South Korea's shared power banks can now mine on the blockchain

TechFlow Selected TechFlow Selected

South Korea's shared power banks can now mine on the blockchain

South Korea's DePIN project Piggycell recently launched its TGE and went live on Binance Alpha.

By: Nicky, Foresight News

On October 28, the South Korean portable charger project Piggycell officially launched its TGE, with its token PIGGY listed on Binance Alpha and OKX perpetual contract markets. Trading data shows that PIGGY surged from an opening price of $1.178 on the 28th to a high of $2.724 on the 29th, representing a gain of over 130%, and is currently stabilizing around $2.

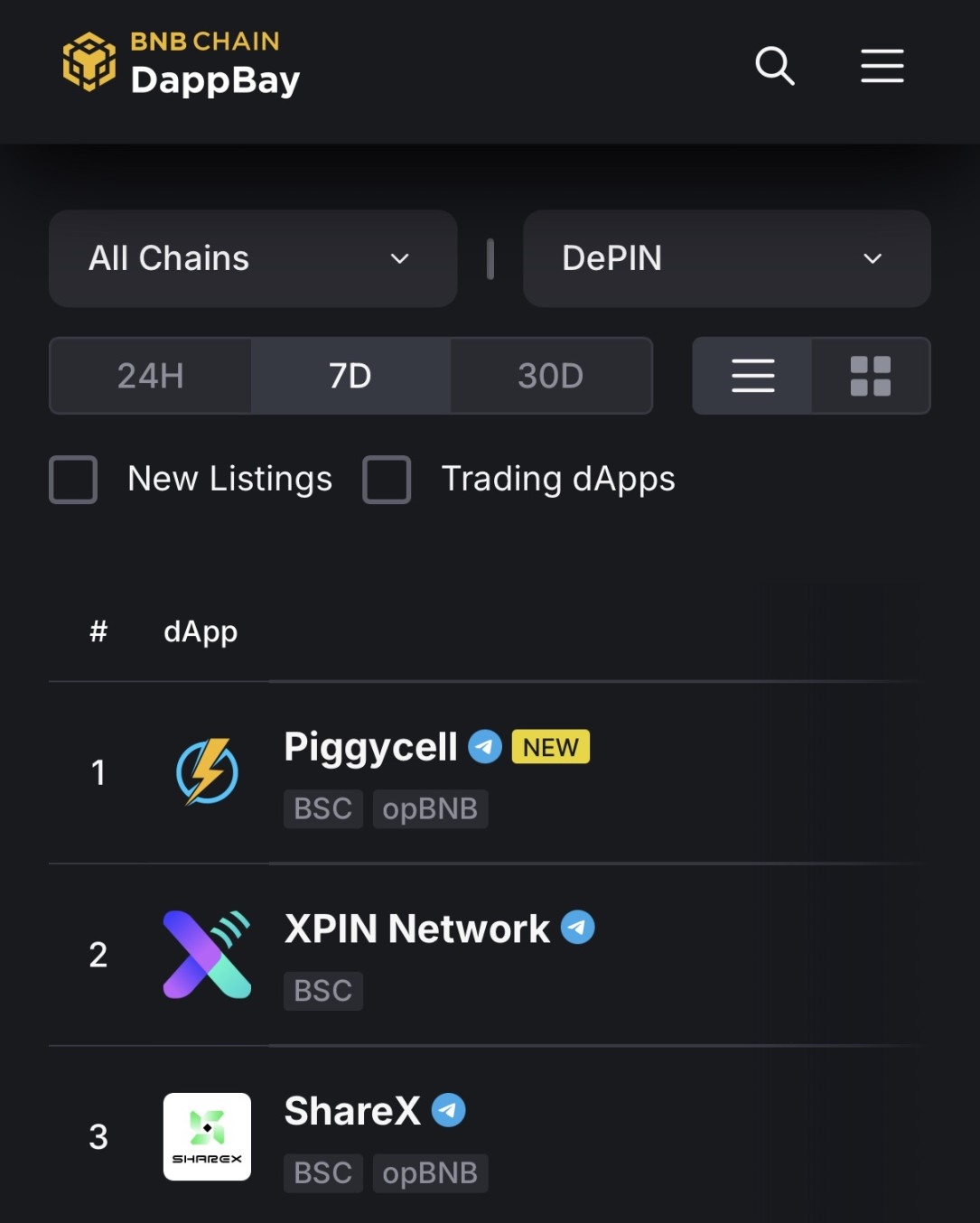

The project currently ranks first in the seven-day popularity list in the DePIN category of BNB Chain DappBay.

