The $6 Billion Stablecoin Wealth Management Business: Where Do Yields Come From, and Where Do Risks Go?

TechFlow Selected TechFlow Selected

The $6 Billion Stablecoin Wealth Management Business: Where Do Yields Come From, and Where Do Risks Go?

Revealing the old and new logics behind high returns.

By: Muyao Shen

Translated by: TechFlow

TechFlow Intro: The collapses of BlockFi and Celsius in 2022 plunged the crypto lending industry into a deep freeze. Yet today, a new “transparent, non-custodial” Vault model is staging a comeback—with $6 billion in assets under management.

This article delves into this emerging sector: how it uses smart contracts to sidestep the black-box risks of traditional centralized lending—and how, under pressure to deliver high yields, it risks repeating the same missteps as Stream Finance.

As the Genius Act pushes stablecoins toward mainstream adoption, are Vaults the foundation for mature crypto finance—or the next shadow banking crisis, dressed in transparency?

This article reveals the old and new logics behind those high yields.

The full article follows:

When the crypto platform Stream Finance collapsed last December—resulting in roughly $93 million in lost user funds—it exposed a familiar fault line in digital assets: promises of “safe yield” often crumble when markets turn.

What made this failure especially alarming wasn’t just the losses—but the mechanism behind them. Stream had positioned itself as part of a new generation of more transparent crypto yield products, designed specifically to avoid the hidden leverage, opaque counterparty risk, and arbitrary risk decisions that brought down centralized lenders like BlockFi and Celsius in the previous cycle.

Instead, it demonstrated how quickly the same forces—leverage, off-platform risk exposure, and centralization—can reemerge once platforms begin chasing yield—even when infrastructure appears safer or transparency more reassuring.

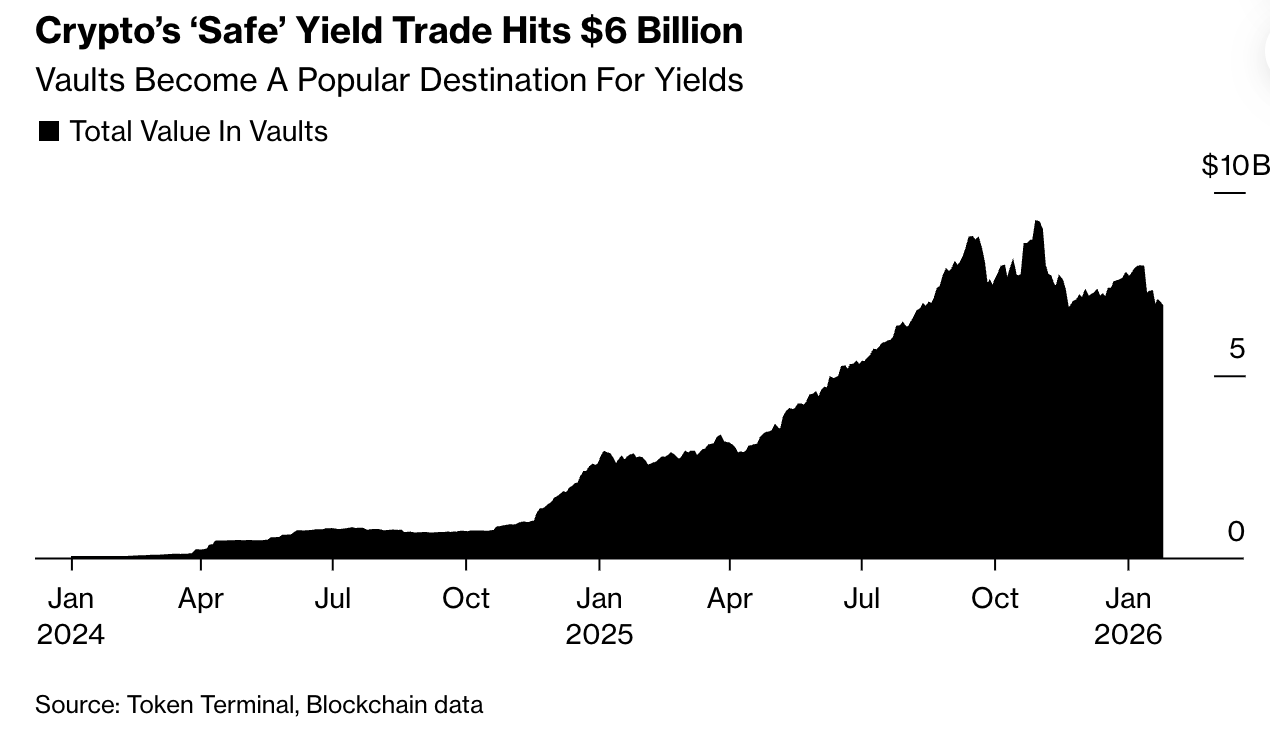

Yet the broader promise of safer crypto yield remains alive. Industry data shows Vaults—the on-chain investment pools built around this idea—now manage over $6 billion in assets. Crypto asset manager Bitwise projects that, driven by rising demand for stablecoin yield, assets in Vaults could double by the end of 2026.

