IOSG: Rising Silently—Is Circle Undervalued Amid the Stablecoin Red Ocean?

TechFlow Selected TechFlow Selected

IOSG: Rising Silently—Is Circle Undervalued Amid the Stablecoin Red Ocean?

Circle demonstrates significant competitive advantages in the stablecoin space, with its core value stemming not only from USDC itself but also from the payment and settlement ecosystem it has built.

Author: Frank, IOSG

I. Circle vs. Tether: Full-Scale War in 2026

On December 12, 2025, Circle received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to establish a national trust bank—the First National Digital Currency Bank. Once fully approved, this critical milestone will enable Circle to provide fiduciary digital asset custody services to top-tier global institutions, accelerating stablecoin market capitalization to $1.2 trillion within three years. Fueled by this momentum, Circle successfully went public in 2025, and with USDC’s accelerating velocity of circulation, it has become the stablecoin issuer most closely aligned with institutional investors. Its current valuation stands at $23 billion.

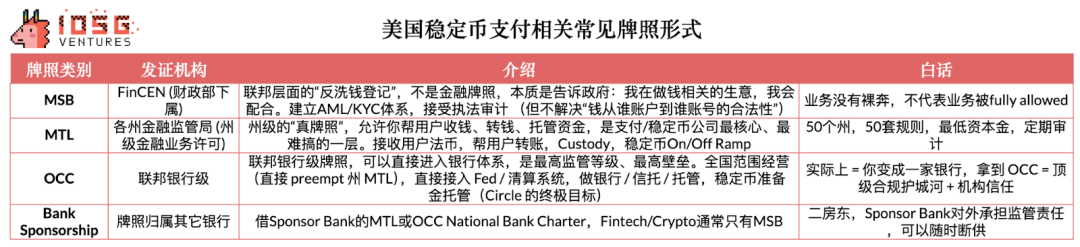

▲ Source: IOSG Ventures

Although Tether—still the market leader in stablecoins—maintains strong profitability exceeding $13 billion, its parent company faces persistent reputational and regulatory pressure. For example, S&P recently downgraded Tether’s reserve rating from “Strong” to “Weak,” and Juventus Football Club rejected its acquisition offer. On November 29, the People’s Bank of China convened a special meeting targeting virtual currency transactions, explicitly identifying stablecoins’ deficiencies in customer due diligence and anti-money laundering (AML) compliance, and highlighting their frequent use in money laundering, fraud, and illicit cross-border fund transfers. In practice, regulatory focus is squarely aimed at offshore stablecoin systems typified by USDT. USDT dominates emerging markets across Asia, Latin America, and Africa—especially in East Asia, where its market share exceeds 90%. Much of its circulation occurs off-chain via peer-to-peer (P2P) and cross-border fund flows, long operating outside formal regulatory oversight and thus viewed by regulators as a “gray-dollar system” exacerbating capital outflows and financial crime risks.

▲ Source: Visa Onchain Analytics

By contrast, the United States and the European Union are pursuing not blanket suppression but regulatory integration through high-compliance frameworks. For instance, the U.S. GENIUS Act explicitly requires stablecoins to maintain 1:1 high-quality reserves, undergo monthly audits, hold federal or state-level licenses, and prohibits using high-risk assets such as Bitcoin or gold as reserves.

In other words, China aims to compress the “offshore stablecoin shadow-dollar system” at its source, while the U.S. and EU seek to build a “controllable, compliant, on-regulatory-rails digital dollar system.” The common ground between these two paths is clear: neither wants opaque, high-risk, non-auditable stablecoins to assume systemic importance. This means compliant issuers like Circle can enter the financial system, whereas offshore stablecoins like Tether will be progressively excluded from developed markets. That explains why Tether has recently accelerated development of USAT—its first U.S.-compliant stablecoin.

▲ Source: Artermis

While Tether may retain dominance in offshore and emerging markets, Circle’s USDC net supply increased by $32 billion over the past year—second only to USDT’s $50 billion increase.

