Here's a scary story: even Koreans aren't speculating on cryptocurrencies much anymore

TechFlow Selected TechFlow Selected

Here's a scary story: even Koreans aren't speculating on cryptocurrencies much anymore

Who will take over the altcoins?

By Liam, TechFlow

If one were to name the world's most enthusiastic cryptocurrency traders, South Koreans would undoubtedly be on the list.

South Korea has long been among the most fervent nations in the global crypto market. So much so that the market even coined a term: "Kimchi Premium," where Bitcoin was once trading 10% higher for South Korean buyers than the global average.

But by 2025, the tide has turned.

Trading volume on Upbit, South Korea’s largest crypto exchange, has plummeted 80% compared to the same period last year. The activity of Bitcoin/KRW pairs is far below previous years. In contrast, the South Korean stock market is booming—KOSPI has surged over 70% this year, continuously hitting record highs.

On KakaoTalk and Naver forums, retail investors who once obsessively discussed altcoins are now talking about “AI semiconductor concept stocks.”

The ghost stories around crypto have arrived, and even South Koreans aren’t trading coins much anymore.

Trading Volume Halved: South Koreans Are Done with Crypto

In recent years, South Korea has been a battleground for the global crypto market.

For exchanges and project teams, it offered high-net-worth, quality users. To put it bluntly, South Koreans were often the primary buyers of altcoins.

Media and films have frequently portrayed stories of South Koreans staying up all night trading crypto—getting rich overnight, only to blow up their accounts shortly after.

So when someone tells you that retail investors in this “nation of crypto traders” have largely stopped trading, it might sound absurd.

But data doesn’t lie.

