After Reaching $1 Billion TVL, Has USDD’s “Yield-Bearing USDT” Narrative Entered the Stablecoin Main Stage?

TechFlow Selected TechFlow Selected

After Reaching $1 Billion TVL, Has USDD’s “Yield-Bearing USDT” Narrative Entered the Stablecoin Main Stage?

USDD is rapidly transforming into an interest-bearing asset that combines stability with capital efficiency, marking an ecological qualitative shift from incentive dependency to genuine utility.

By TechFlow

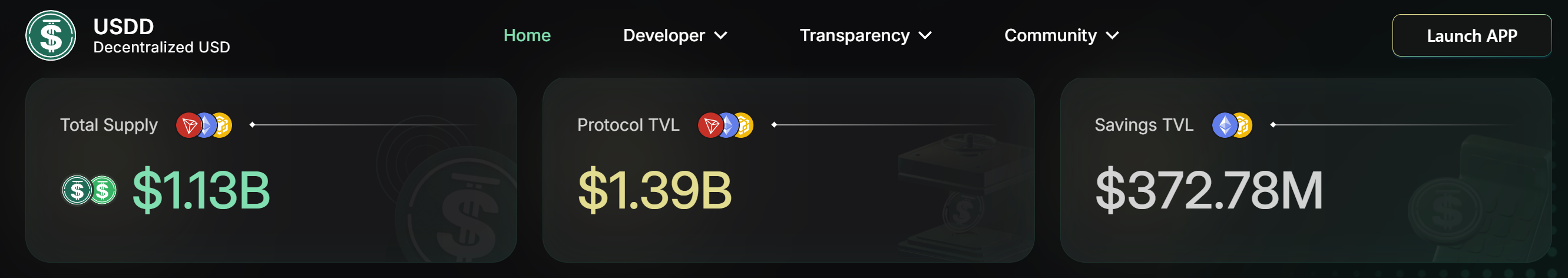

On January 14, 2026, USDD’s total value locked (TVL) surpassed the critical $1 billion threshold.

Within the stablecoin market’s $300 billion total size, this figure may not seem extraordinary—but for USDD, it largely signifies entry into the elite circle of core stablecoin players.

TRON has long been a pivotal battleground for stablecoin issuance and circulation: According to TRONSCAN data, TRON hosts $83.4 billion of the leading stablecoin USDT’s $180 billion total supply—nearly half its global issuance—with a daily trading volume of approximately $30 billion and over 70.69 million unique holder addresses.

Building upon this robust foundation—large user base, high ecosystem demand, and mature infrastructure—the TRON-native USDD, designed to fill the decentralized stablecoin gap, has drawn sustained attention. Notably, on January 25, 2025, USDD announced completion of its 2.0 upgrade.

Technically, this represents a comprehensive breakthrough in stability, security, and decentralization: From over-collateralization and the Price Stability Module (PSM) to decentralized governance, USDD has demonstrated its commitment to building a model stablecoin—one grounded in zero trust, full decentralization, non-freezability, and proven reliability.

Shifting focus to the ecosystem perspective, USDD reveals another layer of evolution: From early-stage yield subsidies offering 20% APY, to today’s multi-pronged strategy—including USDD Earn, interest-bearing token sUSDD, deep DeFi integrations, and the Smart Allocator yield-sharing program—USDD has rapidly transformed into a yield-generating asset that balances stability with capital efficiency. This marks a fundamental ecosystem shift—from subsidy dependency to authentic utility-driven growth.

As USDD celebrates its first anniversary since the 2.0 upgrade, let us examine its growth story through data—and explore a valuable case study illustrating the evolutionary trajectory of decentralized stablecoins.

Underpinned by $1 Billion TVL: USDD’s Shift from “Blood Transfusion” to “Blood Production”

What key metrics has USDD achieved over the past year?

