Stablecoin Public Chain: In the Name of Institutions and Privacy, Pursuing Distribution and Returns

TechFlow Selected TechFlow Selected

Stablecoin Public Chain: In the Name of Institutions and Privacy, Pursuing Distribution and Returns

The whole world is targeting Visa and Mastercard.

Author: Zuoye

Software eats the world, stablecoins eat blockchain.

This time it's no longer Coinbase's Base or Robinhood L2—Circle and Stripe have almost simultaneously chosen to build their own stablecoin Layer 1, completely freeing themselves from the constraints of existing public chains, reconstructing everything from底层 mechanisms to Gas tokens entirely around stablecoins.

When banks lose their dominance, stablecoins rush in to compete.

On the surface, Circle’s Arc and Stripe’s Tempo directly challenge Tron and Ethereum, but in reality they are targeting the global clearing power of the “post-central bank—banking system.” The Visa and SWIFT systems built for fiat currencies can no longer meet the needs of global stablecoin flows.

Cross-border Crisis: Card Networks Yield to Stablecoin Blockchains

The Wintel alliance monopolized the personal PC market for nearly 30 years until ARM rose on mobile devices, with Intel fading despite making no mistakes.

Bank cards and card networks did not emerge together. In 1950, the first card network, Diners Club, created a credit accounting system for restaurants and loyal customers. Loyalty programs became the precursor to credit lines and points systems, only connecting with banking in the 1960s when regional U.S. banks began expanding beyond state and national borders, eventually going global through credit cards.

Compared to banks that must swing cyclically under the Federal Reserve's guidance around leverage, card networks operated by Visa/MasterCard are essentially cash-flow businesses immune to droughts or floods. For example, in 2024 Capital One acquired Discover for $35.3 billion, becoming a giant combining card issuance and network operations.

Traditional banking integration is precisely the precursor to stablecoin issuers building stablecoin blockchains—only through vertical integration can one control all issuance, distribution, and redemption channels.

After Genius Act, the operating logic of the dollar has fundamentally changed. Traditional commercial banks still bear responsibilities for credit creation and monetary supply (M0/M1/M2), but Tether and Circle now hold U.S. Treasury positions larger than those of many sovereign nations.

Stablecoins now directly link to Treasuries. While banks might still issue stablecoins as a lifeline, card networks and cross-border payment channels face existential threats.

