What if Upbit and Bithumb launch their own public blockchain?

TechFlow Selected TechFlow Selected

What if Upbit and Bithumb launch their own public blockchain?

Cryptocurrency exchanges are officially beginning to join the competition in blockchain infrastructure.

Author: Tiger Research

Translation: AididiaoJP, Foresight News

-

Major global exchanges are launching their own public blockchains to explore new revenue streams, and Upbit and Bithumb could also potentially join this race.

-

There are four possible scenarios: a Layer2 based on OP Stack, infrastructure for Korean won stablecoins, leveraging the liquidity characteristics of the Korean market, and tokenization of pre-IPO stocks. Each could serve as a differentiated strategy reflecting Korea’s unique market environment.

-

Of course, regulatory constraints and technical complexity remain significant hurdles. Implementation in the short term is not easy. However, with declining trading volumes and intensifying global competition, it is clear that these two exchanges must seek new growth drivers.

The Dawn of Exchange-Led Blockchain Competition

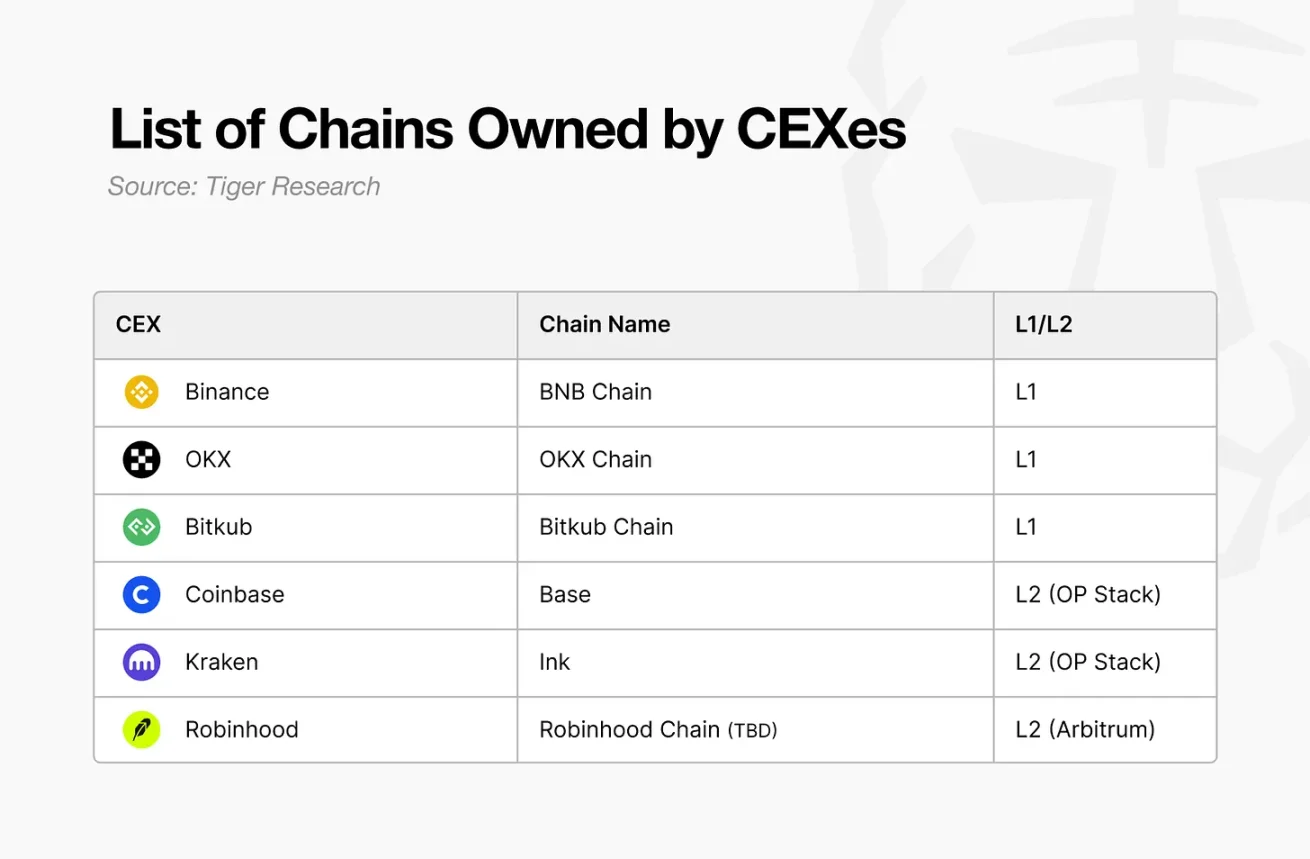

Cryptocurrency exchanges are officially entering the blockchain infrastructure race. With Coinbase's Base, Kraken's Ink, and most recently Robinhood joining, the competitive landscape is becoming increasingly intense.