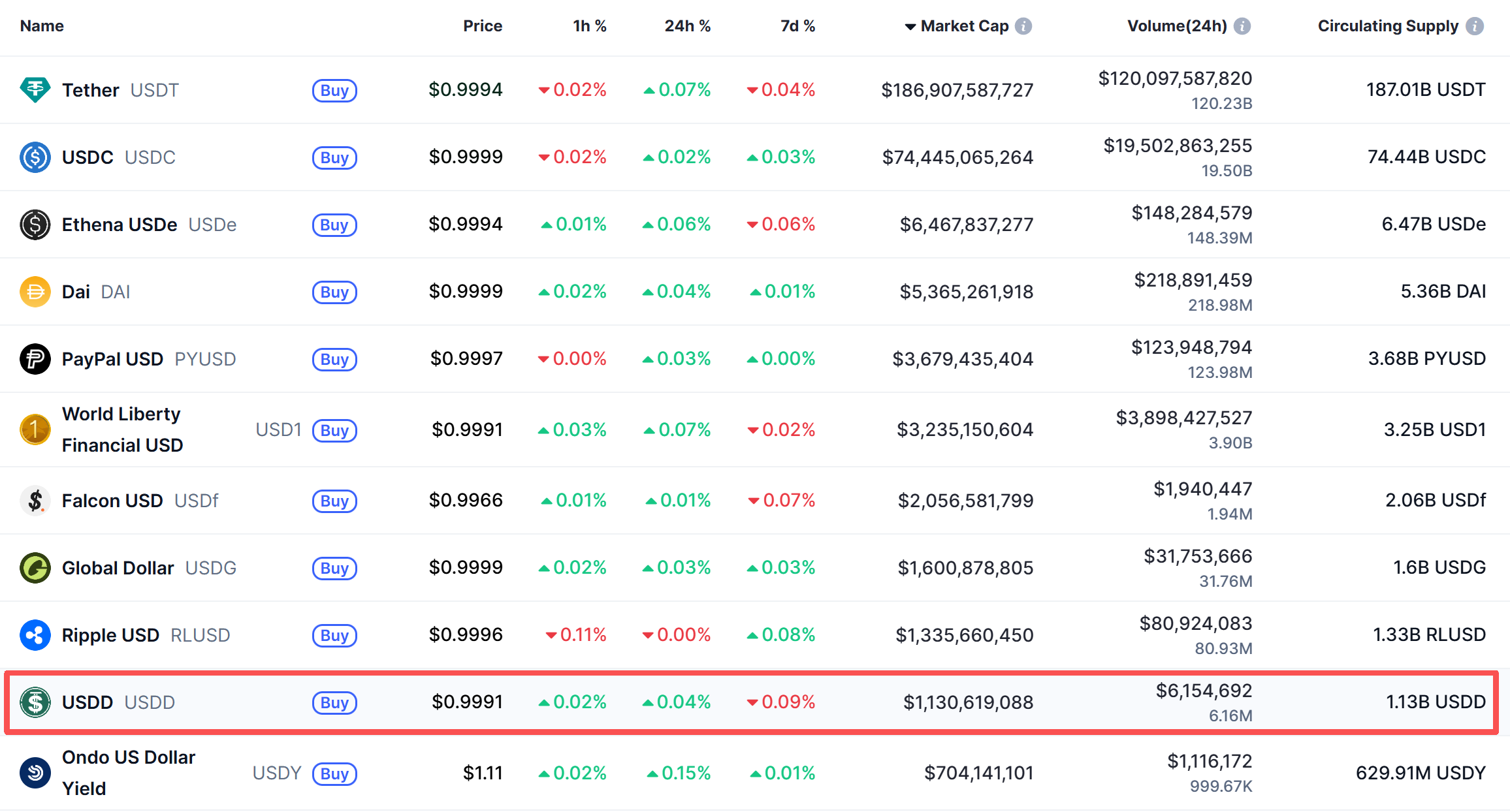

First, TVL breakthrough: Per official data, USDD’s TVL has exceeded $1.39 billion, with circulating supply reaching 1.13 billion tokens. According to CoinMarketCap, both USDD’s market cap and circulating supply rank among the Top 10 stablecoins—placing it firmly within the mainstream competitive arena.

Yet beyond raw capital figures, USDD’s user-side metrics are even more telling.