• Banking → Stablecoin issuers USDT, USDC

• Card networks / SWIFT / PSP → Stablecoin L1

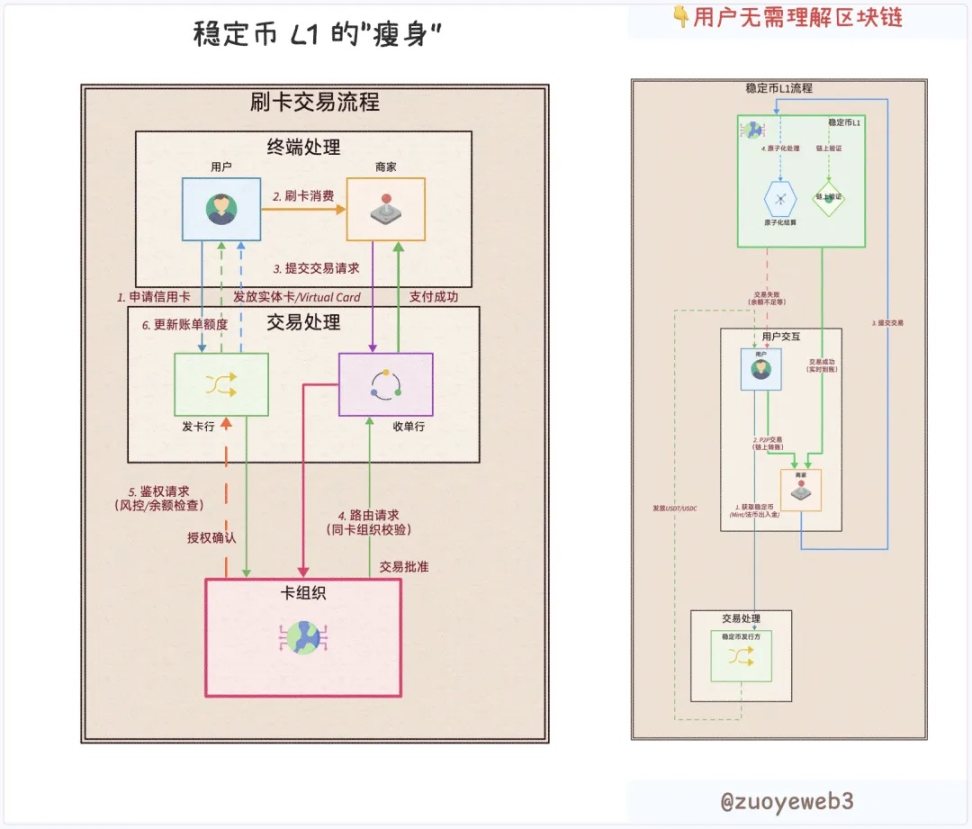

In traditional transaction flows, users, merchants, issuing institutions, acquiring institutions, and card networks are entirely separate roles. But blockchain programmability changes everything—any role can be reduced to "user," whether institutions need private vaults and confidential transfers or individuals seek convenience, differing only in code implementation.

Stablecoin L1 goes further by eliminating the necessity of any non-user institutions—only users, stablecoins, and L1 are needed to interchange and stack any roles and functions, even regulatory compliance checks.

Image caption: Transaction flow innovation

Image source: @zuoyeweb3

Of course, this doesn't mean specialized issuing and technical service providers will disappear. Rather, from a composable code perspective, suppliers become auditable and selectable. Take U Cards as an example—the profits from virtual cards are captured upstream, leaving U Card issuers themselves barely breaking even while shouting for attention.

Technological innovation leads organizational change.

Now you can just build your own Visa from scratch and keep all the profits to distribute back to users.

Like Capital One, which previously had to pay 1.5% fees to Visa/MasterCard before acquiring Discover, USDT/USDC must also pay gas fees to Tron and Ethereum.

Just as Circle promotes Arc, Coinbase Commerce directly integrates with Shopify, and Circle selects Binance as its yield-bearing stablecoin USYC partner.

Tether once claimed it generated 40% of all public chain transaction fees, and Circle even paid Coinbase an extra $300 million subsidy in a single quarter. Therefore, removing existing intermediaries and building proprietary distribution channels and terminal networks becomes a natural progression.

However, Circle chooses to build independently, while Tether opts for external competition via Plasma and Stable.

Stripe is unique—it lacks its own stablecoin but controls a vast end-user network. After acquiring Bridge and Privy, it has completed its technical loop. A bold prediction: Stripe will eventually launch or support its own stablecoin.

To summarize, stablecoin issuers, distribution channels, and terminal networks are all building closed-loop ecosystems:

• Stablecoin issuers: Circle’s Arc, Tether’s Plasma and Stable, USDe’s Converge

• Distribution channels: exchanges like Coinbase and Binance, existing public chains like Ethereum and Tron

• Terminal networks: Stripe’s self-built Tempo

French freedom isn’t British freedom; USDT’s L1 isn’t USDC’s home. When no one wants to settle anymore, competition against existing public chains and card networks surges forward like a mighty river, unstoppable.

Technology Diffusion: Public Chains Are Easy to Build, Institutional Adoption Is Hard to Scale

Extremely defending freedom isn't evil; conservatively pursuing justice isn't virtue.

Privacy is no longer a concern for ordinary users. Just as QUBIC overshadowed Monero far less than treasury strategies did, privacy transactions under liberal ideology are merely a "paid privilege" for institutional users. What regular users truly care about is transaction fees.