Behind this fierce competition lies the inherent limitation of the traditional fee-based business model. While exchange fees are among the most stable and proven revenue sources in the crypto industry, their structural dependence on market conditions necessitates diversification. Moreover, while exchanges previously competed within limited jurisdictions, the battleground has now expanded globally. Additionally, decentralized exchanges (DEXs), which once captured over 25% of the market share, are challenging the dominance of centralized exchanges.

At the same time, as the cryptocurrency industry integrates faster into traditional finance, opportunities for exchanges to go beyond simple trading intermediaries and leverage blockchain infrastructure for derivative businesses are rapidly emerging. Ultimately, these changes mean that exchange-led blockchain competition will only accelerate in the future.

What If Upbit and Bithumb Launched Their Own Blockchain?

As global exchanges rush to launch their own chains, a natural question arises: “Could Korean exchanges like Upbit and Bithumb do the same?” To assess this possibility, it’s essential to examine their current situation and past initiatives.

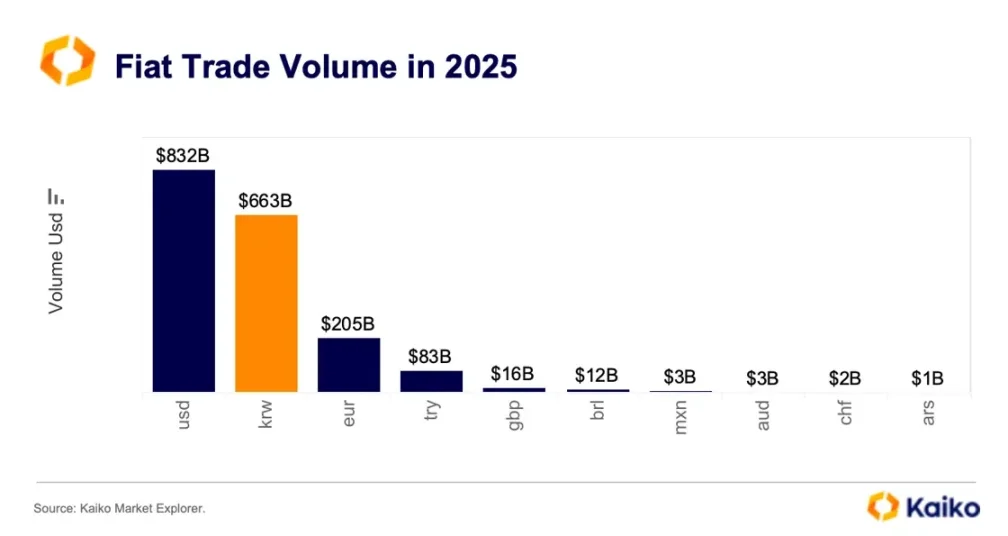

South Korea holds a unique position in the global cryptocurrency market. In fiat-denominated trading volume, the Korean won (KRW) ranks second globally after the U.S. dollar (USD), and at times even surpasses it. It is extremely rare for a single country’s user base to generate such massive trading volume. Thanks to this market environment, Upbit and Bithumb have grown into enterprises with total assets exceeding 5 trillion KRW.