CoinMarketCap shows USDD now boasts over 462,000 holder addresses. A closer look reveals that projects ranked ahead of USDD in both market cap and circulating supply—including Ripple USD (RLUSD) with 6,870 holders, Global Dollar (USDG) with 10,370 holders, and PayPal USD (PYUSD) with 100,300 holders—all fall short of USDD’s 462,000. This highlights USDD’s distinct advantage in user base scale and distribution efficiency—its most vital reservoir for future growth.

Beneath these standout numbers lies another crucial insight: Over the past year, every phase of USDD’s data-driven growth has coincided with progressive transformation on the yield front:

In February 2025, during the initial phase of the USDD 2.0 upgrade, TRON-subsidized staking campaigns (T1 phase) and HTX’s USDD-earning products offered up to 20% APY—propelling USDD’s supply past the 100-million-token mark within two weeks and enabling rapid bootstrapping;

In June 2025, USDD launched Smart Allocator, deploying idle reserve funds to generate real yield for users—accumulating over $9 million in returns to date;

In September 2025, USDD officially expanded cross-chain deployment, natively launching on Ethereum and BNB Chain—significantly enhancing cross-chain liquidity and user reach;

In October 2025, USDD introduced sUSDD, expanding its yield-generating use cases; as USDD’s interest-bearing variant, sUSDD delivers ~12% APY, achieving $300 million TVL within just over two months;

In December 2025, USDD further broadened its ecosystem partnerships—collaborating with top-tier exchanges, wallets, and DeFi protocols including Binance Wallet—to dramatically widen its user footprint and drive TVL past the critical $1 billion threshold.

At this point, the significance becomes clearer: These metrics collectively affirm USDD’s emergence as a formidable contender in the crowded stablecoin landscape.

From static store-of-value to dynamic yield-bearing asset, from subsidy dependence to protocol-native, sustainable yield generation—over this past year, USDD has steadily weaned itself off “subsidy dependency,” gradually mastering “self-sustaining yield generation.”

This growth—driven by upgraded asset functionality and evolved business models—rests fundamentally on robust underlying technical architecture upgrades.

The USDD Upgrade: A “Necessary” Bottom-Layer Restructuring

At its core, the stablecoin business is a philosophy of trust.

Why would users exchange real money for a stablecoin? The answer usually hinges on three pillars: stability, security, and yield.

Prior to the upgrade, USDDOLD exhibited varying degrees of weakness across all three dimensions—largely because it relied heavily on “paternalistic management” by the TRON DAO Reserve:

Under its hybrid algorithmic + centralized reserve model, USDDOLD minting was exclusively handled by the TRON DAO Reserve and whitelisted institutions. Its peg relied on supply adjustments, arbitrage incentives, and excess reserves—all orchestrated primarily by the TRON DAO Reserve—resulting in high centralization, low transparency, and additional de-pegging risks during extreme market conditions.

Simultaneously, for an extended period, USDDOLD’s user yields were almost entirely dependent on subsidies from the TRON DAO Reserve—a clearly unsustainable approach.

The 2.0 upgrade launched by USDD in early 2025 was precisely intended to end this status quo.

A foundational change: USDD transitioned from a hybrid algorithmic stablecoin to an over-collateralized stablecoin—every USDD in circulation is backed by assets exceeding 100% collateralization, with under-collateralized positions automatically liquidated. Moreover, post-upgrade, minting rights were opened to all users: anyone can deposit assets into Vaults to mint USDD.

Accompanying this model shift came a suite of complementary mechanism upgrades:

To achieve tighter price anchoring, USDD introduced the Price Stability Module (PSM), enabling near-zero-fee, seamless swaps between USDD and supported stablecoins. Following initial USDT support, USDD’s PSM on Ethereum and BNB Chain now also supports USDC—meaning arbitrageurs automatically intervene to correct any price deviations, reinforcing stability.

To solidify its “trustless security” foundation, all USDD-supported collateral assets are publicly verifiable on-chain in real time. Additionally, USDD’s smart contracts have undergone comprehensive security audits by third-party firms including ChainSecurity and CertiK. USDD is also progressively developing a fully community-led, decentralized DAO governance framework.

