South Korea's largest exchange Upbit to be acquired by Naver, signaling the crypto market's entry into a "chaebol era"?

TechFlow Selected TechFlow Selected

South Korea's largest exchange Upbit to be acquired by Naver, signaling the crypto market's entry into a "chaebol era"?

Led by conglomerates, rapid advancement, and practicality above all—South Korea has its own model for developing the cryptocurrency industry.

Author: TechFlow

Korea Blockchain Week (KBW) is underway in Seoul, drawing the attention of the global crypto industry to South Korea.

At this very moment, according to a report by Korean media Dong-A Ilbo on Thursday report, South Korea's internet giant Naver plans to conduct a stock swap with Dunamu, the parent company of Upbit, which would make Dunamu its subsidiary.

This means South Korea’s largest internet company will control the country’s largest cryptocurrency exchange.

Currently, the South Korean crypto market is indeed experiencing an unprecedented period of activity.

The combined user accounts across South Korea’s top five exchanges have surpassed 9.6 million, approximately 18.7% of the population. Upbit alone holds over 80% of the market share, with daily trading volumes frequently exceeding $10 billion. The Korean won has become the second-largest fiat currency globally for crypto trading, after the U.S. dollar.

Earlier this month at the Upbit Developer Conference, Dunamu launched GIWA Chain and GIWA Wallet—its own Web3-based blockchain built using OP Rollup technology—showcasing Upbit’s technical ambitions.

(Further reading: Upbit Enters the Public Chain Race: How Big Is Giwa’s On-chain Ambition?)

This proposed stock swap deal did not come out of nowhere.

In July, both parties announced cooperation on developing a Korean won stablecoin; in September, Naver acquired a 70% stake in Dunamu’s securities trading platform. In hindsight, these were all precursors to a full acquisition.

Dunamu is currently valued at approximately 8.26 trillion KRW ($6 billion). If completed, this would be the largest merger or acquisition in South Korea’s crypto history.

Who is Naver? Korea’s Version of Google + Tencent

Naver is South Korea’s largest internet company, with a market capitalization of about $50 billion.

In Korea, Naver occupies a position equivalent to Google plus Tencent. It dominates 70% of the search engine market while building a vast internet ecosystem through its suite of products.

Most Chinese users may not recognize the name Naver, but they certainly know LINE. LINE is a subsidiary of Naver, with over 200 million users in Japan and Southeast Asia, making it one of Asia’s largest instant messaging platforms.

Naver’s business footprint extends far beyond that.

Naver Financial is its fintech subsidiary, and Naver Pay under it is Korea’s largest mobile payment platform, serving 30 million users—nearly half of Korea’s population. From online shopping to offline payments, from money transfers to wealth management, Naver Pay has deeply integrated into Koreans’ daily lives.

Like other global tech giants, Naver acquires users through its core platform (search engine), then continuously expands services to form an ecosystem that users find hard to leave.

In finance, Naver has been accelerating its moves. It established Naver Financial in 2019, launched digital banking services in 2020, obtained a securities brokerage license in 2024, and in September this year, Naver Pay acquired a 70% stake in Securities Plus Unlisted—a subsidiary of Dunamu—for 68.6 billion KRW.

Now acquiring Upbit completes the final piece of Naver’s financial puzzle. Once finalized, Naver will possess:

-

Payment tools (Naver Pay)

-

Securities trading (Securities Plus)

-

Crypto trading (Upbit)

-

An upcoming Korean won stablecoin

This vertical integration allows Naver to offer users end-to-end financial services from fiat to crypto. More importantly, leveraging LINE’s 200 million overseas users, this system could expand beyond Korea to cover the entire Asian market.

Korean Style: When Chaebols Meet Web3

Naver’s acquisition of Upbit is no isolated case. It represents the latest move among major Korean corporations entering the crypto space.