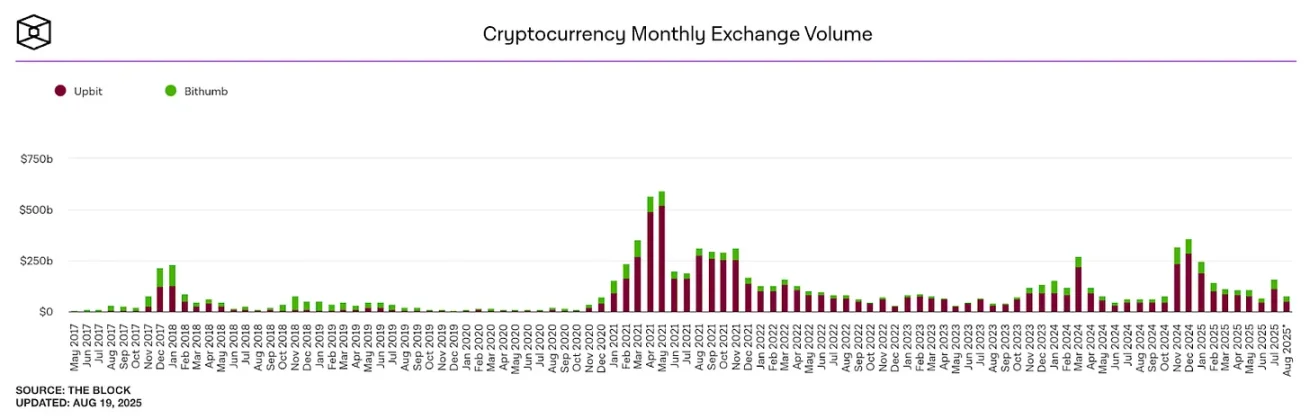

Source: The Block

However, this seemingly solid structure is changing. Since hitting record highs in trading volume in 2021, both exchanges have seen a downward trend. This is due to domestic users migrating to global platforms like Binance and Bybit, or to decentralized exchanges (DEXs). The era in which domestic exchanges can rely solely on Korea’s unique liquidity environment is coming to an end.

The exchanges themselves have sensed this shift. Both Upbit and Bithumb have attempted to expand globally by establishing overseas subsidiaries and diversifying operations. Yet, abroad, the brand of being a "Korean exchange" alone struggles to deliver differentiated competitiveness. Although they’ve launched various platform-based services, most fall far from their core strengths and haven’t yielded significant results. Regulatory crackdowns may have further constrained their ability to diversify.

But now, winds of change are blowing. The pro-crypto policies under a potential second Trump administration are improving the global regulatory climate, enabling exchanges to more actively pursue new growth strategies. In this context, launching their own blockchain is a fully viable option for Upbit and Bithumb.

If they were to launch a chain, different outcomes could be expected—because they could directly leverage their inherent advantages: a large user base and abundant liquidity. Especially when combined with unique characteristics of the Korean market, they could create truly differentiated value.

Scenario 1: Building a Layer2 Based on OP Stack

If these exchanges were to build their own chain, a Layer2 solution would be more likely than a Layer1.

The primary reason is development complexity and resource requirements. Developing and operating a Layer1 demands massive resources. Even for Layer2 rollups, which have lowered entry barriers, substantial expertise is required—evidenced by Kraken’s Ink project, which reportedly involved around 40 developers. From an exchange’s perspective, independently building and maintaining such infrastructure would be a heavy burden. Their goal is platform expansion based on infrastructure, not necessarily building high-performance infrastructure itself.

Regulatory risk is another factor. Layer1 requires issuing a native token, which is practically impossible under Korea’s current regulations and could invite regulatory sanctions. Therefore, a Layer2 model—like Coinbase’s Base—that operates without a native token becomes the most realistic alternative.