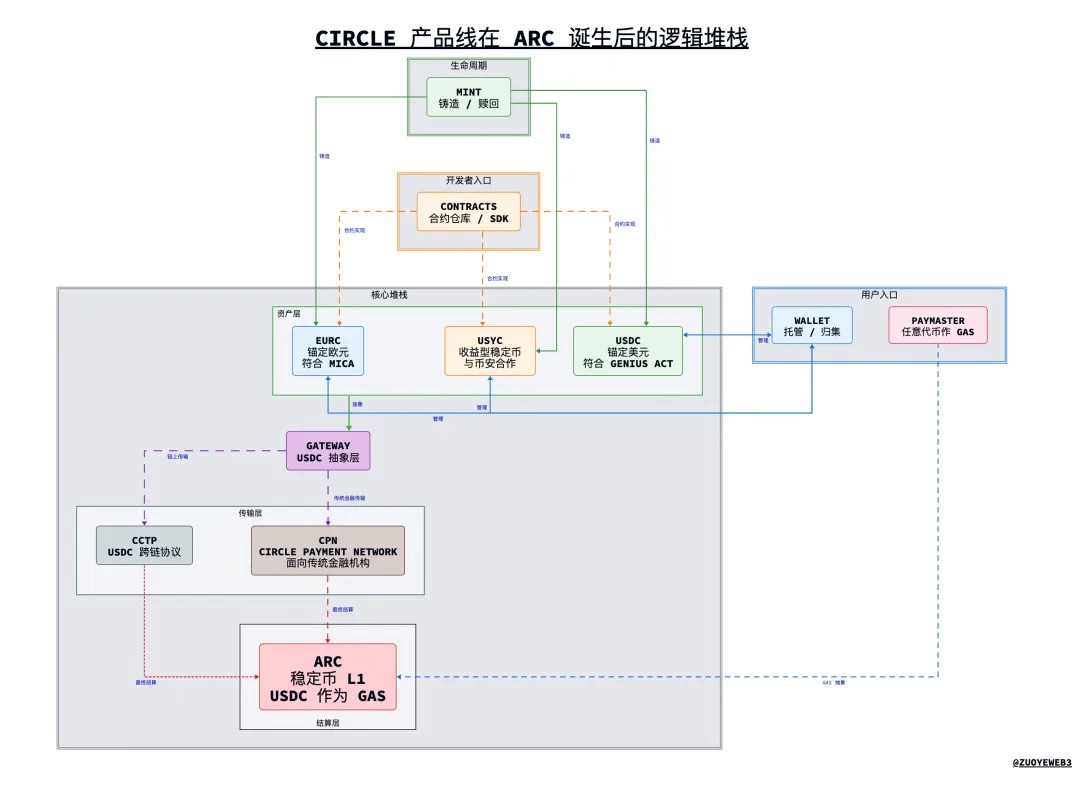

Prior to launching Arc, Circle already had a sprawling product line bordering on complexity. Only under Arc’s unified framework can synergies emerge, allowing USDC to escape its awkward status as a mere附属of Coinbase.

Image caption: Logical stack of Circle's product line after Arc

Image source: @zuoyeweb3

Taking Arc as an example, we can glimpse the future technical architecture of stablecoin blockchains. Note: the following reflects personal interpretation of logical structure and does not necessarily represent actual design (cosmic-level disclaimer).

1. Product Overview

• USDC/EURC/USYC: Circle’s three main stablecoin products. USDC is USD-pegged and compliant with Genius Act, EURC is EUR-pegged and MiCA-compliant, USYC is a yield-bearing stablecoin developed in partnership with Binance

• CPN (Circle Payment Network): A cross-border clearing network initiated by Circle using USDC as base layer, similar to SWIFT

• Mint: Where users mint USDC and other stablecoins

• Circle Wallet: A unified management platform for individuals and institutions to manage various Circle stablecoins

• Contracts: Smart contracts written by Circle for USDC and other stablecoins

• CCTP: Cross-chain transfer standard for USDC

• Gateway: An abstraction layer for USDC, allowing users to interact with USDC directly without knowing underlying chains or technical details

• Paymaster: Allows any token to serve as Gas token

• Arc: A stablecoin Layer 1 initiated by Circle, with USDC as native Gas token

2. Logical Stack

• Main structure: Top-down: USDC/EURC/USYC → Gateway → CCTP/CPN in parallel (CCTP primarily used on-chain, CPN promoted within traditional financial institutions) → Arc

