From “Transaction Chain” to “Settlement Chain”: Research Report on Stable, the Payment-Focused Public Blockchain

TechFlow Selected TechFlow Selected

From “Transaction Chain” to “Settlement Chain”: Research Report on Stable, the Payment-Focused Public Blockchain

Stable, a stablecoin-focused blockchain, is emerging as a project worthy of close attention—thanks to its strategic shift from a “transaction chain” to a “settlement chain,” the critical technical upgrade in version 1.2.0, and its robust capital backing and ecosystem advantages.

Market Reflection: When the Market Falls, Who’s Going Against the Trend?

Recent market conditions have been plain for all to see: Bitcoin has oscillated repeatedly near $70,000, triggering investor panic—even prompting fears of a drop to $60,000. Yet amid this “bullish retreat,” a project called Stable quietly hit a new all-time high, surging over 40% this week.

Why? Because investors are finally realizing: speculation may pause, but as long as people remain alive, they’ll still need stablecoins to pay for goods and services.

The current market correction is essentially a “deleveraging and de-inflation” process—capital is flowing away from ethereal “air coins” toward sectors with real demand: “money-printing machines”—i.e., stablecoin-dedicated blockchains, or Stablechains.

The Sector Everyone’s Watching Right Now: Stablecoin Infrastructure

Over the past few years, stablecoins have functioned more as “liquidity tools” than as “native application layers.” The scale of USDT and USDC has approached—or even surpassed—that of many national currencies’ circulating supply (USDT’s circulation now exceeds $19 billion, serving over 350 million users). Yet their underlying settlement layer remains heavily dependent on general-purpose blockchains like Ethereum.

The problem lies in several structural mismatches:

- Gas fees denominated in ETH are inherently misaligned with stablecoin payment logic;

- Fee volatility during peak times makes them ill-suited for high-frequency, low-value settlements;

- High cross-chain friction increases operational costs for enterprises;

- Financial institutions’ needs around privacy, compliance, and auditability remain difficult to satisfy simultaneously.

Hence, a new sub-sector has recently emerged: “Stablechains”—blockchains purpose-built for stablecoins, aiming to elevate stablecoins from mere “assets” to “native payment rails.”

Key players include:

- Stable (focused on native USDT settlement and payment infrastructure)

- Plasma (more oriented toward stablecoin clearing networks)

- Several customized chains/Layer-2 solutions built around USDC and PYUSD

Overall, success in this sector hinges not on “who has higher TPS,” but on three critical variables:

1) Presence of real-world payment demand;

2) Existence of institutional partnerships;

3) Alignment between network economics and the stablecoin itself.

Why Stable Deserves Close Attention

Among the growing field of stablecoin infrastructure projects, Stable’s recent market performance stands out notably. Ahead of its mainnet v1.2.0 upgrade on February 4, its native token hit an all-time high; it rose ~43% this week, peaking at $0.03, with a current market cap of ~$420 million and an FDV exceeding $2.4 billion—clearly outpacing most peers in the same category.

More intriguingly, this rally isn’t typical “event-driven hype”—it appears instead to reflect gradual fundamental realization.

(1) Product Positioning: From “Trading Chain” to “Settlement Chain”

Stable’s core positioning isn’t about attracting DeFi speculative traffic, but rather about enabling real-world payments, foreign exchange settlement, payroll distribution, and corporate treasury management. This sharply differentiates it from general-purpose smart contract platforms like Ethereum and Solana.

Key distinctions include:

- Stable uses USDT natively as its gas asset (v1.2.0 fully phased out gUSDT in favor of USDT0)

- This means user payments, enterprise settlements, and the entire network economic model revolve entirely around stablecoins

- It fundamentally eliminates the structural friction of paying fees in volatile assets

From a payments perspective, this design choice carries far greater significance than simply boosting TPS.

(2) The v1.2.0 Upgrade: A Critical Step Toward “Production-Grade” Readiness

This upgrade prioritizes practicality—not technical showmanship—but rather focuses on making the network more usable, more reliable, and easier to integrate:

- Consensus & Execution:

- Financial-Institution-Friendly Design:

- Five Key Technical Improvements (engineering-focused):

1) Native Stablecoin Gas: USDT0 becomes the sole gas asset, lowering wallet and enterprise integration costs.

2) Enhanced Staking/Unstaking Observability: New on-chain signals eliminate “guesswork” at the application layer.