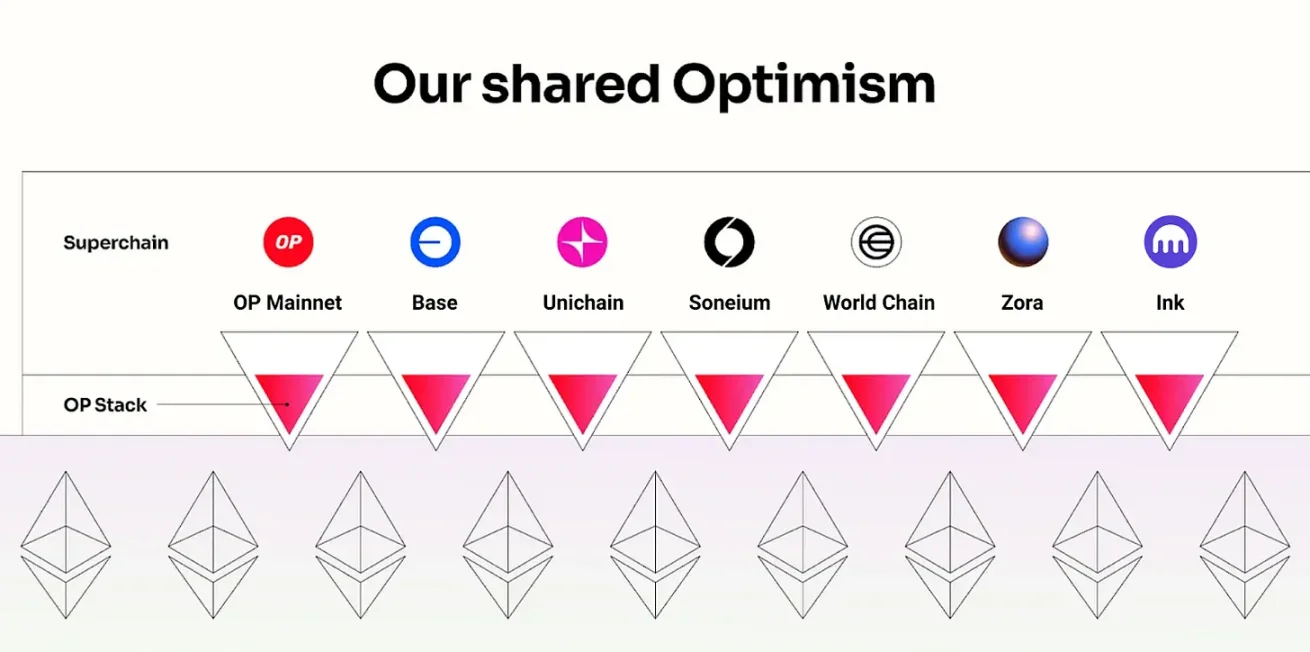

Source: Optimism, Tiger Research

While multiple stacks exist for Layer2 development, the Optimism (OP) Stack has become nearly standard among global exchanges. Both Coinbase’s Base and Kraken’s Ink are built on it, establishing it as a reference model for exchange-led chains. Robinhood is an exception, choosing Arbitrum due to differing strategic goals—Coinbase and Kraken prioritize interoperability and broad ecosystem growth, whereas Robinhood focuses on bringing its financial services on-chain, making Arbitrum’s greater customization flexibility more suitable.

Upbit and Bithumb share goals similar to Coinbase. Both need to overcome the limitations of their fee-centric models and leverage their large user bases to expand into on-chain services and create new revenue streams. For this, openness and interoperability are key. Therefore, if Upbit and Bithumb launch their own chains, the most likely choice would be a public Layer2 based on the OP Stack.

Scenario 2: Korean Won Stablecoin Infrastructure

Another scenario for Upbit and Bithumb launching their own chain is building dedicated infrastructure centered around a Korean won stablecoin.

Upbit's KRW stablecoin trademark, Source: KIPRIS

In fact, both exchanges have shown active interest in the stablecoin market. Upbit and Bithumb have filed trademarks related to stablecoins. Notably, Upbit has partnered with Naver Pay—the leading mobile payment service in Korea—to officially announce plans to launch a Korean won stablecoin. The most plausible scenario centers on Naver Pay issuing the KRW-pegged stablecoin, while Upbit provides the underlying blockchain infrastructure. This structure is necessary because the Virtual Asset User Protection Act prohibits exchanges from listing virtual assets issued by themselves or affiliated parties.