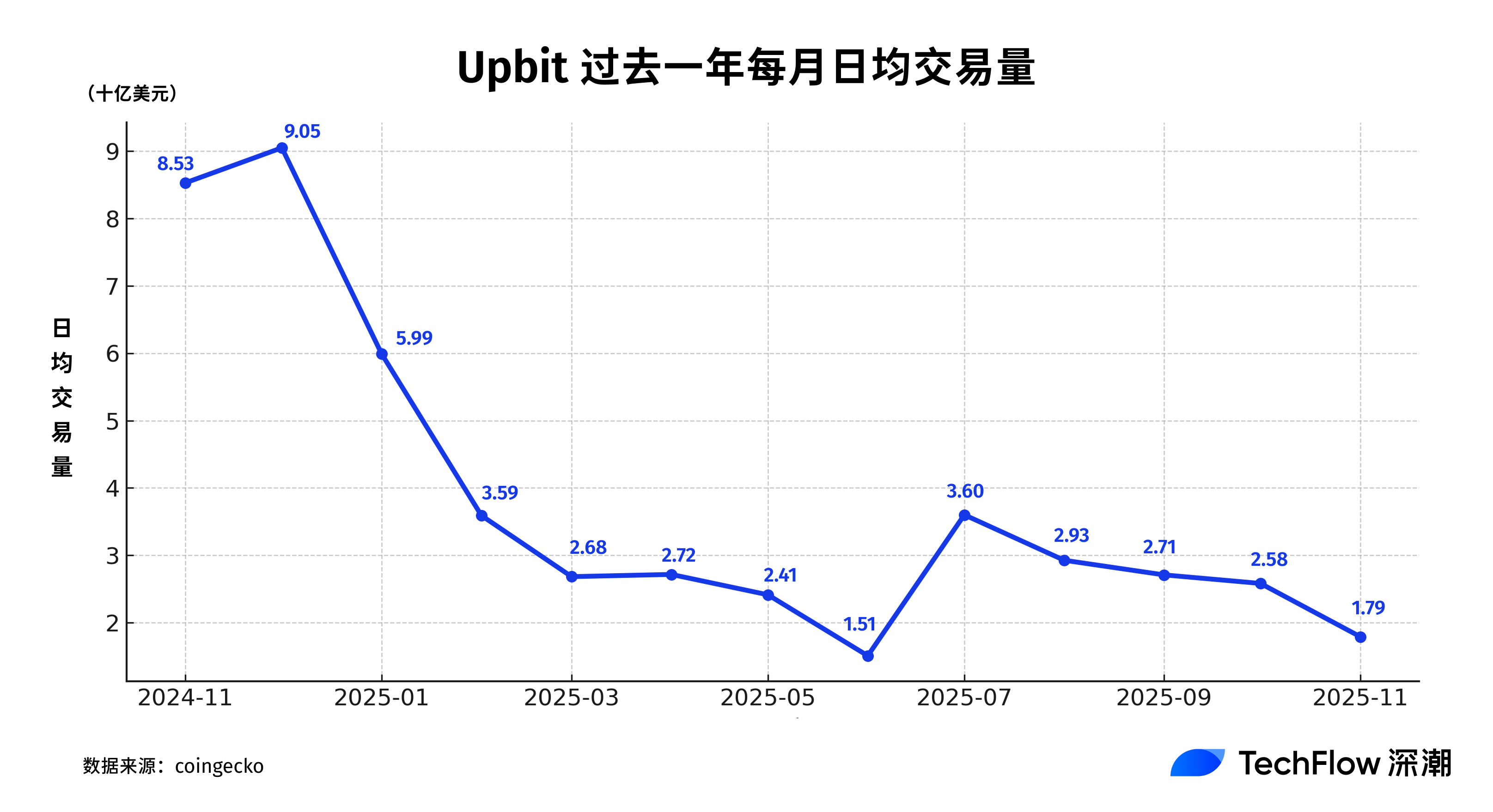

Trading volume on Upbit, South Korea’s largest exchange, has collapsed.

In November 2025, Upbit’s daily average trading volume stood at just $1.78 billion, down 80% from $9 billion in December 2024, and has declined for four consecutive months.

Upbit’s historical peak occurred on December 3, 2024, the night of South Korea’s martial law announcement, when daily volume soared to $27.45 billion—ten times its usual level.

But that night of frenzy marked the top. The market rapidly cooled afterward, with volume dropping off a cliff.

More notably, volatility in trading volume has also significantly decreased.

During the heated period at the end of 2024, daily volume fluctuated wildly between $5–27 billion. In 2025, however, volume has mostly stabilized within the $2–4 billion range, with greatly reduced swings.