Circle has also made significant progress challenging Tether in offshore and emerging markets: its market share in India and Argentina reached 48% and 46.6%, respectively. The primary driver behind USDC’s growing presence in these offshore markets is the explosive growth of crypto card services over the past few years.

▲ Source: Artermis

Crypto cards allow users to spend stablecoins and cryptocurrency balances at traditional merchants and have become one of the fastest-growing segments in digital payments. Transaction volume surged from ~$100 million per month in early 2023 to over $1.5 billion per month by end-2025—a compound annual growth rate (CAGR) of 106%. Annually, this market now exceeds $18 billion, rivaling the $19 billion in P2P stablecoin transfers—which grew only 5% over the same period.

▲ Source: Artermis

Stablecoin cards present real utility—not just novelty—in many offshore markets. In India, numerous users remain unbanked and lack access to credit; crypto-enabled credit cards directly address this gap. Meanwhile, Argentinians grapple with severe inflation and currency depreciation; stablecoin debit cards help them preserve value by holding dollar-pegged assets.

Because stablecoin cards must connect to Visa or Mastercard networks to transact with local merchants, USDC naturally emerges as the optimal compliant stablecoin, capturing substantial transaction volume in offshore regions where stablecoin cards are widely adopted. Thus, we see Circle and Tether intensifying competition in each other’s core domains—and the competitive balance remains too close to call in the short term.

From a valuation perspective, however, the two are incomparable: USDT’s OTC valuation stands at $300 billion, and Bloomberg recently reported that Tether raised $20 billion at a $500 billion valuation. By contrast, Circle’s latest market cap is only $18.5 billion.

▲ Source: Bloomberg

Beyond its market monopoly, Tether’s valuation premium stems from several factors—but foremost is its superior business model: unlike Circle, Tether does not share revenue with Coinbase. According to Circle’s S-1 filing, Coinbase earns 100% of interest income generated from USDC held on its platform. For USDC held elsewhere—on other exchanges, DeFi protocols, or personal wallets—interest income is split 50/50 between Circle and Coinbase.

▲ Source: Beating

Per Beating’s analysis, Coinbase’s Q3 2025 revenue totaled $354.7 million—exactly 50% of Circle’s own $711 million interest income for the same quarter. Put simply, for every $2 of interest Circle earns, $1 goes to Coinbase.

Beyond avoiding revenue sharing, USDT holds another major advantage: flexibility in collateral composition. Circle pursues an ultra-conservative reserve strategy—85% in short-term U.S. Treasuries and overnight reverse repurchase agreements maturing within 90 days, and 15% in cash and equivalents—all custodied by BlackRock or BNY Mellon and audited monthly by Grant Thornton LLP, ensuring real-time verifiable 1:1 reserve coverage against circulating supply.

▲ Source: CoinLaw

By comparison, USDT’s collateral portfolio is significantly more diversified—yielding higher reserve returns, especially amid rising macro risk aversion and surging gold prices.

This prompts a fundamental question: Is highly compliant, regulator-approved stablecoin issuance even a viable business?

II. Circle’s Earnings: Robust Growth in Q3

First, let’s review Circle’s primary revenue model and financial performance. Circle’s stablecoin is minted 1:1 against cash and short-term U.S. Treasury securities. In a high-interest-rate environment, these reserve assets generate substantial interest income.

In Q3, Circle’s revenue reached $740 million (with interest income alone accounting for $711 million), surpassing expectations of $707 million, representing 66% year-on-year (YoY) growth. Though quarter-on-quarter (QoQ) growth dipped slightly—from 13.6% last quarter to 12.5% this quarter—it remains broadly stable.

USDC’s circulating supply nearly doubled, and Adjusted EBITDA margin hit 22.5%. This rare combination of rapid growth and strong profitability distinguishes Circle in fintech, making it one of the few high-growth, high-margin players in the industry.