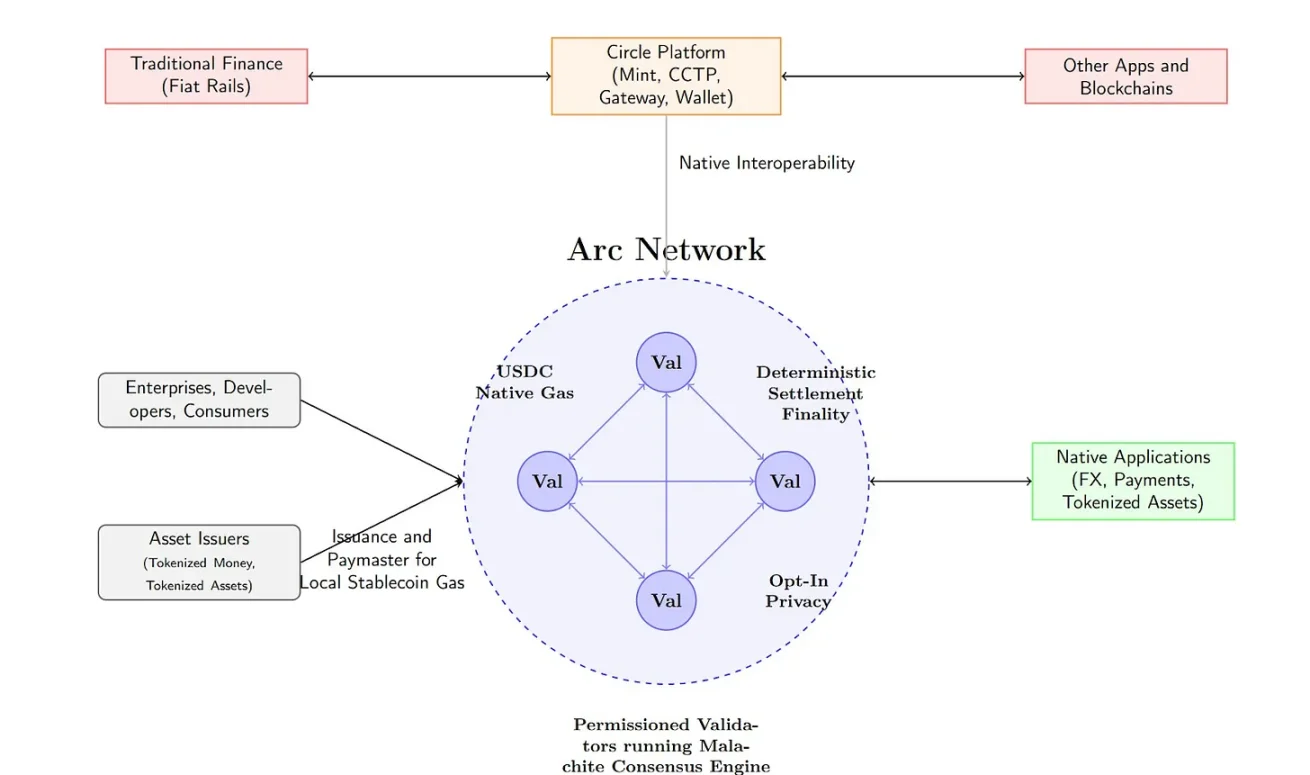

Source: Circle

In this case, the focus would be on building infrastructure optimized specifically for stablecoins. Features like everyday payments or privacy enhancements could differentiate the service, and the network could be designed so that gas fees are paid in the Korean won stablecoin—similar to USDC’s Arc Network. The goal would be to create an ecosystem where all transactions revolve around the stablecoin, offering users predictable costs while generating real demand and sustained usage for the KRW stablecoin.

However, there are technical limitations. Optimism defaults to using Ethereum for gas and does not support custom gas tokens. Therefore, in this scenario, a Layer2 based on the more customizable Arbitrum, or even a Layer1 with the KRW stablecoin as its native token, might be more appropriate.

Scenario 3: Leveraging Korea’s Liquidity Characteristics

One strategy Upbit and Bithumb could pursue is leveraging Korea’s unique liquidity profile. Currently, Korea boasts massive liquidity—second globally in fiat terms—but this liquidity remains confined within exchange systems.