3) STABLE Token Compatibility Fixes: Improved reliability for migrating legacy Solidity contracts.

4) Gas Exemption Mechanism: Enables controlled zero-gas transactions—ideal for payments—with built-in rate limits and caps.

5) Infrastructure Stability Upgrades: Enhances resilience in production environments.

Overall, this upgrade marks the transition from a “functional testnet” to a “scalable, production-ready network.”

(3) Capital & Ecosystem: Stable’s Real Edge

Many blockchains rely on incentive subsidies to attract traffic—but Stable takes a different path: payment use cases first, on-chain activity second.

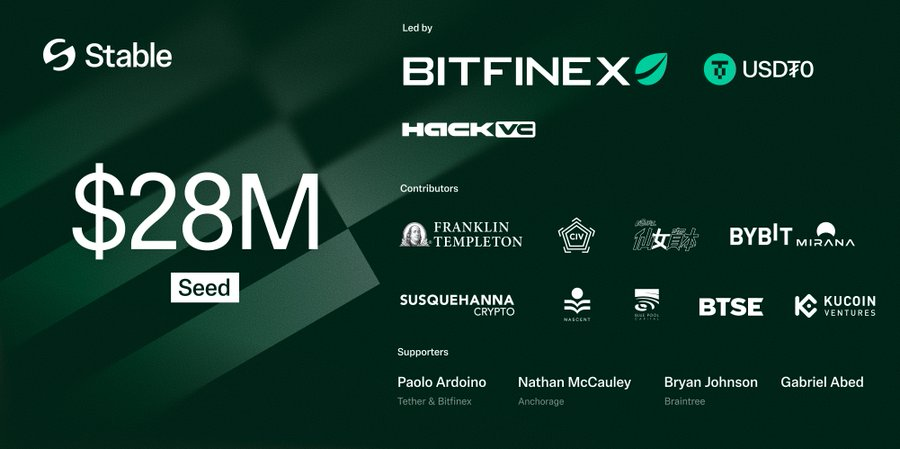

(1) Crypto-Native Capital Support

Stable maintains deep ties with Bitfinex, which provides liquidity, market resources, and ecosystem synergies; it also enjoys backing from Morpho, Paxos, and Anchorage—covering DeFi, compliant stablecoin issuance, and custody.