Crypto’s “Safe” Yield Trade Hits $6 Billion

At their core, Vaults let users deposit crypto into shared pools, with funds deployed into lending or trading strategies designed to generate returns. What sets Vaults apart is how they’re marketed: as a clean break from past opaque lending platforms. Deposits are non-custodial—users never hand assets over to a company. Funds reside in smart contracts, which automatically deploy capital according to pre-set rules, and key risk decisions are visible on-chain. Functionally, Vaults resemble familiar components of traditional finance: pooling capital, converting it into yield, and providing liquidity.

But their structure bears unmistakable crypto DNA. Everything happens outside the regulated banking system. There’s no capital buffer against risk, no regulatory oversight—risk is embedded in software. As markets move, algorithms automatically rebalance positions, liquidate collateral, or unwind trades—automating losses.

In practice, this structure can produce uneven outcomes, as curators—the firms designing and managing Vault strategies—compete on returns, while users discover exactly how much risk they’re willing to bear.

“Some participants will do terribly,” says Paul Frambot, co-founder of Morpho, the infrastructure behind many lending Vaults. “They may not survive.”

For developers like Frambot, such churn isn’t a warning signal—it’s a feature of open, permissionless markets, where strategies are stress-tested publicly, capital flows rapidly, and weaker approaches give way over time to stronger ones.

The timing of this growth is no accident. With the passage of the Genius Act, stablecoins are moving into financial mainstream. As wallets, fintech apps, and custodians race to distribute digital dollars, platforms face a shared challenge: how to generate yield without risking their own capital.

Vaults have become a compromise solution. They offer a way to generate yield while technically keeping assets off the company’s balance sheet. Think of them as traditional funds—but without handing over custody or waiting for quarterly disclosures. That’s how curators pitch the model: users retain control of their assets while accessing professionally managed strategies running autonomously on-chain.

“The curator’s role is analogous to a risk and asset manager—like BlackRock or Blackstone does for the funds and endowments they manage,” says Tarun Chitra, CEO of crypto risk firm Gauntlet, which also operates Vaults. “But unlike BlackRock or Blackstone, it’s non-custodial—so the asset manager never holds users’ assets; they remain in smart contracts at all times.”

This structure aims to correct recurring weaknesses in crypto finance. In prior cycles, products touted as low-risk often masked borrowed funds, reused customer deposits without disclosure, or leaned heavily on a few fragile partners. Algorithmic stablecoin TerraUSD offered near-20% yields via subsidized returns. Centralized lenders like Celsius quietly deployed deposits into highly speculative bets. When markets turned, damage spread rapidly—and without warning.