▲ Source: Circle Q3 Earnings

This quarter, the company’s quarterly net profit (RLDC) reached $292 million—significantly exceeding market expectations. Its growth rate remained flat relative to the prior two quarters. RLDC (Revenue Less Distribution and Other Costs) is calculated as total revenue minus distribution, transaction, and other related costs. RLDC margin—the RLDC as a percentage of total revenue—measures core business profitability.

Operating Income also substantially beat expectations. Last quarter’s Operating Income was negative, primarily due to one-time equity-based compensation ($424 million in stock-based compensation [SBC]) and a $167 million debt extinguishment charge. To facilitate comparability, we use Adjusted EBITDA, which adds back non-core, one-time expenses—including depreciation, amortization, taxes, and equity compensation—to reflect recurring operational performance. Adjusted EBITDA accelerated both YoY (+78%) and QoQ (+31%), far exceeding market expectations.

▲ Circle Q3 Earnings

Therefore, earnings reports closely track the growth rate of “other income” and its share of total revenue. Sustained increases in both metrics signal ongoing improvement in Circle’s revenue model; conversely, declining growth would be a bearish signal.

“Other income” totaled $28.5 million—well above market expectations. However, given last year’s base of only $1 million, YoY comparisons have limited relevance. More meaningful QoQ data shows a 20% growth rate—up from 15% last quarter—confirming this segment’s rapid expansion. Still, “other income” accounts for less than 4% of total revenue, indicating that diversifying Circle’s revenue structure will take time.

Nonetheless, this remains a positive signal. Expecting a fundamental shift in revenue model within six months is unrealistic; steady QoQ growth lays a solid foundation for future diversification.

▲ Source: Circle Q3 Earnings

At a macro level, the stablecoin market is experiencing explosive growth: overall circulating supply rose 59% YoY, and on-chain transaction volume reached 2.3× last year’s level—highlighting enormous market potential.

Within this context, USDC stands out—its market share has steadily climbed to 29%. Notably, even amid recent competition from emerging stablecoins like Phantom’s $CASH, USDC’s upward trajectory remains uninterrupted.

A widespread concern exists: Will increasing stablecoin issuance erode USDC’s position as the leading choice? The proliferation of “stablecoin-as-a-service” platforms—from Bridge to M0 to Agora—and corporate entrants suggest the industry may descend into destructive overcompetition (“involution”), squeezing long-term profitability. Yet this view largely overlooks a critical market reality.

USDC’s market share gains stem primarily from favorable regulatory developments like the GENIUS Act. As the leader in compliant stablecoins, Circle occupies a unique strategic position. Globally—across the U.S., Europe, Asia, and regulated jurisdictions like the UAE and Hong Kong—mainstream institutions prefer Circle’s trusted, transparent, and liquid compliant infrastructure as their go-to partner; otherwise, their operations face regulatory hurdles.

Thus, concerns about new stablecoins challenging USDC’s market leadership are unfounded. On the contrary, USDC is poised not only to solidify its #2 position for years to come but also to mount a serious challenge for market leadership—leveraging its unparalleled compliance advantages. The network-scale-effect barrier may take 2–3 years to overcome.

