Decoding Data: The Listing Black Box of Korean Exchanges

TechFlow Selected TechFlow Selected

Decoding Data: The Listing Black Box of Korean Exchanges

The pace of listing tokens is driven by both policy and market sentiment.

Jointly published by K1 Research and Klein Labs

Overview of Research Methodology

This report analyzes the listing pathways and market dynamics of Korean exchanges by combining data from January 2024 to July 2025, employing a panel fixed-effects regression model to quantify the impact of factors such as BTC price, KRW-denominated trading volume, and policy windows on listing volumes. Through statistical analysis and return calculations, we uncover patterns across the three major exchanges in terms of listing rhythms, sector preferences, and token price performance—providing quantifiable guidance for projects selecting optimal timing, exchange platforms, and marketing strategies.

Key Highlights

1. South Korea ranks among the world’s most active crypto markets: Since 2025, KRW-denominated cryptocurrency trading volume has consistently ranked second globally, trailing only USD markets, while maintaining long-term leadership in altcoin trading. This reflects high acceptance of new tokens and abundant liquidity. For project teams, it represents a high-potential, innovation-friendly primary market.

2. Listing rhythm driven by both market sentiment and regulation: Panel regression results show a significant positive correlation between monthly average BTC price and listing volume, indicating direct influence of market热度 on listing decisions. Policy windows amplify this effect, demonstrating the combined impact of regulatory signals and investor sentiment. Projects entering Korea should strategically align listing timing with market热度, investor attention, and regulatory developments to maximize visibility and optimize trading liquidity through strategic rollout planning.

3. The “bridge effect” and market diffusion mechanism: Overall, Bithumb and Coinone both serve as “bridges,” where certain tokens list first before moving to UPbit, which has higher trading volume. Coinone stands out particularly, achieving secondary amplification in both price and volume. Projects may prioritize Coinone as an entry point, then gradually expand to larger exchanges, enabling coordinated release of resources and热度. All three exchanges belong to the DAXA alliance, enhancing internal transmission and broader market diffusion upon listings.

4. Exchange selection requires differentiated strategy: Clear differences exist among exchanges in user demographics, listing pace, and market influence; pursuing only the largest platform is suboptimal. Projects should match their token characteristics, community structure, and marketing budget with appropriate exchange types and launch sequences to improve ROI.

5. Localized, multi-channel marketing essential for Korea: Effective market entry into Korea goes beyond mere exchange applications, requiring Naver keyword optimization, local crypto forum engagement, offline events, and KOL collaborations. Projects must synchronize listing schedules with localized marketing to create a closed-loop conversion from awareness to trading volume.

1. Introduction

In the global cryptocurrency landscape, South Korea is rising at an astonishing pace. From January 2025 to date, total KRW-denominated crypto trading volume reached $663 billion, making it the world's second-largest crypto market after the U.S. dollar. More notably, Korea has long led the world in non-Bitcoin (altcoin) trading volume. With 25.4% of its population actively participating in cryptocurrency trading, such high engagement is rare globally. This enthusiasm has also given rise to the unique "kimchi premium" phenomenon.

Meanwhile, the Korean government is actively reshaping its crypto regulatory framework, shifting from past restrictive policies toward encouraging innovation and market development. Recent initiatives like the cryptocurrency ETF roadmap and stablecoin development plans not only inject institutional-level tailwinds but further solidify Korea’s strategic position as a key Asian and global crypto hub.

Against this backdrop, studying the potential of Korea’s cryptocurrency market offers actionable insights for projects on “how to list on Korean exchanges,” while helping investors identify opportunities and risks within this unique ecosystem. This report focuses on the listing paths and performance of Korea’s top five exchanges—UPbit, Bithumb, Coinone, Korbit, and GOPAX—using the latest data from 2024 to 2025 to deliver a granular, in-depth analysis that helps readers fully understand the listing ecology and market logic of Korean exchanges.

2. Pre-Listing Preparation: Marketing Is Not Everything, But Indispensable

Successful listings depend not just on technical strength but also on effective marketing. Especially on Korean exchanges, where listing requirements are strict and slots limited, projects must demonstrate excellence in technology, community, and market recognition. Below, we outline key local marketing strategies from the perspective of exchanges, analyzing how they enhance visibility, gain user trust, and attract capital—offering practical experience for successful listings:

2.1 KOLs and Community Influence

In promoting and listing in Korea, quality local KOLs and community networks are indispensable. Currently, several highly active, professionally run Korean crypto communities have established deep roots in the market.

On Telegram, core OG communities known for professional content and audience size between 20,000–40,000 include:

● MBM Creator Academy (@MBMweb3)

● We Crypto Together (@WeCryptoTogether)

● Cobacknam Announcements (@cobacknamannounce)

● Yobeul’s World (@yobeullyANN)

● Telegram Coin Rooms & Channels - CEN (@emperorcoin)

● Jammin123 (@muijammin123)

● Fire Ant CRYPTO (@fireantcrypto)

● Youth Passion Flavor House Co., Ltd. (@minchoisfuture)

These groups represent early-established core OG communities with historical influence and dedicated, atmosphere-building members, enjoying high popularity in Korea.

Additionally, there are smaller communities with around 10,000 members—slightly less in scale but more precisely targeted and highly engaged, including:

● CRYPTO Sea (@crypt0_sea)

● KOOB Crypto 3.0 (KOOB Crypto) (@kookookoob)

● Coin Boy’s Crypto Story (@coinboys)

● Naback’s coin life (@ysytop2)

● Lee Dojin Metaverse Announcement (@leedojin2)

Given Korea’s population of only 50 million, tens of thousands of followers represent a substantial reach compared to English-speaking or general interest communities. Unlike Western markets where X (formerly Twitter) dominates, only a minority use X in Korea—though some KOLs and users are beginning to migrate—while most prefer KakaoTalk and Telegram. Due to stricter speech controls on KakaoTalk, Telegram sees wider adoption.

These KOL communities play vital roles in information dissemination and market sentiment shaping, providing strong foundations for project launches and visibility boosts in Korea. Numerous other unlisted KOLs also wield considerable influence.

2.2 Media Coverage and Article Promotion

High-impact media coverage aligned with local investor preferences is crucial during promotion and listing in Korea. It rapidly builds credibility and expands market awareness and participation.