Project Positioning

Piggycell is a shared power bank service provider with over 95% market share in South Korea, having deployed more than 14,000 charging stations nationwide, operating over 100,000 charging devices, and serving 4 million paying users. The project combines physical charging infrastructure with token economics through blockchain technology, positioning itself as a fusion of real-world assets (RWA) and decentralized physical infrastructure networks (DePIN).

Its core logic is "on-chain real usage data": by recording on-chain high-frequency data such as user charging behavior and device operational status, charging services are transformed into quantifiable digital assets. This model addresses information asymmetry in traditional sharing economies—users can see how their usage translates into earnings, while investors can track the actual operation of underlying assets.

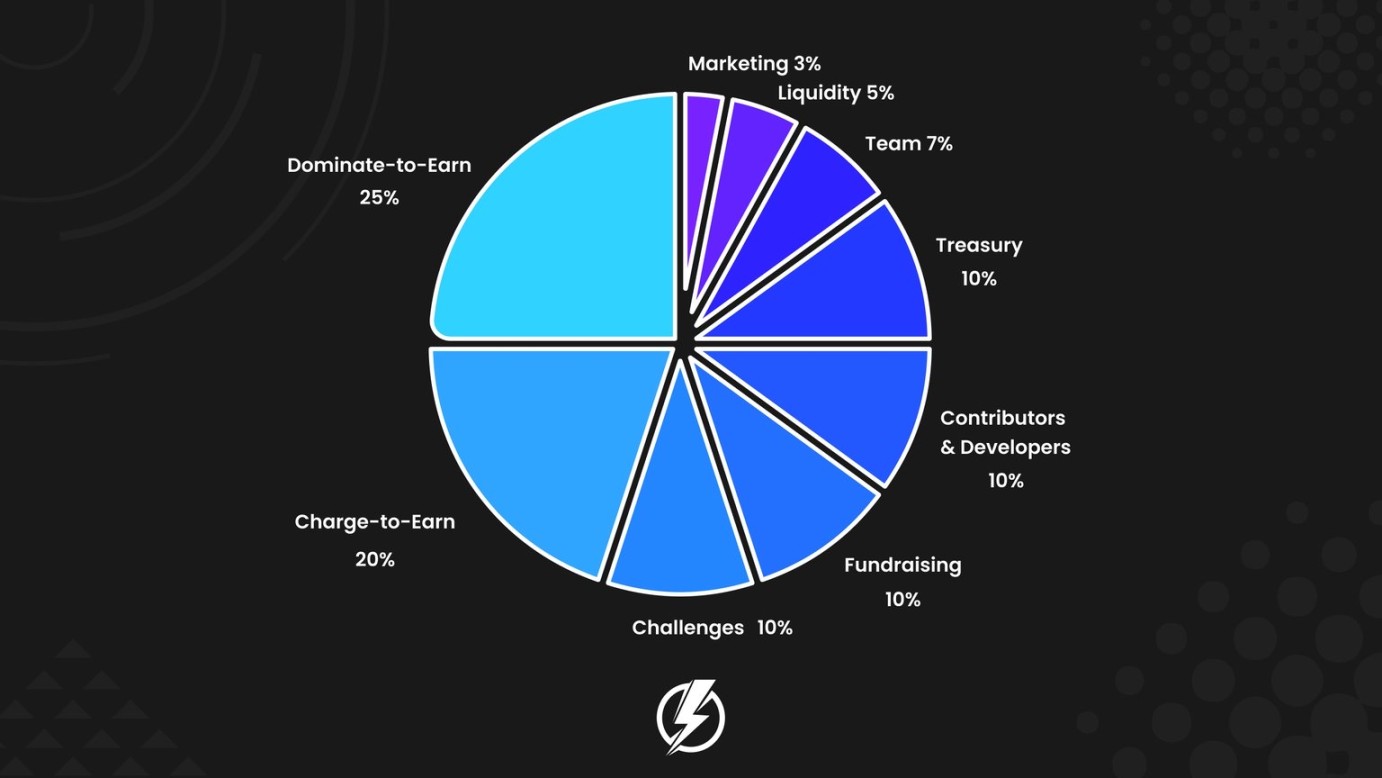

The project's core models include "Charge-to-Earn" and "Dominate-to-Earn." The former rewards users with tokens when they rent power banks, while the latter allows holders of geographic equipment NFTs to share infrastructure revenue.