• Viewing the above as a whole: Mint is the deposit entry, Wallet is the fund aggregation entry, Contracts is the programming entry, Paymaster is an auxiliary function enabling any token as Gas token

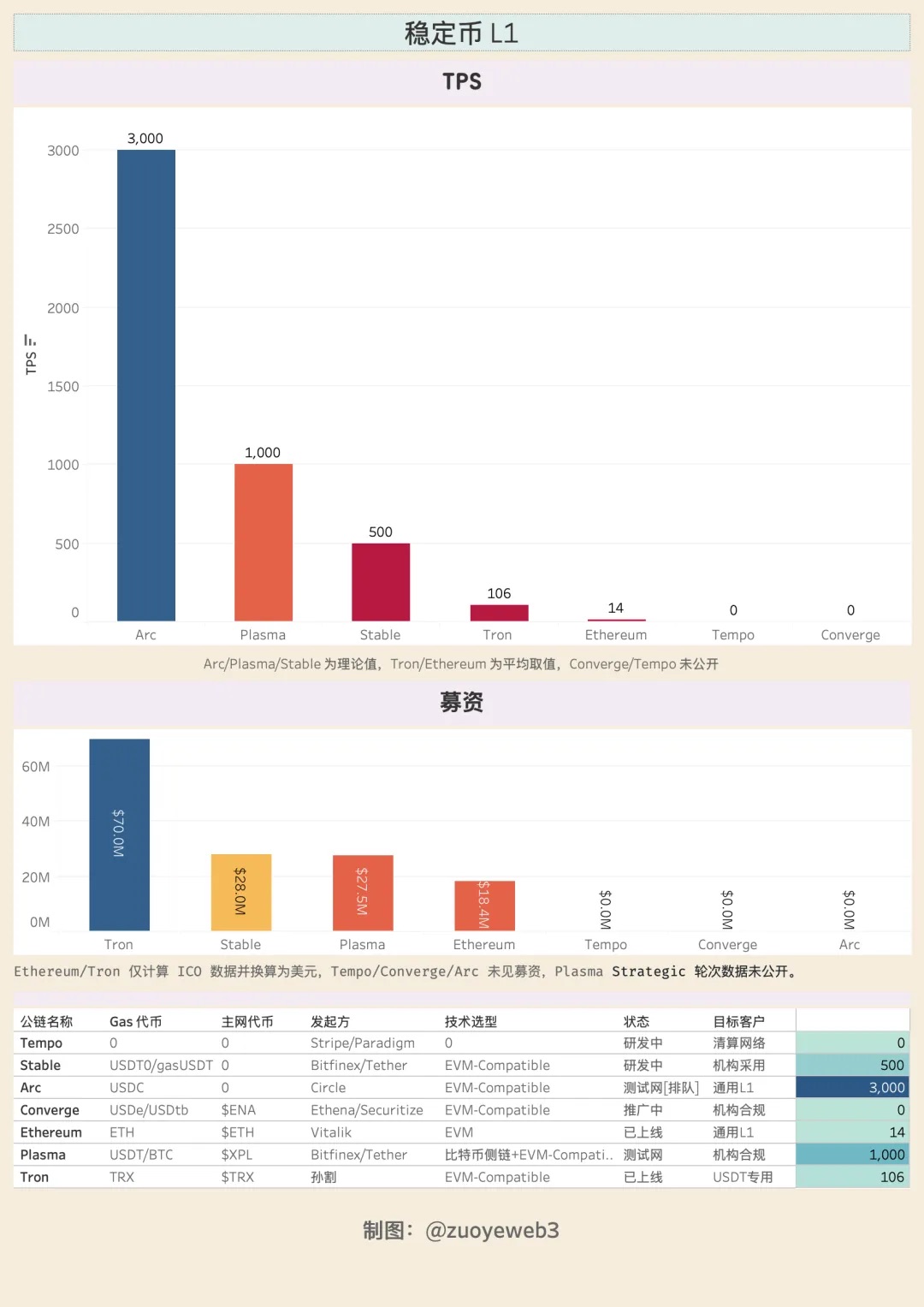

Under a PoS-like, de facto DPOS mechanism, Arc—with up to 20 nodes—can theoretically achieve 3,000 TPS and sub-second transaction confirmation times, with gas fees potentially below $0.01. Thoughtful features like private transfers and vault modes cater specifically to institutions, preparing for large-scale enterprise fund onboarding—this may be a key reason Circle built its own L1. Beyond transactions and transfers, enterprise asset management is another critical battleground.

The general-purpose L1 architecture reserves interfaces and full functionality for more assets like RWA. Malachite, evolved from CometBFT developed by acquired Informal Systems, has theoretical potential of 50,000 TPS.

Followed by familiar EVM compatibility, MEV protection, FX (foreign exchange) engine, and transaction optimization. With Cosmos support, launching Hyperliquid-level products faces no technical bottlenecks. For L2s, deployment difficulty wouldn’t exceed running a Docker instance.

In Arc’s roadmap, cryptographic technologies like TEE, ZK, FHE, and MPC will converge. Today’s technology diffusion makes public chain startup costs nearly constant. The real challenge lies in ecosystem expansion—building distribution channels and terminal networks. Visa took 50 years, the USDT/Tron alliance took 8, and Tether has been issuing USDT for 11.

Time is the greatest enemy of stablecoin L1s, so stablecoins adopt a strategy separating action from messaging:

• Action: Retail adoption → Distribution channels → Institutional adoption

• Messaging: Institutional compliance → Mass adoption

Both Tempo and Converge target institutional adoption. Arc especially emphasizes global compliance. Compliance + institutions form the GTM strategy offered by stablecoin L1s—but this isn’t the whole story. Stablecoin L1s will promote themselves in more "Crypto-native" ways.

Plasma and Converge both partner with Pendle. Circle quietly pushes 24/7 exchange between yield-bearing USYC and USDC. Tempo’s CEO is Matt Huang, founder of Paradigm, signaling a desire to be more blockchain-native rather than fintech-focused.