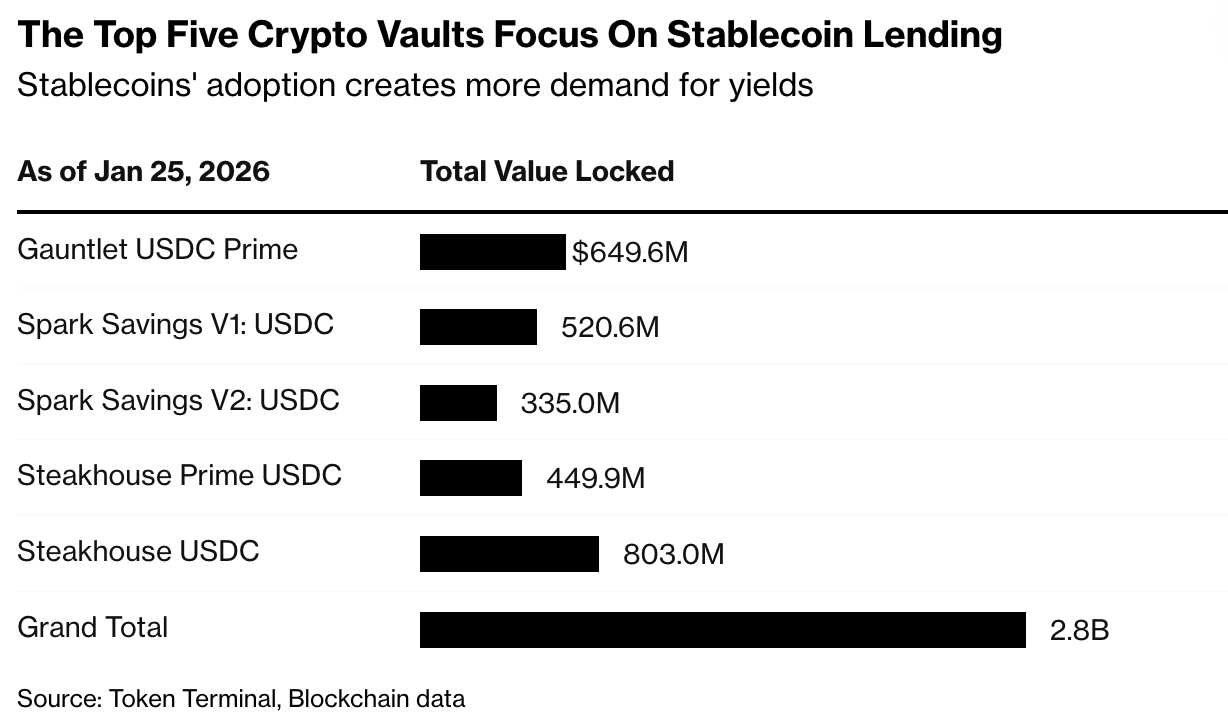

Today’s Vault strategies are generally more restrained. They typically involve floating-rate lending, market-making, or providing liquidity to blockchain protocols—not pure speculation. Take the Steakhouse USDC Vault, which lends stablecoins against its stated basket of blue-chip cryptocurrencies and tokenized real-world assets (RWAs), offering ~3.8% returns. Many Vaults are deliberately designed to be “boring”: their appeal lies not in outsized returns but in the promise of earning yield on digital cash—without surrendering custody or becoming a creditor to a single company.

“People want yield,” says Jonathan Man, portfolio manager and head of multi-strategy solutions at Bitwise, which has just launched its first Vault. “They want their assets to work. Vaults are simply another way to achieve that.”

Vaults could gain further traction if regulators act to ban direct yield payments on stablecoin balances—a proposal floated in market-structure legislation. If that happens, demand for yield won’t vanish—it’ll just shift.

“Every fintech company, every centralized exchange, every custodian is talking to us,” says Sébastien Derivaux, co-founder of Vault curator Steakhouse Financial. “So are traditional finance firms.”

But this restraint isn’t hard-coded into the system. The pressures shaping the industry come from competition—not technology. As stablecoins proliferate, yield becomes the primary tool to attract and retain deposits. Underperforming curators risk losing capital; those offering higher returns draw more inflows. Historically, this dynamic has pushed non-bank lenders—whether in crypto or elsewhere—to loosen standards, increase leverage, or shift risk off-platform. That shift is already reaching major consumer-facing platforms. Crypto exchanges Coinbase and Kraken have both launched products giving retail users access to Vault-like strategies, advertising yields as high as 8%.

In short, transparency can be misleading. Public data tools and visible strategies build confidence—and confidence attracts capital. But once capital arrives, curators face pressure to deliver returns—sometimes by venturing into off-chain transactions that users struggle to assess.

Stream Finance later exposed this fault line, having advertised up to 18% returns before reporting severe losses tied to an unnamed external fund manager. That event triggered a sharp pullback across the Vault industry, with total assets falling from a peak near $10 billion to about $5.4 billion.

Supporters of the model say Stream isn’t representative. Stream Finance did not respond to a request for comment via X DM.

“Celsius, BlockFi—all these, even Stream Finance—I’d group them all as failures of disclosure to end users,” says Bitwise’s Man. “People in crypto always focus more on what the upside could be, and less on what the downside risk really is.”

This distinction may matter now. Vaults were built in response to the last wave of failures, with the explicit goal of making risk visible—not hidden. The unanswered question is whether transparency alone is enough to constrain behavior—or, as in prior shadow banking cases, whether clearer structures simply make investors more comfortable holding risk until the music stops.

“Ultimately, it’s about embracing transparency—and about appropriate disclosure for any product, whether DeFi or non-DeFi,” says Man.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News