(2) Traditional Finance Integration

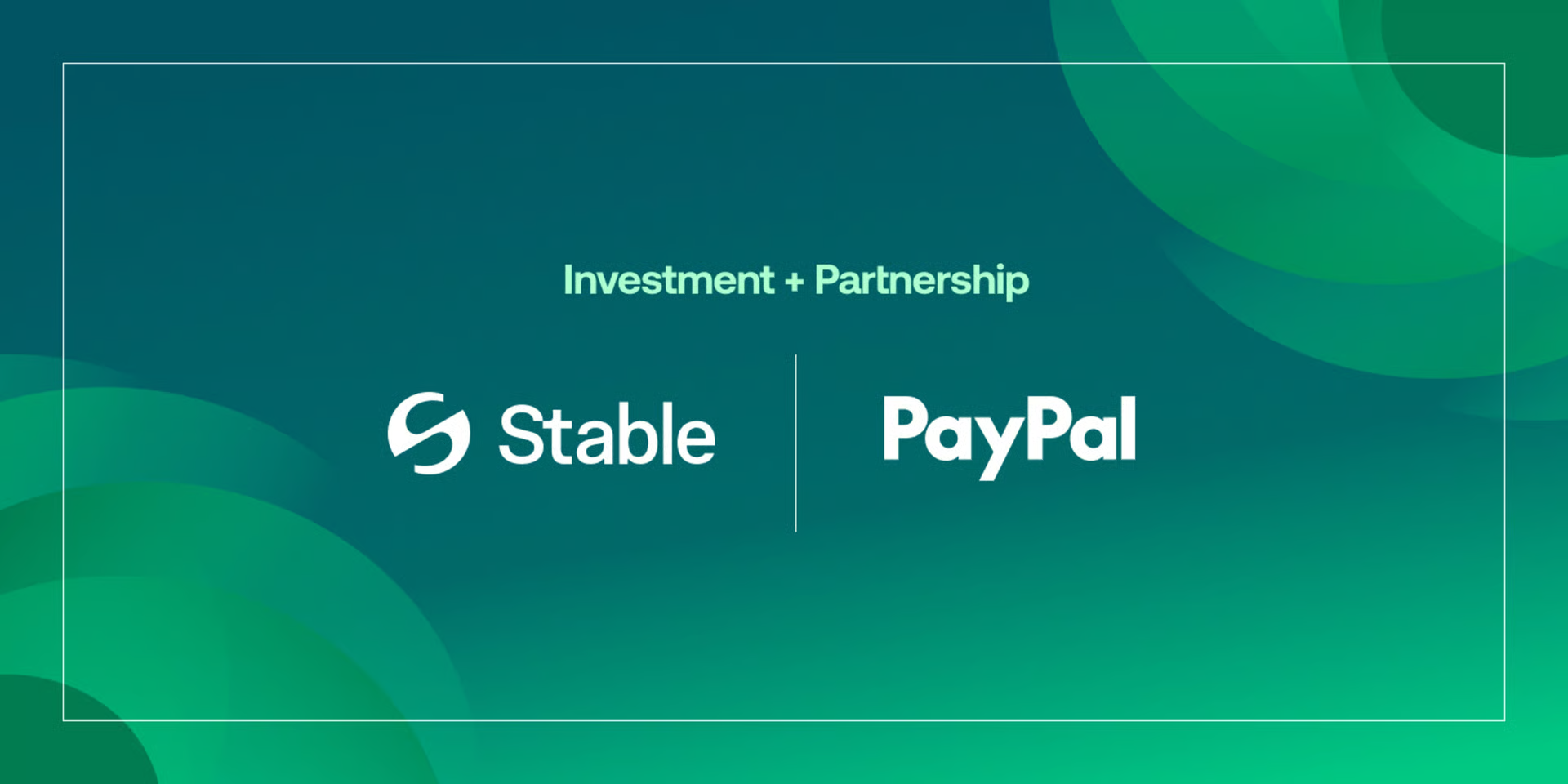

Stable has successfully onboarded several prominent traditional financial institutions—including global asset management leader Franklin Templeton, payments giant PayPal and its venture arm PayPal Ventures, and quantitative trading powerhouse Susquehanna International Group. These heavyweight endorsements bring both capital and credibility—validating Stable’s reliability and long-term potential as a stablecoin payment infrastructure.

Most significantly, PayPal USD (PYUSD) has officially launched on StableChain. This integration enables permissionless usage of PYUSD, broadening its distribution channels, utility, and liquidity—and bridging blockchain-native infrastructure with traditional payment giants.

This is more than just technical integration—it’s institutional endorsement. If PayPal is willing to run PYUSD on Stable, it signals that Stable’s infrastructure meets institutional-grade standards.

Additionally:

- PXP Financial (processing €30 billion in payments annually)

- Chipper Cash (a leading African cross-border payments provider)

have both joined the ecosystem—demonstrating that Stable serves not only Web3 but aims to build cross-border payment rails.

(3) Demand-Driven, Not Token-Incentive-Driven

Some even more telling data points:

- 50+ Payment Service Providers (PSPs) are currently in integration pipelines, with rollouts scheduled soon;

- Coverage spans enterprise fund disbursement, payroll, merchant payments, and more;

- Partner network reach includes:

- Over $2B+ in pre-deposits were secured prior to public launch—indicating genuine enterprise interest.

Moreover, Stable is actively engaging with regulators and collaborating with teams like Basal Pay and Holdstation—participants in regulated pilot programs—to mitigate policy risk.

Stable Project Research Summary

In short, Stable earns “toll fees.” Even in the deepest bear markets, cross-border trade, payroll distribution, and merchant payments remain non-negotiable necessities. As long as money keeps moving, Stable’s network value will grow.

Short-term catalysts: The v1.2.0 rollout and new partnership announcements are tangible, visible drivers.

Long-term ecosystem potential: If Stable truly captures payroll processing for 1 million enterprises, today’s market cap is merely the starting point.

Investment recommendation: Stable is not a speculative “meme coin” betting on improbable breakout odds—it’s an infrastructure dark horse with strong long-term certainty. In today’s market—where fundamentals and verifiable metrics matter more than ever—it’s wiser to allocate attention and capital toward leaders like Stable: projects with real settlement volume and top-tier institutional validation. From a risk-reward perspective, long-term, sustainably growing infrastructure projects offer superior value and investment merit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News