CoinNess

CoinNess is Korea’s leading cryptocurrency media platform, specializing in real-time translation and distribution of international news. Its Live Feed service delivers instant market updates. As Korea’s largest institutional-grade crypto investment information provider, CoinNess partners with national news agency Yonhap Infomax to exclusively supply real-time crypto news. (@coinnessgl)

Blockmedia

As Korea’s first blockchain-dedicated media outlet, Blockmedia consistently covers trends in traditional finance and crypto markets, project developments, and regulatory changes. While slightly slower than CoinNess in timeliness, it has earned industry reputation through high-quality content and deep analysis, covering topics ranging from regulations and technology to lifestyle. (@with_blockmedia)

TokenPost

TokenPost is Korea’s largest blockchain and cryptocurrency media platform, frequently serving as official media partner for government blockchain forums, Asia Crypto Summit, and tech workshops. It operates a data platform and research division offering customized intelligence and in-depth analysis for institutions and enterprises, combining authority with professionalism. (@tokenpost)

Bloomingbit

Bloomingbit is the authoritative crypto information arm of Hankyung Media Group—the most influential and trusted comprehensive financial media group in Korea. It provides round-the-clock blockchain and crypto news curated by industry experts, combining broad reach with professional interpretation, and has become one of the key information sources for institutional investors. (@bloomingbit_io)

2.3 Professional Consulting Firms and Research Platforms

Because many investors struggle to fully grasp project structures and key points, crypto project marketing often relies on professional consulting firms and research teams to interpret core value and market potential, offering investors deeper analysis and decision support.

Despread

As a leading crypto data analytics platform, Despread’s in-depth market research and trend reports help projects understand market dynamics, accurately assess competitiveness, and develop more targeted marketing strategies. (@DeSpreadTeam)

Xangle

Leveraging powerful blockchain data analysis capabilities and transparent project review mechanisms, Xangle provides authoritative risk assessments and decision support for investors. It is a key information platform in the crypto industry. (@Xangle_official)

Tiger Research

Through deep research, GTM consulting, and strategic investments, Tiger Research not only identifies industry trends but also helps projects optimize growth paths and market strategies, driving long-term Web3 ecosystem development. (@Tiger_Research_)

K1 Research

With advanced market analysis and data-driven strategic decision-making, K1 Research delivers deep market insights and trend forecasts for crypto projects and investors. By leveraging data analytics, it supports better investment decisions and risk assessment, contributing to sustainable growth of the crypto ecosystem. (@K1_Research)

2.4 Other Methods

1. SEO Optimization: Beyond the above, fine-tuned SEO strategies tailored to the Korean market can significantly boost exposure and listing success rates—especially effective on Naver.

2. Viral Forum Marketing: Combining community-based and viral forum campaigns effectively amplifies discussion热度 and user attention, enabling cross-community penetration. For example, posting culturally relevant meme images on popular local platforms like Coinpan often sparks organic user creation and sharing, sustaining momentum.

3. Offline Events: In-person events are critical components of Korean project marketing. These include community study groups, seminars, and launch events with live token distributions, which build user trust, brand stickiness, and facilitate word-of-mouth promotion.

4. Event Sponsorships: Includes both crypto and non-crypto events. Common examples in crypto are hackathons. In non-crypto, sports sponsorships—such as football, motorsports, and esports—are widespread, raising project awareness among potential users and boosting brand impact.

5. Kaito Marketing: Kaito leverages algorithms and data to offer ranking and metric tools, allowing projects to monitor user engagement and interaction effects in real time, enabling transparent, efficient targeted promotion. Its cost structure is friendly to small and mid-sized projects, helping increase community activity and precise user targeting—though excessive noise risks alienating users.

6. Professional Marketing Solutions: Engage third-party marketing agencies for full-service managed campaigns, including brand positioning, community management, content creation, and ad placements, to boost visibility and user engagement.

3. Overview of Listings on Korean Exchanges

3.1 Market Share

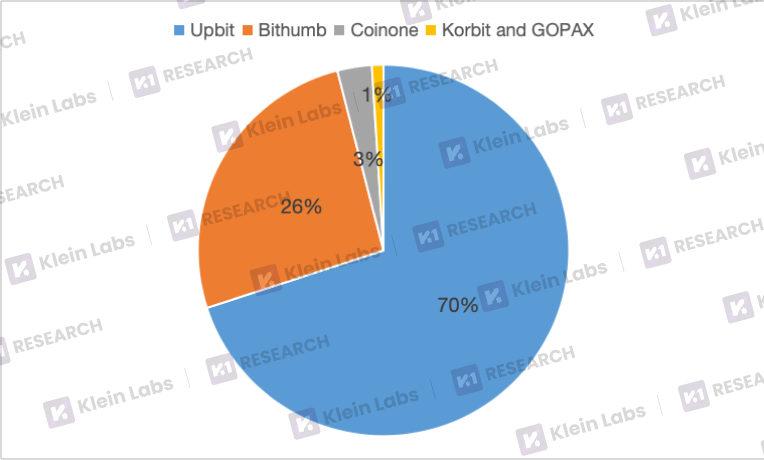

● UPbit: Facing competition from other exchanges offering trading fee waivers, UPbit’s market share declined from a dominant 86% in 2021 to stabilize around 70% by February 2025.

● Bithumb: Thanks to aggressive marketing strategies—including increased spending since 2024 and zero-fee promotions—Bithumb regained significant market share, now holding a stable ~26% of trading volume.

● Coinone: After launching a “zero-fee early bird ticket” in October 2024 to attract new users, coupled with leaderboard contests and event participation codes, Coinone accelerated market share growth while retaining existing users, currently occupying about 3%.

Among all domestic Korean exchanges, the top three—UPbit, Bithumb, and Coinone—collectively hold 99% market share, while Korbit and GOPAX together account for approximately 1%.

All major exchanges participate in the DAXA alliance, enhancing overall industry stability and listing transmission efficiency through information sharing and market coordination. This creates a degree of synchronized listing rhythms and market responses. In 2023, Korea’s five major crypto exchanges formed DAXA (Digital Asset Exchange Alliance), a self-regulatory coalition aimed at improving market transparency, compliance, and investor protection. The alliance standardizes listing criteria to ensure projects meet security and regulatory standards, collaborates with regulators to refine policy, and elevates industry-wide compliance and transparency.