With the “trust” foundation firmly laid, the logic of “yield generation” can operate more effectively: As a flagship upgrade feature, the Smart Allocator intelligently deploys idle protocol reserves into rigorously vetted, high-quality DeFi protocols—generating real yield and returning 100% of proceeds to the ecosystem. Fully transparent and on-chain, this mechanism empowers USDD to achieve protocol-native, sustainable yield—gradually eliminating reliance on subsidies.

This chart offers a clearer visual understanding of the transformation—and how USDD has evolved versus its prior self:

Of course, for users, assets must appreciate—and liquidity needs outlets.

Once USDD established, via its upgrade, a foundational trust layer, a stable value anchor, and a sustainable, self-funding yield-generation framework, growth momentum naturally shifted toward broader adoption, composability, and amplification of USDD as a yield-bearing asset.

Rejecting “Dead Money”: USDD Forges the “Yield-Bearing USDT”

The stablecoin赛道 isn’t lacking methodologies for minting “$1”—what’s scarce is how to make that $1 grow in value.

The recent RMB appreciation, which caused passive USDT holdings to depreciate in purchasing power, vividly illustrates this principle—and exposes a major shortcoming of stablecoins like USDT:

Fundamentally “static dollars,” they generate zero native yield for holders.

USDD aims to fill precisely this gap.

While USDT remains the undisputed leader in the stablecoin space, USDD strives to match its liquidity, global penetration, and usability—but adds a decisive edge in yield generation:

Enabling users to earn low-risk, stable, and substantial native yield—without requiring complex or excessive actions.

In building the “Yield-Bearing USDT,” USDD deploys its own integrated toolkit:

- Stake USDD, earn yield instantly: Through strategic ecosystem partnerships, USDD delivers yield access directly within high-frequency, mass-user environments—on both exchanges and DeFi platforms. Users can stake USDD with one click to earn variable APY across major exchanges including HTX, Kraken, and Bybit—as well as native TRON DeFi protocols such as JustLend DAO.

- sUSDD auto-compounds, delivering “passive income”: Users can swap USDD 1:1 for sUSDD on Ethereum and BNB Chain. sUSDD’s value grows automatically over time—no manual intervention required. Yield accrues directly to the sUSDD balance, letting users “set and forget.”

- Smart Allocator fuels continuous yield generation: Idle USDD cash reserves are automatically deployed across high-liquidity, high-reliability DeFi protocols—including Aave, Morpho, JustLend, and Spark—to earn interest, platform rewards, and funding fees. All yield flows back to USDD and sUSDD holders.

- Broad DeFi integration and ecosystem synergies expand use-case coverage: USDD pursues dual-track expansion—deepening cross-ecosystem penetration via partnership networks while simultaneously creating new yield opportunities through integrations. Currently, USDD collaborates with nearly 30 ecosystem partners and regularly launches time-limited campaigns to boost liquidity and usage—for example, participating in USDD-sUSDD liquidity mining on PancakeSwap to share an extra $125,000 reward pool, or joining Binance Wallet’s Yield+ program to share an extra 300,000 USDD reward pool.

As the ecosystem expands, USDD’s yield-generating use cases will continue multiplying.

Surpassing the $1B TVL Milestone: Entering the $10B TVL Arena

Reflection serves not merely to honor the past—but to calibrate the future.

Having crossed the first $1 billion TVL threshold and secured its seat at the core stablecoin competition table, USDD’s next challenge is clear:

How can this proven growth model—validated throughout 2025—be scaled infinitely to accommodate exponentially larger capital inflows and user bases?

While uncertainty remains, USDD’s 2026 roadmap is unmistakably focused:

First, continuously integrating into more DeFi scenarios and introducing richer, more resilient yield strategies—to strengthen the core narrative of the “Yield-Bearing USDT” and amplify the yield engine;

Second, deepening integrations with infrastructure providers, wallets, and exchanges—to broaden distribution and deepen user experience;

Third, prioritizing community and brand development—launching content creation initiatives, KOL collaborations, and educational programs—to enhance soft power, foster organic growth, and deepen user awareness.

Naturally, true long-termism transcends “short-term wins”—it pursues “cross-cycle resilience”:

It took USDD one year to rise from zero to $1 billion TVL—and claim its place at the core stablecoin table;

Scaling from $1 billion to $2 billion—or even $10 billion—marks where USDD’s real game begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News