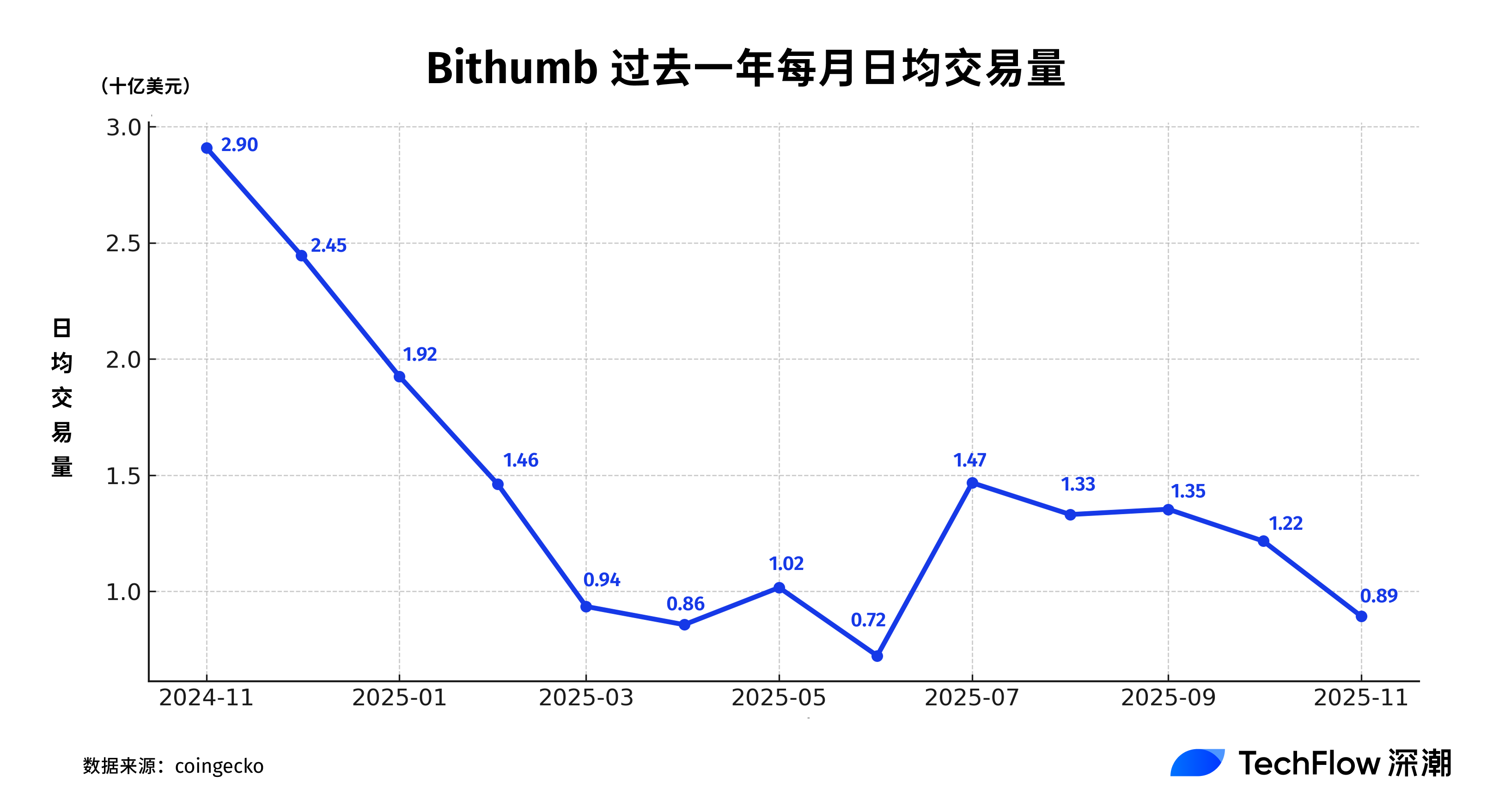

South Korea’s second-largest exchange, Bithumb, shares a similar fate.

At the end of 2024 (December), Bithumb’s daily average volume was approximately $2.45 billion. By November 2025, it had fallen to around $890 million—a drop of about 69%, losing nearly two-thirds of its liquidity.

Both of South Korea’s leading domestic exchanges (Upbit and Bithumb) experiencing simultaneous “volume decline” not only signals cooling trading activity but also reflects a broad retreat in retail investor sentiment.