Source: LlamaRisk

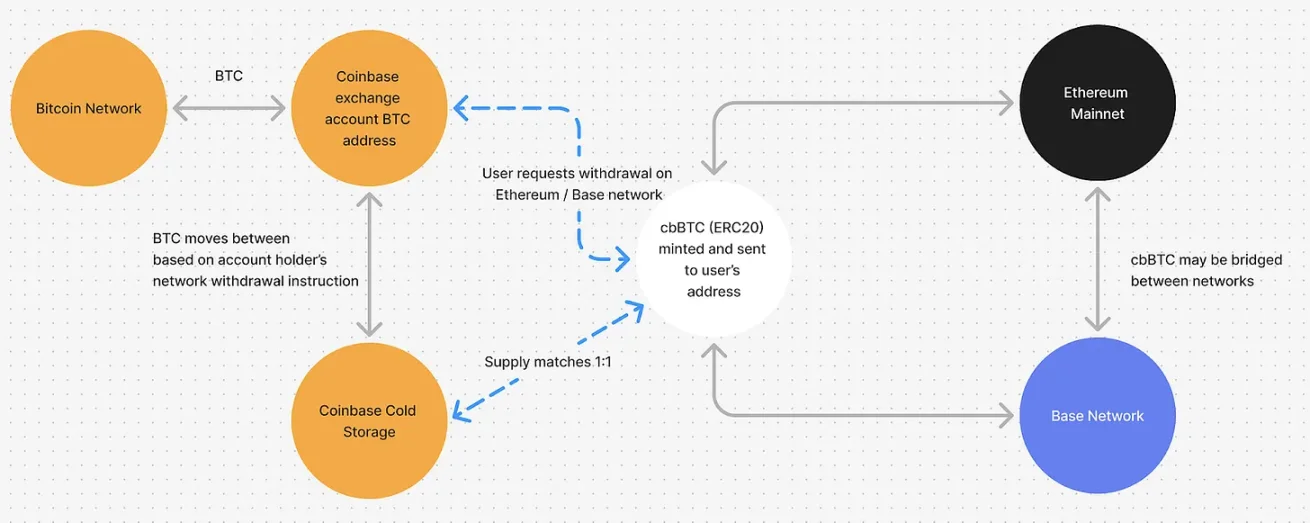

Exchanges could issue wrapped tokens like upBTC or bbBTC backed by custodied assets. Coinbase’s cbBTC is a prime example. While such wrapped tokens can be used across chains, if the exchange offers seamless in-app integration—such as one-click bridging—users are more likely to stay within the exchange’s ecosystem rather than move assets externally. In this case, projects seeking access to rich liquidity would have strong incentives to build on the chain, thereby activating the ecosystem and enabling the exchange to earn infrastructure-based revenues. Furthermore, the exchange could experiment with additional business models like lending using these wrapped tokens.

