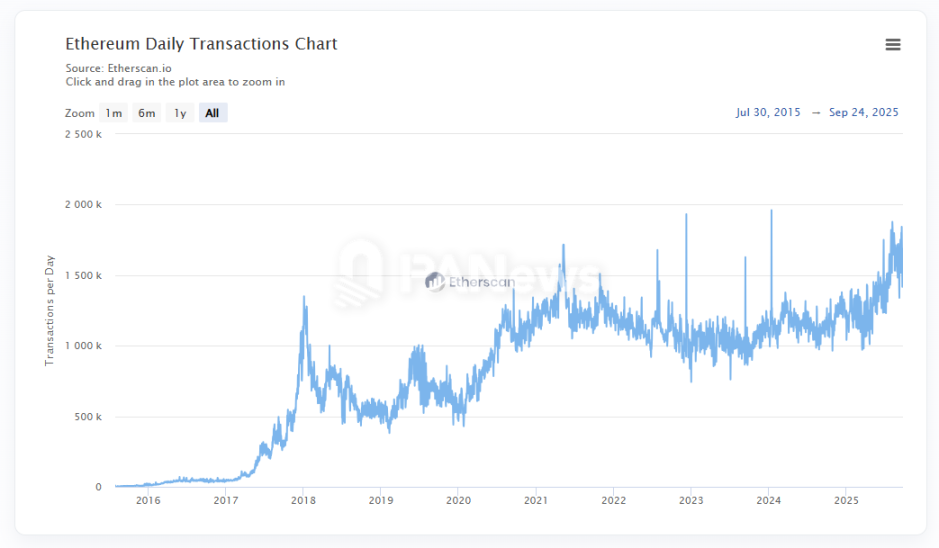

While Ethereum mainnet may not appear particularly dynamic on-chain, it has shown clear improvements in data metrics. For example, throughout 2024, Ethereum’s daily transaction count remained around 1 million. Starting in April 2025, this figure began rising noticeably, now consistently ranging between 1.5 million and 1.8 million—the highest level in Ethereum’s history.

Daily active users show a similar trend. In August, Ethereum’s daily active users peaked at 557,200, the highest in nearly three years. Moreover, this growth is not fleeting but has been sustained over time. As of September 22, daily active users remained above 500,000.

Of course, as a public chain primarily focused on DeFi and infrastructure, Ethereum’s rising热度 does not seem to be driven by new projects. For instance, on September 25, only 198 new pools were created on Ethereum mainnet, with a trading volume of about $11.5 million—just 0.3% of the day’s total on-chain trading volume of $3.88 billion.

Another major change in Ethereum’s data is TVL. Starting in April 2025, Ethereum’s TVL surged from $45 billion to a high of $97 billion. However, this increase may largely stem from the rise in ETH’s price. In fact, the amount of staked ETH has been steadily declining since April, indicating reduced staking activity on the Ethereum chain. Thus, the growth in TVL must come from elsewhere—likely from the expansion of stablecoins. As of September 25, the market cap of stablecoins issued on Ethereum reached $161.7 billion, nearly doubling from $84 billion in December of the previous year.

Base: Transactions Remain Active, But User Loss Raises Alarm

Base maintains relatively active on-chain transactions. Daily transaction counts rose significantly from around 8.4 million in August to 14.48 million on September 21, setting a new record that surpassed the peak seen in January. Additionally, new token creation remains vibrant—Dexscreener recorded 3,586 new pools created in the last 24 hours, a figure even higher than BSC’s.

However, Base has shown a clear downward trend in daily active users since July, dropping from a peak of 2.4 million to 797,000 on September 22—a decline of 67%. Furthermore, Base experienced a net outflow of $99.6 million in the past week, making it one of the chains with the largest net outflows.

Overall, Base remains the most active Ethereum L2 despite the drop in daily active users, maintaining advantages across various metrics.

Arbitrum: Leadership Position Faces Tests

Arbitrum still holds the top position among Ethereum L2s in TVL and stablecoin metrics. However, its daily transaction count shows high volatility—on September 22, it reached 4.28 million transactions, up from 1.92 million the previous day. Such fluctuations reflect Arbitrum’s trading volume patterns over the past year, which have consistently remained highly volatile.

In terms of capital inflows, Arbitrum ranks first among all public chains, with a net inflow of $217 million in the past week. Looking at the sources, USDT and Hyperliquid remain the main contributors, indicating Arbitrum still plays a major role as a capital bridge for Hyperliquid. However, as Hyperliquid launches its own stablecoin USDH, this tailwind may soon fade.

Hyperliquid: Facing Intense Competition from Emerging Rivals

From a public chain perspective, Hyperliquid’s data is unremarkable. While its daily active users have grown noticeably, they only reach 65,200. Weekly transaction counts are around 3 million. However, its TVL has seen substantial growth this year, rising from $1.9 billion in April to $6.1 billion.

From a DEX standpoint, Hyperliquid has recently faced clear competitive pressure from Aster. Since August, its trading volume has shown a noticeable downward trend, shifting from a range of $10–20 billion to $5–10 billion.

Sui: Growth Stalls, Are New Chains Entering a Quiet Phase?

Sui’s development appears to have hit a bottleneck in 2025. Transaction counts have fluctuated around the 10 million mark since the start of the year, with no significant upward movement.

While active addresses are much higher than pre-March 2024 levels, they have remained within the 500,000–1 million daily active range over the past year, showing no clear upward or downward trend. In terms of TVL, Sui has seen a notable decline, falling from $1.24 billion in July to $575 million. Only 40 new pools were created on-chain in the past 24 hours, far below the levels seen during its earlier MEME-driven活跃 phase. It seems Sui, once hailed as a promising new chain, is entering a quiet period.