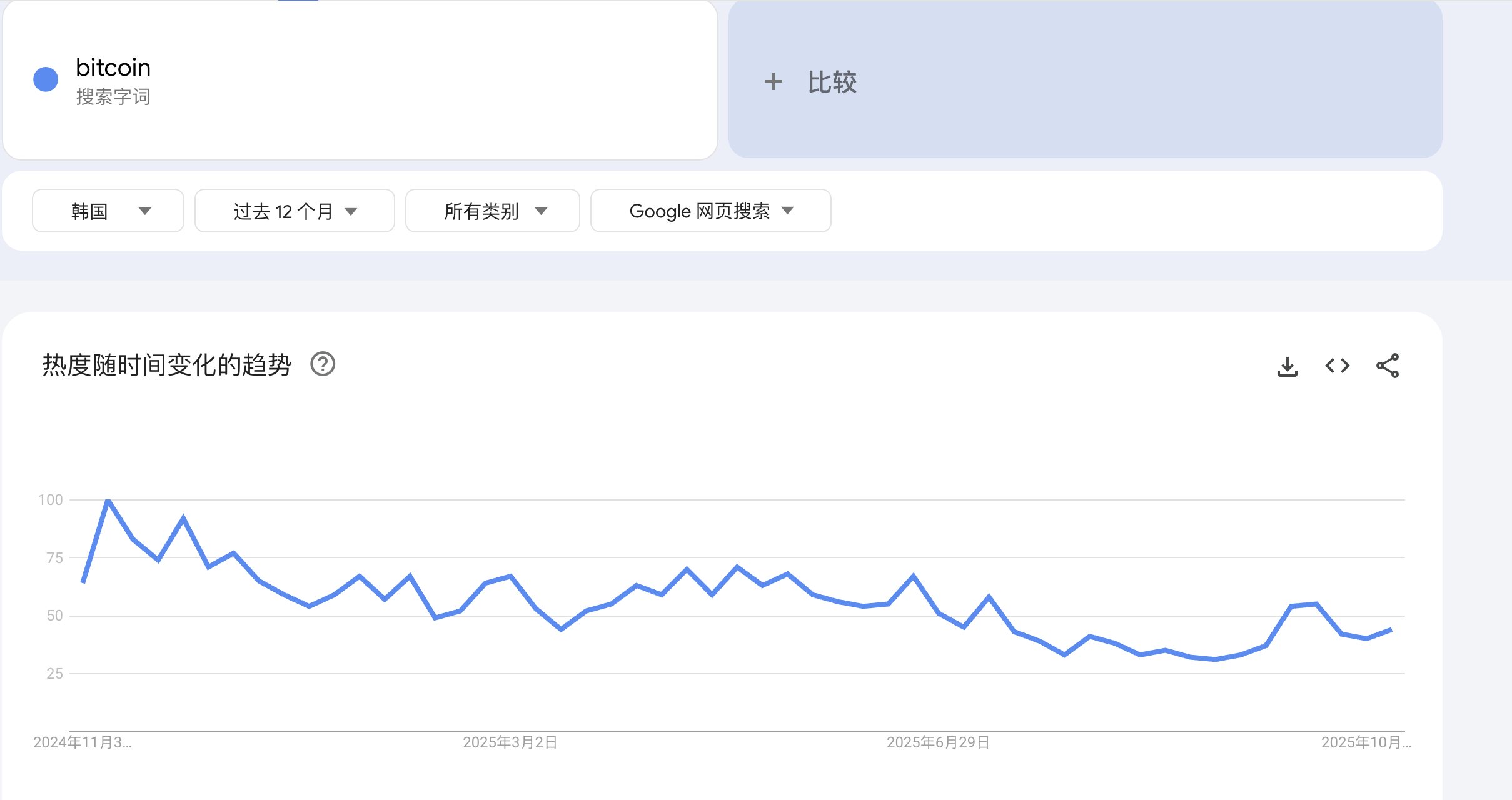

Search trends confirm this: Google search interest for “Bitcoin” in South Korea recently stood at 44, down 66% from its peak of 100 at the end of 2024.

Stock Market Mania

So where has all the money gone? The answer: the stock market.

This year’s South Korean stock market is like a reincarnation of Bitcoin’s 2017 bull run—an epic, frenzied rally.

The benchmark KOSPI index set intraday record highs 17 times in October alone, breaking past the 4,200-point mark. Just in October, it gained nearly 21%, marking the best monthly performance since 2001.

Year-to-date, KOSPI has surged over 72%, outperforming all other major asset classes.

KOSPI’s daily average trading value reached 16.6 trillion won (~$11.5 billion), with a single-day high of 18.9 trillion won—up 44% from September—and brokerage apps briefly crashed due to traffic overload.

And this is just the index. Individual stocks are even more extreme.

Samsung Electronics is up 100% year-to-date; memory giant SK Hynix’s share price rose 70% this quarter and an astonishing 240% year-to-date. Together, the two companies averaged 4.59 trillion won in daily trading volume, accounting for 28% of the entire market.

The market got so hot that the exchange itself stepped in. On Monday evening, the Korea Exchange issued an “Investment Caution” notice for SK Hynix, citing excessively rapid price increases, causing the stock to plunge on Tuesday.

AI as the “National Faith”

Once considered stagnant—with little growth over more than a decade—and frequently dismissed by local media as “a dead-end market,” many South Korean investors previously turned to crypto or U.S. stocks. Why then has the South Korean stock market made such a dramatic turnaround in 2025?

While this rally may appear at first glance to be “retail mania,” the underlying logic is remarkably clear:

Global AI wave + policy support + domestic capital repatriation.

Everyone knows the spark came from AI.

ChatGPT ignited the second wave of the global tech bubble, and South Korea happens to sit at the heart of the supply chain—the “ammunition depot.”