Since June 2025, when the Virtual Asset Committee officially confirmed the applicability of the “zero-fee policy” to Korea’s three major fiat-to-crypto exchanges—UPbit, Bithumb, and Coinone—their dominant market positions have been further consolidated and strengthened.

3.2 Supported Trading Pairs

3.3 Number of Listings

To analyze listing trends, we selected the period from January 2024 to July 2025. This timeframe covers both bull and bear market cycles and includes pivotal political moments in Korea’s crypto market. It offers a comprehensive view of listing volume fluctuations and market conditions, providing reliable reference for understanding listing patterns and marketing strategies.

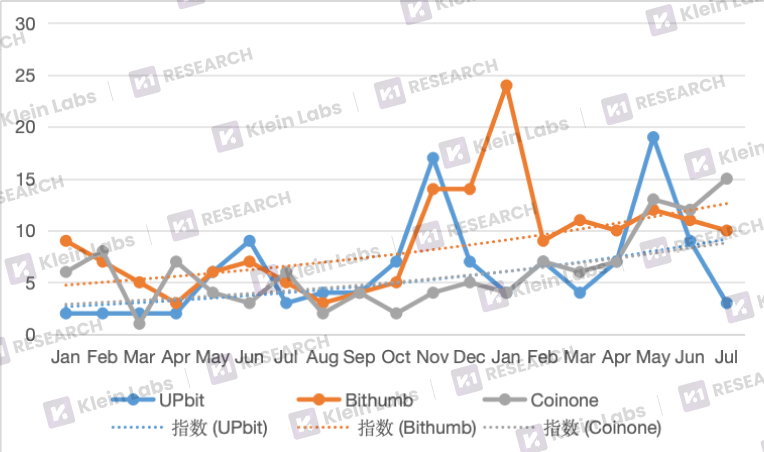

Overall, listing numbers showed significant growth during the observation period, especially active in Q2 2024 and H1 2025. During this time, nearly all major exchanges accelerated new token listings, pushing market activity to relatively high levels—a trend closely tied to policy environment shifts.

● Q2 2024: The "Virtual Asset User Protection Act" was set to take effect on July 19. In the two months preceding implementation, leading exchanges like UPbit and Bithumb clearly sped up listing and audit processes, seizing a brief “window period” to onboard more projects before stricter listing rules and legacy token reviews took effect. This temporary surge directly boosted overall market listing volume.

● H1 2025: Political factors again played a major role. During the presidential election, Lee Jae-myung explicitly pledged full support for Korea’s domestic crypto industry, advocating legalization and regulatory easing. This policy expectation, followed by the introduction of the "Digital Asset Basic Act," strengthened market confidence. For what is already the world’s most active and speculative altcoin market, the legislation was widely seen as a major positive, prompting exchanges and projects to accelerate deployments in the short term.

In detail, against the backdrop of a broader listing boom, differing strategies among exchanges reflect distinct considerations in resource allocation, risk tolerance, and competitive positioning.

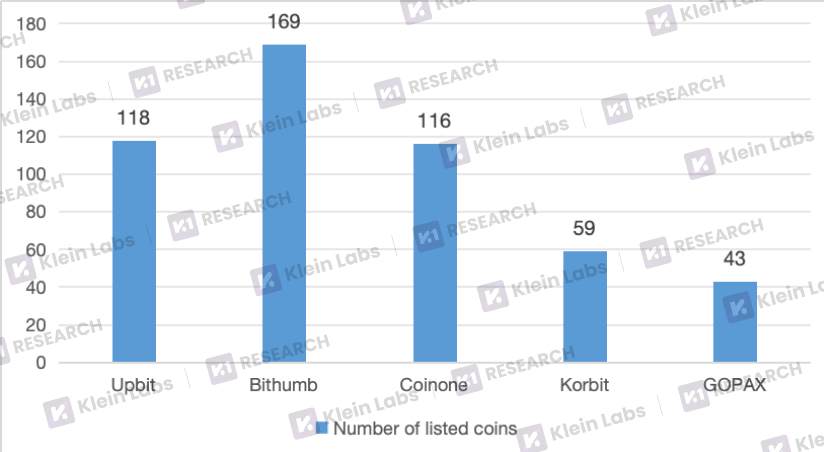

● Bithumb leads in total listing volume, surpassing other exchanges. Bithumb holds advantages in user base and liquidity and maintains a relatively aggressive listing pace to seize market opportunities.

● Among the top three, UPbit and Coinone have similar listing volumes, reflecting more conservative and cautious approaches focused on ecosystem stability and compliance.

● In contrast, Gopax and Korbit have significantly fewer listings, indicating smaller-scale new token introductions—closely related to their limited market size, capital strength, and risk control capacity.

4. Analysis of Listing Pathways

After gaining preliminary understanding of the listing characteristics and overall situation across major Korean exchanges, we now conduct deeper analysis using specific listing price data. By comparing detailed metrics on listing types and performance across exchanges, we clarify commonalities and differences in project selection, pricing strategies, and market feedback—providing intuitive, data-backed perspectives on each exchange’s operational logic and competitive strategy.

To more accurately capture overarching patterns and trend features in Korean listings, our subsequent analysis will focus primarily on the three exchanges with the highest market share.

4.1 Listing Volume and Influencing Factor Analysis

4.1.1 Monthly Listing Volume Overview Across Three Major Exchanges

Overall Trend: Starting November 2024, listing volumes across all three exchanges began rising. Increased listings reflect heightened market sentiment. In November 2024, the U.S. presidential election concluded with Trump’s victory, renewing market confidence. Simultaneously, Bitcoin prices hit new highs, with strong performances in sectors like Layer 1, memecoins, AI, and DeSci, creating favorable market conditions. Exchange listing activities noticeably increased, following the typical pattern of higher listing volumes during bull markets.

Detailed Analysis:

● UPbit: Shows clear peak patterns, with significant differences between dense and slow listing periods. It recorded three peaks—in June 2024, November 2024, and May 2025. The latter two coincided with bull market phases:

In November 2024, Bitcoin rose nearly 40%, fueling overall market prosperity;

In May 2025, Bitcoin broke the $100,000 mark, Ethereum rebounded strongly, and listings were concentrated in the Layer 1 sector, amplified by the pre-enactment regulatory window of the Digital Asset Basic Act.