Specifically, "Charge-to-Earn" enables users to earn PIGGY token rewards by borrowing and charging power banks based on duration, turning everyday consumption into asset accumulation. "Dominate-to-Earn" allows users to purchase NFTs tied to physical devices, becoming "shareholders" of regional infrastructure and earning a proportional share of revenues generated by the devices.

Funding Background and Team Information

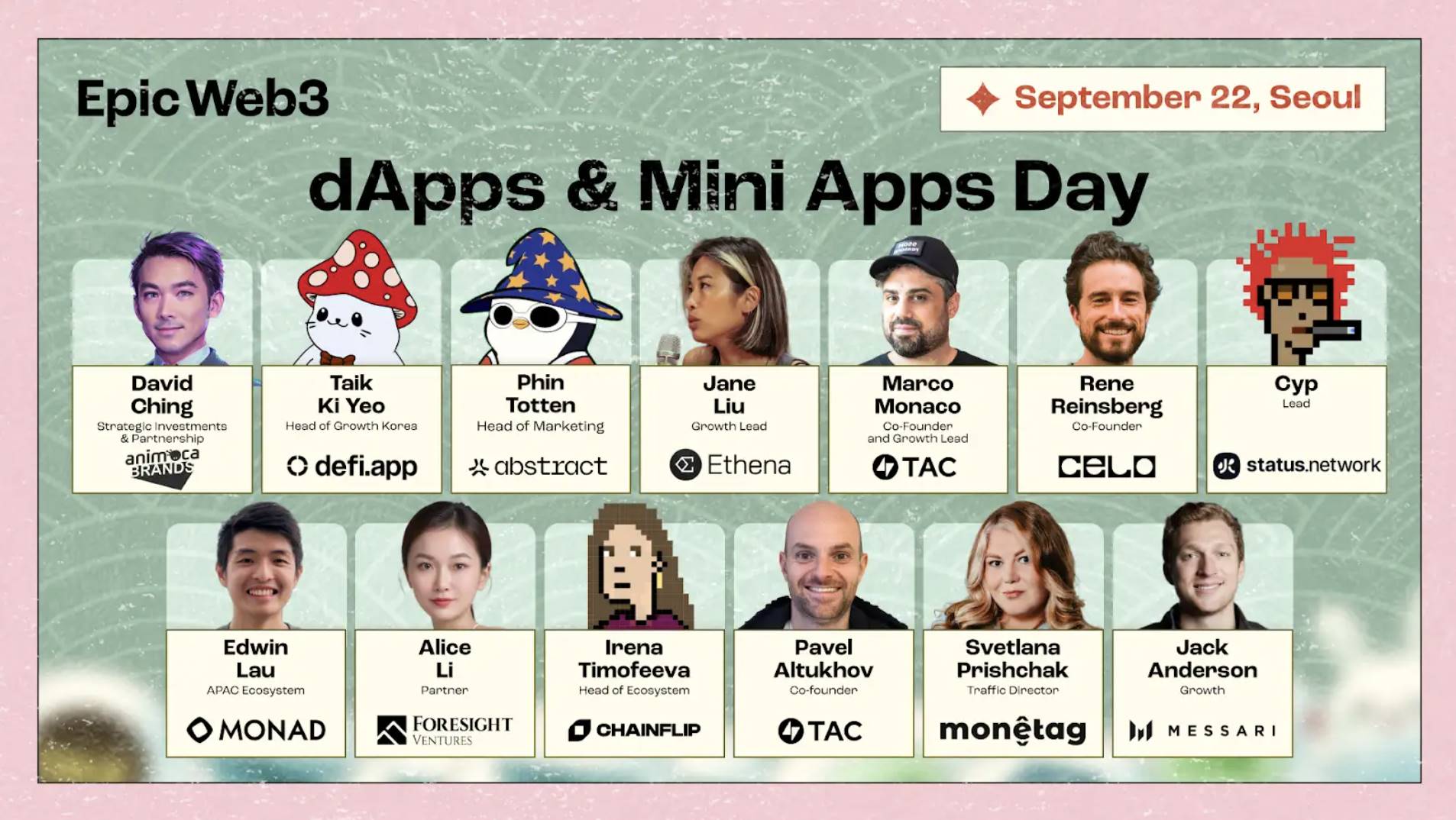

In February 2025, Piggycell announced the completion of a $10 million seed round. Investors include institutions such as Animoca Brands and ICP HUBS, as well as South Korean traditional financial institutions including Shinhan Financial Group and Hana Financial Group. DWF Labs also participated as a public partner.