South Korea dominates the global memory chip market. SK Hynix and Samsung Electronics almost monopolize high-bandwidth memory (HBM), the key component for training large AI models.

This means that every time Nvidia or AMD ships more GPUs, Korean firms’ profit curves rise in tandem.

At the end of October, SK Hynix reported Q3 revenue of $17.1 billion and operating profit of $8 billion—up 62% year-on-year, both record highs.

Even more crucially, SK Hynix has already secured customer demand for all its DRAM and NAND capacity through 2026, amid severe supply shortages.

South Koreans began to realize:

AI may be America’s narrative, but the profits are flowing to Korea.

If Nvidia is the soul of U.S. stocks, retail investors in Korea have found their faith in SK Hynix.

Moving from crypto to stocks, they’re still chasing the dream of “10x returns,” but now buying Samsung or SK Hynix also lets them wear the crown of “patriot.”

Also, don’t overlook a critical backdrop: the South Korean government is actively propping up the stock market.

For years, Korean equities suffered from what’s known as the “Korea Discount.”

Chaebol family monopolies, poor corporate governance, low shareholder returns—all led to chronic undervaluation of Korean firms. Even Samsung traded below global peers. After rising 240%, SK Hynix still trades at a PE of just 14.

Since taking office, President Yoon Suk-yeol has launched a reform agenda dubbed the “Korean Shareholder Value Revolution”:

Promoting higher dividends and share buybacks;

Curtailing chaebol cross-shareholdings;

Reducing capital gains taxes and encouraging pension funds and retail investors to increase domestic allocations.

This reform has been described by media as a “national effort to escape the Korea discount.”

As a result, overseas capital is returning, while local institutions and retail investors are rushing back “home to buy stocks.”

Of course, another reality is: there’s nowhere else to put the money.

The property market has cooled under high interest rates, U.S. stocks are expensive, and the crypto market offers little more than passive bag-holding.

Investors needed a new gambling table—and the stock market delivered a legal casino.

Data from the Bank of Korea shows that over 5 million new brokerage accounts were opened by domestic retail investors in the first half of this year, and downloads of brokerage apps surged.

The pace of capital inflow into KOSPI is faster than during the 2021 retail rush into crypto.

Meanwhile, Korean pension and insurance funds are also increasing stakes in domestic tech stocks.

From the state to institutions to individuals, everyone is rushing into the stock market. You could even call it a “national retail bull market.”

Speculation Never Sleeps

Unlike the crypto market, which relies purely on “sentiment” to pump prices, this stock market rally at least has some earnings backing.

But ultimately, we must acknowledge:

This bull market is fundamentally a nationwide “emotional resonance.”

The South Koreans haven’t changed—they’ve just switched tables. And they don’t just gamble; they leverage heavily.

According to Bloomberg, South Korean retail investors are significantly increasing leverage, causing margin loan balances to double over five years, with heavy inflows into high-leverage and inverse ETFs.

Data from Glodon shows that in 2025, leveraged funds accounted for 28.7% of total retail holdings—up 9% from last year. Holdings in 3x leveraged products jumped from 5.1% to 12.8%, and leverage usage among 25–35-year-olds reached 41.2%.

This generation of retail investors comes hardwired with a “go all-in gene.”

Yet, as South Korean retail investors flood into the stock market, a question arises:

“If even South Koreans aren’t trading crypto anymore, who will buy altcoins?”

For years, the South Korean market served as the final buyer for altcoins.

From Dogecoin to PEPE, from LUNA to XRP, Korean retail investors appeared in nearly every speculative boom.

They represented the ultimate “sentiment barometer” for the global crypto market—if Korea was still buying, the bubble hadn’t peaked yet.

Now, with both Upbit and Bithumb seeing sharp volume declines, the crypto market has lost its last believers—and thus, its biggest fuel source.

Altcoins have no one left to buy the dip.

Perhaps we’ll need to wait until the global AI-driven stock rally fades, or until crypto can tell a compelling enough story again.

Only then will the dormant gamblers awaken and return to the blockchain to place their bets once more.

After all, gamblers never disappear—they just move to a different casino.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News