Although BTC and ETH performed weakly in June 2024, Korea’s overall crypto market cap remained high. Additionally, exchanges launched a public official crypto asset disclosure system, boosting transparency and market sentiment, leading UPbit to experience a listing peak that month.

● Bithumb: Reached peak listing volume in January 2025. From November 2024 onward, its monthly listing count surged to 24 new tokens, then stabilized at around 10 per month—nearly double the average in H1 2024. Since its 2023 strategic shift, Bithumb has steadily grown its market share. With the new administration supportive of crypto, Bithumb adopted a more aggressive offensive listing strategy to capture market share.

In early 2025, Bithumb accelerated listing pace to capitalize on user growth trends. This move correlated with December 2024 data showing 33% of new Korean crypto investors being first-time users—driven largely by Bitcoin halving and Trump’s election win—indicating sustained expansion of the user base.

● Coinone: Maintained a balanced listing rhythm, with consistently high volumes in Q1 of both 2024 and 2025. In May 2025, Coinone saw a significant spike, exceeding previous monthly highs. This growth stemmed from earlier fee-reduction policies and increased marketing spend, successfully securing loyal users. Combined with multiple favorable crypto developments and the passage of the Digital Asset Basic Act, Coinone gained stronger policy backing. Consequently, it expanded listing categories and supported more trading pairs to attract users and grow market share.

Like UPbit, Coinone peaked in May 2025; however, unlike UPbit, whose listings sharply dropped in July, Coinone reached another record high that same month. This indicates differing strategies in responding to market conditions. Overall, listing rhythm correlates closely with BTC price and market sentiment—Coinone tends to stay actively listed during upward trends to sustain growth momentum.

In terms of index curves, UPbit and Coinone follow similar overall trends but differ in style. UPbit shows more pronounced peaks and troughs, creating cyclical adjustments that maintain equilibrium. Coinone’s curve tracks BTC price movements more closely—steadier and continuously upward—suggesting its listing strategy directly follows market trends for stable expansion.

4.1.2 Quantitative Analysis of Factors Affecting Listing Volume

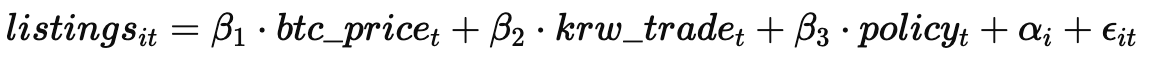

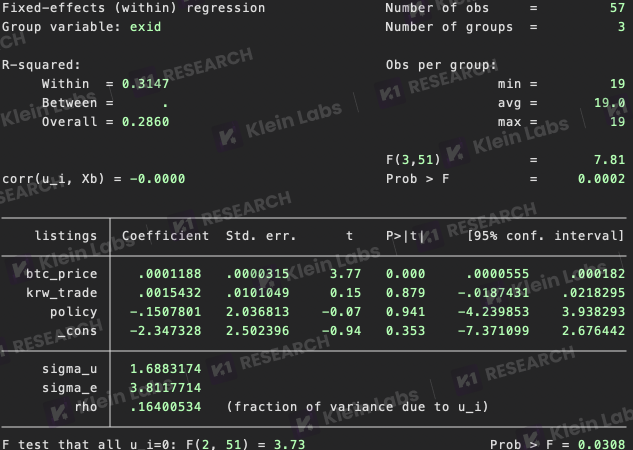

This section uses a panel fixed-effects regression model to systematically evaluate the impact of BTC price, KRW-denominated trading volume, and policy factors on listing volumes at major Korean exchanges.

● Panel data combines time-series and cross-sectional dimensions, allowing us to control for individual differences while capturing dynamic variable effects over time. Compared to single cross-sectional or time-series analyses, panel methods improve estimation accuracy and reduce omitted-variable bias.

● The fixed-effects model controls for time-invariant exchange-specific characteristics, preventing long-term structural differences from distorting coefficient estimates. By introducing exchange fixed effects αᵢ, the model focuses on time-varying changes, more accurately identifying marginal impacts of BTC price fluctuations, trading volume shifts, and policy windows on listing decisions.

● In interpreting results, we treat p-values as the core measure of statistical significance. When a variable’s p-value exceeds 0.05, we cannot reject the null hypothesis (“coefficient equals zero”) at the 5% significance level—meaning the model lacks sufficient evidence of a stable statistical relationship with listing volume during the sample period. However, statistical insignificance does not imply economic irrelevance. In the highly volatile crypto environment, short-term noise, measurement errors, and individual heterogeneity may mask true effects. Therefore, for variables with p > 0.05, we apply cautious interpretation, supplementing with economic reasoning and potential mechanisms rather than relying solely on statistical significance.

We specify the following model:

Where:

listings: number of listings on exchange i in month t

btc_price: monthly average BTC price (USD)

krw_trade: total monthly trading volume denominated in KRW (unit: Billion)

policy: policy dummy variable (1 = policy window period, 0 = otherwise)

αᵢ: exchange fixed effect, controlling for long-term strategic differences across exchanges.

Panel Regression Results Explanation:

● BTC price shows significant positive correlation. For every $1 increase in BTC price, average listing count increases by ~0.00012; a $10,000 rise in monthly average BTC price corresponds to ~1.19 additional listings, with extremely low p-value, confirming statistical robustness.

● Changes in KRW-denominated trading volume show no significant correlation with listing counts, possibly due to large short-term volatility and project heterogeneity not directly driving exchange listing strategies.

● Policy window period shows no significant impact on listing volume, suggesting varied responses among exchanges to policy shifts.

● Fixed effect αᵢ helps control for long-term exchange strategy differences, enabling the model to focus on time-varying influences.