Piggycell’s core team is led by co-founder John Lee, who has extensive experience in Web2 infrastructure and previously operated Chungjeondwaeji, a successful portable charging network in South Korea. Under his leadership, the company successfully transitioned from a traditional Web2 business to a Web3 platform.

Token Economics

The project adopts a dual-chain architecture, with 80% of tokens deployed on BNB Chain and 20% on the ICP network.

PIGGY has a total supply of 100 million tokens, allocated across institutional, team, and community incentives: 10% for institutions, 7% for the team, 10% for the treasury, 25% for user holdings, 20% for charging activity rewards, 10% for mission challenges, 10% for partners, 5% for liquidity, and 3% for marketing. The current circulating supply is approximately 7.2458 million.

Despite strong market performance, community feedback indicates that Piggycell's airdrop and Galxe rewards have not yet been distributed, drawing attention from some users.

User Experience and Future Plans

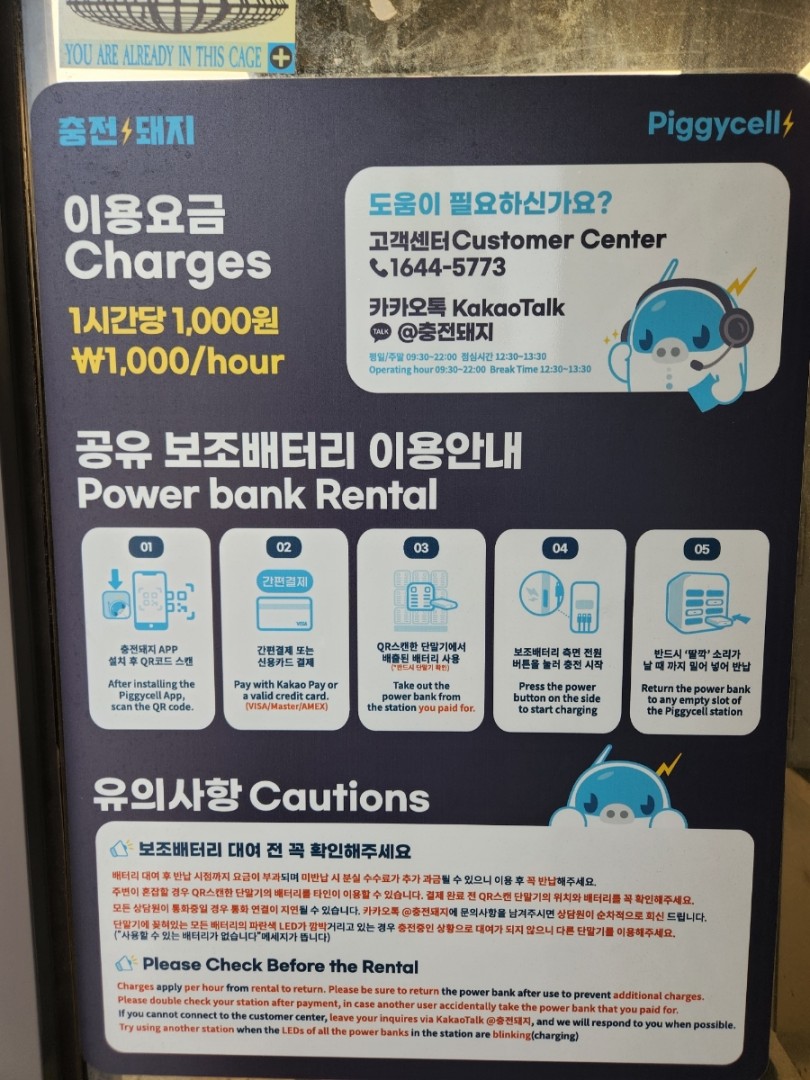

Different from the complex operations of most Web3 applications, Piggycell maintains Web2-level convenience: users can borrow power banks by scanning a QR code, supported by local payment tools like Kakao Pay, with no restrictions on return locations. The charging rate is 1,000 Korean won per hour.

Looking ahead, Piggycell plans to launch an "Energy-as-a-Service" (EaaS) platform, enabling individuals or businesses to register and lease energy devices (such as power banks and wall-mounted chargers), with automated revenue distribution via smart contracts. Additionally, leveraging on-chain data, the platform will explore carbon credit issuance and ESG compliance solutions, further expanding RWA use cases.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News