▲ Source: Circle Q3 Earnings

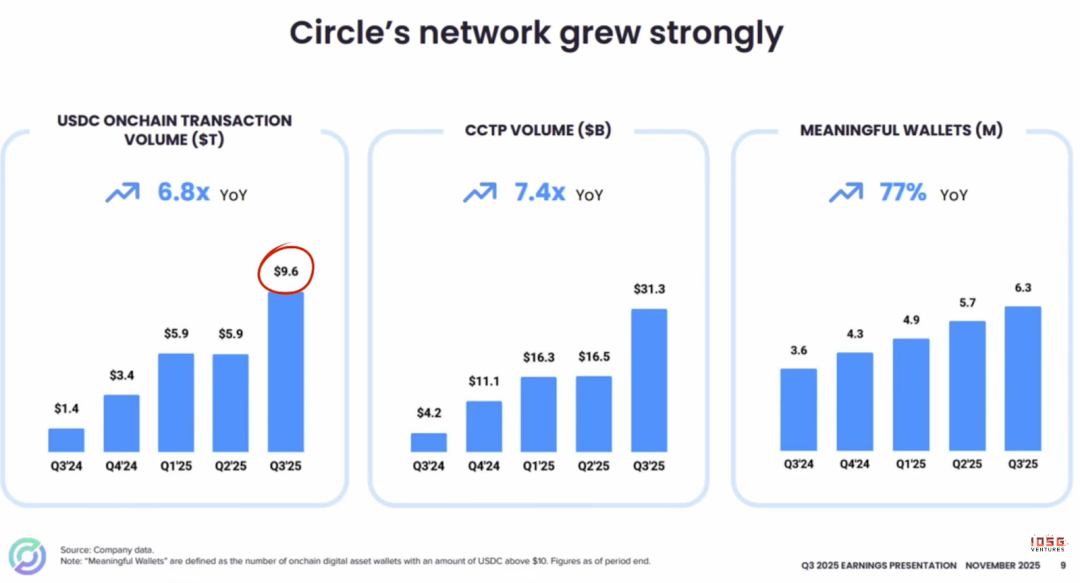

USDC’s on-chain activity is exploding: on-chain transaction volume surged to $9.6 trillion—6.8× last year’s level.

This growth stems from the success of its Cross-Chain Transfer Protocol (CCTP). CCTP enables seamless, unified USDC transfers across blockchains by burning tokens on the source chain and minting native USDC on the destination chain—eliminating the complexity and risks inherent in traditional cross-chain bridges.

Across all metrics—on-chain transaction volume, CCTP usage, and growth in active wallets (balances > $10)—the conclusion is unequivocal: USDC’s adoption and network velocity are expanding continuously and significantly.

▲ Source: Visa

On ecosystem partnerships, Visa announced on December 16 its rollout of USDC settlement services on its U.S. network, enabling U.S. financial institutions—including Cross River Bank and Lead Bank (the first adopters)—to settle with Visa via Solana blockchain using USDC.

- Those familiar with the stablecoin B2B payment landscape know Cross River Bank and Lead Bank rank among the most crypto-friendly U.S. licensed banks. For example, they serve as sponsor banks for firms like Baanx and Bridge, allowing non-bank fintechs to “borrow” their banking licenses to issue physical cards—or even white-label card programs. For B2B stablecoin payment providers, this also enables access to traditional payment networks—including Visa/Mastercard Principal Membership—and channels like VisaNet, MastercardNet, ACH, FedWire, and RTP for fiat clearing and settlement.

▲ Source: IOSG Ventures

The significance lies in enhancing settlement without altering consumer card-swipe experience: Visa partners can convert all settlement transactions on their Visa cards to USDC—enabling 7-day-a-week settlement instead of the traditional 5-business-day window, thereby accelerating fund flow and liquidity. Historically, although Visa authorizes transactions 24/7 across 150 million merchant locations globally, settlement remains constrained by bank operating hours, wire cutoff times, and holidays. A Friday authorization may not settle until Tuesday if Monday is a bank holiday.

For Visa, stablecoins and blockchain represent not a threat but a strategic entry point. Visa’s logic is simple: aggressively promote stablecoin-linked Visa cards. Because regardless of payment method, consumers ultimately convert stablecoins to fiat—and that “fiat landing” step must first clear through VisaNet before interbank fiat settlement. Currently, the vast majority of crypto card transaction volume clears in fiat (Method #1 in the next chart), defaulting to 24/5 settlement because it requires no merchant integration. Crypto-to-fiat conversion happens pre-settlement, so by the time the transaction reaches the network, it is indistinguishable from any other card payment—i.e., from the merchant’s clearing perspective, it’s all fiat. The advantage resides solely on the user side: ability to spend crypto and onboard funds without SWIFT.