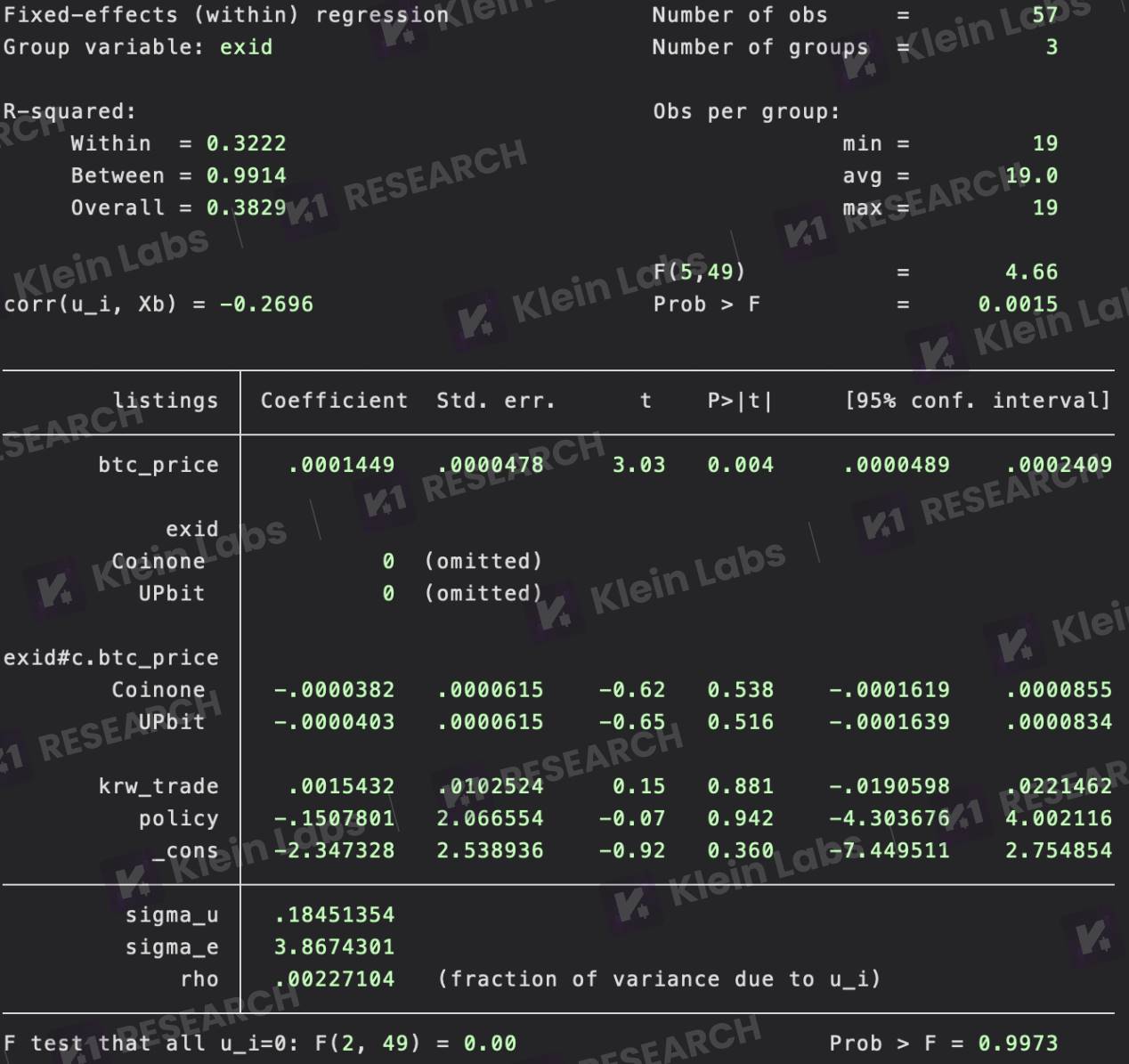

Further analysis of exchange differences reveals:

● UPbit and Bithumb show slightly lower marginal responses to BTC price compared to Coinone, though these differences are not statistically significant—indicating broadly similar positive reactions across all three exchanges to BTC price swings.

● Specifically, Coinone is especially sensitive to BTC price changes. For instance, a $10,000 increase in average BTC price predicts a ~1.45 increase in Coinone’s listing count, suggesting rising prices incentivize new listings to capture market热度 and investor attention.

● Overall, BTC price signals significantly influence Korean exchanges’ short-term listing decisions, serving as a key reference for projects choosing listing windows.

Combining both analyses, conclusions are:

● During favorable market conditions, all three exchanges adopt synchronized expansion strategies, though Coinone is more sensitive to market trends.

● BTC price is the primary driver of listing volume, outweighing inter-exchange strategic divergence.

● The Korean crypto market is largely guided by macro trends, with exchange-specific differences having limited impact on long-term strategy.

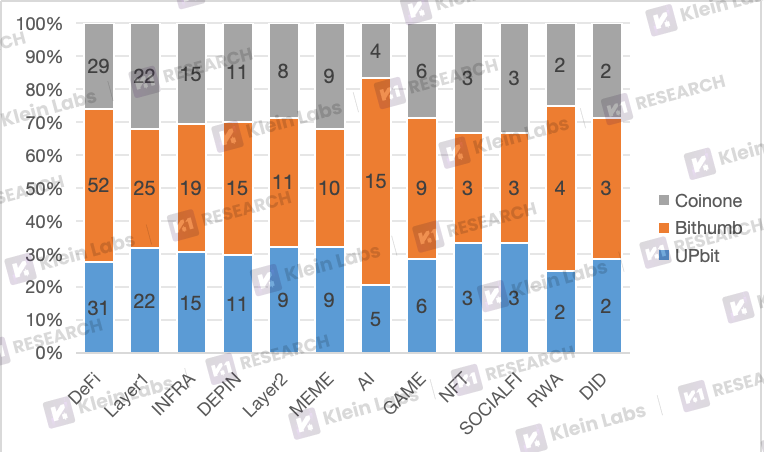

4.2 Sector Analysis of Listings

To deeply examine sector preferences in new listings across Korea’s top three exchanges, we conducted systematic sorting and analysis of recent listings. This insight helps projects formulate viable listing strategies and enables investors to identify promising assets and track local market trends.

Commonalities

● Across all three exchanges, DeFi, Layer 1, and Infra projects dominate in listing numbers. This shows platforms remain highly focused on sectors with real utility, especially DeFi ecosystems and Web3 foundational infrastructure. DeFi projects account for roughly one-third of total listings.