Avalanche: On-Chain Activity Surges, RWA May Become Future Focus

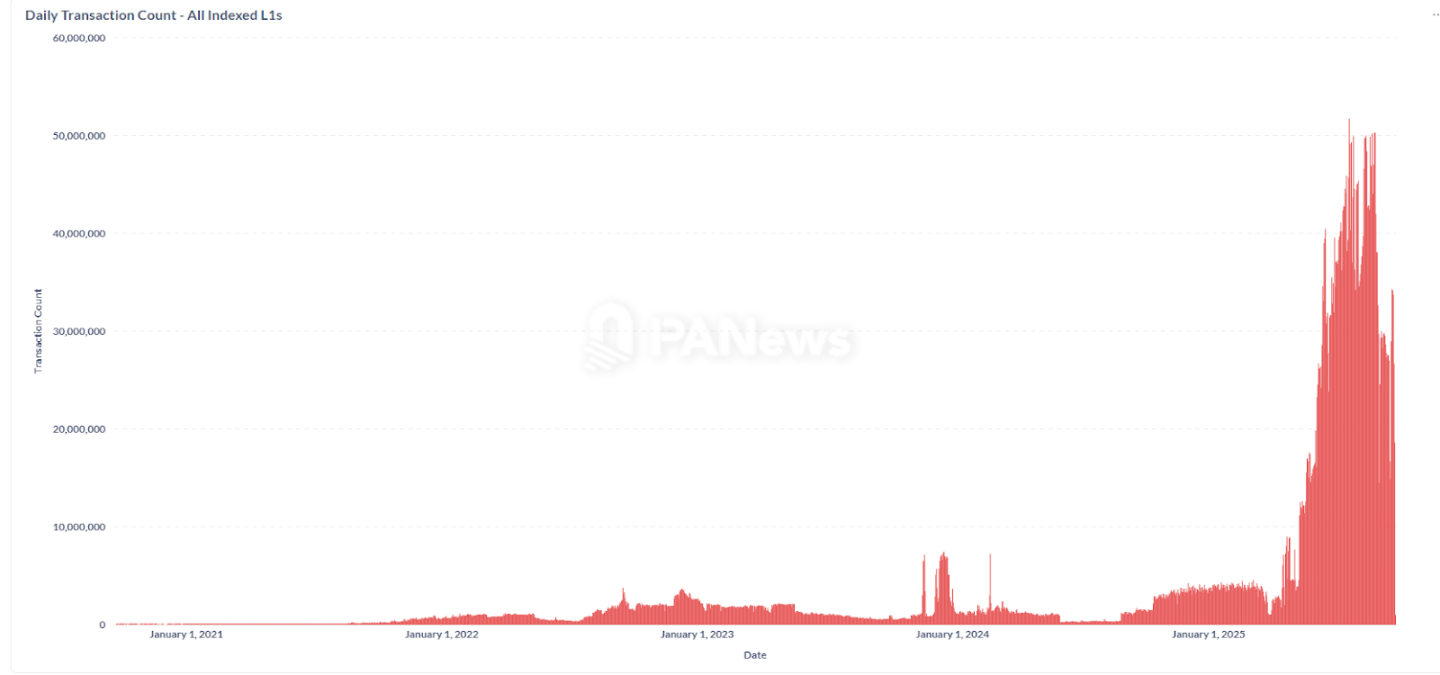

After years of dormancy, Avalanche has finally erupted recently. The most striking metric is in active addresses—since September, Avalanche L1s’ daily active addresses have surged from hundreds of thousands to millions, peaking at a record 29 million on September 22. Transaction counts have also suddenly jumped to the 50 million level.

However, this surge seems less related to the activity of Avalanche’s C-Chain. Looking solely at C-Chain data, active addresses remain around 200,000—while increased, the gap with overall figures is enormous. PANews speculates this abnormal spike may be linked to stress testing on one of Avalanche’s subnets. In August, Grove Finance planned to deploy approximately $250 million worth of RWA on the Avalanche blockchain via Centrifuge and Janus Henderson.

On September 23, AgriFORCE announced it would rebrand as AVAX One and raise $550 million, becoming the first Nasdaq-listed company focused on acquiring Avalanche (AVAX) tokens. Judging from its ecosystem roadmap, Avalanche is increasingly focusing on RWA and stablecoin development.

World Chain: The "Truth" Behind Massive Inflows—Team Token Migration

World Chain is mentioned here because it ranked second in net inflows among public chains in the past week, with $119 million in net inflow. However, this inflow likely wasn’t user-driven but rather a strategic internal token migration by the Worldcoin team. On September 22, the Worldcoin team wallet transferred 110 million WLD from Ethereum mainnet, with 85 million (worth $111 million) bridged to World Chain.

The recent data clearly shows that competition in the public blockchain space has entered a new stage. BSC has successfully captured significant traffic and capital from Solana, powered by the wealth effect of breakout applications and strategic ecosystem moves, staging a classic "comeback." Ethereum, leveraging its strong network consensus and foundation, demonstrates stabilizing "ballast" strength in stablecoins and infrastructure.

Meanwhile, the internal competition among Layer2s and the growth struggles of emerging chains reveal a market driven by both technological iteration and narrative building. No public chain’s leadership is guaranteed; only continuous innovation, a thriving developer ecosystem, and the ability to capture the next market trend can ensure lasting success in this endless battle for traffic. The future landscape remains full of uncertainty.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News