▲ Source: Artermis

Even as Visa pilots USDC settlement for 24/7 clearing, this poses no threat—it aligns with Visa’s strategic interests. Stablecoin integration doesn’t alter its underlying business logic. All stablecoin card transactions still route through VisaNet and incur “toll fees.” Visa’s core revenue model rests on three pillars: interchange fees charged to issuing banks, acquirer service fees charged to acquiring banks, and network clearing fees collected via VisaNet. Thus, Visa has no need to issue its own stablecoin. Its strategy is clear: continually onboard more stablecoin issuers (e.g., Bridge, Rain, Reap), support more stablecoin types (e.g., USDC, EURC, USDG, PYUSD), and integrate more blockchain networks (Ethereum, Solana, Stellar, Avalanche). The sole objective: channel more transaction volume through its network. Visa’s moat lies in controlling the merchant-side channel entrance. Regardless of how on-chain transactions occur, the “last-mile” fiat clearing remains tethered to VisaNet—the “single bridge”—ensuring Visa retains toll-collection power. As of November 30, Visa’s stablecoin settlement pilot achieved a milestone monthly transaction volume of $3.5 billion annualized—a 460% YoY increase.

Traditional process:

Swipe → VisaNet authorization → VisaNet clearing → Interbank settlement (T+1–T+3 via banking systems)

Stablecoin settlement process:

Swipe → VisaNet authorization → VisaNet clearing → USDC settlement (real-time, on-chain)

↑

Only this step changes!

But if Visa opts out:

User → Stablecoin wallet → Merchant receives USDC directly → Visa bypassed ✗

For Circle, this partnership reinforces its institutional credibility as the top-tier compliant stablecoin and opens a vital channel from crypto-native users to traditional financial institutions. However, given the extremely high liquidity and short dwell time of such settlement funds, its near-term contribution to Circle’s interest income is negligible. Per blogger Didier’s estimate, the resulting “working inventory balance” amounts to only ~0.09% of current USDC total supply.

Thus, the partnership’s short-term value lies in “laying pipelines”; its long-term potential hinges on whether transaction volume flowing through those pipes grows significantly—generating meaningful deposit-based revenue for Circle. Simply put, Circle is actively “making friends” to expand USDC’s utility. On the trading-asset front, USDC has integrated with Kraken, Fireblocks, and Hyperliquid—platforms serving retail, institutional, and on-chain users. Simultaneously, Circle is accelerating partnerships with banking infrastructure and retail digital-dollar initiatives. Collectively, these moves strengthen Circle’s network effects and broaden its application scope—laying a solid foundation for future revenue-model transformation.

▲ Source: Circle Q3 Earnings

III. Strategic Transformation in 2026: From “Minting” to “Ecosystem”

▲ Source: Circle’s 2025 Year in Review

Earlier, when analyzing earnings, we noted Circle’s urgent priority: scaling “other income”—and briefly mentioned CCTP. Circle’s 2026 strategic roadmap reveals its breakout plan.

Among these, I believe the two most promising near-term “other income” categories are:

- Transaction Service Fees: Including minting/redemption fees and large-transfer fees. To gauge this revenue’s potential, consider the macro backdrop: USDC’s network processed a staggering $4.6 trillion in transaction volume this year. Circle Mint provides large-scale USDC minting/redemption services to exchanges and institutions, charging 0.1%–0.3% fees. This business generated $3.2 million in Q3 2025. Its proprietary CCTP cross-chain and technical services—supporting seamless USDC transfers across 23 blockchains—charge 0.05% of cross-chain volume, contributing $2.8 million in Q3 2025.