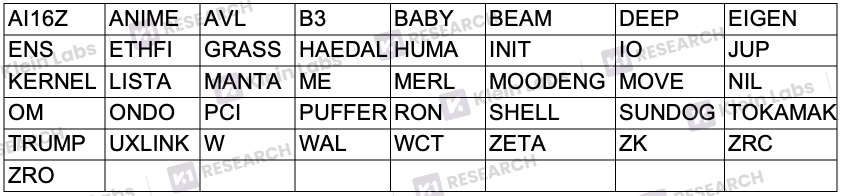

● Within DeFi, the three exchanges jointly listed 12 major overseas blue-chip projects: BABY, COW, DEEP, DRIFT, ENA, HAEDAL, JTO, JUP, KERNEL, PUFFER, W, ZRO—all well-known globally with strong user bases—revealing convergence in high-quality DeFi asset selection.

● In contrast, emerging sectors like NFT and SocialFi see far fewer listings across all three platforms. From explosive growth in 2020, through roller-coaster market swings, to prolonged NFT winter, market sentiment and liquidity have remained under pressure. Recently, the NFT market has rebounded strongly, and the three exchanges selectively added three top-tier blue-chip NFTs: PENGU, ME, ANIME. Nonetheless, overall attitudes toward NFTs remain relatively cautious and observational.

Differences

● Bithumb leads in total listing volume during the observed period. Compared to UPbit and Coinone, Bithumb’s new listings have higher proportions in DeFi and AI sectors, reflecting its keen ability to capture market opportunities and respond quickly to trends during the 2024 AI boom.

Coinone and UPbit show high overlap in total listing volume and timing, yet differ markedly in specific token selection styles. Taking DeFi as an example:

● UPbit independently listed established projects like COMP and BNT—long-supported, market-proven veterans—highlighting emphasis on stability and historical performance.

● Coinone independently listed newer but high-potential innovative DeFi projects like NAVX and YALA, demonstrating openness to emerging quality projects and forward-looking positioning, adopting more inclusive criteria favoring early-stage innovations with long-term growth potential.

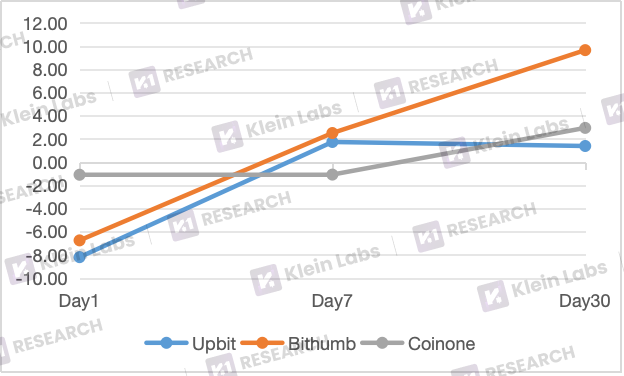

4.3 Token Price Performance Analysis

This study primarily examines post-listing price performance of new tokens on the three major exchanges. We analyze price changes relative to the exchange’s initial pricing at Day 1, Day 7, and Day 30 to identify trends, volatility patterns, and market reactions.

● Day 1 price reflects immediate market acceptance, influenced by FOMO and buying pressure—it’s a critical phase of initial market pricing;

● Days 1–7 capture short-term sentiment and initial recognition of project fundamentals, measuring sustainability of market热度 and helping assess fair initial pricing;

● Days 1–30 reveal long-term support strength. As short-term speculation cools and traders exit, price and volume trends become key indicators of genuine market acceptance.

To avoid distortion from extreme values, we exclude top and bottom 25% outliers and use trimmed mean analysis to more accurately reflect typical price behavior.

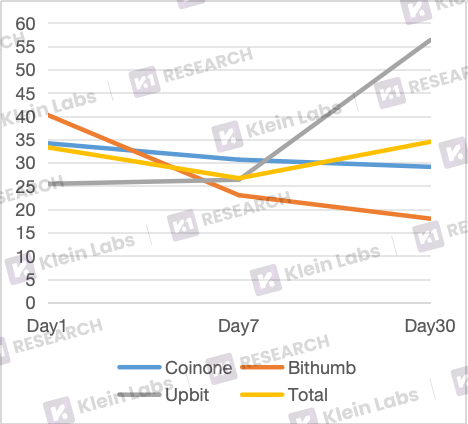

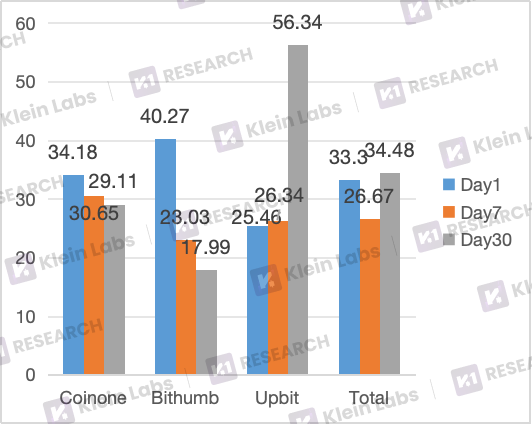

● UPbit: Lowest average closing price on Day 1, likely due to large user base and concentrated sell-offs by speculators, pressuring initial price. On average, prices rebound quickly by Day 7, then rise more gradually, showing steady post-correction growth.

● Bithumb: Exhibits the largest average price fluctuation—both gains and losses are intense—possibly due to higher listing volume and greater market activity. Although the curve shows an upward trend, steep slopes and wide swings may increase investor risk.

● Coinone: Smallest price movement, indicating high stability and predictability. Prices remain steady throughout the observation period, with Day 30 gains even exceeding UPbit—showing that despite limited short-term volatility, tokens retain strong long-term upside. This smooth return profile implies lower price risk, better suited for investors seeking stable returns and long-term value.

4.4 Return Analysis: The Bridge Effect of Exchange Listings

4.4.1 Research Method

In this study, we analyze secondary metrics—token returns—to assess how initial listing exchanges affect new token price performance. Compared to absolute prices, returns offer distinct advantages:

1. Eliminates unit effects: Returns are relative measures, unaffected by face value or trading unit differences, enabling cross-token and cross-exchange comparisons.

2. Reduces scale bias: Direct price comparisons can mislead due to vast price disparities; returns normalize scales, highlighting movement magnitude over absolute figures.

3. Captures market sensitivity: Returns reflect investor sentiment and behavioral responses to new listings, helping measure the impact of initial exchange choice on price volatility.