Kakao began earlier. In 2019, it launched the Klaytn public chain and promoted the Klip wallet through KakaoTalk’s 50 million users. The KLAY token currently ranks within the global top 50 by market cap. In September this year, Klaytn announced a merger with Finschia chain formerly developed by LINE, forming the new Kaia chain.

Samsung took a hardware-first approach. Starting with the Galaxy S10 in 2019, Samsung phones have included built-in crypto wallets. Samsung SDS also provides blockchain solutions for enterprise clients. While Samsung does not directly operate an exchange, its infrastructure-level moves are clearly visible.

Traditional financial institutions are also accelerating their entry. In August this year, eight banks including KB Financial and Shinhan Financial announced a joint project to develop a Korean won stablecoin—exactly one month after Naver and Dunamu revealed their stablecoin collaboration.

This corporate-dominated landscape is no surprise in Korea.

The Korean economy has long been dominated by large conglomerates, with the top ten chaebols accounting for a major portion of the country’s GDP. When new industries emerge, these large firms typically enter quickly and establish dominance.

Dunamu was founded in 2012 and launched Upbit in 2017. In such a market environment, it’s not easy for an independent company to reach a valuation of 8.26 trillion KRW. Choosing to join the Naver ecosystem now may be a strategic decision amid intensifying competition.

From past developments, Korean conglomerates entering crypto share several characteristics:

First, massive and rapid resource allocation. Kakao went from deciding to build a blockchain to launching the Klaytn mainnet in about a year. Naver moved from announcing a stablecoin partnership in July to preparing a full acquisition of Dunamu in just over two months.

Second, high alignment with government policy. This year, the Korean government paused its central bank digital currency project and shifted support toward privately developed stablecoins—a policy shift coinciding precisely with accelerated corporate moves into crypto.

Third, building independent ecosystems. Naver has its own payment system, Kakao its own blockchain, and bank consortia aim to launch their own stablecoins. Each group builds relatively closed systems, resulting in high switching costs between different ecosystems.

This model leads to ever-increasing market concentration.