- RWA Tokenization Services: Via its acquisition of Hashnote, Circle launched the tokenized Treasury fund USYC, charging a 0.25% annual management fee. Its assets under management (AUM) have reached $1.54 billion. When acquired in January last year, >97% of USYC tokens were purchased and held by Usual Protocol as reserve assets for its USD0 stablecoin. Post-acquisition, Circle is distributing USYC across more exchanges and channels to amplify its role as a compliant yield-bearing asset. One of the most notable recent developments is Deribit’s integration of USYC. As a leading crypto derivatives exchange, Deribit now accepts USYC as full-margin collateral for futures and options trading. This integration delivers multiple advantages:

- Collateral generates yield while securing trading positions

- Lower opportunity cost versus non-yielding stablecoins

- Collateral appreciation may reduce overall trading costs

- Maintains liquidity—can be withdrawn anytime

For active traders, this means your “idle” trading capital—even when posted as margin—continues generating yield: a feat impossible under traditional margin models.

Looking further ahead, the two most promising long-term “other income” categories for Circle are:

First, Circle’s proprietary ARC public blockchain: The ARC public testnet is live, with over 100 global enterprises—including prominent institutions—already participating in testing. Management expects mainnet launch in 2026. Developers across the ecosystem can seamlessly integrate with this infrastructure, which will also deeply interoperate with Circle’s suite of platforms. Additionally, management is exploring the possibility of launching an ARC-native token.

▲ Source: Circle Q3 Earnings

Its core significance is:

- Vertical Integration: Payment medium (USDC) + Channel (Coinbase, Visa) + Settlement layer (ARC public blockchain)

- Value Capture Reclamation: Previously, USDC ran atop Ethereum and Solana—gas fees, MEV, and ecosystem value accrued to those chains. ARC allows Circle to reclaim that value.

▲ Source: Circle

Second, CPN (Circle Payments Network): A B2B payment network for institutions, delivering cross-border payments and settlements powered by USDC.

If ARC is the underlying operating system, CPN is the top-layer application. Three products are already live: CPN Console, CPN Marketplace, and CPN Payouts.

What does CPN aim to disrupt?

- Traditional cross-border payment chain: SWIFT + correspondent banks + local clearing systems (e.g., U.S. ACH)

- Stablecoin settlement eliminates all intermediate layers—CPN maintains participants’ ledgers internally

- Airwallex, though bypassing SWIFT and correspondent banks (via pre-funded pools in each country), still relies on local clearing systems and requires bank accounts

- CPN’s ultimate vision: No bank accounts required

Though CPN has accumulated ~500 potential customers, management explicitly states its current priority is not monetization—but attracting high-quality users and scaling the network. Once network effects mature, CPN can charge fees far below traditional models—this is Circle’s second growth curve.

Conclusion: Circle’s Moat and Long-Term Value

Circle demonstrates significant competitive advantages in the stablecoin space. Its core value derives not merely from USDC itself, but from the broader payments and settlement ecosystem it has built. The stablecoin market may evolve toward a “winner-takes-most” structure—and Circle has already established leadership via three moats:

- Network Effects: USDC boasts the broadest reach and best interoperability, creating a powerful ecosystem flywheel. Users or merchants opting out of USDC forfeit substantial opportunity costs.

- Liquidity Network: USDC possesses the most robust and extensive integrated liquidity network—providing strong support for trading and settlement.

- Regulatory Infrastructure: Circle holds 55 regulatory licenses—the most compliant stablecoin issuer today—building a formidable compliance moat. In the U.S., legislation like the GENIUS Act and clear regulatory frameworks grant Circle exceptional compliance certainty—a distinct advantage many crypto firms lack.

▲ Notebook LLM Generated

With the stablecoin market projected to reach $2 trillion in total issuance by 2030, Circle is well-positioned—leveraging its core moats and execution excellence—to sustain dominance in the digital dollar ecosystem. Despite challenges including low-rate environments, revenue-model concentration, and high revenue-sharing costs, Circle is transitioning from a pure interest-spread model to a USDC-centric network-services and infrastructure model. Its high-compliance path may raise short-term operating costs, but it solidifies long-term regulatory advantages—enabling Circle to capture value from global traditional finance and institutional markets.