Scenario 4: Entering the Pre-IPO Stock Tokenization Market

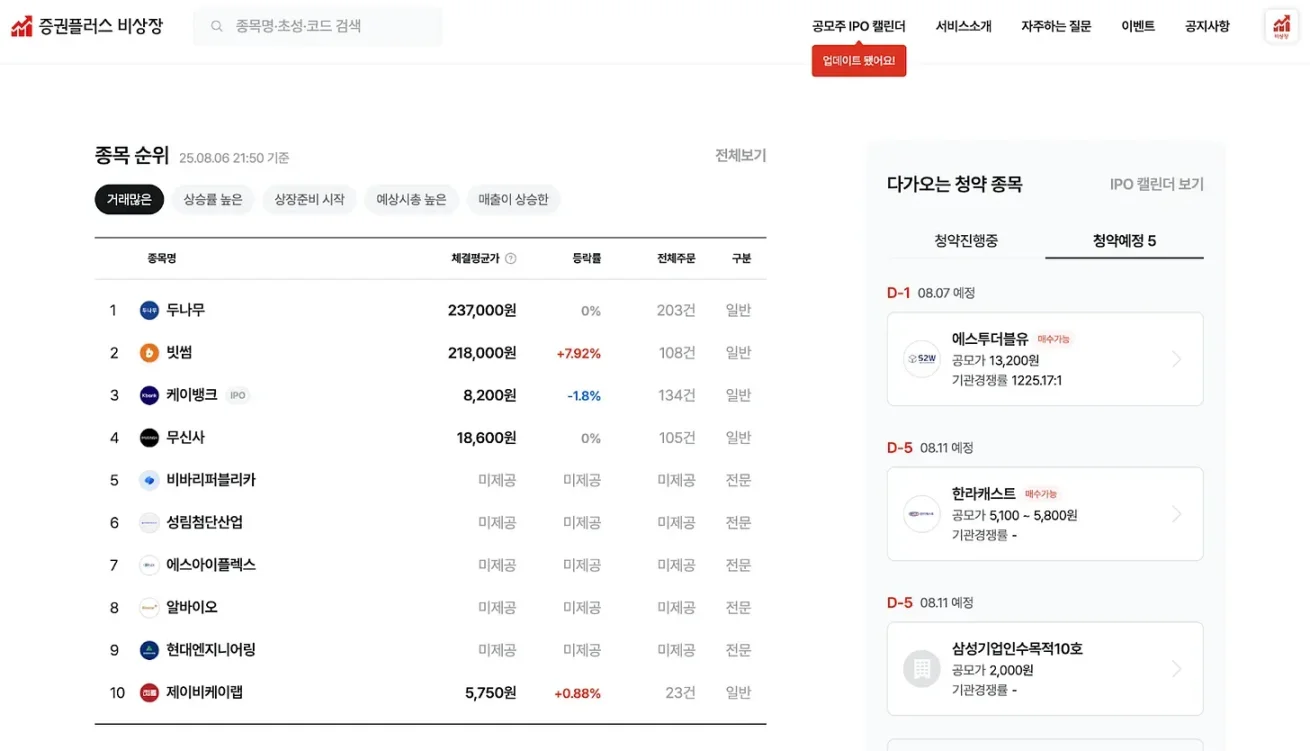

Another strategic path for Upbit and Bithumb is entering the pre-IPO stock tokenization market. Dunamu, operator of Upbit, already runs a pre-IPO stock trading platform via Securities Plus, gaining relevant experience. However, this platform remains limited to a P2P model that connects buyers and sellers, suffering from low transaction success rates and limited liquidity.

Source: Ustockplus

Tokenizing pre-IPO stocks on a dedicated blockchain would change this dynamic. Tokenized shares could be traded in real time via liquidity pools or market makers, with ownership transfers handled automatically and transparently through smart contracts. Beyond improved trading efficiency, on-chain systems could enable features like automatic dividend distribution, conditional trades, and programmable shareholder rights—unlocking financial products impossible under traditional securities frameworks.

It’s also notable that Naver is currently pursuing the acquisition of Dunamu’s Securities Plus pre-IPO business. A feasible model could involve Upbit providing the blockchain infrastructure while Naver handles platform operations and physical share management. This separation of roles—infrastructure versus asset custody—could reduce regulatory risks and offer a practical pathway to enter the tokenization market while overcoming the limitations of the current service.

Conclusion

We’ve explored various scenarios for Upbit and Bithumb launching their own blockchains. However, reality presents numerous challenges. The biggest obstacle is regulation. South Korea adopts a strict regulatory approach, making it difficult to introduce services not explicitly permitted by law. Both exchanges are designated as large conglomerates, increasing regulatory scrutiny. Additionally, the lack of Web3-native leaders like Jesse Pollak of Base is seen as a limiting factor. Technical complexity and the low likelihood of launching a self-operated blockchain in the short term further complicate matters.

Nevertheless, there remains considerable room for experimentation. Domestic trading volume has been declining since peaking in 2021, and global competition is intensifying. The existing fee-based model faces clear growth limits, and past attempts at revenue diversification have yielded little success. Sustained growth requires new drivers, and bold moves like building a proprietary blockchain may represent just such a path. It could be the most realistic diversification strategy—one that fully leverages each exchange’s core strengths in user base and liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News