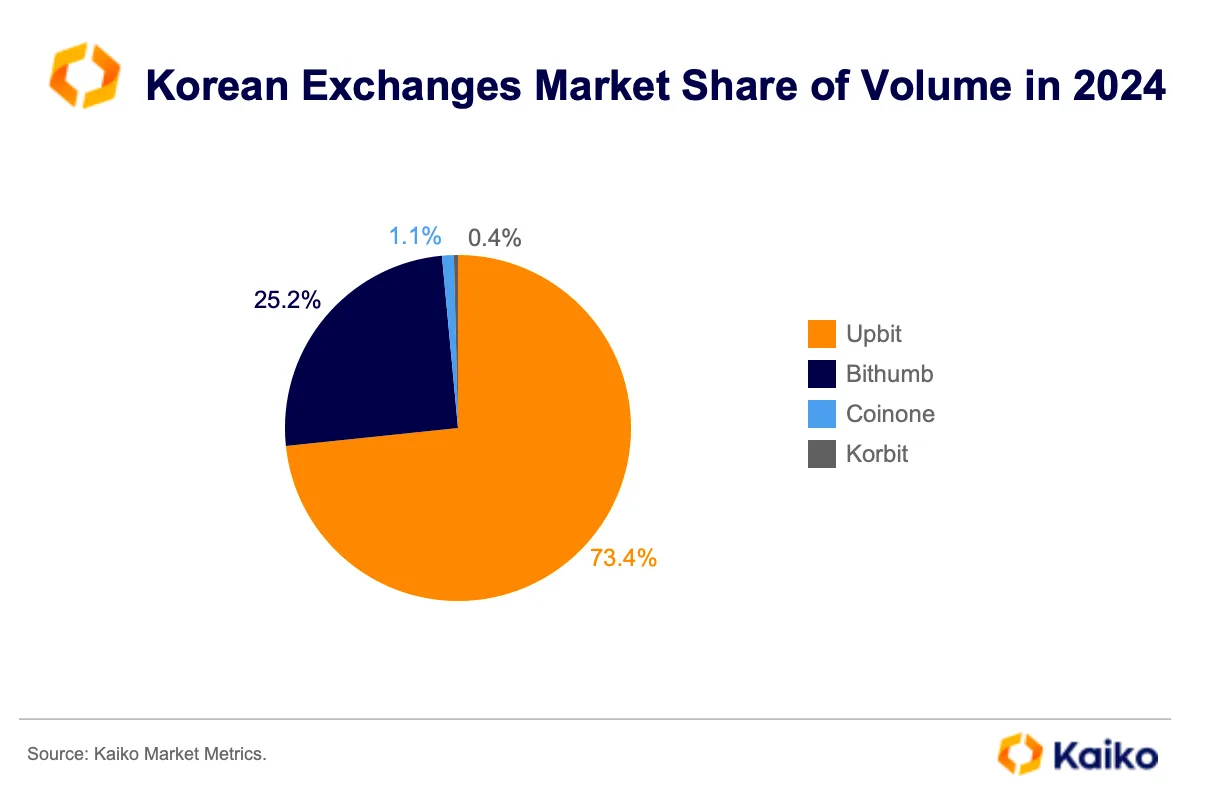

Public data shows Upbit once accounted for around 73% of trading volume in Korea, Bithumb about 25%, with the rest split among Coinone, Korbit, and others. With Upbit’s acquisition by Naver, market concentration may rise further.

Chaebol-led, fast-moving, and practicality-focused—South Korea has its own model for crypto industry development.

You might think this seems less decentralized, but Koreans don’t seem to mind. Nearly 20% of South Koreans participate in crypto trading, and they care more about convenience and security.

The “New Chaebol Era” in the Global Crypto Market

It’s not just Korea. Looking globally, the current crypto market is undergoing a transformation—from grassroots startups to monopolization by giants.

Consider the Middle East. Binance recently received investment from Abu Dhabi’s sovereign wealth fund. While the amount remains undisclosed, market rumors suggest billions of dollars. Dubai’s royal family supports multiple crypto projects, aiming to turn Dubai into the “global crypto capital.” Saudi Arabia’s Public Investment Fund (PIF) is also actively investing in blockchain.

The U.S. has taken a different path: traditional finance gradually absorbing the crypto market, ultimately turning it into another asset class.

As governments grow friendlier toward crypto, Wall Street institutions are shifting stance. BlackRock launched a Bitcoin ETF, Fidelity offers crypto custody, Goldman Sachs has begun crypto trading...

Coinbase remains relatively independent, yet its institutional business占比 keeps rising, while retail investors are increasingly sidelined.

Japan’s situation is more nuanced. Rakuten acquired a crypto exchange back in 2018, and SBI Holdings operates one of Japan’s largest crypto platforms. But unlike the aggressive moves of Korean chaebols, Japanese corporate crypto strategies are more conservative—more like defensive investments.

Beneath these differing models lies varying regional interpretations of cryptocurrency, yet the outcomes appear similar: independent crypto firms face shrinking room to survive, while institutional ownership of attractive crypto assets continues to grow.

For example, major CEXs and crypto infrastructure companies (like stablecoin issuers), considering compliance and attracting more users, either gradually accept large investments from traditional capital or aim for listing on public markets.

BTC and ETH have become sought-after assets in corporate crypto treasury strategies.

Perhaps a more accurate description is that the crypto market is stratifying.

The upper layer is institution-dominated, compliant, and centralized—home to ETFs, custody services, and licensed exchanges. The lower layer is community-driven, experimental, and decentralized—hosting Perp DEXs and Meme coins.

The mainstream market is controlled by big capital, serving retail and institutional users alike; the fringe market remains decentralized, continuing technological innovation and experimentation.

Whether this trend is good or bad may not have a simple answer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News