4.4.2 Token Screening and Sample Selection

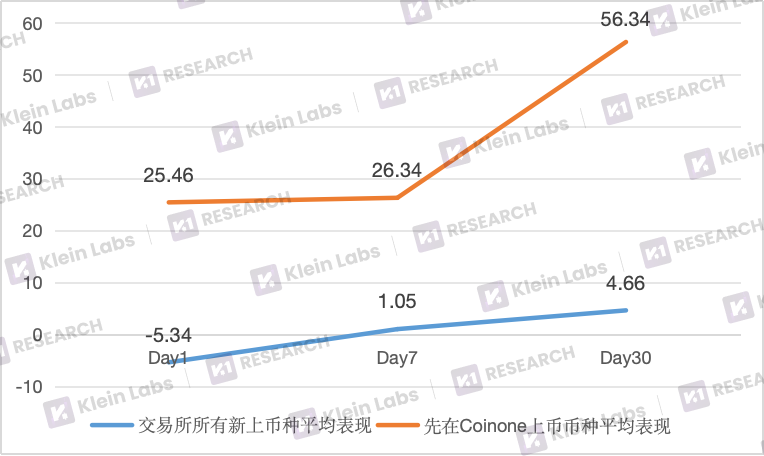

Data shows both Bithumb and Coinone exhibit a “bridge effect.” Specifically, 57 tokens listed first on Bithumb before appearing on UPbit; Coinone similarly stands out, with 41 tokens debuting there before being listed on UPbit and Bithumb, averaging a 93.6-day gap. Next, we analyze Coinone’s characteristics in listing rhythm and market linkage using these cases.

For representative projects like EIGEN, ENS, ETHFI, Coinone’s deployment came over a year ahead. Overall, these tokens delivered average returns above market benchmarks, further validating Coinone’s “bridge role”—introducing promising assets early and channeling them to higher-volume, broader-coverage platforms.

This bridge effect manifests not only temporally but also in performance: Tokens listed early on Coinone provided substantial excess returns to early participants. When later listed on other major exchanges, they created cross-platform price and liquidity transmission. Thus, Coinone plays a dual role—as both a project incubator and asset circulation hub within Korea’s exchange ecosystem.

4.4.3 Return Time Window Analysis

From temporal price performance, Coinone-listed tokens perform best overall. Across Day 1, Day 7, and Day 30, Coinone outperforms the market average in two windows and slightly underperforms in one. In contrast, UPbit and Bithumb exceed the average in only one window and fall below average in others.

Overall, in medium-short term stages, projects initially listed on Coinone and Bithumb tend to perform best; in long-term development, UPbit shows more stable and superior average performance.

● UPbit: Adopts a relatively conservative approach initially, typically listing projects only after market热度 is validated. It performs weakest on Day 1 but leverages superior liquidity and massive user base to surpass others by Day 30—becoming top performer—indicating its tokens receive stronger late-stage funding attention and secondary rallies.

● Bithumb: Strategy heavily relies on market热度—best Day 1 performance, strong short-term effect—but overall returns decline afterward, lacking sustainability. Without ongoing maintenance and marketing support, short-term spikes fail to translate into medium-long term advantages.

● Coinone: Leverages first-mover premium by front-loading popular assets, giving early participants arbitrage opportunities during cross-platform listings and increasing appeal to early investors. Coinone willingly assumes early listing risks to gain access to high-return token curation rights, consistently outperforming market averages across most time horizons.

With clear differences in token performance across exchanges, investors can tailor strategies based on risk appetite and holding period:

● Short-term speculators: Should closely monitor Bithumb new listings on Day 1 to exploit short-term market热度 for profit-taking.

● Medium-long term trend investors: Better served tracking UPbit new listings at Day 30 to capture late-stage capital inflows and secondary rally potential.

● Early mover advantage seekers: Should watch Coinone’s early listing announcements closely, leveraging its first-mover and bridge effects to earn premium returns during cross-exchange rollouts.

4.4.4 Global Return Performance

Statistical results show tokens listed on Coinone significantly outperform the overall average of all newly listed tokens, exhibiting broad-based gains. This suggests these early Coinone-listed tokens not only possess strong project quality and market competitiveness but also reflect Coinone’s foresight and precision in listing selection. The ability to identify and introduce quality assets early is central to its bridge function within Korea’s exchange ecosystem.

The findings also suggest a viable listing strategy: Launching on a platform with early screening advantages allows projects to gain initial market attention and price momentum, then expand liquidity and user reach via larger exchanges later—creating a complete market development path from early exposure to long-term value accumulation.

5. Successful Listing Marketing Case Studies

Korean exchanges generally have high listing barriers: Strict requirements cover technical capability, compliance, team background, market potential, community foundation, and early user activity—limiting eligible projects. This means projects must excel in both fundamental strength and marketing strategy to succeed.

Below are five standout cases—projects with exceptional early marketing and strong post-listing price performance. We analyze their marketing traits to provide reference for other projects. By learning from these successes, teams can strategically plan outreach, community building, media collaboration, and early user incentives—increasing chances of approval and smooth listing.

5.1 UXLink

● Media Partnerships and Feature Articles

UXLink partnered with multiple blockchain media outlets and research institutions to publish feature articles and technical analyses, boosting market visibility. CoinDesk Korea provided in-depth analysis of UXLink’s cross-chain technology, enhancing technical credibility; CryptoSlate published interviews detailing UXLink’s ecosystem design and tokenomics; TokenPost and BlockBeats republished coverage in Korean and Asian communities, expanding exposure and community interest.

● Ecosystem Expansion and Strategic Collaborations

UXLink built its community on Telegram, partnering with TON ecosystem, UOB, Arbitrum, Animoca Brands, etc. Through cross-chain interoperability, AMAs, and technical workshops, it achieved 150% active user growth and 200% daily trading volume increase within three months—significantly enhancing liquidity and market influence while advancing decentralized finance ecosystems. Additionally, UXLink sponsored Consensus Hong Kong and co-hosted the “AI Agent Rising” event with BNB Chain and Meet48 in Hong Kong, further boosting industry visibility and community recognition.

● Incentive Mechanisms and User Engagement

Participated in AIRDROP2049, distributing SBT points via social graph on-chain to encourage user interaction and community participation, while improving on-chain reputation and activity.