This logic mirrors China’s mobile payments landscape: WeChat Pay and Alipay dominate virtually all daily payment scenarios. A merchant failing to integrate either loses massive customer reach and suffers severe revenue impact. This explains why new entrants—like Douyin Pay—struggle to scale rapidly: even with strong product features, lacking user bases and merchant networks prevents achieving critical mass and activating the ecosystem flywheel.

Similarly, USDC has established analogous “first-mover advantage” in the digital dollar payments and settlement ecosystem. Its network effects and interoperability make it extremely difficult for new entrants to displace its entrenched position. For merchants and institutions, integrating USDC is not just convenient—it’s a prerequisite for market access.

Beyond these advantages, Circle’s business model offers exceptionally high marginal efficiency and scalable revenue.

Interest income from stablecoin reserves scales rapidly with issuance growth, while operating-cost growth lags significantly—delivering high marginal profitability.

Moreover, Circle’s leadership has repeatedly demonstrated crisis resilience—earning broad recognition. During the 2023 SVB-induced USDC de-peg crisis, Circle proved its crisis-management and execution prowess. When Silicon Valley Bank (SVB) collapsed, part of Circle’s USDC reserves were held there, triggering market fears about USDC’s 1:1 dollar backing—and causing a brief de-peg (below $1). Circle’s key actions then included:

- Rapid factual disclosure: Clearly stating exposed SVB exposure—no ambiguity

- Continuous updates: Regularly syncing market progress—no communication blackouts

- Explicit commitment: Emphasizing Circle would fully backstop USDC’s 1:1 redemption, even at loss

Through decisive, transparent communication, Circle stabilized market confidence. It has also recruited experienced leaders: its newest President is former CFTC Chairman Heath Tarbert, who previously served as U.S. Treasury Assistant Secretary.

From a short-term perspective, Circle still faces structural and market-level pressures. First, as global monetary policy enters a rate-cutting cycle, falling rates will directly compress Circle’s reserve-interest-driven revenue—heightening its sensitivity to macro interest-rate shifts in the near term. Concurrently, its revenue model remains relatively concentrated—highly dependent on USDC scale and interest rates—with insufficient diversified non-interest revenue buffers. Second, to sustain USDC’s circulation scale and network effects, Circle pays high revenue-share costs to exchanges, payment platforms, and other distribution channels—potentially further eroding margins during slowdowns.

At the market level, Circle’s stock price has trended downward recently, trading below its 50-day moving average at ~$80/share—reflecting cautious short-term sentiment and technical pressure. The primary catalyst was the December 2, 2025 lock-up expiration—180 days post-IPO. This expiration was massive, effectively approaching full float: pre-expiration, only ~17.2% of shares were publicly traded. Post-expiration, nearly all shares became eligible for trading—increasing the free float by ~400%. Selling pressure stemmed mainly from early investors and management, whose typical cost basis sits well below $10/share. Insiders can sell continuously via 10b5-1 trading plans. For example, Director Patrick Sean Neville sold 35,000 shares at $90/share on December 12, 2025.

Beyond this, Circle’s biggest short-term risk is that many investors may short Circle during rate declines—as a hedge against falling rates. Yet Circle’s latent growth potential lies in its diversified ecosystem: Circle is not just a USDC issuer—it’s building a comprehensive fintech ecosystem spanning payments, trading, and Web3 services—enhancing revenue diversification and user retention.

Overall, Circle’s long-term value is clear—but short-term volatility must be tolerated. Technical and macro uncertainty may persist. Valuation-wise, Circle’s current share price appears somewhat undervalued relative to intrinsic value. Wall Street’s DCF models place its intrinsic value at $142/share—above the current market price—indicating a fundamental safety margin. Notably, Circle’s stable cash flows, clear regulatory standing, and relatively controlled risk exposures yield a WACC of just 4.02%—closer to low-risk, highly predictable utilities than volatile tech or crypto firms—reflecting capital markets’ view of its core cash flows as stable and defensive assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News