Institutional adoption has always been a compliance tactic. Like Meta claiming user privacy protection, in real business, user base must come first to drive institutional adoption. Remember, USDT’s earliest and largest user base was always everyday people in Africa, Latin America, and Asia—now they’ve entered institutional view.

Distribution channels have never been institutions’ strength. Ground troops remain the foundation of the internet.

Image caption: Comparison of stablecoin L1s

Image source: @zuoyeweb3

New stablecoin L1s either raise substantial funds or stand behind powerful backers. Under Genius Act and MiCA regulations, they generally cannot pay interest to users or use it for customer acquisition. Yet USDe reached $10 billion in issuance within a month via circular lending.

The gap between on-chain yield distribution and user conversion creates space for interest-bearing stablecoins. USDe manages the chain side, while USDtb becomes a Genius Act-compliant stablecoin with Anchorage’s support.

Yield significantly boosts user adoption—a fatal temptation. Beyond rule-defined boundaries, every player gets room to shine.

Conclusion

Before stablecoin L1s, TRC-20 USDT served as the de facto global USDT clearing network. USDT was the only stablecoin with genuine real-world users, so Tether didn’t need to share revenue with exchanges. USDC was merely its compliant proxy, much like how Coinbase mirrors Binance on Nasdaq.

Stablecoin L1s are challenging Visa and Ethereum. The global monetary circulation system is being fundamentally reshaped. Global dollar usage is gradually declining, yet stablecoin L1s are already targeting foreign exchange trading. The market is always right—stablecoins want to do more.

More than a decade after blockchain’s inception, seeing innovation in the public chain space remains exciting. Perhaps most reassuring is that Web3 isn’t just Fintech 2.0—DeFi is changing CeFi|TradiFi, and stablecoins are transforming banks (deposits, cross-border payments).

Let’s hope stablecoin L1s remain true inheritors of blockchain’s core principles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News