5.2 Mantle Network

● Media Partnerships and Feature Articles

Mantle Network systematically deployed media outreach, collaborating with renowned outlets and research firms to publish feature stories and technical analyses, significantly boosting industry influence. Klein Labs provided comprehensive ecosystem breakdowns for investor reference; Binance Square published interviews explaining Mantle’s modular architecture and Eigen-DA data availability support, strengthening technical credibility; Messari released in-depth research reports, attracting capital attention; TokenPost and CoinNess republished updates on Mantle’s progress in Korea, expanding awareness in Asian communities;

● Community Management and Social Media Promotion

Mantle Network actively manages social and community platforms, cultivating a highly engaged user base. Over 800k followers on X, with regular project updates and community interactions; official Telegram and Discord communities exceed 200k members, regularly hosting AMAs and discussions to strengthen user involvement and belonging. Such meticulous community operations support information spread and sustain high user activity and loyalty.

● Incentive Mechanisms and User Participation

Mantle Network enhanced user activity through incentive programs. The Mantle Journey user engagement program launched in August 2025 used Soulbound Token minting to distribute a 20 million MNT rewards pool to participants and dApps, incentivizing community growth and ecosystem vitality. These measures boosted user loyalty and validated the economic appeal of the ecosystem, forming a self-reinforcing community loop.

5.3 Flock.io

● Media Partnerships and Feature Articles

Flock.io systematically executed media outreach, partnering with Messari, Cointelegraph Korea, and others to publish feature articles and market analyses, enhancing industry influence; Klein Labs delivered comprehensive ecosystem breakdowns for investment reference; TokenPost covered Flock.io’s progress in Korea, strengthening local market awareness.

● Ecosystem Expansion and Strategic Collaborations

Flock.io partnered with Alibaba Cloud Qwen and Base to bring centralized AI models to decentralized platforms, enabling decentralized transaction and wallet management. Through Web3 Agent models, locally-run AI assistants protect user privacy, while community AMAs and technical workshops significantly boost user activity and market influence, reinforcing decentralized ecosystem development.

● Incentive Mechanisms and User Engagement

Flock.io co-led the Qwen × FLock × Base AI Hackathon. The event attracted developer clubs from Korea’s SKY universities and KAIST, advancing decentralized AI model innovation and real-world application via federated learning, strengthening Flock.io’s technical leadership and industry influence in the decentralized AI ecosystem.

5.4 BigTime

● Media Partnerships and Feature Articles

BigTime systematically deployed media outreach, collaborating with CoinDesk Korea, CryptoSlate, TokenPost, and others to publish feature stories and ecosystem analyses, boosting industry influence; Messari provided in-depth analysis of its game economy and token incentives for investor reference; BlockBeats reported on BigTime’s community events in Asia, enhancing local market recognition.

● Viral Forum Marketing

BigTime implemented viral marketing via community forums, X, and Discord, activating player interaction and information spread. Game party systems and invite codes encouraged players to recruit new users, rapidly expanding community size while increasing stickiness and brand impact.

● Incentive Mechanisms and User Participation

Access to BigTime required invitation codes, creating short-term “hard-to-get” hype and significantly boosting community activity—reflecting strong demand. The project also offered multiple incentives: free OTC gaming, voice channel support, daily NFT drop rate sharing, shared elite dungeon access—effectively increasing user engagement and community vibrancy.

5.5 Sign

● Media Partnerships and Feature Articles

Sign systematically deployed media outreach, collaborating with Tiger Research, CoinDesk Korea, CryptoSlate, and others to publish feature stories and technical analyses, increasing industry awareness and capital attention; TokenPost and BlockBeats republished coverage, expanding exposure and influence in Korean and Asian communities.

● Community Forums and Viral Marketing

Sign used cultural symbols to build strong identity and belonging, successfully growing a self-sustaining community of over 50,000 members. High community loyalty—some core members even tattooed the Sign logo—demonstrating profound cultural impact and social propagation effect.

● Incentive Mechanisms and User Participation

Sign encouraged user interaction and content sharing through on-chain tasks, airdrop rewards, and a fair incentive system based on soulbound tokens (SBTs); high community incentives combined with diversified product matrix effectively penetrated the on-chain trust and distribution infrastructure market, driving the flourishing growth and self-reinforcement of the “Orange Dynasty” community.

The above cases fully demonstrate that through systematic, multi-dimensional marketing strategies, projects not only gain capital attention and user endorsement but also successfully enter Korea’s stringent, limited-capacity exchange market. This indicates they’ve met high standards in both project strength and market validation—providing replicable success models and references for other projects.

6. Conclusion

Within the global cryptocurrency landscape, Korea’s uniqueness and vibrancy offer valuable reference models for projects. Data shows that the resonance between policy and market sentiment significantly affects listing rhythms; BTC price fluctuations not only shape investor confidence but also subtly reshape exchange listing strategies. This dual market-policy driver reminds project teams that global launch plans must incorporate macro trends and regulatory dynamics into decision-making frameworks.

More notably, Coinone’s prominent “listing bridge effect”—where its early listings often signal follow-up actions by other major exchanges—not only generates secondary liquidity but also amplifies project visibility. This implies that, with limited resources, precisely selecting entry platforms may leverage greater market impact than blindly chasing top-tier exchanges.

However, Korea’s experience cannot be simply copied. Success depends on nuanced factors: user profiles, community cultures, listing review mechanisms, and localized promotional resources—all determine project outcomes. For projects pursuing global expansion, true competitiveness lies in deeply integrating data analysis, market judgment, and localized execution—appearing on the right platform, at the right time, with the right strategy.

The crypto market evolves rapidly, but underlying patterns endure. Korea’s case shows that project success depends not only on technology and vision but also on precise understanding of market microstructures and emotional fluctuations. Going forward, can projects seize short-term gains while planting seeds for long-term value? The answer lies in every strategic choice made before their first step.

7. References

1. Kaiko: Korean Crypto Market Report

2. Simplicity: Token Launch Dynamics: The Science Behind Price Performance

3. Namu Wiki:Controversies on Cryptocurrency Regulation in South Korea

4. [Video] Democratic Party Considering Establishment of Digital Asset Authority... Will Cryptocurrencies Be Regulated Like Stocks?

5. DeSpread Research: 2024 Republic of Korea Individual Virtual Asset Investor Trend Report

6. UPbit & Bithumb, 2025 Listing Strategies Diverged... Conservative vs Offensive

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News